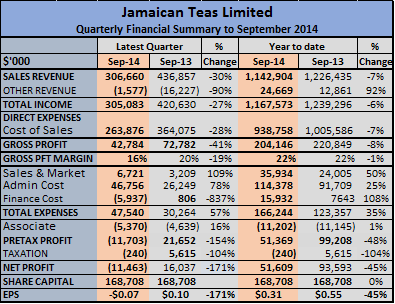

Jamaican Teas reported sharply lower profit, last year to September, of $52.7 million versus $93 million in 2013, with earnings per share of 31 cents. The figures were reported in the group’s audited financial statements release last week.

Jamaican Teas reported sharply lower profit, last year to September, of $52.7 million versus $93 million in 2013, with earnings per share of 31 cents. The figures were reported in the group’s audited financial statements release last week.

The results emanated from sale revenues of $1.14 billion down from $1.23 billion in 2013. There was approximately $50 million coffee sales included in the 2013 results with none in 2014. In 2013 the real estate segment contributed $185 million in revenues compared to only $26 million in 2014 with most coming in the September 2013 quarter.

Gross profit margin shrank slightly from 21.89 percent to 21 percent for the year, helping to cut gross profit by $17 million. Other operating income climbed to $24.7 million from $12.9 million in 2013, partially due to losses on sale of, and impairment of investments incurred in 2013, amounting to $13.5 million, but did not occur in 2014.

Changes in our distributorship in the Florida at the start of the fiscal year resulted in some short-term fall out in sales and increased marketing cost. A new distributor was appointed in the US market that will provide wider distribution in some key cities within that country. Revenues are expected to benefit from this development starting with the December quarter. The 2015 revenues, should also benefit from the completion of sales of 16 units in the first phase of the real estate development in St Thomas. The supermarket in Savanna-la-Mar was close to a break even by year-end and while the one in Kingston remained profitable. The Montego Bay supermarket reported losses in line with what was incurred in the prior year.

There was approximately $50 million increased borrowed funds at the end of the year, putting borrowings at $304 million. The profile of the debt changed markedly, with long-term loans accounting for two thirds of the debt at the end of the fiscal year compared with just 2 percent in 2013. The portfolio of investments including equities, stood at $123 million at the year-end and shareholders’ equity of $635 million.

There was approximately $50 million increased borrowed funds at the end of the year, putting borrowings at $304 million. The profile of the debt changed markedly, with long-term loans accounting for two thirds of the debt at the end of the fiscal year compared with just 2 percent in 2013. The portfolio of investments including equities, stood at $123 million at the year-end and shareholders’ equity of $635 million.The company imports of black and green tea in bulk for packaging and the distribution local and overseas. it also packages and distributes herbal teas and distributes other bottled water, coconut milk and other pre-packaged food items. the group operates supermarkets and is involved in the rental of residential properties and the development of real estate for resale.The stock is listed on the Jamaica Stock Exchange and last traded at $2.50.