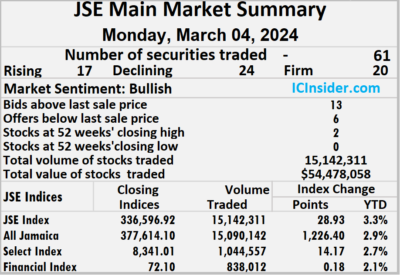

Trading on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks traded declining 27 percent with a 42 percent lower value than on Friday, following trading in 61 securities up from 59 on Friday, with prices of 17 stocks rising, 24 declining and 20 ending unchanged.

Investors traded 15,142,311 shares for $54,478,058, well down on 20,803,919 units at $94,602,958 on Friday.

Investors traded 15,142,311 shares for $54,478,058, well down on 20,803,919 units at $94,602,958 on Friday.

Trading averaged 248,235 shares at $893,083 compared to 352,609 units at $1,603,440 on Friday and month to date, an average of 299,552 units at $1,242,342 compared with February that closed with an average of 385,143 units at $3,418,046.

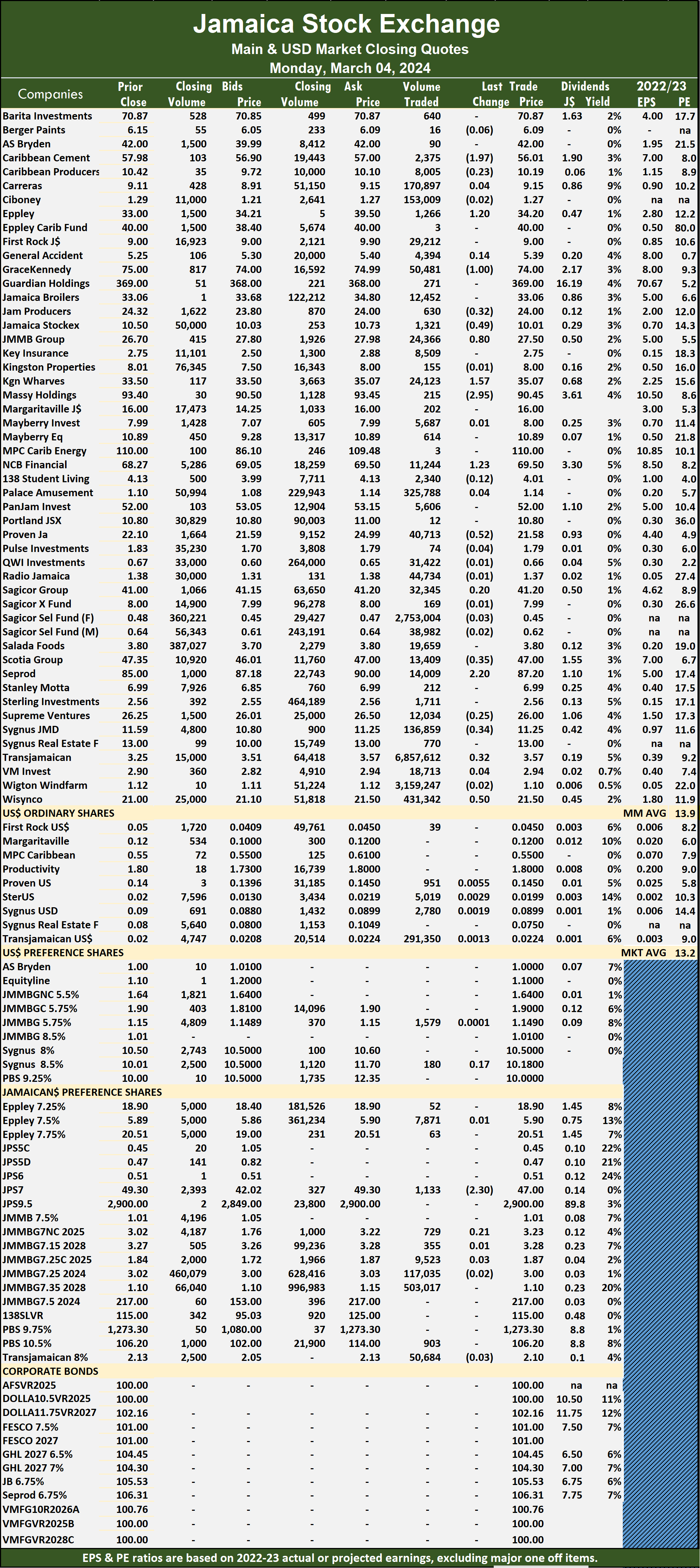

Transjamaican Highway led trading with 6.86 million shares for 45.3 percent of total volume followed by Wigton Windfarm with 3.16 million units for 20.9 percent of the day’s trade and Sagicor Select Financial Fund with 2.75 million units for 18.2 percent of the day’s trade.

The All Jamaican Composite Index rose 1,226.40 points to end the day at 377,614.10, the JSE Main Index increased 28.93 points to close at 336,596.92 and the JSE Financial Index increased 0.18 points to 72.10.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

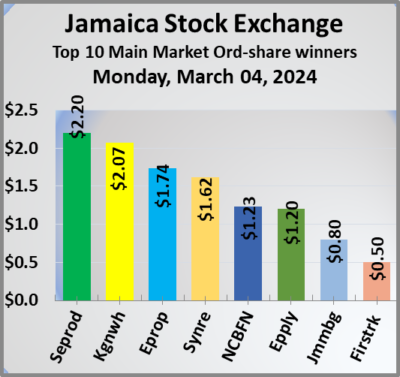

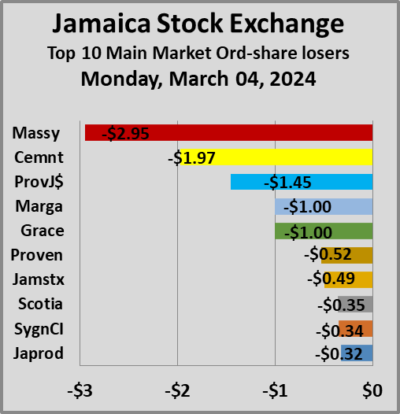

At the close, Caribbean Cement lost $1.97 to end at $56.01 as investors exchanged 2,375 stock units, Eppley increased $1.20 to $34.20 with 1,266 shares clearing the market, GraceKennedy dropped $1 and ended at $74 with investors dealing in 50,481 units. Jamaica Producers fell 32 cents in closing at $24 with 630 stocks crossing the market, Jamaica Stock Exchange declined 49 cents to close at $10.01 while exchanging 1,321 units, JMMB Group climbed 80 cents to $27.50 with investors transferring 24,366 stocks. Kingston Wharves rose $1.57 in closing at $35.07 trading 24,123 shares, Massy Holdings sank $2.95 to close at $90.45 in an exchange of 215 stock units, NCB Financial advanced $1.23 and ended at $69.50 and closed with an exchange of 11,244 shares.  Proven Investments shed 52 cents to end at $21.58 with an exchange of 40,713 stock units, Scotia Group dipped 35 cents in closing at $47 after 13,409 stocks passed through the market, Seprod popped $2.20 to $87.20 after exchanging 14,009 units. Sygnus Credit Investments skidded 34 cents to close at $11.25 with investors trading 136,859 stocks, Transjamaican Highway rallied 32 cents and ended at a 52 weeks’ high of $3.57 in an exchange of 6,857,612 shares and Wisynco Group gained 50 cents to end at $21.50 with traders dealing in 431,342 units.

Proven Investments shed 52 cents to end at $21.58 with an exchange of 40,713 stock units, Scotia Group dipped 35 cents in closing at $47 after 13,409 stocks passed through the market, Seprod popped $2.20 to $87.20 after exchanging 14,009 units. Sygnus Credit Investments skidded 34 cents to close at $11.25 with investors trading 136,859 stocks, Transjamaican Highway rallied 32 cents and ended at a 52 weeks’ high of $3.57 in an exchange of 6,857,612 shares and Wisynco Group gained 50 cents to end at $21.50 with traders dealing in 431,342 units.

In the preference segment, Jamaica Public Service 7% fell $2.30 to $47 after 1,133 stock units crossed the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

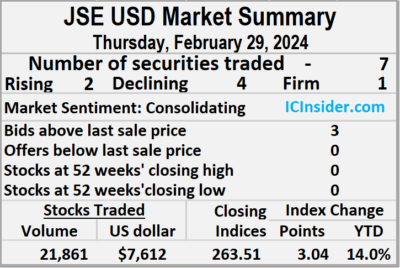

Record close for JSE USD market

The Jamaica Stock Exchange US dollar market ended at a record close on Thursday with the volume of stocks traded declining by 83 percent after a 70 percent drop in the amount of dollars changing hands on Wednesday, resulting in trading in seven securities, compared to five on Wednesday with prices of two rising, four declining and one ending unchanged.

The market closed with an exchange of 21,861 shares for US$7,612 compared to 125,830 units at US$25,026 on Wednesday.

The market closed with an exchange of 21,861 shares for US$7,612 compared to 125,830 units at US$25,026 on Wednesday.

Trading averaged 3,123 units at US$1,087 versus 25,166 shares at US$5,005 on Wednesday, with a month to date average of 46,765 shares at US$6,084 compared with 49,133 units at US$6,355 on the previous day and January that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index popped 3.04 points to close at a record high of 263.47.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share gained 0.4 of one cent and ended at 4.5 US cents after investors finished trading 200 stocks, Margaritaville dropped 1.03 cents to 11.75 US cents while exchanging 325 units,  Productive Business Solutions sank 5 cents to end at US$1.80 with an exchange of 3,157 shares. Proven Investments remained at 14.44 US cents after 1,046 stock units changed hands, Sygnus Credit Investments popped 0.07 of a cent to close at 8.97 US cents after a transfer of 100 shares and Transjamaican Highway skidded 0.01 of a cent to 2.1 US cents in switching ownership of 16,019 units.

Productive Business Solutions sank 5 cents to end at US$1.80 with an exchange of 3,157 shares. Proven Investments remained at 14.44 US cents after 1,046 stock units changed hands, Sygnus Credit Investments popped 0.07 of a cent to close at 8.97 US cents after a transfer of 100 shares and Transjamaican Highway skidded 0.01 of a cent to 2.1 US cents in switching ownership of 16,019 units.

In the preference segment, JMMB Group US8.5% preference share lost 0.01 of a cent to close at US$1.1489 with investors dealing in 1,014 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Sharp fall in trading

Trading dropped by 92 percent after 30 percent fewer US dollars passed through the Jamaica Stock Exchange US dollar market on Tuesday, and resulted in trading of seven securities, compared to nine on Monday with prices of two rising, three declining and two ending unchanged.

The market closed with an exchange of 6,443 shares for US$7,499 down from 83,412 units at US$10,690 on Monday.

The market closed with an exchange of 6,443 shares for US$7,499 down from 83,412 units at US$10,690 on Monday.

Trading averaged 920 units at US$1,071 versus 9,268 shares at US$1,188 on Monday, with a month to date average of 50,100 shares at US$6,410 compared with 53,042 units at US$6,729 on the previous day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index popped 4.23 points to 261.54.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, First Rock Real Estate USD share sank 0.6 of a cent to close at 4.1 US cents as investors traded 3,600 stocks, MPC Caribbean Clean Energy lost 6 cents to close at 55 US cents with 38 units clearing the market, Proven Investments popped 0.8 of a cent to end at 14.5 US cents with investors transferring 1,167 shares.  Sterling Investments increased 0.24 of a cent in closing at 1.99 US cents after an exchange of 490 stock units and Transjamaican Highway remained at 2.13 US cents with an exchange of 1 share,

Sterling Investments increased 0.24 of a cent in closing at 1.99 US cents after an exchange of 490 stock units and Transjamaican Highway remained at 2.13 US cents with an exchange of 1 share,

In the preference segment, JMMB Group US8.5% preference share ended at US$1.149, with 500 units crossing the market and Sygnus Credit Investments E8.5% declined US$1.01 in closing at US$10.01 while exchanging 647 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Buoyant trading for JSE USD Market

The Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks traded rising 241 percent after 39 percent more dollars changed compared to Friday, resulting in trading in nine securities, compared to 10 on Friday with prices of three rising, two declining and four ending unchanged.

The market closed with trading in 610,533 shares for US$78,231 up from 178,798 units at US$56,398 on Friday.

The market closed with trading in 610,533 shares for US$78,231 up from 178,798 units at US$56,398 on Friday.

Trading averaged 67,837 units at US$8,692 up from 17,880 shares at US$5,640 on Friday, with a month to date average of 53,788 shares at US$7,011 compared with 52,146 units at US$6,815 on the previous trading day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index increased 1.67 points to close at 255.68, up 10.7 percent for the year to date.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share remained at 4.7 US cents with a transfer of 5,635 stock units, Proven Investments ended at 14.5 US cents as investors exchanged 455,584 shares, Sterling Investments ended at 1.7 US cents, with 2,000 stocks crossing the market.  Sygnus Credit Investments climbed 0.3 of a cent in closing at 8.8 US cents with investors trading 3,085 units, Sygnus Real Estate Finance USD share declined 0.8 of one cent to 7.2 US cents with 56,900 shares clearing the market and Transjamaican Highway rose 0.14 of a cent to 2.05 US cents with traders dealing in 86,318 stock units.

Sygnus Credit Investments climbed 0.3 of a cent in closing at 8.8 US cents with investors trading 3,085 units, Sygnus Real Estate Finance USD share declined 0.8 of one cent to 7.2 US cents with 56,900 shares clearing the market and Transjamaican Highway rose 0.14 of a cent to 2.05 US cents with traders dealing in 86,318 stock units.

In the preference segment, JMMB Group 5.75% advanced 26 cents in closing at US$1.81 in exchanging 577 units, Productive Business Solutions 9.25% preference share ended at US$11.05 with investors transferring 423 stocks and Sygnus Credit Investments E8.5% fell 72 cents to end at US$11.02 in switching ownership of 11 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

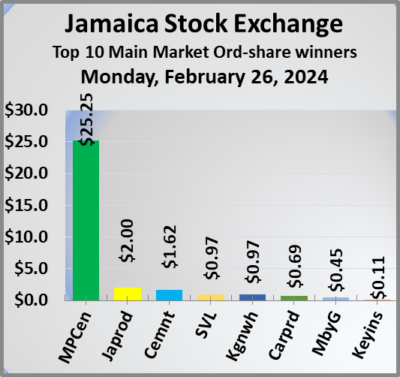

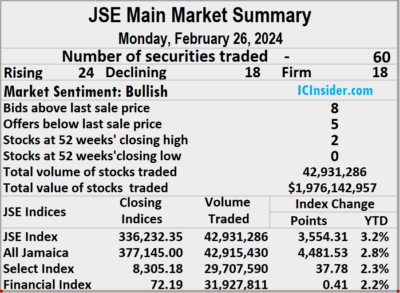

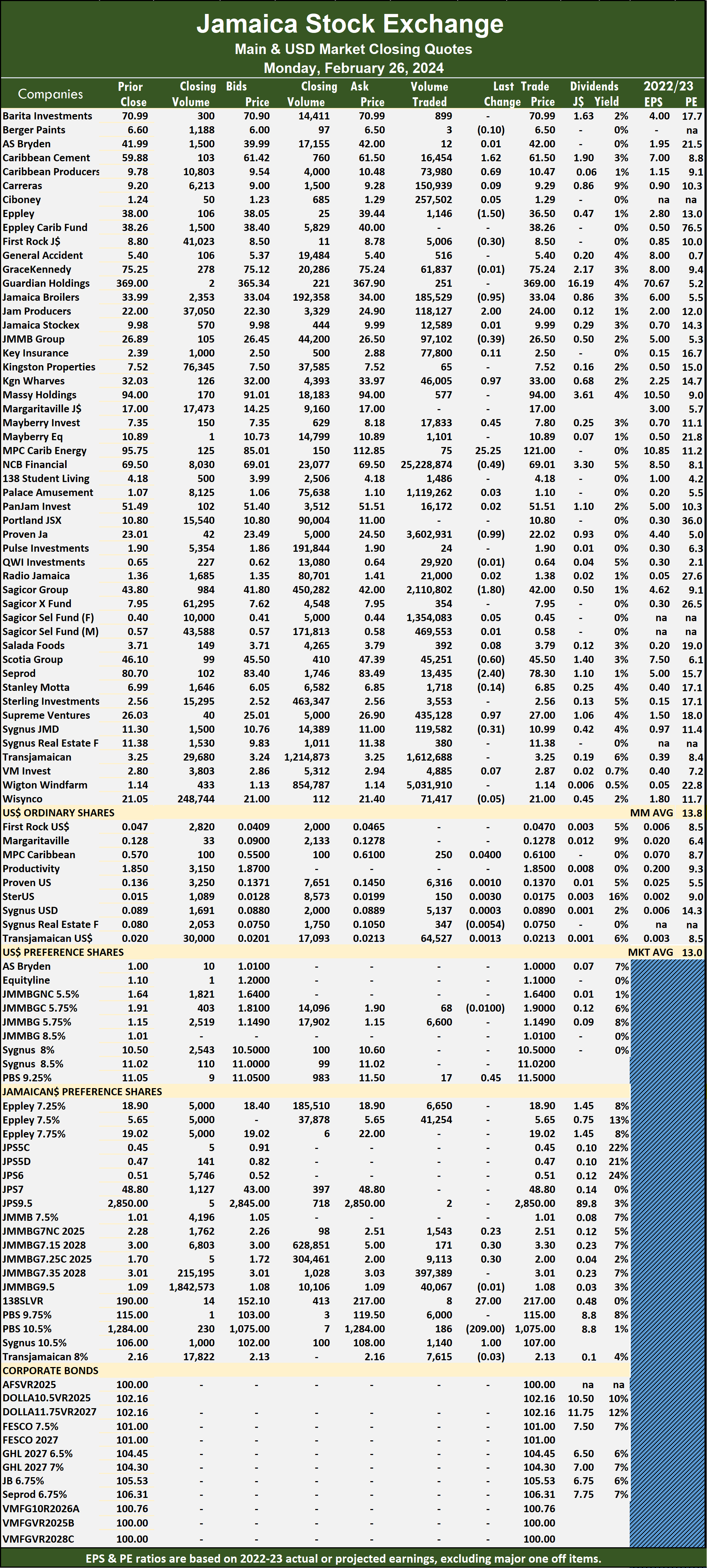

The market closed after 42,931,286 shares were traded for $1,976,142,956 in comparison with 11,253,996 stock units at $82,073,604 on Friday.

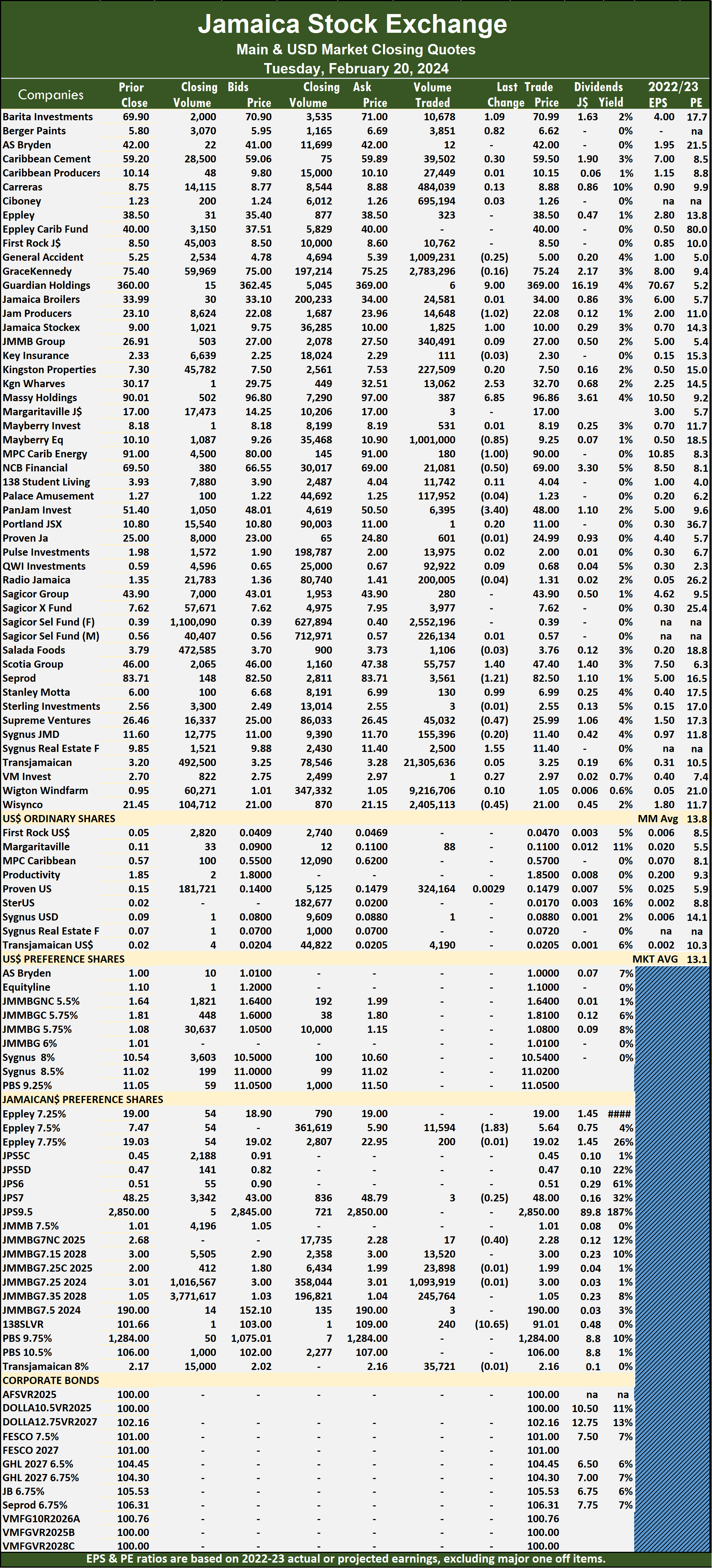

The market closed after 42,931,286 shares were traded for $1,976,142,956 in comparison with 11,253,996 stock units at $82,073,604 on Friday. The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. MPC Caribbean Clean Energy jumped $25.25 to end at $121 after an exchange of 75 units, NCB Financial skidded 49 cents to $69.01 with a transfer of 25,228,874 stocks, Proven Investments sank 99 cents in closing at $22.02 after an exchange of 3,602,931 stock units. Sagicor Group shed $1.80 to close at $42 with investors trading 2,110,802 shares, Scotia Group dropped 60 cents and ended at $45.50 as investors exchanged 45,251 stock units, Seprod fell $2.40 to end at $78.30, with 13,435 units crossing the market. Supreme Ventures gained 97 cents in closing at $27 with investors dealing in 435,128 stocks and Sygnus Credit Investments skidded 31 cents to $10.99 while exchanging 119,582 units.

MPC Caribbean Clean Energy jumped $25.25 to end at $121 after an exchange of 75 units, NCB Financial skidded 49 cents to $69.01 with a transfer of 25,228,874 stocks, Proven Investments sank 99 cents in closing at $22.02 after an exchange of 3,602,931 stock units. Sagicor Group shed $1.80 to close at $42 with investors trading 2,110,802 shares, Scotia Group dropped 60 cents and ended at $45.50 as investors exchanged 45,251 stock units, Seprod fell $2.40 to end at $78.30, with 13,435 units crossing the market. Supreme Ventures gained 97 cents in closing at $27 with investors dealing in 435,128 stocks and Sygnus Credit Investments skidded 31 cents to $10.99 while exchanging 119,582 units. 138 Student Living preference share rose $27 and ended at $217 in an exchange of 8 stocks, Productive Business Solutions 10.5 % preference share sank $209 to $1,075 after 186 units passed through the market and Sygnus Credit Investments C10.5% gained $1 to end at $107, with 1,140 stocks crossing the exchange.

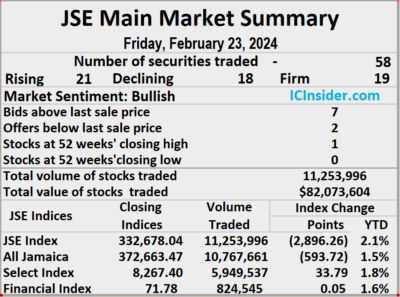

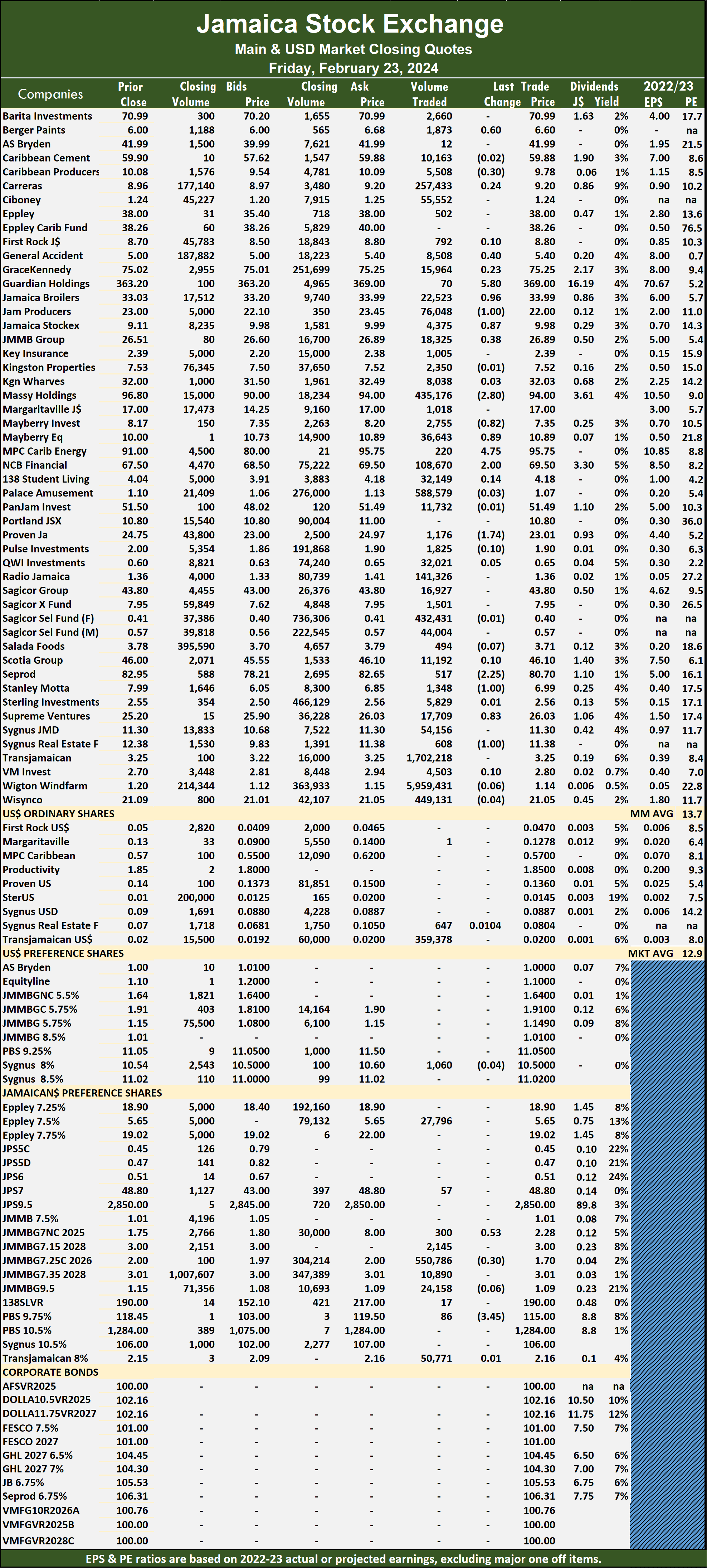

138 Student Living preference share rose $27 and ended at $217 in an exchange of 8 stocks, Productive Business Solutions 10.5 % preference share sank $209 to $1,075 after 186 units passed through the market and Sygnus Credit Investments C10.5% gained $1 to end at $107, with 1,140 stocks crossing the exchange. The market closed Friday with trading in 11,253,996 shares for $82,073,604 compared with 25,124,811 units at $45,570,028 on Thursday.

The market closed Friday with trading in 11,253,996 shares for $82,073,604 compared with 25,124,811 units at $45,570,028 on Thursday. Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and two with lower offers.

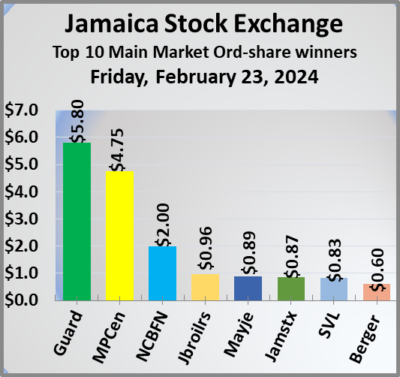

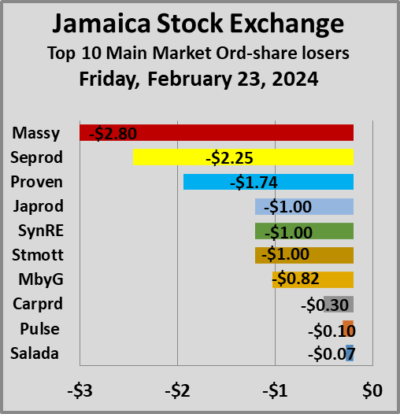

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and two with lower offers. NCB Financial gained $2 to end at $69.50 and closed with 108,670 shares changing hands, Proven Investments lost $1.74 and ended at $23.01 as investors exchanged 1,176 units, Seprod dropped $2.25 to close at $80.70 after 517 stocks passed through the market and Supreme Ventures rose 83 cents to $26.03 in an exchange of 17,709 stock units.

NCB Financial gained $2 to end at $69.50 and closed with 108,670 shares changing hands, Proven Investments lost $1.74 and ended at $23.01 as investors exchanged 1,176 units, Seprod dropped $2.25 to close at $80.70 after 517 stocks passed through the market and Supreme Ventures rose 83 cents to $26.03 in an exchange of 17,709 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

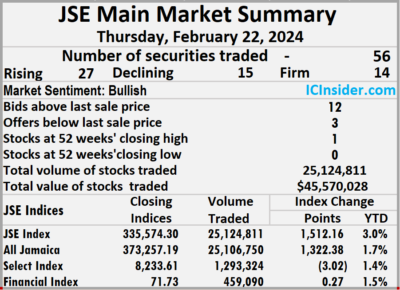

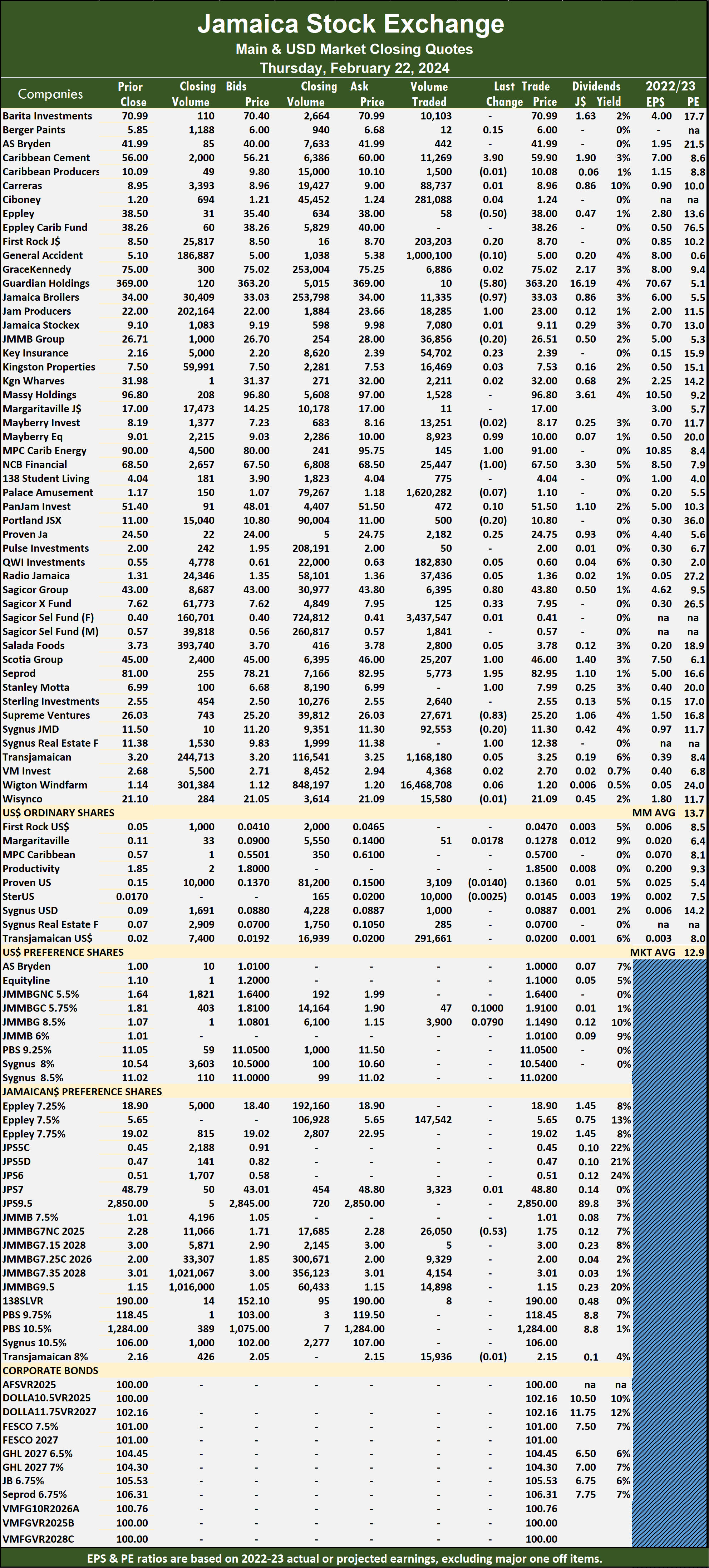

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed on Thursday with 25,124,811 shares being exchanged for $45,570,028 versus 33,827,768 units at $70,975,052 on Wednesday.

The market closed on Thursday with 25,124,811 shares being exchanged for $45,570,028 versus 33,827,768 units at $70,975,052 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year, ending around August 2024.

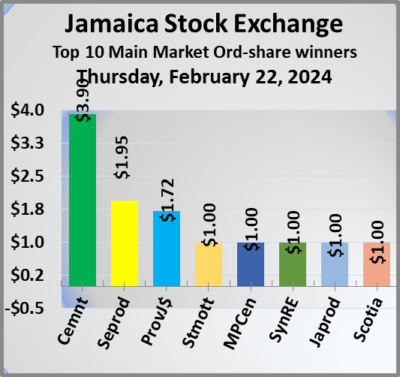

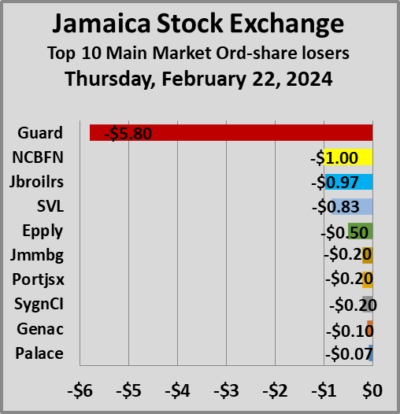

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year, ending around August 2024. MPC Caribbean Clean Energy rose $1 and ended at $91 with an exchange of 145 stocks, NCB Financial shed $1 to end at $67.50 in switching ownership of 25,447 stock units, Sagicor Group advanced 80 cents in closing at $43.80 with traders dealing in 6,395 shares. Sagicor Real Estate Fund climbed 33 cents to close at $7.95 in an exchange of 125 units, Scotia Group rallied $1 to $46, with 25,207 stocks crossing the market, Seprod popped $1.95 in closing at $82.95 in trading 5,773 stock units and Supreme Ventures declined by 83 cents to end at $25.20, with 27,671 shares crossing the exchange.

MPC Caribbean Clean Energy rose $1 and ended at $91 with an exchange of 145 stocks, NCB Financial shed $1 to end at $67.50 in switching ownership of 25,447 stock units, Sagicor Group advanced 80 cents in closing at $43.80 with traders dealing in 6,395 shares. Sagicor Real Estate Fund climbed 33 cents to close at $7.95 in an exchange of 125 units, Scotia Group rallied $1 to $46, with 25,207 stocks crossing the market, Seprod popped $1.95 in closing at $82.95 in trading 5,773 stock units and Supreme Ventures declined by 83 cents to end at $25.20, with 27,671 shares crossing the exchange. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

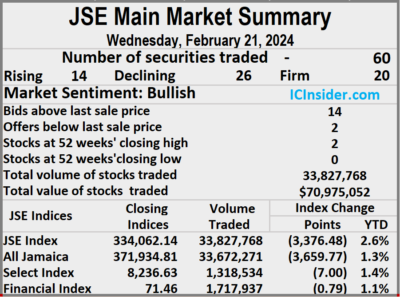

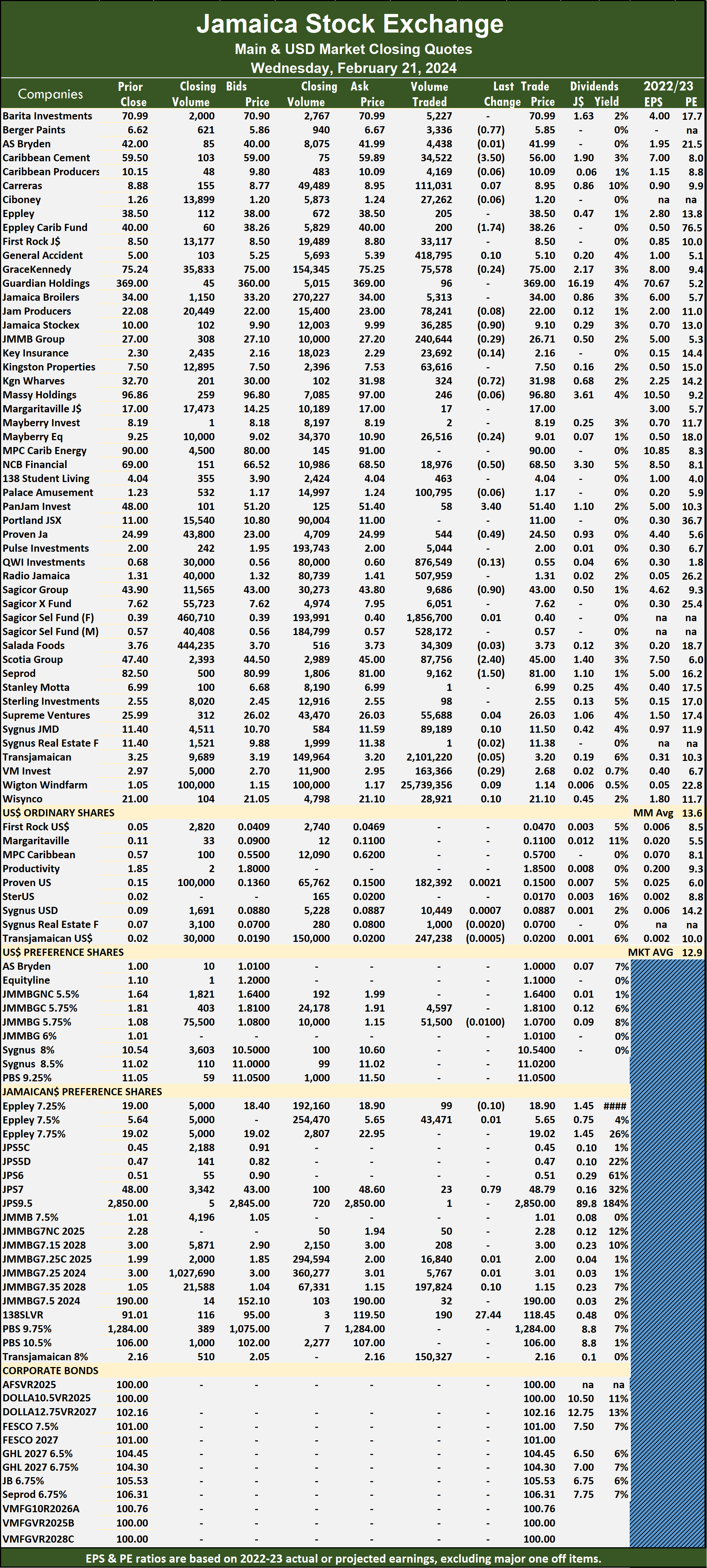

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with 33,827,768 shares being traded for $70,975,052 compared with 44,551,752 units at $385,321,406 on Tuesday.

The market closed with 33,827,768 shares being traded for $70,975,052 compared with 44,551,752 units at $385,321,406 on Tuesday. The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

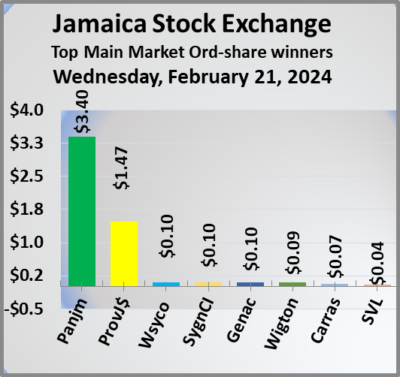

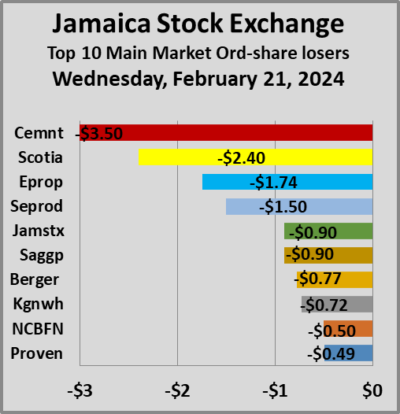

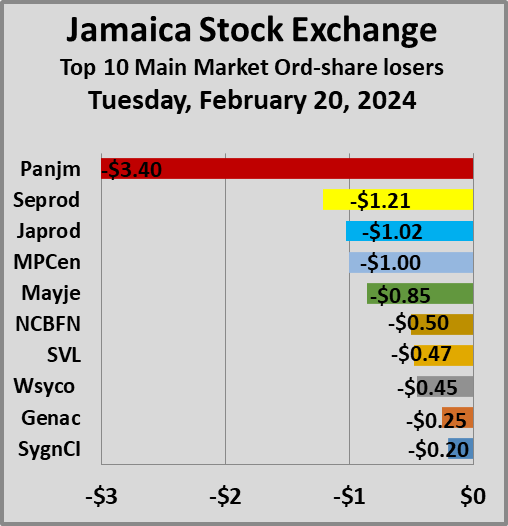

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. Pan Jamaica advanced $3.40 in closing at $51.40 with traders dealing in 58 stocks, Proven Investments skidded 49 cents to end at $24.50, with 544 stock units changing hands, Sagicor Group declined 90 cents to $43 with an exchange of 9,686 shares. Scotia Group fell $2.40 to $45 with 87,756 stocks clearing the market and Seprod dipped $1.50 to close at $81 while exchanging 9,162 units.

Pan Jamaica advanced $3.40 in closing at $51.40 with traders dealing in 58 stocks, Proven Investments skidded 49 cents to end at $24.50, with 544 stock units changing hands, Sagicor Group declined 90 cents to $43 with an exchange of 9,686 shares. Scotia Group fell $2.40 to $45 with 87,756 stocks clearing the market and Seprod dipped $1.50 to close at $81 while exchanging 9,162 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

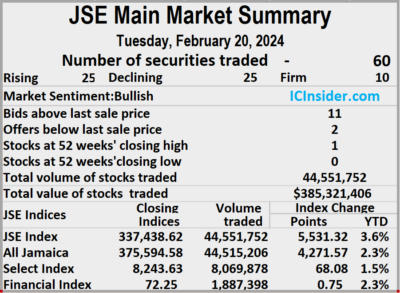

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading ended with a solid 78 percent rise in the volume of stocks traded and a 146 percent jump in value compared with Monday, following trading in 60 securities similar to Monday, and ending with with rising and declining price splitting 50 stocks equally, at 25 each with 10 ending unchanged.

Trading ended with a solid 78 percent rise in the volume of stocks traded and a 146 percent jump in value compared with Monday, following trading in 60 securities similar to Monday, and ending with with rising and declining price splitting 50 stocks equally, at 25 each with 10 ending unchanged. Wisynco Group closed with 2.41 million units for 5.4 percent market share and JMMB Group 7.35% – 2028 with 1.09 million units for 2.5 percent of total volume.

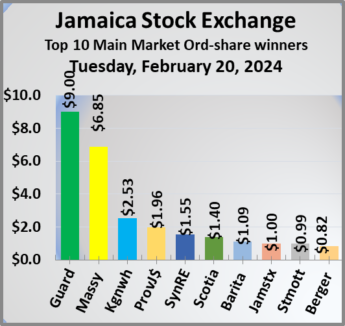

Wisynco Group closed with 2.41 million units for 5.4 percent market share and JMMB Group 7.35% – 2028 with 1.09 million units for 2.5 percent of total volume. Kingston Wharves increased $2.53 in closing at $32.70 after an exchange of 13,062 shares, Massy Holdings jumped $6.85 to $96.86 in trading 387 stocks, Mayberry Jamaican Equities sank 85 cents to $9.25, with 1,001,000 shares crossing the market. MPC Caribbean Clean Energy fell $1 to close at $90 with investors dealing in 180 stock units, NCB Financial skidded 50 cents to $69 after trading 21,081 units, Pan Jamaica lost $3.40 in closing at $48 with an exchange of 6,395 stocks. Scotia Group rose $1.40 to a 52 weeks’ closing high of $47.40 after 55,757 shares passed through the market, Seprod declined $1.21 to end at $82.50 while exchanging 3,561 stocks, Stanley Motta rallied 99 cents and ended at $6.99 with investors swapping 130 units. Supreme Ventures dropped 47 cents to $25.99 after a transfer of 45,032 stock units, Sygnus Real Estate Finance increased $1.55 to close at $11.40, with 2,500 shares crossing the market and Wisynco Group dipped 45 cents to end at $21 with investors transferring 2,405,113 stock units.

Kingston Wharves increased $2.53 in closing at $32.70 after an exchange of 13,062 shares, Massy Holdings jumped $6.85 to $96.86 in trading 387 stocks, Mayberry Jamaican Equities sank 85 cents to $9.25, with 1,001,000 shares crossing the market. MPC Caribbean Clean Energy fell $1 to close at $90 with investors dealing in 180 stock units, NCB Financial skidded 50 cents to $69 after trading 21,081 units, Pan Jamaica lost $3.40 in closing at $48 with an exchange of 6,395 stocks. Scotia Group rose $1.40 to a 52 weeks’ closing high of $47.40 after 55,757 shares passed through the market, Seprod declined $1.21 to end at $82.50 while exchanging 3,561 stocks, Stanley Motta rallied 99 cents and ended at $6.99 with investors swapping 130 units. Supreme Ventures dropped 47 cents to $25.99 after a transfer of 45,032 stock units, Sygnus Real Estate Finance increased $1.55 to close at $11.40, with 2,500 shares crossing the market and Wisynco Group dipped 45 cents to end at $21 with investors transferring 2,405,113 stock units. In the preference segment, Eppley 7.50% preference share fell $1.83 in closing at $5.64 after an exchange of 11,594 stocks, JMMB Group 7% preference share dropped 40 cents and ended at $2.28 with a transfer of 17 units and Productive Business Solutions 9.75% preference share shed $10.65 to $91.01 after exchanging 240 stocks.

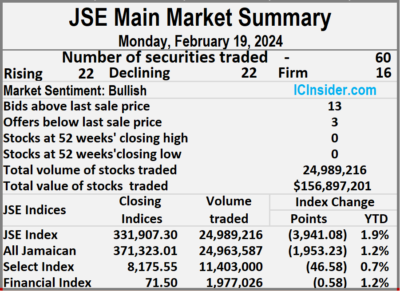

In the preference segment, Eppley 7.50% preference share fell $1.83 in closing at $5.64 after an exchange of 11,594 stocks, JMMB Group 7% preference share dropped 40 cents and ended at $2.28 with a transfer of 17 units and Productive Business Solutions 9.75% preference share shed $10.65 to $91.01 after exchanging 240 stocks. Trading ended with an exchange of 24,989,216 shares for $156,897,201 compared with 9,234,717 stock units at $63,291,889 on Friday.

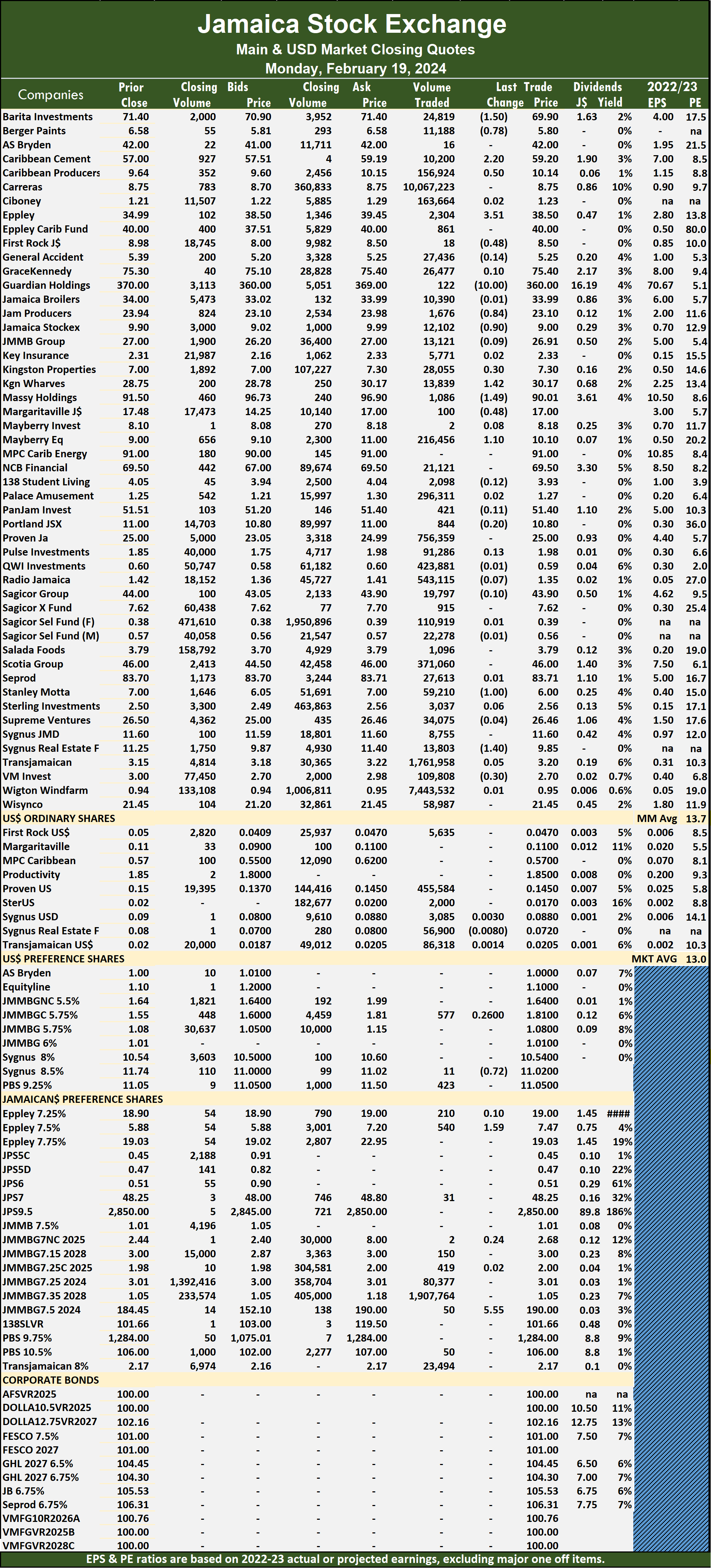

Trading ended with an exchange of 24,989,216 shares for $156,897,201 compared with 9,234,717 stock units at $63,291,889 on Friday. The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

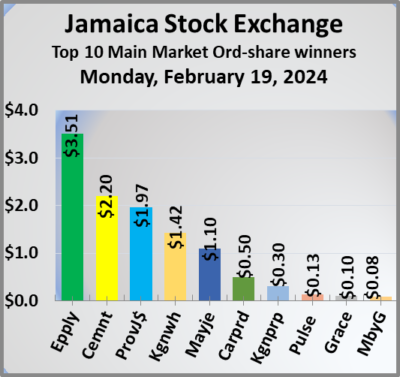

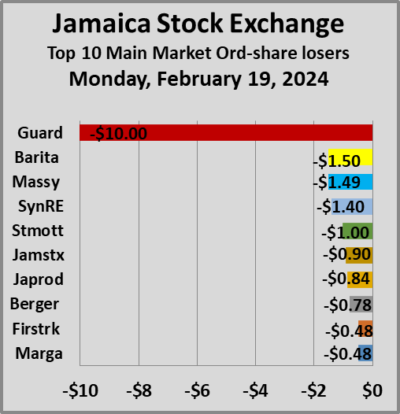

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. Kingston Properties rose 30 cents to $7.30 in switching ownership of 28,055 stocks, Kingston Wharves popped $1.42 to $30.17 with investors trading 13,839 units, Margaritaville fell 48 cents to close at $17 after an exchange of 100 stock units. Massy Holdings dipped $1.49 to close trading 1,086 shares at $90.01, Mayberry Jamaican Equities climbed $1.10 to $10.10 as investors exchanged 216,456 stocks, Stanley Motta sank $1 and ended at $6 after 59,210 units passed through the market. Sygnus Real Estate Finance skidded $1.40 to $9.85 with a transfer of 13,803 stock units and Victoria Mutual Investments lost 30 cents, closing at $2.70 after trading 109,808 shares.

Kingston Properties rose 30 cents to $7.30 in switching ownership of 28,055 stocks, Kingston Wharves popped $1.42 to $30.17 with investors trading 13,839 units, Margaritaville fell 48 cents to close at $17 after an exchange of 100 stock units. Massy Holdings dipped $1.49 to close trading 1,086 shares at $90.01, Mayberry Jamaican Equities climbed $1.10 to $10.10 as investors exchanged 216,456 stocks, Stanley Motta sank $1 and ended at $6 after 59,210 units passed through the market. Sygnus Real Estate Finance skidded $1.40 to $9.85 with a transfer of 13,803 stock units and Victoria Mutual Investments lost 30 cents, closing at $2.70 after trading 109,808 shares. In the preference segment, Eppley 7.50% preference share rallied $1.59 and ended at $7.47 after 540 stocks crossed the market and 138 Student Living preference share rose $5.55 to close at $190 after an exchange of 50 units.

In the preference segment, Eppley 7.50% preference share rallied $1.59 and ended at $7.47 after 540 stocks crossed the market and 138 Student Living preference share rose $5.55 to close at $190 after an exchange of 50 units.