NCB traded at a 52 weeks’ high of $130 on Thursday.

The Jamaica Stock Exchange main market ended at a 10th consecutive record close on Thursday with the all Jamaica composite Index pushing nearer to the 400,000 mark aided by a rise in the price of 18 main market stocks.

The market closed with the All Jamaica Composite Index surging 5,960.37 points higher to a record close at 384,731.07 and the JSE Index jumping 5,430.57 points to a record close of 350,533.51. Thursday’s close brings to 33, the number of record close for the year and 21 since the start of July. The main market surged to new record high at the start of the morning session and continued to create new highs during the first 90 minutes of trading as NCB Financial traded at $125 and Kingston Wharves at $75 to be aided by Jamaica Producers that traded as high as $28.50.

Market activities resulted in 30 securities trading, including 2 in the US dollar market compared to 34 securities trading on Wednesday.  At the end of trading, the prices of 20 stocks rose, 4 declined and 6 closed trading, unchanged. The main market ended with 11,678,084 units valued at $147,689,924 changing hands, compared to 3,156,915 units valued at $54,279,819, on Wednesday.

At the end of trading, the prices of 20 stocks rose, 4 declined and 6 closed trading, unchanged. The main market ended with 11,678,084 units valued at $147,689,924 changing hands, compared to 3,156,915 units valued at $54,279,819, on Wednesday.

The day’s volume was led by, JMMB Group 7.5% preference share closed with 8,042,693 shares and 59.4 percent of the day’s volume, the JMMB Group 7.25% preference share ended with 2,772,000 shares, 20.5 percent of main market volume,and Wisynco Group with 620,232 units for just 4.6 percent of the volume traded.

Trading resulted in an average of 483,444 units valued at an average of $2,448,792, in contrast to 432,522 units valued at an average of $5,469,997 on Wednesday. The average volume and value for the month to date amounts to 469,931 shares valued $4,332,558, compared to 468,476 shares valued $4,558,933 traded on the immediately preceding trading day.

JSE breaks several records in trading on Thursday morning

August closed, with an average of 224,564 shares valued at $4,310,285, for each security traded.

In the main market activity, Barita Investments gained 77 cents and closed at $11.27, trading 2,850 shares, Caribbean Cement added $1.44 to finish at $50 with 14,153 shares trading, Grace Kennedy fell $2 to end at $57, trading 238,210 shares, Jamaica Broilers climbed $1.05 in trading 108,185 stock units at record high of $31, Jamaica Producers gained 50 cents and finished trading 7,000 units at a record high of $23, JMMB Group climbed 98 cents and ended trading 142,794 shares at $30.99. Kingston Wharves jumped $4 and ended trading 13,948 stock units to close at a record high of $74, Mayberry Investments jumped $2 to settle at $9, with 271,631 units changing hands, NCB Financial Group jumped $8 and ended trading 121,984 shares at a record close of $130, PanJam Investment gained $1 and closed at $55 trading 7,285 stock units, Sagicor Real Estate Fund fell 52 cents and settled at $11.23, trading 124,980 shares. Scotia Group rose $1.18 in trading 56,316 units at $56.20, Supreme Ventures added 35 cents and ended at $16.40, 11,824 shares changing hands.

PanJam Investment gained $1 and closed at $55 trading 7,285 stock units, Sagicor Real Estate Fund fell 52 cents and settled at $11.23, trading 124,980 shares. Scotia Group rose $1.18 in trading 56,316 units at $56.20, Supreme Ventures added 35 cents and ended at $16.40, 11,824 shares changing hands.

Trading in the US dollar market closed with 24,665 units valued US$9,781 as , JMMB Group 6% preference share completed trading of 4,950 stock units at $1.06, and Sygnus Credit Investments ended trading of 19,715 shares at 12 US cents. The JSE USD Equities Index advanced by 1.94 points to close at 169.56.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading is very strong for continuation of the market’s rally and shows 11 stocks ended with bids higher than their last selling prices and 1 closing with a lower offer.

The day’s volume was led by, Sagicor Real Estate Fund with 8,692,402 shares and 74.4 percent of main market volume, followed by JMMB Group 7.50% preference share closing with 980,000 units and just 8.4 percent of the day’s volume and Carreras with 522,434 units just 4.47 percent of volume traded.

The day’s volume was led by, Sagicor Real Estate Fund with 8,692,402 shares and 74.4 percent of main market volume, followed by JMMB Group 7.50% preference share closing with 980,000 units and just 8.4 percent of the day’s volume and Carreras with 522,434 units just 4.47 percent of volume traded.

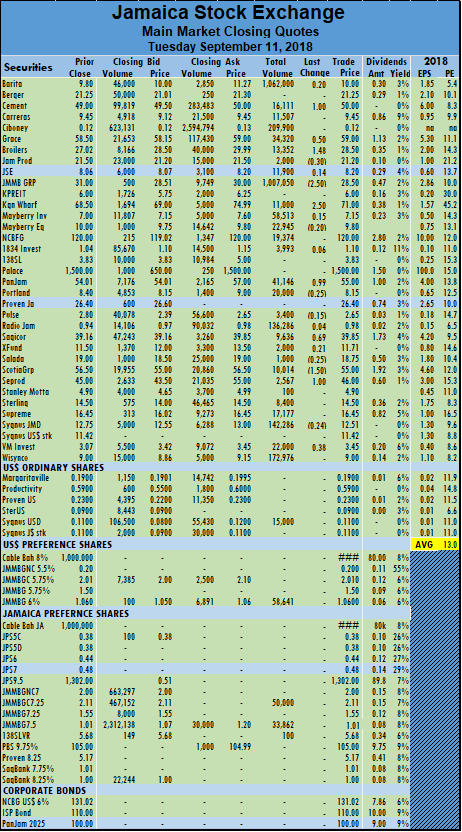

$1.50 to $55, in exchanging 10,014 units, ahead of nine months’ results due after trading on Wednesday, Seprod rose $1 and ended trading of 2,567 stock units to close of $46, Sygnus Credit Investments lost 24 cents to close of $12.51, after trading 142,286 shares were traded and Victoria Mutual Investments recovered 38 cents of the loss on Monday and concluded trading of 22,000 stock units at $3.45.

$1.50 to $55, in exchanging 10,014 units, ahead of nine months’ results due after trading on Wednesday, Seprod rose $1 and ended trading of 2,567 stock units to close of $46, Sygnus Credit Investments lost 24 cents to close of $12.51, after trading 142,286 shares were traded and Victoria Mutual Investments recovered 38 cents of the loss on Monday and concluded trading of 22,000 stock units at $3.45. Records continue to be broken with Jamaica Stock Exchange main market on Monday ending at another record close and the 7th in the past 7 days.

Records continue to be broken with Jamaica Stock Exchange main market on Monday ending at another record close and the 7th in the past 7 days.  The day’s volume was led by, Carreras with 634,224 units and 19 percent of main market volume, followed by Scotia Group closed with 464,889 units and just 14 percent of the day’s volume and JMMB Group 7% preference share with 336,703 units, accounting for 10 percent of the volume traded.

The day’s volume was led by, Carreras with 634,224 units and 19 percent of main market volume, followed by Scotia Group closed with 464,889 units and just 14 percent of the day’s volume and JMMB Group 7% preference share with 336,703 units, accounting for 10 percent of the volume traded. NCB Financial Group jumped $5 and ended trading of 78,818 shares at record close of $120, Scotia Group dropped $3 to $56.50, in exchanging 464,889 units, Stanley Motta rose 30 cents and ended trading 9,638 stock units to close of $4.90, Sygnus Credit Investments gained 25 cents to close of $12.75, after trading 16,382 shares were traded, Victoria Mutual Investments lost 45 cents and concluded trading of 300,891 stock units at a new low of $3.07 and Wisynco Group fell 25 cents, finishing at $9 with 152,027 units changing hands.

NCB Financial Group jumped $5 and ended trading of 78,818 shares at record close of $120, Scotia Group dropped $3 to $56.50, in exchanging 464,889 units, Stanley Motta rose 30 cents and ended trading 9,638 stock units to close of $4.90, Sygnus Credit Investments gained 25 cents to close of $12.75, after trading 16,382 shares were traded, Victoria Mutual Investments lost 45 cents and concluded trading of 300,891 stock units at a new low of $3.07 and Wisynco Group fell 25 cents, finishing at $9 with 152,027 units changing hands. The Jamaica Stock Exchange main market scaled new heights on Wednesday when the All Jamaica Composite Index surged nearly 10,000 points in the morning session to a new record high for the market but pulled back later to end with more modest gains at a new record closing high.

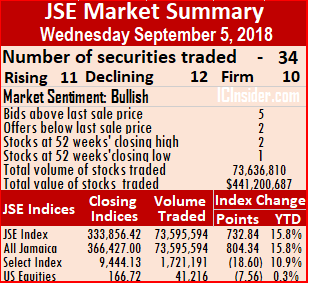

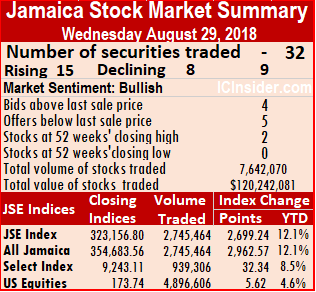

The Jamaica Stock Exchange main market scaled new heights on Wednesday when the All Jamaica Composite Index surged nearly 10,000 points in the morning session to a new record high for the market but pulled back later to end with more modest gains at a new record closing high.  The day’s volume was led by, 138 Student Living with 67,901,000 shares, accounting for 92.26 percent of the volume traded, followed by JMMB Group 7.50% preference share with 1,421,537 units and a mere 1.93 percent of the day’s volume and NCB Financial Group with 1,227,676 units and just 1.67 percent of main market volume.

The day’s volume was led by, 138 Student Living with 67,901,000 shares, accounting for 92.26 percent of the volume traded, followed by JMMB Group 7.50% preference share with 1,421,537 units and a mere 1.93 percent of the day’s volume and NCB Financial Group with 1,227,676 units and just 1.67 percent of main market volume. 138 Student Living had a big day in exchanging 67,901,000 stock units as the price slipped 49 cents to finish at a 52 weeks’ low of $3.80, Sagicor Real Estate Fund jumped $1.40 and settled at $13.50, trading 202,641 shares, Seprod rose 50 cents and finished trading 480 shares at $43.50, Supreme Ventures rose 40 cents and ended at $15.90, with 73,148 shares changing hands, Sygnus Credit Investments US dollar share traded 4,000 units in the Jamaican dollar market and dropped $2.30 to $11.42, while the Jamaican dollar denominated share, traded 24,397 units to gain 50 cents and close at $12.50.

138 Student Living had a big day in exchanging 67,901,000 stock units as the price slipped 49 cents to finish at a 52 weeks’ low of $3.80, Sagicor Real Estate Fund jumped $1.40 and settled at $13.50, trading 202,641 shares, Seprod rose 50 cents and finished trading 480 shares at $43.50, Supreme Ventures rose 40 cents and ended at $15.90, with 73,148 shares changing hands, Sygnus Credit Investments US dollar share traded 4,000 units in the Jamaican dollar market and dropped $2.30 to $11.42, while the Jamaican dollar denominated share, traded 24,397 units to gain 50 cents and close at $12.50. At the end of trading, the prices of 9 stocks rose, 12 declined and 11 closed trading, unchanged.

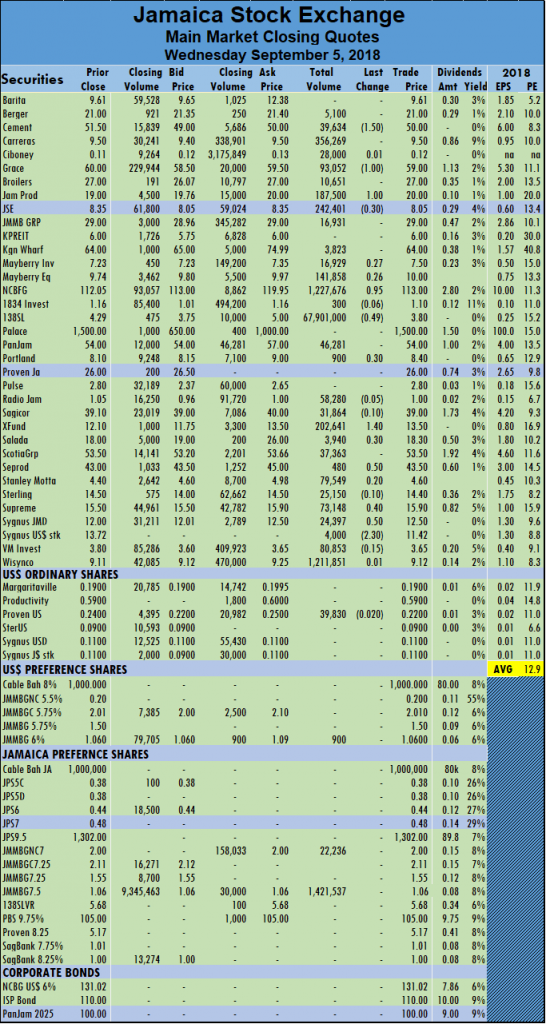

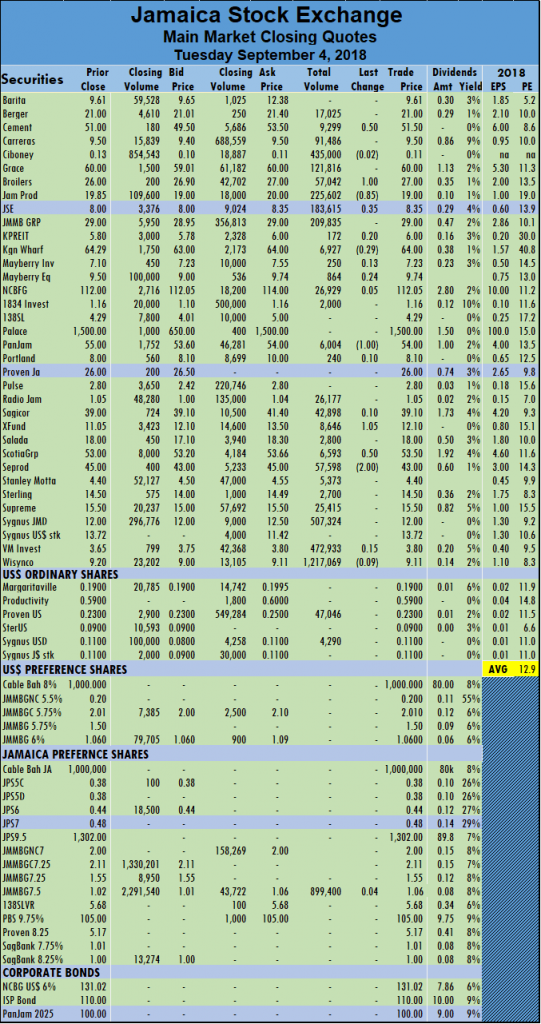

At the end of trading, the prices of 9 stocks rose, 12 declined and 11 closed trading, unchanged. Kingston Wharves lost 29 cents and finished at $64, trading 6,927 stock units, PanJam Investment lost $1 and closed at $54, exchanging 6,004 stock units, strong> Sagicor Real Estate Fund rose $1.05 to settle at $12.10, with 8,646 shares trading, Scotia Group rose 50 cents in trading 6,593 units at $53.50 and Seprod finished trading 57,598 shares after falling $2 to end at $43.

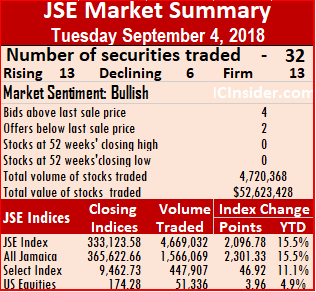

Kingston Wharves lost 29 cents and finished at $64, trading 6,927 stock units, PanJam Investment lost $1 and closed at $54, exchanging 6,004 stock units, strong> Sagicor Real Estate Fund rose $1.05 to settle at $12.10, with 8,646 shares trading, Scotia Group rose 50 cents in trading 6,593 units at $53.50 and Seprod finished trading 57,598 shares after falling $2 to end at $43. The Jamaica Stock Exchange main market started September off on a bright the market continued from the record breaker run on Friday to end at yet another record close.

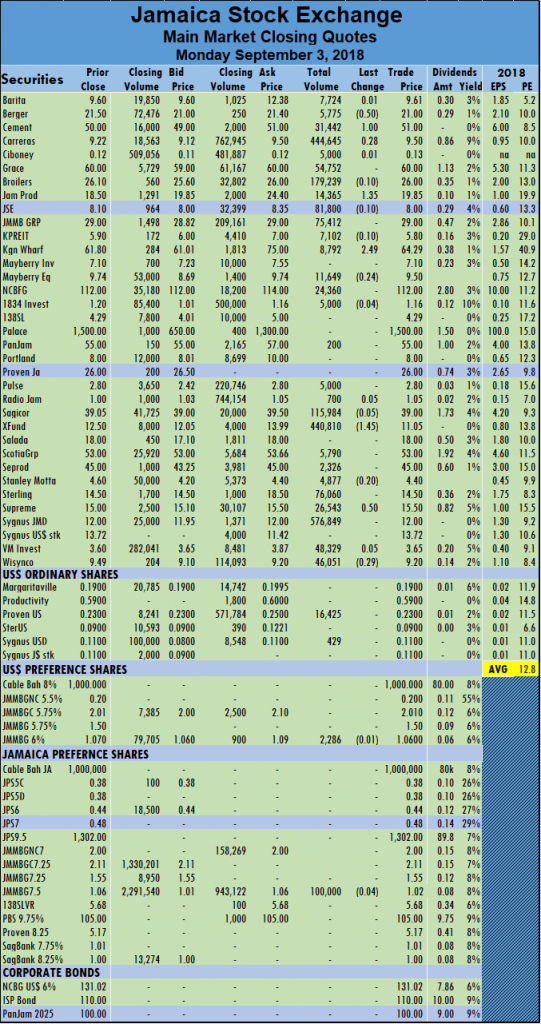

The Jamaica Stock Exchange main market started September off on a bright the market continued from the record breaker run on Friday to end at yet another record close.  The day’s volume was led by, Sygnus Credit Investments with 576,849 shares accounting for 23.97 percent of the volume traded, followed by Carreras with 444,645 units 18.48 percent of the day’s volume and Sagicor Real Estate Fund with 440,810 units 18.32 percent of main market volume.

The day’s volume was led by, Sygnus Credit Investments with 576,849 shares accounting for 23.97 percent of the volume traded, followed by Carreras with 444,645 units 18.48 percent of the day’s volume and Sagicor Real Estate Fund with 440,810 units 18.32 percent of main market volume. lost 90 cents in trading 10,639 stock units at $26.10, Kingston Wharves climbed $2.49 and finished at $64.29, after trading 8,792 stock units, Sagicor Real Estate Fund lost $1.45 and settled at $11.05, in trading 440,810 shares, Supreme Ventures gained 50 cents and closed at $15.50, exchanging 26,543 shares and Wisynco Group lost 29 cents and concluded trading at $9.20, with 46,051 stock units changing hands.

lost 90 cents in trading 10,639 stock units at $26.10, Kingston Wharves climbed $2.49 and finished at $64.29, after trading 8,792 stock units, Sagicor Real Estate Fund lost $1.45 and settled at $11.05, in trading 440,810 shares, Supreme Ventures gained 50 cents and closed at $15.50, exchanging 26,543 shares and Wisynco Group lost 29 cents and concluded trading at $9.20, with 46,051 stock units changing hands. The day’s volume was led by, Victoria Mutual Investments with 984,214 shares accounting for 35.85 percent of the volume traded, followed by Sagicor Real Estate X Fund with 373,447 units and 13.60 percent of the main market volume Radio Jamaica with 187,582 units and 6.8 percent of the day’s volume.

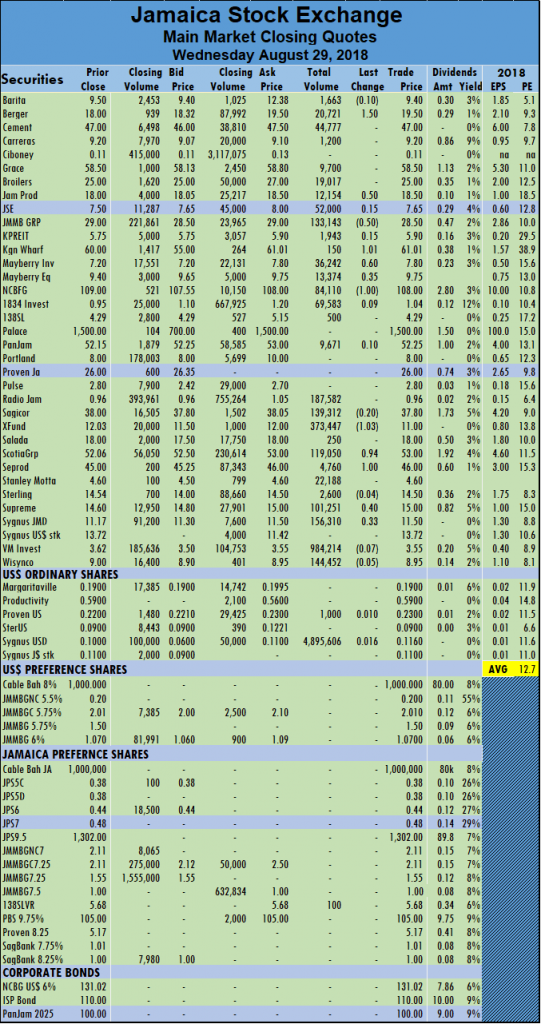

The day’s volume was led by, Victoria Mutual Investments with 984,214 shares accounting for 35.85 percent of the volume traded, followed by Sagicor Real Estate X Fund with 373,447 units and 13.60 percent of the main market volume Radio Jamaica with 187,582 units and 6.8 percent of the day’s volume. NCB Financial Group lost $1 and ended trading 84,110 shares at $108.00. Sagicor Real Estate Fund lost $1.03, in settling at $11 in trading 373,447 shares, Scotia Group traded 119,050 shares and gained 94 cents to end at $53, Seprod finished trading 4,760 shares after rising $1 to close at $46, Supreme Ventures rose 40 cents and ended at $15, with 101,251 shares changing hands and Sygnus Credit Investments traded 156,310 shares and rose 33 cents to $11.50.

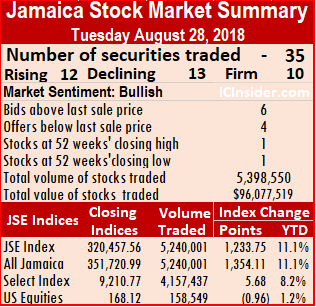

NCB Financial Group lost $1 and ended trading 84,110 shares at $108.00. Sagicor Real Estate Fund lost $1.03, in settling at $11 in trading 373,447 shares, Scotia Group traded 119,050 shares and gained 94 cents to end at $53, Seprod finished trading 4,760 shares after rising $1 to close at $46, Supreme Ventures rose 40 cents and ended at $15, with 101,251 shares changing hands and Sygnus Credit Investments traded 156,310 shares and rose 33 cents to $11.50. At the end of trading, the prices of 12 stocks rose, 13 declined and 10 closed trading unchanged. Stanley Motta closed with 2,211 units changing hands after falling 35 cents to close at an all-time low of $4.60 while Kingston Wharves jumped to a new record high of $60.

At the end of trading, the prices of 12 stocks rose, 13 declined and 10 closed trading unchanged. Stanley Motta closed with 2,211 units changing hands after falling 35 cents to close at an all-time low of $4.60 while Kingston Wharves jumped to a new record high of $60. Mayberry Jamaican Equities fell 60 cents and settled at $9.40 trading 82,449 units, 138 Student Living finished with a gain of 28 cents at $4.29, with 2,900 stock units, Portland JSX dived $1.48 and ended at $8, with 350 units, Scotia Group lost 44 cents in trading 30,342 shares to close at $52.06, Supreme Ventures fell 40 cents and ended at $14.60, with 140,992 shares changing hands.

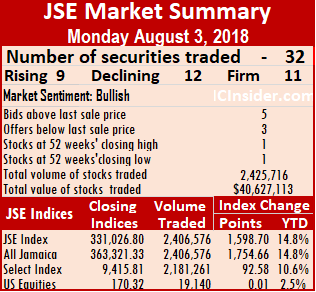

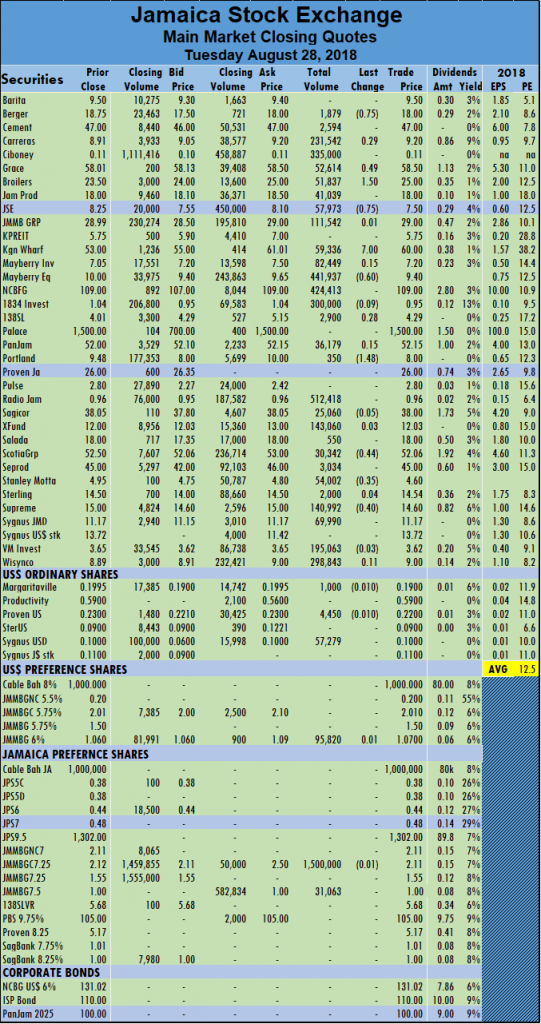

Mayberry Jamaican Equities fell 60 cents and settled at $9.40 trading 82,449 units, 138 Student Living finished with a gain of 28 cents at $4.29, with 2,900 stock units, Portland JSX dived $1.48 and ended at $8, with 350 units, Scotia Group lost 44 cents in trading 30,342 shares to close at $52.06, Supreme Ventures fell 40 cents and ended at $14.60, with 140,992 shares changing hands. Temperature on the Jamaica Stock Exchange was far more subdued in trading on Monday with both volume and value pulling sharply from Friday’s levels and leaving the two major indices down at the close.

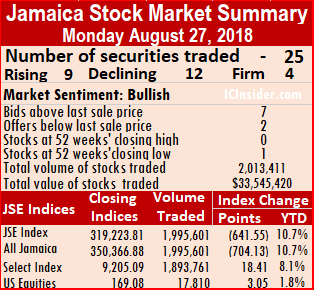

Temperature on the Jamaica Stock Exchange was far more subdued in trading on Monday with both volume and value pulling sharply from Friday’s levels and leaving the two major indices down at the close.  At the end of trading, the prices of 9 stocks rose, 12 declined and 4 closed trading unchanged. Stanley Motta closed with 2,211 units changing hands after falling 5 cents to close at an all-time low of $4.95.

At the end of trading, the prices of 9 stocks rose, 12 declined and 4 closed trading unchanged. Stanley Motta closed with 2,211 units changing hands after falling 5 cents to close at an all-time low of $4.95. Jamaica Producers rose 70 cents and finished trading 43,354 units at $18, Mayberry Investments fell 95 cents to settle at $7.05, in exchanging 6,993 shares. NCB Financial Group fell $1 and ended trading 12,713 shares at $109, Sagicor Group gained 40 cents and settled at $38.05, trading 6,713 stock units. Sagicor Real Estate Fund climbed $1 and closed at $12 exchanging 23,171 shares, Salada Foods gained 50 cents and ended trading 19,300 stock units at $18, Scotia Group traded 101,372 units at and closed $52.50, after adding 50 cents and Supreme Ventures lost 50 cents and ended at $15, in the trading of 17,810 shares.

Jamaica Producers rose 70 cents and finished trading 43,354 units at $18, Mayberry Investments fell 95 cents to settle at $7.05, in exchanging 6,993 shares. NCB Financial Group fell $1 and ended trading 12,713 shares at $109, Sagicor Group gained 40 cents and settled at $38.05, trading 6,713 stock units. Sagicor Real Estate Fund climbed $1 and closed at $12 exchanging 23,171 shares, Salada Foods gained 50 cents and ended trading 19,300 stock units at $18, Scotia Group traded 101,372 units at and closed $52.50, after adding 50 cents and Supreme Ventures lost 50 cents and ended at $15, in the trading of 17,810 shares.