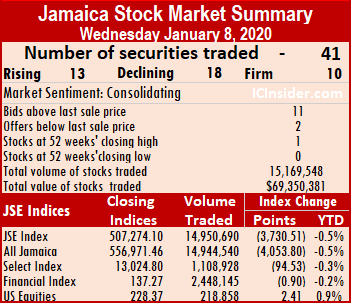

The main market of the Jamaican Stock Exchange pulled back at the end of trading on Wednesday with large declines in the major indices as declining stocks bettered advancers.

The main market of the Jamaican Stock Exchange pulled back at the end of trading on Wednesday with large declines in the major indices as declining stocks bettered advancers.

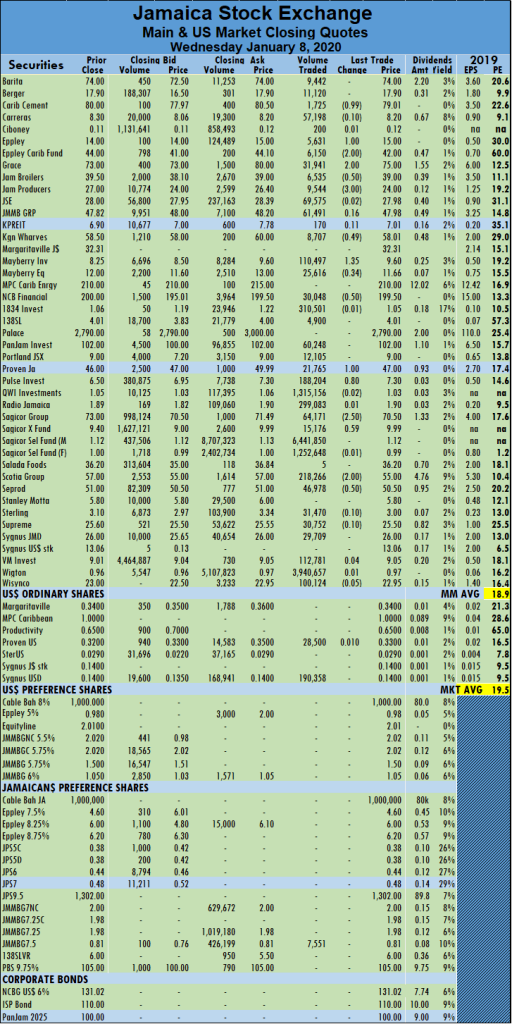

At the close, JSE All Jamaican Composite Index dived 4,053.80 points to 556,971.46. The JSE Market Index dropped 3,730.51 to close at 507,274.10 while the JSE Financial Index declined by 0.90 points to close at 137.27.

The market closed with 41 securities changing hands in the Main and US dollar markets, with the prices of 13 advancing, 18 declining and 10 stocks remaining unchanged. The JSE Main Market activity ended, with 39 securities accounting for 14,950,690 units, valued $64,523,919 in contrast to 16,653,296 units valued $85,713,471 from 40 securities on Tuesday.

Sagicor Select – Financial Fund dominated trading, with 6.4 million shares and 43 percent of shares traded followed by Wigton Windfarm with 3.9 million units for 26 percent of the day’s trade and QWI Investments with 1.3 million shares for 9 percent of the market share.

The Market closed with an average of 383,351 units valued at an average of $1,654,459 for each security traded. In contrast to 416,332 units for an average of $2,142,837 on Tuesday. The average volume and value for the month to date amounts to 470,120 units valued at $2,039,050 for each security changing hands, compared to 492,094 units valued at $2,136,446 for each security crossing the exchange. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security.

Trading in December resulted in an average of 595,143 units for $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eleven stocks ending, with bids higher than their last selling prices and two closing, with lower offers. The PE ratio of the market ended at 19.5, with the Main Market ending at 18.9 times the current year’s earnings.

In the prime market, Caribbean Cement dropped 99 cents to end at $79.01 with the trading of 1,725 units, Eppley gained $1 to close at $15 after exchanging 5,631 shares, while Eppley Caribbean slipped $2 to settle at $42 with 6,150 stock units changing hands. Grace Kennedy climbed by $2 to end at $75 with 31,941 units crossing the exchange, Jamaica Broilers fell 50 cents to $39 with 6,535 units changing hands, Jamaica Producers lost $3 to end at $24, with 9,544 stock units traded. Kingston Wharves shed 49 cents to end at $58.01 with 8,707 units crossing the exchange. Mayberry Investments climbed $1.35 in trading 110,497 shares to end at $9.60, while Mayberry Equities declined by 34 cents to finish at $11.66 with 25616 units changing hands,  NCB Financial lost 50 cents trading 30,048 shares to close at $199.50. Proven Investments advanced by $1 to settle at $47 with a swap of 21,765 shares, Pulse Investments rose by 80 cents to end at weeks’ high of $7.30 with 188,204 units changing hands, Sagicor Group lost $2.50, trading 64,171 shares to end at $70.50. Sagicor Property Fund picked up 59 cents to close at $9.99 with an exchange of 15,176 stock units, Scotia Group lost $2 to close at $55 with 218,266 units crossing the exchange and Seprod declined by 50 cents to end at $50.50 with 46,978 shares transferred.

NCB Financial lost 50 cents trading 30,048 shares to close at $199.50. Proven Investments advanced by $1 to settle at $47 with a swap of 21,765 shares, Pulse Investments rose by 80 cents to end at weeks’ high of $7.30 with 188,204 units changing hands, Sagicor Group lost $2.50, trading 64,171 shares to end at $70.50. Sagicor Property Fund picked up 59 cents to close at $9.99 with an exchange of 15,176 stock units, Scotia Group lost $2 to close at $55 with 218,266 units crossing the exchange and Seprod declined by 50 cents to end at $50.50 with 46,978 shares transferred.

Trading in the US dollar market closed with 218,858 valued at over US$36,018. The market index gained 2.41 points to close at 228.37. Proven Investments picked up 1 cent to close at 33 US cents with 28,500 stock units changing hands while Sygnus Credit Investments closed at 14 cents in trading 190,358 shares.

JSE Main Market dives

Gains for JSE Main Market

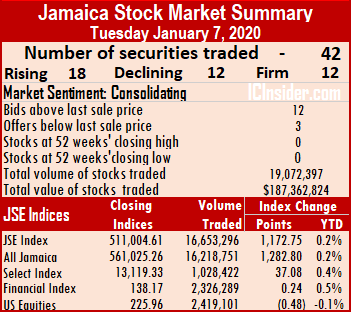

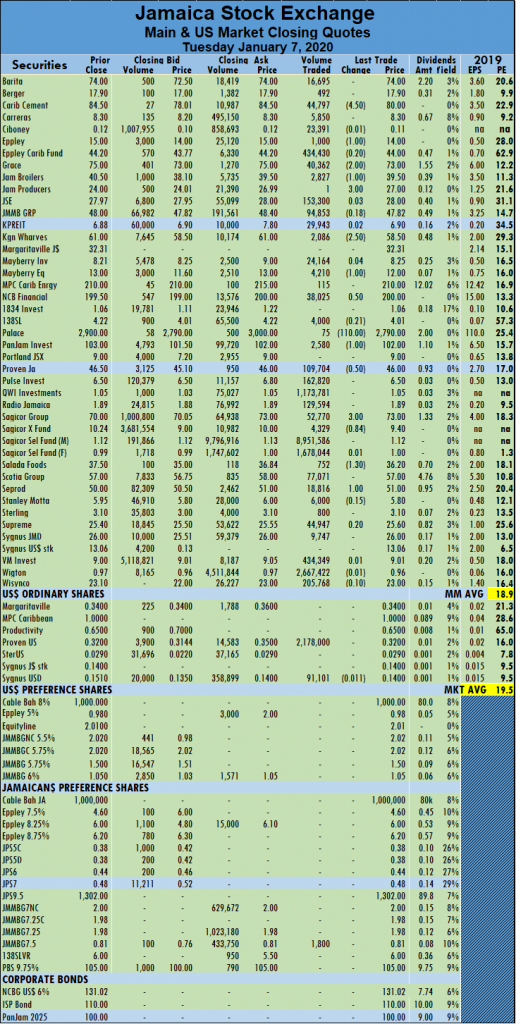

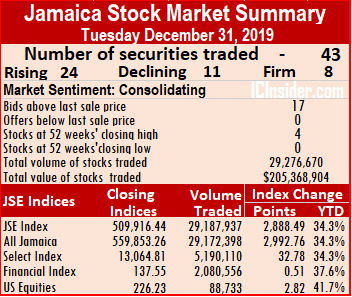

Trading remains buoyant on the Main Market of the Jamaica Stock Exchange on Tuesday, with market activities accounting for 40 securities changing hands, compared to 39 listings trading on Monday.

Trading remains buoyant on the Main Market of the Jamaica Stock Exchange on Tuesday, with market activities accounting for 40 securities changing hands, compared to 39 listings trading on Monday.

A total of 42 securities traded in the Main and US dollar market, with prices of 18 advancing, 12 declining and 13 stocks holding firm.

The JSE Main Market activity ended, with 16,653,296 shares, valued $85,713,471 in contrast to 9,751,709 units for $42,684,443 on Monday.

At the close, JSE All Jamaican Composite Index gained 1,282.80 points to 561,025.26. The JSE Market Index gained 1,172.75 points to close at 511,004.61 and the JSE Financial Index advanced by 0.24 points to close at 138.17.

Sagicor Select – Financial Fund dominated trading, with 8.95 million shares for 54 percent of stock traded. Wigton Windfarm ended with 2.67 million units for 16 percent of the day’s trade and Sagicor Select – Manufacturing & Distribution Fund ended with 1.67 million shares for 10 percent of market share.

The Market closed with an average of 416,332 units valued at an average of $2,142,837 for each security traded. In contrast to 250,044 units for an average of $1,094,473 on Monday. The average volume and value for the month to date amounts to 492,094 units valued at $2,136,446 for each security changing hands, compared to 518,678 shares at $2,134,204 for each security crossing the exchange. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows twelve stocks ending, with bids higher than their last selling prices with three closing, with lower offers. The PE ratio of the market ended at 19.5, with the Main Market ending at 18.9 times the current year’s earnings.

In the prime market, Caribbean Cement dropped $4.50 to end at $80 in exchanging 44,797 stock units, Eppley lost $1 to close at $14, after trading 1,000 shares, Grace Kennedy fell $2 to end at $73 with 40,362 units crossing the exchange. Jamaica Broilers lost $1 to settle at $39.50, with 2,827 units changing hands, Jamaica Producers surged $3 to end at $27, with just one stock unit traded, Kingston Wharves shed $2.50 to end at $58.50 with 2,086 units changing hands.  Mayberry Jamaican Equities lost $1 to end at $12 in trading 4,210 units, NCB Financial fell 50 cents in exchanging 38,025 to close at $200. Palace Amusement dropped by $110 to close at $2,790 after trading 75 units. Pan Jam Investment lost $1 with a transfer of 2,580 shares to end at $102. Proven Investments dropped 50 cents in exchanging 109,704 units to close at $46. Sagicor Group gained $3, trading 52,770 shares to end at $73, while Sagicor Property Fund lost 84 cents to end the day at $9.40 with 4,329 stock units changing hands. Salada Foods declined by $1.30 to close at $36.20 with 752 units crossing the exchange, and Seprod lost $1 to end at $51 with the transfer of 18,616 shares.

Mayberry Jamaican Equities lost $1 to end at $12 in trading 4,210 units, NCB Financial fell 50 cents in exchanging 38,025 to close at $200. Palace Amusement dropped by $110 to close at $2,790 after trading 75 units. Pan Jam Investment lost $1 with a transfer of 2,580 shares to end at $102. Proven Investments dropped 50 cents in exchanging 109,704 units to close at $46. Sagicor Group gained $3, trading 52,770 shares to end at $73, while Sagicor Property Fund lost 84 cents to end the day at $9.40 with 4,329 stock units changing hands. Salada Foods declined by $1.30 to close at $36.20 with 752 units crossing the exchange, and Seprod lost $1 to end at $51 with the transfer of 18,616 shares.

Trading in the US dollar market closed with 2,419,101 valued at US$758,577. The market index declined by 0.48 points to close at 225.96. Proven Investments held firm at 32 US cents with 2,178,000 stock units trading while Sygnus Credit Investments fell by 1.1 cents to trade 91,101 units at 14 US cents.

Trading drops for JSE Main Market

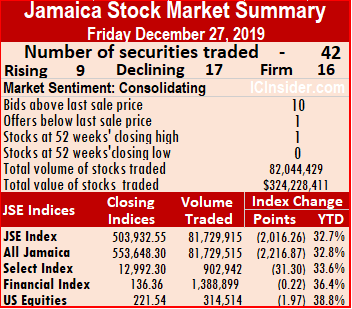

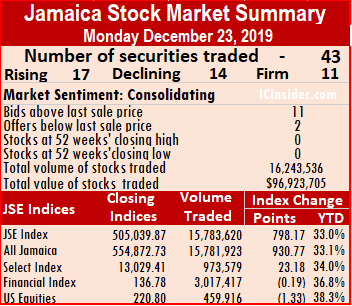

Declines in primary indices of the JSE Main Market continues at the close on Monday, with a greater fall than that suffered on Friday as trading volume and value fell sharply.

Declines in primary indices of the JSE Main Market continues at the close on Monday, with a greater fall than that suffered on Friday as trading volume and value fell sharply.

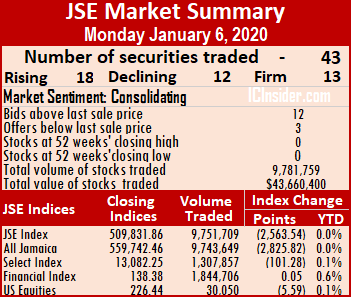

The market closed with 43 securities changing hands in the Main and US dollar markets, with the prices of 18 advancing, 12 declining and 13 stocks unchanged. The JSE Main Market activity ended, with 39 securities trading and accounting for 9,751,709 shares, valued $42,684,443 in contrast to 10,152,496 units for $85,998,804, from 41 securities on Friday.

At the close, JSE All Jamaican Composite Index dropped 2,825.82 points to close at 559,742.46. The JSE Market Index declined by 2,563.54 points to 509,831.86 and the JSE Financial Index lost 0.45 points to end at 137.93.

Sagicor Select – Financial Funds dominated trading, with 3.5 million shares and 35.5 percent of shares traded, followed by Wigton Windfarm with 2.54 million units for 26 percent of the day’s trade and QWI Investments rounded out the top three, with 993,376 shares for 10 percent of market share.

The market closed, with an average of 250,044 units valued at $1,094,473 for each security traded, in contrast to 247,622 units valued at an average of $2,097,532 on Friday. The average volume and value for the month, amounts to 518,678 shares at $2,134,204 for each security crossing the exchange, compared to 658,367 units for $2,674,864 trading to date for each stock changing hands. Trading in December, resulted in an average of 595,143 units for $9,344,514 for each security changing hands.

Trading in December, resulted in an average of 595,143 units for $9,344,514 for each security changing hands.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows twelve stocks ending, with bids higher than their last selling prices, with three closing, with a lower offer. The PE ratio of the market ended at 19.7, with the Main Market ending at 19.1 times the current year’s earnings.

At the close of trading in the prime market, Berger Paints dropped 60 cents in trading 506 units at $17.90, Caribbean Cement jumped $4.50 to end at $84.50 in exchanging 5,811 stock units, Eppley Caribbean Property Fund climbed $4.20 to end at $$44.20 with 8,060 shares changing hands. Grace Kennedy jumped $3 to close at $75, after trading 19,945 units, JMMB Group climbed $1 in trading 65,704 units to settle at $48. NCB Financial lost 50 cents to end at $199.50, after trading 20,234 stock units, PanJam Investment added $3.49 to end at $103, with 500 units crossing the exchange, Portland JSX gained $1.80 in exchanging 9,000 shares to close at $9.  Proven Investments rose by 50 cents in trading 3,227 units to close at $46.50, Sagicor Group added $1.30 to close at $70 with 8,597 units crossing the exchange, Scotia Group fell $2 to close at $57 with an exchange of 23,956 stock units, Supreme exchanged 43,790 shares and gained 40 cents to close at $25.40 and Wisynco Group fell 85 cents to $23.10, with 37,212 shares changing hands.

Proven Investments rose by 50 cents in trading 3,227 units to close at $46.50, Sagicor Group added $1.30 to close at $70 with 8,597 units crossing the exchange, Scotia Group fell $2 to close at $57 with an exchange of 23,956 stock units, Supreme exchanged 43,790 shares and gained 40 cents to close at $25.40 and Wisynco Group fell 85 cents to $23.10, with 37,212 shares changing hands.

Trading in the US dollar market closed with 30,050 units valued at over $7,229. The market index dropped by 5.59 points to close at 226.44. Margaritaville lost 2 cents to close at 34 US cents in exchanging 375 units, Proven Investments gained a fraction of a cent to end at 32 US cents in trading 5,440 units, Sterling Investments held firm at 3 US cents with 235 shares changing hands and Sygnus Credit Investments closed at 15 US cents in trading 14,000 units.

Drop for JSE Main Market

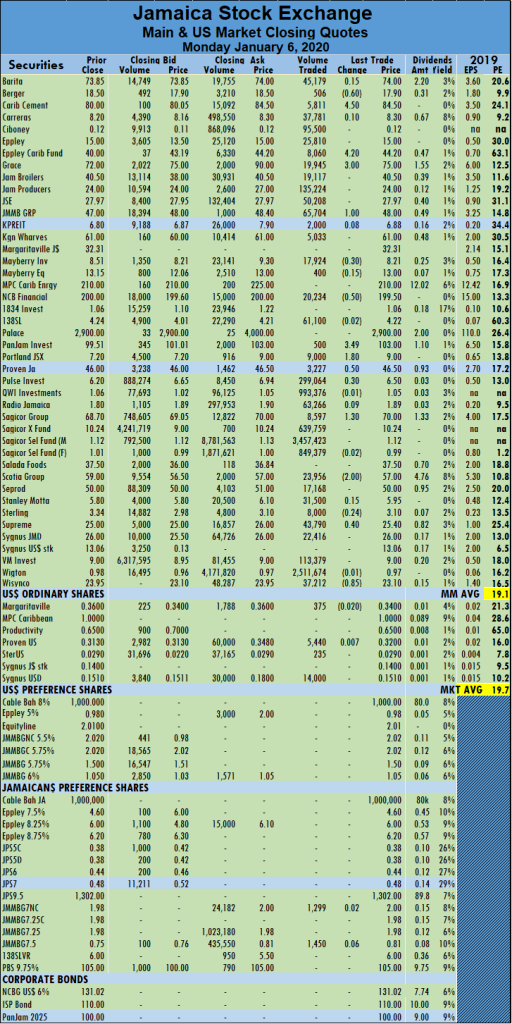

More stocks declined than rose at the end of trading on the JSE Main Market on Friday, leading to a modest fall in the primary indices of the market.

More stocks declined than rose at the end of trading on the JSE Main Market on Friday, leading to a modest fall in the primary indices of the market.

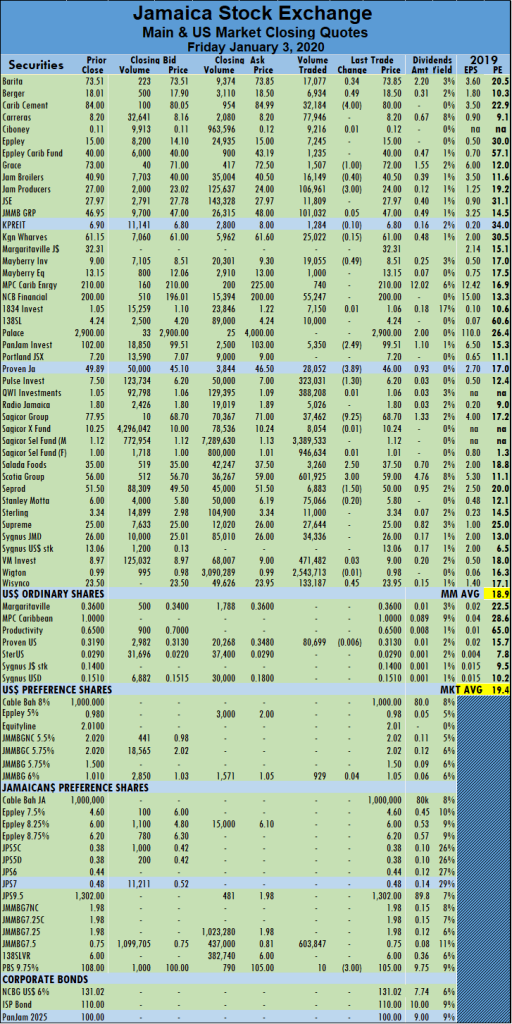

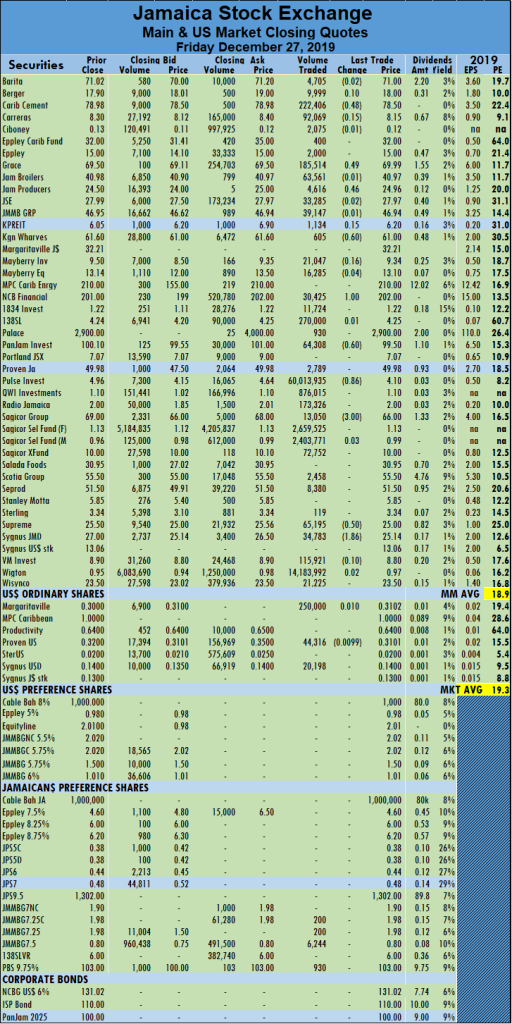

The market closed with 43 securities changing hands in the Main and US dollar markets, with the prices of 12 advancing, 16 declining and 15 stocks remaining unchanged. The JSE Main Market activity ended, with 41 securities accounting for 10,152,496 units, valued $85,998,804 in contrast to 39,225,030 units for $114,615,971, from 34 securities on Thursday.

At the close, JSE All Jamaican Composite Index dropped 653.75 points to 562,568.28. The JSE Market Index declined by 470.69 points to close at 512,395.40 and the JSE Financial Index gained 0.05 points to close at 138.38.

Sagicor Select – Financial Fund dominated trading, with 3.4 million shares for 33.4 percent of total shares traded, followed by Wigton Windfarm with 2.54 million units for 25 percent of the day’s trade and Sagicor Select – Manufacturing & Distribution Fund with 946,634 shares for 9 percent of market share.

The market closed, with an average of 247,622 units valued at $2,097,532 for each security traded, in contrast to 1,153,677 units valued at an average of $3,371,058 on Thursday. The average volume and value for the month to date amounts to 658,367 units for $2,674,864 for each security changing hands. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security traded.

The market closed, with an average of 247,622 units valued at $2,097,532 for each security traded, in contrast to 1,153,677 units valued at an average of $3,371,058 on Thursday. The average volume and value for the month to date amounts to 658,367 units for $2,674,864 for each security changing hands. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending, with bids higher than their last selling prices with one closing, with a lower offer. The PE ratio of the market ended at 19.4, with the Main Market ending at 18.9 times the current year’s earnings.

In the prime market, Barita Investments gained 34 cents to close at $73.85, with 17,077 shares changing hands, Berger Paints added 49 cents in trading 6,934 units at $18.50, Caribbean Cement dropped $4 to end at $80 in exchanging 32,184 stock units. Grace Kennedy lost $1 to close at $72, after trading 1,507 shares, Jamaica Broilers lost 40 cents to settle at $40.50, with 16,149 units changing hands, Jamaica Producers declined $3 to end at $24, with 106,961 stock units crossing the exchange. Mayberry Investments lost 49 cents to end at $8.51, in trading 19,055 stock units, PanJam Investment shed $2.49 to end at $99.51, with 5,350 units crossing the exchange.  Proven Investments dropped $3.89 in exchanging 28,052 units to close at $46, Pulse Investments declined $1.30 with 323,031 shares changing hands, to end at $6.20. Sagicor Group dived $9.25 trading 37,462 stock units at $68.70, Salada Foods jumped $2.50 to close at $37.50 with 3,260 changing hands, Scotia Group rose $3 to close at $59 with an exchange of 601,925 stock units. Seprod lost $1.50 to end at $50 with a transfer of 6,883 shares and Wisynco Group gained 45 cents to $23.95, with 133,187 shares changing hands.

Proven Investments dropped $3.89 in exchanging 28,052 units to close at $46, Pulse Investments declined $1.30 with 323,031 shares changing hands, to end at $6.20. Sagicor Group dived $9.25 trading 37,462 stock units at $68.70, Salada Foods jumped $2.50 to close at $37.50 with 3,260 changing hands, Scotia Group rose $3 to close at $59 with an exchange of 601,925 stock units. Seprod lost $1.50 to end at $50 with a transfer of 6,883 shares and Wisynco Group gained 45 cents to $23.95, with 133,187 shares changing hands.

Trading in the US dollar market closed with 84,128 units valued at over $28,707. The market index advanced 4.88 points to close at 232.03. Proven Investments fell 0.06 cents in exchanging 80,669 units to close at 31.30 US cents, Sterling Investments rose 0.04 cents in trading 1,600 units to close at 2.9 US cents and JMMB Group 6.0% preference share gained 4 cents in trading 929 units at US$1.05.

Big gains for JSE Main Market Index

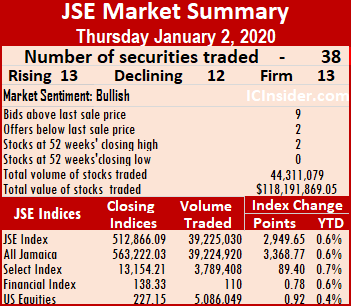

Rising and falling JSE Main Market stocks were almost equal in number on the first trading day on the new-year when market activity closed on Thursday.

Rising and falling JSE Main Market stocks were almost equal in number on the first trading day on the new-year when market activity closed on Thursday.

The market’s move resulted in a big bounce in the market index, bringing the gains in the last four days to 9,573.73 points. Trading closed with 38 securities changing hands in the Main and US dollar market, with 13 advancing, 12 declining and the prices of 13 stocks remaining unchanged. The JSE Main Market activity ended, with 34 securities accounting for 39,225,030 units valued $114,615,971 in contrast to 29,187,937 units valued at $201,537,949, from 43 securities on Tuesday.

At the close, JSE All Jamaican Composite Index jumped 3,368.77 points to close at 563,222.03. The JSE Market Index climbed 2,949.65 points to 512,866.09 and the JSE Financial Index gained 0.78 points to close at 138.33.

Wigton Windfarm dominated trading, with 25.9 million shares and 66 percent of the units traded, followed by Sagicor Select – Financial Fund with 5.5 million units for 14 percent of the day’s trade and Carreras rounding out the top three with 3.34 million shares for 8.5 percent of market share.

The market closed, with an average of 1,153,677 units valued at an average of $3,371,058 for each security traded, in contrast to 788,863 units valued at an average of $5,446,972 on Tuesday. The market closed out December, with an average of 595,143 units for $9,344,514 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending, with bids higher than their last selling prices and two closing, with lower offers. The PE ratio of the market ended at 19.7, with the Main Market ending at 19.1 times the current year’s earnings.

In the prime market activity, Barita Investments dropped $1.48 to $73.51, with 38,799 shares changing hands, Caribbean Cement lost 50 cents to end at $84 in trading of 11,559 stock units. Eppley gained 90 cents to close at $15 while exchanging 1,153 stock units, Eppley Caribbean Property Fund dipped $2 to close at $40 with an exchange of 7,939 units. Jamaica Producers declined by $1.50 to end at $27, with 31,783 stock units changing hands. JMMB Group fell 55 cents to end at $46.95, with an exchange of 35,221 units. Mayberry Investments lost 55 cents to end at $9, in trading 10,795 stock units Mayberry Jamaican Equities shed 86 cents to end at $13.15, trading 51,577 shares,  PanJam Investment gained $1 to end at $102, with 239,379 units crossing the exchange. Proven Investments gained $1.89 in exchanging 4,211 units to close at $49.89, Pulse Investments climbed $2.25 with 65,000 shares changing hands, to end at a 52 weeks’ high of $7.50, after trading at an all-time high of $6.20. Sagicor Real Estate Fund lost 25 cents in trading 3,150 shares at $10.25 and Scotia Group rose 50 cents to close at $56 with an exchange of 185,416 stock units.

PanJam Investment gained $1 to end at $102, with 239,379 units crossing the exchange. Proven Investments gained $1.89 in exchanging 4,211 units to close at $49.89, Pulse Investments climbed $2.25 with 65,000 shares changing hands, to end at a 52 weeks’ high of $7.50, after trading at an all-time high of $6.20. Sagicor Real Estate Fund lost 25 cents in trading 3,150 shares at $10.25 and Scotia Group rose 50 cents to close at $56 with an exchange of 185,416 stock units.

Trading in the US dollar market closed with 83,015 units valued at $26,886. The market index advanced 0.92 points to close at 227.15. Proven Investments fell 2.9 cents in exchanging 64,466 units to close at 31.9 US cents, Sterling Investments rose 0.04 cent in trading 1,600 units to close at 2.9 US cents. Sygnus Credit Investments rose 0.01 cent in exchanging 4,500 stock units to close at a 52 weeks’ high of 15.1 US cents and in the preference segment, JMMB Group 6.0% preference share traded 2,190 units at US$1.01.

More big gains for JSE Main Market

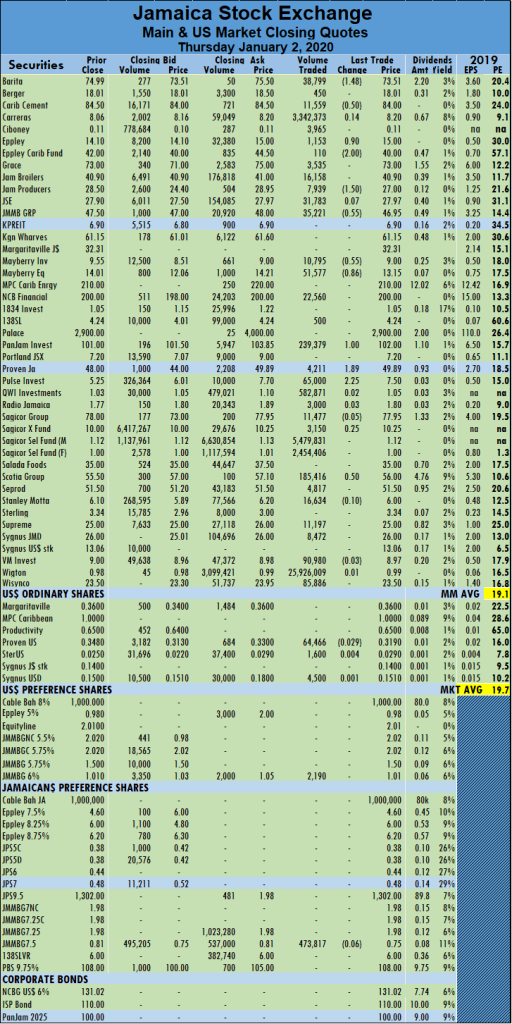

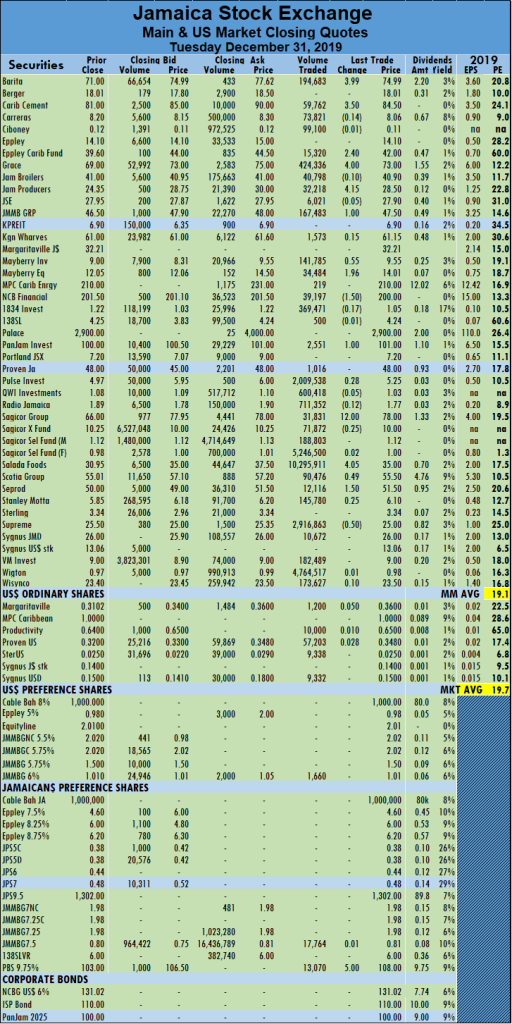

Prices of several stocks bounced sharply on the JSE Main Market as the year came to an end with 43 securities changing hands in the Main and US dollar markets, with 24 advancing, 11 declining and the prices of 8 stocks remaining unchanged after four stocks ended at 52 weeks’ highs.

Prices of several stocks bounced sharply on the JSE Main Market as the year came to an end with 43 securities changing hands in the Main and US dollar markets, with 24 advancing, 11 declining and the prices of 8 stocks remaining unchanged after four stocks ended at 52 weeks’ highs.

At the close, JSE All Jamaican Composite Index jumped 2,992.76 points to end at 559,853.26, for a rise of 34.3 percent for the year, the JSE Market Index climbed 2,888.49 points to 509,916.44, up 34.3 percent for the year and the JSE Financial Index gained 0.51 points to close at 137.55, a gain of 37.6 percent for the year.

The JSE Main Market activity ended, with 37 securities accounting for 29,187,937 units valued at $201,537,949 in contrast to 15,775,842 units amounting to $99,372,463, on Monday, from 40 securities.

Sagicor Select – Manufacturing and Distribution Fund dominated market activity, with 10.3 million units and 35 percent of the volume changing hands, Sagicor Select – Financial Fund followed, with 5.2 million stock units for 18 percent of the market volume and Wigton Windfarm with 4.8 million shares for 16 percent market share.

The market closed, with an average of 788,863 units valued at an average of $5,446,972 for each security traded, in contrast to 394,396 units valued at $2,484,312 on Monday. The average volume and value for the month to date amounts to 595,143 units for $9,344,514 and previously, an average of 585,624 units for $9,023,435 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 17 stocks ending, with bids higher than their last selling prices with none closing, with a lower offer. The PE ratio of the market ended at 19.7, with the Main Market ending at 19.2 times the current year’s earnings.

In the prime market, Barita Investments jumped $3.99 to $74.99, with 194,683 shares changing hands, Caribbean Cement climbed $3.50 to end at $84.50 in trading of 59,762 stock units, Eppley traded 500 shares but lost 90 cents to end at $14.10, Eppley Caribbean Property Fund jumped $2.40 to close at $42 with an exchange of 15,320 units. Grace Kennedy jumped $4 to close at a 52 weeks’ high of $73, after exchanging 424,336 shares, Jamaica Producers rose $4.15 to end at $28.50, with 32,218 stock units changing hands. JMMB Group added $1 to finish at $47.50 with an exchange of 167,483 units. Mayberry Investments rose 55 cents to end at $9.55, in trading 141,785 stock units Mayberry Jamaican Equities climbed $1.96 to close at a 52 weeks’ high of $14.01, trading 34,484 shares, NCB Financial declined $1.50 to close at $200 in the transferring of 39,197 stock units. PanJam Investment gained $1 to end at $101, with 2,551 units crossing the exchange, Pulse Investments climbed 28 cents with 2,009,538 shares changing hands, to end at a 52 weeks’ high of $5.25, after trading at an all-time high of $6.20. Salada Foods jumped $4.05 to close at $35 with 10,295,911 changing hands.  Scotia Group rose 49 cents to close at $55.50 with an exchange of 90,476 stock units, Seprod recovered $1.50 previously lost to end at $51.50 with a transfer of 12,116 shares and Supreme Ventures lost 50 cents to end at $25, after exchanging 2,916,863 shares.

Scotia Group rose 49 cents to close at $55.50 with an exchange of 90,476 stock units, Seprod recovered $1.50 previously lost to end at $51.50 with a transfer of 12,116 shares and Supreme Ventures lost 50 cents to end at $25, after exchanging 2,916,863 shares.

Trading in the US dollar market closed with 88,733 units amounting to $28,589. The market index advanced 2.82 points to close at 226.23 and is up 41.7 percent in 2019. Margaritaville gained half a cent trading 1,200 shares to close at 52 weeks’ high of 36 US cents, Productive Business Solutions traded 10,000 shares to end at 65 US cents, an increase of one cent. Proven Investments gained 2.8 cents in exchanging 57,203 units to close at 34.8 US cents, Sterling Investments traded 9,338 units to close at 2.5 US cents, Sygnus Credit Investments transferred 9,332 stock to close at 15 US cents and in the preference segment, JMMB Group 6.0% preference share traded 10,000 units at US$1.01.

Big gains for JSE Main Market

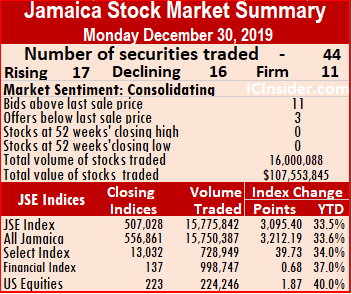

The Main Market of the Jamaica Stock Exchange recovered sharply on Monday’s from a sharp fall on Friday, with lower volume, valued 70 percent less than on Friday.

The Main Market of the Jamaica Stock Exchange recovered sharply on Monday’s from a sharp fall on Friday, with lower volume, valued 70 percent less than on Friday.

At the close, JSE All Jamaican Composite Index surged 3,212.19 points to end the day at 556,860.50, the JSE Market Index climbed 3,095.40 points to close at 507,027.95 and the JSE Financial Index gained 0.68 points to close at 137.04.

The market closed, with 44 securities changing hands in the Main and US dollar markets, with 17 advancing, 16 declining and the prices of 11 stocks closed unchanged. JSE Main Market activity ended, with 40 securities accounting for 15,775,842 units amounting to $99,372,463 in contrast to 81,729,915 for $324,228,411, from 39 securities trading on Friday.

Wigton Windfarm dominated trading, with 7.8 million shares and 49.4 percent of the day’s volume. Pulse Investments followed with 2.4 million units for 15 percent of the day’s trade, after trading 60 million shares on Friday and Sagicor Select Funds – Financial completing the top three with 2.2 million shares for 14 percent of market share.

The market closed, with an average of 394,396 units valued at $2,484,312 for each security traded, in contrast to 2,095,639 units valued at $8,313,549 on Tuesday.  The average volume and value for the month to date amounts to 585,624 units for $9,023,435 and previously, an average of 596,352 units for $9,410,939 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

The average volume and value for the month to date amounts to 585,624 units for $9,023,435 and previously, an average of 596,352 units for $9,410,939 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 stocks ending, with bids higher than their last selling prices and three closed, with lower offers. The PE ratio of the market ended at 19.3, with the Main Market ending at 18.9 times the current year’s earnings.

In the prime market, Caribbean Cement climbed $2.50 to end at $81 in trading of 85,932 stock units; Eppley traded 500 shares but lost 90 cents to end at $14.10, Eppley Caribbean Property Fund jumped $7.60 to close at $39.60 with an exchange of 25,455 stock units. Grace Kennedy fell 99 cents to close at $69, after exchanging 31,888 shares, Jamaica Producers rose 46 cents to end at $24.96, with 14,597 shares changing hands. JMMB Group fell 44 cents to end at $46.50 with an exchange of 127,208 shares, Kingston Properties rose 70 cents to $6.90 with 200 stock units trading. Mayberry Investments lost 34 cents to end at $9, in trading 3,338 shares Mayberry Jamaican Equities lost $1.05 to end at $12.05, trading 49,733 shares, NCB Financial declined 50 cents to close at $201.50 in the transferring of 10,806 stock units, PanJam Investment gained 50 cents to $100, with 40,041 shares crossing the exchange.  Pulse Investments climbed 87 cents to end the day at $4.97, with 2,364,988 shares changing hands, Scotia Group dropped 49 to close at $55.01 with an exchange of 6,888 shares, Seprod lost $1.50 to end at $50 with a transfer of 125,952 shares, Supreme Ventures gained 50 cents to end at $25.50, after exchanging 51,287 shares and Sygnus Credit Investments rose by 86 to end at $26 with 52,067 stock units trading.

Pulse Investments climbed 87 cents to end the day at $4.97, with 2,364,988 shares changing hands, Scotia Group dropped 49 to close at $55.01 with an exchange of 6,888 shares, Seprod lost $1.50 to end at $50 with a transfer of 125,952 shares, Supreme Ventures gained 50 cents to end at $25.50, after exchanging 51,287 shares and Sygnus Credit Investments rose by 86 to end at $26 with 52,067 stock units trading.

Trading in the US dollar market closed with 224,246 units for US$61,055, with the market index declining 1.87 points to close at 223.41. Proven Investments close trading of 15,214 shares to end at 32 US cents after rising 1 cent, Sygnus Credit Investments exchanged 71,520 stock units gaining 1 cent to close at 15 US cents. Sterling Investments traded 17, 812 units and rose half of a cent at 2.5 US cents and JMMB Group 6% preference share traded 10,000 units at US$1.01.

Sharp fall for JSE Main Market

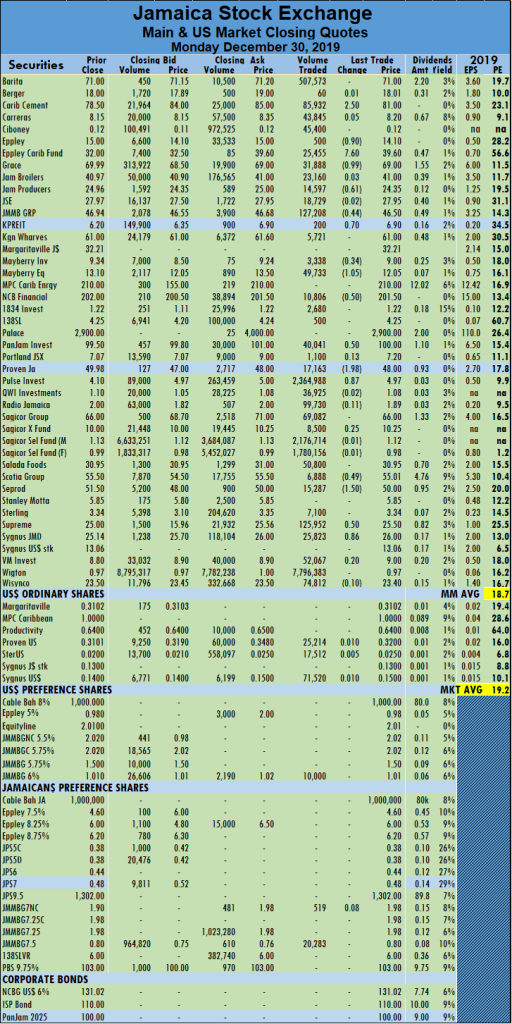

With trading resuming on the Main Market of the Jamaica Stock Exchange on Friday after the two days break for the Christmas holidays, investors pushed the market down on higher volume but lower value than on Tuesday.

With trading resuming on the Main Market of the Jamaica Stock Exchange on Friday after the two days break for the Christmas holidays, investors pushed the market down on higher volume but lower value than on Tuesday.

At the close of trading, the JSE All Jamaican Composite Index dropped 2,216.87 points to 553,648.38, the JSE Market Index sank 2,016.26 points to close at 503,932.55 and the JSE Financial Index declined by 0.22 points to 136.36.

The market closed, with 42 securities changing hands in the Main and US dollar markets, with 17 advancing, 10 declining and the prices of 15 stocks closed unchanged. JSE Main Market activity ended, with 39 securities accounting for 81,729,915 units amounting to $324,228,411 in contrast to 35,380,225 valued at $722,803,611 from 39 securities changing hands on Tuesday.

Pulse Investments dominated trading, with 60 million shares and 73 percent of volume traded followed by Wigton Windfarm with 14.2 million units for 17 percent of the day’s trade, and Sagicor Select Funds – Financial with 2.7 million shares for 3 percent market share.

The market closed, with an average of 2,095,639 units valued at $8,313,549 for each security traded, in contrast to 907,185 units valued at $18,533,426 on Tuesday. The average volume and value for the month to date amounts to 596,352 units for $9,410,939 and previously, an average of 509,598 units for $9,478,232 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 stocks ending, with bids higher than their last selling prices and one closed, with a lower offer. The PE ratio of the market ended at 19.3, with the Main Market ending at 18.9 times the current year’s earnings.

In the premier market, Caribbean Cement lost 48 cents to end at $78.50 in transferring of 222,406 stock units; Grace Kennedy gained 49 cents to close at $69.99, after exchanging 185,514 shares, Jamaica Producers rose 46 cents to end at $24.96, with 4,616 shares changing hands. Kingston Wharves fell 60 cents to $61 with 605 stock units trading. NCB Financial climbed $1 to close at $202 in the transferring of 30,245 stock units,  PanJam Investment fell 60 cents to $99.50, with 64,308 shares crossing the exchange. Pulse Investments dropped 86 cents to end the day at $4.10, with a whopping 60,013,935 shares changing hands. Sagicor Group dropped $3 to close at $66 with an exchange of 13,050 shares, Supreme Ventures lost 50 cents to end at $25, after exchanging 65,195 shares and Sygnus Credit Investments lost $1.86 to end at $25.14 with 34,783 stock units trading.

PanJam Investment fell 60 cents to $99.50, with 64,308 shares crossing the exchange. Pulse Investments dropped 86 cents to end the day at $4.10, with a whopping 60,013,935 shares changing hands. Sagicor Group dropped $3 to close at $66 with an exchange of 13,050 shares, Supreme Ventures lost 50 cents to end at $25, after exchanging 65,195 shares and Sygnus Credit Investments lost $1.86 to end at $25.14 with 34,783 stock units trading.

Trading in the US dollar market closed with 314,514 amounting to $94,537, with the market index declining 1.97 points to close at 221.54. Margaritaville rose 1 cent in trading 250,000 shares to end at 52 weeks’ high of 31.02 US cents, Proven Investments slipped 1 cent in trading 44,316 shares to close at 31.01 US cents and Sygnus Credit Investments exchanged 20,198 stock units and held firm at 14 US cents.

Big jump in JSE Main Market trading

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains in the two primary market indices on Tuesday as advancing stocks subdued decliners with a surge of cash passing through the market.

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains in the two primary market indices on Tuesday as advancing stocks subdued decliners with a surge of cash passing through the market.

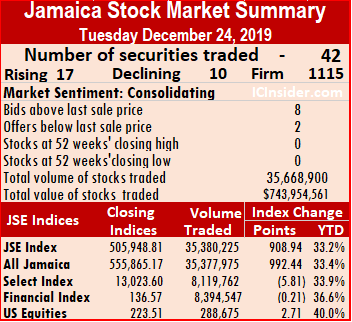

The market closed, with 42 securities changing hands in the Main and US dollar markets, with 17 advancing, 10 declining and the prices of 15 stocks closed unchanged. JSE Main Market activity ended, with 39 securities accounting for 35,380,225 units valued at $722,803,611, in contrast to 15,783,620 units for a consideration of $75,868,402 on Monday, from 39 securities changing hands.

At the close of trading, the JSE All Jamaican Composite Index rose 992.44 points to 555,865.17, the JSE Market Index climbed 908.94 points to close at 505,948.81 and the JSE Financial Index fell 0.21 points to 136.57.

Wigton Windfarm dominated trading, with 9 million shares and 25.5 percent of volumes traded followed by Scotia Group with 5.4 million units for 15 percent of the day’s trade and Sagicor Select Manufacturing and Distribution fund rounding out the top three with 4.6 million shares for 13 percent market share.

The market closed, with an average of 907,185 units valued at an average of $18,533,426 for each security traded, in contrast to 404,708 units valued at an average of $1,945,344 on Tuesday. The average volume and value for the month to date amounts to 509,598 units for $9,478,232 and previously, an average of 485,179 units for $8,886,686 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ending, with bids higher than their last selling prices and two closed, with lower offers. The PE ratio of the market ended at 19.4, with the Main Market ending at 19 times the current year’s earnings.

In the premier market, Barita Investments lost 62 cents to settle at $71.02, with 6,925 shares changing hands, Caribbean Cement jumped $1.48 to $78.98 in transferring of 5,901 stock units, Grace Kennedy gained $1.30 to end at $69.50, after exchanging 1,455,867 shares, Kingston Wharves gained 59 cents to end at $61.60 with 1,495 stock units trading. Mayberry Jamaican Equities gained 39 cents to end at $13.14, with 1,020,626 stock units trading, MPC Caribbean jumped $15 to close at $210 to end at $210 with an exchange of 100 stock units, PanJam Investment fell 90 cents to end at $100.10, with 64,578 shares crossing the exchange. Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group lost 99 cents to $69 with 193,572 shares changing hands. Seprod jumped $3 in exchanging 2,931,938 shares to close at $51.50, Sterling Investments added 39 cents to close at $3.34 with an exchange of 10,000 stock units, Supreme Ventures added 560cents to end at $2550., while trading 58,057 shares and Wisynco Group lost 95 cents to $23.50, with 133,370 shares changing hands.

Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group lost 99 cents to $69 with 193,572 shares changing hands. Seprod jumped $3 in exchanging 2,931,938 shares to close at $51.50, Sterling Investments added 39 cents to close at $3.34 with an exchange of 10,000 stock units, Supreme Ventures added 560cents to end at $2550., while trading 58,057 shares and Wisynco Group lost 95 cents to $23.50, with 133,370 shares changing hands.

Trading in the US dollar market closed with 288,675 units amounting to $43,882, with the market index adding 2.71 points to close at 223.51. Productive Business Solutions traded 500 shares to close 1 cent higher at 64 US cents, Proven Investments had 18,304 shares changing hands to end at 32 US cents and Sygnus Credit Investments traded 261,871 stock units to close at 14 US cents.

Moderate gains for JSE Main Market

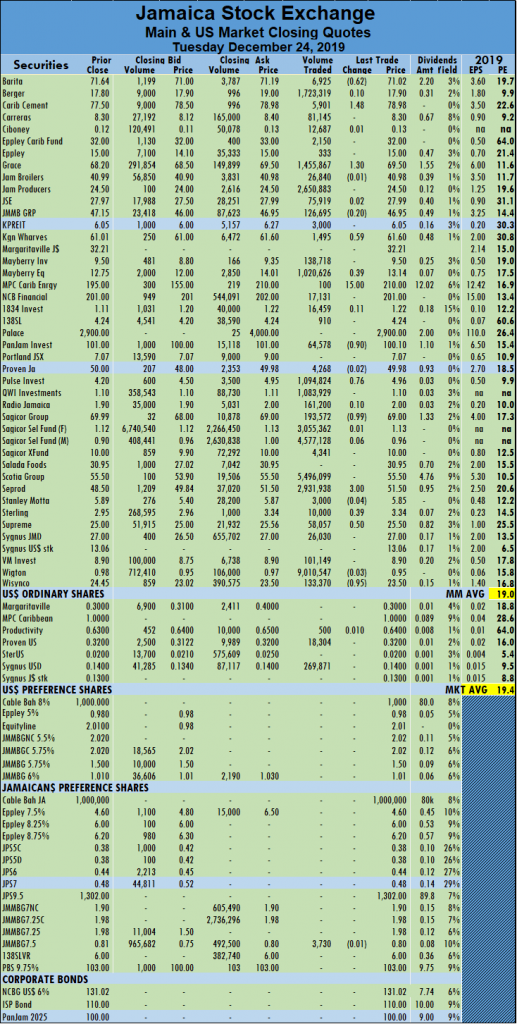

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains for the two primary market indices on Monday as rising stocks edged out decliners after trading declined again following a sharp drop on Friday.

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains for the two primary market indices on Monday as rising stocks edged out decliners after trading declined again following a sharp drop on Friday.

At the close of trading, the JSE All Jamaican Composite Index gained 930.77 points to 554,872.73, the JSE Market Index added 798.17 points to close at 505,039.87 and the JSE Financial Index dropped 1.19 points to 136.78.

The market closed, with 43 securities changing hands in the Main and US dollar markets, with 18 advancing, 16 declining and the prices of 9 stocks closed unchanged. JSE Main Market activity ended, with 39 securities accounting for 15,783,620 units for a consideration of $75,868,401.70, in contrast to 37,939,404 units with a consideration of $92,284,016, on Friday, from 41 securities changing hands.

Sagicor Select – Financial fund was the market leader with 3.7 million shares and 3 percent of the volume traded, closely followed by Sagicor Select – Manufacturing and Distribution fund with 3.5million shares and 22 percent of the day’s trade. JMMB Group rounded out the top three with 3.1 million units and 19 percent of the market share.

The market closed, with an average of 404,708 units valued at an average of $1,945,344 for each security traded, in contrast to 925,351 units at $2,250,830 on Monday. The average volume and value for the month to date amounts to 485,179 units for $8,886,686 and previously, an average of 490,445 units for $9,371,834 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 stocks ending, with bids higher than their last selling prices and two closed, with lower offers. The PE ratio of the market ended at 19.2, with the Main Market ending at 18.8 times the current year’s earnings.

In the JSE Main Market, Caribbean Cement jumped $2.50 to end at $77.50 with a transfer of 2,410 stock units, Eppley Caribbean Property Fund traded 1,070 units and rose 95 cents to close at $32, Grace Kennedy lost 80 cents to end at $68.20, after exchanging 2,050 shares. Jamaica Producers gained $1 to end at $24.50 with 55,9161 stock units trading, JMMB Group fell 65 cents to settle at $47.15, with 85,373 shares changing hands, units. Mayberry Jamaican Equities gained 75 cents to end at $12.75, with 15,000 stock units trading, MPC Caribbean dived $36 to end at $195 with an exchange of 627 stock units, NCB Financial Group declined by $2 to close at $201, in swapping 74,987 shares.  PanJam Investment fell 99 cents to end at $101, with 17,366 shares crossing the exchange, Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group jumped $3.99 to $69.99 with 25,664 shares changing hands. Sagicor Real Estate Fund gained $1.20 to $10 with 36,350 shares, Scotia Group gained $1.50 to end at $55.50, in transferring 339,093 shares, Seprod lost $1.50 in trading 53,370 units to close at $48.50 and Supreme Ventures shed 56 cents to end at $25 while trading 24,197 stock units.

PanJam Investment fell 99 cents to end at $101, with 17,366 shares crossing the exchange, Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group jumped $3.99 to $69.99 with 25,664 shares changing hands. Sagicor Real Estate Fund gained $1.20 to $10 with 36,350 shares, Scotia Group gained $1.50 to end at $55.50, in transferring 339,093 shares, Seprod lost $1.50 in trading 53,370 units to close at $48.50 and Supreme Ventures shed 56 cents to end at $25 while trading 24,197 stock units.

Trading in the US dollar market closed with 459,916 units amounting to $158,311, with the market index losing 1.33 points to close at 220.80. Productive Business Solution traded 60 shares to end at 63 US cents, a decline of 2 cents, Proven Investments lost 2 cents after exchanging 363,839 shares to close at 32 US cents, Sygnus Credit Investments exchanged 81,017 stock units, to close at 14 US cents and JMMB Group 5.5% preference share traded 15,000 units at US$2.02.

- « Previous Page

- 1

- …

- 105

- 106

- 107

- 108

- 109

- …

- 200

- Next Page »