On a day of very low trading, the All Jamaican Composite Index added to the strong gains on Thursday to close 1,130.64 points up to 428,191.40 on Tuesday while the JSE Index advanced 1,027.45 points to close at 390,104.27.

On a day of very low trading, the All Jamaican Composite Index added to the strong gains on Thursday to close 1,130.64 points up to 428,191.40 on Tuesday while the JSE Index advanced 1,027.45 points to close at 390,104.27.

Market activity on the main market of the Jamaica Stock Exchange remained subdued with just 1,509,697 units changing hands for $34,816,059, compared to 3,564,657 units valued $53,154,918 on Thursday.

At the close, the main and US markets had 31 securities traded, compared to 28 on Thursday leading to 10 advancing, 11 declining and 10 closing unchanged.

Barita Investments led trading with a mere 225,658 shares, accounting for 15 percent of total main market volume, followed by Mayberry Jamaican Equities with 184,148 units and 12 percent of the day’s trades and Wisynco Group with 167,463 units for 11 percent of volume traded.

Market activity ended with an average of 53,918 units valued at an average of $1,243,431 for each security traded. In contrast to 132,024 units valued at an average of $1,968,701 on Thursday. The average volume and value for the month to date amounts to 136,995 shares at $2,302,086 for each security, compared to 142,319 shares at $2,375,277 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 11 stocks ending with bids higher than their last selling prices and just 2 closing with lower offers.

In main market activity, Barita Investments lost $1 to close at $39, with an exchange of 225,658 shares, Caribbean Cement dropped $1 to $64 with 37,388 shares changing hands, Grace Kennedy gained 45 cents in trading 21,340 stock units at $60, Jamaica Broilers rose 65 cents to close at $31.65, with an exchange of 10,391 shares. Jamaica Producers fell 26 cents to close at $21, after trading 15,500 stock units, JMMB Group added 90 cents to settle at $31.50, with 5,389 units changing hands. Mayberry Investments recovered 50 cents in trading 3,900 shares, to close at  $8, Mayberry Jamaican Equities climbed $1 with 184,148 units trading, to close at $10. Palace Amusement dropped $200 to close at $1,250 after trading 120 units, Sagicor Group lost 47 cents to $44.53 in an exchange of 30,587 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group rose 30 cents and finished trading 15,798 shares at $50.50 and Sygnus Credit Investments rose 50 cents trading of 59,500 units at $12.

$8, Mayberry Jamaican Equities climbed $1 with 184,148 units trading, to close at $10. Palace Amusement dropped $200 to close at $1,250 after trading 120 units, Sagicor Group lost 47 cents to $44.53 in an exchange of 30,587 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group rose 30 cents and finished trading 15,798 shares at $50.50 and Sygnus Credit Investments rose 50 cents trading of 59,500 units at $12.

Trading in the US dollar market ended with 65,070 shares trading with a value of US$8,900. JMMB Group 6% preference share traded 2,320 units and closed at US$1.04 Proven Investments traded 5,650 shares at 23 US cents and Sygnus Credit Investments rose 1 cent and ended trading of 57,100 units at 9 US cents leaving the JSE USD Equities Index fell 0.95 points to close at 178.31.

More gains for JSE majors – Tuesday

Sharp jump in JSE indices – Thursday

Sagicor Group jumped $5.50 on Thursday.

Sagicor Group jumped $5.50 to help push the All Jamaican Composite Index a healthy 6,934.04 points to close at 427,060.76 on Thursday while the JSE Index jumped a sizable 6,301.17 points to 389,076.82.

Market activity picked up on the main market of the Jamaica Stock Exchange with 3,564,657 units valued $53,154,918 traded compared to 3,197,837 units valued $101,850,841 on Wednesday.

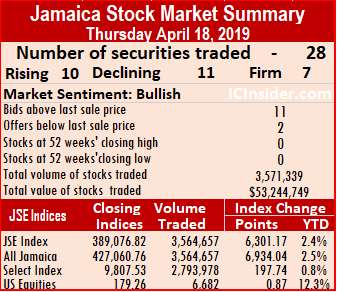

At the close, the main and US markets had 28 securities traded, compared to 29 on Wednesday leading to 10 advancing, 11 declining and 7 closing unchanged.

Sagicor Real Estate Fund led trading with 999,193 shares, accounting for 28 percent of total main market volume, followed by 1834 Investments with 623,879 units and 17.5 percent of the day’s trades and Radio Jamaica with 570,068 units for 16 percent of volume traded.

Market activity ended with an average of 132,024 units valued at an average of $1,968,701 for each security traded. In contrast to 114,208 units for an average of $3,637,530 on Wednesday. The average volume and value for the month to date amounts to 142,319 shares at $2,375,277 for each security, compared to 142,996 shares at $2,404,318 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 11 stocks ending with bids higher than their last selling prices and just 2 closing with lower offers.

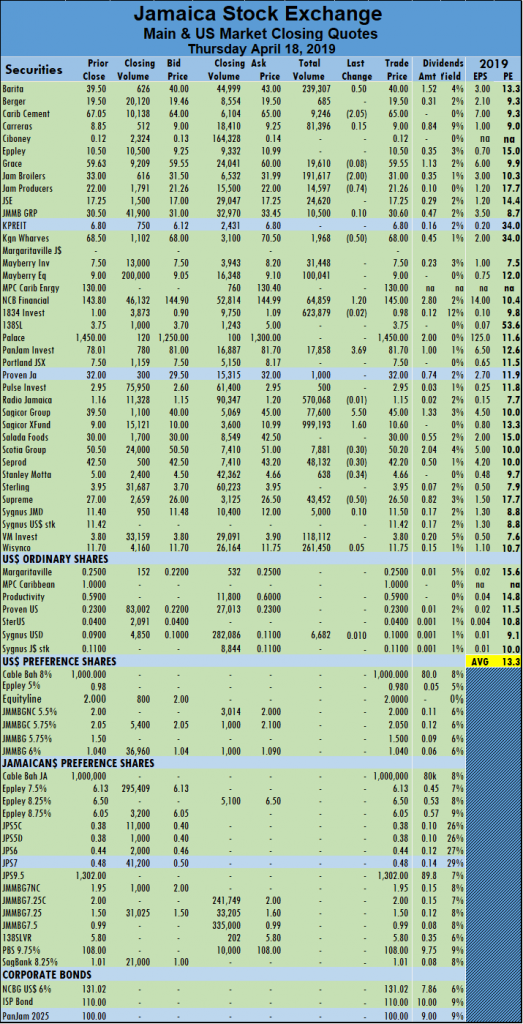

In main market activity, Barita Investments gained 50 cents to close at $40, with an exchange of 239,307 shares, Caribbean Cement dropped $2.05 to $65 with 9,246 shares changing hands, Jamaica Broilers lost $2 to close at $31, with an exchange of 191,617 shares. Jamaica Producers fell 74 cents to close at $21.26, after trading 14,597 stock units, Kingston Wharves shed  50 cents to settle at $68, with 1,968 units changing hands. NCB Financial Group recovered the $1.20 lost on Wednesday in trading 64,859 shares, to close at $145, PanJam Investment jumped $3.69 to close at $81.70 after trading 17,858 units, Sagicor Group jumped $5.50 to $45 in an exchange of 77,600 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group fell 30 cents and finished trading 7,881 shares at $50.20, Seprod closed at $42.20 with a loss of 30 cents while trading 48,132 shares. Stanley Motta lost 34 cents and ended at $4.66, in trading 638 shares and Supreme Ventures lost 50 cents in finishing at $26.50, with 43,452 units changing hands.

50 cents to settle at $68, with 1,968 units changing hands. NCB Financial Group recovered the $1.20 lost on Wednesday in trading 64,859 shares, to close at $145, PanJam Investment jumped $3.69 to close at $81.70 after trading 17,858 units, Sagicor Group jumped $5.50 to $45 in an exchange of 77,600 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group fell 30 cents and finished trading 7,881 shares at $50.20, Seprod closed at $42.20 with a loss of 30 cents while trading 48,132 shares. Stanley Motta lost 34 cents and ended at $4.66, in trading 638 shares and Supreme Ventures lost 50 cents in finishing at $26.50, with 43,452 units changing hands.

Trading in the US dollar market ended with just one security trading. Sygnus Credit Investments rose 1 cent and ended trading of 6,682 units at 10 US cents leaving the JSE USD Equities Index rose 0.87 points to close at 179.26.

JSE trading boosted – Wednesday

Market activity picked up on the main market of the Jamaica Stock Exchange on Wednesday with 3,197,837 units valued $101,850,841 traded compared to 1,271,826 units valued $41,461,461 on Tuesday.

Market activity picked up on the main market of the Jamaica Stock Exchange on Wednesday with 3,197,837 units valued $101,850,841 traded compared to 1,271,826 units valued $41,461,461 on Tuesday.

At the close of the market, the JSE All Jamaican Composite Index increased by 272.70 points to 420,126.72 and the JSE Index advanced 247.81 points to close at 382,775.65. The main and US markets had 29 securities traded, compared to 33 on Tuesday leading to 12 advancing, 9 declining and 8 closing unchanged.

Grace Kennedy led trading with 1,129,961 shares, accounting for 35 percent of total main market volume, followed by Wisynco Group with 670,925 units and 21 percent of the day’s trades and Radio Jamaica with 421,639 units for 13 percent of volume traded.

Market activity ended with an average of 114,208 units valued at an average of $3,637,530 for each security traded, in contrast to 43,856 units for an average of $1,429,706 on Tuesday.  The average volume and value for the month to date amounts to 142,996 shares at $2,404,318 for each security, compared to 145,107 shares at $2,305,661 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

The average volume and value for the month to date amounts to 142,996 shares at $2,404,318 for each security, compared to 145,107 shares at $2,305,661 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 11 stocks ending with bids higher than their last selling prices and just 4 closing with lower offers.

In main market activity, Barita Investments rose $1.90 to close at $39.50, with an exchange of 74,708 shares, Caribbean Cement climbed $1.55 to $67.05, with a mere 10,981 shares changing hands, Grace Kennedy traded 1,129,961 stock units after falling 37 cents to end at $59.63, Jamaica Broilers climbed $1.80 to close at $33, with an exchange of 53,160 shares. Jamaica Producers fell 25 cents to close at $22, after trading 69,348 stock units, Kingston Wharves gained 50 cents to settle at $68.50, with 650 units changing hands. Mayberry Investments declined $1 trading  69,600 shares, to close at $7.50, Mayberry Jamaican Equities fell 50 cents trading 138,162 shares at $9.50. NCB Financial Group dropped $1.20 in trading with 14,174 shares, to close at $143.80, PanJam Investment lost 99 cents after ending at $78.01 and trading 41,290 units, Sagicor Group rose 45 cents to $39.50 in an exchange of 10,772 shares. Scotia Group rose 30 cents and finished trading 28,076 shares at $50.50, Seprod closed at $42.50 with a gain of 50 cents while trading 11,100 shares, Supreme Ventures gained $2 in finishing at $27, with 278,135 units changing hands and Wisynco Group gained 35 cents trading 670,925 units, to close at $11.70.

69,600 shares, to close at $7.50, Mayberry Jamaican Equities fell 50 cents trading 138,162 shares at $9.50. NCB Financial Group dropped $1.20 in trading with 14,174 shares, to close at $143.80, PanJam Investment lost 99 cents after ending at $78.01 and trading 41,290 units, Sagicor Group rose 45 cents to $39.50 in an exchange of 10,772 shares. Scotia Group rose 30 cents and finished trading 28,076 shares at $50.50, Seprod closed at $42.50 with a gain of 50 cents while trading 11,100 shares, Supreme Ventures gained $2 in finishing at $27, with 278,135 units changing hands and Wisynco Group gained 35 cents trading 670,925 units, to close at $11.70.

Trading in the US dollar market ended with just one security trading. Proven Investments ended trading with 5,000 units at 23 US cents leaving the JSE USD Equities Index unchanged at the close at 178.39.

Wigton IPO weights on JSE trading – Tuesday

Wigton IPO over shadows JSE trading.

Reports are that more than 4,500 applications were in the system before close of trading on Tuesday for what is turning out to be well sort after shares in the first renewable shares offer to come to the market.

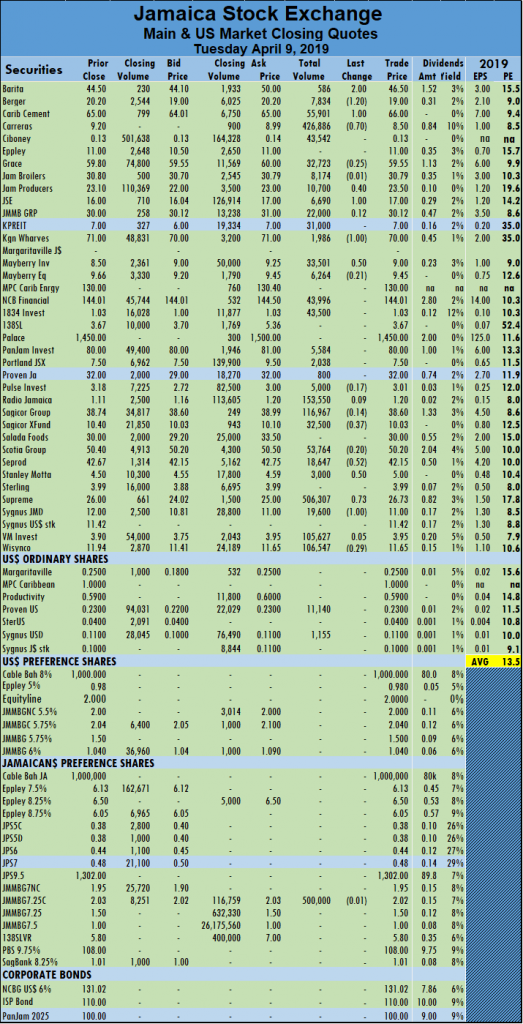

Trading on the main market of the Jamaica Stock Exchange ended Tuesday with the JSE All Jamaican Composite Index climbing 2,743.03 points to 419,854.02 and the JSE Index advancing by 2,492.67 points to 382,527.84.

At the close of the main and US markets, 33 securities traded, compared to 28 on Monday leading to 10 advancing, 14 declining and 9 closing unchanged.

Mayberry Jamaican Equities led with 276,530 shares, accounting for 22 percent of total main market volume, followed by Sagicor Real Estate Fund with 146,545 units with 12 percent of the day’s trades and Scotia Group with a mere 120,670 units for 9 percent of volume traded.

Market activity ended with an average of 43,856 units valued at an average of $1,429,706 for each security traded, in contrast to 55,353 units at $1,446,448 on Monday. The average volume and value for the month to date amounts to 145,107 shares at $2,305,661 for each security, compared to 153,425 shares at $2,384,798 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 7 stocks ending with bids higher than their last selling prices and just 1 closing with a lower offer.

In main market activity, Barita Investments lost $1.90 to close at $37.60, with an exchange of 5,231 shares, Caribbean Cement declined $1 to $65.50, with a mere 770 shares changing hands, Carreras fell 28 cents trading 91,573 units at $8.75, Jamaica Broilers climbed $1.80 to close at $33, with an exchange of 53,160 shares. Jamaica Producers fell $1.15, to close at $22.25, after trading 5,990 shares, Jamaica Stock Exchange gained 67 cents to close at $17.25, after trading 18,622 shares, JMMB Group concluded trading 27,058 shares at $30.50, after gaining 50 cents, Kingston Wharves dropped $2 to settle at $68, with 1,500 units changing hands.

Mayberry Jamaican Equities rose 90 cents trading 276,530 shares at $9.50, PanJam Investment fell $2 and ended at $79 trading 10,830 units, Sagicor Real Estate Fund dropped $1.30 in an exchange of 146,545 shares to close at a 52 weeks’ low of $9, Seprod closed at $42 with a loss of 50 cents while trading 1,236 shares. Stanley Motta gained 50 cents to end at $5, exchanging 986 shares, Supreme Ventures gave up $1 in finishing at $25, with 34,782 units changing hands Sygnus Credit Investments shed 60 cents in trading 13,800 units to close at $11.40 and Wisynco Group gained 29 cents trading 64,250 units, to close at $11.35.

Mayberry Jamaican Equities rose 90 cents trading 276,530 shares at $9.50, PanJam Investment fell $2 and ended at $79 trading 10,830 units, Sagicor Real Estate Fund dropped $1.30 in an exchange of 146,545 shares to close at a 52 weeks’ low of $9, Seprod closed at $42 with a loss of 50 cents while trading 1,236 shares. Stanley Motta gained 50 cents to end at $5, exchanging 986 shares, Supreme Ventures gave up $1 in finishing at $25, with 34,782 units changing hands Sygnus Credit Investments shed 60 cents in trading 13,800 units to close at $11.40 and Wisynco Group gained 29 cents trading 64,250 units, to close at $11.35.Trading in the US dollar market ended with 34,592 units valued $12,596. Eppley 5% preference share, closed at 98 US cents with 5,292 shares changing hands and JMMB Group 5.75% preference share settled gained 1 cent and ended at US$2.05 trading1,000 shares, Proven Investments ended trading with 20,000 units at 23 US cents and Sygnus Credit Investments shed 2 cents in trading 8,300 units to close at 9 US cents. The JSE USD Equities Index lost 0.89 points to close at 178.39.

JSE main market drops – Monday

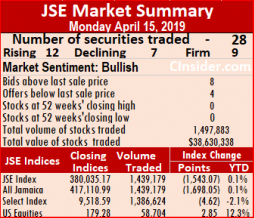

Trading on the main market of the Jamaica Stock Exchange ended Monday as the JSE All Jamaican Composite Index sank 1,698.05 points to 417,110.99 and the JSE Index dropping 1,543.07 points to close at 380,035.17, with a positive advance decline ratio.

Trading on the main market of the Jamaica Stock Exchange ended Monday as the JSE All Jamaican Composite Index sank 1,698.05 points to 417,110.99 and the JSE Index dropping 1,543.07 points to close at 380,035.17, with a positive advance decline ratio.

At the close of the main and US markets, 28 securities traded, compared to 30 on Friday leading to 12 advancing, 7 declining and 9 closing unchanged.

Trading ended with just 1,439,179 units valued at just $37,607,638 compared to 2,536,555 units valued $102,402,822 crossing the exchange on Friday.

Wisynco Group led with 603,633 shares, accounting for 42 percent of total main market volume, followed by Sagicor Group with 254,940 units with 18 percent of the day’s trades and Carreras with a mere 152,725 units for 11 percent of volume traded.

volume, followed by Sagicor Group with 254,940 units with 18 percent of the day’s trades and Carreras with a mere 152,725 units for 11 percent of volume traded.

Market activity ended with an average of 55,353 units at $1,446,448 for each security traded, in contrast to 84,552 units at $3,413,427 on Friday. The average volume and value for the month to date amounts to 153,425 shares at $2,384,798 for each security, compared to 161,222 shares at $2,467,500 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 8 stocks ending with bids higher than their last selling prices and 4 closing with lower offers.

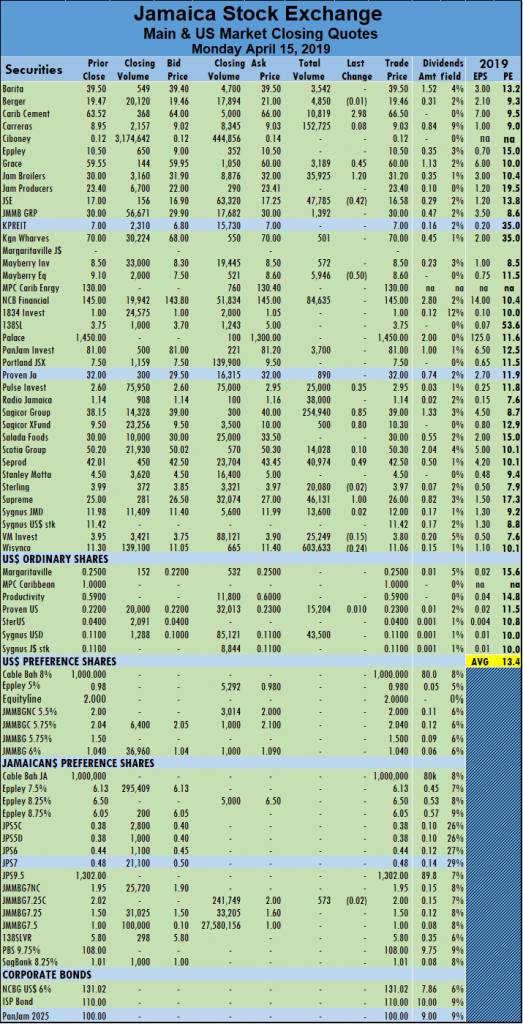

In main market activity, Caribbean Cement gained $2.98 to finish at $66.50, with 10,819 shares changing hands, Grace Kennedy traded 3,189 stock units and added 45 cents to close at $60, Jamaica Broilers climbed $1.20 to close at $31.20, with an exchange of 35,925 shares. Jamaica Stock Exchange fell 42 cents to close at $16.58, after trading 47,785 shares, Mayberry Jamaican Equities lost 50 cents trading 5,946 shares at $8.6, Pulse Investments rose 35 cents and finished at $2.95, with 25,000 shares crossing the exchange, Sagicor Group rose 85 cents in trading 254,940 shares to close at $39. Sagicor Real Estate Fund exchanged just 500 shares to close at $10.30, after gaining 80 cents, Supreme Ventures rose $1 and finished at $26, with 46,131 units changing hands and Wisynco Group fell 24 cents trading 603,633 units to close at $11.06.

Jamaica Stock Exchange fell 42 cents to close at $16.58, after trading 47,785 shares, Mayberry Jamaican Equities lost 50 cents trading 5,946 shares at $8.6, Pulse Investments rose 35 cents and finished at $2.95, with 25,000 shares crossing the exchange, Sagicor Group rose 85 cents in trading 254,940 shares to close at $39. Sagicor Real Estate Fund exchanged just 500 shares to close at $10.30, after gaining 80 cents, Supreme Ventures rose $1 and finished at $26, with 46,131 units changing hands and Wisynco Group fell 24 cents trading 603,633 units to close at $11.06.

Trading in the US dollar market ended with 58,704 units valued at $7,867. Proven Investments gained 1 cents and ended trading with 15,204 units at 23 US cents and Sygnus Credit Investments shed 1 cent in trading 43,500 units to close at 11 US cents. The JSE USD Equities Index rose 2.85 points to close at 179.28.

Falling stocks clobber JSE – Thursday

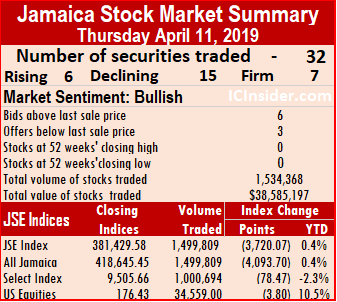

Trading on the main market of the Jamaica Stock Exchange ended Thursday with JSE All Jamaican Composite Index dropping 4,093.70 points to 418,645.45 and the JSE Index diving by 3,720.07 points to 381,429.58 following a decline advance ratio of 5 to 2.

Trading on the main market of the Jamaica Stock Exchange ended Thursday with JSE All Jamaican Composite Index dropping 4,093.70 points to 418,645.45 and the JSE Index diving by 3,720.07 points to 381,429.58 following a decline advance ratio of 5 to 2.

At the close of the main and US markets, 32 securities traded, compared to 33 on Wednesday leading to just 6 advancing, 15 declining and 11 closing unchanged.

Trading ended with just 1,499,809 units valued a mere $37,984,293 compared to 1,945,908 units valued just $26,582,198 crossing the exchange on Wednesday.

Wisynco Group led with just 286,871 shares, accounting for 19 percent of total main market volume, followed by Barita Investments with just 202,682 units with 13.5 percent of the day’s trades and  Victoria Mutual Investments with a mere 138,470 units or 9 percent of volume traded.

Victoria Mutual Investments with a mere 138,470 units or 9 percent of volume traded.

Market activity ended with an average of 49,994 units valued at an average of $1,266,143, in contrast to 77,588 units valued at $1,371,263 on Wednesday. The average volume and value for the month to date amounts to 168,967 shares at $2,360,413 for each security, compared to 182,335 shares at $2,500,108 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 6 stocks ending with bids higher than their last selling prices and 3 closing with lower offers.

In main market activity, Barita Investments dived $7 to close at $43, with a 202,682 shares changing hands, Berger Paints jumped $1.20 and ended at $20.20, with 217 stock units trading, Caribbean Cement fell $2 to finish at $64, with 30,573 changing hands, Carreras lost 35 cents and concluded trading of 71,125 units at $8.90. Eppley ended with a loss of 50 cents trading 4,348 shares to close at $10.50, Jamaica Broilers climbed $1.20 to close at $31.20, with 29,456 shares changing  hands, Jamaica Producers lost 45 cents to close at $21.55, trading 116,272 shares. JMMB Group fell 79 cents to end at $30.01, with an exchange of 33,468 shares, NCB Financial gave back the 99 cents it gained on Wednesday to settle at $144.01, trading 21,081 units, Pulse Investments lost 30 cents and finished at $2.70, with 113,778 shares crossing the exchange. Sagicor Group fell $1.85 in trading 109,632 shares at $37.15, Seprod lost 75 cents to close at $42, with 11,431 shares traded and Supreme Ventures lost $1 and finished at $26, with 44,274 units changing hands.

hands, Jamaica Producers lost 45 cents to close at $21.55, trading 116,272 shares. JMMB Group fell 79 cents to end at $30.01, with an exchange of 33,468 shares, NCB Financial gave back the 99 cents it gained on Wednesday to settle at $144.01, trading 21,081 units, Pulse Investments lost 30 cents and finished at $2.70, with 113,778 shares crossing the exchange. Sagicor Group fell $1.85 in trading 109,632 shares at $37.15, Seprod lost 75 cents to close at $42, with 11,431 shares traded and Supreme Ventures lost $1 and finished at $26, with 44,274 units changing hands.

Trading in the US dollar market ended with 34,559 units valued at US$4,622. Proven Investments ended trading with 7,500 units at 22 US cents and Sygnus Credit Investments gained 1 cent in trading 27,059 units to close at 11 US cents. The JSE USD Equities Index declined by 3.80 points to close at 176.43.

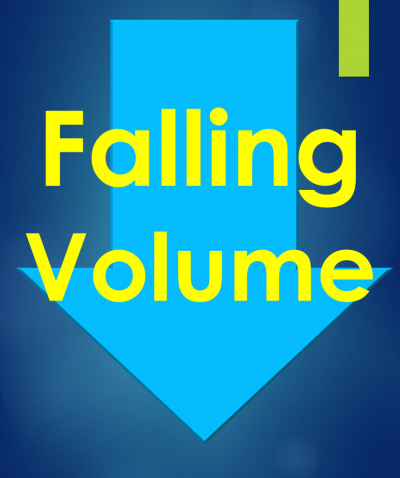

Volume plunges on JSE – Wednesday

Main market volume contracts.

The Jamaica Stock Exchange ended with gains on Wednesday but with limited volume passing through the market.

At the close, JSE All Jamaican Composite Index rose 1,558.08 points to close at 422,739.15 and the JSE Index advanced by 1,415.84 points to 385,149.65

At the close of the main and US markets, 33 securities traded, compared to 29 on Tuesday leading to 10 advancing, 14 declining and 9 closing unchanged.

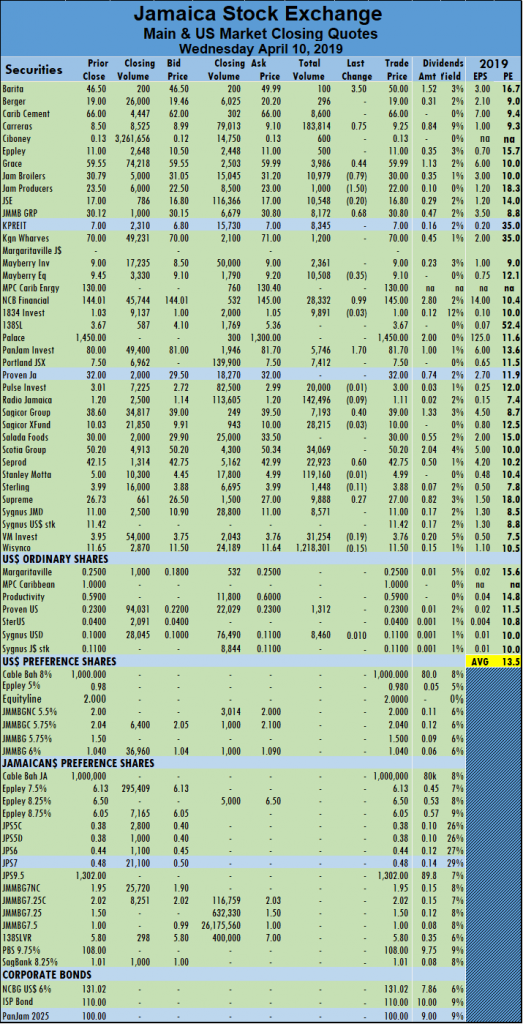

Trading ended with 1,945,908 units valued just $26,582,198 compared to 2,405,214 units valued at $42,509,143 crossing the exchange on Tuesday.

Wisynco Group led with 1.2 million units, accounting for 63 percent of total main market volume, followed by Carreras with just 183,814 units with 9.5 percent of the day’s trades and Radio Jamaica with a mere 142,496 units or 7 percent of volume traded.

Market activity ended with an average of 77,588 units valued at $1,371,263, in contrast to 75,715 shares  valued at $3,510,251 on Tuesday. The average volume and value for the month to date amounts to 182,335 shares at $2,500,108 for each security, compared to 198,040 shares at $2,749,721 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

valued at $3,510,251 on Tuesday. The average volume and value for the month to date amounts to 182,335 shares at $2,500,108 for each security, compared to 198,040 shares at $2,749,721 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 6 stocks ending with bids higher than their last selling prices and 5 closing with lower offers.

In main market activity, Barita Investments climbed $3.50 to close at $50, with a mere 100 shares changing hands, Carreras gained 75 cents and concluded trading of 183,814 units at $9.25. Grace Kennedy added 44 cents to end at $59.99, with 3,986 stock units changing hands, Jamaica Broilers finished with a loss of 79 cents in closing high of at $30, with 10,979 shares changing hands, Jamaica Producers dropped  $1.50 to close at $22, trading 1,000 shares. JMMB Group added 68 cents to end at $30.80, with an exchange of 8,172 shares, NCB Financial rose 99 cents to settle at $145, trading 28,332 units, Mayberry Jamaican Equities lost 35 cents in trading 10,508 shares, at $9.10. PanJam Investment jumped $1.70 trading 5,746 to close at $81.70, Sagicor Group gained 40 cents in trading 7,193 shares at $39, Seprod rose 60 cents to close at $42.75, with 22,923 shares traded and Supreme Ventures rose 27 cents and finished at $27, with 9,888 units changing hands.

$1.50 to close at $22, trading 1,000 shares. JMMB Group added 68 cents to end at $30.80, with an exchange of 8,172 shares, NCB Financial rose 99 cents to settle at $145, trading 28,332 units, Mayberry Jamaican Equities lost 35 cents in trading 10,508 shares, at $9.10. PanJam Investment jumped $1.70 trading 5,746 to close at $81.70, Sagicor Group gained 40 cents in trading 7,193 shares at $39, Seprod rose 60 cents to close at $42.75, with 22,923 shares traded and Supreme Ventures rose 27 cents and finished at $27, with 9,888 units changing hands.

Trading in the US dollar market ended with 9,772 units valued at US$1,232. Proven Investments ended trading with 1,312 units at 22 US cents and Sygnus Credit Investments gained 1 cent in trading 8,460 units to close at 11 US cents. The JSE USD Equities Index advanced by 3.08 points to close at 180.23.

New IPO pressures JSE stocks – Tuesday

Wigton IPO propectus is out.

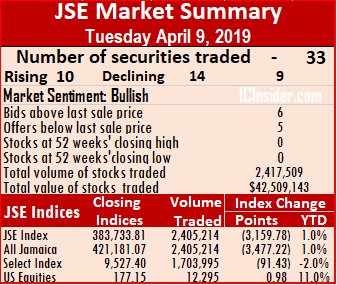

At the close, JSE All Jamaican Composite Index dropped 3,477.22 points to 421,181.07 and the JSE Index suffered a big fall of 3,159.78 points to 383,733.81.

At the close of the main and US markets, 33 securities traded, compared to 29 on Monday leading to 10 advancing, 14 declining and 9 closing unchanged.

Trading ended with 2,405,214 units valued at $42,509,143 compared to 2,044,315 units valued at $94,776,769 crossing the exchange on Monday.

Supreme Ventures led trading with 506,307 units comprising 21 percent of total main market volume, followed by JMMB Group with 500,000 shares or 21 percent of the day’s trades and Carreras with 426,886 units and 18 percent of the volume traded.

Market activity ended with an average of 77,588 units valued at $1,371,263, in contrast to 75,715 shares valued at $3,510,251 on Monday. The average volume and value for the month to date amounts to 198,040 shares at $2,749,721 for each security, compared to 216,255 shares at $2,996,728 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 6 stocks ending with bids higher than their last selling prices and 5 closing with lower offers.

In main market activity, Barita Investments climbed $2 to $46.50, with 586 shares changing hands, Berger Paints slid $1.20 to end at $19, with 7,834 stock units changing hands, Caribbean Cement finished $1 higher to an all-time closing high of $66, with 55,901 shares changing hands, Carreras dropped 70 cents and concluded trading of 426,886 units at $8.50. Jamaica Producers gained 40 cents to close at $23.50, trading 10,700 shares. Jamaica Stock Exchange added $1 to end at $17, with an exchange of 6,690

shares, Kingston Wharves gave up $1 to settle at $70, trading 1,986 units, Mayberry Investments gained 50 cents in trading 33,501 shares, at $9. Sagicor Real Estate Fund lost 37 cents in trading 32,500 shares at $10.03, Seprod lost 52 cents to close at $42.15, with 18,647 shares traded, Stanley Motta gained 50 cents and ended at $5, in trading 3,000 shares and Supreme Ventures rose 73 cents and finished at $26.73, with 506,307 units changing hands.

shares, Kingston Wharves gave up $1 to settle at $70, trading 1,986 units, Mayberry Investments gained 50 cents in trading 33,501 shares, at $9. Sagicor Real Estate Fund lost 37 cents in trading 32,500 shares at $10.03, Seprod lost 52 cents to close at $42.15, with 18,647 shares traded, Stanley Motta gained 50 cents and ended at $5, in trading 3,000 shares and Supreme Ventures rose 73 cents and finished at $26.73, with 506,307 units changing hands.Trading in the US dollar market ended with 12,295units valued at US$2,616. Proven Investments lost 1 cent and ended trading with 11,140 units at 22 US cents and Sygnus Credit Investments traded 1,155 units at 10 US cents. The JSE USD Equities Index advanced by 0.98 points to close at 177.15.

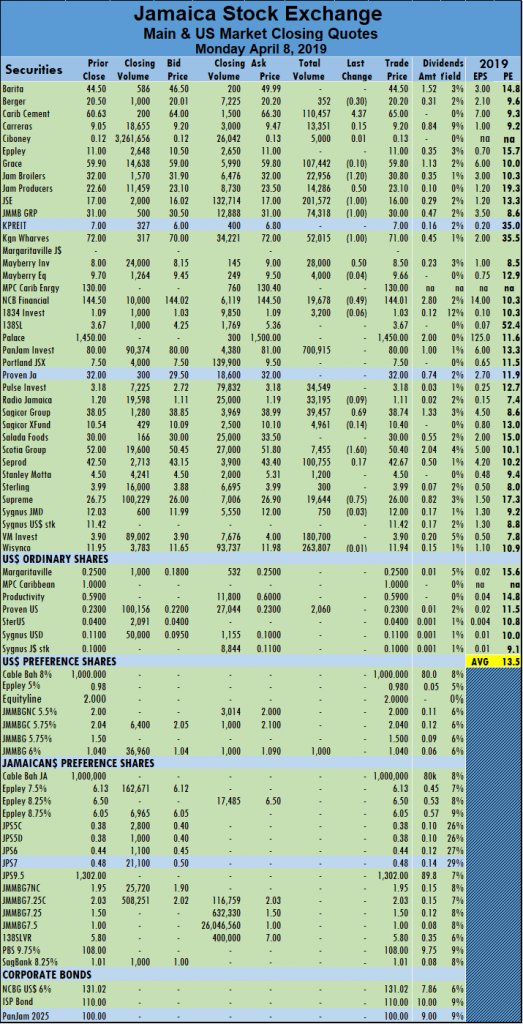

Main market inched higher – Monday

Caribbean Cement closed trading at a new closing high of $65.

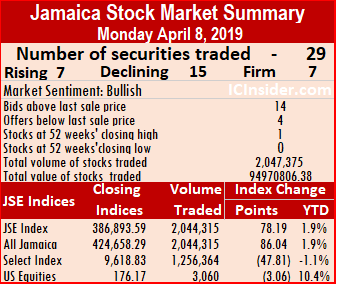

Trading on the main market of the Jamaica Stock Exchange ended on Monday with JSE All Jamaican Composite Index rising just 86.04 points to 424,658.29 and the JSE Index advancing by 78.19 points to 386,893.59.

At the close of the main and US markets, 29 securities traded, compared to 30 on Friday and leading to 7 advancing, 15 declining and 7 closing unchanged.

Trading ended with 2,044,315 units valued at $94,776,769 compared to 1,601,348 units valued $55,418,482 crossing the exchange on Friday.

PanJam Investment led trading with 700,915 shares, comprising 34 percent of total main market volume, followed by Wisynco Group with 263,807 units or 13 percent and Jamaica Stock Exchange with 201,572 stock units and 10 percent of the day’s trades.

Market activity ended with an average of 75,715 units valued at $3,510,251, in contrast to 59,309  shares valued at $2,052,536 on Friday. The average volume and value for the month to date amounts to 216,255 shares at $2,996,728 for each security, compared to 289,643 shares at $3,590,315 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

shares valued at $2,052,536 on Friday. The average volume and value for the month to date amounts to 216,255 shares at $2,996,728 for each security, compared to 289,643 shares at $3,590,315 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 9 stocks ending with bids higher than their last selling prices and 4 closing with lower offers.

In main market activity, Berger Paints slid 30 cents to end at $20.20, with 352 stock units changing hands, Caribbean Cement finished $4.37 higher at a all-time closing high of $65, with 110,457 shares changing hands, Jamaica Broilers lost $1.20 and finished trading of 22,956 units at $30.80, Jamaica Producers rose 50 cents to close at $23.10, trading 14,286 shares. JMMB Group concluded trading of 74,318 shares with a fall of $1 at $30, Jamaica Stock Exchange lost $1 to end at $16, with an exchange of 201,572 shares, Kingston Wharves gave up $1 to settle at $71, trading 52,015 units, Mayberry Investments gained 50 cents in  trading 28,000 shares, at $8.50. NCB Financial Group traded 19,678 shares in losing 49 cents to close at $144.01, Sagicor Group gained 69 cents, ending trading with 39,457 stock units at $38.74, Scotia Group dropped $1.60 trading 7,455 shares at $50.40 and Supreme Ventures lost 75 cents, finishing at $26, with 19,644 units changing hands.

trading 28,000 shares, at $8.50. NCB Financial Group traded 19,678 shares in losing 49 cents to close at $144.01, Sagicor Group gained 69 cents, ending trading with 39,457 stock units at $38.74, Scotia Group dropped $1.60 trading 7,455 shares at $50.40 and Supreme Ventures lost 75 cents, finishing at $26, with 19,644 units changing hands.

Trading in the US dollar market ended with 3,060 units valued at US$1,497. JMMB Group 6% preference share traded 1,000 units to close at US$1.04 and Proven Investments ended with 2,060 units trading at 23 US cents. The JSE USD Equities Index declined 3.06 points to close at 176.17.

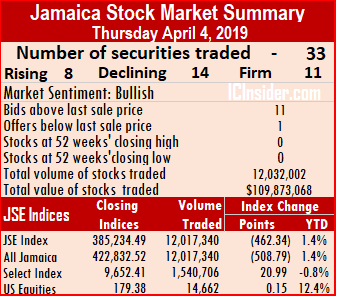

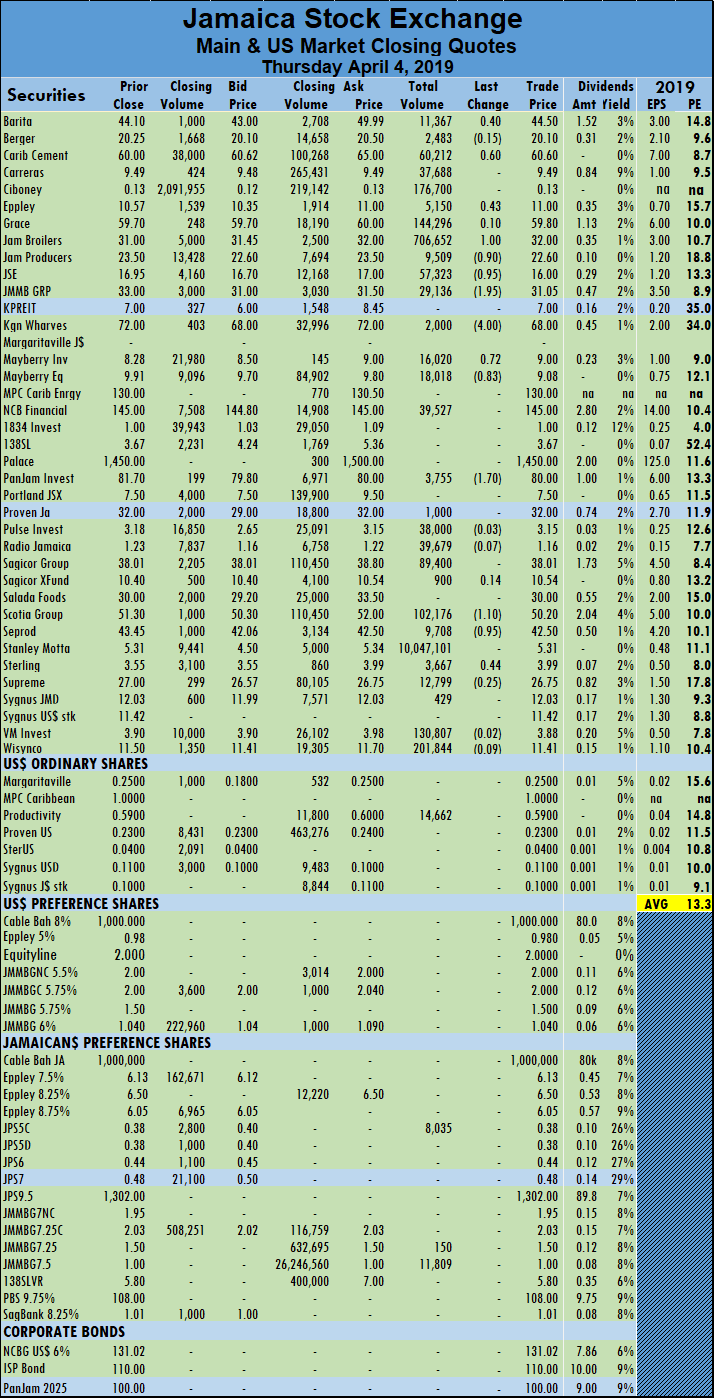

Motta in another big trade – Thursday

Stanley Motta 58 Half Way Tree building.

Stanley Motta led trading with 10 million shares for 84 percentage of the day’s volume on the main market of the Jamaica Stock Exchange on Thursday, down from 11.2 million units on Wednesday.

Trading ended with 12,017,340 units valued $109,444,077 crossing the exchange, compared to 22,489,492 units valued at $166,148,557 changing hands on Wednesday.

Market activity ended with an average of 375,542 units valued $3,420,127, in contrast to 725,467 shares valued at $5,359,631 on Wednesday. The average volume and value for the month to date amounts to 341,904 shares at $3,094,443 for each security, compared to 110,352 units valued at $1,654,394 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

At the close of the main and US markets, 33 securities traded, compared to 32 on Wednesday and leading to 8 advancing, 14 declining and 11 closing unchanged as investors pushed Kingston Wharves by $4 to $72 and JMMB Group by $2.99 to $33.

The JSE All Jamaican Composite Index lost 508.79 points to 422,832.52 and the JSE Index declined by 462.34 points to 385,234.49.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 11 stocks ending with bids higher than their last selling prices and 1 closing with a lower offer.

In main market activity, Barita Investments rose 40 cents and ended at $44.50, trading 11,367 stock units, Caribbean Cement added60 cents in trading of 60,212 shares changing hands, Eppley gained 43 cents and ended trading 5,150 shares at $11, Jamaica Broilers increased by $1 in trading 706,652 units to close at $32. Jamaica Producers fell 90 cents to close at $22.60, with 9,509 shares changing hands.

Jamaica Stock Exchange declined 95 cents to end at $16, with an exchange of 57,323 shares, JMMB Group lost $1.95 in trading of 29,136 shares to close at $31.05, Kingston Wharves dropped $4 to settle at $68, trading 2,000 units, Mayberry Investments rose 72 cents in trading 16,020 shares, at $9. Mayberry Jamaican Equities lost 83 cents and ended trading of 18,018 shares at $9.08, PanJam Investment lost $1.70 to finish at $80, trading 3,755 shares, Scotia Group lost $1.10 trading 102,176 shares at $50.20, Seprod fell 95 cents to close at $42.50 in trading 9,708 shares and Sterling Investments added 44 cents trading with 3,667 stock units at $3.99.

Jamaica Stock Exchange declined 95 cents to end at $16, with an exchange of 57,323 shares, JMMB Group lost $1.95 in trading of 29,136 shares to close at $31.05, Kingston Wharves dropped $4 to settle at $68, trading 2,000 units, Mayberry Investments rose 72 cents in trading 16,020 shares, at $9. Mayberry Jamaican Equities lost 83 cents and ended trading of 18,018 shares at $9.08, PanJam Investment lost $1.70 to finish at $80, trading 3,755 shares, Scotia Group lost $1.10 trading 102,176 shares at $50.20, Seprod fell 95 cents to close at $42.50 in trading 9,708 shares and Sterling Investments added 44 cents trading with 3,667 stock units at $3.99.Trading in the US dollar market ended with 14,662 units with Productive Business Solution being the sole stock trading and ended at 59 US cents. The JSE USD Equities Index gained 0.15 points to close at 179.38.

- « Previous Page

- 1

- …

- 115

- 116

- 117

- 118

- 119

- …

- 152

- Next Page »