The Trinidad and Tobago Stock Exchange listed Agostini’s Limited signed an Agreement to acquire all the shares of Health Brands Limited, a Jamaican pharmaceutical and personal care distribution company owned by Athol Smith.

The transaction has received regulatory approval and the due diligence process is nearing completion the company stated its release to the Trinidad and Tobago Stock Exchange. It is expected that this transaction will be finalized by the end of June 2023, and we will make a further announcement at that time.

The transaction has received regulatory approval and the due diligence process is nearing completion the company stated its release to the Trinidad and Tobago Stock Exchange. It is expected that this transaction will be finalized by the end of June 2023, and we will make a further announcement at that time.

Reports are that the owner approach some Jamaican companies in the sector but apparently, no one was willing to pay the price the seller was looking for. Smith had previously sold his Consumer Brands business to GraceKennedy in 2017, at the time, sales at the company were said to be generating sales of more than $2 billion reports are that the Health Brands revenues could be in the above region as well.

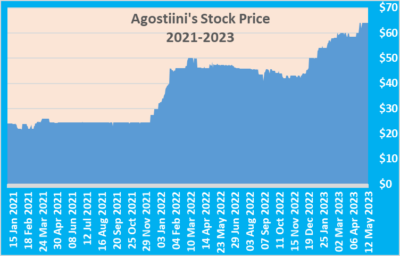

Agostini’s has a market capitalization of TT$4.4 billion with a stock price of $64.04. The company reported revenues of $1.13 billion for the March quarter 16 percent up from $971 million in 2022 with the half year coming in with an increase of 14 percent to $2.4 billion compared to $2.1 billion in the previous year. Quarterly profit attributable to shareholders jumped 43 percent to $63 million over $44 million in 2022 and the half year was up 97 percent to $209 million above the $106 million in 2022.

The company has been in an acquisition mode, acquiring 80% of the outstanding shares of Chinook Trading Canada Limited, a Canadian base consumer products business with trading operations primarily in Caribbean Region. The company states that these acquisitions are consistent with the group’s strategic objective of expansion in more business segments and greater geographical diversification.

The company has been in an acquisition mode, acquiring 80% of the outstanding shares of Chinook Trading Canada Limited, a Canadian base consumer products business with trading operations primarily in Caribbean Region. The company states that these acquisitions are consistent with the group’s strategic objective of expansion in more business segments and greater geographical diversification.

Last year December, they acquired Collins and Carlyle business and disposed of Agostini’s Interior contractors division which the group considers is no longer strategically compatible with the group objectives.

For the half year earnings per share was $3.03 up from $1.53 in 2022 with the March quarter delivering EPS of 92 cents compared to 65 cents in 2022 and $2.91 for the 2022 fiscal year.

Shareholders’ equity closed out the half year at $1.55 billion. The stock traded on the TTSE at $64.25 on Friday, up 28 percent for the year.

Agostini’s buys Jamaica’s Health Brands

More expansion coming for Dolla Financial

Dolla Financial reported record profit for the 2023 first quarter that jumped 90 percent to $125 million before tax, from just $66 million last year, with aftertax profit coming in at $123 million, 128 percent higher than the $59 million reported for 2022, but the company is not satisfied, with that and plans increased borrowing to on lend and acquisition while having eyes on branch expansion.

The company borrowed $1.17 million in 2022 but used most of the available funds on hand at the start of the year, with loans granted to borrowers absorbing $550 million in the March quarter, leaving the company with just $117 million in cash funds. In order to maintain the current profit momentum the company will need to add new loans from lenders to keep funding the expansion.

The company borrowed $1.17 million in 2022 but used most of the available funds on hand at the start of the year, with loans granted to borrowers absorbing $550 million in the March quarter, leaving the company with just $117 million in cash funds. In order to maintain the current profit momentum the company will need to add new loans from lenders to keep funding the expansion.

In an investor briefing, the CEO Kadeem Mairs indicated that they are in the process of negotiating a US$7 million loan that will be used to fund loan expansion and acquisition that they are currently looking at. Such acquisitions will be subject to regulatory approval before they will be able to complete such transactions.

The company is also seeking to establish an 800 square foot branch in May Pen in the complex that houses the supermarket operated by Derrimon Trading.

Importantly, Mairs pointed out that 80 percent of loans granted are secured and therefore result in a low credit default.

IC Insider.com forecast is for the 2023 earnings per share to be 40 cents and is partially predicated on timely loan funding.

SSL investors may soon hear about shares at JSE

Stock market investors who are clients of Stock and Securities with shares held in the Jamaica Central Securities Depository (JCSD) may hear by next week if their accounts will be the subject of a sale of assets to another financial institution, a development that if were the happen would maximise the proceeds from all the company’s physical and intangible assets in the interest of all the company’s creditors.

The Jamaica Stock Exchange subsidiary

Stock market clients of SSL have been unable to trade their stocks since the Jamaica Stock Exchange terminated its Member Dealers Agreement with Stocks and Securities Limited (SSL) effective February 24. Consequently, SSL and its clients were allowed to trade on the exchange.

Some SSL clients have been upset about their inability to trade, made worse by the absence of an update on the matter.

ICInsider.com contacted the Managing Director at the Jamaica Stock Exchange, Marlene Street, to elicit her response on a number of issues relating to the ability of investors to get access to their shareholdings held through SSL.

What is the position of shareholders and their shares in the central depository?

Response: Shareholders who have their securities deposited in the JCSD can rest assured that their securities are safe. Ownership of these securities cannot be transferred without their consent. Shareholders may view their statement from the JCSD Portal at jcsdportal.jamstockex.com or from the JSE’s website at jamstockex.com.”

Can shareholders access their shares now and if not, when and what is holding it up?

Response: “All shares held by investors at the JCSD are held under the account of a Broker Participant. To purchase or sell shares, an investor goes through their broker, the same applies if they desire to transfer their shares applies. Since the shares are held under the account of SSL, in this instance, the JCSD cannot transfer securities without their concurrence.”

Response: “All shares held by investors at the JCSD are held under the account of a Broker Participant. To purchase or sell shares, an investor goes through their broker, the same applies if they desire to transfer their shares applies. Since the shares are held under the account of SSL, in this instance, the JCSD cannot transfer securities without their concurrence.”

“ We have written to the Temporary Manager of SSL to request approval to transfer the securities held by JCSD SSL account holders to brokers of the investors’ choice. We are aware that the Temporary Manager and the FSC are in discussions regarding same however, we await a final response to be able to guide the investors on how to access their shares.”

600 to 1 stock split for Palace

Palace Amusement Company advised that the Board of directors will recommend to shareholders at their upcoming Annual General Meeting to be held on January 24, 2023, that the existing shares be split into 600 units for each currently issued and that the authorised share capital of the Company be increased from 1,500,000 shares to an Unlimited number of shares.

Palace Amusement is recommending 600 to one stock split.

If the resolution if approved at the meeting will take effect from the close of business on February 28, 2023, resulting in the total issued share capital of the company being increased from 1,437,028 ordinary shares to 862,216,800 ordinary shares.

The shares were last traded on Friday at $1,179 each on the Main Market of the Jamaica Stock Exchange but jumped nearly 20 percent in Wednesday’s trading session to $1,400, leading to a suspension in trading in the stock. The move will be welcomed by many of the company’s shareholders some of whom have been clamouring for the splitting of the stock for some time and will result in greater liquidity for the stock.

PanJam and Jamaica Producers merger

Jamaica Producers and PanJam Investment announced an agreement to amalgamate their businesses to create a new group of companies, with the transaction expected to be completed within the first quarter of 2023 and is expected to take advantage of opportunities both locally and globally.

This arrangement, subject to the approval of the shareholders and the relevant regulators, will result in PanJam acquiring JP’s operating assets in exchange for JP taking a 34.5% interest in PanJam. Following the transaction, PanJam will ultimately hold the combined businesses and will be renamed Pan Jamaica Group Limited. JP will emerge as the largest shareholder of the Group, with its shares in the Group being its principal operating asset. Both companies will remain listed on the Main Market of the Jamaica Stock Exchange.

This arrangement, subject to the approval of the shareholders and the relevant regulators, will result in PanJam acquiring JP’s operating assets in exchange for JP taking a 34.5% interest in PanJam. Following the transaction, PanJam will ultimately hold the combined businesses and will be renamed Pan Jamaica Group Limited. JP will emerge as the largest shareholder of the Group, with its shares in the Group being its principal operating asset. Both companies will remain listed on the Main Market of the Jamaica Stock Exchange.

The combined entity “ is expected to deliver significant value for all shareholders through a strong and diverse portfolio of businesses not only in Jamaica but also internationally,” a release from the companies stated.

Stephen Facey Chairman & Paul Hanworth Chief Operating Officer

The new Group will have substantial holdings in real estate and infrastructure, speciality food and drink manufacturing, agri-business, financial services and a global services network of interests in hotels and attractions, business process outsourcing, shipping, logistics and port operations.

According to JP’s Chief Executive Officer, Jeffrey Hall: “This transaction is not our first opportunity to partner with PanJam. We achieved great commercial success for shareholders in our joint investment in Mavis Bank Coffee Company. We also experienced, first-hand, our compatibility around our shared commitment to integrity, seriousness of purpose, nation building and shareholder returns. JP and PanJam operate businesses that have been tested over time and always come out stronger. With a joint balance sheet of over $100 billion in assets, we will have the scale to be more formidable, more global and more resilient.” PanJam’s Chief Executive Officer, Joanna Banks stated: “PanJam has done exceptionally well by building great partnerships with like-minded entities. The proposed business combination represents the creation of the quintessential Jamaican conglomerate, a geographically and operationally diversified company focused on value creation for all stakeholders through investment in key sectors of the global economy. Our internal analysis points to a future that we are all excited about – one in which our combined enterprises become the regional investment vehicle and investor of choice.”

Jamaica Producers former HQ

The expanded Pan Jamaica Group will be led by JP’s current CEO, Jeffrey Hall, who will hold the position of CEO and Executive Vice Chairman of the Board of Directors. PanJam’s current CEO, Joanna Banks will hold the position of President of Pan Jamaica Group. Stephen Facey will serve as Chairman of the Group’s Board, which will include directors from both JP and PanJam. Charles Johnston, JP’s Chairman, Jeffrey Hall and Alan Buckland, JP’s current Chief Financial Officer, are expected to join the Group’s Board.

Both JP and PanJam have long legacies of investing in and contributing to the growth of Jamaica. JP, founded as a co-operative of banana growers over 90 years ago, has re-positioned itself as a multinational group of companies, with a strong footprint not only in Jamaica through its port operations at Kingston Wharves Limited and its agricultural holdings and food businesses, but also globally, through its European juice holdings, shipping line and global logistics businesses. Charles Johnston, the longstanding Chairman of JP will continue in that role. PanJam has invested in Jamaica for close to 60 years. It has an expansive real estate portfolio comprised of high-end commercial and hospitality properties, and is a well-known leader in real estate management and development. It is also a successful private equity investor with actively-managed and strategic holdings in an array of speciality food manufacturing and distribution, hospitality and business process outsourcing providers. Additionally, PanJam has a significant footprint in the financial services industry through its 30.2% stake in Sagicor Group Jamaica Limited.

The stock prices of both companies rose in the morning session on the Jamaica Stock Exchange, with Jamaica Producers rising 8.3 percent to $22 from a close on Friday of $18.31 and Pan Jam Investment jumping just over 18 percent to $58 form the last traded price of $49.

Jamaica Broilers flees Haiti

After several years of operating in a challenging and economically hostile environment, Jamaica Broilers decided to pull the plug on their loss making Haitian operation that once showed promise of long term viability.

The Board of Directors on Wednesday “accepted the recommendation of management to discontinue its operations in Haiti as conducting business in that jurisdiction has become unviable.”

For the fiscal year to April 2022, the Haitian market suffered a big blow, with sales nose-diving 44 percent to $1.3 billion from $2.4 billion in 2021 as that country continues to suffer from economic and social instability.

That segment results showed a worsening outturn with a loss of $365 million, from a loss of just $7 million in 2021. Up to the January quarter, the results showed a loss of just $11 million from revenues of $1.1 billion, but the company made an impairment provision of $141 million for this operation which is charged to cost of sales and administration and other expenses. Overall the group wrote down the value of their investment in Haiti by $904 million to just $308 million. The Haitian operation reported a loss of $83 million in the quarter to July, up from a loss of$48 million in 2021, with revenues of $86 million down from $426 million in 2021.

Revenue for the group in the July quarter this year amounted to $22.98 billion, up 30.5 percent from $17.6 million in 2021, with profit surging 288 percent to $1.1 billion from just $275 million in 2021.

In early trading on the Jamaica Stock Exchange, on Friday, Jamaica Broilers opened at $29.

Mayberry coming structure

Mayberry Investments announced its intention to undertake a reorganization of the Group to facilitate ease of ongoing regulatory monitoring and allow for greater flexibility in operating to take greater advantage of opportunities in unregulated markets.

Mayberry Ithe lead broker.

The reorganisation which will be undertaken pursuant to a Court-approved Scheme of Arrangement will result in a new parent company, Mayberry Group Limited, will be established in Saint Lucia and will, in turn, and a new financial holding company in Jamaica, Mayberry Holdings Limited

Mayberry Jamaica Equities and Widebase will become direct subsidiaries of Mayberry Group. Mayberry Investments will become a wholly-owned subsidiary of Mayberry Holdings.

Shareholders in MIL will become direct owners Mayberry Group, the ultimate parent company. The reorganization is conditional upon the Scheme of arrangement being approved by the Jamaican Supreme Court and the Jamaica Stock Exchange (“JSE”) approving Mayberry Group, the new parent company, for listing by Introduction on the main market of the JSE, in place of MIL.

For the quarter to March this year, Mayberry Investments reported a profit attributable to shareholders of $692 million up from a loss of $331 million for the first quarter in 2021, with a major turnaround in net unrealized losses of $761 million on investment in associates to gains of $868 million.

Stock split to lift Fosrich to 3rd largest

Fosrich proposed 10 to 1 stock split will lift the issued shares to the third highest in Jamaica with 5 billion shares and make by far the company with the largest number of issued shares on Junior Market if shareholders approve the split as proposed.

Only Wigton Windfarm with 11 billion issued shares and Transjamaican Highway with 12.5 billion will be ahead of Fosrich. The next closes will be Sagicor Group with 3.9 billion issued shares.

Only Wigton Windfarm with 11 billion issued shares and Transjamaican Highway with 12.5 billion will be ahead of Fosrich. The next closes will be Sagicor Group with 3.9 billion issued shares.

Shareholders of Fosrich at the Annual General Meeting scheduled to be held on June 21 will consider increasing the authorised share capital of the company from 512,821,000 to 15 billion by the creation of an additional 14,487,179,000 ordinary shares.

The shareholders are asked to approve the splitting of issued shares into 10 units with effect from the close of business on July 6. If approved will result in the total issued shares being increased to 5,022,755,550 ordinary shares of no par value.”

The Company is requesting authorisation to issue up to 126 million shares by way of a Rights Issue to existing stockholders and or the public, on terms to be decided by the directors.

The company expanded into the manufacturing of PVC pipes and the repairs of transformers, resulting in a big surge in revenues and profits that helped in fueling the stock price to a high of $38 this year from just $7.20 a year ago.

Or the quarter to March this year revenues jumped a solid 64 percent to $900 million and profit surged 314 percent to $159 million, with earnings per share of 32 cents.

The companies, owned by Ricardo Allen and John Bailey, respectively, bring their ownership in the 2022 listed Junior Market company to just under 24 percent and under 9 percent, respectively, in a move that is a vote of confidence in the future growth of the company.

The companies, owned by Ricardo Allen and John Bailey, respectively, bring their ownership in the 2022 listed Junior Market company to just under 24 percent and under 9 percent, respectively, in a move that is a vote of confidence in the future growth of the company.