Newly listed MailPac Group more than doubled in price, trading as high as $2.60 but closed the week at $2.22 and dropped out of the TOP Junior Market listing.

Newly listed MailPac Group more than doubled in price, trading as high as $2.60 but closed the week at $2.22 and dropped out of the TOP Junior Market listing.

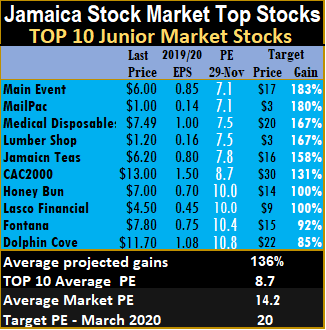

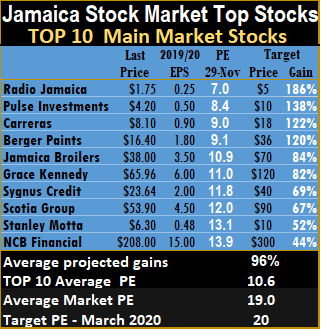

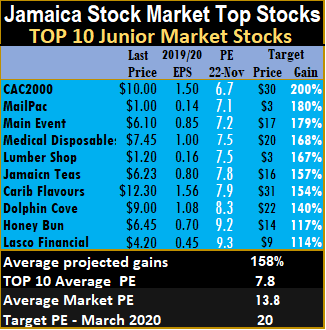

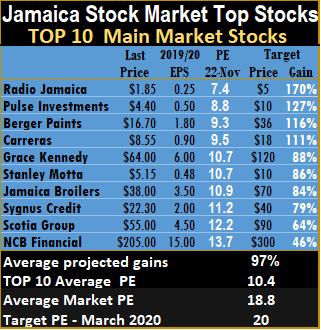

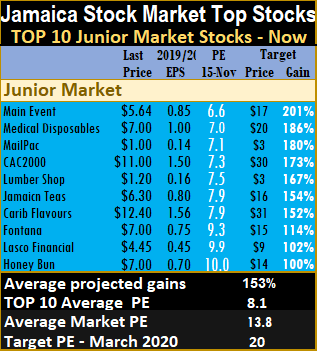

IC Insider.com has upgraded the average targeted PE to March 2020 based on the valuation of more than 22 times earnings, that the market has placed on several stocks currently.

Honey Bun also jumped ship after posting strong growth with full-year results showing profit rising 67 percent to hit $157 million from a 17 percent rise in revenues to $1.54 billion. The stock closed at $8, up from $7 last week, but traded at a record high of $9.20 on Friday. Honey Bun entered the TOP 10 in the first week in October at $6.15 and left with a gain of 30 percent, but it still has more gains ahead of it. tTech price fell to $5.35 and re-entered the TOP 10 along with Caribbean Flavours, with its price dropping from $17.90 last week to close at $15.64 to return to the TOP 10. PanJam Investment moved into the JSE Main Market Top 10 at the expense of Stanley Motta.

The past week was generally good for stocks as the JSE Main Market rose 4,691 points and the Junior Market climbed 89 points. The Junior Market movement was partially helped by the steep rise in the price of MailPac, from the IPO price of $1. Importantly, the Junior Market has made a sharp break out of a downward sloping channel that started after the market peaked in Mid-August. It now seems to be heading higher, with a healthy break out of the channel.

the Junior Market has made a sharp break out of a downward sloping channel that started after the market peaked in Mid-August. It now seems to be heading higher, with a healthy break out of the channel.

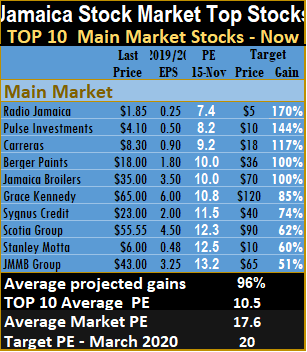

IC Insider.com has upgraded the target PE ratios to 25 with several stocks trading at that around 22 currently. The average projected gains for the IC TOP 10 stocks are 187 percent for Junior Market stocks and 145 percent for JSE Main market Top 10 shares.

Medical Disposables lead the top three Junior Market stocks with projected gains of 257 percent, followed by Main Event with potential profits of 246 percent and Lumber Depot with 233 percent.

Radio Jamaica is the lead stock with projected gains of 247 percent, followed by Pulse Investments in the number two spot with a projected growth of 164 percent and Carreras with a likely increase of 111percent is next.

The JSE Main Market closed the week, with an overall PE of 21.5 and the Junior Market at 14.6, an improvement over the previous week’s 14.2, based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 8.9 from 8.7 last week with the Main Market PE at 10.5.

The TOP 10 stocks now trade at a discount of 39 percent to the average for Junior Market stocks and JSE Main Market stocks trade at a discount of 51 percent to the overall market.

IC TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Possible values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

With the closing of the two initial public offers of MailPac Group and Lumber Depot last week, things started to return to more normally in the market this past week with the two main markets recording net gains for the week.

With the closing of the two initial public offers of MailPac Group and Lumber Depot last week, things started to return to more normally in the market this past week with the two main markets recording net gains for the week.

Importantly, the company is on the way to earn 70 cents per share for 2020.

Importantly, the company is on the way to earn 70 cents per share for 2020.

Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list. Mail Pac Group and shareholders are selling 500 million shares at $1 each to raise $500 million with the offer opening on November 22. Applications from the general public must be for a minimum of 10,000 shares.

Mail Pac Group and shareholders are selling 500 million shares at $1 each to raise $500 million with the offer opening on November 22. Applications from the general public must be for a minimum of 10,000 shares.