Trading on the Junior Market saw a major improvement in advance decline ratio with compared to 8 stocks advancing and 10 declining on Wednesday.

Trading on the Junior Market saw a major improvement in advance decline ratio with compared to 8 stocks advancing and 10 declining on Wednesday.

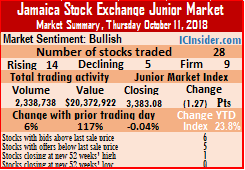

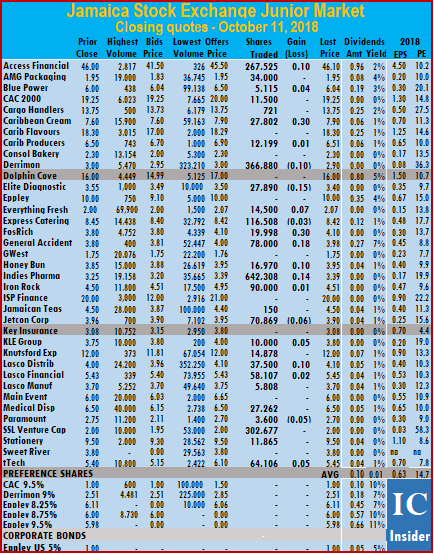

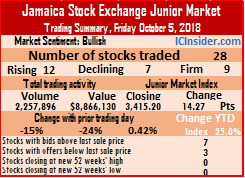

The market closed 14 securities rising just 5 declining stocks, while 9 stocks remained unchanged as 28 securities changed hands, compared to 27 securities on Wednesday, leading to the market index declining 1.27 points to close at 3,383.08.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading had 6 stocks ending with bids higher than their last selling prices, 5 closed with lower offers. reflecting a bias to losing stocks in trading on Friday.

Market activities, resulted in an exchange of 2,338,738 units valued at $20,372,922, compared to 2,216,539 units valued at $9,402,220 on Wednesday.

Trading closed with an average 83,526 units for an average of $727,604 in contrast to 82,094 units for an average of $348,230 on Wednesday. Trading for the month to date averages 78,752 for an average of $371,731 compared to averages of 78,153 for an average of $327,047 previously. September, ended with an average of 484,335 at $2,628,299 for each security traded.

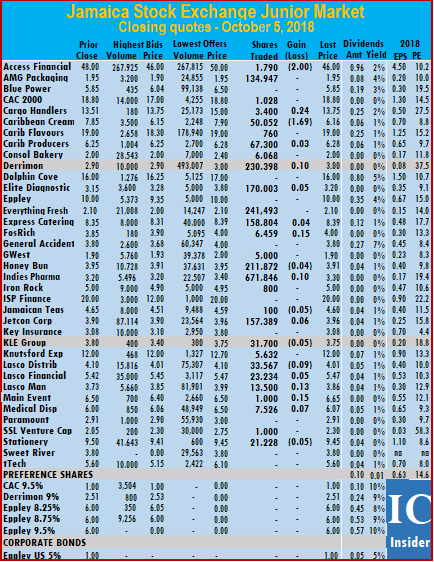

At the close of trading, Access Financial closed 10 cents higher at $46.10, with 267,525 shares traded, AMG Packaging ended at $1.95, with an exchange of 34,000 stock units, Blue Power concluded trading of 5,115 units and rose 4 cents higher to $6.04, CAC2000 finished at $19.25, with 11,500 shares trading, Cargo Handlers settled at $13.75, with an exchange of 721 shares. Caribbean Cream ended trading 27,802 shares, 30 cents higher at $7.90, Caribbean Producers finished trading 12,199 units and rose 1 cent higher to $6.51, Derrimon Trading ended with a loss of 10 cents at $2.90, with 366,880 shares changing hands, Elite Diagnostic finished with a loss of 15 cents at $3.40, in exchanging 27,890 stock units. Everything Fresh traded 14,500 shares and gained 7 cents to close at $2.07, Express Catering ended trading of 116,508 shares with a loss of 3 cents at $8.42, FosRich Group traded 30 cents higher at $4.10, with 19,998 shares changing hands, General Accident closed 18 cents higher at $3.98, in the trading of 78,000 shares,  Honey Bun ended 10 cents higher at $3.95, after 16,970 units traded. Indies Pharma added 14 cents and ended with 642,308 shares changing hands, at $3.39. Iron Rock concluded trading 90,000 shares, with a rise of 1 cent to close at $4.51, Jamaican Teas settled at $4.50, with just 150 shares trading, Jetcon Corporation ended trading with a loss of 6 cents at $3.90, with 70,869 stock units, KLE Group finished trading of 10,000 shares and rose 5 cents to close at $3.80. Knutsford Express closed at $12, with 14,878 shares changing hands, Lasco Distributors ended 10 cents higher at $4.10, exchanging 37,500 shares, Lasco Financial concluded trading of 58,107 stock units, and rose by 2 cents to $5.45, Lasco Manufacturing closed at $3.70, with 5,808 units changing hands. Medical Disposables ended trading at $6.50, with an exchange of 27,262 shares, Paramount Trading closed with a loss of 5 cents at $2.70, with 3,600 shares, Stationery and Office finished trading 11,865 stock units at $9.50 and tTech ended 5 cents higher at $5.45, with 64,106 shares changing hands.

Honey Bun ended 10 cents higher at $3.95, after 16,970 units traded. Indies Pharma added 14 cents and ended with 642,308 shares changing hands, at $3.39. Iron Rock concluded trading 90,000 shares, with a rise of 1 cent to close at $4.51, Jamaican Teas settled at $4.50, with just 150 shares trading, Jetcon Corporation ended trading with a loss of 6 cents at $3.90, with 70,869 stock units, KLE Group finished trading of 10,000 shares and rose 5 cents to close at $3.80. Knutsford Express closed at $12, with 14,878 shares changing hands, Lasco Distributors ended 10 cents higher at $4.10, exchanging 37,500 shares, Lasco Financial concluded trading of 58,107 stock units, and rose by 2 cents to $5.45, Lasco Manufacturing closed at $3.70, with 5,808 units changing hands. Medical Disposables ended trading at $6.50, with an exchange of 27,262 shares, Paramount Trading closed with a loss of 5 cents at $2.70, with 3,600 shares, Stationery and Office finished trading 11,865 stock units at $9.50 and tTech ended 5 cents higher at $5.45, with 64,106 shares changing hands.

Prices of securities trading for the day are those at which the last trade took place.

All Jamaica hits record 418,000

Jamaica Stock Exchange All Jamaica Composite index hit the 418,000 mark in trading on Monday, as it gained 1,044.42 points to reach a record 418,000.53. The JSE Main Index rose 951.59 to a record 380,845.80 with 14 minutes of trading elapsing.

Jamaica Stock Exchange All Jamaica Composite index hit the 418,000 mark in trading on Monday, as it gained 1,044.42 points to reach a record 418,000.53. The JSE Main Index rose 951.59 to a record 380,845.80 with 14 minutes of trading elapsing.

The Junior Market has moved modestly by 8.44 to 3,423.64.

The main market pulled back slightly with 22 minutes of trading passing, with the All Jamaica Composite Index at 417,968.53 and the JSE Main Index at 380,816.64 in a relatively quiet trading session so far.

Gwest’s share issue response inadequate

The response by GWest the issue of preference shares is inadequate and they still have a number of questions to answer about the issue and the lack of disclosure in the prospectus and the audited financial statements.

The response by GWest the issue of preference shares is inadequate and they still have a number of questions to answer about the issue and the lack of disclosure in the prospectus and the audited financial statements.

The openness of directors with their investors is critical in cementing trust between them. A prospectus is a contractual invitation to the public to purchase shares in the offering company. It requires that full disclosure of all material information is made, so that prospective investors can make rational decisions pertaining to the shares being offered for sale. Any rational person reading GWest prospectus would come to the conclusion that the only matter agreed on at the extra-ordinary meeting of November 27 was that which was disclosed in section Page 45 of the prospectus which list details of the “Recent Capital Restructuring of the company to be as follows”:

“At an extraordinary general meeting the shareholders of the Company approved the following actions in respect of the capital structure of the Company: The re-registration of the Company as a public company in accordance with the Companies Act, adopting new Articles of Incorporation for that purpose:”

a)”The increase of the authorized share capital. (b)The subdivision of each Share”

“The disapplication of any pre-emption rights, howsoever arising, for the purposes of the issue of new Shares for subscription. The conversion of all fully paid Shares to stock on issue.”

There is no mention of the issue of any other type of share. Any decision to issue other shares should have been disclosed in this section if a meeting took place before the date of the prospectus.

Dr. Konrad Kirlew, chairman of GWest.

The fact that it was not, is the clearest sign that there was inadequate disclosure of important and material information and that the issue of preference shares after, should not stand before approved by a meeting of the new owners.

The vast majority of Junior Market companies have limited administrative staff, as such all the skill set to properly run them are not in their employ. The end results is that mistakes are made and will continue to be made. Recognizing, that most of them don’t have the knowhow of running a public company, the JSE created the creature called a Mentor, but not even that seems to be adequate to fill the breach.

According to the company in a release to the JSE, “Sections 18 and 19 in the November 2017 GWEST Prospectus specifically disclosed that shareholders loans were to be converted to preference shares, thereby reducing the servicing cost to the Company: Shares in the capital of the Company are under the control of the Directors, as expressly provided for in the Articles of Incorporation.”

That is nonsense. The prospectus only has 16 sections, with the last (section 16) being signed by the directors.

Section 11 contains projections along with supporting notes that were reviewed by Ernst and Young who signed their report on November 28.

The extraordinary meeting at which the change in share capital was approved was said to be held on the November 27. According to the resolution, the directors were given authority to issue, to allot such Cumulative Non-redeemable Preference Shares at such subscription price per Preference Share as the Directors of the Company or such Committee may deem fit, the same to be allotted to shareholders of the Company who have invested in the capital of Company (in cash or in kind) with the understanding/pursuant to agreement(s) that such investment(s) will be recognized as shareholder loans or by the issue of preference shares, in each case on terms and conditions determined by the Directors of the Company, subject always to the Articles of Incorporation of the Company”.

Having given the directors the authority to determine the terms and conditions of the preference shares, GWest in releasing information of the above resolution has not presented the minutes of the meeting of the directors that agreed on the terms. The fact that the extraordinary meeting did not set out the terms of the issue of the shares is even more reason why it should have been fully disclosed in the prospectus.

The company refers to 18 and 19 but it appears they mean notes 18 and 19 of section 11 that deals with the projections. What does the section say about the preference shares?

Note 18. “Borrowings| This relates to the NCB Term Loan and shareholders’ loans converted to preference shares.”

“NCB Term Loan| The terms of this loan for $350 million, include a repayment period of eight years payable in equal quarterly installments and an interest rate of 11.5% per annum.”

“Preference Shares| 50% of shareholders’ loan will be converted to non-redeemable preference shares with interest at 10% per annum. The remaining 50% will remain as shareholder’s loan with no fixed repayment with interest at 10% per annum for the J$ amounts and 4% per annum for the US$ amounts.”

Note 19. “Shareholders’ Loan| This amount relates to funds advanced by the shareholders. It is assumed that outstanding balances will continue to attract interest at the prevailing rates of 15% and 4%, respectively for J$ and US$ funds. However, once the IPO is completed and the Company becomes publicly-listed, it is assumed that the interest rates will be reduced to 6% and 2% for J$ and US$ denominated loans, respectively on the remaining balance not converted to preference shares. With respect to the J$ denominated balance, the interest rate is assumed to increase annually by 1%, with a cap at 10% by 2022. The Directors are of the view that these rates are more in line with arm’s length rates prevailing within the market.”

Nowhere in the prospectus is there any reference to a meeting called to approve the issue of any shares other than ordinary shares and the terms of those shares. Under no stretch of the imagination could assumptions included in a financial projections be regarded as disclosure of an agreement to issue shares or that a resolution was already passed to do so. Earlier in the prospectus it is made clear that futuristic statements are just that, as they may not be achieved. That the company withheld pertinent and material information from the new investors even when they had a number of occasions to do so, is glaring and concerning. That the Jamaica Stock Exchange sees nothing wrong with what has transpired is plain shocking, even more shocking is that they did not ensure that proper and full disclosure of the information was included in the relevant part of the prospectus.

The directors cannot over ride, the company’s act that requires that all changes in share capital of a company be approved by shareholders at a general meeting. From all indications this was not agreed to before the prospectus was published, in which case it appears that the new shareholders would have to approve it at a general meeting.

To compound the problem, the preference shares were issued to connected parties to the company. That alone should have alerted all concerned that all decisions should be properly executed.

Of note, the Audited accounts to March 2018, made no mention of the issue of additional shares that were issued or to be issued. It is the norm in auditing, that minutes of meetings are made available to the auditors and the directors have a responsibility to ensure that the financial statements are accurate. The directors need to state if the audited accounts correctly disclose all relevant information pertaining to the share capital. They need to state why they all signed the Prospectus with no mention being made of the resolution to modify the share capital indicating full details of the resolution.

What date did the directors meet to determine the terms of the preference shares and why were those terms not disclosed in the prospectus for all to see?

The Jamaica Stock Exchange requires that they should be advised in advance of any meeting of directors called to alter the share capital of a company and after the meeting the outcome of the meeting is to be communicated to them as well. There are no indications that the directors complied with this section of the Stock Exchange rules.

The handling of this matter is not the way to properly operate in the capital market.

All Jamaica pass 415,000 Points

Gains in Grace Kennedy, Scotia Group, Seprod and NCB Financial were mostly responsible in pushing Jamaica Stock Exchange main market to a new record high in early trading on Friday.

Gains in Grace Kennedy, Scotia Group, Seprod and NCB Financial were mostly responsible in pushing Jamaica Stock Exchange main market to a new record high in early trading on Friday.

The All Jamaica Composite Index jumped 7,892.89 points to a record 415,112.65 and the JSE Index surged by 7,191.32 points to a record of 378,214.61 points after 41 minutes of opening of the market.

The Junior Market has not participated in the bullishness and slipped 3.76 points to 3,397.17.

All Jamaica claims 411,546 – Thursday

The main market of the Jamaica Stock Exchange broke through 410,000 mark based on movement of the All Jamaica Composite Index in early trading on Wednesday and moved higher by 3,093.31 points to a record 411,545.91.

The main market of the Jamaica Stock Exchange broke through 410,000 mark based on movement of the All Jamaica Composite Index in early trading on Wednesday and moved higher by 3,093.31 points to a record 411,545.91.

The JSE Index that jumped to a record 374,251.61 in early trading moved on to 374,964.90 with gains of 2,818.36, The Junior Market rose 19.93 points to 3,401.72. Grace Kennedy raced to an all-time high of $75, NCB Financial moved up to a record of $131, Supreme Ventures climbed to $21.70, JMMB Group jumped to $35 and Mayberry Jamaican Equities traded at $12.

The main market broke through all resistance points, with the last being 400,000 points with the next big one being 510,000 points region. If it got there in 2018, would represent a gain of 24 percent from current levels and lift the gains for the year to 60 percent.

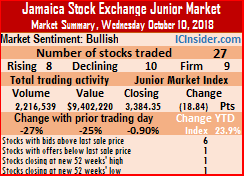

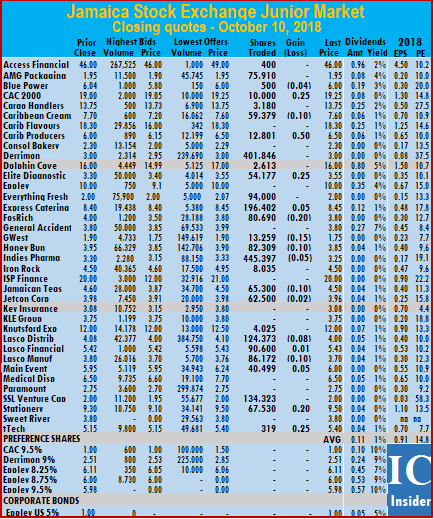

Trading on the Junior Market saw an improved advance, decline ratio with 8 stocks advancing and 10 declining compared to Tuesday when declining stocks overwhelmed advancing ones by 25 percent, while 9 stocks remained unchanged.

Trading on the Junior Market saw an improved advance, decline ratio with 8 stocks advancing and 10 declining compared to Tuesday when declining stocks overwhelmed advancing ones by 25 percent, while 9 stocks remained unchanged.  averages of 77,610 for an average of $324,129 previously. September, ended with an average of 484,335 at $2,628,299 for each security traded.

averages of 77,610 for an average of $324,129 previously. September, ended with an average of 484,335 at $2,628,299 for each security traded. closed with a loss of 15 cents at an all-time low of $1.75, with an exchange of 13,259 stock units.

closed with a loss of 15 cents at an all-time low of $1.75, with an exchange of 13,259 stock units.  17 Junior Market stocks fell, representing 46 percent of all listed ordinary shares, with 6 rising in trading on Tuesday as 31 securities changed hands, compared to 28 securities on Tuesday.

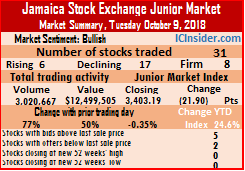

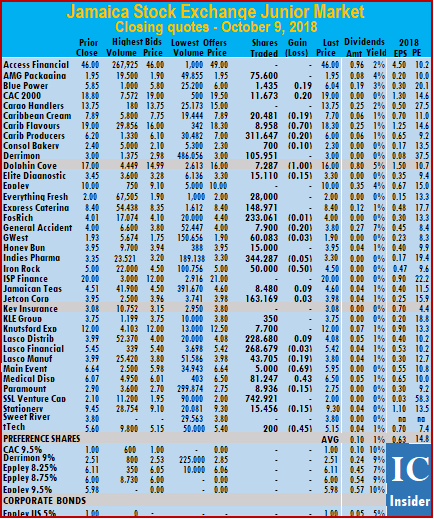

17 Junior Market stocks fell, representing 46 percent of all listed ordinary shares, with 6 rising in trading on Tuesday as 31 securities changed hands, compared to 28 securities on Tuesday. averages of 73,884 for an average of $309,271 previously. September, ended with an average of 484,335 at $2,628,299 for each security traded.

averages of 73,884 for an average of $309,271 previously. September, ended with an average of 484,335 at $2,628,299 for each security traded. General Accident finished trading 7,900 shares with a loss of 20 cents at $3.80.

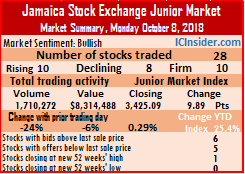

General Accident finished trading 7,900 shares with a loss of 20 cents at $3.80.  The Junior Market of the Jamaica Stock Exchange ended trading on Monday with 28 securities changing hands, as 10 securities advanced, 7 declined and 8 remained unchanged. The Junior Market Index advanced 9.89 points to 3,425.09.

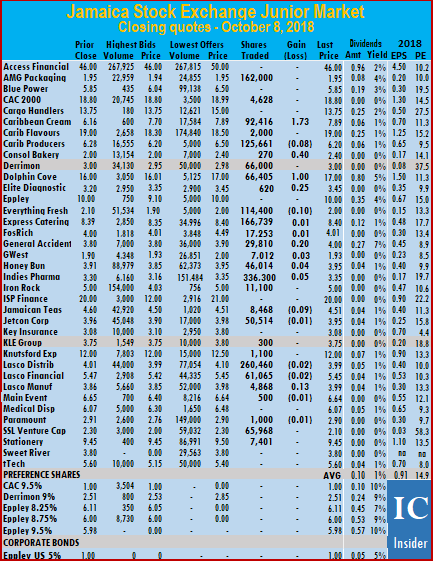

The Junior Market of the Jamaica Stock Exchange ended trading on Monday with 28 securities changing hands, as 10 securities advanced, 7 declined and 8 remained unchanged. The Junior Market Index advanced 9.89 points to 3,425.09. of $316,647 on Friday. Trading for the month to date averages 73,884 for an average of $309,271 compared to averages of 76,500 for an average of $311,790 previously. September, ended with an average of 484,335 at $2,628,299 for each security traded.

of $316,647 on Friday. Trading for the month to date averages 73,884 for an average of $309,271 compared to averages of 76,500 for an average of $311,790 previously. September, ended with an average of 484,335 at $2,628,299 for each security traded. Honey Bun ended 4 cents higher at $3.95, while exchanging 46,014 units, Indies Pharma gained 5 cents and ended with 336,300 shares changing hands to close at $3.35. Iron Rock concluded trading 11,100 shares at $5, Jamaican Teas settled with a loss of 9 cents at $4.51, with 8,468 shares being exchanged, Jetcon Corporation ended trading 50,514 stock units with a loss of 1 cent to end at $3.95. KLE Group finished trading 300 shares at $3.75, Knutsford Express closed at $12, with 1,100 shares trading, Lasco Distributors ended with a loss of 2 cents at $3.99, in exchanging 260,460 shares, Lasco Financial concluded trading with a loss of 2 cents at $5.45, with 61,065 stock units. Lasco Manufacturing closed 13 cents higher at $3.99, exchanging 4,868 units, Main Event settled with a loss of 1 cent at $6.64, after trading 500 shares, Paramount Trading traded with a loss of 1 cent at $2.90, with 1,000 shares and Stationery and Office finished trading at $9.45, with 7,401 stock units changing hands.

Honey Bun ended 4 cents higher at $3.95, while exchanging 46,014 units, Indies Pharma gained 5 cents and ended with 336,300 shares changing hands to close at $3.35. Iron Rock concluded trading 11,100 shares at $5, Jamaican Teas settled with a loss of 9 cents at $4.51, with 8,468 shares being exchanged, Jetcon Corporation ended trading 50,514 stock units with a loss of 1 cent to end at $3.95. KLE Group finished trading 300 shares at $3.75, Knutsford Express closed at $12, with 1,100 shares trading, Lasco Distributors ended with a loss of 2 cents at $3.99, in exchanging 260,460 shares, Lasco Financial concluded trading with a loss of 2 cents at $5.45, with 61,065 stock units. Lasco Manufacturing closed 13 cents higher at $3.99, exchanging 4,868 units, Main Event settled with a loss of 1 cent at $6.64, after trading 500 shares, Paramount Trading traded with a loss of 1 cent at $2.90, with 1,000 shares and Stationery and Office finished trading at $9.45, with 7,401 stock units changing hands.

Jamaican Teas settled with a loss of 5 cents at $4.60, exchanging 100 shares, Jetcon Corporation ended trading 157,389 stock units and rose 6 cents to $3.96, KLE Group finished trading with a loss of 5 cents at $3.75, with 31,700 shares, Knutsford Express closed at $12, in exchanging 5,632 shares, Lasco Distributors ended with a loss of 9 cents at $4.01, with 33,567 shares changing hands, Lasco Financial concluded trading 5 cents higher at $5.47, with 23,234 stock units. Lasco Manufacturing finished 13 cents higher at $3.86, trading 13,500 units, Main Event settled with a rise of 15 cents to $6.65, trading 1,000 shares, Medical Disposables ended trading 7 cents higher at $6.07, with 7,526 shares being exchanged, SSL Venture Capital traded 1,000 shares at $2.30 after trading at a 52 weeks’ high of $2.50 and Stationery and Office finished trading with a loss of 5 cents at $9.45, with 21,228 stock units changing hands.

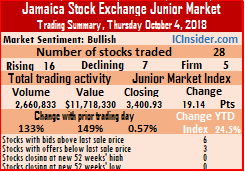

Jamaican Teas settled with a loss of 5 cents at $4.60, exchanging 100 shares, Jetcon Corporation ended trading 157,389 stock units and rose 6 cents to $3.96, KLE Group finished trading with a loss of 5 cents at $3.75, with 31,700 shares, Knutsford Express closed at $12, in exchanging 5,632 shares, Lasco Distributors ended with a loss of 9 cents at $4.01, with 33,567 shares changing hands, Lasco Financial concluded trading 5 cents higher at $5.47, with 23,234 stock units. Lasco Manufacturing finished 13 cents higher at $3.86, trading 13,500 units, Main Event settled with a rise of 15 cents to $6.65, trading 1,000 shares, Medical Disposables ended trading 7 cents higher at $6.07, with 7,526 shares being exchanged, SSL Venture Capital traded 1,000 shares at $2.30 after trading at a 52 weeks’ high of $2.50 and Stationery and Office finished trading with a loss of 5 cents at $9.45, with 21,228 stock units changing hands. The Junior Market Index gained 19.14 points to close at 3,400.93, after 28 securities changed hands, resulting in the prices of 16 securities rising, 8 declining and 5 remaining unchanged.

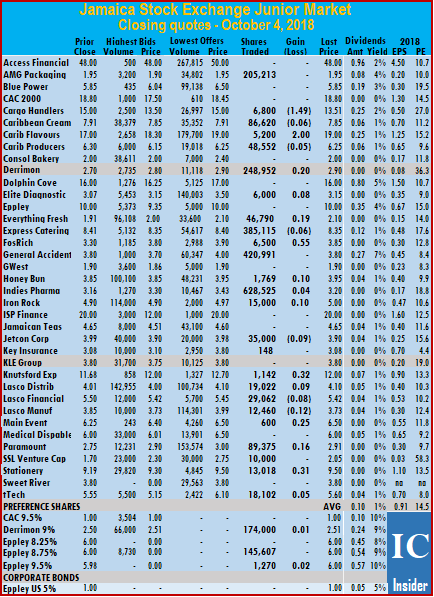

The Junior Market Index gained 19.14 points to close at 3,400.93, after 28 securities changed hands, resulting in the prices of 16 securities rising, 8 declining and 5 remaining unchanged.  86,620 shares changing hands, Caribbean Flavours traded 5,200 stock units and rose $2 to end at $19, Caribbean Producers finished trading 48,552 units with a loss of 5 cents at $6.25, Derrimon Trading ended 20 cents higher at $2.90, with 248,952 shares changing hands. Elite Diagnostic finished 8 cents higher at $3.15, with 6,000 stock units changing hands, Everything Fresh gained 19 cents and ended trading of 46,790 shares at $2.10, Express Catering ended trading 385,115 shares with a loss of 6 cents at $8.35, FosRich Group traded 6,500 shares and gained 55 cents to $3.85, General Accident finished trading 420,991 shares, at $3.80, Indies Pharma rose 4 cents and ended with 628,525 shares changing hands to close at $3.20. Honey Bun ended 10 cents higher at $3.95, with 1,769 units changing hands, Iron Rock concluded trading of 15,000 shares and climbed 10 cents higher to $5, Jetcon Corporation ended trading with 35,000 stock units with a loss of 9 cents at $3.90.

86,620 shares changing hands, Caribbean Flavours traded 5,200 stock units and rose $2 to end at $19, Caribbean Producers finished trading 48,552 units with a loss of 5 cents at $6.25, Derrimon Trading ended 20 cents higher at $2.90, with 248,952 shares changing hands. Elite Diagnostic finished 8 cents higher at $3.15, with 6,000 stock units changing hands, Everything Fresh gained 19 cents and ended trading of 46,790 shares at $2.10, Express Catering ended trading 385,115 shares with a loss of 6 cents at $8.35, FosRich Group traded 6,500 shares and gained 55 cents to $3.85, General Accident finished trading 420,991 shares, at $3.80, Indies Pharma rose 4 cents and ended with 628,525 shares changing hands to close at $3.20. Honey Bun ended 10 cents higher at $3.95, with 1,769 units changing hands, Iron Rock concluded trading of 15,000 shares and climbed 10 cents higher to $5, Jetcon Corporation ended trading with 35,000 stock units with a loss of 9 cents at $3.90.  Key Insurance traded at $3.08, with 148 units changing hands, Knutsford Express closed 32 cents higher at $12, with 1,142 shares, Lasco Distributors ended 9 cents higher at $4.10, with 19,022 shares changing hands, Lasco Financial concluded trading of 29,062 stock units with a loss of 8 cents at $5.42. Lasco Manufacturing finished with a loss of 12 cents at $3.73, with 12,460 units trading, Main Event settled 25 cents higher at $6.50, with 600 shares, Paramount Trading climbed 16 cents higher to $2.91, exchanging 89,375 shares, Stationery and Office finished trading 13,018 stock units and rose 31 cents to $9.50 and tTech ended 5 cents higher at $5.60, with 18,102 shares changing hands. In the junior market preference segment, Derrimon Trading 9% ended 26 cents higher at $2.51, trading 174,000 stock units, Eppley 8.75% finished at $6, with 145,607 shares, Eppley 9.5% settled with a loss of 2 cents at $6, with 1,270 shares, changing hands.

Key Insurance traded at $3.08, with 148 units changing hands, Knutsford Express closed 32 cents higher at $12, with 1,142 shares, Lasco Distributors ended 9 cents higher at $4.10, with 19,022 shares changing hands, Lasco Financial concluded trading of 29,062 stock units with a loss of 8 cents at $5.42. Lasco Manufacturing finished with a loss of 12 cents at $3.73, with 12,460 units trading, Main Event settled 25 cents higher at $6.50, with 600 shares, Paramount Trading climbed 16 cents higher to $2.91, exchanging 89,375 shares, Stationery and Office finished trading 13,018 stock units and rose 31 cents to $9.50 and tTech ended 5 cents higher at $5.60, with 18,102 shares changing hands. In the junior market preference segment, Derrimon Trading 9% ended 26 cents higher at $2.51, trading 174,000 stock units, Eppley 8.75% finished at $6, with 145,607 shares, Eppley 9.5% settled with a loss of 2 cents at $6, with 1,270 shares, changing hands.