The Main Market of the Jamaica Stock Exchange continued its winning ways on Wednesday after a brief break on Monday when the market indices slipped and ended with advancing stocks outpacing declining ones three to two.

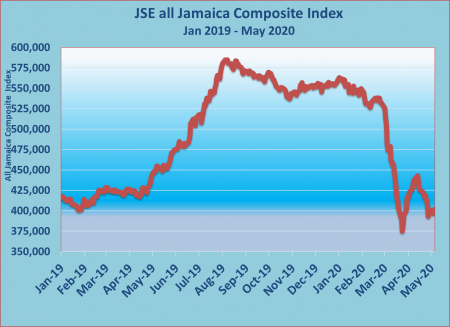

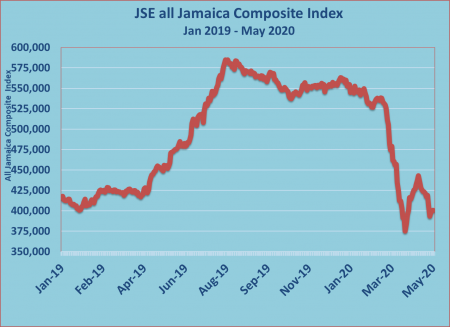

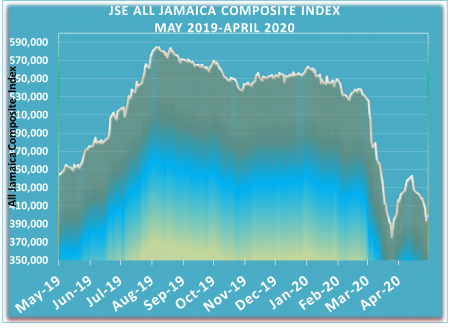

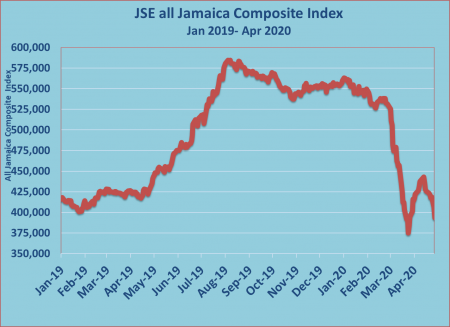

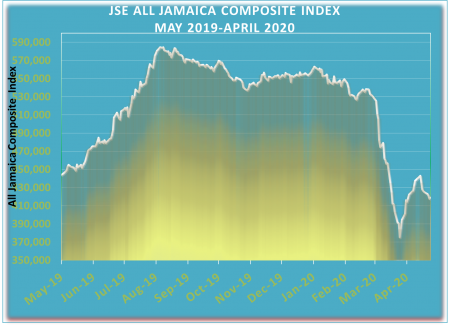

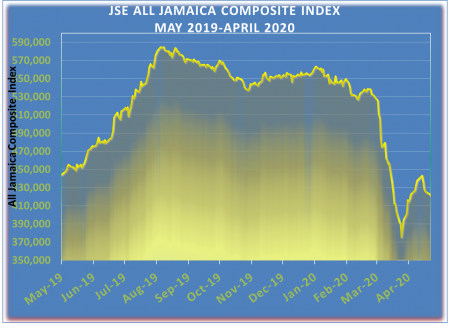

JSE Main Market showing signs of recovery after falling following BOJ suspension of banks’ dividend payments.

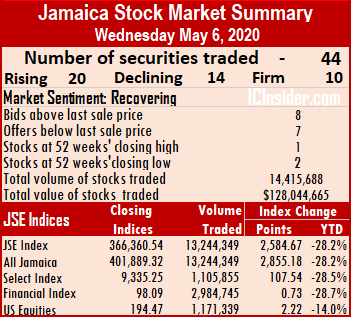

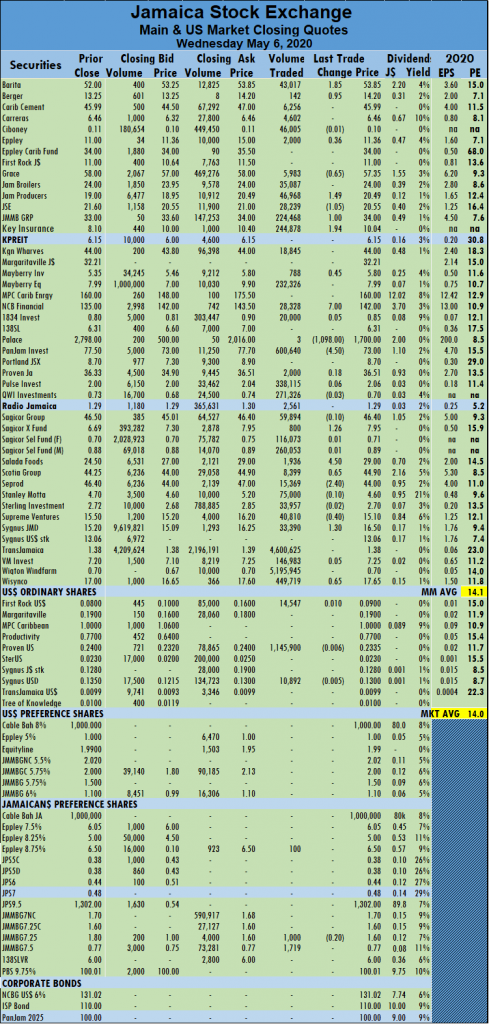

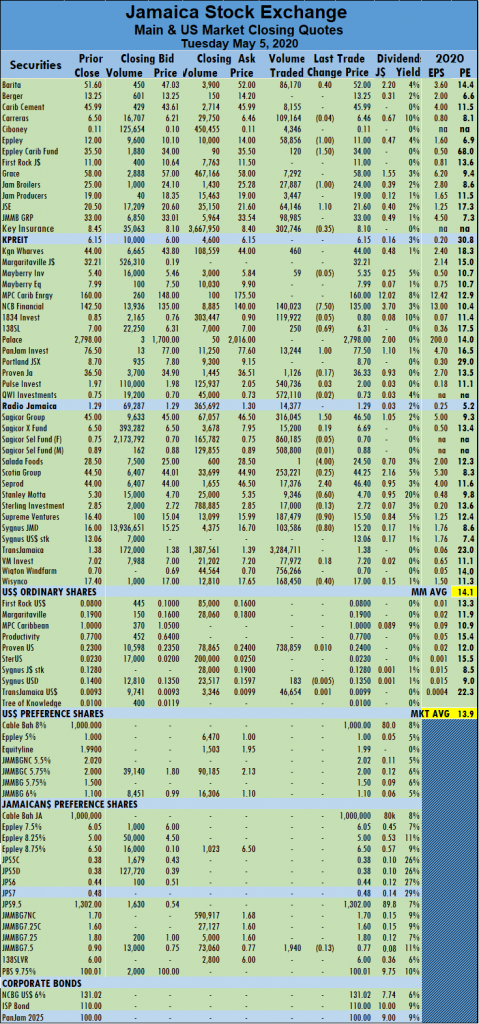

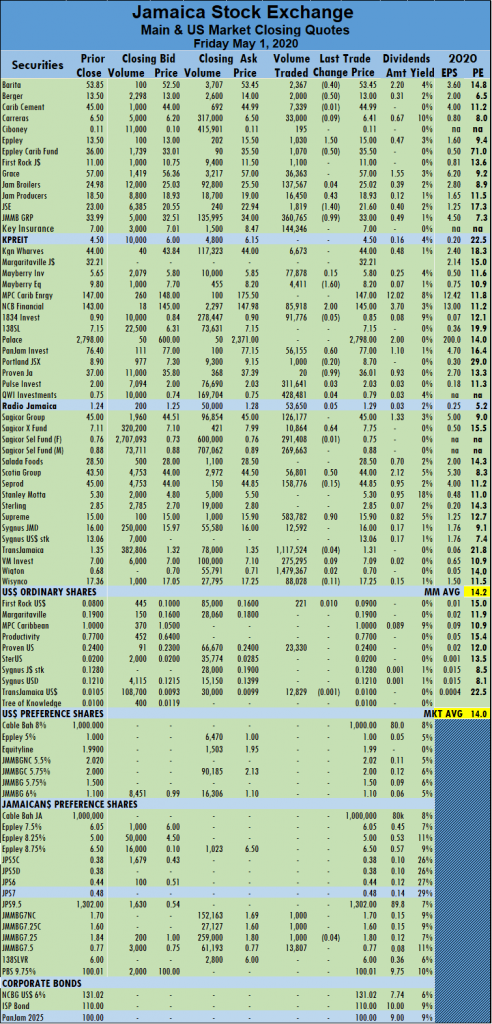

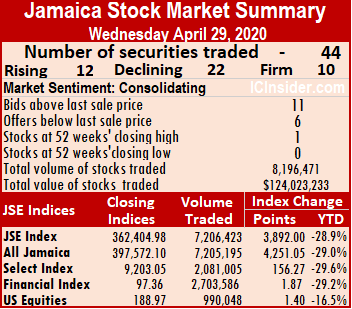

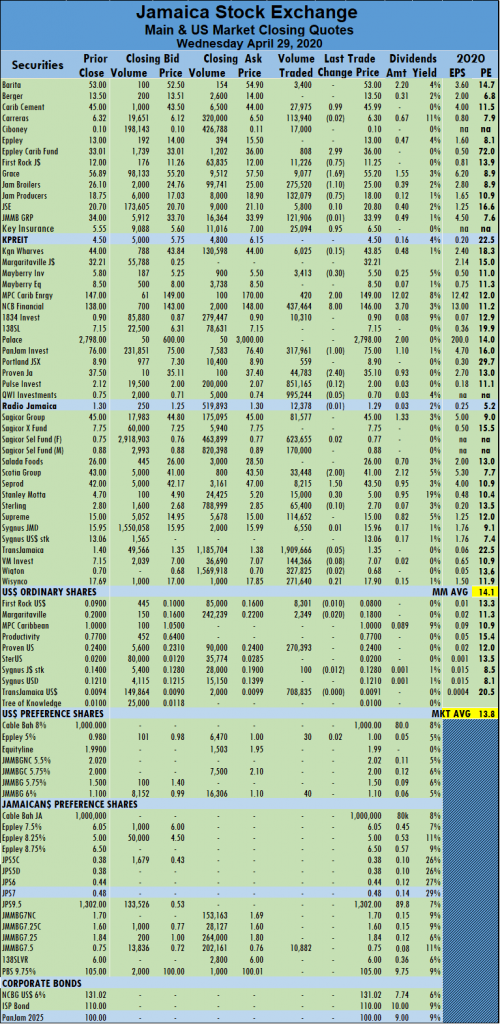

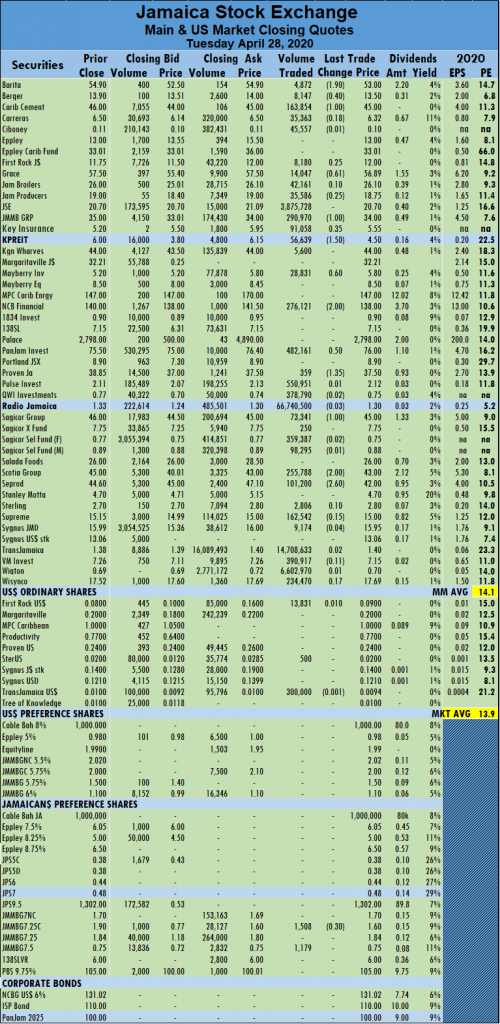

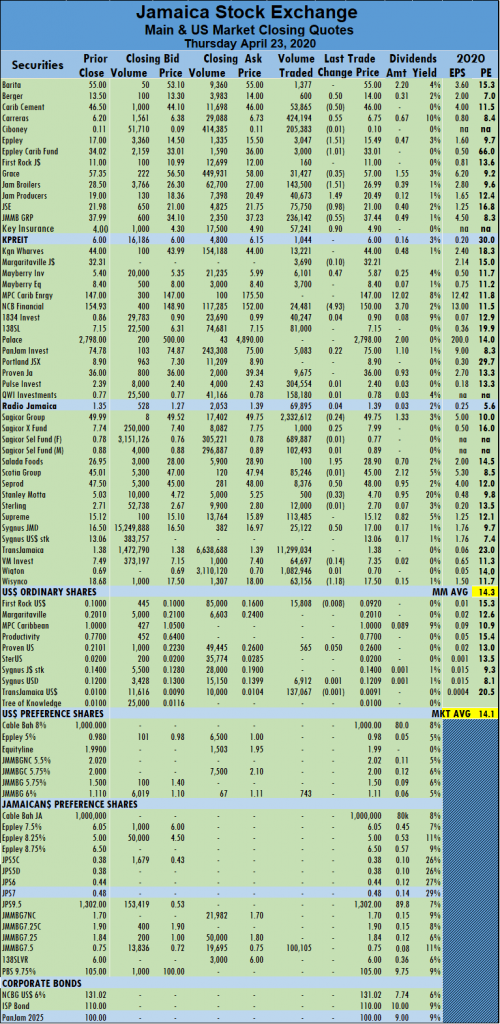

The market closed with 44 securities changing hands in the Main and US dollar markets with prices of 20 stocks advancing, 14 declining, including a big fall in the price of Palace Amusement by $1,098 and 10 securities trading firm. The JSE Main Market activity ended with 38 securities accounting for 13,244,349 units valued at $91,265,025, in contrast to 8,751,199 units valued at $77,299,031 from 38 securities on Tuesday.

Wigton Windfarm led trading with 5.2 million shares for 39 percent of total volume followed by Trans Jamaican Highway with 4.6 million units for 35 percent of the day’s trade and PanJam Investment with 600,640 units for 4.5 percent market share.

The Market closed with an average of 323,033 units at $2,225,976 for each security traded, in contrast to 230,295 units valued at an average of $2,034,185 on Tuesday. The average volume and value for the month to date amount to 362,134 units at $2,453,398 for each stock changing hands, compared to 375,605 units with an average value of $2,531,754 previously. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The Market closed with an average of 323,033 units at $2,225,976 for each security traded, in contrast to 230,295 units valued at an average of $2,034,185 on Tuesday. The average volume and value for the month to date amount to 362,134 units at $2,453,398 for each stock changing hands, compared to 375,605 units with an average value of $2,531,754 previously. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and seven stocks closing with lower offers. The PE ratio of the market ended at 14, while the Main Market ended at 14.1 times 2020/21 earnings.

In the Main Market, Barita Investments added $1.85 to finish at $53.85, with 43,017 stock units changing hands, Berger Paints gained 95 cents, transferring 142 units to close at $14.20, Eppley ended 36 cents higher at $11.36, after trading 2,000 units. Grace Kennedy finished at $57.35, with a loss of 65 cents after swapping 5,983 units, Jamaica Producers advanced to $20.49, after rising $1.49 exchanging 46,968 stock units, Jamaica Stock Exchange fell $1.05 to $20.55, with a transfer of 28,239 units. JMMB Group closed $1 higher to $34, with an exchange of 224,468 shares, Key Insurance climbed $1.94 to end at a new record high of $10.04, after trading 244,878 shares, Mayberry Investments gained 45 cents in swapping 788 units and closed at $5.80.

NCB Financial Group advanced $7 to $142, in trading 28,328 units, Palace Amusement dived $1,098 trading just three shares to close at $1,700, PanJam Investment declined by $4.50 to a 52 weeks’ low of $73, with 600,640 shares changing hands. Sagicor Real Estate Fund closed at $7.95, with gains of $1.26 with 800 units crossing the market. Salada Foods climbed $4.50 to $29 in exchanging 1,936 units, Scotia Group gained 65 cents to end at $44.90, with a transfer of 8,399 units. Seprod fell to $44, with a loss of $2.40 trading 15,369 units, Supreme Ventures closed 40 cents lower to $15.10, with 40,810 stock units changing hands, Sygnus Credit Investments gained $1.30 to reach $16.50, after swapping 33,390 stock units and Wisynco Group ended the 65 cents higher at $17.65, with a transfer of 449,719 shares.

NCB Financial Group advanced $7 to $142, in trading 28,328 units, Palace Amusement dived $1,098 trading just three shares to close at $1,700, PanJam Investment declined by $4.50 to a 52 weeks’ low of $73, with 600,640 shares changing hands. Sagicor Real Estate Fund closed at $7.95, with gains of $1.26 with 800 units crossing the market. Salada Foods climbed $4.50 to $29 in exchanging 1,936 units, Scotia Group gained 65 cents to end at $44.90, with a transfer of 8,399 units. Seprod fell to $44, with a loss of $2.40 trading 15,369 units, Supreme Ventures closed 40 cents lower to $15.10, with 40,810 stock units changing hands, Sygnus Credit Investments gained $1.30 to reach $16.50, after swapping 33,390 stock units and Wisynco Group ended the 65 cents higher at $17.65, with a transfer of 449,719 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

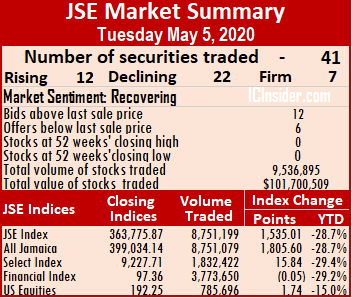

At the close, the JSE All Jamaican Composite Index advanced 1,805.60 points to 399,034.14, the JSE Market Index gained 1,535.01 points to end at 363,775.87 and the JSE Financial Index lost 0.05 points to 97.36.

At the close, the JSE All Jamaican Composite Index advanced 1,805.60 points to 399,034.14, the JSE Market Index gained 1,535.01 points to end at 363,775.87 and the JSE Financial Index lost 0.05 points to 97.36. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

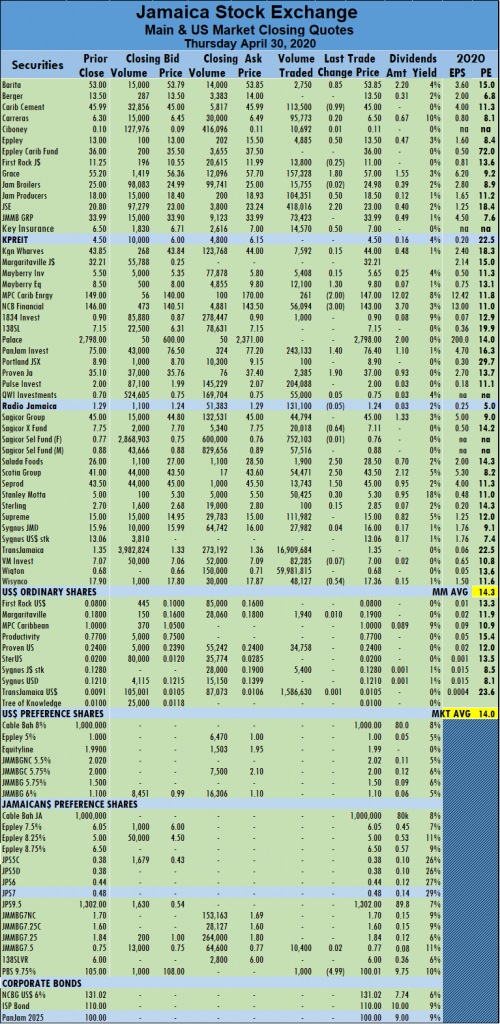

Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. NCB Financial Group sustained a loss of $7.50 to close at $135, after transferring 140,023 shares, 138 Student Living closed 69 cents lower to $6.31, in swapping 250 units, PanJam Investment picked up $1 to end at $77.50 trading 13,244 stock units. Sagicor Group ended at $46.50, with gains of $1.50 exchanging 316,045 shares, Salada Foods tumbled $4 to $24.50, after trading a mere one stock unit, Seprod advanced $2.40 to $46.40, with an exchange of 17,376 stock units. Stanley Motta fell by 60 cents to $4.70, in transferring 9,346 units, Supreme Ventures ended 90 cents lower at $15.50, after swapping 187,479 shares, Sygnus Credit Investments closed at $15.20, with a loss of 80 cents exchanging 103,586 shares and Wisynco Group lost 40 cents trading 168,450 shares to finish at $17.

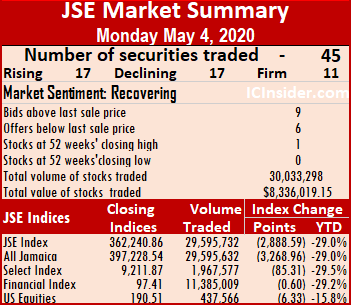

NCB Financial Group sustained a loss of $7.50 to close at $135, after transferring 140,023 shares, 138 Student Living closed 69 cents lower to $6.31, in swapping 250 units, PanJam Investment picked up $1 to end at $77.50 trading 13,244 stock units. Sagicor Group ended at $46.50, with gains of $1.50 exchanging 316,045 shares, Salada Foods tumbled $4 to $24.50, after trading a mere one stock unit, Seprod advanced $2.40 to $46.40, with an exchange of 17,376 stock units. Stanley Motta fell by 60 cents to $4.70, in transferring 9,346 units, Supreme Ventures ended 90 cents lower at $15.50, after swapping 187,479 shares, Sygnus Credit Investments closed at $15.20, with a loss of 80 cents exchanging 103,586 shares and Wisynco Group lost 40 cents trading 168,450 shares to finish at $17. At the close of trading, the JSE All Jamaican Composite Index declined by 3,268.96 points to 397,228.54, the JSE Market Index dropped 2,888.59 points to 362,240.86 and the JSE Financial Index lost 0.60 points to 97.41.

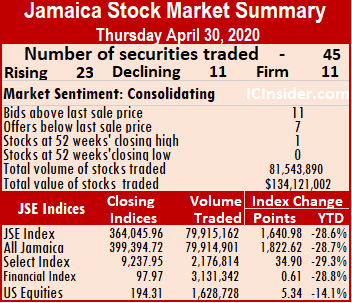

At the close of trading, the JSE All Jamaican Composite Index declined by 3,268.96 points to 397,228.54, the JSE Market Index dropped 2,888.59 points to 362,240.86 and the JSE Financial Index lost 0.60 points to 97.41. IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and six stocks closing with lower offers. The PE ratio of the market ended at 14.1, while the Main Market ended at 14.3 times 2020/21 earnings.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and six stocks closing with lower offers. The PE ratio of the market ended at 14.1, while the Main Market ended at 14.3 times 2020/21 earnings. Mayberry Investments shed 40 cents to close at $5.40, in switching ownership of 74,079 shares, MPC Caribbean Clean Energy climbed $13 to $160 trading a mere 100 units. NCB Financial Group closed at $142.50, with a loss of $2.50 after transferring 115,522 shares, PanJam Investment lost 50 cents to close at $76.50, with 230 units changing hands, Proven Investments rose 49 cents exchanging 11,104 units to end at $36.50. Sagicor Real Estate Fund closed $1.25 lower to settle at $6.50, in swapping 6,438 units, Scotia Group added 50 cents to finish at $44.50, in trading 9,250 units, Seprod ended at $44, with a loss of 85 cents exchanging 6,938 units and Supreme Ventures added 50 cents to close at $16.40, trading 229,782 shares.

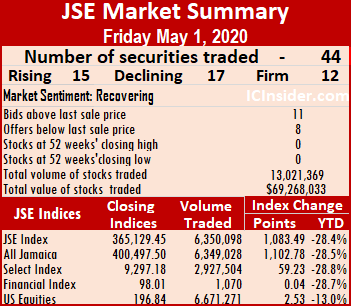

Mayberry Investments shed 40 cents to close at $5.40, in switching ownership of 74,079 shares, MPC Caribbean Clean Energy climbed $13 to $160 trading a mere 100 units. NCB Financial Group closed at $142.50, with a loss of $2.50 after transferring 115,522 shares, PanJam Investment lost 50 cents to close at $76.50, with 230 units changing hands, Proven Investments rose 49 cents exchanging 11,104 units to end at $36.50. Sagicor Real Estate Fund closed $1.25 lower to settle at $6.50, in swapping 6,438 units, Scotia Group added 50 cents to finish at $44.50, in trading 9,250 units, Seprod ended at $44, with a loss of 85 cents exchanging 6,938 units and Supreme Ventures added 50 cents to close at $16.40, trading 229,782 shares. At the close of trading, the JSE All Jamaican Composite Index advanced by 1,102.78 points to 400,497.50, the JSE Market Index climbed 1,083.49 points to 365,129.45 and the JSE Financial Index added 0.04 points to 98.01.

At the close of trading, the JSE All Jamaican Composite Index advanced by 1,102.78 points to 400,497.50, the JSE Market Index climbed 1,083.49 points to 365,129.45 and the JSE Financial Index added 0.04 points to 98.01. The Market closed with an average of 154,880 units at $1,669,401 for each security traded, in contrast to 1,949,150 units valued at an average of $3,182,761 on Thursday. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The Market closed with an average of 154,880 units at $1,669,401 for each security traded, in contrast to 1,949,150 units valued at an average of $3,182,761 on Thursday. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Jamaica Stock Exchange fell $1.40 to $21.60, after exchanging 1,819 units. JMMB Group declined to $33, with a loss of 99 cents trading 360,765 shares, Mayberry Jamaican Equities closed $1.60 lower to $8.20 trading 4,411 units, NCB Financial Group closed at $145, with gains of $2 after swapping 85,918 shares. PanJam Investment gained 60 cents to close at $77, with 56,155 shares changing hands, Proven Investments shed 99 cents with a transfer of a mere 20 units and closed at $36.01, Sagicor Real Estate Fund gained 64 cents to settle at $7.75, in swapping 10,864 stock units. Scotia Group closed 50 cents higher at $44, in trading 56,801 shares and Supreme Ventures gained 90 cents to end at $15.90, trading 583,782 shares.

Jamaica Stock Exchange fell $1.40 to $21.60, after exchanging 1,819 units. JMMB Group declined to $33, with a loss of 99 cents trading 360,765 shares, Mayberry Jamaican Equities closed $1.60 lower to $8.20 trading 4,411 units, NCB Financial Group closed at $145, with gains of $2 after swapping 85,918 shares. PanJam Investment gained 60 cents to close at $77, with 56,155 shares changing hands, Proven Investments shed 99 cents with a transfer of a mere 20 units and closed at $36.01, Sagicor Real Estate Fund gained 64 cents to settle at $7.75, in swapping 10,864 stock units. Scotia Group closed 50 cents higher at $44, in trading 56,801 shares and Supreme Ventures gained 90 cents to end at $15.90, trading 583,782 shares. At the close, the JSE All Jamaican Composite Index increased 1,822.62 points to 399,394.72, the JSE Market Index gained 1,640.98 points to close at 364,045.96 and the JSE Financial Index rose 0.61 points to 97.97.

At the close, the JSE All Jamaican Composite Index increased 1,822.62 points to 399,394.72, the JSE Market Index gained 1,640.98 points to close at 364,045.96 and the JSE Financial Index rose 0.61 points to 97.97. The average volume and value for the month to date amount to 1,077,021 units valued at $3,829,201 for each security changing hands, compared to 1,033,414 units valued at $3,863,268 previously. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The average volume and value for the month to date amount to 1,077,021 units valued at $3,829,201 for each security changing hands, compared to 1,033,414 units valued at $3,863,268 previously. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Mayberry Equities climbed $1.30 to $9.80 trading 12,100 units, MPC Caribbean Clean Energy dropped $2 to $147 after just 261 units crossed through the exchange. NCB Financial Group shed $3 in closing at $143, trading 56,094 shares, PanJam Investment closed $1.40 higher at $76.40, in exchanging 243,133 stock units, Proven Investments gained $1.90 to finish at $37, with 2,385 stock units changing hands. Sagicor Real Estate Fund lost 64 cents exchanging 20,018 units to settle at $7.11, Salada Foods climbed $2.50 to $28.50 after trading 1,900 units, Scotia Group rose $2.50 to $43.50, after transferring 54,471 stock units. Seprod picked up $1.50 to close at $45, in trading 13,743 shares and Wisynco Group lost 54 cents to end at $17.36, with 48,127 units crossing the exchange.

Mayberry Equities climbed $1.30 to $9.80 trading 12,100 units, MPC Caribbean Clean Energy dropped $2 to $147 after just 261 units crossed through the exchange. NCB Financial Group shed $3 in closing at $143, trading 56,094 shares, PanJam Investment closed $1.40 higher at $76.40, in exchanging 243,133 stock units, Proven Investments gained $1.90 to finish at $37, with 2,385 stock units changing hands. Sagicor Real Estate Fund lost 64 cents exchanging 20,018 units to settle at $7.11, Salada Foods climbed $2.50 to $28.50 after trading 1,900 units, Scotia Group rose $2.50 to $43.50, after transferring 54,471 stock units. Seprod picked up $1.50 to close at $45, in trading 13,743 shares and Wisynco Group lost 54 cents to end at $17.36, with 48,127 units crossing the exchange.

The average volume and value for the month to date amount to 1,033,414 units valued at $3,863,268 for each security changing hands, compared to 1,073,044 units valued at $3,888,297 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The average volume and value for the month to date amount to 1,033,414 units valued at $3,863,268 for each security changing hands, compared to 1,073,044 units valued at $3,888,297 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Key Insurance raked in 95 cents to reach a record high of $6.50, with a transfer of 25,094 stock units, Mayberry Investments lost 30 cents trading 3,413 units and closed at $5.50, MPC Caribbean Clean Energy climbed $2 to $149, after swapping 420 units. NCB Financial Group recovered $8 of the recent losses to close at $146, trading 437,464 shares, PanJam Investment closed $1 lower at $75, in exchanging 317,961 shares, Proven Investments declined $2.40 to finish at $35.10, with 44,783 stock units changing hands. Scotia Group fell $2 to $41, after transferring 33,448 stock units, Seprod picked up $1.50 to close at $43.50, in trading 8,215 units and Stanley Motta gained 30 cents to end the day at $5, with 15,000 units crossing the exchange.

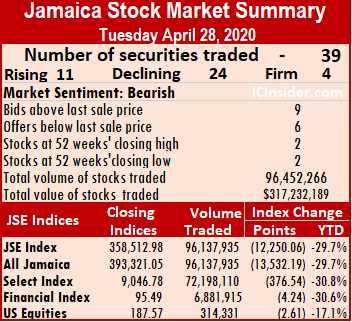

Key Insurance raked in 95 cents to reach a record high of $6.50, with a transfer of 25,094 stock units, Mayberry Investments lost 30 cents trading 3,413 units and closed at $5.50, MPC Caribbean Clean Energy climbed $2 to $149, after swapping 420 units. NCB Financial Group recovered $8 of the recent losses to close at $146, trading 437,464 shares, PanJam Investment closed $1 lower at $75, in exchanging 317,961 shares, Proven Investments declined $2.40 to finish at $35.10, with 44,783 stock units changing hands. Scotia Group fell $2 to $41, after transferring 33,448 stock units, Seprod picked up $1.50 to close at $43.50, in trading 8,215 units and Stanley Motta gained 30 cents to end the day at $5, with 15,000 units crossing the exchange. At the close, the JSE All Jamaican Composite Index declined 11,964.17 on Monday, fell a further by 13,352.19 points to close at 393,321.05. The JSE Market Index dropped 12,250.06 points on top of the 10,830.61 points fall on Monday to 358,512.98 and the JSE Financial Index lost 4.24 points to 95.49. The losses pushed the year to date loss to 30 percent, for main market stocks and ahead of the Junior Market that is down by 28 percent for the year.

At the close, the JSE All Jamaican Composite Index declined 11,964.17 on Monday, fell a further by 13,352.19 points to close at 393,321.05. The JSE Market Index dropped 12,250.06 points on top of the 10,830.61 points fall on Monday to 358,512.98 and the JSE Financial Index lost 4.24 points to 95.49. The losses pushed the year to date loss to 30 percent, for main market stocks and ahead of the Junior Market that is down by 28 percent for the year. The Market closed with an average of 2,670,498 units valued at an average of $8,796,150 for each security traded, in contrast to 467,969 units valued at an average of $2,080,475 on Monday. The average volume and value for the month to date amount to 1,073,044 units valued at $3,888,797 for each security changing hands, compared to 996,058 units valued at $3,638,209 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The Market closed with an average of 2,670,498 units valued at an average of $8,796,150 for each security traded, in contrast to 467,969 units valued at an average of $2,080,475 on Monday. The average volume and value for the month to date amount to 1,073,044 units valued at $3,888,797 for each security changing hands, compared to 996,058 units valued at $3,638,209 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Key Insurance added 35 cents to finish at a 52 weeks’ high of $5.55, after swapping 91,058 shares. Kingston Properties ended at a 52 weeks’ high of $4.50, with a loss of $1.50 after a transfer of 56,639 stock units, Mayberry Investments gained 60 cents trading 28,831 units and closed at $5.80, NCB Financial Group fell $2 to close at a 52 weeks’ high of $138, with an exchange of 276,121 shares. PanJam Investment closed 50 cents higher to $76 after 482,161 shares changed hands, Proven Investments declined to $37.50, after losing $1.35 transferring 359 units, Sagicor Group closed $1 lower to $45, in swapping 73,341 shares. Scotia Group traded $2 lower to end at $43, with an exchange of 255,788 shares and Seprod ended with a loss of $2.60 to close at $42, in trading 101,200 shares.

Key Insurance added 35 cents to finish at a 52 weeks’ high of $5.55, after swapping 91,058 shares. Kingston Properties ended at a 52 weeks’ high of $4.50, with a loss of $1.50 after a transfer of 56,639 stock units, Mayberry Investments gained 60 cents trading 28,831 units and closed at $5.80, NCB Financial Group fell $2 to close at a 52 weeks’ high of $138, with an exchange of 276,121 shares. PanJam Investment closed 50 cents higher to $76 after 482,161 shares changed hands, Proven Investments declined to $37.50, after losing $1.35 transferring 359 units, Sagicor Group closed $1 lower to $45, in swapping 73,341 shares. Scotia Group traded $2 lower to end at $43, with an exchange of 255,788 shares and Seprod ended with a loss of $2.60 to close at $42, in trading 101,200 shares.

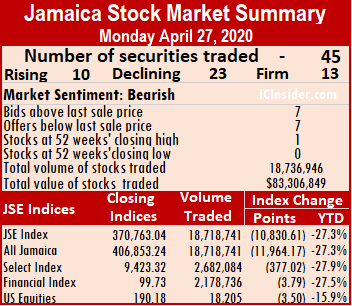

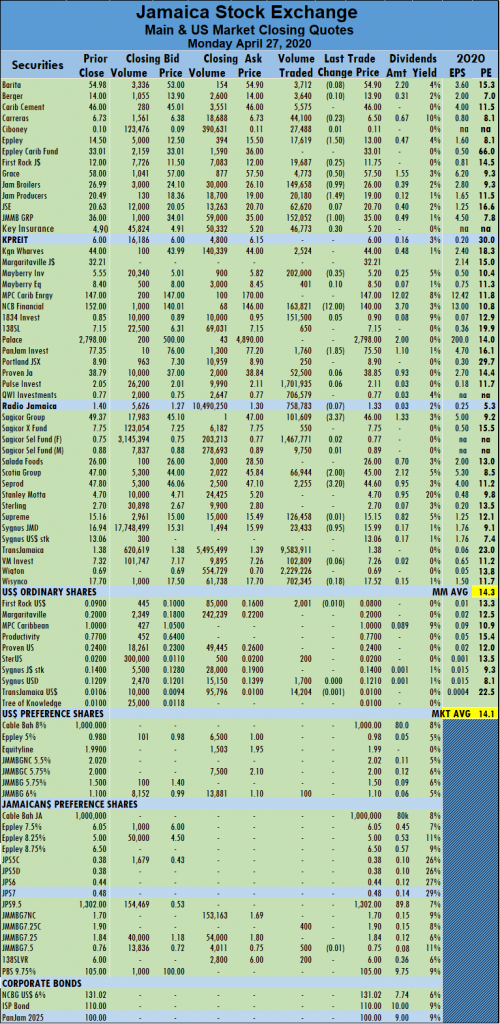

The Market closed with an average of 467,969 units valued $2,080,475 for each security traded, in contrast to 410,412 units valued at an average of $2,124,137 on Friday. The average volume and value for the month to date amount to 996,058 units valued at $3,638,209 for each security changing hands, compared to 1,025,936 units valued at $3,731,907 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The Market closed with an average of 467,969 units valued $2,080,475 for each security traded, in contrast to 410,412 units valued at an average of $2,124,137 on Friday. The average volume and value for the month to date amount to 996,058 units valued at $3,638,209 for each security changing hands, compared to 1,025,936 units valued at $3,731,907 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Key Insurance gained 30 cents after exchanging 46,773 stock units and closed at a 52 weeks’ high of $5.20, Mayberry Investments shed 35 cents to settle at $5.20, with a transfer of 202,000 shares. NCB Financial Group plunged $12 to end at $140, in trading 163,821 shares in reaction to the suspension of dividend payments by banks, mandated by Bank of Jamaica. PanJam Investment fell $1.85 to $75.50, with 1,760 units changing hands, Sagicor Group closed $3.37 lower in reaction to the suspension of dividends announced by Jamaica Central Bank and finished at $46, after trading 101,069 shares. Scotia Group also reacted negatively to the dividend suspension dropping $2 lower to end at $45, with 66,944 stock units crossing the exchange, Seprod fell $3.20 to $44.60, in transferring 2,255 units and Sygnus Credit Investments closed at $15.99, shedding 95 cents trading 23,433 stock units.

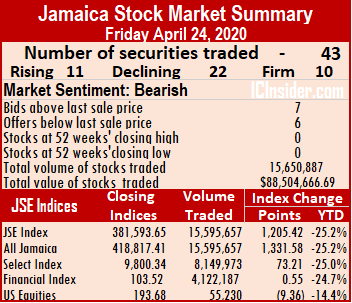

Key Insurance gained 30 cents after exchanging 46,773 stock units and closed at a 52 weeks’ high of $5.20, Mayberry Investments shed 35 cents to settle at $5.20, with a transfer of 202,000 shares. NCB Financial Group plunged $12 to end at $140, in trading 163,821 shares in reaction to the suspension of dividend payments by banks, mandated by Bank of Jamaica. PanJam Investment fell $1.85 to $75.50, with 1,760 units changing hands, Sagicor Group closed $3.37 lower in reaction to the suspension of dividends announced by Jamaica Central Bank and finished at $46, after trading 101,069 shares. Scotia Group also reacted negatively to the dividend suspension dropping $2 lower to end at $45, with 66,944 stock units crossing the exchange, Seprod fell $3.20 to $44.60, in transferring 2,255 units and Sygnus Credit Investments closed at $15.99, shedding 95 cents trading 23,433 stock units. At the close, the All Jamaican Composite Index rose 1,331.58 points to close at 418,817, the JSE Market Index gained 1,205.42 points to close at 381,593.65 and the JSE Financial Index added 0.55 points to 103.52.

At the close, the All Jamaican Composite Index rose 1,331.58 points to close at 418,817, the JSE Market Index gained 1,205.42 points to close at 381,593.65 and the JSE Financial Index added 0.55 points to 103.52. The Market closed with an average of 410,412 units valued at $2,124,137 for each security traded, in contrast to 418,093 units valued at $3,884,360 on Wednesday. The average volume and value for the month to date amount to 1,025,936 units valued at $3,731,907 for each security changing hands, compared to 1,060,899 units valued at $3,829,348 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

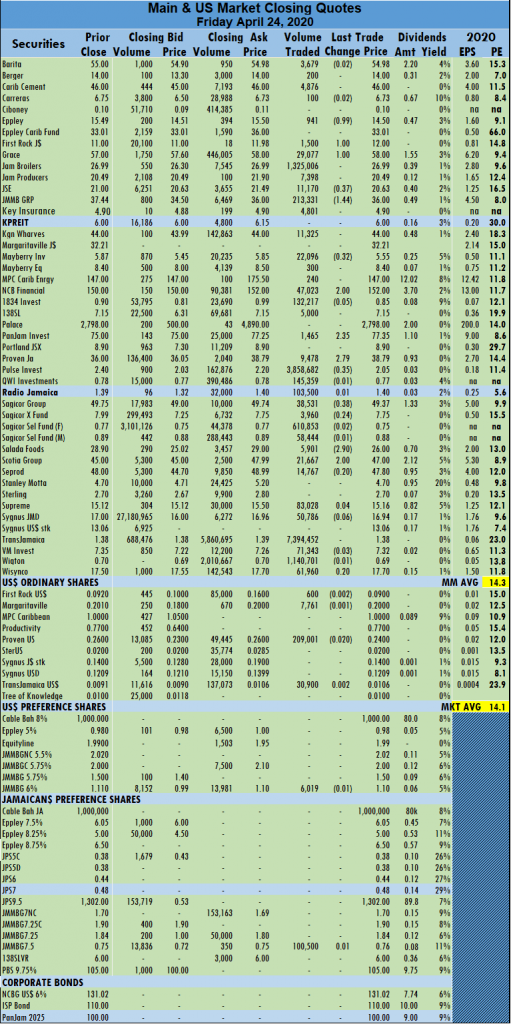

The Market closed with an average of 410,412 units valued at $2,124,137 for each security traded, in contrast to 418,093 units valued at $3,884,360 on Wednesday. The average volume and value for the month to date amount to 1,025,936 units valued at $3,731,907 for each security changing hands, compared to 1,060,899 units valued at $3,829,348 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Jamaica Stock Exchange lost 37 cents to end at $20.63 after 11,170 shares passed through the market, JMMB Group dropped $1.44 and closed at $36, after exchanging 213,331 stock units, Mayberry Investments gained 32 cents trading 22,096 stock units and closed at $5.55.NCB Financial Group rose $2 to end at $152, with 47,023 units changing hands, PanJam Investment traded 1,465 and fell $2.35 to close at $77.35, Proven Investments jumped $2.79 to close at $38.79 after 9,478 shares changed hands. Pulse Investments lost 35 cents in exchanging 3,858,682 stock units at $2.05, Salada Foods dropped $2.90 to $26, in exchanging 5,901 units. Sagicor Group traded 38,531 and lost 38 cents to end at $49.37 and Scotia Group rose $2 after transferring 21,667 stock units to finish at $47.

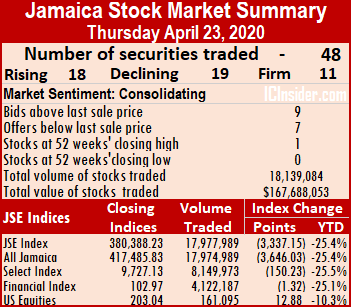

Jamaica Stock Exchange lost 37 cents to end at $20.63 after 11,170 shares passed through the market, JMMB Group dropped $1.44 and closed at $36, after exchanging 213,331 stock units, Mayberry Investments gained 32 cents trading 22,096 stock units and closed at $5.55.NCB Financial Group rose $2 to end at $152, with 47,023 units changing hands, PanJam Investment traded 1,465 and fell $2.35 to close at $77.35, Proven Investments jumped $2.79 to close at $38.79 after 9,478 shares changed hands. Pulse Investments lost 35 cents in exchanging 3,858,682 stock units at $2.05, Salada Foods dropped $2.90 to $26, in exchanging 5,901 units. Sagicor Group traded 38,531 and lost 38 cents to end at $49.37 and Scotia Group rose $2 after transferring 21,667 stock units to finish at $47. The JSE Market Index fell by 3,337.15 points to 380,388.23 and the JSE Financial Index slid 1.32 points to 102.97.

The JSE Market Index fell by 3,337.15 points to 380,388.23 and the JSE Financial Index slid 1.32 points to 102.97. IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and seven securities closing with lower offers. The PE ratio of the market ended at 14.1, while the Main Market ended at 14.3 times 2020-21 earnings.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and seven securities closing with lower offers. The PE ratio of the market ended at 14.1, while the Main Market ended at 14.3 times 2020-21 earnings. Key Insurance gained 90 cents to finish at a record $4.90, with 57,241 units changing hands. Mayberry Investments gained 47 cents trading 6,101 stock units and closed at $5.87, NCB Financial Group sustained a loss of $4.93 to end at $150, in swapping 24,481 units, Salada Foods bounced $1.95 to $28.90, having gained in exchanging 100 units. Seprod rose 50 cents after transferring 8,376 stock units to finish at $48, Stanley Motta traded 500 units at $4.70, after picking up 33 cents, Sygnus Credit Investments added 50 cents to end at $17, with 25,122 stock units changing hands and Wisynco Group ended the day at $17.50, with a loss of $1.18 with 63,156 shares crossing the exchange.

Key Insurance gained 90 cents to finish at a record $4.90, with 57,241 units changing hands. Mayberry Investments gained 47 cents trading 6,101 stock units and closed at $5.87, NCB Financial Group sustained a loss of $4.93 to end at $150, in swapping 24,481 units, Salada Foods bounced $1.95 to $28.90, having gained in exchanging 100 units. Seprod rose 50 cents after transferring 8,376 stock units to finish at $48, Stanley Motta traded 500 units at $4.70, after picking up 33 cents, Sygnus Credit Investments added 50 cents to end at $17, with 25,122 stock units changing hands and Wisynco Group ended the day at $17.50, with a loss of $1.18 with 63,156 shares crossing the exchange.