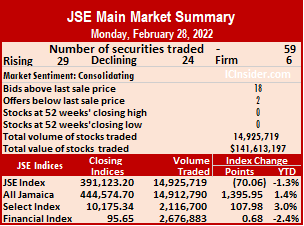

Advancing stocks dominated market activity on the Jamaica Stock Exchange Main Market Monday with the volume of shares trading dropping 87 percent and the value 69 percent lower than on Friday as the All Jamaican Composite Index rallied 1,395.95 points to settle at 444,574.70, the JSE Main Index dropped 70.06 points to 391,123.20 and the JSE Financial Index rose 0.68 points to close at 95.65.

Trading ended with 59 securities compared to 56 on Friday, with 29 rising, 24 declining and six ending unchanged.

Trading ended with 59 securities compared to 56 on Friday, with 29 rising, 24 declining and six ending unchanged.

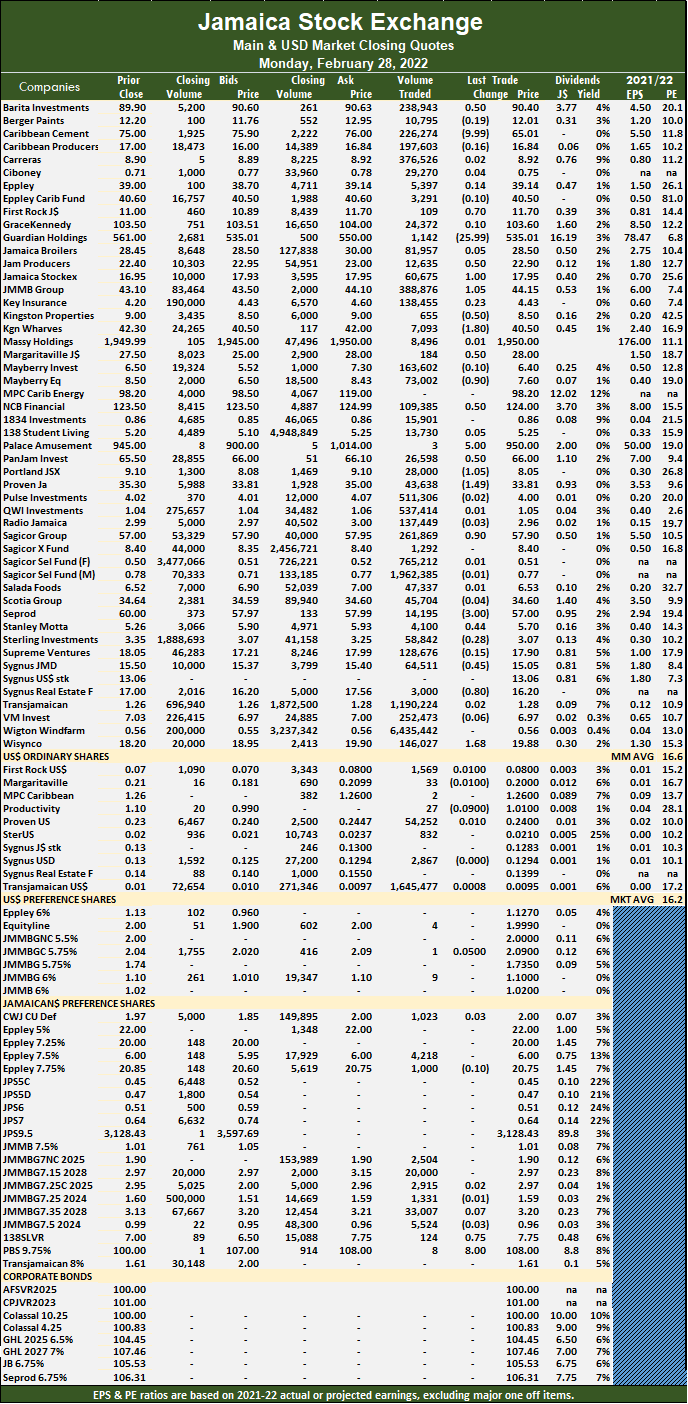

The PE Ratio, a formula for computing appropriate stock values, averages 16.6. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 14,925,719 shares were exchanged for $141,613,197 versus 114,219,281 units at $449,573,144 on Friday. Wigton Windfarm led trading with 43.1 percent of total volume with a transfer of 6.44 million shares followed by Sagicor Select Manufacturing & Distribution Fund with 13.1 percent for 1.96 million units and Transjamaican Highway, 8 percent after trading 1.19 million units.

Trading averages 252,978 units at $2,400,224, down from 2,039,630 shares at $8,028,092 on Friday and month to date, an average of 392,520 units at $3,199,976, compared to 400,144 units at $3,243,666 on the previous trading day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows 18 stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments gained 50 cents to close at $90.40 with 238,943 shares crossing the market, Caribbean Cement dipped $9.99 to $65.01 after exchanging 226,274 stocks, First Rock Capital rallied 70 cents in closing at $11.70 in trading 109 stock units. Guardian Holdings dropped $25.99 to $535.01 with the swapping of 1,142 units, Jamaica Producers gained 50 cents in ending at $22.90 with 12,635 stocks clearing the market, Jamaica Stock Exchange rose $1 to $17.95 in switching ownership of 60,675 shares. JMMB Group advanced $1.05 to $44.15 in transferring 388,876 stocks, Kingston Properties lost 50 cents in ending at $8.50 with 655 units changing hands, Kingston Wharves declined $1.80 in closing at $40.50 in switching ownership of 7,093 stock units. Margaritaville gained 50 cents to end at $28 in trading 184 shares, Mayberry Jamaican Equities fell 90 cents in closing at $7.60 with a transfer of 73,002 units, NCB Financial popped 50 cents to $124 after exchanging 109,385 stocks. Palace Amusement climbed $5 to end at $950 in trading 3 shares, PanJam Investment gained 50 cents to close at $66 with 26,598 stocks changing hands, Portland JSX declined $1.05 to $8.05 in switching ownership of 28,000 stock units. Proven Investments fell $1.49 in closing at $33.81 after crossing the exchange with 43,638 units, Sagicor Group rose 90 cents to end at $57.90 with the swapping of 261,869 stocks, Seprod declined $3 to $57 in exchanging 14,195 shares.

At the close, Barita Investments gained 50 cents to close at $90.40 with 238,943 shares crossing the market, Caribbean Cement dipped $9.99 to $65.01 after exchanging 226,274 stocks, First Rock Capital rallied 70 cents in closing at $11.70 in trading 109 stock units. Guardian Holdings dropped $25.99 to $535.01 with the swapping of 1,142 units, Jamaica Producers gained 50 cents in ending at $22.90 with 12,635 stocks clearing the market, Jamaica Stock Exchange rose $1 to $17.95 in switching ownership of 60,675 shares. JMMB Group advanced $1.05 to $44.15 in transferring 388,876 stocks, Kingston Properties lost 50 cents in ending at $8.50 with 655 units changing hands, Kingston Wharves declined $1.80 in closing at $40.50 in switching ownership of 7,093 stock units. Margaritaville gained 50 cents to end at $28 in trading 184 shares, Mayberry Jamaican Equities fell 90 cents in closing at $7.60 with a transfer of 73,002 units, NCB Financial popped 50 cents to $124 after exchanging 109,385 stocks. Palace Amusement climbed $5 to end at $950 in trading 3 shares, PanJam Investment gained 50 cents to close at $66 with 26,598 stocks changing hands, Portland JSX declined $1.05 to $8.05 in switching ownership of 28,000 stock units. Proven Investments fell $1.49 in closing at $33.81 after crossing the exchange with 43,638 units, Sagicor Group rose 90 cents to end at $57.90 with the swapping of 261,869 stocks, Seprod declined $3 to $57 in exchanging 14,195 shares.  Stanley Motta gained 44 cents in ending at $5.70 after trading 4,100 stocks, Sygnus Credit Investments shed 45 cents to end at $15.05 in an exchange of 64,511 stock units, Sygnus Real Estate Finance fell 80 cents to $16.20 with the swapping of 3,000 shares and Wisynco Group advanced $1.68 to $19.88 in switching ownership of 146,027 units.

Stanley Motta gained 44 cents in ending at $5.70 after trading 4,100 stocks, Sygnus Credit Investments shed 45 cents to end at $15.05 in an exchange of 64,511 stock units, Sygnus Real Estate Finance fell 80 cents to $16.20 with the swapping of 3,000 shares and Wisynco Group advanced $1.68 to $19.88 in switching ownership of 146,027 units.

In the preference segment, 138 Student Living preference share rallied 75 cents to end at $7.75 with 124 stocks crossing the market and Productive Business Solutions 9.75% preference shares popped $8 to $108 with the swapping of 8 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rising stocks had upper hand Monday

JSE Main Market continues in consolidation mode

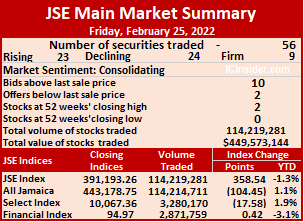

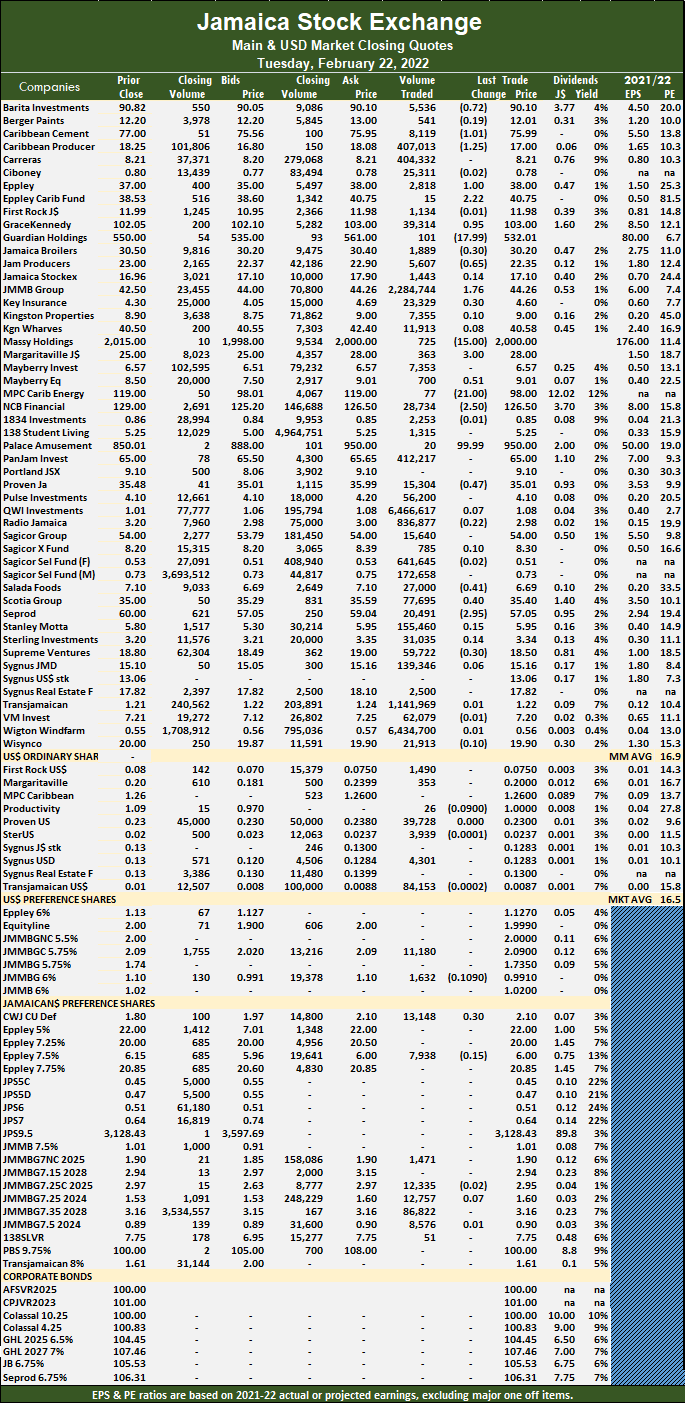

Market activity ended on Friday with the volume of shares surging 559 percent valued 227 percent more than Thursday on the Jamaica Stock Exchange Main Market as declining stocks once more bettered those rising but just.

The All Jamaican Composite Index fell 104.45 points to 443,178.75, the JSE Main Index rose 358.54 points to close at 391,193.26 and the JSE Financial Index added 0.4 points to end at 94.97.

The All Jamaican Composite Index fell 104.45 points to 443,178.75, the JSE Main Index rose 358.54 points to close at 391,193.26 and the JSE Financial Index added 0.4 points to end at 94.97.

Trading ended with 56 securities compared to 53 on Thursday, with 23 rising, 24 declining and nine ending unchanged.

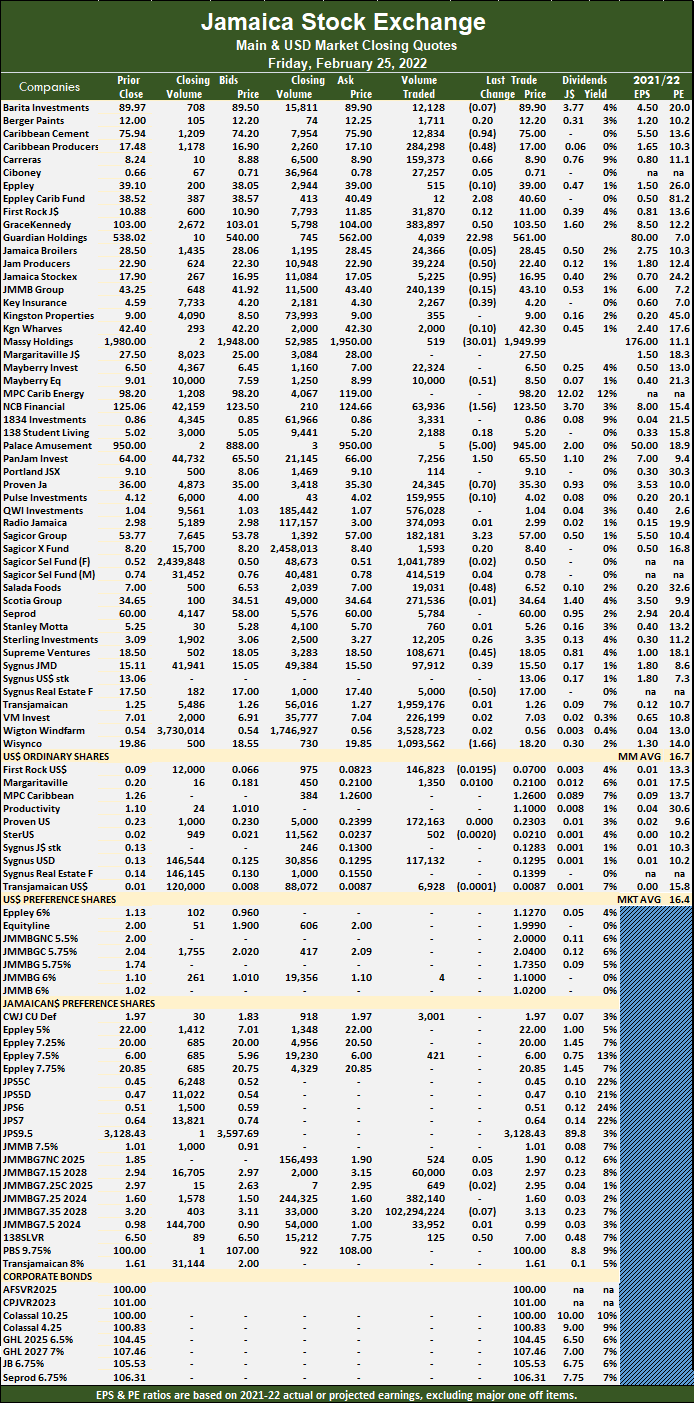

The PE Ratio, a formula for computing appropriate stock values, averages 16.7. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 114,219,281 shares were exchanged for $449,573,144 versus 17,324,391 units at $137,517,118 on Thursday. JMMB Group 7.35% – 2028 dominated trading with 89.6 percent of total volume for an exchange of 102.29 million shares followed by Wigton Windfarm with 3.1 percent for 3.53 million units, Transjamaican Highway chipped in with 1.7 percent after an exchange of 1.96 million units, Wisynco Group accounted for 1 percent after trading 1.09 million units and Sagicor Select Financial Fund, 0.9 percent with 1.04 million units changing hands.

Trading averaged 2,039,630 units at $8,028,092, up from 326,875 shares at $2,594,663 on Thursday and month to date, an average of 400,144 units at $3,243,666 versus 310,484 units at $2,982,018 on the previous trading day. January closed with an average of 235,328 units at $2,397,571.

Trading averaged 2,039,630 units at $8,028,092, up from 326,875 shares at $2,594,663 on Thursday and month to date, an average of 400,144 units at $3,243,666 versus 310,484 units at $2,982,018 on the previous trading day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and two ended with lower offers.

At the close, Caribbean Cement fell 94 cents after ending at $75 in switching ownership of 12,834 shares, Caribbean Producers lost 48 cents to close at $17 after exchanging 284,298 stocks, Carreras gained 66 cents to end at $8.90 with 159,373 units crossing the market. Eppley Caribbean Property Fund popped $2.08 in closing at $40.60 in trading 12 stock units, GraceKennedy gained 50 cents to finish at $103.50 with 383,897 shares changing hands, Guardian Holdings climbed $22.98 to end at $561 in switching ownership of 4,039 stock units. Jamaica Producers lost 50 cents to close at $22.40 with a transfer of 39,224 stocks, Jamaica Stock Exchange fell 95 cents to $16.95 with 5,225 units clearing the market, Key Insurance lost 39 cents to close at $4.20 in trading 2,267 stocks. Massy Holdings dropped $30.01 to $1,949.99 after 519 units crossed the market, Mayberry Jamaican Equities lost 51 cents in closing at $8.50 in an exchange of 10,000 stock units, NCB Financial declined $1.56 to $123.50 with the swapping of 63,936 shares.  Palace Amusement declined $5 to $945 after an exchange of 5 units, PanJam Investment rose $1.50 to $65.50 in transferring 7,256 stocks, Proven Investments fell 70 cents to $35.30 with an exchange of 24,345 stock units. Sagicor Group rallied $3.23 to $57 with 182,181 shares changing hands, Salada Foods lost 48 cents at $6.52 in trading 19,031 stock units, Supreme Ventures fell 45 cents in closing at $18.05 after exchanging 108,671 stocks. Sygnus Credit Investments gained 39 cents to close at $15.50 with 97,912 units changing hands, Sygnus Real Estate Finance shed 50 cents to $17 with a transfer of 5,000 shares and Wisynco Group declined $1.66 to $18.20 with an exchange of 1,093,562 stocks.

Palace Amusement declined $5 to $945 after an exchange of 5 units, PanJam Investment rose $1.50 to $65.50 in transferring 7,256 stocks, Proven Investments fell 70 cents to $35.30 with an exchange of 24,345 stock units. Sagicor Group rallied $3.23 to $57 with 182,181 shares changing hands, Salada Foods lost 48 cents at $6.52 in trading 19,031 stock units, Supreme Ventures fell 45 cents in closing at $18.05 after exchanging 108,671 stocks. Sygnus Credit Investments gained 39 cents to close at $15.50 with 97,912 units changing hands, Sygnus Real Estate Finance shed 50 cents to $17 with a transfer of 5,000 shares and Wisynco Group declined $1.66 to $18.20 with an exchange of 1,093,562 stocks.

In the preference segment, 138 Student Living preference share popped 50 cents to $7 after trading 125 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

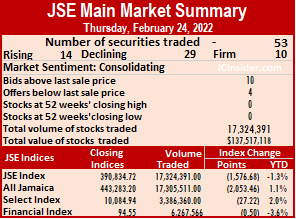

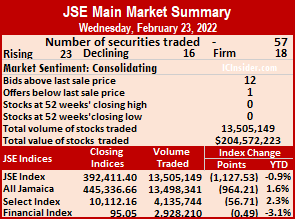

Main Market stocks falter Thursday

Market activity ended on Thursday with the volume of shares traded rising 28 percent with the value 33 percent lower than on Wednesday on the Jamaica Stock Exchange Main Market as rising stocks ended numbering well below those declining.

The All Jamaican Composite Index dropped 2,053.46 points to close at 443,283.20, the JSE Main Index declined 1,576.68 points to 390,834.72 and the JSE Financial Index slipped 0.50 points to close at 94.55.

The All Jamaican Composite Index dropped 2,053.46 points to close at 443,283.20, the JSE Main Index declined 1,576.68 points to 390,834.72 and the JSE Financial Index slipped 0.50 points to close at 94.55.

Trading ended with 53 securities versus 57 on Wednesday, with 14 rising, 29 declining and 10 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16.7. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 17,324,391 shares were traded for $137,517,118 versus 13,505,149 units at $204,572,223 on Wednesday. Wigton Windfarm led trading with 45.8 percent of total volume with an exchange of 7.93 million shares followed by Transjamaican Highway with 19.8 percent for 3.44 million units and Carreras with 9.1 percent after trading 1.58 million units.

Trading averaged 326,875 units at $2,594,663 on Thursday, compared to 236,932 shares at $3,588,986 on Wednesday and for the month to date, an average of 310,484 units at $2,982,018 compared to 309,590 units at $3,003,161 on the previous day. January averaged 235,328 units at $2,397,571.

Trading averaged 326,875 units at $2,594,663 on Thursday, compared to 236,932 shares at $3,588,986 on Wednesday and for the month to date, an average of 310,484 units at $2,982,018 compared to 309,590 units at $3,003,161 on the previous day. January averaged 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Caribbean Cement shed 91 cents to close at $75.94, with 10,372 shares crossing the market, Caribbean Producers lost 37 cents to end at $17.48 trading 191,062 units, Eppley rose $1.10 to $39.10 with an exchange of 125 stocks. Eppley Caribbean Property Fund fell $1.48 in closing at $38.52 with 4,548 stock units switching owners, GraceKennedy declined $2.45 to $103 after transferring 163,759 shares, Jamaica Broilers fell $1.21 to close at $28.50 with 9,596 units crossing the exchange. Jamaica Producers gained 45 cents to end at $22.90 with 8,588 stocks clearing the market, Jamaica Stock Exchange rallied 80 cents to $17.90 in exchanging 15,924 stock units, JMMB Group fell $1.25 in closing at $43.25 with a transfer of 458,337 shares.  Kingston Properties gained 50 cents to finish at $9, with the swapping of 265 stock units, Kingston Wharves declined $1.10 in ending at $42.40 in switching ownership of 1,526 stocks, Massy Holdings popped $10.50 to close at $1,980 with 10,224 units changing hands. PanJam Investment shed $1 in closing at $64, with the swapping of 320,378 stocks, Proven Investments gained 50 cents to settle at $36 in an exchange of 30,990 stock units, Salada Foods gained 49 cents to end at $7 in trading 1,945 units. Supreme Ventures lost 48 cents to close at $18.50 with the swapping of 142,526 shares, Sygnus Real Estate Finance lost 32 cents after ending at $17.50 and an exchange of 630 stocks.

Kingston Properties gained 50 cents to finish at $9, with the swapping of 265 stock units, Kingston Wharves declined $1.10 in ending at $42.40 in switching ownership of 1,526 stocks, Massy Holdings popped $10.50 to close at $1,980 with 10,224 units changing hands. PanJam Investment shed $1 in closing at $64, with the swapping of 320,378 stocks, Proven Investments gained 50 cents to settle at $36 in an exchange of 30,990 stock units, Salada Foods gained 49 cents to end at $7 in trading 1,945 units. Supreme Ventures lost 48 cents to close at $18.50 with the swapping of 142,526 shares, Sygnus Real Estate Finance lost 32 cents after ending at $17.50 and an exchange of 630 stocks.

In the preference segment, 138 Student Living preference share fell $1.25 to close at $6.50, with 289 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

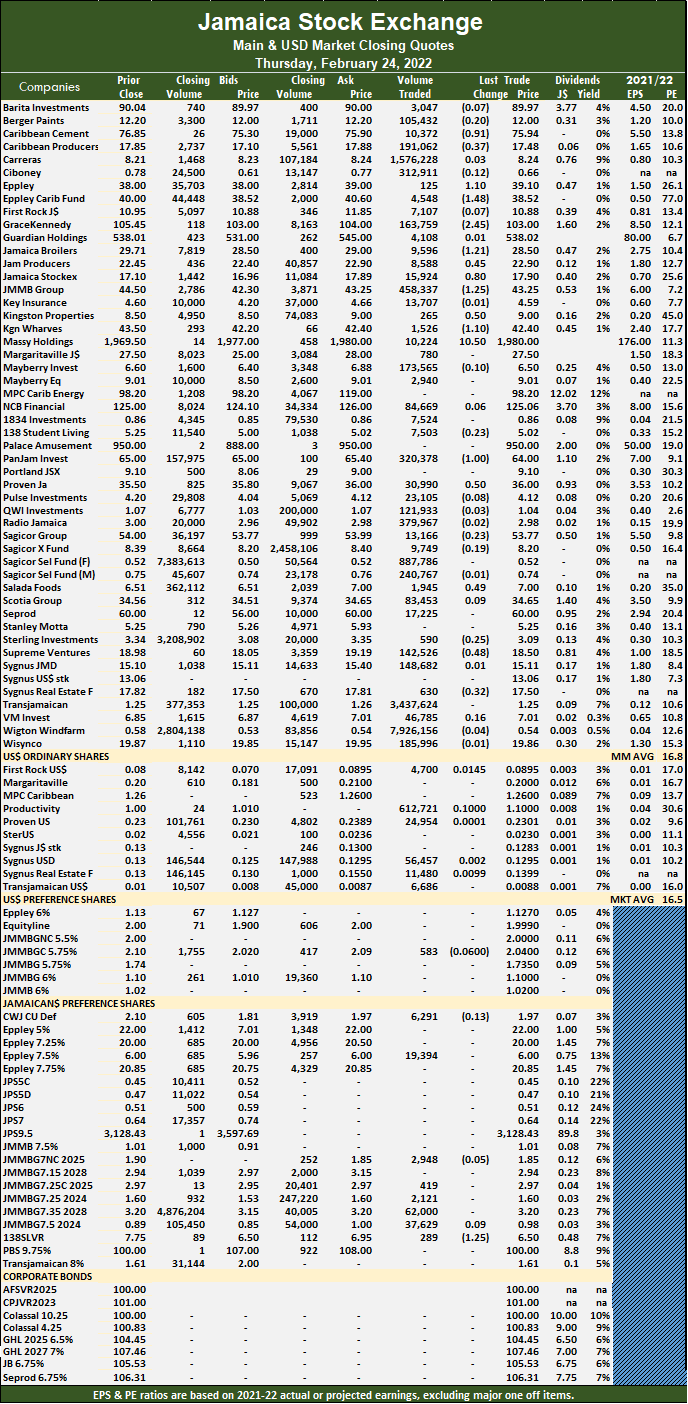

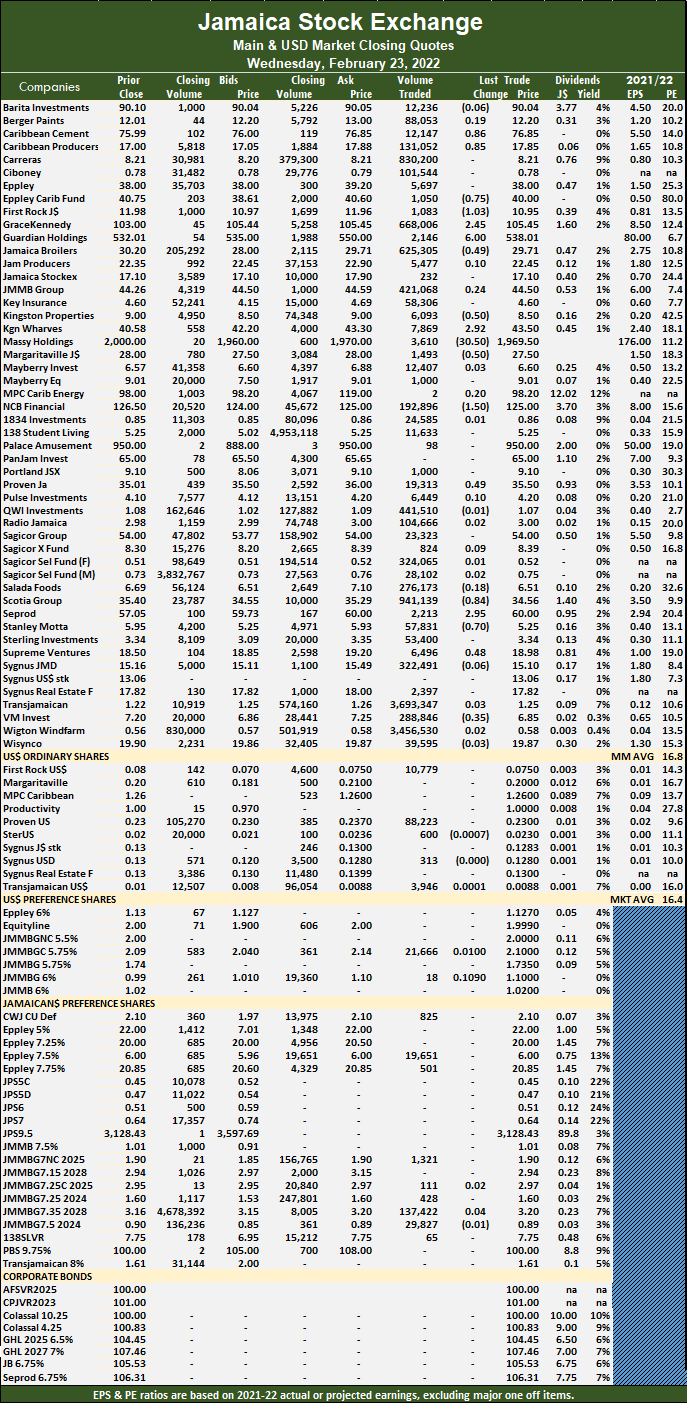

Pullback for JSE Main Market

Market activity ended on Wednesday with the volume of shares declining 33 percent with 17 percent greater value than in trading on Tuesday on the Jamaica Stock Exchange Main Market as rising stocks exceeded those declining by a decent margin but that did not prevent the main indices from slipping.

The All Jamaican Composite Index fell 964.21 points to 445,336.66, the JSE Main Index declined 1,127.53 points to settle at 392,411.40 and the JSE Financial Index lost 0.49 points to end at 95.05.

The All Jamaican Composite Index fell 964.21 points to 445,336.66, the JSE Main Index declined 1,127.53 points to settle at 392,411.40 and the JSE Financial Index lost 0.49 points to end at 95.05.

Trading ended with 57 securities up from 56 on Tuesday, with 23 rising, 16 declining and 18 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16.8. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 13,505,149 shares were exchanged for $204,572,223 versus 20,207,005 units at $174,517,332 on Tuesday. Transjamaican Highway led trading with 27.4 percent of total volume in transferring 3.69 million shares followed by Wigton Windfarm with 25.6 percent for 3.46 million units and Scotia Group with 7 percent market share for 941,139 units.

Trading averages 236,932 units at $3,588,986, compared to 360,839 shares at $3,116,381 on Tuesday and month to date, an average of 309,590 units at $3,003,161, compared to 314,121 units at $2,966,627 on the previous trading day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Caribbean Cement rose 86 cents to end at $76.85 with 12,147 shares changing hands, Caribbean Producers gained 85 cents in closing at $17.85 after clearing the market with 131,052 stock units, Eppley Caribbean Property Fund declined 75 cents to finish at $40 in trading 1,050 units. First Rock Capital shed $1.03 to end $10.95 with an exchange of 1,083 stocks, GraceKennedy rallied $2.45 after ending at $105.45 with 609,750 units crossing the exchange, Guardian Holdings climbed $6 to $538.01 in trading 2,146 stocks. Jamaica Broilers lost 49 cents to settle at $29.71 in switching ownership of 625,305 shares, Kingston Properties dipped 50 cents to close at $8.50 with the swapping of 6,093 units, Kingston Wharves advanced $2.92 in closing at $43.50 after 7,869 shares crossed the market. Margaritaville lost 50 cents to end at $27.50 with 1,493 stocks changing hands, Massy Holdings dropped $30.50 to close at $1,969.50 in switching ownership of 3,610 units, NCB Financial declined $1.50 to end at $125 with an exchange of 192,896 stock units.

At the close, Caribbean Cement rose 86 cents to end at $76.85 with 12,147 shares changing hands, Caribbean Producers gained 85 cents in closing at $17.85 after clearing the market with 131,052 stock units, Eppley Caribbean Property Fund declined 75 cents to finish at $40 in trading 1,050 units. First Rock Capital shed $1.03 to end $10.95 with an exchange of 1,083 stocks, GraceKennedy rallied $2.45 after ending at $105.45 with 609,750 units crossing the exchange, Guardian Holdings climbed $6 to $538.01 in trading 2,146 stocks. Jamaica Broilers lost 49 cents to settle at $29.71 in switching ownership of 625,305 shares, Kingston Properties dipped 50 cents to close at $8.50 with the swapping of 6,093 units, Kingston Wharves advanced $2.92 in closing at $43.50 after 7,869 shares crossed the market. Margaritaville lost 50 cents to end at $27.50 with 1,493 stocks changing hands, Massy Holdings dropped $30.50 to close at $1,969.50 in switching ownership of 3,610 units, NCB Financial declined $1.50 to end at $125 with an exchange of 192,896 stock units.  Proven Investments gained 49 cents to close at $35.50 in transferring 19,313 shares, Scotia Group fell 84 cents to $34.56 after trading 941,139 stocks, Seprod popped $2.95 in ending at $60 in exchanging 2,213 units. Stanley Motta lost 70 cents to close at $5.25 with 57,831 stock units changing hands, Supreme Ventures gained 48 cents to settle at $18.98 with the swapping of 6,496 stocks and Victoria Mutual Investments shed 35 cents to end at $6.85 in trading 288,846 units.

Proven Investments gained 49 cents to close at $35.50 in transferring 19,313 shares, Scotia Group fell 84 cents to $34.56 after trading 941,139 stocks, Seprod popped $2.95 in ending at $60 in exchanging 2,213 units. Stanley Motta lost 70 cents to close at $5.25 with 57,831 stock units changing hands, Supreme Ventures gained 48 cents to settle at $18.98 with the swapping of 6,496 stocks and Victoria Mutual Investments shed 35 cents to end at $6.85 in trading 288,846 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading rises on JSE Main Market

Market activity ended on Tuesday, with the volume of shares trading slightly more and the value 26 percent higher than on Monday at the close of the Jamaica Stock Exchange Main Market as rising stocks were just edged out by those declining.

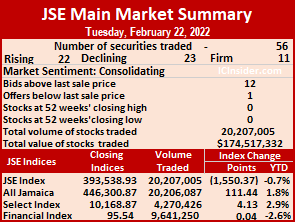

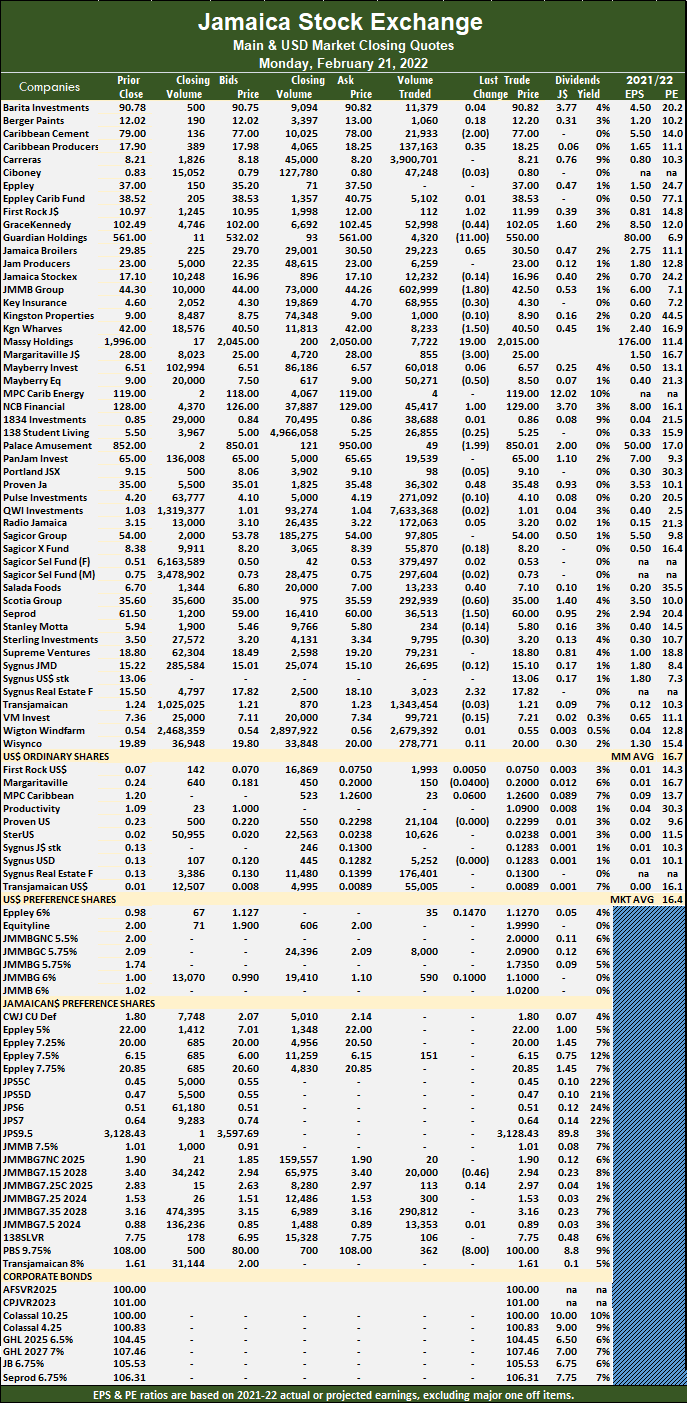

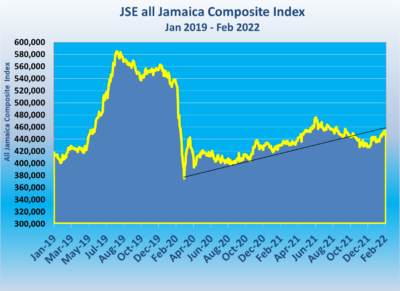

The All Jamaican Composite Index jumped 111.44 points to close at 446,300.87, the JSE Main Index fell 1,550.37 points to 393,538.93 and the JSE Financial Index added 0.04 points to close at 95.54.

The All Jamaican Composite Index jumped 111.44 points to close at 446,300.87, the JSE Main Index fell 1,550.37 points to 393,538.93 and the JSE Financial Index added 0.04 points to close at 95.54.

Trading ended with 56 securities versus 57 on Monday, with 22 rising, 23 declining and 11 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16.9. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 20,207,005 shares were exchanged for $174,517,332 versus 19,292,252 units at $138,707,283 on Monday. QWI Investments led trading with 32 percent of total volume for an exchange of 6.47 million shares followed by Wigton Windfarm with 31.8 percent for 6.43 million units, JMMB Group controlled 11.3 percent for 2.28 million units and Transjamaican Highway ended with 5.7 percent after trading 1.14 million units.

Trading averages 360,839 units at $3,116,381, compared to 338,461 shares at $2,433,461 on Monday and month to date, an average of 314,121 units at $2,966,627, compared to 311,071 units at $2,956,852 on the previous trading day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Barita Investments dipped 72 cents in ending at $90.10 after exchanging 5,536 shares, Caribbean Cement shed $1.01 in closing at $75.99 with a transfer of 8,119 units, Caribbean Producers fell $1.25 to $17 in trading 407,013 stocks. Eppley advanced $1 to end at $38 with 2,818 stock units changing hands, Eppley Caribbean Property Fund rallied $2.22 to close at $40.75 in switching ownership of 15 units, GraceKennedy rose 95 cents in closing at $103 with the swapping of 39,314 shares. Guardian Holdings dropped $17.99 to $532.01 in exchanging 101 units, Jamaica Broilers lost 30 cents to end at $30.20 with 1,889 stocks crossing the exchange, Jamaica Producers shed 65 cents to close at $22.35 in transferring 5,607 stock units. JMMB Group advanced $1.76 to $44.26 after exchanging 2,284,744 shares, Key Insurance gained 30 cents to finish at $4.60 in trading 23,329 units, Margaritaville advanced $3 to close at $28 in switching ownership of 363 stocks. Massy Holdings declined $15 in closing at $2,000 with the swapping of 725 shares, Mayberry Jamaican Equities popped 51 cents in ending at $9.01 with 700 stocks changing hands, MPC Caribbean Clean Energy dropped $21 to end at $98 in an exchange of 77 stock units.

At the close, Barita Investments dipped 72 cents in ending at $90.10 after exchanging 5,536 shares, Caribbean Cement shed $1.01 in closing at $75.99 with a transfer of 8,119 units, Caribbean Producers fell $1.25 to $17 in trading 407,013 stocks. Eppley advanced $1 to end at $38 with 2,818 stock units changing hands, Eppley Caribbean Property Fund rallied $2.22 to close at $40.75 in switching ownership of 15 units, GraceKennedy rose 95 cents in closing at $103 with the swapping of 39,314 shares. Guardian Holdings dropped $17.99 to $532.01 in exchanging 101 units, Jamaica Broilers lost 30 cents to end at $30.20 with 1,889 stocks crossing the exchange, Jamaica Producers shed 65 cents to close at $22.35 in transferring 5,607 stock units. JMMB Group advanced $1.76 to $44.26 after exchanging 2,284,744 shares, Key Insurance gained 30 cents to finish at $4.60 in trading 23,329 units, Margaritaville advanced $3 to close at $28 in switching ownership of 363 stocks. Massy Holdings declined $15 in closing at $2,000 with the swapping of 725 shares, Mayberry Jamaican Equities popped 51 cents in ending at $9.01 with 700 stocks changing hands, MPC Caribbean Clean Energy dropped $21 to end at $98 in an exchange of 77 stock units.  NCB Financial fell $2.50 in closing at $126.50 with 28,734 units crossing the market, Palace Amusement jumped $99.99 to end at $950 with 20 stocks clearing the market, Proven Investments lost 47 cents at $35.01 with 15,304 stock units changing hands. Salada Foods fell 41 cents to close at $6.69 with a transfer of 27,000 stocks, Scotia Group gained 40 cents to end at $35.40 in trading 77,695 shares, Seprod fell $2.95 to close at $57.05 in exchanging 20,491 stocks and Supreme Ventures lost 30 cents to end at $18.50 after exchanging 59,722 units.

NCB Financial fell $2.50 in closing at $126.50 with 28,734 units crossing the market, Palace Amusement jumped $99.99 to end at $950 with 20 stocks clearing the market, Proven Investments lost 47 cents at $35.01 with 15,304 stock units changing hands. Salada Foods fell 41 cents to close at $6.69 with a transfer of 27,000 stocks, Scotia Group gained 40 cents to end at $35.40 in trading 77,695 shares, Seprod fell $2.95 to close at $57.05 in exchanging 20,491 stocks and Supreme Ventures lost 30 cents to end at $18.50 after exchanging 59,722 units.

In the preference segment, Community & Workers Credit Union gained 30 cents in closing at $2.10 with 13,148 shares clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market stocks pulled back on Monday

Market activity ended Monday with the volume of shares jumping 52 percent, but with the value 18 percent lower than on Friday at the close of trading on the Jamaica Stock Exchange Main Market as declining beat out rising stocks by a wide margin.

The All Jamaican Composite Index fell 1,542.17 points to 446,189.43, the JSE Main Index shed 124.48 points to settle at 395,089.30 and the JSE Financial Index lost 0.05 points to end at 95.50.

The All Jamaican Composite Index fell 1,542.17 points to 446,189.43, the JSE Main Index shed 124.48 points to settle at 395,089.30 and the JSE Financial Index lost 0.05 points to end at 95.50.

Trading ended with 57 securities up from 53 on Friday, with 19 rising, 27 declining and 11 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16.7. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 19,292,252 shares were traded for $138,707,283 versus 12,658,052 units at $170,186,122 on Friday. QWI Investments led trading with 39.6 percent of total volume after a transferring of 7.63 million shares followed by Carreras with 20.2 percent for 3.90 million units, Wigton Windfarm exchanged 2.68 million units for 13.9 percent market share and Transjamaican Highway accounted for 7 percent with 1.34 million units changing hands.

Trading averages 338,461 units at $2,433,461, compared to 238,831 shares at $3,211,059 on Friday and month to date, an average of 311,071 units at $2,956,852, compared to 309,122 units at $2,994,098 on the previous trading day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Caribbean Cement declined $2 to $77 in an exchange of 21,933 shares, Caribbean Producers rallied 35 cents to end at $18.25 in trading 137,163 stocks, First Rock Capital advanced $1.02 in closing at $11.99 with a transfer of 112 units. GraceKennedy shed 44 cents after ending at $102.05 with 52,998 stock units changing hands, Guardian Holdings dropped $11 to close at $550 in switching ownership of 4,320 units, Jamaica Broilers rose 65 cents to close at $30.50 after exchanging 29,223 stocks. JMMB Group fell $1.80 in closing at $42.50 with 602,999 shares crossing the market, Key Insurance lost 30 cents in ending at $4.30 with the swapping of 68,955 stocks, Kingston Wharves declined $1.50 to end at $40.50 after exchanging 8,233 units. Margaritaville fell $3 to $25 in trading 855 stock units, Massy Holdings popped $19 in ending at $2,015 with the swapping of 7,722 stocks, Mayberry Jamaican Equities shed 50 cents in closing at $8.50 in transferring 50,271 shares. NCB Financial rose $1 to $129 with 45,417 stock units crossing the market, Palace Amusement fell $1.99 to close at $850.01 with 49 stocks changing hands, Proven Investments gained 48 cents to end at $35.48 in trading 36,302 shares.

At the close, Caribbean Cement declined $2 to $77 in an exchange of 21,933 shares, Caribbean Producers rallied 35 cents to end at $18.25 in trading 137,163 stocks, First Rock Capital advanced $1.02 in closing at $11.99 with a transfer of 112 units. GraceKennedy shed 44 cents after ending at $102.05 with 52,998 stock units changing hands, Guardian Holdings dropped $11 to close at $550 in switching ownership of 4,320 units, Jamaica Broilers rose 65 cents to close at $30.50 after exchanging 29,223 stocks. JMMB Group fell $1.80 in closing at $42.50 with 602,999 shares crossing the market, Key Insurance lost 30 cents in ending at $4.30 with the swapping of 68,955 stocks, Kingston Wharves declined $1.50 to end at $40.50 after exchanging 8,233 units. Margaritaville fell $3 to $25 in trading 855 stock units, Massy Holdings popped $19 in ending at $2,015 with the swapping of 7,722 stocks, Mayberry Jamaican Equities shed 50 cents in closing at $8.50 in transferring 50,271 shares. NCB Financial rose $1 to $129 with 45,417 stock units crossing the market, Palace Amusement fell $1.99 to close at $850.01 with 49 stocks changing hands, Proven Investments gained 48 cents to end at $35.48 in trading 36,302 shares.  Salada Foods picked up 40 cents in ending at $7.10 after exchanging 13,233 units, Scotia Group shed 60 cents to end at $35 in switching ownership of 292,939 shares, Seprod fell $1.50 in closing at $60 in exchanging 36,513 units. Sterling Investments lost 30 cents to end at $3.20 with the swapping of 9,795 stocks and Sygnus Real Estate Finance advanced $2.32 to close at $17.82 in an exchange of 3,023 stock units.

Salada Foods picked up 40 cents in ending at $7.10 after exchanging 13,233 units, Scotia Group shed 60 cents to end at $35 in switching ownership of 292,939 shares, Seprod fell $1.50 in closing at $60 in exchanging 36,513 units. Sterling Investments lost 30 cents to end at $3.20 with the swapping of 9,795 stocks and Sygnus Real Estate Finance advanced $2.32 to close at $17.82 in an exchange of 3,023 stock units.

In the preference segment, JMMB Group 7.15% – due 2028 lost 46 cents after ending at $2.94 with 20,000 units changing hands and Productive Business Solutions 9.75% preference share declined $8 to $100 in transferring 362 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Mild recovery for JSE Main Market

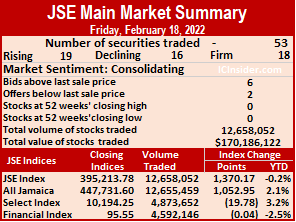

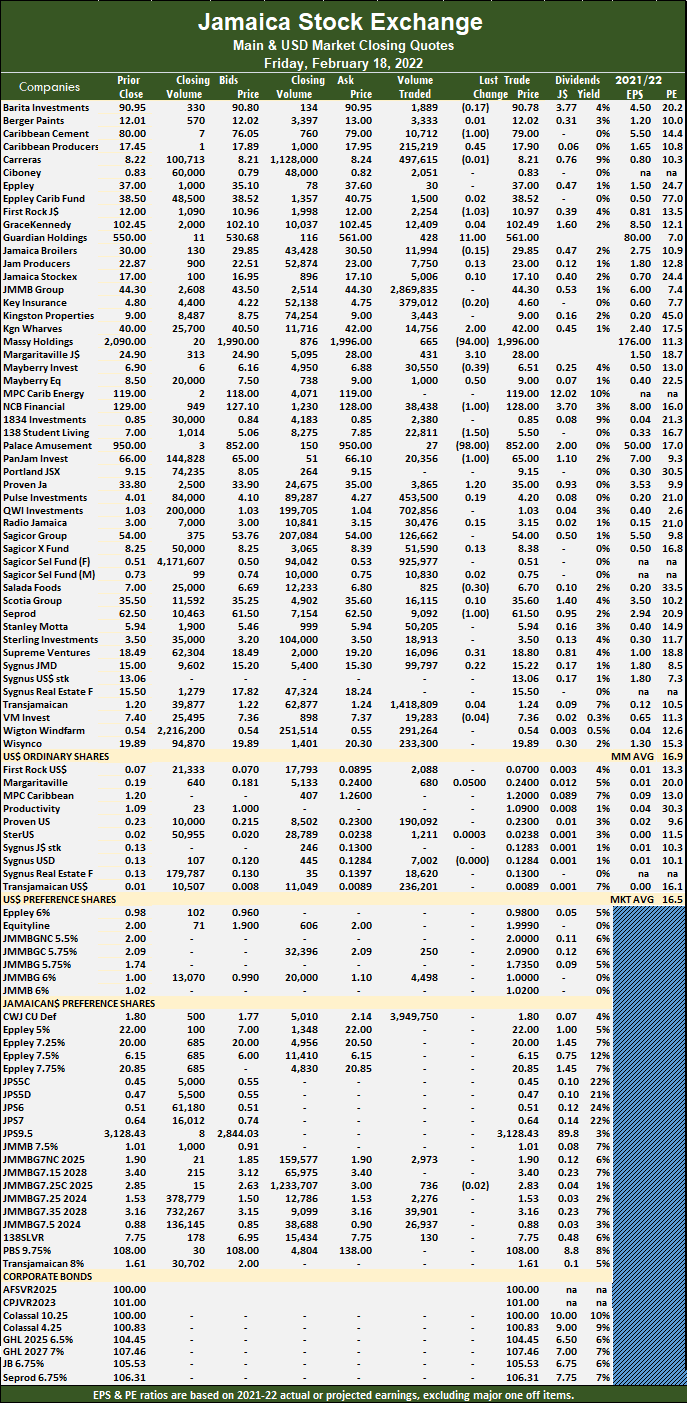

Market activity ended on Friday with the volume of shares declining 48 percent and the value just marginally lower than Thursday’s levels on the Jamaica Stock Exchange Main Market as rising stocks exceeded those declining, leading the market indices to close with a modest rise.

The All Jamaican Composite Index advanced 1,052.95 points to 447,731.60, the JSE Main Index rallied 1,370.17 points to 395,213.78 and the JSE Financial Index dipped 0.04 points to settle at 95.55.

The All Jamaican Composite Index advanced 1,052.95 points to 447,731.60, the JSE Main Index rallied 1,370.17 points to 395,213.78 and the JSE Financial Index dipped 0.04 points to settle at 95.55.

A total of 53 securities traded compared to 57 on Thursday, with 19 rising, 16 declining and 18 ending unchanged. Sterling Investments traded at an intraday high of $3.65 before pulling back to $3.50.

The PE Ratio, a formula for computing appropriate stock values, averages 16.9. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Trading ended with an exchange of 12,658,052 shares for $170,186,122 versus 24,469,891 units at $177,150,417 on Thursday. Community & Workers Credit Union led trading with 31.2 percent of total volume for 3.95 million shares followed by JMMB Group, 22.7 percent, with 2.87 million units and Transjamaican Highway, 11.2 percent after 1.42 million units changed hands.

Trading averaged 238,831 units at $3,211,059 versus 429,296 shares at $3,107,902 on Thursday and month to date, an average of 309,122 units at $2,994,098, compared to 314,103 units at $2,978,725 on the previous day. January closed with an average of 235,328 units at $2,397,571.

Trading averaged 238,831 units at $3,211,059 versus 429,296 shares at $3,107,902 on Thursday and month to date, an average of 309,122 units at $2,994,098, compared to 314,103 units at $2,978,725 on the previous day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Caribbean Cement fell $1 in closing at $79 after an exchange of 10,712 shares, Caribbean Producers gained 45 cents to close at $17.90 with a transfer of 215,219 stock units, First Rock Capital shed $1.03 at $10.97 in switching ownership of 2,254 units. Guardian Holdings popped $11 to end at $561 in an exchange of 428 stocks, Kingston Wharves rallied $2 in ending at $42 after swapping 14,756 shares, Margaritaville advanced $3.10 in closing at $28 in trading 431 units. Massy Holdings dropped $94 to close at $1,996 with 665 stocks crossing the exchange, Mayberry Investments lost 39 cents to finish at $6.51 after a transfer of 30,550 shares, Mayberry Jamaican Equities gained 50 cents to end at $9 with 1,000 stocks changing hands.  NCB Financial shed $1 in ending at $128 with 38,438 stock units crossing the market, 138 Student Living fell $1.50 to $5.50 with an exchange of 22,811 shares, Palace Amusement dropped $98 to close at $852 with 27 units clearing the market. PanJam Investment shed $1 in closing at $65 in trading 20,356 stocks, Proven Investments climbed $1.20 to end at $35 with the swapping of 3,865 stock units, Salada Foods lost 30 cents to settle at $6.70 in exchanging 825 shares. Seprod fell $1 to end at $61.50 in switching ownership of 9,092 stocks and Supreme Ventures gained 31 cents in closing at $18.80 with 16,096 shares traded.

NCB Financial shed $1 in ending at $128 with 38,438 stock units crossing the market, 138 Student Living fell $1.50 to $5.50 with an exchange of 22,811 shares, Palace Amusement dropped $98 to close at $852 with 27 units clearing the market. PanJam Investment shed $1 in closing at $65 in trading 20,356 stocks, Proven Investments climbed $1.20 to end at $35 with the swapping of 3,865 stock units, Salada Foods lost 30 cents to settle at $6.70 in exchanging 825 shares. Seprod fell $1 to end at $61.50 in switching ownership of 9,092 stocks and Supreme Ventures gained 31 cents in closing at $18.80 with 16,096 shares traded.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

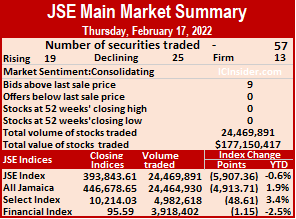

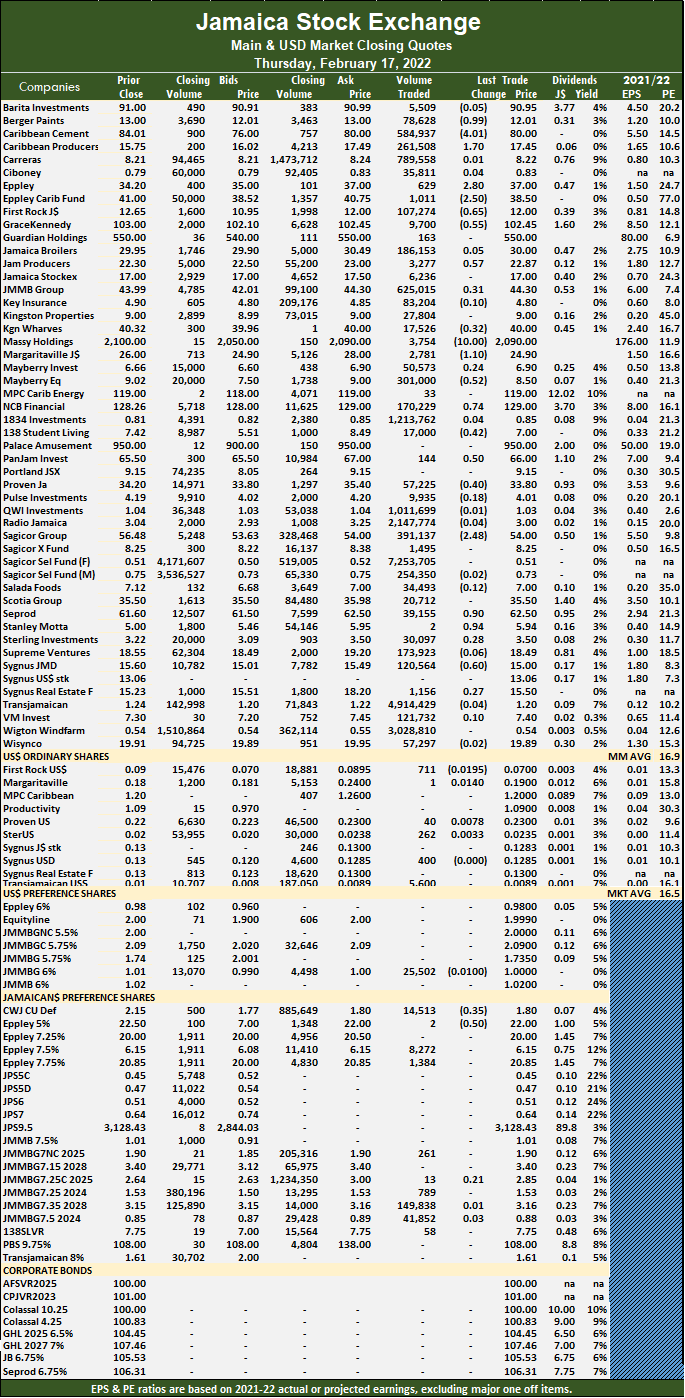

Big Main Market fall

Main Market stocks mostly declined on Thursday with little change in the volume and value of shares trading compared to Wednesday on the Jamaica Stock Exchange Main Market and resulted in the All Jamaican Composite Index dropping 4,913.71 points to close at 446,678.65, while the JSE Main Index plunged 5,907.36 points to settle at 393,843.61. The JSE Financial Index slipped 1.15 points to 95.59.

A total of 57 securities traded for a third consecutive day on Wednesday, with prices of 19 stocks rising, 25 declining and 13 ending unchanged.

A total of 57 securities traded for a third consecutive day on Wednesday, with prices of 19 stocks rising, 25 declining and 13 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16.9. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 24,469,891 shares were exchanged for $177,150,417 versus 25,678,501 units at $170,560,569 on Wednesday. Sagicor Select Financial Fund led trading with 29.6 percent of total volume with a transfer of 7.25 million shares followed by Transjamaican Highway, 20.1 percent with 4.91 million units, Wigton Windfarm contributed 12.4 percent with 3.03 million units, Radio Jamaica, 8.8 percent market share with 2.15 million units, 1834 Investments held on to 5 percent after an exchange of 1.21 million units and QWI Investments with 4.1 percent after trading 1.01 million units.

Trading averages 429,296 units at $3,107,902, versus 450,500 shares at $2,992,291 on Wednesday and month to date, an average of 314,103 units at $2,978,725, compared to 304,601 units at $2,968,069 on the previous day.January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and none with lower offers.

At the close, Berger Paints shed 99 cents to close at $12.01 with 78,628 stocks crossing the market, Caribbean Cement declined $4.01 to $80 with the swapping of 584,937 units, Caribbean Producers rose $1.70 to $17.45 trading 261,508 stock units. Eppley advanced $2.80 to end at $37 with a transfer of 629 units, Eppley Caribbean Property Fund fell $2.50 to close at $38.50 in an exchange of 1,011 stocks, First Rock Capital lost 65 cents after ending at $12 in switching ownership of 107,274 units. GraceKennedy lost 55 cents to close at $102.45 with 9,700 shares clearing the market, Jamaica Producers popped 57 cents to $22.87 after exchanging 3,277 stocks, JMMB Group rallied 31 cents to $44.30 with the swapping of 625,015 stock units. Kingston Wharves lost 32 cents to end at $40 in exchanging 17,526shares, Margaritaville shed $1.10 to close at $24.90 with 2,781 units changing hands, Massy Holdings declined $10 after ending at $2,090 in transferring 3,754 stocks. Mayberry Jamaican Equities lost 52 cents to finish at $8.50 after 301,000 shares crossed the market, NCB Financial gained 74 cents in closing at $129 with an exchange of 170,229 units, 138 Student Living lost 42 cents in closing at $7 after trading 17,000 shares.

At the close, Berger Paints shed 99 cents to close at $12.01 with 78,628 stocks crossing the market, Caribbean Cement declined $4.01 to $80 with the swapping of 584,937 units, Caribbean Producers rose $1.70 to $17.45 trading 261,508 stock units. Eppley advanced $2.80 to end at $37 with a transfer of 629 units, Eppley Caribbean Property Fund fell $2.50 to close at $38.50 in an exchange of 1,011 stocks, First Rock Capital lost 65 cents after ending at $12 in switching ownership of 107,274 units. GraceKennedy lost 55 cents to close at $102.45 with 9,700 shares clearing the market, Jamaica Producers popped 57 cents to $22.87 after exchanging 3,277 stocks, JMMB Group rallied 31 cents to $44.30 with the swapping of 625,015 stock units. Kingston Wharves lost 32 cents to end at $40 in exchanging 17,526shares, Margaritaville shed $1.10 to close at $24.90 with 2,781 units changing hands, Massy Holdings declined $10 after ending at $2,090 in transferring 3,754 stocks. Mayberry Jamaican Equities lost 52 cents to finish at $8.50 after 301,000 shares crossed the market, NCB Financial gained 74 cents in closing at $129 with an exchange of 170,229 units, 138 Student Living lost 42 cents in closing at $7 after trading 17,000 shares.  PanJam Investment rose 50 cents to $66 in switching ownership of 144 shares, Proven Investments shed 40 cents to close at $33.80 with a transfer of 57,225 stocks, Sagicor Group fell $2.48 to finish at $54 with the swapping of 391,137 shares. Seprod gained 90 cents to end at $62.50 with 39,155 units changing hands, Stanley Motta rose 94 cents $5.94 in trading 2 stock units and Sygnus Credit Investments shed 60 cents to end at $15 with 120,564 units clearing the market.

PanJam Investment rose 50 cents to $66 in switching ownership of 144 shares, Proven Investments shed 40 cents to close at $33.80 with a transfer of 57,225 stocks, Sagicor Group fell $2.48 to finish at $54 with the swapping of 391,137 shares. Seprod gained 90 cents to end at $62.50 with 39,155 units changing hands, Stanley Motta rose 94 cents $5.94 in trading 2 stock units and Sygnus Credit Investments shed 60 cents to end at $15 with 120,564 units clearing the market.

In the preference segment, Community & Workers Credit Union lost 35 cents to close at $1.80 with an exchange of 14,513 stock units and Eppley 5% preference share shed 50 cents to end at $22 after two shares were traded.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Slippage for JSE Main Market

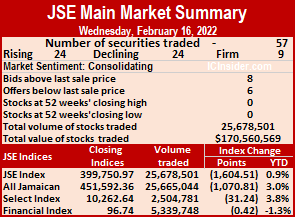

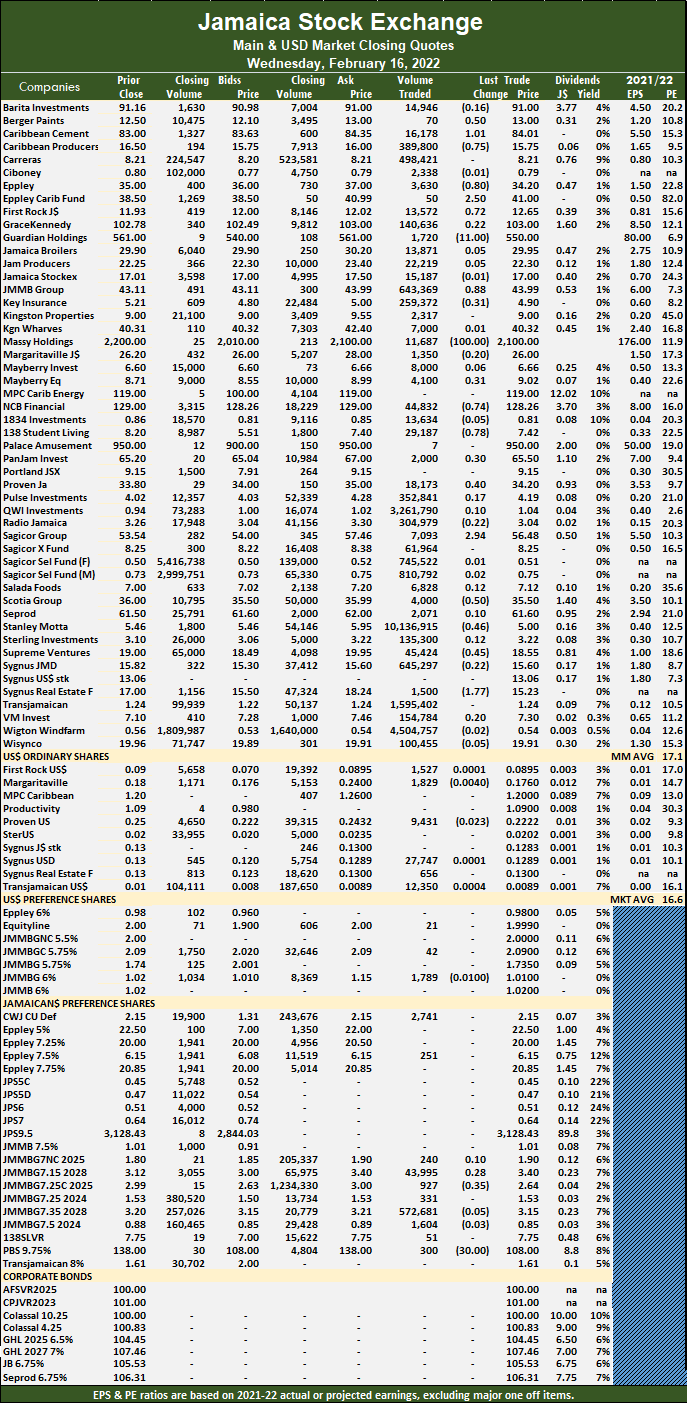

Market activity ended on Wednesday with the volume of shares trading rising marginally above Tuesday’s levels but with a 20 percent lower value leading to an equal number of 24 stocks each, rising and declining on the Jamaica Stock Exchange Main Market as nine ended unchanged following the trading of 57 securities.

The All Jamaican Composite Index shed 1,070.81 points to end at 451,592.36, the JSE Main Index declined 1,604.51 points to 399,750.97 and the JSE Financial Index lost 0.42 points to close at 96.74.

The All Jamaican Composite Index shed 1,070.81 points to end at 451,592.36, the JSE Main Index declined 1,604.51 points to 399,750.97 and the JSE Financial Index lost 0.42 points to close at 96.74.

The PE Ratio, a formula for computing appropriate stock values, averages 16.9. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years, ending up to August 2022.

Overall, 25,678,501 shares were exchanged for $170,560,569 versus 25,075,120 units at $212,434,651 on Tuesday. Stanley Motta led trading with 39.5 percent of total volume for an exchange of 10.14 million shares followed by Wigton Windfarm, 17.5 percent with 4.50 million units, QWI Investments controlled 12.7 percent after an exchange of 3.26 million units and Transjamaican Highway with 6.2 percent after transferring 1.60 million units.

Trading averages 450,500 units at $2,992,291, compared to 439,914 shares at $3,726,924 on Tuesday and month to date, an average of 304,601 units at $2,968,069, compared to 291,484 units at $2,965,891 on the previous day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, Berger Paints gained 50 cents to close at $13 after exchanging 70 stock units, Caribbean Cement rose $1.01 to $84.01 with 16,178 units crossing the market, Caribbean Producers lost 75 cents at $15.75 in exchanging 389,800 stocks. Eppley shed 80 cents in closing at $34.20 with the swapping of 3,630 shares, Eppley Caribbean Property Fund rallied $2.50 to $41 in trading 50 units, First Rock Capital gained 72 cents to close at $12.65 with 13,572 stocks clearing the market. Guardian Holdings dropped $11 to $550 with a transfer of 1,720 stock units, JMMB Group rose 88 cents to end at $43.99 with 643,369 shares changing hands, Key Insurance lost 31 cents to finish at $4.90 in switching ownership of 259,372 stocks. Massy Holdings declined $100 after ending at $2,100 in trading 11,687 units, Mayberry Jamaican Equities gained 31 cents to finish at $9.02 in an exchange of 4,100 shares, NCB Financial shed 74 cents to end at $128.26 in transferring 44,832 stocks. 138 Student Living fell 78 cents to settle at $7.42 in switching ownership of 29,187 shares, PanJam Investment popped 30 cents to close at $65.50 with the swapping of 2,000 stock units, Proven Investments gained 40 cents in closing at $34.20 after 18,173 units cleared the market. Sagicor Group popped $2.94 to $56.48 with 7,093 shares crossing the exchange, Scotia Group lost 50 cents in closing at $35.50 switching ownership of 4,000 stocks, Stanley Motta shed 46 cents after ending at $5 in an exchange of 10,136,915 shares.

At the close, Berger Paints gained 50 cents to close at $13 after exchanging 70 stock units, Caribbean Cement rose $1.01 to $84.01 with 16,178 units crossing the market, Caribbean Producers lost 75 cents at $15.75 in exchanging 389,800 stocks. Eppley shed 80 cents in closing at $34.20 with the swapping of 3,630 shares, Eppley Caribbean Property Fund rallied $2.50 to $41 in trading 50 units, First Rock Capital gained 72 cents to close at $12.65 with 13,572 stocks clearing the market. Guardian Holdings dropped $11 to $550 with a transfer of 1,720 stock units, JMMB Group rose 88 cents to end at $43.99 with 643,369 shares changing hands, Key Insurance lost 31 cents to finish at $4.90 in switching ownership of 259,372 stocks. Massy Holdings declined $100 after ending at $2,100 in trading 11,687 units, Mayberry Jamaican Equities gained 31 cents to finish at $9.02 in an exchange of 4,100 shares, NCB Financial shed 74 cents to end at $128.26 in transferring 44,832 stocks. 138 Student Living fell 78 cents to settle at $7.42 in switching ownership of 29,187 shares, PanJam Investment popped 30 cents to close at $65.50 with the swapping of 2,000 stock units, Proven Investments gained 40 cents in closing at $34.20 after 18,173 units cleared the market. Sagicor Group popped $2.94 to $56.48 with 7,093 shares crossing the exchange, Scotia Group lost 50 cents in closing at $35.50 switching ownership of 4,000 stocks, Stanley Motta shed 46 cents after ending at $5 in an exchange of 10,136,915 shares.  Supreme Ventures lost 45 cents to end at $18.55 after 45,424 stock units changed hands and Sygnus Real Estate Finance declined $1.77 to close at $15.23 with the swapping of 1,500 shares.

Supreme Ventures lost 45 cents to end at $18.55 after 45,424 stock units changed hands and Sygnus Real Estate Finance declined $1.77 to close at $15.23 with the swapping of 1,500 shares.

In the preference segment, JMMB Group 7.25% preference share lost 35 cents to end at $2.64 with 927 stock units changing hands and Productive Business Solutions 9.75% preference share fell $30 in closing at $108 with a transfer of 300 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

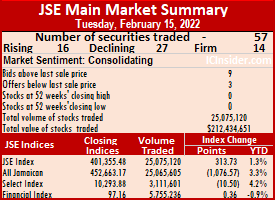

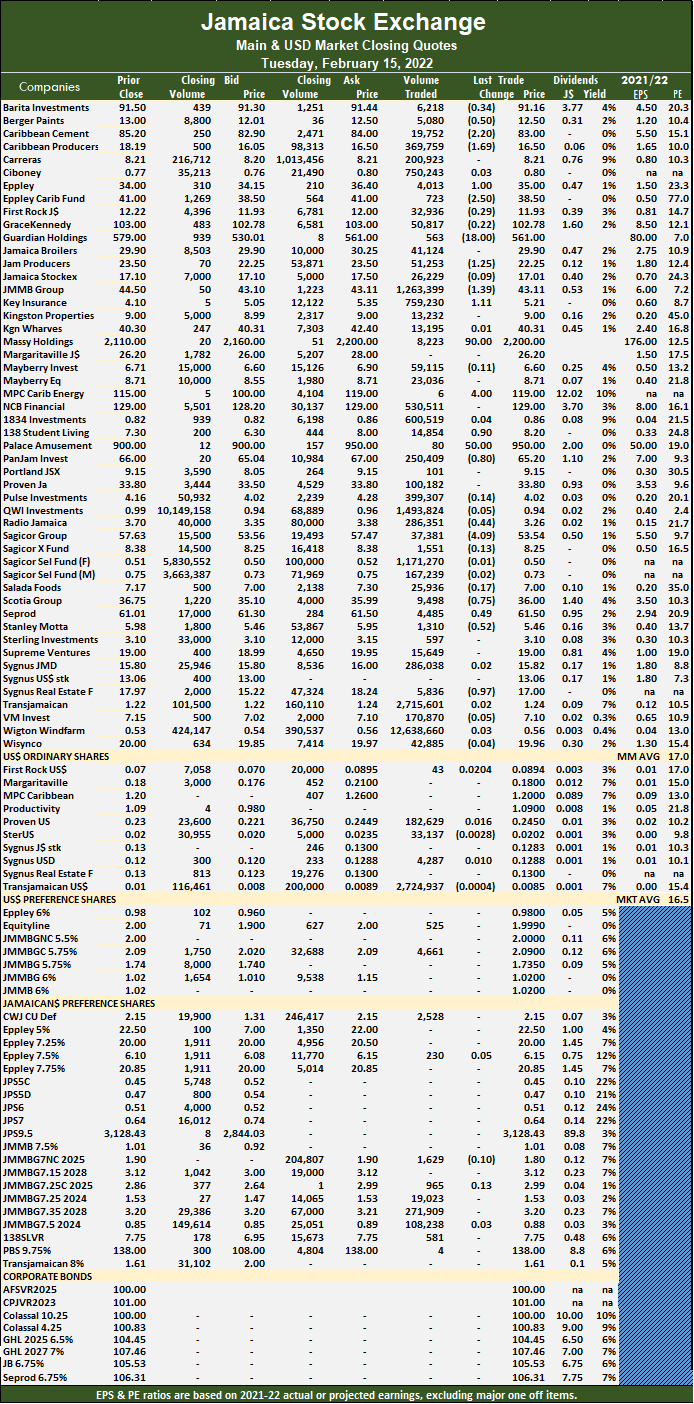

Falling stocks crushed winners on JSE Main Market

Declining stock dominated Main Market activity on Tuesday with 47 percent of stock losing value at the close compared to 28 percent rising as the volume of shares traded rising 61 percent and the value increasing 66 percent higher than on Monday at the close of the Jamaica Stock Exchange Main Market.

The All Jamaican Composite Index dropped 1,076.57 points to end at 452,663.17, the JSE Main Index rose 313.73 points to 401,355.48 and the JSE Financial Index rallied 0.36 points to end at 97.16.

The All Jamaican Composite Index dropped 1,076.57 points to end at 452,663.17, the JSE Main Index rose 313.73 points to 401,355.48 and the JSE Financial Index rallied 0.36 points to end at 97.16.

Overall, 57 securities traded against 58 on Monday, with 16 rising, 27 declining and 14 ending unchanged.

The PE Ratio, a formula used in computing appropriate stock values, averages 17. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 25,075,120 shares were exchanged for $212,434,651 up from 15,556,075 units at $127,688,648 on Monday. Wigton Windfarm led trading with 50.4 percent of total volume for 12.64 million shares followed by Transjamaican Highway with 10.8 percent for 2.72 million units, QWI Investments controlled 6 percent, with 1.49 million units, JMMB Group accounted for 5 percent with 1.26 million units and Sagicor Select Financial Fund with 4.7 percent and 1.17 million units changing hands.

Trading averages 439,914 units at $3,726,924 compared to 268,208 shares $2,201,528 on Monday and month to date, an average of 291,484 units at $2,965,891, compared to 276,821 units at $2,890,711 on the previous day. January closed with an average of 235,328 units at $2,397,571.

Trading averages 439,914 units at $3,726,924 compared to 268,208 shares $2,201,528 on Monday and month to date, an average of 291,484 units at $2,965,891, compared to 276,821 units at $2,890,711 on the previous day. January closed with an average of 235,328 units at $2,397,571.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments lost 34 cents to end at $91.16 with the swapping of 6,218 stocks, Berger Paints shed 50 cents after ending at $12.50 with an exchange of 5,080 units, Caribbean Cement declined $2.20 to $83 after trading 19,752 stock units. Caribbean Producers fell $1.69 to $16.50 in an exchange of 369,759 shares, Eppley rose $1 to $35 after 4,013 stocks changed hands, Eppley Caribbean Property Fund declined $2.50 to $38.50 in trading 723 stock units. Guardian Holdings dropped $18 in closing at $561 after ownership of 563 shares were switched, Jamaica Producers fell $1.25 to $22.25 in exchanging 51,253 stock units, JMMB Group dropped $1.39 to close at $43.11 with the swapping of 1,263,399 shares. Key Insurance advanced $1.11 to $5.21 after trading 759,230 units, Massy Holdings climbed $90 in closing at $2,200 after exchanging 8,223 stocks, MPC Caribbean Clean Energy rallied $4 to end at $119 in transferring 6 stocks.  138 Student Living rose 90 cents to close at $8.20 with 14,854 shares crossing the market, Palace Amusement popped $50 to close at $950 in switching ownership of 80 units, PanJam Investment shed 80 cents to $65.20 with 250,409 stock units clearing the market. Radio Jamaica lost 44 cents to end at $3.26 in trading 286,351 shares, Sagicor Group declined $4.09 to $53.54 with 37,381 units crossing the market, Scotia Group shed 75 cents to close at $36 with 9,498 shares changing hands. Seprod gained 49 cents in closing at $61.50 after switching ownership of 4,485 stocks, Stanley Motta lost 52 cents to settle at $5.46 after exchanging 1,310 stock units and Sygnus Real Estate Finance fell 97 cents to $17 in trading 5,836 shares.

138 Student Living rose 90 cents to close at $8.20 with 14,854 shares crossing the market, Palace Amusement popped $50 to close at $950 in switching ownership of 80 units, PanJam Investment shed 80 cents to $65.20 with 250,409 stock units clearing the market. Radio Jamaica lost 44 cents to end at $3.26 in trading 286,351 shares, Sagicor Group declined $4.09 to $53.54 with 37,381 units crossing the market, Scotia Group shed 75 cents to close at $36 with 9,498 shares changing hands. Seprod gained 49 cents in closing at $61.50 after switching ownership of 4,485 stocks, Stanley Motta lost 52 cents to settle at $5.46 after exchanging 1,310 stock units and Sygnus Real Estate Finance fell 97 cents to $17 in trading 5,836 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 51

- 52

- 53

- 54

- 55

- …

- 113

- Next Page »