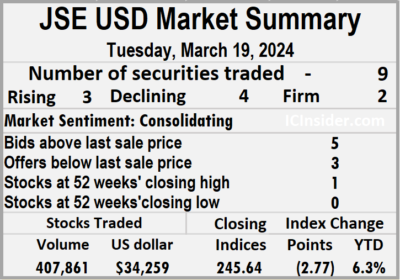

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the volume of stocks exchanged rising 136 percent after a 25 percent fall in the amount of US dollars changing hands than on Monday, resulting in trading in nine securities, compared to 11 on Monday with prices of three rising, four declining and two ending unchanged.

The market closed with an exchange of 407,861 shares for US$34,259 compared to 172,660 units at US$45,981 on Monday.

The market closed with an exchange of 407,861 shares for US$34,259 compared to 172,660 units at US$45,981 on Monday.

Trading averaged 45,318 units at US$3,807 versus 15,696 shares at US$4,180 on Monday, with a month to date average of 65,370 shares at US$4,599 compared with 67,444 units at US$4,681 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index skidded 2.77 points to end the day at 245.64.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden sank 0.14 of a cent to close at 22.01 US cents in an exchange of 150 units, First Rock Real Estate USD share remained at 4.5 US cents with investors trading 2,043 stocks, Margaritaville ended at 10 US cents in switching ownership of 1,266 shares.  Proven Investments climbed 0.9 of one cent in closing at 16 US cents while exchanging 134,548 stock units, Sygnus Credit Investments dipped 1.58 cents and ended at 7.41 US cents with 100,173 shares clearing the market, Sygnus Real Estate Finance USD share rose 2.25 cents to a 52 weeks’ high of 12.74 US cents after a transfer of 504 units and Transjamaican Highway lost 0.11 of a cent and ended at 2.07 US cents, with 167,984 stocks crossing the exchange.

Proven Investments climbed 0.9 of one cent in closing at 16 US cents while exchanging 134,548 stock units, Sygnus Credit Investments dipped 1.58 cents and ended at 7.41 US cents with 100,173 shares clearing the market, Sygnus Real Estate Finance USD share rose 2.25 cents to a 52 weeks’ high of 12.74 US cents after a transfer of 504 units and Transjamaican Highway lost 0.11 of a cent and ended at 2.07 US cents, with 167,984 stocks crossing the exchange.

In the preference segment, JMMB Group US8.5% preference share advanced 0.9 of one cent in closing at US$1.169 with investors swapping 1,183 stock units and Sygnus Credit Investments E8.5% fell 29 cents to close at US$10.51, with 10 shares crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Falling stocks edged out risers on JSE USD Market

Sharp jump in trading funds in JSE USD Market

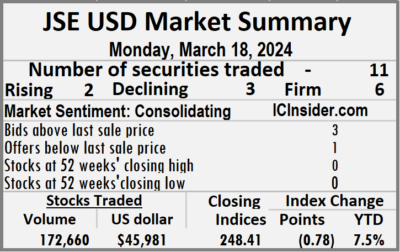

Investors traded more securities on the Jamaica Stock Exchange US dollar market on Monday than on Friday, but the volume of stocks exchanged declined by 34 percent after 136 percent more US dollars passed through the market than on Friday, resulting in trading in 11 securities, up from nine on Friday with prices of two rising, three declining and six ending unchanged.

The market closed with an exchange of 172,660 shares for US$45,981 compared to 262,328 units at US$19,513 on Friday.

The market closed with an exchange of 172,660 shares for US$45,981 compared to 262,328 units at US$19,513 on Friday.

Trading averaged 15,696 units at US$4,180 versus 29,148 shares at US$2,168 on Friday, with a month to date average of 67,444 shares at US$4,681 compared with 74,934 units at US$4,754 on the previous trading day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index lost 0.78 points to close at 248.41.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden rose 0.15 of a cent to 22.15 US cents after a transfer of 1,800 units, First Rock Real Estate USD share remained at 4.5 US cents after trading 2,000 stocks, Margaritaville ended at 10 US cents after an exchange of 100 shares. Productive Business Solutions dipped 3 cents and ended at US$1.70 with 100 stock units clearing the market, Proven Investments remained at 15.1 US cents after an exchange of 54,910 shares,  Sterling Investments ended at 1.7 US cents with investors transferring 32,650 stocks. Sygnus Credit Investments remained at 8.99 US cents after 4,630 units crossed the exchange, Sygnus Real Estate Finance USD share ended at 10.49 US cents with a transfer of 8,553 stock units and Transjamaican Highway fell 0.01 of a cent in closing at 2.18 US cents as investors exchanged 42,737 shares.

Sterling Investments ended at 1.7 US cents with investors transferring 32,650 stocks. Sygnus Credit Investments remained at 8.99 US cents after 4,630 units crossed the exchange, Sygnus Real Estate Finance USD share ended at 10.49 US cents with a transfer of 8,553 stock units and Transjamaican Highway fell 0.01 of a cent in closing at 2.18 US cents as investors exchanged 42,737 shares.

In the preference segment, JMMB Group US8.5% preference share declined 3.9 cents and ended at US$1.16, with 24,699 units crossing the market and Sygnus Credit Investments E 8.5% rallied 40 cents to US$10.80 in an exchange of 481 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD Market rises on lower trades

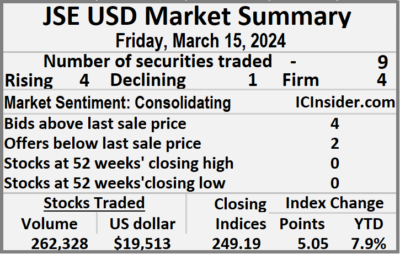

Trading ended on the Jamaica Stock Exchange US dollar market on Friday, with a sharp 66 percent decline in the volume of stocks exchanged following 14 percent more money changed hands than on Thursday, resulting in trading in nine securities, compared to six on Thursday with prices of four rising, one declining and four ending unchanged.

The market closed with an exchange of 262,328 shares for US$19,513 compared to 771,589 units at US$17,159 on Thursday.

The market closed with an exchange of 262,328 shares for US$19,513 compared to 771,589 units at US$17,159 on Thursday.

Trading averaged 29,148 units at US$2,168 versus 128,598 shares at US$2,860 on Thursday, with a month to date average of 74,934 shares at US$4,754 compared with 81,084 units at US$5,101 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index rose 5.05 points to close at 249.19.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, AS Bryden ended at 22 US cents while exchanging 383 units, First Rock Real Estate USD share remained at 4.5 US cents after 182,833 stocks passed through the market, Margaritaville lost 2 cents to close at 10 US cents after an exchange of 14,391 shares. Proven Investments ended at 15.1 US cents with 8,040 stock units clearing the market, Sygnus Credit Investments remained at 8.99 US cents with traders dealing in 5,539 shares, Sygnus Real Estate Finance USD share gained 3.67 cents to end at 10.49 US cents, with 1,191 units crossing the exchange and Transjamaican Highway popped 0.08 of a cent and ended at 2.19 US cents in switching ownership of 44,284 stocks.

Proven Investments ended at 15.1 US cents with 8,040 stock units clearing the market, Sygnus Credit Investments remained at 8.99 US cents with traders dealing in 5,539 shares, Sygnus Real Estate Finance USD share gained 3.67 cents to end at 10.49 US cents, with 1,191 units crossing the exchange and Transjamaican Highway popped 0.08 of a cent and ended at 2.19 US cents in switching ownership of 44,284 stocks.

In the preference segment, JMMB Group US8.5% preference share rallied 3.89 cents in closing at US$1.199 after an exchange of 5,650 stock units and Productive Business Solutions 9.25% preference share rose US$2 to end at US$12 with investors transferring 17 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD Market get one new listing

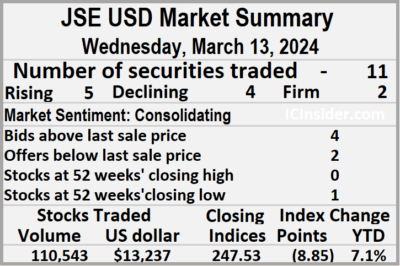

One new security was listed on the Jamaica Stock Exchange US dollar market on Wednesday, with AS Bryden ordinary share started trading for the first time with the price falling 0.34 of a cent to 22 cents on a day when the volume of stocks that were exchanged declined 96 percent after 89 percent fewer US dollars changed hands than on Tuesday, resulting in trading in 11 securities, compared to eight on Tuesday with prices of five rising, four declining and two ending unchanged.

The market closed with an exchange of 110,543 shares for US$13,237 compared to 2,937,043 units at US$118,791 on Tuesday.

The market closed with an exchange of 110,543 shares for US$13,237 compared to 2,937,043 units at US$118,791 on Tuesday.

Trading averaged 10,049 units at US$1,203 versus 367,130 shares at US$14,849 on Tuesday, with a month to date average of 76,411 shares at US$5,322 compared with 91,011 units at US$6,228 on the previous day and February with an average of 46,765 units for US$6,084.

The US Denominated Equities Index dipped 8.85 points to end the day at 247.53.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, AS Bryden lost 0.34 of a cent and ended at 22 US cents after exchanging a mere 100 units, First Rock Real Estate USD share sank 0.2 of a cent to 4.2 US cents and closed with an exchange of 26,937 stocks, Margaritaville rose 2 cents to 12 US cents with a transfer of 100 shares. Productive Business Solutions skidded 7 cents in closing at US$1.73 while exchanging 18 stock units, Proven Investments advanced 1.2 cents to end at 15.7 US cents after a transfer of 2,347 shares,  Sterling Investments popped 0.01 of a cent in closing at 1.51 US cents in switching ownership of 1,500 stocks. Sygnus Credit Investments ended at 8.99 US cents after an exchange of 23,534 units, Sygnus Real Estate Finance USD share lost 0.68 of one cent and ended at 6.82 US cents with investors transferring 2,547 stock units and Transjamaican Highway rallied 0.17 of a cent to close at 2.2 US cents in an exchange of 48,963 shares.

Sterling Investments popped 0.01 of a cent in closing at 1.51 US cents in switching ownership of 1,500 stocks. Sygnus Credit Investments ended at 8.99 US cents after an exchange of 23,534 units, Sygnus Real Estate Finance USD share lost 0.68 of one cent and ended at 6.82 US cents with investors transferring 2,547 stock units and Transjamaican Highway rallied 0.17 of a cent to close at 2.2 US cents in an exchange of 48,963 shares.

In the preference segment, JMMB Group US8.5% preference share remained at US$1.1601 with investors trading 1,341 stock units and JMMB Group 5.75% increased by 23.5 cents in closing at US$2.145 after 3,156 units passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big surge in JSE USD trading

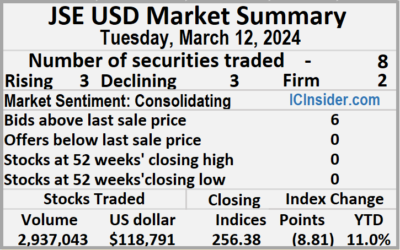

Trading surged on the Jamaica Stock Exchange US dollar market ended on Tuesday, with a 4,733 percent leap in the volume of stocks exchanged after a 256 percent jump in the amount of money changing hands compared to Monday, resulting in trading in eight securities, compared to seven on Monday with prices of three rising, three declining and two ending unchanged.

The market closed with an exchange of 2,937,043 shares for US$118,791 compared to 60,767 units at US$33,398 on Monday.

The market closed with an exchange of 2,937,043 shares for US$118,791 compared to 60,767 units at US$33,398 on Monday.

Trading averaged 367,130 units at US$14,849 versus 8,681 shares at US$4,771 on Monday, with a month to date average of 91,011 shares at US$6,228 compared with 38,416 units at US$4,586 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index dropped 8.81 points to settle at 256.38.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Margaritaville slipped 1 cent to 10 US cents in an exchange of 534 stocks, MPC Caribbean Clean Energy dipped 1 cent to 54 US cents, with 176 units crossing the market, Proven Investments popped 0.1 of a cent to end at 14.5 US cents as investors exchanged 384,951 shares.  Sygnus Credit Investments remained at 8.99 US cents after a transfer of 2,814 stocks and Transjamaican Highway fell 0.24 of a cent to close at 2.03 US cents in clearing the market of 2,543,144 shares.

Sygnus Credit Investments remained at 8.99 US cents after a transfer of 2,814 stocks and Transjamaican Highway fell 0.24 of a cent to close at 2.03 US cents in clearing the market of 2,543,144 shares.

In the preference segment, JMMB Group US8.5% preference share rose 1.01 cents to US$1.1601 in an exchange of 1,329 stocks. JMMB Group 5.75% ended at US$1.91 with investors transferring 4,093 units and Sygnus Credit Investments US8% climbed 10 cents to close at US$10.60 after an exchange of two stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading plunged on JSE US Market

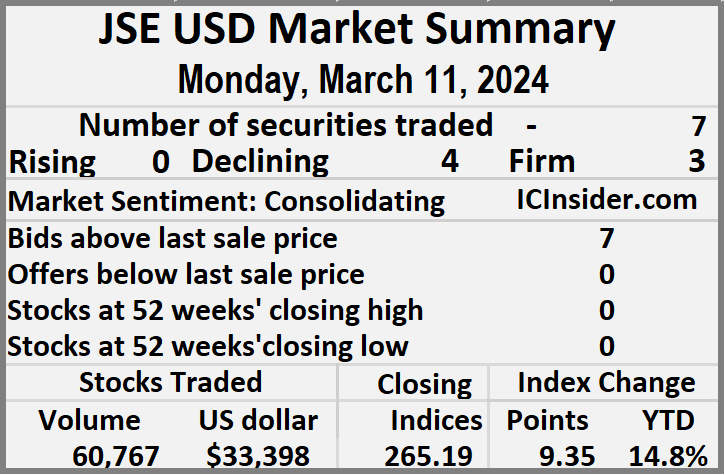

Investors traded more securities on the Jamaica Stock Exchange US dollar market on Monday, but the volume of stocks exchanged declined 92 percent with a 48 percent lower value than on Friday, resulting in trading in seven securities, compared to four on Friday with prices of no rising, four declining and three ending unchanged.

The market closed with an exchange of 60,767 shares for US$33,398 compared to 765,260 units at US$64,253 on Friday.

The market closed with an exchange of 60,767 shares for US$33,398 compared to 765,260 units at US$64,253 on Friday.

Trading averaged 8,681 units at US$4,771 versus 191,315 shares at US$16,063 on Friday, with a month to date average of 38,416 shares at US$4,586 compared with 44,363 units at US$4,549 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index advanced 9.35 points to end trading at 265.19.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Margaritaville shed 1 cent to end at 11 US cents after an exchange of 2,806 stock units, Proven Investments ended at 14.4 US cents in switching ownership of 300 stocks and Transjamaican Highway fell 0.03 of a cent in closing at 2.27 US cents, with 41,298 shares crossing the exchange.

In the preference segment, JMMB Group US8.5% preference share dipped 1 cent to close at US$1.15 with a transfer of 1,800 stock units, JMMB Group 5.75% remained at US$1.91 after 14,303 shares passed through the market, Sygnus Credit Investments US8% ended at US$10.50 after 160 stock units changed hands and Sygnus Credit Investments E8.5% sank 10 cents to close at US$10.40 in trading 100 units.

In the preference segment, JMMB Group US8.5% preference share dipped 1 cent to close at US$1.15 with a transfer of 1,800 stock units, JMMB Group 5.75% remained at US$1.91 after 14,303 shares passed through the market, Sygnus Credit Investments US8% ended at US$10.50 after 160 stock units changed hands and Sygnus Credit Investments E8.5% sank 10 cents to close at US$10.40 in trading 100 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading surge on JSE USD Market

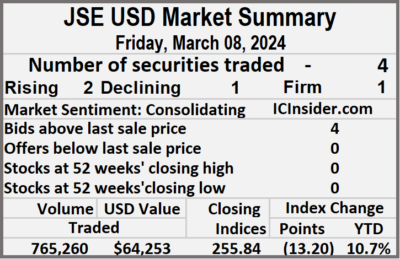

Trading picked up sharply on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks exchanged rising 933 percent after 190 percent bounce in the amount of US dollars that changed hands compared with trading on Thursday, similar to trading on Thursday the market closed on Friday with trading in four securities, with prices of two rising, one declining and one ending unchanged.

The market closed with an exchange of 765,260 shares for US$64,253 up sharply from 74,096 units at US$22,194 on Thursday.

The market closed with an exchange of 765,260 shares for US$64,253 up sharply from 74,096 units at US$22,194 on Thursday.

Trading averaged 191,315 units at US$16,063 versus 18,524 shares at US$5,548 on Thursday, with a month to date average of 44,363 shares at US$4,549 compared with 25,402 units at US$3,063 on the previous day and February with an average of 46,765 units for US$6,084.

The US Denominated Equities Index dropped 13.20 points to conclude trading at 255.84.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8, The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and none with a lower offer.

At the close, Margaritaville ended at 12 US cents while exchanging 160 stocks, Proven Investments dipped 0.1 of a cent in closing at 14.4 US cents after trading 23,545 units and Transjamaican Highway advanced 0.05 of a cent to 2.3 US cents after an exchange of 717,424 shares.

At the close, Margaritaville ended at 12 US cents while exchanging 160 stocks, Proven Investments dipped 0.1 of a cent in closing at 14.4 US cents after trading 23,545 units and Transjamaican Highway advanced 0.05 of a cent to 2.3 US cents after an exchange of 717,424 shares.

In the preference segment, JMMB Group 5.75% popped 1 cent and ended at US$1.91 with investors transferring 24,131 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading rises on the JSE USD market

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks exchanged rising 40 percent after 48 percent fewer US dollars changed hands compared with Thursday, resulting in trading in eight securities, compared to seven on Thursday with prices of two rising, four declining and two ending unchanged.

The market closed with an exchange of 30,628 shares for US$3,928 compared with 21,861 units at US$7,612 on Thursday.

The market closed with an exchange of 30,628 shares for US$3,928 compared with 21,861 units at US$7,612 on Thursday.

Trading averaged 3,829 units at US$491 compared with 3,123 shares at US$1,087 on Thursday, compared with February with an average of 46,765 units for US$6,084.

The US Denominated Equities Index dropped 5.26 points to end the day at 258.25.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Margaritaville climbed 0.25 of one cent and ended at 12 US cents after a transfer of 300 units, Productive Business Solutions ended at US$1.80 after 104 stocks passed through the market, Proven Investments declined 0.49 of one cent to end at 13.95 US cents in switching ownership of 500 shares.  Sterling Investments fell 0.29 of a cent in closing at 1.7 US cents, with 329 stock units crossing the market, Sygnus Credit Investments dropped 0.17 of a cent to close at 8.8 US cents with investors transferring 1,000 shares and Transjamaican Highway rose 0.01 of a cent to 2.11 US cents after trading of 26,564 stocks.

Sterling Investments fell 0.29 of a cent in closing at 1.7 US cents, with 329 stock units crossing the market, Sygnus Credit Investments dropped 0.17 of a cent to close at 8.8 US cents with investors transferring 1,000 shares and Transjamaican Highway rose 0.01 of a cent to 2.11 US cents after trading of 26,564 stocks.

In the preference segment, JMMB Group US8.5% preference share remained at US$1.1489 with an exchange of 1,732 units and Productive Business Solutions 9.25% preference share lost US$1.50 and ended at US$10, with 99 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

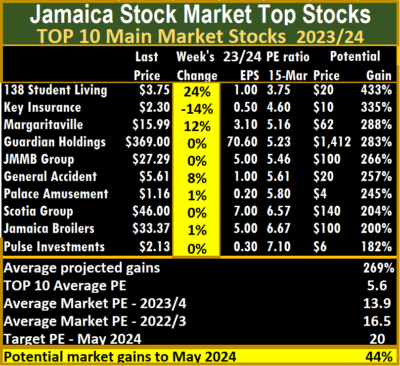

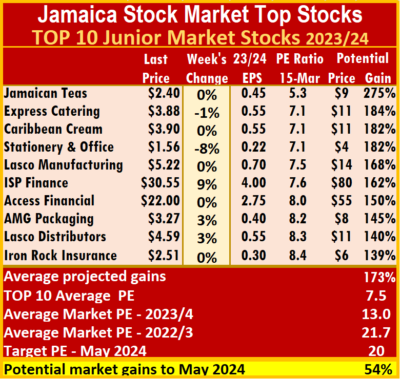

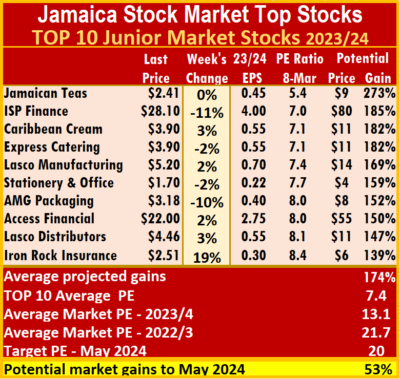

The ICTOP10 ended the past weeks, with a 9 percent jump in the price of ISP Finance to $30.55 and an 8 percent fall in Stationery & Office Supplies to $1.56.

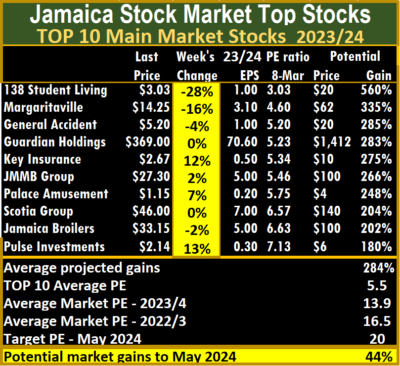

The ICTOP10 ended the past weeks, with a 9 percent jump in the price of ISP Finance to $30.55 and an 8 percent fall in Stationery & Office Supplies to $1.56. The average PE for the JSE Main Market ICTOP 10 stands at 5.6, well below the market average of 13.9 and the Junior Market TOP10 sits at 7.4 over half of the market, with an average of 13.

The average PE for the JSE Main Market ICTOP 10 stands at 5.6, well below the market average of 13.9 and the Junior Market TOP10 sits at 7.4 over half of the market, with an average of 13. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

with an average of 28 and 20 excluding the highest PE ratios, and a PE of 25 for the top half and 18 excluding the stocks with overweight values.

with an average of 28 and 20 excluding the highest PE ratios, and a PE of 25 for the top half and 18 excluding the stocks with overweight values. remove emotions in selecting stocks for investments that often result in costly mistakes.

remove emotions in selecting stocks for investments that often result in costly mistakes.