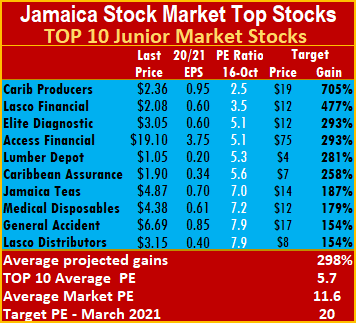

Investors responded strongly to Caribbean Cream more than doubling profit in the half year to August and a tripling of second quarter profit by pushing the stock up 9 percent on Friday, accounting for the second highest volume for the day. The rise in the stock price resulted in it moving out of IC TOP 10 Junior Market listing and replaced by Lumber Depot.

Lumber Depot returns to the top flight of stocks with earnings per share projected at 20 cents for the current fiscal year and the price just over $1. The Main Market is as you were last week, with no new change.

Lumber Depot returns to the top flight of stocks with earnings per share projected at 20 cents for the current fiscal year and the price just over $1. The Main Market is as you were last week, with no new change.

The Main Market closed the past week higher than the highest level since the beginning of July, except for September 30, another reminder that the market traditionally commences rallying in July each year and slowly builds towards the end of the year. The Junior Market closed the week just above the close of the previous week. That disguises the critical signal that is the market is currently sending. The jump in Caribbean Cream’s price this past week speaks eloquently to the underlying interest that is still in the market and displayed by the demand for Barita Investment stock, with investors’ demand pushing the price within a few dollars of the record high. The broader signal is the big surge that the Junior Market will experience in a few weeks as short term moving averages cross over longer-term ones to confirm a strong rally to come.

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Grace Kennedy.

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Grace Kennedy.

The local stock market’s targeted average PE ratio is 20 based on companies’ profits reporting full year’s results from now to the second quarter in 2021.  The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market.

The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 298 percent and 144 percent for the JSE Main Market, based on 2020-21 earnings, indicating potentially greater gains in the Junior Market than the Main Market.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

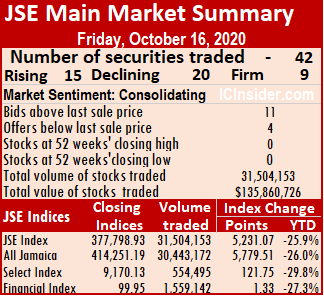

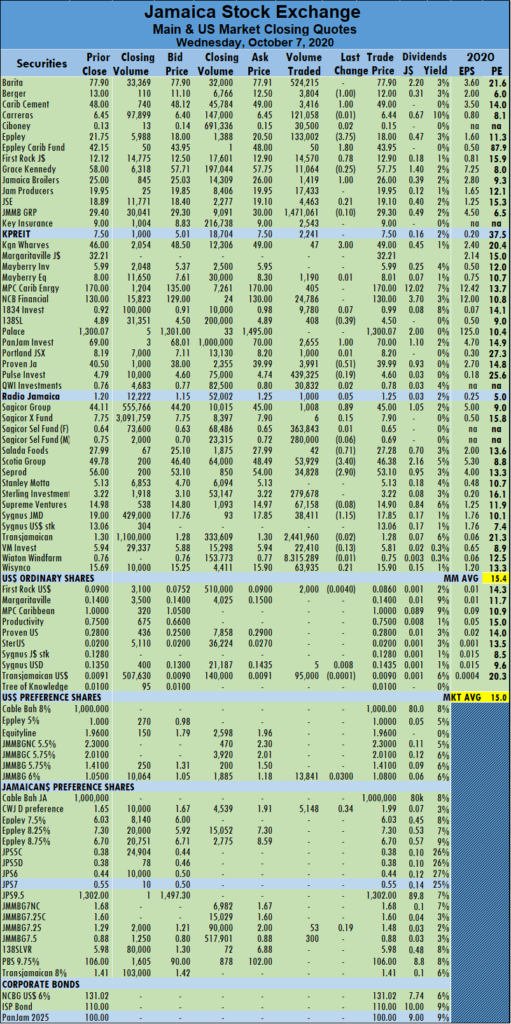

The All Jamaican Composite Index jumped 5,779.51 points to 414,251.19 and the Main Index climbed 5,231.07 points to 377,798.93, while the JSE Financial Index rose 1.33 points to settle at 99.95.

The All Jamaican Composite Index jumped 5,779.51 points to 414,251.19 and the Main Index climbed 5,231.07 points to 377,798.93, while the JSE Financial Index rose 1.33 points to settle at 99.95. The Investor’s Choice bid-offer indicator reading shows 12 stocks ending with bids higher than their last selling prices and four with lower offers.

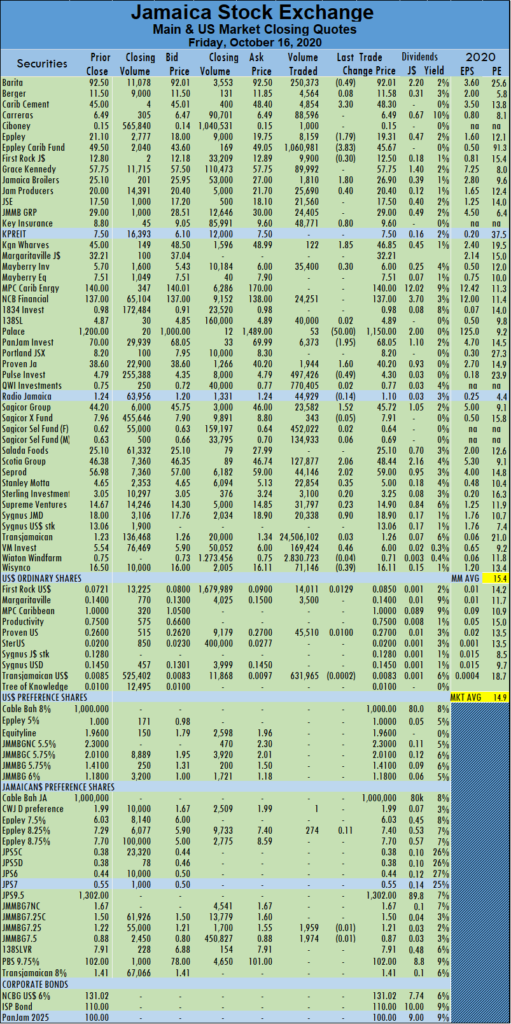

The Investor’s Choice bid-offer indicator reading shows 12 stocks ending with bids higher than their last selling prices and four with lower offers. Palace Amusement dropped $50 in closing at $1,150, with a transfer of 53 units, Pan Jam Investment fell $1.95 to $68.05 after trading 6,373 stock units. Proven Investments gained $1.60 to end at $40.20 with an exchange of 1,944 stock units, Pulse Investments lost 49 cents in closing at $4.30, after the transfer of 497,426 shares, Sagicor Group rose $1.52 to end at $45.72, with 23,582 stock units changing hands. Scotia Group climbed $2.06 to $48.44, trading 127,877 shares, Seprod settled at $59, with gains of $2.02 with the transfer of 44,146 shares, Stanley Motta gained 35 cents to close at $5, in exchanging 22,854 stock units. Sygnus Credit Investments finished 90 cents higher at $18.90, with 20,338 stock units crossing the market, Victoria Mutual Investments gained 46 cents to settle at $6 after exchanging 169,424 shares and Wisynco Group lost 39 cents to close at $16.11, trading 71,146 stock units.

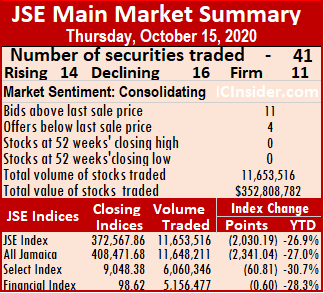

Palace Amusement dropped $50 in closing at $1,150, with a transfer of 53 units, Pan Jam Investment fell $1.95 to $68.05 after trading 6,373 stock units. Proven Investments gained $1.60 to end at $40.20 with an exchange of 1,944 stock units, Pulse Investments lost 49 cents in closing at $4.30, after the transfer of 497,426 shares, Sagicor Group rose $1.52 to end at $45.72, with 23,582 stock units changing hands. Scotia Group climbed $2.06 to $48.44, trading 127,877 shares, Seprod settled at $59, with gains of $2.02 with the transfer of 44,146 shares, Stanley Motta gained 35 cents to close at $5, in exchanging 22,854 stock units. Sygnus Credit Investments finished 90 cents higher at $18.90, with 20,338 stock units crossing the market, Victoria Mutual Investments gained 46 cents to settle at $6 after exchanging 169,424 shares and Wisynco Group lost 39 cents to close at $16.11, trading 71,146 stock units. At the close, the All Jamaican Composite Index dropped 2,341.04 points to 408,471.68, the Main Index fell 2,030.19 points to 372,567.86 and the JSE Financial Index lost 0.60 points to settle at 98.62.

At the close, the All Jamaican Composite Index dropped 2,341.04 points to 408,471.68, the Main Index fell 2,030.19 points to 372,567.86 and the JSE Financial Index lost 0.60 points to settle at 98.62. Trading ended with an average of 284,232 units changing hands at $8,605,092 for each traded security compared to an average of 761,427 shares at $40,258,610 on Wednesday. The average trade for the month to date ended at 316,587 units at $6,160,243 for each security, in contrast to 319,665 units at $5,927,670. Trading month to date compares well to September’s average of 265,170 units at $3,271,625.

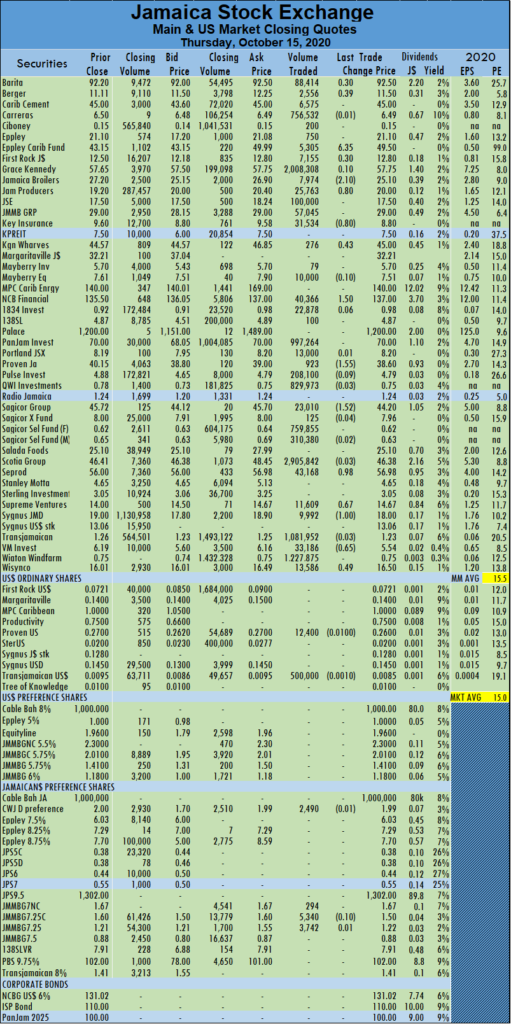

Trading ended with an average of 284,232 units changing hands at $8,605,092 for each traded security compared to an average of 761,427 shares at $40,258,610 on Wednesday. The average trade for the month to date ended at 316,587 units at $6,160,243 for each security, in contrast to 319,665 units at $5,927,670. Trading month to date compares well to September’s average of 265,170 units at $3,271,625. First Rock Capital ended 30 cents higher at $12.80, in transferring 7,155 units, Jamaica Broilers Group declined by $2.10 to settle at $25.10, with investors swapping 7,974 units, Jamaica Producers rose 80 cents to end at $20, with 25,763 stock units crossing the exchange. Key Insurance shed 80 cents in closing at $8.80, trading 31,534 shares, Kingston Wharves gained 43 cents to finish at $45, in transferring 276 units, NCB Financial climbed $1.50 to settle at $137, with 40,366 shares changing hands. Proven Investments fell $1.55 to end at $38.60 trading 923 units, Sagicor Group declined $1.52 to settle at $44.20, with 23,010 stock units crossing the exchange, Seprod closed 98 cents higher to $56.98 after 43,168 shares passed through the market. Supreme Ventures ended with gains of 67 cents as investors switched ownership of 11,609 stock units, Sygnus Credit Investments shed $1 to end at $18, in exchanging 9,992 units, Victoria Mutual Investments lost 65 cents to settle at $5.54, with 33,186 stock units changing hands and Wisynco Group gained 49 cents to end at $16.50 trading 13,586 stock units.

First Rock Capital ended 30 cents higher at $12.80, in transferring 7,155 units, Jamaica Broilers Group declined by $2.10 to settle at $25.10, with investors swapping 7,974 units, Jamaica Producers rose 80 cents to end at $20, with 25,763 stock units crossing the exchange. Key Insurance shed 80 cents in closing at $8.80, trading 31,534 shares, Kingston Wharves gained 43 cents to finish at $45, in transferring 276 units, NCB Financial climbed $1.50 to settle at $137, with 40,366 shares changing hands. Proven Investments fell $1.55 to end at $38.60 trading 923 units, Sagicor Group declined $1.52 to settle at $44.20, with 23,010 stock units crossing the exchange, Seprod closed 98 cents higher to $56.98 after 43,168 shares passed through the market. Supreme Ventures ended with gains of 67 cents as investors switched ownership of 11,609 stock units, Sygnus Credit Investments shed $1 to end at $18, in exchanging 9,992 units, Victoria Mutual Investments lost 65 cents to settle at $5.54, with 33,186 stock units changing hands and Wisynco Group gained 49 cents to end at $16.50 trading 13,586 stock units.

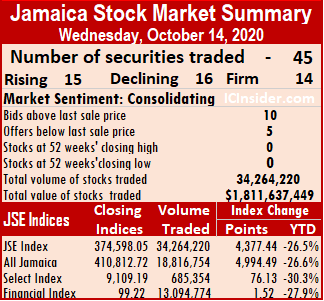

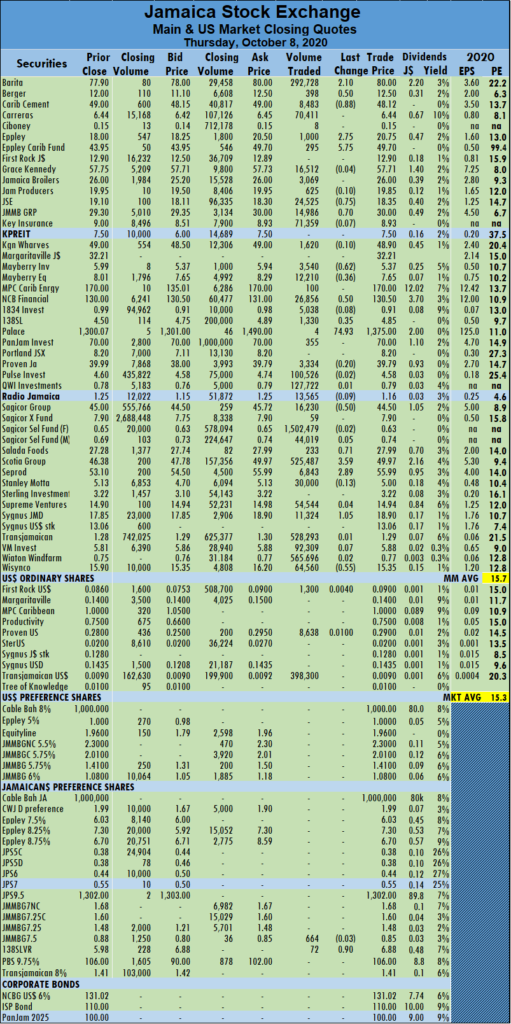

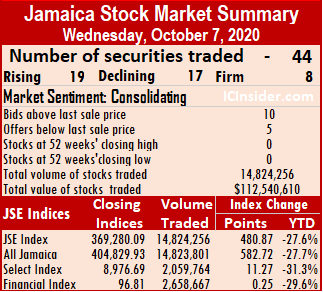

Eppley Caribbean Property Fund led trading with 45.1 percent of total volume with 15.45 million shares, followed by Barita Investments with 35.4 percent as 12.14 million units passed through the market, Transjamaican Highway ended with 6 percent market share after 2.07 million units traded and Wigton Windfarm closed with 5.7 percent market share after 1.95 million units changed hands.

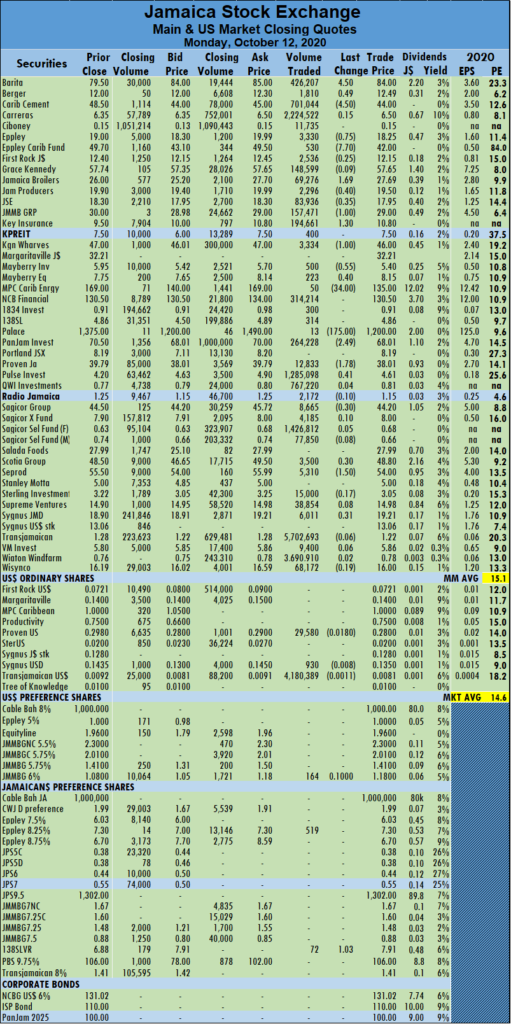

Eppley Caribbean Property Fund led trading with 45.1 percent of total volume with 15.45 million shares, followed by Barita Investments with 35.4 percent as 12.14 million units passed through the market, Transjamaican Highway ended with 6 percent market share after 2.07 million units traded and Wigton Windfarm closed with 5.7 percent market share after 1.95 million units changed hands. Jamaica Broilers Group shed 30 cents, exchanging 15,596 stock units to end at $27.20, Jamaica Stock Exchange closed at $17.50, after losing 55 cents with 19,433 stock units changing hands, Key Insurance declined by $1.30 to end at $9.60, after crossing the market with 520,574 shares. Kingston Wharves climbed $4.55 to $44.57 in trading 744 units, MPC Caribbean Clean Energy advanced by $5 to $140, with a transfer of only one unit, NCB Financial gained 50 cents in closing at $135.50 in exchanging 12,048 units. Sagicor Group rose $1.61 to $45.72, with 15,464 units passing through the market, Scotia Group shed 33 cents trading 62,120 shares and closed at $46.41, Seprod climbed $2 to $56, in exchanging 14,820 units. Stanley Motta lost 35 cents to end at $4.65 after trading 11,537 units, Supreme Ventures slid 90 cents in closing at $14, with 32,582 units crossing the exchange and Victoria Mutual Investments gained 32 cents to finish at $6.19 after investors trading 58,707 shares.

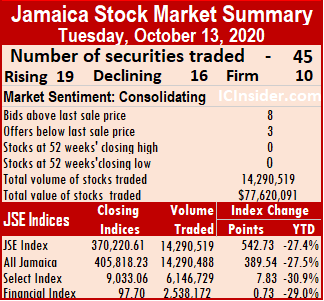

Jamaica Broilers Group shed 30 cents, exchanging 15,596 stock units to end at $27.20, Jamaica Stock Exchange closed at $17.50, after losing 55 cents with 19,433 stock units changing hands, Key Insurance declined by $1.30 to end at $9.60, after crossing the market with 520,574 shares. Kingston Wharves climbed $4.55 to $44.57 in trading 744 units, MPC Caribbean Clean Energy advanced by $5 to $140, with a transfer of only one unit, NCB Financial gained 50 cents in closing at $135.50 in exchanging 12,048 units. Sagicor Group rose $1.61 to $45.72, with 15,464 units passing through the market, Scotia Group shed 33 cents trading 62,120 shares and closed at $46.41, Seprod climbed $2 to $56, in exchanging 14,820 units. Stanley Motta lost 35 cents to end at $4.65 after trading 11,537 units, Supreme Ventures slid 90 cents in closing at $14, with 32,582 units crossing the exchange and Victoria Mutual Investments gained 32 cents to finish at $6.19 after investors trading 58,707 shares. At the close, the All Jamaican Composite Index rose 389.54 points to 405,818.23, the Main Index gained 542.73 points to 370,220.61 and the JSE Financial Index added 0.73 points to settle at 97.70.

At the close, the All Jamaican Composite Index rose 389.54 points to 405,818.23, the Main Index gained 542.73 points to 370,220.61 and the JSE Financial Index added 0.73 points to settle at 97.70. The average trade for the month to date ended at 268,164 units at $1,925,358 for each security, in contrast to 261,644 units at $1,951,813. Trading month to date compares well to September’s average of 265,170 units at $3,271,625.

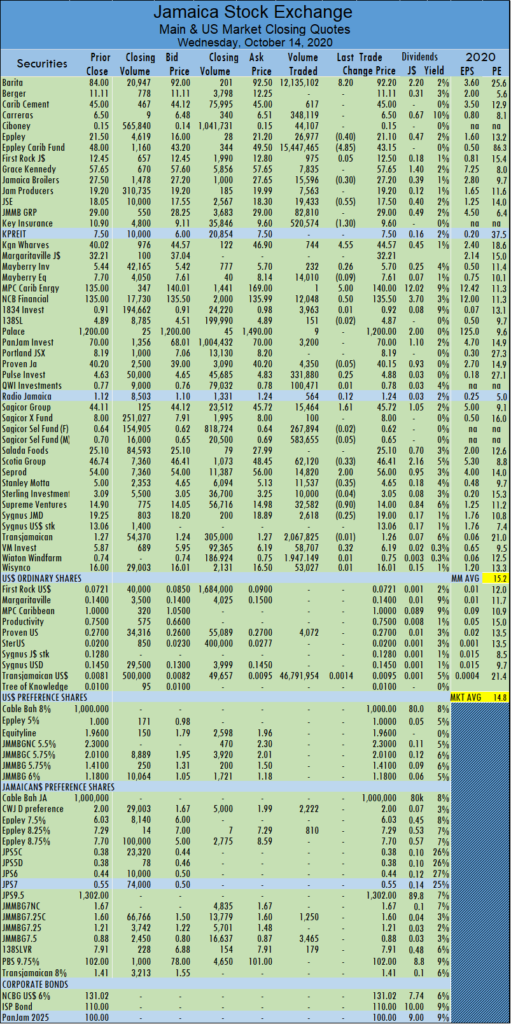

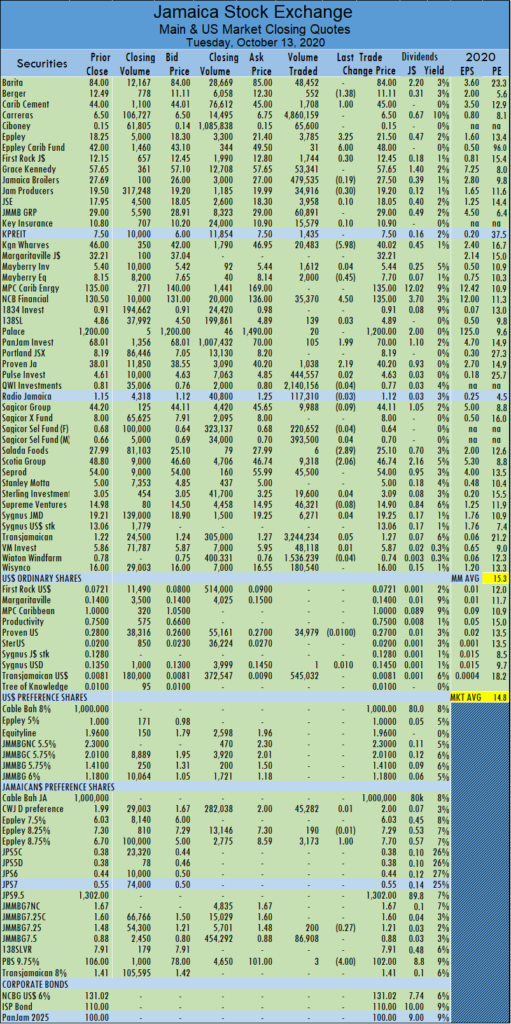

The average trade for the month to date ended at 268,164 units at $1,925,358 for each security, in contrast to 261,644 units at $1,951,813. Trading month to date compares well to September’s average of 265,170 units at $3,271,625. Jamaica Producers lost 30 cents to settle at $19.20 trading 34,916 shares, Kingston Wharves declined $5.98 in closing at $40.02, in an exchange of 20,483 stock units, Mayberry Jamaican Equities lost 45 cents to settle at $7.70, with a transfer of 2,000 units. NCB Financial advanced by $4.50 to $135 after 35,370 shares crossed the market, PanJam Investment rose $1.99 in exchanging 105 units at $70. Proven Investments closed at $40.20, after rising $2.19 with a transfer of 1,038 stock units, Salada Foods ended at $25.10, after losing $2.89 trading a mere 6 shares and Scotia Group fell $2.06 to settle at $46.74, in exchanging 9,318 stock units.

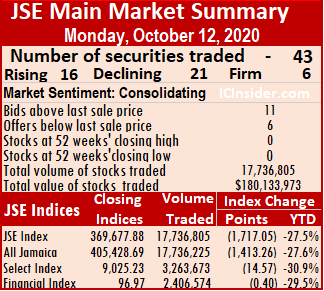

Jamaica Producers lost 30 cents to settle at $19.20 trading 34,916 shares, Kingston Wharves declined $5.98 in closing at $40.02, in an exchange of 20,483 stock units, Mayberry Jamaican Equities lost 45 cents to settle at $7.70, with a transfer of 2,000 units. NCB Financial advanced by $4.50 to $135 after 35,370 shares crossed the market, PanJam Investment rose $1.99 in exchanging 105 units at $70. Proven Investments closed at $40.20, after rising $2.19 with a transfer of 1,038 stock units, Salada Foods ended at $25.10, after losing $2.89 trading a mere 6 shares and Scotia Group fell $2.06 to settle at $46.74, in exchanging 9,318 stock units. At the close, the All Jamaican Composite Index declined 1,413.26 points to end at 405,428.69, the Main Index dropped 1,717.05 points to 369,677.88 and the JSE Financial Index shed 0.40 points to settle at 96.97.

At the close, the All Jamaican Composite Index declined 1,413.26 points to end at 405,428.69, the Main Index dropped 1,717.05 points to 369,677.88 and the JSE Financial Index shed 0.40 points to settle at 96.97. The average trade for the month to date ended at 261,644 units at $1,951,813 for each security, in contrast to 239,879 units at $1,628,974. September ended with an average of 265,170 units at $3,271,625.

The average trade for the month to date ended at 261,644 units at $1,951,813 for each security, in contrast to 239,879 units at $1,628,974. September ended with an average of 265,170 units at $3,271,625. Mayberry Investments lost 55 cents to end at $5.40, with 500 units changing hands, Mayberry Jamaican Equities ended at $8.15, after gaining 40 cents with investors switching ownership of 223 stocks, MPC Caribbean Clean Energy dropped $34 to end at $135 trading 50 units. Palace Amusement dipped $175 to $1,200 in clearing the market with 13 units, PanJam Investment closed $2.49 lower at $68.01, in trading 264,228 shares, Proven Investments fell $1.78 to settle at $38.01, with 12,833 stock units passing through the market. Pulse Investments gained 41 cents in closing at $4.61 trading 1,285,098 shares, Sagicor Group lost 30 cents to end at $44.20, with investors swapping 8,665 stock units, Scotia Group gained 30 cents to close at $48.80, in exchanging 3,500 units. Seprod declined $1.50 to end at $54, trading 5,310 stock units and Sygnus Credit Investments gained 31 cents to settle at $19.21 in an exchange of 6,011 stock units.

Mayberry Investments lost 55 cents to end at $5.40, with 500 units changing hands, Mayberry Jamaican Equities ended at $8.15, after gaining 40 cents with investors switching ownership of 223 stocks, MPC Caribbean Clean Energy dropped $34 to end at $135 trading 50 units. Palace Amusement dipped $175 to $1,200 in clearing the market with 13 units, PanJam Investment closed $2.49 lower at $68.01, in trading 264,228 shares, Proven Investments fell $1.78 to settle at $38.01, with 12,833 stock units passing through the market. Pulse Investments gained 41 cents in closing at $4.61 trading 1,285,098 shares, Sagicor Group lost 30 cents to end at $44.20, with investors swapping 8,665 stock units, Scotia Group gained 30 cents to close at $48.80, in exchanging 3,500 units. Seprod declined $1.50 to end at $54, trading 5,310 stock units and Sygnus Credit Investments gained 31 cents to settle at $19.21 in an exchange of 6,011 stock units.

The markets moved moderately higher to close at their highest levels since mid-August for the. The Main Market closed the past week higher than the previous one, but the Junior Market closed the week lower than the prior one.

The markets moved moderately higher to close at their highest levels since mid-August for the. The Main Market closed the past week higher than the previous one, but the Junior Market closed the week lower than the prior one. With expected gains of 152 to 240 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Carreras. Radio Jamaica is now down to the fifth spot with slightly lower earnings per share of 15 cents from 20 cents previously.

With expected gains of 152 to 240 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Carreras. Radio Jamaica is now down to the fifth spot with slightly lower earnings per share of 15 cents from 20 cents previously. The average projected gain for the Junior Market IC TOP 10 stocks is 279 percent and 145 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market.

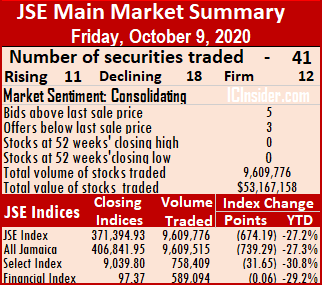

The average projected gain for the Junior Market IC TOP 10 stocks is 279 percent and 145 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market. At the close, the All Jamaican Composite Index lost 739.29 points to settle at 406,841.95, the Main Index lost 674.19 points to finish 371,394.93, the JSE Financial Index shed 0.06 points to end at 97.37.

At the close, the All Jamaican Composite Index lost 739.29 points to settle at 406,841.95, the Main Index lost 674.19 points to finish 371,394.93, the JSE Financial Index shed 0.06 points to end at 97.37. Trading concluded with an average of 234,385 units changing hands at $1,296,760 for each security, compared to an average of 101,034 shares at $1,503,956 on Thursday. The average trade for the month to date ended at 239,879 units at $1,628,974 for each security, in contrast to 240,756 units at $1,681,973 on Thursday. Trading for the month to date compares adversely to September’s average of 265,170 at $3,271,625.

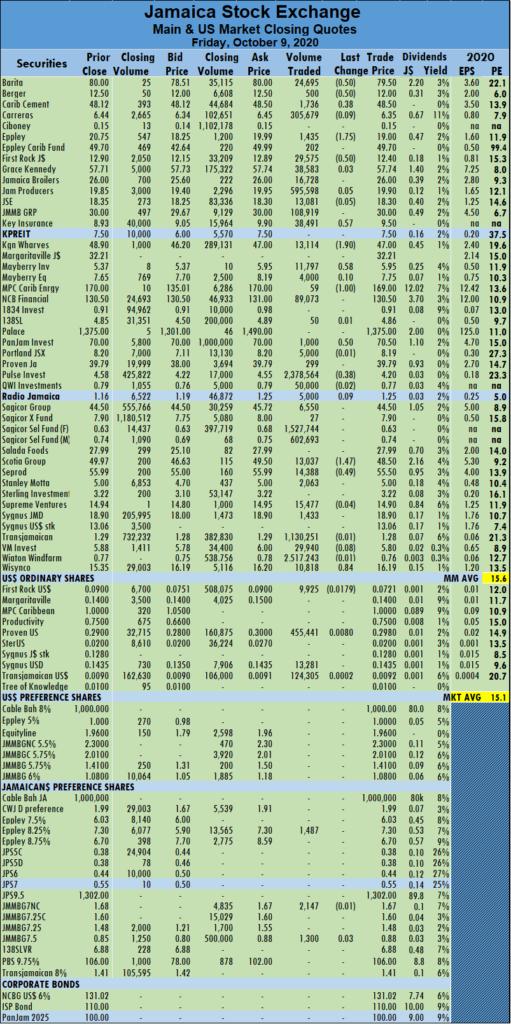

Trading concluded with an average of 234,385 units changing hands at $1,296,760 for each security, compared to an average of 101,034 shares at $1,503,956 on Thursday. The average trade for the month to date ended at 239,879 units at $1,628,974 for each security, in contrast to 240,756 units at $1,681,973 on Thursday. Trading for the month to date compares adversely to September’s average of 265,170 at $3,271,625. Eppley shed $1.75 to close at $19 with 1,435 units trading, First Rock Capital fell 50 cents to finish at $12.40 with investors transferring 29,575 stocks, Key Insurance rose 57 cents to settle at $9.50 with an exchange of 38,491 stocks. Kingston Wharves dropped $1.90 to end at $47 with 13,114 stock units changing hands, Mayberry Investments gained 58 cents to close at $5.95 trading 11,797 shares, MPC Caribbean Clean Energy declined $1 to finish at $169 with investors transferring 59 stock units. PanJam Investment climbed 50 cents to settle at $70.50 with 1,000 units passing through the market, Pulse Investments fell 38 cents to end at $4.20 with an exchange of 2,378,564 stock units, Scotia Group lost $1.47 to close at $48.50 with 13,037 stocks changing hands. Seprod dropped 49 cents to settle at $55.50 after trading 14,388 stock units and Wisynco Group climbed 84 cents to finish at $16.19 with 10,818 units crossing the exchange.

Eppley shed $1.75 to close at $19 with 1,435 units trading, First Rock Capital fell 50 cents to finish at $12.40 with investors transferring 29,575 stocks, Key Insurance rose 57 cents to settle at $9.50 with an exchange of 38,491 stocks. Kingston Wharves dropped $1.90 to end at $47 with 13,114 stock units changing hands, Mayberry Investments gained 58 cents to close at $5.95 trading 11,797 shares, MPC Caribbean Clean Energy declined $1 to finish at $169 with investors transferring 59 stock units. PanJam Investment climbed 50 cents to settle at $70.50 with 1,000 units passing through the market, Pulse Investments fell 38 cents to end at $4.20 with an exchange of 2,378,564 stock units, Scotia Group lost $1.47 to close at $48.50 with 13,037 stocks changing hands. Seprod dropped 49 cents to settle at $55.50 after trading 14,388 stock units and Wisynco Group climbed 84 cents to finish at $16.19 with 10,818 units crossing the exchange. The average trade for the month to date ended at 240,756 units for $1,681,973 for each security, in contrast to 268,050 units at $1,716,749. Trading for the month to date compares to September’s average of 265,170 units at $3,271,625.

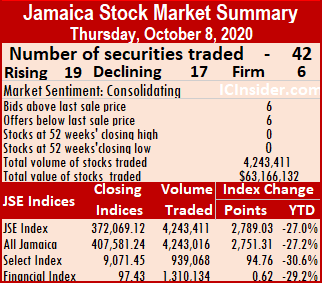

The average trade for the month to date ended at 240,756 units for $1,681,973 for each security, in contrast to 268,050 units at $1,716,749. Trading for the month to date compares to September’s average of 265,170 units at $3,271,625. Mayberry Investments shed 62 cents to end at $5.37, with investors switching ownership of 3,540 units, Mayberry Jamaican Equities lost 36 cents after ending at $7.65 with an exchange of 12,210 stock units, NCB Financial gained 50 cents to close at $130.50, after crossing the exchange with 26,856 shares. 138 Student Living rose 35 cents to close at $4.85 while exchanging 1,330 units, Palace Amusement jumped $74.93 in closing at $1,375, after transferring a mere 4 units, Sagicor Group fell 50 cents to $44.50, with 16,230 stock units changing hands, Salada Foods rose 71 cents to $27.99 trading 233 units. Scotia Group climbed $3.59 to settle at $49.97, with 525,487 shares passing through the market, Seprod closed at $55.99, after rising $2.89 after 6,843 units crossed the market, Sygnus Credit Investments gained $1.05 to settle at $18.90, in exchanging 11,324 stock units and Wisynco Group slipped 55 cents to $15.35, after crossing the exchange with 64,560 shares. In the preference segment of the Main Market, 138 Student Living Preference shares gained 90 cents to close at $6.88, after exchanging 72 units.

Mayberry Investments shed 62 cents to end at $5.37, with investors switching ownership of 3,540 units, Mayberry Jamaican Equities lost 36 cents after ending at $7.65 with an exchange of 12,210 stock units, NCB Financial gained 50 cents to close at $130.50, after crossing the exchange with 26,856 shares. 138 Student Living rose 35 cents to close at $4.85 while exchanging 1,330 units, Palace Amusement jumped $74.93 in closing at $1,375, after transferring a mere 4 units, Sagicor Group fell 50 cents to $44.50, with 16,230 stock units changing hands, Salada Foods rose 71 cents to $27.99 trading 233 units. Scotia Group climbed $3.59 to settle at $49.97, with 525,487 shares passing through the market, Seprod closed at $55.99, after rising $2.89 after 6,843 units crossed the market, Sygnus Credit Investments gained $1.05 to settle at $18.90, in exchanging 11,324 stock units and Wisynco Group slipped 55 cents to $15.35, after crossing the exchange with 64,560 shares. In the preference segment of the Main Market, 138 Student Living Preference shares gained 90 cents to close at $6.88, after exchanging 72 units. The average trade for the month to date ended at 268,050 units at $1,716,749 for each security, in contrast to 250,330 units at $1,500,353. Trading, month to date, compares well to September’s average of 265,170 units at $3,271,625.

The average trade for the month to date ended at 268,050 units at $1,716,749 for each security, in contrast to 250,330 units at $1,500,353. Trading, month to date, compares well to September’s average of 265,170 units at $3,271,625. Kingston advanced by $3 to $49, with investors swapping 47 units. 138 Student Living lost 39 cents to close at $4.50, in exchange of 408 units, PanJam Investment settled at $70, with gains of $1 after trading 2,655 units, Proven Investments lost 51 cents to end at $39.99, in clearing the market with 3,991 units, Sagicor Group rose 89 cents to end at $45, after an exchange of 1,008 units. Salada Foods shed 71 cents to finish at $27.28, in trading 42 units, Scotia Group declined $3.40 to end at $46.38, with 53 929 shares trading, Seprod finished at $53.10, after losing $2.90 and exchanging 34,828 shares and Sygnus Credit Investments declined by $1.15 to end at $17.85 trading 38,411 shares.

Kingston advanced by $3 to $49, with investors swapping 47 units. 138 Student Living lost 39 cents to close at $4.50, in exchange of 408 units, PanJam Investment settled at $70, with gains of $1 after trading 2,655 units, Proven Investments lost 51 cents to end at $39.99, in clearing the market with 3,991 units, Sagicor Group rose 89 cents to end at $45, after an exchange of 1,008 units. Salada Foods shed 71 cents to finish at $27.28, in trading 42 units, Scotia Group declined $3.40 to end at $46.38, with 53 929 shares trading, Seprod finished at $53.10, after losing $2.90 and exchanging 34,828 shares and Sygnus Credit Investments declined by $1.15 to end at $17.85 trading 38,411 shares.