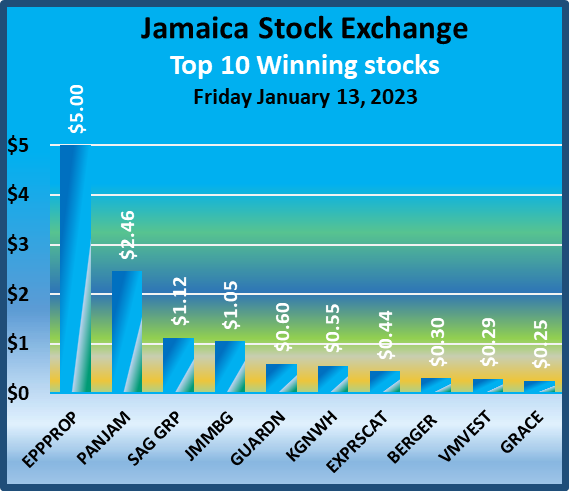

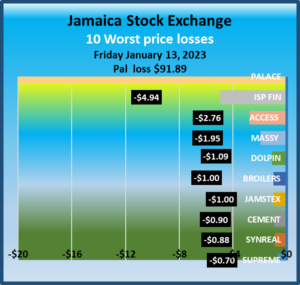

Stocks traded mixed on Friday after the funds entering the market jumped sharply over Thursday’s level with trading resulting in a rise of the JSE Main Market but lower than the previous week’s close, while the Junior Market and the JSE USD Market fell, with the Junior market ending higher than the previous week while the JSE USD market closed lower than the prior week.

Trading ended, with an exchange of 11,034,785 shares versus 12,548,350 units on Thursday, with the value falling to $166.7 million from $55.7 million on the previous trading day. The JSE USD market ended with the value of stocks traded falling to US$6,623 from US$99,750 on Thursday.

Trading ended, with an exchange of 11,034,785 shares versus 12,548,350 units on Thursday, with the value falling to $166.7 million from $55.7 million on the previous trading day. The JSE USD market ended with the value of stocks traded falling to US$6,623 from US$99,750 on Thursday.

At the close, the Combined Market Index popped 1,746.27 points to 358,542.64, the All Jamaican Composite Index jumped 3,343.14 points to 392,986.76, the JSE Main Index rose 2,244.00 points to 345,497.10, the Junior Market dropped 37.78 points to end at 3,948.47 and the JSE US dollar market lost 1.47 points to close at 227.32.

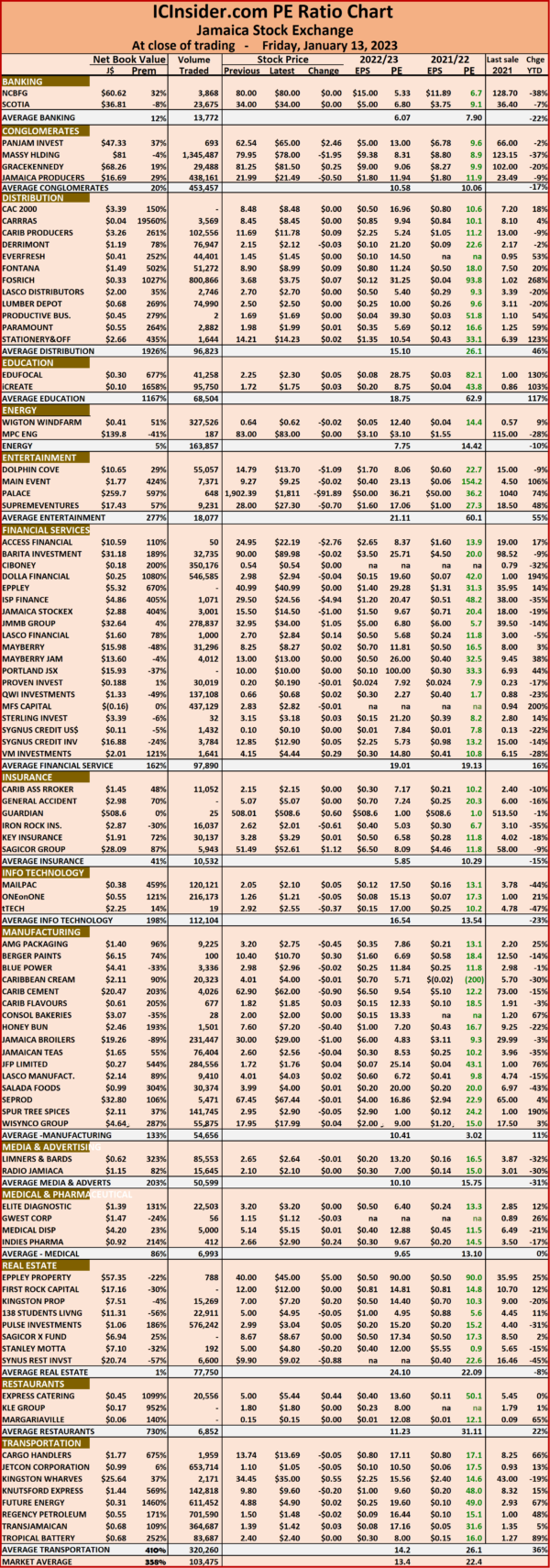

The market’s PE ratio ended at 22.4 based on 2021-22 earnings and 13.4 times those for 2022-23 at the close of trading.

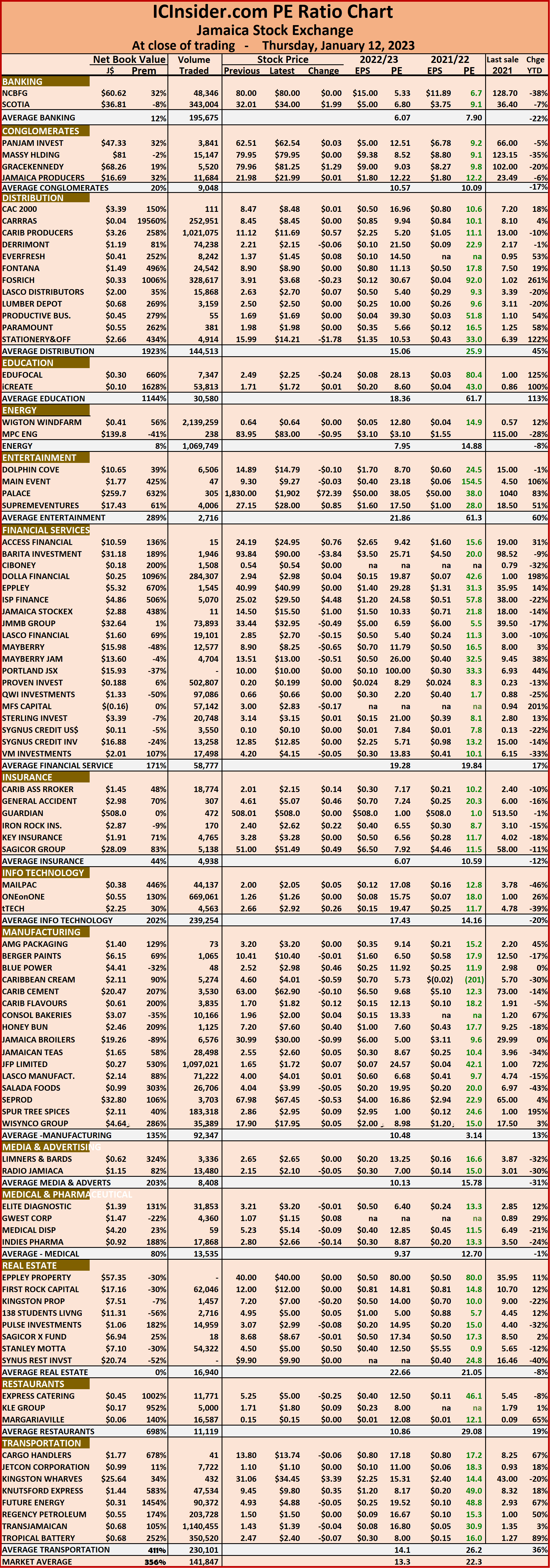

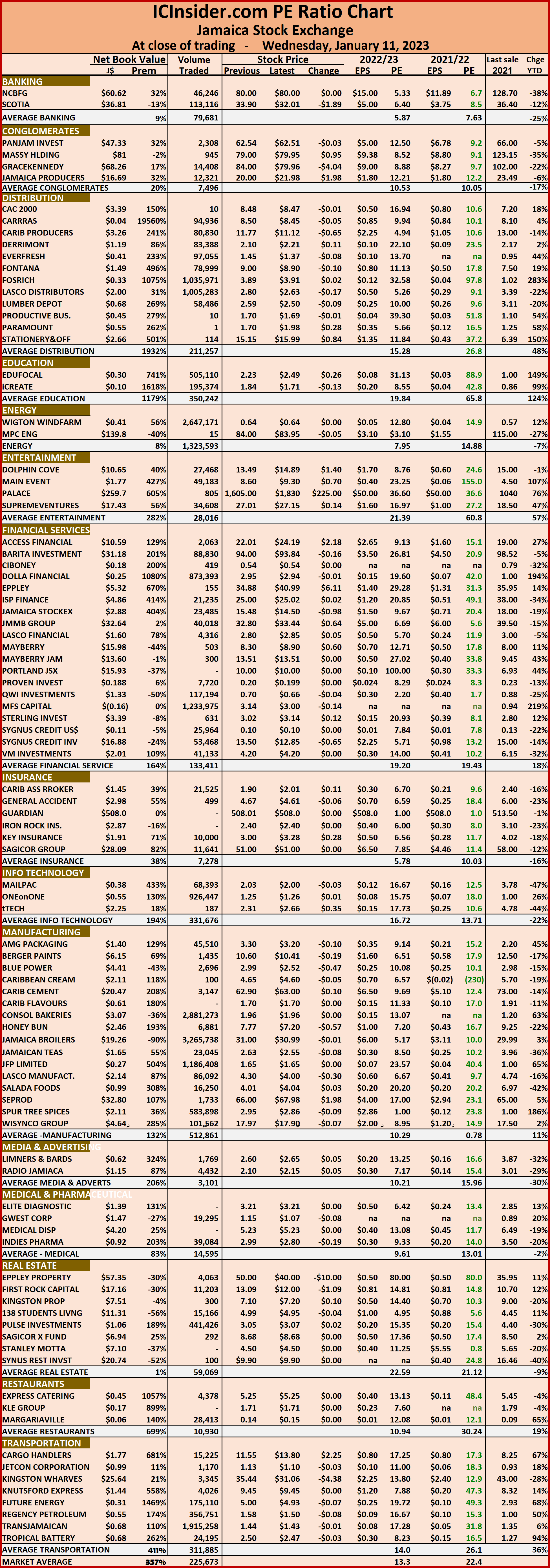

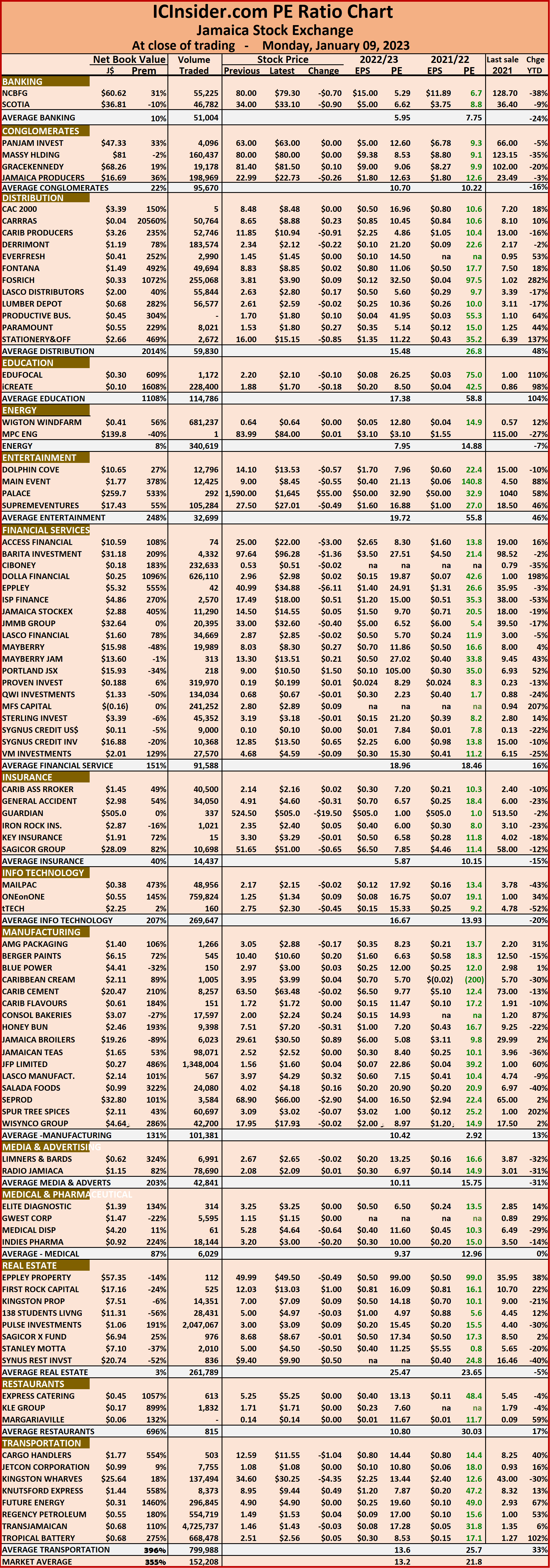

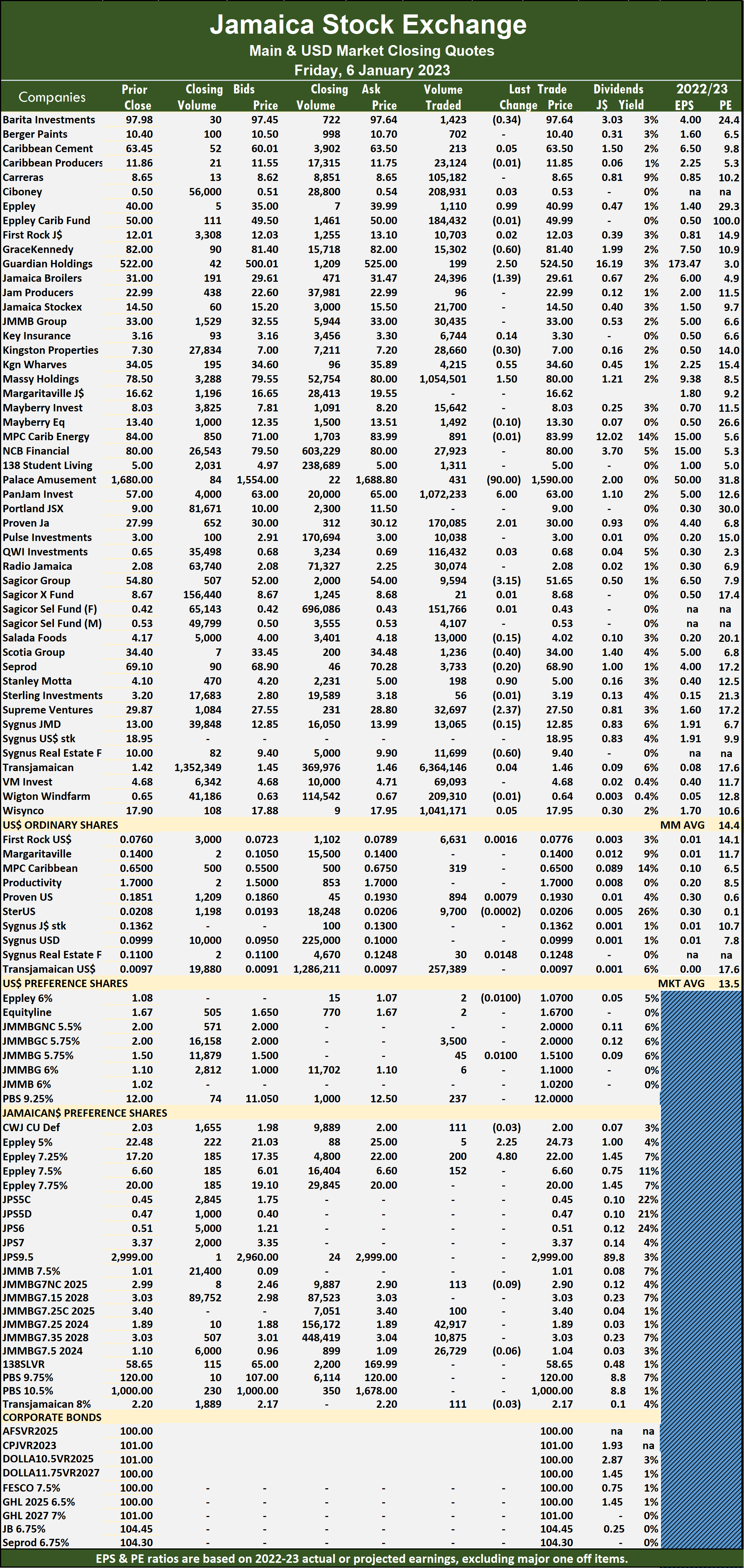

Investors need pertinent information to successfully navigate many investment options in the local stock market.  The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.  Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

JSE majors rise Juniors fall on Friday

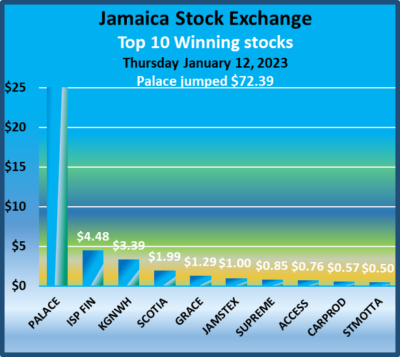

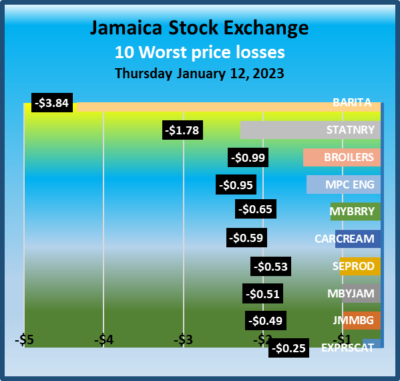

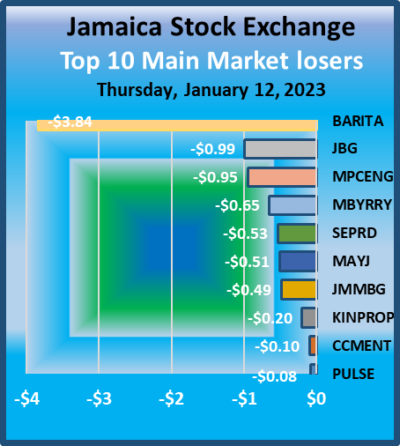

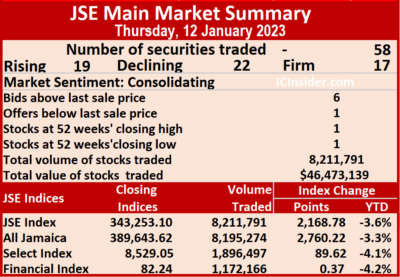

Jamaica Stock Exchange mostly gained Thursday

Stocks traded sharply higher at the commencement of trading on Thursday with the JSE Main Index rising 4,219.58 points to 345,303.90, the Junior Market jumping 88.70 points to 4,001.98 within 15 minutes of opening and the market kept most of the early gains to deliver a positive end to trading on Thursday and the JSE USD Market fell moderately to close out the day.

Trading ended, with an exchange of 12,548,35 shares versus 21,678,787 units on Wednesday, with the value falling to $55.7 million from $155.5 million on the previous trading day. The JSE USD market ended with the value of stocks traded falling to US$99,750 from US$9,740 on Wednesday.

Trading ended, with an exchange of 12,548,35 shares versus 21,678,787 units on Wednesday, with the value falling to $55.7 million from $155.5 million on the previous trading day. The JSE USD market ended with the value of stocks traded falling to US$99,750 from US$9,740 on Wednesday.

At the close, the Combined Market Index popped 2,693.16 points to 356,796.37, the All Jamaican Composite Index jumped 2,760.22 points to 389,643.62, the JSE Main Index rose 2,168.78 points to end at 343,253.10, the Junior Market surged 72.97 points to end at 3,986.25 and the JSE USdollar market rose 1.25 points to close at 228.79.

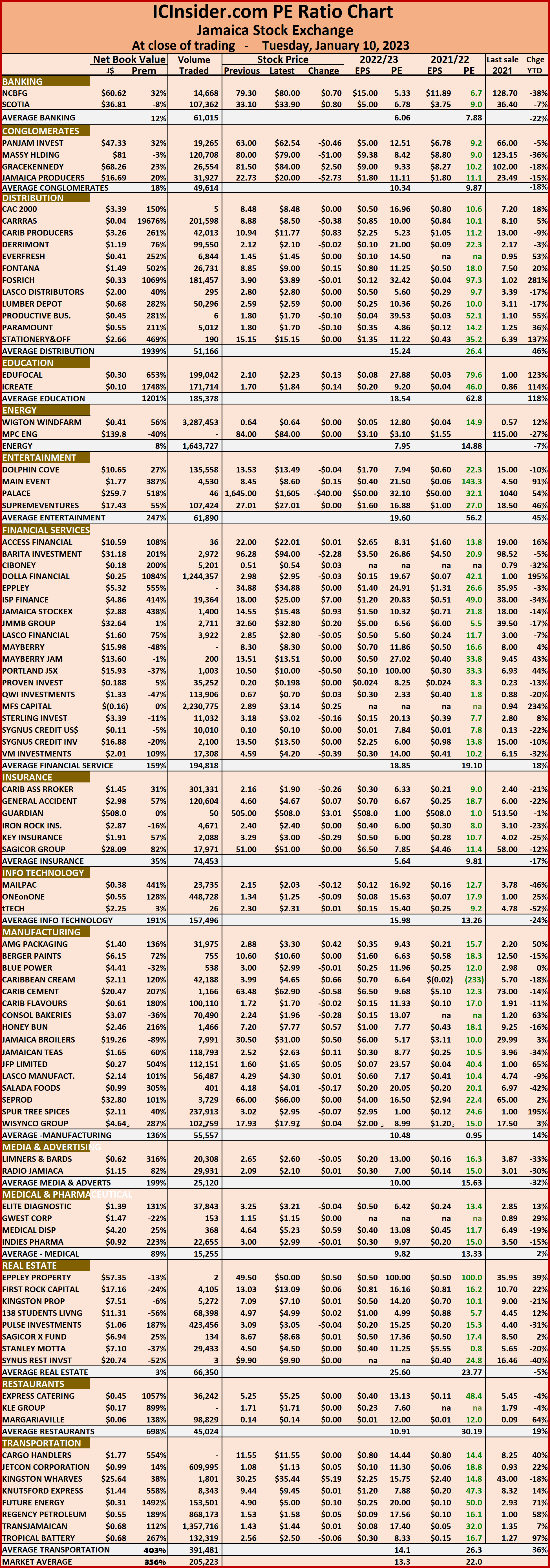

The market’s PE ratio ended at 22.3 based on 2021-22 earnings and 13.3 times those for 2022-23 at the close of trading.

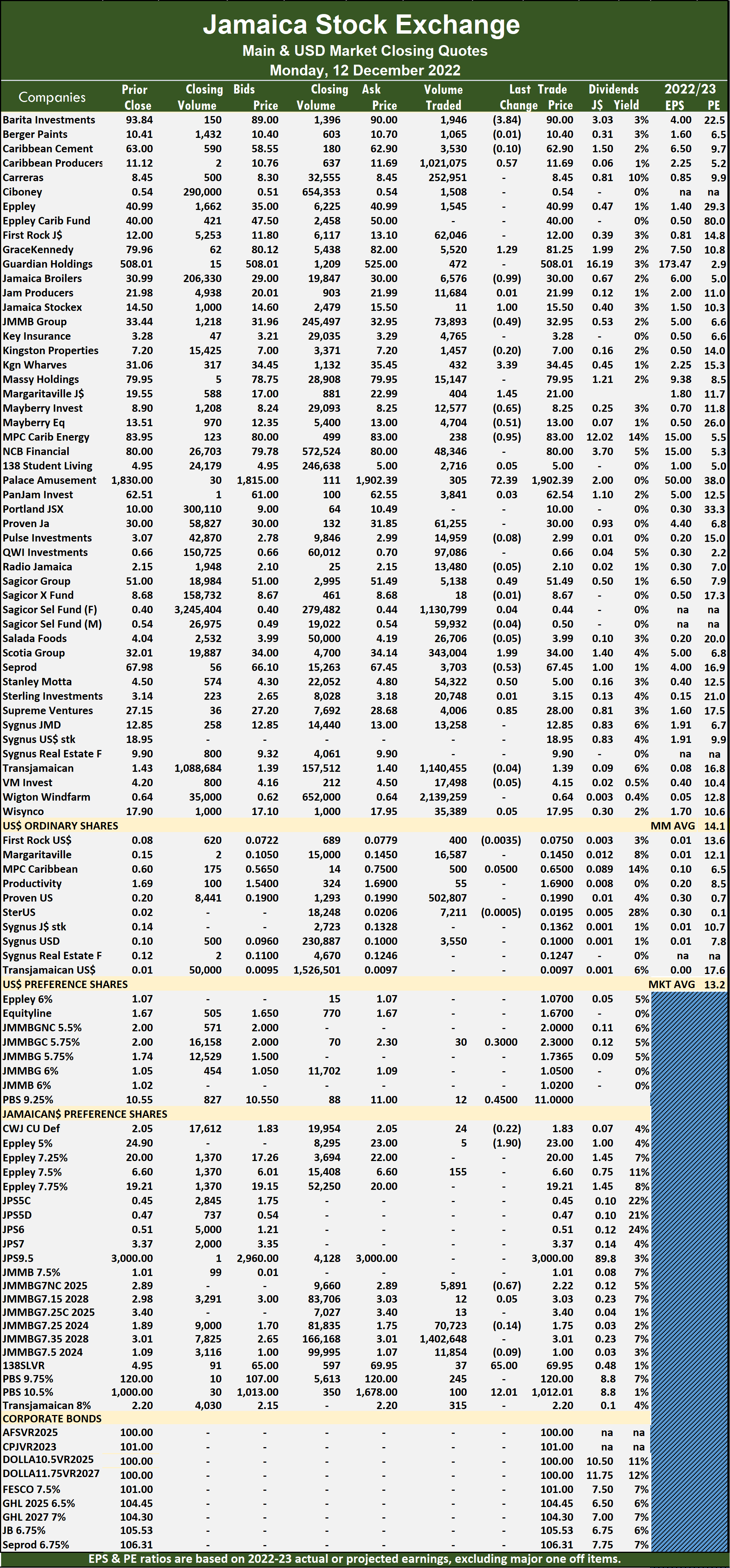

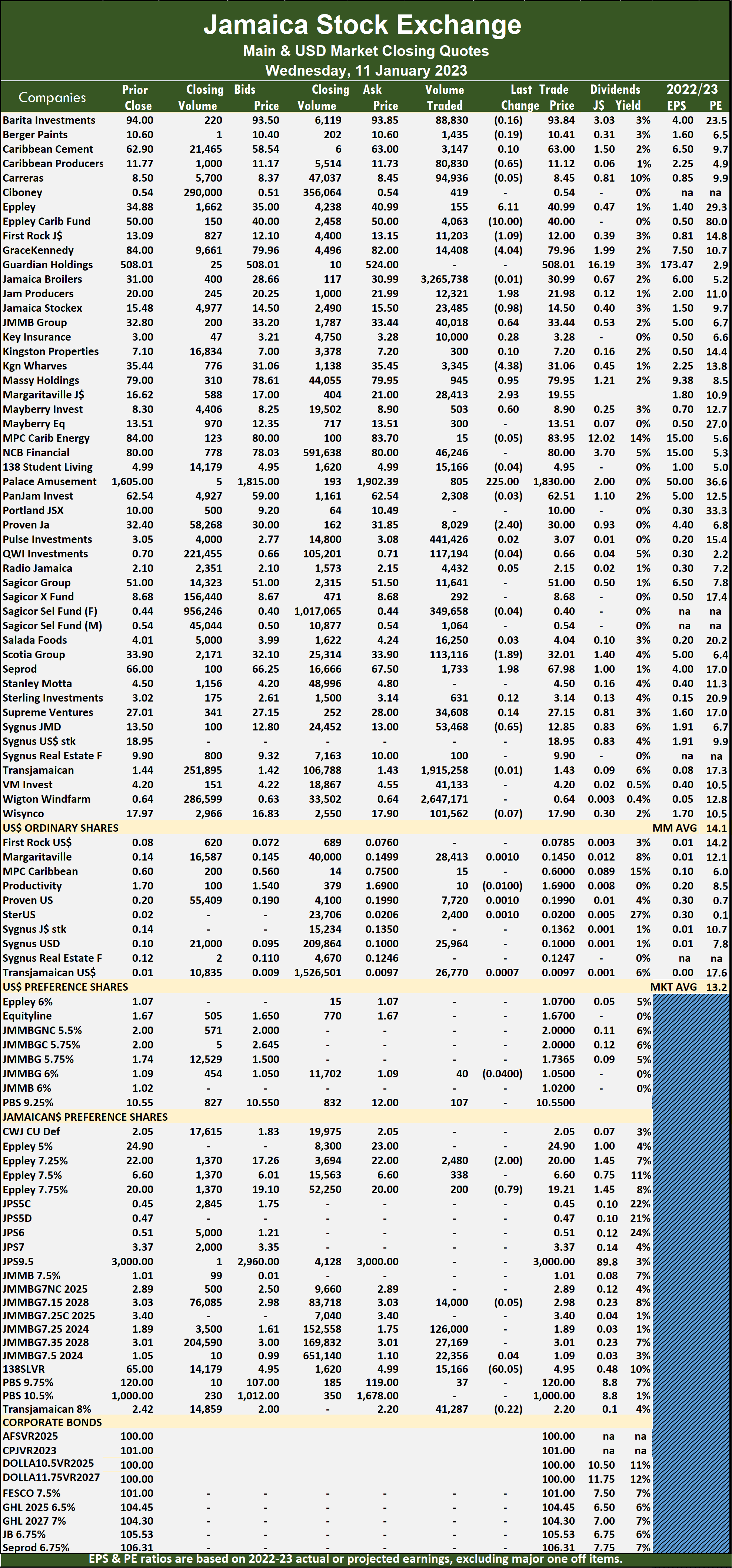

Investors need pertinent information to successfully navigate many investment options in the local stock market.  The ICInsider.comPE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The ICInsider.comPE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.  Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

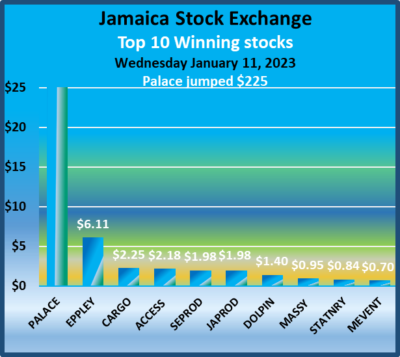

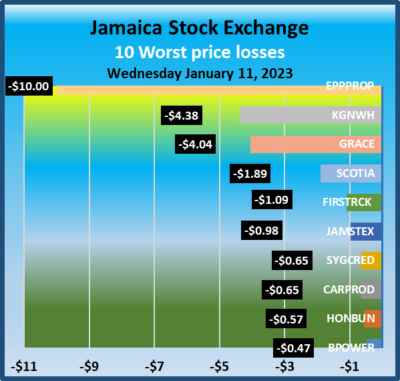

Trading rises on Jamaica Stock Exchange as prices fall

The value of stocks trading picked up on the Jamaica Stock Exchange on Wednesday well over the sub-par levels on Monday and Tuesday. However, the Main Market and the Junior Market indices declined and the JSE USD Market enjoyed a bounce.

Trading ended with an exchange of 21,678,787 shares compared with 16,753,008 units on Tuesday, with the value falling to $155.5 million from $57.5 million on the previous trading day. The JSE USD market ended with the value of stocks traded falling to US$9,740 from US$22,972 on Tuesday.

Trading ended with an exchange of 21,678,787 shares compared with 16,753,008 units on Tuesday, with the value falling to $155.5 million from $57.5 million on the previous trading day. The JSE USD market ended with the value of stocks traded falling to US$9,740 from US$22,972 on Tuesday.

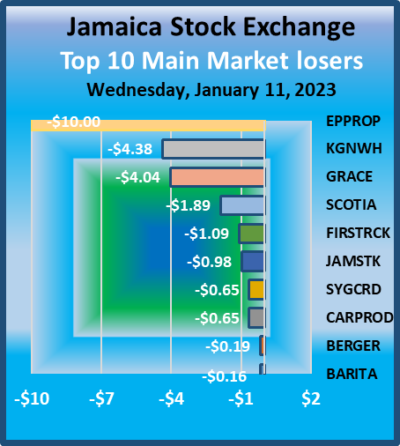

At the close, the Combined Market Index dived 3078.85 points to 354,103.21, the All Jamaican Composite Index dropped 3,634.92 points to 386,883.40, the JSE Main Index fell 2,841.02 points to 341,084.32, the Junior Market dived 46.69 points to end at 3,913.28 and the JSE US dollar market rose 4.02 points to close at 230.04.

The market’s PE ratio ended at 22.4 based on 2021-22 earnings and 13.3 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market.  The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

JSE Main Market trading falls

The value of stocks trading continues to be low on the Jamaica Stock Exchange, with value traded on Tuesday falling below Monday’s level, leading to a jump in the Junior Market index and modest increases for that of the Main Market and slippage for the JSE USD Market.

Trading ended with an exchange of 16,753,008 shares versus 16,619,413 units on Monday, with the value falling to $57.5 million from $68 million on the previous trading day. The JSE USD market ended with the value of stocks traded amounting to US$22,972 down from US$74,761 on Monday.

Trading ended with an exchange of 16,753,008 shares versus 16,619,413 units on Monday, with the value falling to $57.5 million from $68 million on the previous trading day. The JSE USD market ended with the value of stocks traded amounting to US$22,972 down from US$74,761 on Monday.

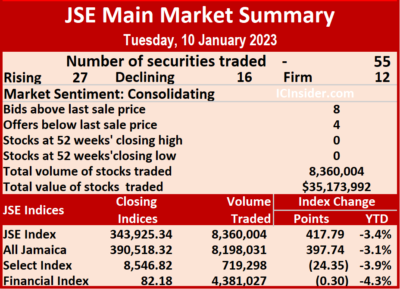

At the close, the Combined Market Index popped 905.12 points to 357,182.06, the All Jamaican Composite Index rose 397.74 points to close at 390,518.32, the JSE Main Index gained 417.79 points to 343,923.34, the Junior Market jumped 56.12 points as it gave back some of the early trading gains to end at 3,959.97 and the JSE US dollar market fell 5.76 to 226.02.

The market’s PE ratio ended at 22 based on 2021-22 earnings and 13.3 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market.  The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.  Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

JSE Main Market drops Juniors pop

Trading on the Jamaica Stock Exchange dropped on Monday, with the market indices dropping for the Main Market and just slipping for the JSE USD Market while the Junior Market just held up by a few points after the value of shares traded in the overall plunged sharply below $70 million.

Trading ended, with an exchange of 16,619,413 shares versus 17,408,795 units on Friday, with the value falling sharply to $68 million from $217.47 million on the previous trading day. The JSE USD market ended with the value of stocks traded amounting to US$74,761 up from US$11,314 on Friday.

Trading ended, with an exchange of 16,619,413 shares versus 17,408,795 units on Friday, with the value falling sharply to $68 million from $217.47 million on the previous trading day. The JSE USD market ended with the value of stocks traded amounting to US$74,761 up from US$11,314 on Friday.

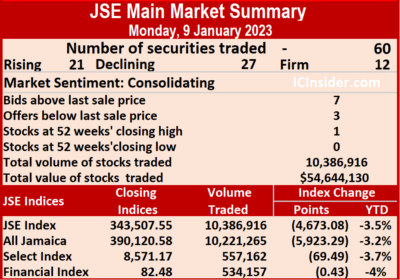

At the close, the Combined Market Index dropped 4,330.84 points to 356,276.94, the All Jamaican Composite Index fell 5,923.29 points to 390,120.58, the JSE Main Index shed 4,673.08 points to 343,507.55, the Junior Market held on to 3.07 points of the early trading gains to end at 3,903.85 and the JSE US dollar market closed at 231.78 after slipping 2.03 points.

The market’s PE ratio ended at 21.2 based on 2021-22 earnings and 13.2 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.  Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

A total of 8,211,791 shares were exchanged for $46,473,139, down from 9,841,967 units at $126,164,786 on Wednesday.

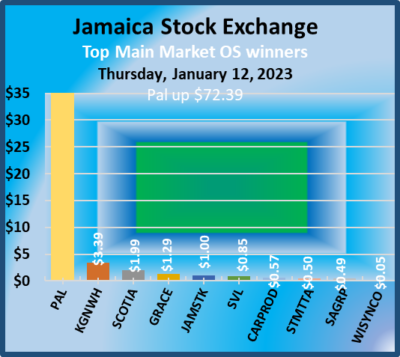

A total of 8,211,791 shares were exchanged for $46,473,139, down from 9,841,967 units at $126,164,786 on Wednesday. The All Jamaican Composite Index climbed 2,760.22 points to 389,643.62, the JSE Main Index rose 2,168.78 points to 343,253.10 and the JSE Financial Index popped 0.37 points to 82.24.

The All Jamaican Composite Index climbed 2,760.22 points to 389,643.62, the JSE Main Index rose 2,168.78 points to 343,253.10 and the JSE Financial Index popped 0.37 points to 82.24. Kingston Wharves climbed $3.39 to $34.45 with a transfer of 432 shares, Margaritaville rallied $1.45 to $21 in the swapping of 404 stocks, Mayberry Investments fell 65 cents to $8.25 after 12,577 stocks cleared the market. Mayberry Jamaican Equities fell 51 cents to $13 with 4,704 stock units changing hands, MPC Caribbean Clean Energy shed 95 cents in closing at $83, trading 238 units, Palace Amusement climbed $72.39 to a 52 weeks’ high of $1,902.39 after a transfer of 305 shares. Sagicor Group gained 49 cents to end at $51.49, trading 5,138 stocks, Scotia Group rose $1.99 to $34 in an exchange of 343,004 shares, Seprod fell 53 cents to $67.45 after 3,703 stock units passed through the market. Stanley Motta rallied 50 cents to $5 with investors transferring 54,322 units and Supreme Ventures advanced 85 cents to $28 with 4,006 shares changing hands.

Kingston Wharves climbed $3.39 to $34.45 with a transfer of 432 shares, Margaritaville rallied $1.45 to $21 in the swapping of 404 stocks, Mayberry Investments fell 65 cents to $8.25 after 12,577 stocks cleared the market. Mayberry Jamaican Equities fell 51 cents to $13 with 4,704 stock units changing hands, MPC Caribbean Clean Energy shed 95 cents in closing at $83, trading 238 units, Palace Amusement climbed $72.39 to a 52 weeks’ high of $1,902.39 after a transfer of 305 shares. Sagicor Group gained 49 cents to end at $51.49, trading 5,138 stocks, Scotia Group rose $1.99 to $34 in an exchange of 343,004 shares, Seprod fell 53 cents to $67.45 after 3,703 stock units passed through the market. Stanley Motta rallied 50 cents to $5 with investors transferring 54,322 units and Supreme Ventures advanced 85 cents to $28 with 4,006 shares changing hands. Eppley 5% preference share fell $1.90 to end at $23 in an exchange of 5 stocks, JMMB Group 7% preference share shed 67 cents to close at $2.22 with the swapping of 5,891 units and 138 Student Living preference share advanced $4.95 to $69.95 after exchanging 37 stocks.

Eppley 5% preference share fell $1.90 to end at $23 in an exchange of 5 stocks, JMMB Group 7% preference share shed 67 cents to close at $2.22 with the swapping of 5,891 units and 138 Student Living preference share advanced $4.95 to $69.95 after exchanging 37 stocks. The All Jamaican Composite Index dropped 3,634.92 points to 386,883.40, the JSE Main Index declined 2,841.02 points to 341,084.32 and the JSE Financial Index shed 0.31 points to settle at 81.87.

The All Jamaican Composite Index dropped 3,634.92 points to 386,883.40, the JSE Main Index declined 2,841.02 points to 341,084.32 and the JSE Financial Index shed 0.31 points to settle at 81.87. Highway with 1.92 million units for 19.5 percent market share.

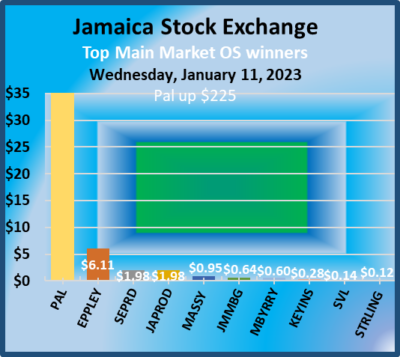

Highway with 1.92 million units for 19.5 percent market share. Jamaica Producers popped $1.98 to $21.98 as investors traded 12,321 stock units. Jamaica Stock Exchange shed 98 cents to end at $14.50 with investors transferring 23,485 units, JMMB Group rallied 64 cents to $33.44 with 40,018 shares changing hands, Kingston Wharves declined $4.38 to close at $31.06 in swapping 3,345 units. Margaritaville advanced $2.93 to $19.55 after a transfer of 28,413 shares, Massy Holdings rose 95 cents in closing at $79.95 with the swapping of 945 stock units, Mayberry Investments gained 60 cents to end at $8.90, trading 503 stocks. Palace Amusement jumped $225 to close at a 52 weeks’ high of $1,830 in transferring 805 units, Proven Investments shed $2.40 in ending at $30 with 8,029 stocks changing hands, Scotia Group dipped $1.89 to $32.01 in trading 113,116 shares.

Jamaica Producers popped $1.98 to $21.98 as investors traded 12,321 stock units. Jamaica Stock Exchange shed 98 cents to end at $14.50 with investors transferring 23,485 units, JMMB Group rallied 64 cents to $33.44 with 40,018 shares changing hands, Kingston Wharves declined $4.38 to close at $31.06 in swapping 3,345 units. Margaritaville advanced $2.93 to $19.55 after a transfer of 28,413 shares, Massy Holdings rose 95 cents in closing at $79.95 with the swapping of 945 stock units, Mayberry Investments gained 60 cents to end at $8.90, trading 503 stocks. Palace Amusement jumped $225 to close at a 52 weeks’ high of $1,830 in transferring 805 units, Proven Investments shed $2.40 in ending at $30 with 8,029 stocks changing hands, Scotia Group dipped $1.89 to $32.01 in trading 113,116 shares.  Seprod advanced $1.98 to $67.98 in switching ownership of 1,733 stock units and Sygnus Credit Investments lost 65 cents in closing at $12.85 after exchanging 53,468 shares.

Seprod advanced $1.98 to $67.98 in switching ownership of 1,733 stock units and Sygnus Credit Investments lost 65 cents in closing at $12.85 after exchanging 53,468 shares. A total of 8,360,004 shares were traded for a mere $35,173,992 compared with 10,386,916 units at $54,644,130 on Monday.

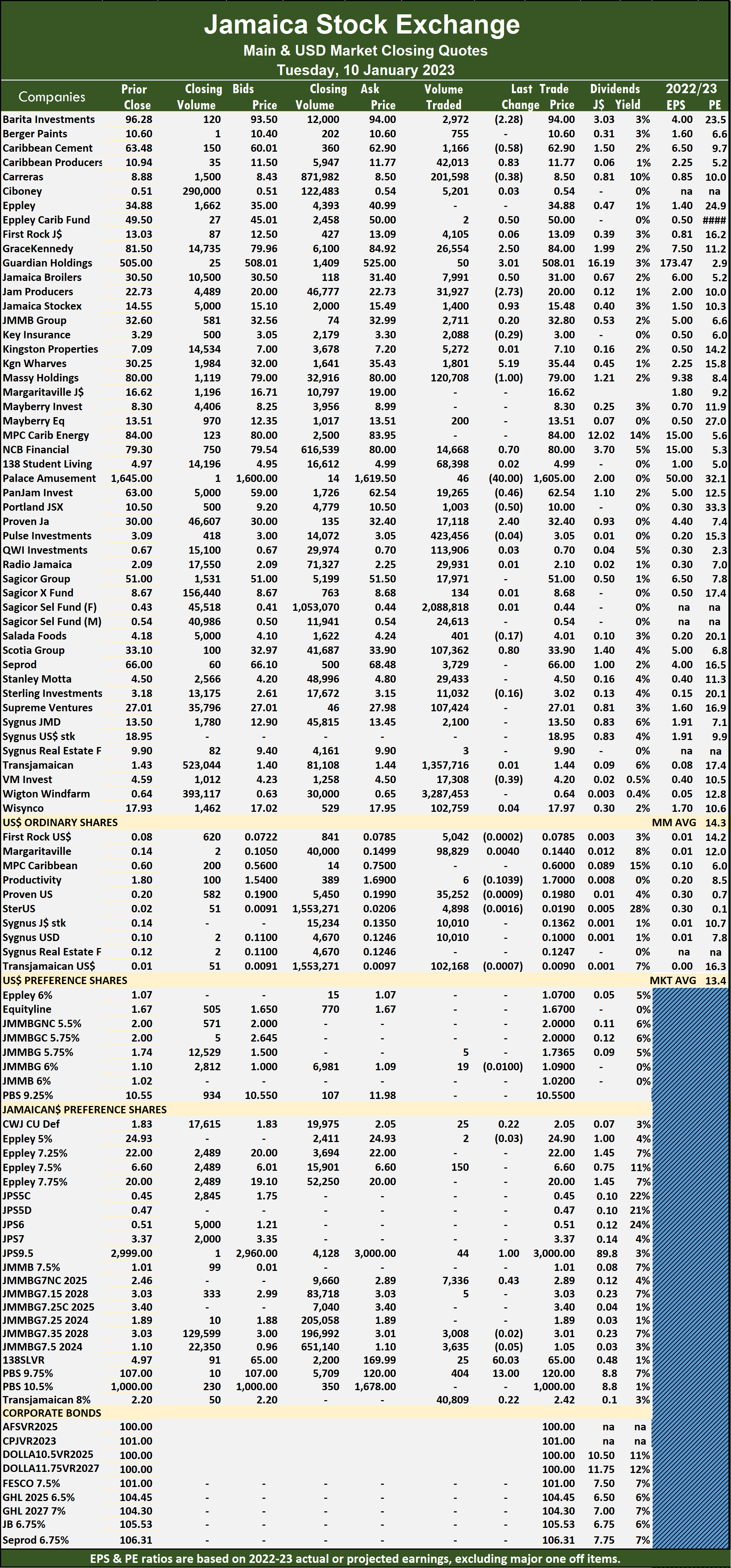

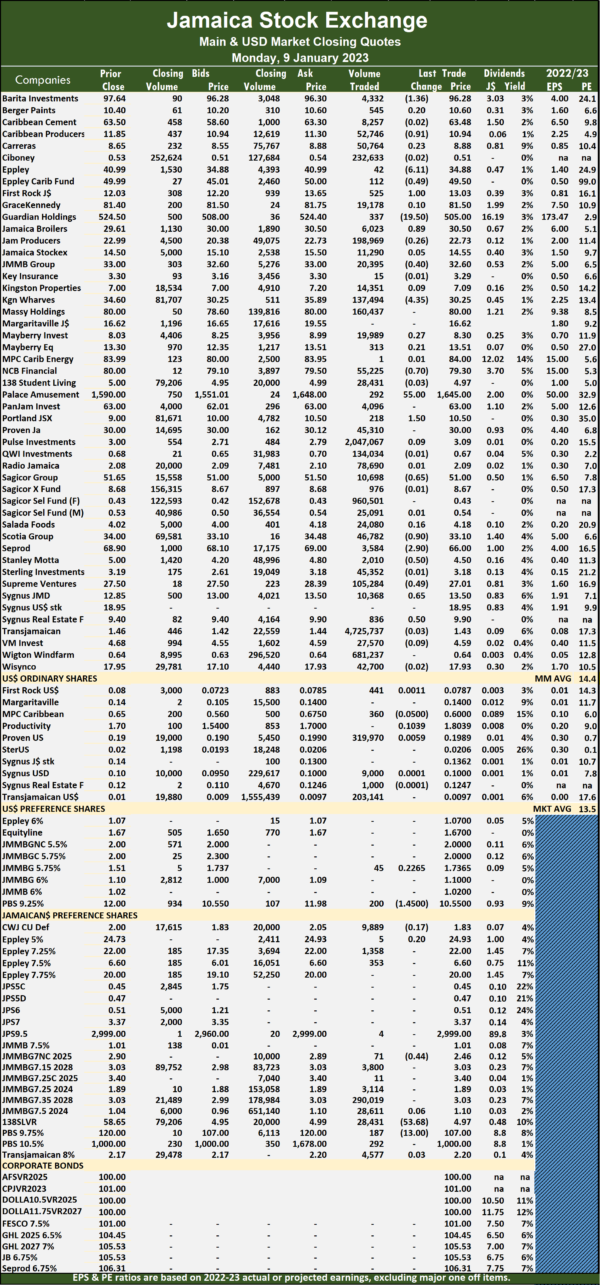

A total of 8,360,004 shares were traded for a mere $35,173,992 compared with 10,386,916 units at $54,644,130 on Monday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

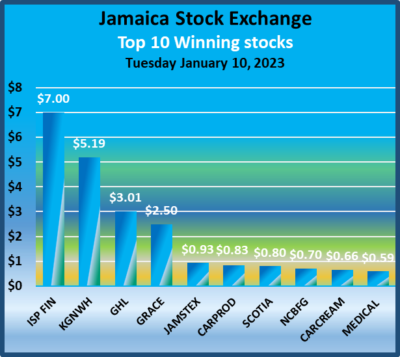

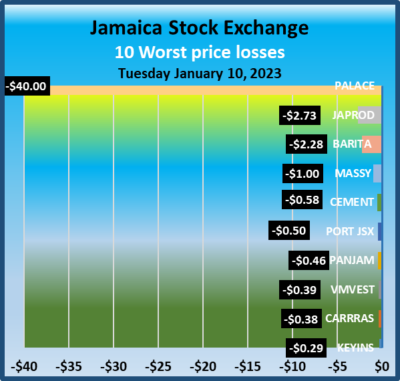

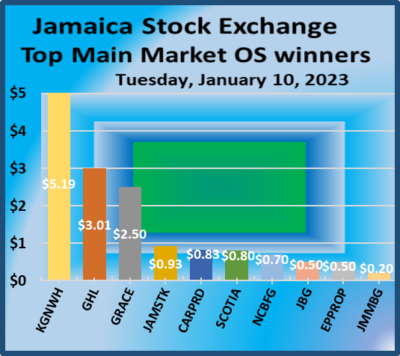

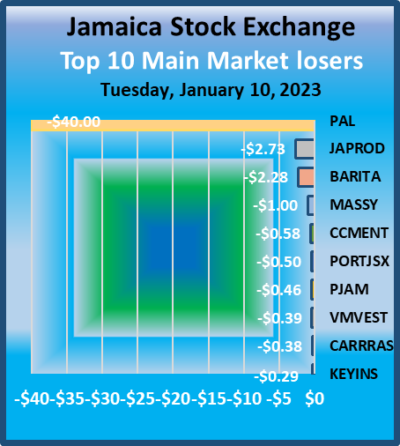

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. Jamaica Producers fell $2.73 to $20 with the swapping of 31,927 shares, Jamaica Stock Exchange advanced 93 cents to $15.48 in trading 1,400 shares. Kingston Wharves popped $5.19 to end at $35.44 with 1,801 units clearing the market, Massy Holdings dipped $1 to close at $79 after trading 120,708 stocks, NCB Financial rose 70 cents to $80 after 14,668 stock units cleared the market. Palace Amusement fell $40 to close at $1,605 in an exchange of 46 units, PanJam Investment shed 46 cents to end at $62.54 with a transfer of 19,265 stocks, Portland JSX lost 50 cents in closing at $10 after 1,003 stock units crossed the market. Proven Investments popped $2.40 to $32.40 in switching ownership of 17,118 shares and Scotia Group rose 80 cents to $33.90 in exchanging 107,362 stocks.

Jamaica Producers fell $2.73 to $20 with the swapping of 31,927 shares, Jamaica Stock Exchange advanced 93 cents to $15.48 in trading 1,400 shares. Kingston Wharves popped $5.19 to end at $35.44 with 1,801 units clearing the market, Massy Holdings dipped $1 to close at $79 after trading 120,708 stocks, NCB Financial rose 70 cents to $80 after 14,668 stock units cleared the market. Palace Amusement fell $40 to close at $1,605 in an exchange of 46 units, PanJam Investment shed 46 cents to end at $62.54 with a transfer of 19,265 stocks, Portland JSX lost 50 cents in closing at $10 after 1,003 stock units crossed the market. Proven Investments popped $2.40 to $32.40 in switching ownership of 17,118 shares and Scotia Group rose 80 cents to $33.90 in exchanging 107,362 stocks. JMMB Group 7% preference share rallied 43 cents to $2.89 after an exchange of 7,336 stock units, 138 Student Living preference share advanced $6.35 to close at $65 as investors exchanged 25 units and Productive Business Solutions 9.75% preference share climbed $13 in closing at $120 in trading 404 stocks.

JMMB Group 7% preference share rallied 43 cents to $2.89 after an exchange of 7,336 stock units, 138 Student Living preference share advanced $6.35 to close at $65 as investors exchanged 25 units and Productive Business Solutions 9.75% preference share climbed $13 in closing at $120 in trading 404 stocks. A total of 10,386,916 shares were traded for $54,644,130 versus 11,174,825 units at $201,235,785 on Friday.

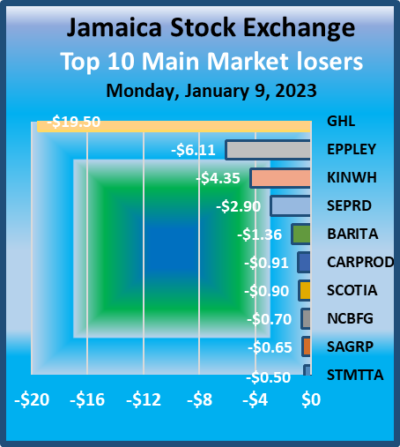

A total of 10,386,916 shares were traded for $54,644,130 versus 11,174,825 units at $201,235,785 on Friday. Main Index dropped 4,673.08 points to 343,507.55 and the JSE Financial Index declined 0.43 points to close at 82.48.

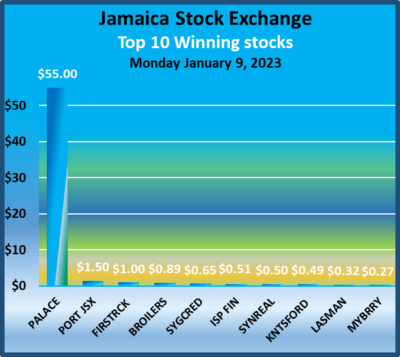

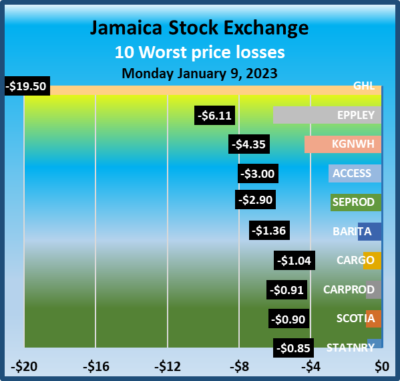

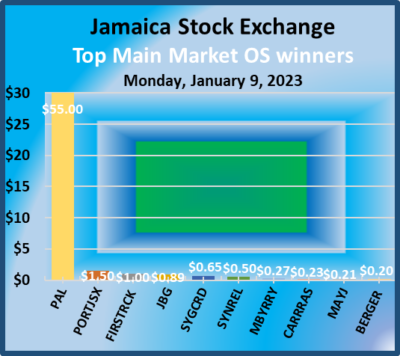

Main Index dropped 4,673.08 points to 343,507.55 and the JSE Financial Index declined 0.43 points to close at 82.48. Guardian Holdings dropped $19.50 to $505 with investors transferring 337 units. Jamaica Broilers rose 89 cents to $30.50 with 6,023 shares clearing the market, JMMB Group fell 40 cents to $32.60 trading 20,395 stock units, Kingston Wharves fell $4.35 to end at $30.25 in switching ownership of 137,494 stocks.NCB Financial shed 70 cents in closing at $79.30 in exchanging 55,225 units, Palace Amusement climbed $55 to $1,645 with 292 shares passing through the market, Portland JSX advanced $1.50 to $10.50 after a transfer of 218 stock units. Sagicor Group declined 65 cents to $51 in exchanging 10,698 stock units, Scotia Group lost 90 cents to close at $33.10 as investors swapped 46,782 shares, Seprod shed $2.90 in ending at $66 with a transfer of 3,584 units. Stanley Motta fell 50 cents to finish at $4.50 in trading 2,010 stocks, Supreme Ventures lost 49 cents to close at $27.01 after transferring 105,284 shares, Sygnus Credit Investments advanced 65 cents to end at $13.50 with an exchange of 10,368 stock units and Sygnus Real Estate Finance gained 50 cents to close at $9.90 with the swapping of 836 units.

Guardian Holdings dropped $19.50 to $505 with investors transferring 337 units. Jamaica Broilers rose 89 cents to $30.50 with 6,023 shares clearing the market, JMMB Group fell 40 cents to $32.60 trading 20,395 stock units, Kingston Wharves fell $4.35 to end at $30.25 in switching ownership of 137,494 stocks.NCB Financial shed 70 cents in closing at $79.30 in exchanging 55,225 units, Palace Amusement climbed $55 to $1,645 with 292 shares passing through the market, Portland JSX advanced $1.50 to $10.50 after a transfer of 218 stock units. Sagicor Group declined 65 cents to $51 in exchanging 10,698 stock units, Scotia Group lost 90 cents to close at $33.10 as investors swapped 46,782 shares, Seprod shed $2.90 in ending at $66 with a transfer of 3,584 units. Stanley Motta fell 50 cents to finish at $4.50 in trading 2,010 stocks, Supreme Ventures lost 49 cents to close at $27.01 after transferring 105,284 shares, Sygnus Credit Investments advanced 65 cents to end at $13.50 with an exchange of 10,368 stock units and Sygnus Real Estate Finance gained 50 cents to close at $9.90 with the swapping of 836 units. In the preference segment, JMMB Group 7% preference share fell 44 cents to $2.46 in trading 71 stocks and Productive Business Solutions 9.75% preference share dropped $13 in closing at $107 with the swapping of 187 stocks.

In the preference segment, JMMB Group 7% preference share fell 44 cents to $2.46 in trading 71 stocks and Productive Business Solutions 9.75% preference share dropped $13 in closing at $107 with the swapping of 187 stocks. The All Jamaican Composite Index jumped 3,559.20 points to 396,043.87, the JSE Main Index climbed 2,768.71 points to 348,180.63 and the JSE Financial Index popped 0.93 points to settle at 82.91.

The All Jamaican Composite Index jumped 3,559.20 points to 396,043.87, the JSE Main Index climbed 2,768.71 points to 348,180.63 and the JSE Financial Index popped 0.93 points to settle at 82.91. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

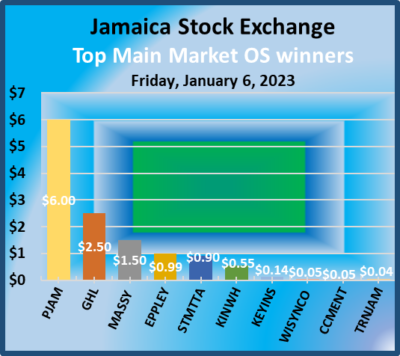

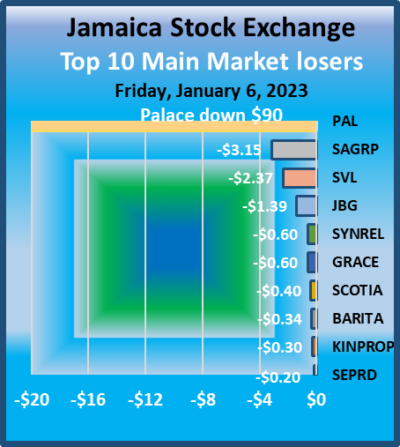

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. Palace Amusement shed $90 in ending at $1590 with investors trading 431 stocks, PanJam Investment rallied $6 to $63 with 1,072,233 shares crossing the market, Proven Investments climbed $2.01 in closing at $30 in an exchange of 170,085 stocks. Sagicor Group dropped $3.15 to close at $51.65 after exchanging 9,594 shares, Scotia Group fell 40 cents in ending at $34 in trading 1,236 units, Stanley Motta popped 90 cents to end at $5 as investors exchanged 198 stock units. Supreme Ventures dipped $2.37 in closing at $27.50 after 32,697 shares crossed the market and Sygnus Real Estate Finance fell 60 cents to close at $9.40, trading 11,699 stocks.

Palace Amusement shed $90 in ending at $1590 with investors trading 431 stocks, PanJam Investment rallied $6 to $63 with 1,072,233 shares crossing the market, Proven Investments climbed $2.01 in closing at $30 in an exchange of 170,085 stocks. Sagicor Group dropped $3.15 to close at $51.65 after exchanging 9,594 shares, Scotia Group fell 40 cents in ending at $34 in trading 1,236 units, Stanley Motta popped 90 cents to end at $5 as investors exchanged 198 stock units. Supreme Ventures dipped $2.37 in closing at $27.50 after 32,697 shares crossed the market and Sygnus Real Estate Finance fell 60 cents to close at $9.40, trading 11,699 stocks. In the preference segment, Eppley 5% preference share increased $2.25 to $24.73 with five units passing through the market and Eppley 7.25% preference share gained $4.80 to end at $22 after an exchange of 200 stock units.

In the preference segment, Eppley 5% preference share increased $2.25 to $24.73 with five units passing through the market and Eppley 7.25% preference share gained $4.80 to end at $22 after an exchange of 200 stock units.