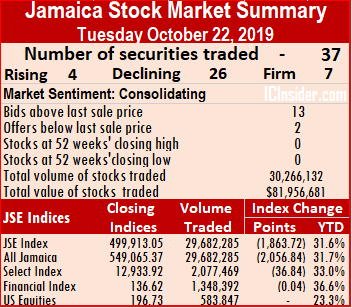

The Jamaica Stock Exchange main market declined as the prices of 26 stocks tumbled and just 4 rose on Tuesday and just 7 closed with the prices unchanged as 37 securities changed hands in both the main and US dollar markets.

The Jamaica Stock Exchange main market declined as the prices of 26 stocks tumbled and just 4 rose on Tuesday and just 7 closed with the prices unchanged as 37 securities changed hands in both the main and US dollar markets.

At the close of trading, the All Jamaican Composite Index declined by 2,056.84 points to 549,065.37, the JSE Index falling 1,863.72 points to 499,913.05 and The JSE Financial Index that was started early this year, inched just 0.04 points lower, to end at 136.62.

Main market activity ended with 35 securities trading, resulting in 29,682,285 units valued at $61,647,404 in contrast to 31,484,701 units valued at $125,777,352 from 34 securities trading on Friday.

Wigton Windfarm led trading with 20.7 million units for 70 percent of total volume, followed by Sagicor Select Funds with 7.1 million shares for 24 percent of the market’s trade and QWI Investments 635,758 units accounting for 2 percent of the day’s trade.

The market closed with an average of 848,065 units valued at $1,761,354 for each security traded, in contrast to 1,015,636 units for an average of $4,057,334 on Friday.  The average volume and value for the month to date amounts to 924,647 shares at a value of $14,346,378 for each security traded and previously 929,723 shares at $15,239,838 for each stock traded. The market closed September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

The average volume and value for the month to date amounts to 924,647 shares at a value of $14,346,378 for each security traded and previously 929,723 shares at $15,239,838 for each stock traded. The market closed September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer reading shows 13 securities ended with bids higher than their last selling prices and 2 with lower offers. The PE ratio of the market ended at 16.2 with the main market ending at 16.8 times 2019 current year’s earnings.

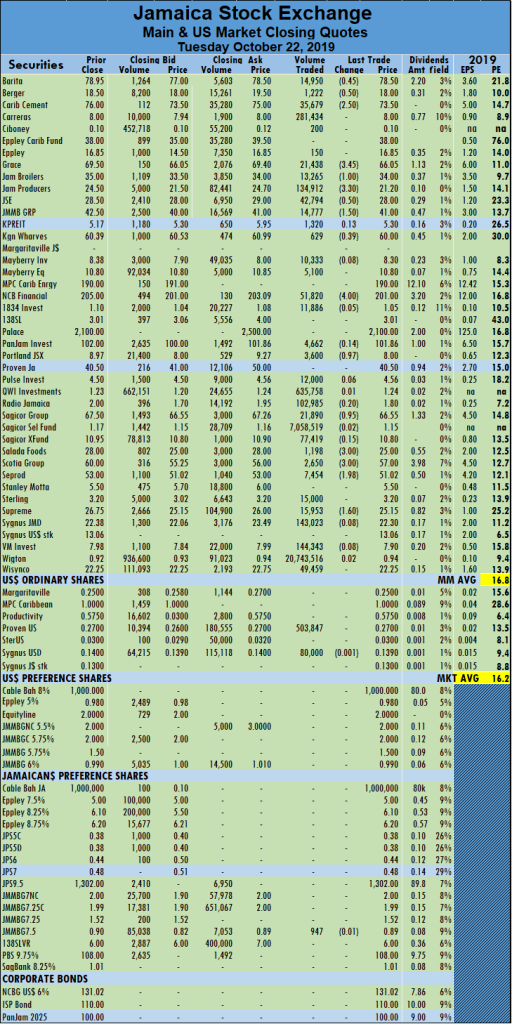

In main market activity, Barita closed 45 cents lower to $78.50, after trading 14,950 shares, Berger Paints ended at $1 and lost 50 cents in swapping 1,222 shares, Carib Cement dived $2.50 trading 35,679 shares, in closing at $73.50. Grace Kennedy declined by $3.45 to close at $66.05 with 21,438 shares changing hands, Jamaica Broilers lost $1 in exchanging 13,265 shares to settle at $34, Jamaica Producers closed $3.30 lower to $21.20 while trading 134,912 shares, Jamaica Stock Exchange dropped 50 cents at $28 with 42,794 shares traded. JMMB Group slid to $41, losing $1.50 in swapping 14,777 shares.  Kingston Wharves lost 39 cents to settle at $60 trading 629 shares, NCB Financial closed $4 lower to $201 with an exchange of 51,820 shares, Portland JSX fell by 97 cents to $8, after trading 3,600 shares, Sagicor Group settled at $66.55, after losing 95 cents with 21,890 shares changing hands. Salada Foods closed $3 lower to $25, in swapping 1,198 shares, Scotia Group dropped $3 and ended at $57 in exchanging 2,650 shares, Seprod lost $1.98 to close at $51.02 after exchanging 7,454 shares and Supreme Ventures closed $1.60 lower to $25.15 with 15,953 shares changing hands.

Kingston Wharves lost 39 cents to settle at $60 trading 629 shares, NCB Financial closed $4 lower to $201 with an exchange of 51,820 shares, Portland JSX fell by 97 cents to $8, after trading 3,600 shares, Sagicor Group settled at $66.55, after losing 95 cents with 21,890 shares changing hands. Salada Foods closed $3 lower to $25, in swapping 1,198 shares, Scotia Group dropped $3 and ended at $57 in exchanging 2,650 shares, Seprod lost $1.98 to close at $51.02 after exchanging 7,454 shares and Supreme Ventures closed $1.60 lower to $25.15 with 15,953 shares changing hands.

Trading in the US dollar market ended with 583,847 units valued at $147,169 and the market index closed at 196.73. Proven Investments traded 503,847 units to close at 27 US cents and Sygnus Credit Investments ended the day’s trading at 13.9 US cents, after falling a fraction of 1 US cent with 80,000 shares changing hands.

26 JSE stocks fall just 4 rise on Tuesday

42% gain pushes MPC out of IC TOP 10

Infrequent trader MPC Caribbean Clean Energy after just six weeks on the TOP 10 main market chart with the price at $134 dropped out this week, with the price hitting $190 for a gain of 42 percent.

Infrequent trader MPC Caribbean Clean Energy after just six weeks on the TOP 10 main market chart with the price at $134 dropped out this week, with the price hitting $190 for a gain of 42 percent.

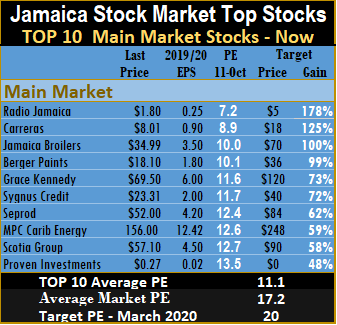

MPC was the only stock leaving the main market listing and is replaced by Stanley Motta with the stock price dropping to $5.50. Jetcon Corporation returns to the Junior Market after General Accident rising to $8 and falling to the 13th position on the overall Junior Market ranking.

Market activity resulted in no change to the top three Junior Market stocks, leaving Caribbean Producers with projected gains of 240 percent as the leader,

followed by Iron Rock with potential gains of 204 percent and Jamaican Teas with 158 percent.

followed by Iron Rock with potential gains of 204 percent and Jamaican Teas with 158 percent.

Increased investors’ interest pushed the price of Radio Jamaica to $1.99 with projected gains now down to 151 percent from last week’s 213 percent but still remains the leading main market stock with potential gains. Carreras sits at the number two spot with likely gains of 125 percent and Jamaica Broilers with projected gains of 100 percent is next.

The main market, closed the week with the overall PE of 17.3, inching up from 17.2 for the previous week and the Junior Market rose to 12 from 11.1 last week based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks average rose to 7.9 from 7.7 and the main market PE remains at 11.1.

The main market, closed the week with the overall PE of 17.3, inching up from 17.2 for the previous week and the Junior Market rose to 12 from 11.1 last week based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks average rose to 7.9 from 7.7 and the main market PE remains at 11.1.

The TOP 10 stocks now trade at a discount of 34 percent to the average for Junior Market stocks and main market stocks trade at a discount of 36 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the  PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

More trading higher prices for JSE

The Jamaica Stock Exchange main market moved higher on greater volume and value than on Thursday with the JSE All Jamaican Composite Index gaining 2,291.72 points to 551,122.21 and the JSE Index rising 2,582.15 points to 501,776.77.

The Jamaica Stock Exchange main market moved higher on greater volume and value than on Thursday with the JSE All Jamaican Composite Index gaining 2,291.72 points to 551,122.21 and the JSE Index rising 2,582.15 points to 501,776.77.

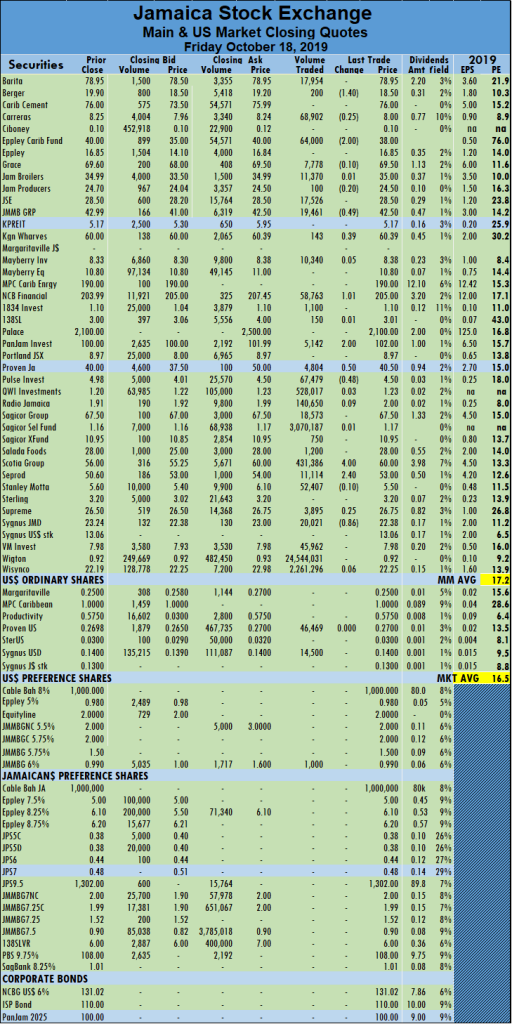

At the same time, the JSE Financial Index that measures all the stocks in this sector in the three JSE markets rose 0.91 points to close at 136.66. Trading ended with 34 securities changing hands in the main and US dollar markets with 15 stocks advancing, 9 declining and 10 trading firm. Main market activity ended with 34 securities trading, resulting in 31,484,701 units valued at $125,777,352 in contrast to 22,536,647 units valued at $48,207,025 from 38 securities trading on Thursday.

Wigton Windfarm led trading with 24.5 million units for 78 percent of total volume, followed by Sagicor Select Funds with 3.1 million shares for 10 percent of the market’s trade and Wisynco Group with 2.3 million units accounting for 7 percent of the day’s trade.

The market closed with an average of 1,015,636 units valued at $4,057,334 for each security traded, in contrast to 593,070 units for an average of $1,268,606 on Thursday and well below the averages for September. The average volume and value for the month to date amounts to 929,723 shares at a value of $15,239,838 for each security traded and previously 924,365 shares at $15,990,179 for each stock traded. The market closed September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer reading shows 8 securities ended with bids higher than their last selling prices and 5 with lower offers. The PE ratio of the market ended at 16.5 with the main market ending at 17.2 times 2019 current year’s earnings.

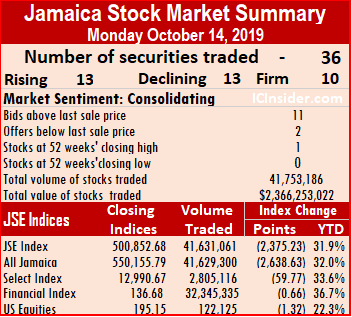

In main market activity, Berger closed $1.40 lower to settle at $18.50 with an exchange of just 200 shares, Carreras lost 25 cents trading 68,902 shares and ending at $8, Eppley Caribbean Property Fund declined by $2 to $38 with 64,000 shares changing hands, JMMB Group slid by 49 cents to $42.50, in swapping 19,461 shares.  Kingston Wharves gained 39 cents to settle at $60.39 trading a mere 143 shares, NCB Financial added $1.01 with an exchange of 58,763 shares to close at $205, PanJam Investment closed $2 higher at $102, after trading 5,142 shares, Proven Investments gained 50 cents to close at $40.50 with 4,804 shares changing hands. Pulse Investments lost 48 cents to settle at $4.50, after trading 67,479 shares. Scotia Group closed $4 higher at $60, in swapping 431,386 shares, Seprod gained $2.40 and ending at $53 after trading 11,114 shares and Sygnus Credit Investments closed 86 cents down to $22.38 with 20,021 shares changing hands.

Kingston Wharves gained 39 cents to settle at $60.39 trading a mere 143 shares, NCB Financial added $1.01 with an exchange of 58,763 shares to close at $205, PanJam Investment closed $2 higher at $102, after trading 5,142 shares, Proven Investments gained 50 cents to close at $40.50 with 4,804 shares changing hands. Pulse Investments lost 48 cents to settle at $4.50, after trading 67,479 shares. Scotia Group closed $4 higher at $60, in swapping 431,386 shares, Seprod gained $2.40 and ending at $53 after trading 11,114 shares and Sygnus Credit Investments closed 86 cents down to $22.38 with 20,021 shares changing hands.

Trading in the US dollar market ended with 61,969 units valued at $15,558 and the market index lost 0.01 point to end at 196.73. Proven Investments traded 46,469 units to close at 27 US cents from 26.98 cents on Thursday, Sygnus Credit Investments ended the day’s trade at 14 US cents after exchanging 14,500 shares and JMMB Group 6% preference shares closed at 99 US cents in swapping 1,000 shares.

JSE majors steady on low volume

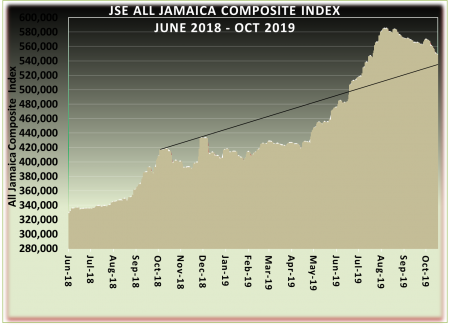

The Jamaica Stock Exchange main market inched higher on higher volume but lower value than on Wednesday with the market appearing to find support at current levels after falling more than 6 percent from the peak in the first week in August.

The Jamaica Stock Exchange main market inched higher on higher volume but lower value than on Wednesday with the market appearing to find support at current levels after falling more than 6 percent from the peak in the first week in August.

At the close the JSE All Jamaican Composite Index added just 104.29 points to close at 548,200.49, the JSE Index gained 189.56 points to 499,194.62 and the JSE Financial Index rose 0.15 points to 135.75.

Trading ended with 39 securities changing hands in the main and US dollar markets with 12 stocks advancing, 15 declining and 12 trading firm. Main market activity ended with 38 securities trading, resulting in 22,536,647 units valued at a mere $48,207,025, in contrast to 13,077,566 units valued at $68,716,819 from 37 securities trading on Wednesday.

Wigton Windfarm led trading with 10.6 million units for 47 percent of total volume, followed by Sagicor Select Funds with 10.2 million shares for 45 percent of the market’s trade and QWI Investments with 656,908 accounting for 3 percent of the day’s trade.

The market closed with an average of 593,070 units valued at $1,268,606 for each security traded, in contrast to 353,448 units for an average of $1,857,211 on Wednesday. The average volume and value for the month to date amounts to 924,365 shares at a value of $15,990,179 for each security traded and previously 951,792 shares at $17,309,566 for each stock traded. The market closed September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

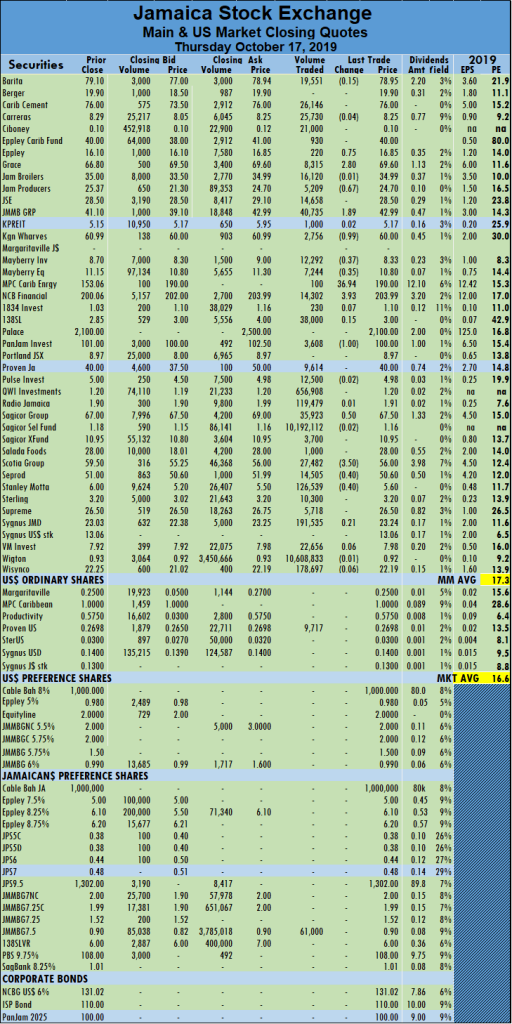

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer reading shows 5 securities ended with bids higher than their last selling prices and 2 with lower offers. The PE ratio of the market ended at 16.6 with the main market ending at 17.3 times 2019 current year’s earnings.

In main market activity, Eppley rose 75 cents to close at $16.85 with a mere 220 shares changing hands, Grace Kennedy added $2.80 to close at $69.60 trading 8,315 shares, Jamaica Producers lost 67 cents with 5,209 shares changing hands in closing at $24.70, JMMB Group gained $1.89 to end at $42.99 in swapping 40,735 shares.  Kingston Wharves dropped 99 cents to settle at $60 in trading 2,756 shares, Mayberry Investments lost 37 cents to close at $8.33 with 12,292 shares changing hands, Mayberry Jamaican Equities closed 35 cents lower at $10.80 with 7,244 shares crossing the exchange. MPC Caribbean Clean Energy traded just 100 shares, in gaining $36.94 to close at a record high of $190, NCB Financial advanced $3.93 with an exchange of 14,302 shares to close at $203.99, PanJam Investment declined by $1 and closed at $100 after trading 3,608 shares, Sagicor Group added 50 cents, after 35,923 shares changed hands to settle at $67.50.Scotia Group closed $3.50 lower at $56, after swapping 27,482 shares, Seprod lost 40 cents to settle at $50.60 trading 14,505 shares and Stanley Motta closed 40 cents lower to $5.60 with 126,539 shares changing hands.

Kingston Wharves dropped 99 cents to settle at $60 in trading 2,756 shares, Mayberry Investments lost 37 cents to close at $8.33 with 12,292 shares changing hands, Mayberry Jamaican Equities closed 35 cents lower at $10.80 with 7,244 shares crossing the exchange. MPC Caribbean Clean Energy traded just 100 shares, in gaining $36.94 to close at a record high of $190, NCB Financial advanced $3.93 with an exchange of 14,302 shares to close at $203.99, PanJam Investment declined by $1 and closed at $100 after trading 3,608 shares, Sagicor Group added 50 cents, after 35,923 shares changed hands to settle at $67.50.Scotia Group closed $3.50 lower at $56, after swapping 27,482 shares, Seprod lost 40 cents to settle at $50.60 trading 14,505 shares and Stanley Motta closed 40 cents lower to $5.60 with 126,539 shares changing hands.

Trading in the US dollar market ended with Proven Investments being the sole stock trading 9,717 units valued at $2,622 to close at 26.98 US cents with the market index gaining 0.08 points to 196.74.

Modest gains for JSE majors

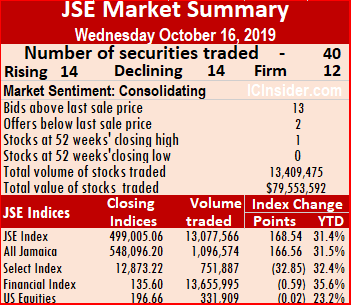

The Jamaica Stock Exchange main market climbed marginally on lower volume and value with the JSE All Jamaican Composite Index adding just 166.56 points to close at 548,096.20, the JSE Index rising 168.54 points to 499,005.06 and the JSE Financial Index slipping 0.59 points to 135.60.

The Jamaica Stock Exchange main market climbed marginally on lower volume and value with the JSE All Jamaican Composite Index adding just 166.56 points to close at 548,096.20, the JSE Index rising 168.54 points to 499,005.06 and the JSE Financial Index slipping 0.59 points to 135.60.

Trading ended with 40 securities changing hands in the main and US dollar markets with 14 stocks advancing, 14 declining and 12 trading firm. Main market activity ended with 37 securities trading, resulting in 13,077,566 units valued at $68,716,819 in contrast to 40,595,146 units valued at $1,769,588,600 from 36 securities trading on Tuesday.

Wigton Windfarm led trading with 6.3 million units for 48 percent of total volume, followed by Sagicor Select Funds with 3.4 million shares for 26 percent of the market’s trade and QWI Investments with 2 million units accounting for 14 percent of the day’s trade.

The market closed with an average of 353,448 units valued at $1,857,211 for each security traded, in contrast to 1,127,643 units for an average of $49,155,239 on Tuesday.  The average volume and value for the month to date amounts to 951,792shares at a value of $17,309,566 for each security traded and previously 1,004,254 shares at $18,786,922 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

The average volume and value for the month to date amounts to 951,792shares at a value of $17,309,566 for each security traded and previously 1,004,254 shares at $18,786,922 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer reading shows 13 securities ended with bids higher than their last selling prices and 2 with lower offers. The PE ratio of the market ended at 16.5 with the main market ending at 17.2 times 2019 current year’s earnings.

In main market activity, Caribbean Cement lost 81 cents to close at $76 with 10,346 shares changing hands, Grace Kennedy gained 45 cents to close at $66.80 after exchanging 34,590 shares, Jamaica Broilers closed $1.94 higher in trading 23,816 shares to settle at $35,Jamaica Producers advanced by $4.07 with 8,063 shares changing hands in closing at $25.37. Jamaica Stock Exchange lost 50 cents, ending at $28.50 with 35,156 units traded, JMMB Group closed 90 cents lower to $41.10 in swapping 157,024 shares after the company announced the issue price for the ordinary shares to raise up to $12.4 billion at up to $38.70 each. Mayberry Investments lost 30 cents to settle at $8.70 with 5,300 shares changing hands, PanJam Investment gained 75 cents, in closing at $101 after trading 18,654 shares,  Pulse Investments closed 51 cents higher to a new closing high of $5 in an exchange of 226,000 shares. Salada Foods fell by $1.30 to $28 with 11,200 shares traded, Scotia Group advanced by $3.30, after 13,966 shares changed hands to settle at $59.50, Supreme Ventures gained 45 cents to close at $26.50 with 26,155 shares being exchanged and Sygnus Credit Investments lost 67 cents, in closing at $23.03 after trading 4,582 shares.

Pulse Investments closed 51 cents higher to a new closing high of $5 in an exchange of 226,000 shares. Salada Foods fell by $1.30 to $28 with 11,200 shares traded, Scotia Group advanced by $3.30, after 13,966 shares changed hands to settle at $59.50, Supreme Ventures gained 45 cents to close at $26.50 with 26,155 shares being exchanged and Sygnus Credit Investments lost 67 cents, in closing at $23.03 after trading 4,582 shares.

Trading in the US dollar market ended with 331,909 units valued at $79,101 and the market index dipped 0.02 points to 196.66. Proven Investments exchanged 285,009 units to close at 26.98 US cents, Sterling Investmentsended at 3 US cents after losing 0.03 of a US cent trading 38,000 shares and Sygnus Credit Investmentslost 0.01 of a US cent to close at 14 US cents with 8,900 shares changing hands.

Another big Barita trade

Barita Investments headquarters

Barita Investments had another day of big trades with 22 million shares valued at $1.9 billion crossing the Jamaica Stock Exchange main market on Tuesday, following the 28.5 million units on Monday and more than 18.8 million shares last week.

The company in releases to the exchange stated “that five directors and five connected parties purchased a total of 20,575,536 shares during the period October 14 to15” and “that a Director and two connected parties purchased a total of 2,939,469 shares during the period October 7 to 8.”

The Jamaica Stock Exchange main market declined for the seventh consecutive day on slightly lower volume valued 25 percent lower than on Monday as short-term correction continues for the market. Trading ended with 38 securities changing hands in the main and US dollar markets with 16 stocks advancing, 18 declining and 4 trading firm. The market closed with the JSE All Jamaican Composite Index falling by 2,226.15 points to close at 547,929.64. The JSE Index declined 2,016.16 points to 498,836.52 and the JSE Financial Index lost 0.49 points in ending at 136.19.

Main market activity ended with 36 securities trading, resulting in 40,595,146 units valued at $1,769,588,600 in contrast to 41,631,061 units valued at $2,360,959,252 from 32 securities trading on Monday.

The large Barita Investments trade accounted for 53 percent of total volume, followed by Wigton Windfarm with 13.8 million shares for 34 percent of the market’s trade and Sagicor Select Funds with 2.67 million units accounting for 7 percent of the day’s volume. QWI Investments was the only other company with million shares trade as it closed with just over 1 million units changing hands.

The Market closed with an average of 1,127,643 units valued at $49,155,239 for each security traded, in contrast to 1,300,971 units for an average of $73,779,977 on Monday. The average volume and value for the month to date amounts to 1,004,254 shares for $18,786,922 for each security traded and previously 992,746 shares at $15,672,223 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 securities ended with bids higher than their last selling prices and 2 with lower offers. The PE ratio of the market ended at 16.4 with the main market ending at 17 times 2019 current year’s earnings.

In main market activity, Berger gained $1 to close at $19.90 as a mere 400 units changed hands, Grace Kennedy gained 35 cents in exchanging 99,563 shares to settle at $66.35, Jamaica Broilers dropped 94 cents trading 41,753 shares to end at $33.06. Jamaica Stock Exchange gained 85 cents in closing at $29 with an exchange of 10,659 shares, JMMB Group lost $1 to settle at $42, with 19,715 crossing the exchange. Kingston Wharves closed 99 cents higher trading just 541 shares, to end at $60.99,  NCB Financial fell by $1.94, closing at $200.06 with 55,949 shares changing hands. PanJam Investment lost 75 cents and ended at $100.25 after 2,108 shares crossed the exchange, Sagicor Group traded 19,892 shares, losing $1.93 to settle at $67.07, Salada Foods gained 30 cents, after 1,699 shares changed hands to close at $29.30. Scotia Group closed 80 cents lower to $56.20 with 6,200 shares traded, Seprod fell by $1.99 to end at $51.01 with an exchange of 3,000 shares, Supreme Ventures declined $1.35, closing at $26.05 with 30,137 shares crossing the exchange. Sygnus Credit Investments gained 70 cents to close at $23.70 in the trading of 72,818 shares and Wisynco Group lost 75 cents to end at $22.25 trading 394,938 shares.

NCB Financial fell by $1.94, closing at $200.06 with 55,949 shares changing hands. PanJam Investment lost 75 cents and ended at $100.25 after 2,108 shares crossed the exchange, Sagicor Group traded 19,892 shares, losing $1.93 to settle at $67.07, Salada Foods gained 30 cents, after 1,699 shares changed hands to close at $29.30. Scotia Group closed 80 cents lower to $56.20 with 6,200 shares traded, Seprod fell by $1.99 to end at $51.01 with an exchange of 3,000 shares, Supreme Ventures declined $1.35, closing at $26.05 with 30,137 shares crossing the exchange. Sygnus Credit Investments gained 70 cents to close at $23.70 in the trading of 72,818 shares and Wisynco Group lost 75 cents to end at $22.25 trading 394,938 shares.

Trading in the US dollar market ended with 159,923 units valued at $16,410 and the market index gained 1.53 points to close at 196.68. Sterling Investments lost 0.3 of a US cent to close at 2.71 US cents with an exchange of 110,167 shares and Proven Investments gained 0.01 of a US cent to close at 26.98 US cents and 49,756 shares changing hands.

Barita tops market with 28.5m trade

Barita Investments traded 28.5 million shares valued at $2.25 billion on the Jamaica Stock Exchange main market on Monday on a day when the market lost more grounds as it continues its short term correction.

Barita Investments traded 28.5 million shares valued at $2.25 billion on the Jamaica Stock Exchange main market on Monday on a day when the market lost more grounds as it continues its short term correction.

The big Barita trade follows four days last week when it traded more than 2 million shares crossed the exchange on each occasion and well above the normal daily trading levels. On October 7th a total of 6.1 million shares traded, followed by 8.1 million shares the following day, to be followed by 2.67 million units on the 9th and 2 million on the 11th for a total of more than 18.8 million

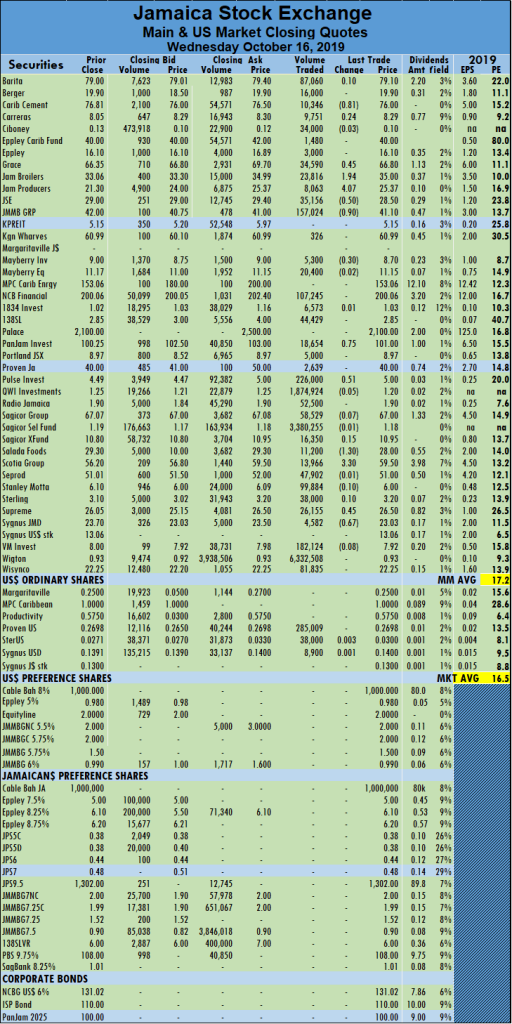

The Jamaica Stock Exchange main market suffered another decline with a higher volume and significantly higher value than on Friday as the main market goes through a mild correction of 5 percent. Trading ended with 36 securities changing hands in the main and US dollar markets with 13 stocks advancing, 13 declining and 10 stocks trading firm.  The market closed with the JSE All Jamaican Composite Index dropping 2,638.63 points to close at 550,155.79. The JSE Index declined 2,375.23 points to 500,852.68 and the JSE Financial Index lost 0.66 points to close at 136.68.

The market closed with the JSE All Jamaican Composite Index dropping 2,638.63 points to close at 550,155.79. The JSE Index declined 2,375.23 points to 500,852.68 and the JSE Financial Index lost 0.66 points to close at 136.68.

Main market activity ended with 32 securities trading resulting in 41,631,061 units valued at $2,360,959,252, in contrast to 11,554,366 units valued at $237,158,383 from 37 securities trading on Friday.

The big Barita Investments trade accounted for 68 percent of total volume, followed by Wigton Windfarm with 6 million shares for 14 percent of the market’s trade and recently listed QWI Investments with 1.8 million units accounting for 4 percent of the day’s volume. Stocks trading more than a million units were Jamaica Producers with 1.2 million shares, Radio Jamaica with 1.2 million stock units and Sagicor Select Funds with 1.3 million units.

The Market closed with an average of 1,300,971 units valued at $73,779,977 for each security traded, in contrast to 312,280 units for an average of $6,409,686 on Friday. The average volume and value for the month to date amounts to 992,746 shares for $15,672,223 for each security traded and previously 964,884 shares at $9,843,232 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

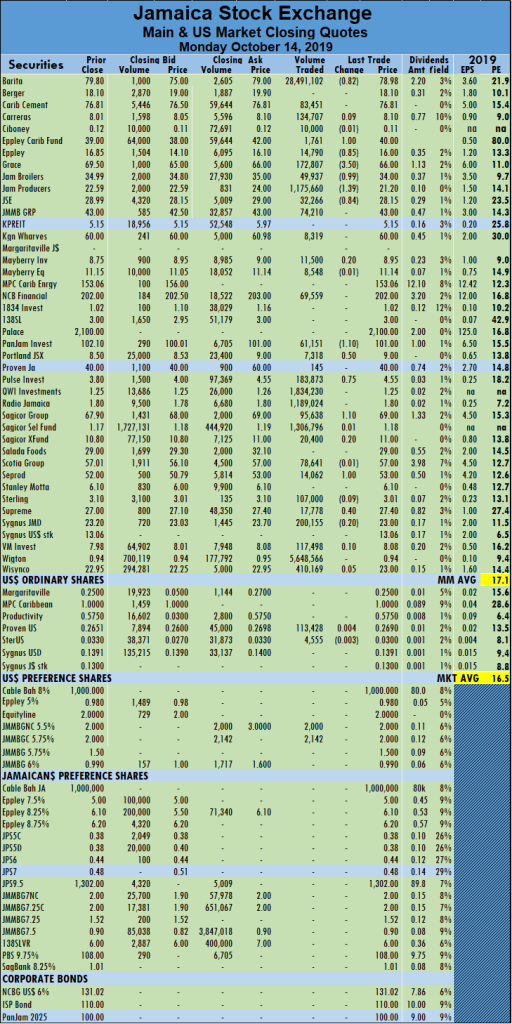

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 securities ended with bids higher than their last selling prices and 2 with lower offers. The PE ratio of the market ended at 16.5 with the main market ending at 17.1 times 2019 current year’s earnings.

In main market activity, Barita lost 82 cents to close at $78.98 as 28,491,102 shares crossed the exchange, Eppley Caribbean Property Fund closed $1 higher, after exchanging 1,761 shares, to close at $40, Eppley traded 14,790 shares gaining 85 cents to settle at $16, Grace Kennedy dived $3.50 exchanging 172,807 shares to settle at $66. Jamaica Broilers slid 99 cents in swapping 49,937 shares to end at $34, Jamaica Producers closed $1.39 lower at $21.20 after 1,175,660 shares changed hands. Jamaica Stock Exchange slid 84 cents in closing at $28.15 with 32,266 shares traded, PanJam Investment lost $1.10 and ended at $101, after 61,151 shares crossed the exchange. Portland JSX gained 50 cents to settle at $9 with an exchange of 7,318 shares, Pulse Investments climbed 75 cents trading 183,873 shares to end at a 52 weeks’ closing high of $4.55. Sagicor Group traded 95,638 shares in gaining $1.10 to settle at $69, Seprod added $1 to end at $53 with an exchange of 14,062 shares and Supreme Ventures gained 40 cents, closing at $27.40 with 17,778 shares crossing the exchange.

In main market activity, Barita lost 82 cents to close at $78.98 as 28,491,102 shares crossed the exchange, Eppley Caribbean Property Fund closed $1 higher, after exchanging 1,761 shares, to close at $40, Eppley traded 14,790 shares gaining 85 cents to settle at $16, Grace Kennedy dived $3.50 exchanging 172,807 shares to settle at $66. Jamaica Broilers slid 99 cents in swapping 49,937 shares to end at $34, Jamaica Producers closed $1.39 lower at $21.20 after 1,175,660 shares changed hands. Jamaica Stock Exchange slid 84 cents in closing at $28.15 with 32,266 shares traded, PanJam Investment lost $1.10 and ended at $101, after 61,151 shares crossed the exchange. Portland JSX gained 50 cents to settle at $9 with an exchange of 7,318 shares, Pulse Investments climbed 75 cents trading 183,873 shares to end at a 52 weeks’ closing high of $4.55. Sagicor Group traded 95,638 shares in gaining $1.10 to settle at $69, Seprod added $1 to end at $53 with an exchange of 14,062 shares and Supreme Ventures gained 40 cents, closing at $27.40 with 17,778 shares crossing the exchange.

Trading in the US dollar market ended with 122,125 units valued at $38,361 and the market index dipped 1.32 points to close at 195.15. Proven Investments gained 0.4 of a US cent to close at 26.90 US cents with 113,428 shares changing hands, Sterling Investments fell 0.3 of a cent and exchanged 4,555 shares, to close at 3 US cents, JMMB Group 5.5% preference share traded 2,000 units to end at US$2 and JMMB Group 5.75% preference share traded 2,142 units to end at US$2.

Financials & entertainers join IC TOP 10

Scotia Group joins IC TOP 10

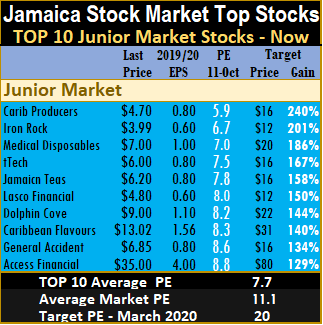

Buy Rated Junior Market stocks have two new entrants this week with Dolphin Cove price dropping to $9 and Access Financial trading at $35 joining the list while Honey Bun with the price rising to $6.50 and CAC2000 that rose to $13.50 exiting the top listing. Scotia Group dropped back to $57.10 from $61.50 at the end of the previous week and returns to the main market TOP 10 list at the expense of Stanley Motta.

Market activity resulted in no change to the top three Junior Market stocks, leaving Caribbean Producers

with projected gains of 240 percent as the leader, followed by Iron Rock Insurance with potential gains of 201 percent and Medical Disposables with 186 percent.

with projected gains of 240 percent as the leader, followed by Iron Rock Insurance with potential gains of 201 percent and Medical Disposables with 186 percent.Radio Jamaica (RJR) share price that slipped during the previous week to a low of $1.35 and closed that week at $1.60, climbed further this past week with increased investors’ interest that pushed the price to $1.80 with projected gains to 213 percent, to remain the leading main market stock. Carreras sits at the number two spot with likely gains of 125 percent and Jamaica Broilers with projected gains of 100 percent is next. Berger Paints slipped to the fourth spot with a downward revision of earnings to $1.80 for the year.

The main market, closed the week with the overall PE of 17.2, inching up from 17.1 for the previous week and the Junior Market remaining unchanged at 11.1 based on current year’s earnings.

The PE ratio for Junior Market Top 10 stocks average remains at 7.7 and the main market PE at 11.1, up from 10.4 at the close of the previous week.

The PE ratio for Junior Market Top 10 stocks average remains at 7.7 and the main market PE at 11.1, up from 10.4 at the close of the previous week.The TOP 10 stocks now trade at a discount of 31 percent to the average for the Junior Market stocks and main market stocks trade at a discount of 36 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with

the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

One week of declines for JSE Majors

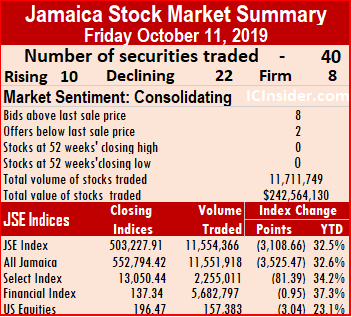

The Jamaica Stock Exchange main market suffered another declined for a fifth consecutive day on Friday, with reduced volume but with a much higher value than on Thursday as the main market goes through a mild correction of 5 percent.

The Jamaica Stock Exchange main market suffered another declined for a fifth consecutive day on Friday, with reduced volume but with a much higher value than on Thursday as the main market goes through a mild correction of 5 percent.

Trading ended with 40 securities changing hands in the main and US dollar markets with 10 stocks advancing, 22 declining and 8 stocks trading firm. The market closed with the JSE All Jamaican Composite Index falling 3,525.47 points to close at 552,794.42. The JSE Index dropped 3,108.66 points to 506,336.57 and the JSE Financial Index lost 0.95 points to close at 137.34.

Main market activity ended with 37 securities trading resulting in 11,554,366 units valued at $237,158,383, in contrast to 15,417,353 units valued at $67,593,610 from 36 securities trading on Thursday.

Wigton Windfarm led trading with 5.2 million units for 45 percent of total volume, followed by Barita Investments with 2 million shares for 17 percent of the market’s trade and QWI Investments with 1.6 million units accounting for 14 percent of the day’s trade. The only other stock trading more than a million units was Sagicor Select Funds with 1.1 million shares.

The Market closed with an average of 312,280 units valued at $6,409,686 for each security traded, in contrast to 453,452 units for an average of $1,988,047 on Thursday. The average volume and value for the month to date amounts to 964,884 shares for $9,843,232 for each security traded and previously 1,041,055 shares at $10,293,733 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 securities ended with bids higher than their last selling prices and 2 with lower offers. The PE ratio of the market ended at 16.4 with the main market ending at 17 times 2019 current year’s earnings.

In main market activity, Berger lost 50 cents to close at $18.10, in the swapping of 1,600 shares, Caribbean Cement closed 69 cents lower after 7,462 shares changed hands to end at $76.81, Eppley Caribbean Fund jumped $4, after exchanging 2,448 shares, to close at $39. Jamaica Stock Exchange slid 99 cents in closing at $28.99 as 23,121 shares changed hands, JMMB Group traded 74,042 shares gaining 90 cents to end at $43, Kingston Wharves closed $2.59 higher to settle at $60, after exchanging a mere 500 shares. Mayberry Equities lost 35 cents to close at $11.15 with 6,700 shares traded,  NCB Financial plummeted $5.50 to close at $202 while exchanging 142,640 units, PanJam Investment lost 90 cents and ended at $102.10 after 67,595 shares crossed the exchange. Sagicor Group traded 37,028 shares in losing $1.10 to close at $67.90, Scotia Group closed $2.98 lower in exchanging 231,475 shares to end at $57.01, Seprod gained $1.50 to end at $52 with an exchange of 23,087 shares and Supreme Ventures lost 50 cents to settle at $27 with 74,136 shares trading.

NCB Financial plummeted $5.50 to close at $202 while exchanging 142,640 units, PanJam Investment lost 90 cents and ended at $102.10 after 67,595 shares crossed the exchange. Sagicor Group traded 37,028 shares in losing $1.10 to close at $67.90, Scotia Group closed $2.98 lower in exchanging 231,475 shares to end at $57.01, Seprod gained $1.50 to end at $52 with an exchange of 23,087 shares and Supreme Ventures lost 50 cents to settle at $27 with 74,136 shares trading.

Trading in the US dollar market ended with 157,383 units valued at $40,043 and the market index fell by 3.04 points to close at 196.47. Margaritaville lost 3 cents and closed at 25 US cents with 3,856 shares changing hands, Proven Investments fell half a cent and exchanged 139,727 shares, to close at 26.51 US cents and Sygnus Credit Investments traded 13,800 units to inched higher from 13.9 US cents to end at 13.91 US cents.

4th day of decline for JSE majors

The Jamaica Stock Exchange main market declined for a fourth consecutive day on Thursday with less volume and value traded dropping sharply from Wednesday’s levels.

The Jamaica Stock Exchange main market declined for a fourth consecutive day on Thursday with less volume and value traded dropping sharply from Wednesday’s levels.

Trading ended with 36 securities changing hands in the main and US dollar markets with 19 advancing, 9 declining and 8 trading firm. The market closed with the JSE All Jamaican Composite Index declining 1,369.89 points to close at 556,319.89. The JSE Index dropped 1,210.28 points to 506,336.57 and the JSE Financial Index lost 0.23 points to close at 138.29.

Main market activity ended with 34 securities trading resulting in 15,417,353 units valued at $67,593,610, in contrast to 31,141,186 units valued at $368,051,491 from 36 securities trading on Wednesday.

QWI Investments led trading with 4.8 million units for 31 percent of total volume, followed by Sagicor Select Funds with 4.5 million shares for 29 percent of the market’s trade and Wigton Windfarm with 4 million units accounting for 26 percent of the day’s trade. No other stock traded more than a million units.

The Market closed with an average of 453,452 units valued at $1,988,047 for each security traded. In contrast to 865,033 units for an average of $10,223,653 on Wednesday. The average volume and value for the month to date amounts to 1,041,055 shares for $10,293,733 for each security traded and previously 1,111,651 shares at $11,432,416 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 securities ended with bids higher than their last selling prices and one with a lower offer.

In main market activity, Barita Investments rose 39 cents at $80, 4,491 in the swapping of shares, Caribbean Cement rose 68 cents after 8,547 shares changed hands to end at $77.50, Eppley gained $1.85, after exchanging 7,430 shares, to close at $16.85. Grace Kennedy rose 75 cents to $69.75 with 12,284 shares traded, Jamaica Broilers rose $1 in closing at $35 as 29,564 shares changed hands. Jamaica Producers traded 4,000 shares and gained 58 cents to end at $22.59,  JMMB Group lost 90 cents to close at $42.10 after trading 20,062 shares, Kingston Wharves dropped $4.59 to settle at $57.41, after exchanging 18,100 shares. Mayberry Equities recovered the 47 cents it lost on Wednesday to close at $11.50 with 508 shares traded, NCB Financial surged $5.50 to close at $207.50 while exchanging 33,212 units, Scotia Group closed $1.19 higher in swapping 153,105 shares to end at $59.99 and Seprod dropped $3.50 to end at $50.50 with an exchange of 12,792 shares.

JMMB Group lost 90 cents to close at $42.10 after trading 20,062 shares, Kingston Wharves dropped $4.59 to settle at $57.41, after exchanging 18,100 shares. Mayberry Equities recovered the 47 cents it lost on Wednesday to close at $11.50 with 508 shares traded, NCB Financial surged $5.50 to close at $207.50 while exchanging 33,212 units, Scotia Group closed $1.19 higher in swapping 153,105 shares to end at $59.99 and Seprod dropped $3.50 to end at $50.50 with an exchange of 12,792 shares.

Trading in the US dollar market ended with 13,100 units valued at $2,828 and the market index advanced by 1.05 points to close at 199.51. Proven Investments exchanged 7,700 shares, to close at 26.98 US cents and Sygnus Credit Investments slipped a fraction of a cent to trading 5,400 units to end at 13.9 US cents.

- « Previous Page

- 1

- …

- 119

- 120

- 121

- 122

- 123

- …

- 242

- Next Page »