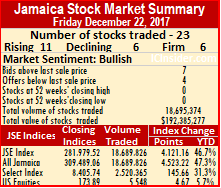

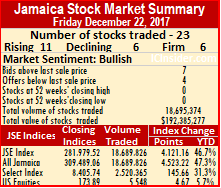

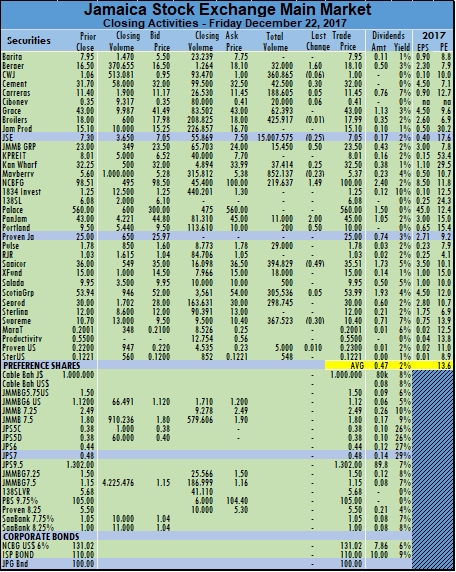

In trading on the Main Market of the Jamaica Stock Exchange on Friday, the All Jamaican Composite Index jumped sharply by 4,523.22 points to 309,489.06 and the JSE Index surged 4,121.16 points to close at 281,979.52.

In trading on the Main Market of the Jamaica Stock Exchange on Friday, the All Jamaican Composite Index jumped sharply by 4,523.22 points to 309,489.06 and the JSE Index surged 4,121.16 points to close at 281,979.52.

Trading ended with 21 securities changing hands, of which 9 advanced, 4 declined and 8 traded firm Thursday.

Trading returned to more normal levels, with 18,689,826 units valued at $192,233,164 trading compared to 171,582,338 units valued at $1,664,149,762 from 21 securities on Thursday. Shares in Jamaica Stock Exchange, accounted for 15 million units of the volume traded on Friday.

An average of 889,992 units traded for an average of $9,153,960 on Friday, in contrast to an average of 8,170,588 units for an average of $79,245,227 on Thursday.  The average volume and value for the month to date amounts to 765,616 units valued at $10,279,783 and previously, 758,238 units valued at $10,351,426. In contrast, November closed with average of 349,084 units at an average of $5,801,440 for each security traded.

The average volume and value for the month to date amounts to 765,616 units valued at $10,279,783 and previously, 758,238 units valued at $10,351,426. In contrast, November closed with average of 349,084 units at an average of $5,801,440 for each security traded.

IC bid-offer Indicator| At the end of trading in the main and the US dollar markets, the Investor’s Choice bid-offer indicator reading shows 7 stocks ended with bids higher than their last selling prices and 4 with lower offers.

Traded in the US dollar market ended with Proven Investments US ordinary share rose 1 US cent with 5,000 units changing hands at 23 US cents and Sterling Investments traded 548 units to close unchanged at 12.21 US cents. The total value of trading amounted to US$11,012 with the JSE USD Equities Index closing 4.67 points higher at 173.89.

Apart from the big trade in JSE shares the other major movers at the close of the market on Friday are, Berger Paints with a rise of $1.60, NCB Financial Group rising $1.49 and PanJam Investment jumped $2.

For more details of market activities see – “JSE stocks supply 80% of Friday’s trade.”

Big 4,523 points surge in JSE index

J$125.05 to US dollar mid-day Friday

The average rate for exchanging the Jamaican dollar against the US dollar, dropped to $125.05 at mid-day on Friday but ended slightly higher by the close of trading and now seems set to be at the $125 level by the end of the year.

The average rate for exchanging the Jamaican dollar against the US dollar, dropped to $125.05 at mid-day on Friday but ended slightly higher by the close of trading and now seems set to be at the $125 level by the end of the year.

On Friday at midday dealers purchased US$11.56 million at an average rate of J$124.12 and sold US$11.66 million at an average of J$125.05. At mid-day on Thursday dealers purchased US$17.14 million at an average rate of J$124.66 while they sold US$10.63 million at an average of J$125.28.

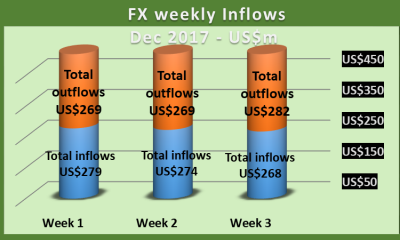

In a remarkable week for the local currency, dealers sold the equivalent of US$282 million while buying US$268 million as the rate slipped from 125.49 at the end of the prior week to $125.22 for sale of US dollars. Unlike august to November when the bank of Jamaica weekly BFIXT auction was active no sales took place in December and none are planned for the next four weeks.

The rate the public bought the US dollar ended at $125.22 at the close with dealers selling US$45.45 million in US currency, compared US$60.19 million at an average rate of $125.34 on Thursday. US currency purchases by dealers, amounted to US$39.05 million on Friday, at an average rate of $123.95, compared to Thursday, with US$47.45 million at $124.23.

The rate the public bought the US dollar ended at $125.22 at the close with dealers selling US$45.45 million in US currency, compared US$60.19 million at an average rate of $125.34 on Thursday. US currency purchases by dealers, amounted to US$39.05 million on Friday, at an average rate of $123.95, compared to Thursday, with US$47.45 million at $124.23.

Dealers’ purchased US$46.49 million, versus US$51.81 million on Thursday in all currencies, in Jamaica’s Forex market and sold US$51.79 million compared with US$62.42 million sold, previously.

The selling rate for the Canadian dollar climbed to J$98.95 from J$96.33 at the close on Thursday. The selling rate for the British Pound fell to J$167.57 versus J$167.61 previously and the euro lost value against the Jamaican dollar at J$148.19 to buy the European common currency, versus the prior selling rate of J$150.67.

Junior Market sheds nearly 46 points

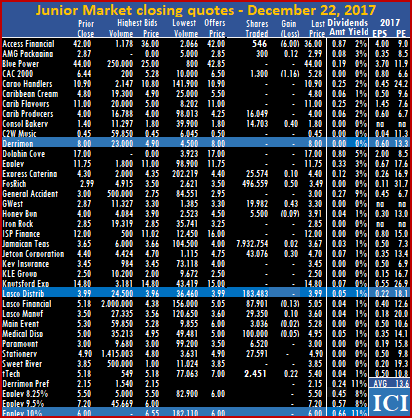

Trading on the Junior Market of the Jamaica Stock Exchange resulted in the Market Index dropping 45.82 points, to close at 2,694.81 on Friday as 19 securities changing hands with the prices of 8 securities advanced, 6 declined and 5 remained unchanged.

Trading on the Junior Market of the Jamaica Stock Exchange resulted in the Market Index dropping 45.82 points, to close at 2,694.81 on Friday as 19 securities changing hands with the prices of 8 securities advanced, 6 declined and 5 remained unchanged.

Market activities closed with 8,996,675 units valued at $33,076,071 compared to 1,516,632 units valued at $6,748,760 from 17 securities on Thursday. By the close, Jamaican Teas traded 7.93 million units to dominate trading and FosRich and GWest traded at record close.

Trading ended with an average of 473,509 units for an average of $1,740,846 in contrast to 90,155 units for an average of $399,626 on Thursday. The average volume and value for the month to date, amounts to units 561,932 valued at $2,583,423 and previously 568,154 units valued at $2,642,716. In contrast, November closed with average of 107,477 units valued at $545,989 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 2 stocks ending with bids higher than the last selling prices and 3 with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 2 stocks ending with bids higher than the last selling prices and 3 with lower offers.

At the close of the market, Access Financial dived $6 cents to close at $36, with only 546 shares trading, AMG Packaging ended 12 cents higher at $2.99, with 300 stock units, CAC 2000 settled with a loss of $1.16 at $5.28, with 1,300 shares, Caribbean Producers closed at $4, with 16,049 shares, Consolidated Bakeries ended 40 cents higher at $1.80, with 14,703 stock units. Express Catering ended trading 10 cents higher at $4.40, with 25,574 stock units, FosRich Group traded 496,559 shares and gained 50 cents to end at record close of $3.49, GWest Corporation traded 19,982 shares and ended at $3.30 with a gain of 43 cents, Honey Bun finished trading with a loss of 9 cents at $3.91, with 5,500 shares, Jamaican Teas concluded trading 2 cents higher at $3.67, with 7,932,754 units,  Jetcon Corporation finished 30 cents higher at $4.70, with 43,076 shares. Lasco Distributors finished trading at $3.99, with 183,483 shares, Lasco Financial closed with a loss of 13 cents at $5.05, with 87,901 shares, Lasco Manufacturing ended 10 cents higher at $3.60, with 29,350 stock units, Main Event concluded trading with a loss of 2 cents at $5.28, with 3,036 units. Medical Disposables finished with a loss of 5 cents at $4.95, with 100,000 shares, Paramount Trading settled at $3, with 6,520 shares, Stationery and Office ended trading at $4.90, with 27,591 stock units and tTech finished trading 22 cents higher at $5.40, with 2,451 shares.

Jetcon Corporation finished 30 cents higher at $4.70, with 43,076 shares. Lasco Distributors finished trading at $3.99, with 183,483 shares, Lasco Financial closed with a loss of 13 cents at $5.05, with 87,901 shares, Lasco Manufacturing ended 10 cents higher at $3.60, with 29,350 stock units, Main Event concluded trading with a loss of 2 cents at $5.28, with 3,036 units. Medical Disposables finished with a loss of 5 cents at $4.95, with 100,000 shares, Paramount Trading settled at $3, with 6,520 shares, Stationery and Office ended trading at $4.90, with 27,591 stock units and tTech finished trading 22 cents higher at $5.40, with 2,451 shares.

Prices of securities trading for the day are those at which the last trade took place.

JSE stocks supply 80% of Friday’s trade

Shares of Jamaica Stock Exchange dominated trading and accounted for 80 percent of the 18,689,826 units valued at $192,233,164 traded on the Main Market of the on Friday.

Shares of Jamaica Stock Exchange dominated trading and accounted for 80 percent of the 18,689,826 units valued at $192,233,164 traded on the Main Market of the on Friday.

Main market activity, ended with 21 securities changing hands, of which 10 advanced, 6 declined and 5 traded firm. At the close, the All Jamaican Composite Index surged 4,523.22 points to 309,489.06 and the JSE Index climbed by 4,121.16 points to close at 281,979.52.

In the main market activity, Berger Paints closed $1.60 higher at $18.10, with 32,000 shares trading, Cable & Wireless settled with a loss of 6 cents at $1, with 360,865 shares, Caribbean Cement ended trading 30 cents higher at $32, with 42,500 stock units,  Carreras traded 5 cents higher at $11.45, with 188,605 units, Ciboney Group finished trading 6 cents higher at 41 cents, with 20,000 shares. Grace Kennedy closed at $43, with 62,393 shares, Jamaica Broilers ended with a loss of 1 cent at $17.99, with 425,917 stock units, Jamaica Stock Exchange finished with a loss of 25 cents at $7.05, with 15,007,575 shares, JMMB Group settled 50 cents higher at $23.50, with 15,450 shares. JMMB Group ended trading 50 cents higher at $23.50, with 15,450 stock units, Kingston Wharves finished trading 25 cents higher at $32.50, with 37,414 shares, Mayberry Investments closed with a loss of 23 cents at $5.37, with 852,137 shares, NCB Financial ended $1.49 higher at $100, with 219,637 stock units.

Carreras traded 5 cents higher at $11.45, with 188,605 units, Ciboney Group finished trading 6 cents higher at 41 cents, with 20,000 shares. Grace Kennedy closed at $43, with 62,393 shares, Jamaica Broilers ended with a loss of 1 cent at $17.99, with 425,917 stock units, Jamaica Stock Exchange finished with a loss of 25 cents at $7.05, with 15,007,575 shares, JMMB Group settled 50 cents higher at $23.50, with 15,450 shares. JMMB Group ended trading 50 cents higher at $23.50, with 15,450 stock units, Kingston Wharves finished trading 25 cents higher at $32.50, with 37,414 shares, Mayberry Investments closed with a loss of 23 cents at $5.37, with 852,137 shares, NCB Financial ended $1.49 higher at $100, with 219,637 stock units. PanJam Investment finished $2 higher at $45, with 11,000 shares, Portland JSX settled 50 cents higher at $10, with 200 shares, Pulse Investments ended trading at $1.78, with 29,000 stock units, Sagicor Group finished trading with a loss of 49 cents at $35.51, with 394,829 shares. Sagicor Real Estate Fund closed at $15, with 18,000 shares, Salada Foods ended at $9.95, with 500 stock units, Scotia Group concluded trading 5 cents higher at $53.99, with 305,536 units, Seprod finished at $30, with 298,745 shares and Supreme Ventures ended trading with a loss of 30 cents at $10.40, with 367,523 stock units changing hands.

PanJam Investment finished $2 higher at $45, with 11,000 shares, Portland JSX settled 50 cents higher at $10, with 200 shares, Pulse Investments ended trading at $1.78, with 29,000 stock units, Sagicor Group finished trading with a loss of 49 cents at $35.51, with 394,829 shares. Sagicor Real Estate Fund closed at $15, with 18,000 shares, Salada Foods ended at $9.95, with 500 stock units, Scotia Group concluded trading 5 cents higher at $53.99, with 305,536 units, Seprod finished at $30, with 298,745 shares and Supreme Ventures ended trading with a loss of 30 cents at $10.40, with 367,523 stock units changing hands.

Prices of securities trading for the day are those at which the last trade took place. For more details of market activities, see “Big 4,523 points surge in JSE index.”

Gains exceed losses but indices drop

Scotia Group’s stock price jumps $3.74 on Thursday

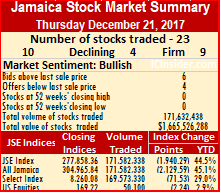

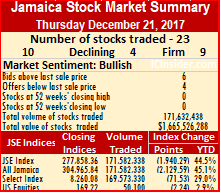

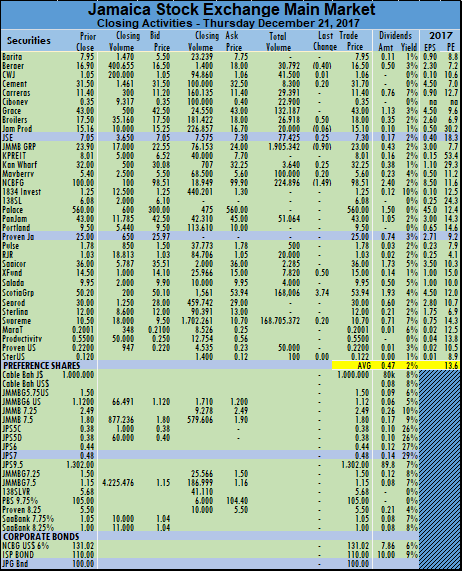

In trading on the Main Market of the Jamaica Stock Exchange on Thursday, the All Jamaican Composite Index dropped 2,129.59 points to 304,965.84 and the JSE Index dived 1,940.29 points to 277,858.36.

Trading ended with 21 securities changing hands, of which 9 advanced, 4 declined and 8 traded firm.

Trading jumped to 171,582,338 units valued at $1,664,149,762 compared to 1,811,480 units valued at $72,434,801 from 27 Securities on Wednesday. Supreme Ventures traded 168.7 million units to dominate market activities after accounting for 98.3 percent of volume traded.

An average of 8,170,588 units for an average of $79,245,227 traded, in contrast to 67,092 units for an average of $2,682,770 on Wednesday. The average volume and value for the month to date amounts to 758,238 units valued at $10,351,426 and previously, 290,793 units valued at $5,669,323. In contrast, November closed with average of 349,084 units at an average of $5,801,440 for each security traded.

IC bid-offer Indicator| At the end of trading in the main and the US dollar markets, the Investor’s Choice bid-offer indicator reading shows 11 stocks ended with bids higher than their last selling prices and 2 with lower offers.

Trading in the US dollar market, ended with Proven Investments US ordinary share having 50,000 units changing hands at 22 US cents and Sterling Investments exchanging just 100 units and rising moderately in price to 0.1221 US cents from 0.12 cents. The total value of trading amounted to US$11,012 with the US dollar Equities Index closing 2.24 points down, at 169.22.

Trading in the US dollar market, ended with Proven Investments US ordinary share having 50,000 units changing hands at 22 US cents and Sterling Investments exchanging just 100 units and rising moderately in price to 0.1221 US cents from 0.12 cents. The total value of trading amounted to US$11,012 with the US dollar Equities Index closing 2.24 points down, at 169.22.

The major movers at the close are, JMMB Group lost 90 cents in trading 1,905,342 shares, Kingston Wharves gaining $1 and NCB Financial Group closing $1.49 lower, but Scotia Group jumped $3.74.

For more details of market activities see – “Supreme Ventures in big Thursday trade .”

GWest list & FosRich gains 99c

In trading on the Junior Market Jamaica Stock Exchange on Thursday, FosRich finally traded after listing on Tuesday, while GWest listed on Thursday and rose to $2.87 from its IPO price of $2.50.

In trading on the Junior Market Jamaica Stock Exchange on Thursday, FosRich finally traded after listing on Tuesday, while GWest listed on Thursday and rose to $2.87 from its IPO price of $2.50.

At the close of market activities, the prices of 6 securities advanced, 5 declined and 6 remained unchanged. The Junior Market Index advanced by 36.88 points to close at 2,740.63 with the two new listing contributing to the gain.

Trading on concluded with 16 securities changing hands, resulting in an exchange of 1,516,632 units valued at $6,748,760 compared to just 393,186 units valued at $1,610,823 on Wednesday from 11 securities.

Trading ended with an average of 89,214 units for an average of $399,986 in contrast to 35,744 units for an average of $146,438 on Wednesday.  The average volume and value for the month to date, amounts to 568,154 units valued at $2,642,716 and previously, 600,336 units valued at $2,793,615. In contrast, November closed with average of 107,477 units valued at $545,989 for each security traded.

The average volume and value for the month to date, amounts to 568,154 units valued at $2,642,716 and previously, 600,336 units valued at $2,793,615. In contrast, November closed with average of 107,477 units valued at $545,989 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 6 stocks ending with bids higher than the last selling prices and 7 with lower offers.

At the close of the market, Cargo Handlers ended trading 3 cents higher at $10.90, with 40,888 stock units, Caribbean Producers closed 20 cents higher at $4, with 322,112 shares, Eppley settled with a loss of 25 cents at $11.75, with 1,100 shares, Express Catering ended trading at $4.30, with 4,900 stock units, FosRich Group traded 16,000 shares at $2.99 up 99 cents from $2 at the IPO, General Accident traded 25 cents higher at $3, with 500,000 units. GWest Corporation traded for the first time and ended at $2.87 with a gain of 37 cents from the IPO price of $2.50. Honey Bun finished trading with a loss of 50 cents at $4, with 11,850 shares, Knutsford Express traded 80 cents higher at $14.80, with 23,359 units, Lasco Distributors finished trading at $3.99, with 2,200 shares, Lasco Financial closed at $5.18, with 2,360 shares. Lasco Manufacturing ended with a loss of 1 cent at $3.50, with 121,239 stock units, Main Event concluded trading at $5.30, with 296,246 units, Paramount Trading settled with a loss of 2 cents at $3, with 33,833 shares, Stationery and Office ended trading with a loss of 9 cents at $4.90, with 50,780 stock units and tTech finished trading at $5.18, with 86,765 shares changing hands.

GWest Corporation traded for the first time and ended at $2.87 with a gain of 37 cents from the IPO price of $2.50. Honey Bun finished trading with a loss of 50 cents at $4, with 11,850 shares, Knutsford Express traded 80 cents higher at $14.80, with 23,359 units, Lasco Distributors finished trading at $3.99, with 2,200 shares, Lasco Financial closed at $5.18, with 2,360 shares. Lasco Manufacturing ended with a loss of 1 cent at $3.50, with 121,239 stock units, Main Event concluded trading at $5.30, with 296,246 units, Paramount Trading settled with a loss of 2 cents at $3, with 33,833 shares, Stationery and Office ended trading with a loss of 9 cents at $4.90, with 50,780 stock units and tTech finished trading at $5.18, with 86,765 shares changing hands.

Prices of securities trading for the day are those at which the last trade took place.

Supreme Ventures in big Thursday trade

Supreme Ventures traded the most shares on Thursday.

Supreme Ventures accounted for 98 percent of the volume traded on the Main Market of the Jamaica Stock Exchange on Thursday, resulting from 168.7 million shares changing hands and bumping the market volume to 171,582,338 units valued at $1,664,149,762.

Main market activity ended with 21 securities changing hands, of which 11 advanced, 4 declined and 8 traded firm. In contrast, 27 securities changed hands on Wednesday with to 1,811,480 units valued at $72,434,801 passing through the exchange.

Main market activity ended with 21 securities changing hands, of which 11 advanced, 4 declined and 8 traded firm. In contrast, 27 securities changed hands on Wednesday with to 1,811,480 units valued at $72,434,801 passing through the exchange.

At the close, the All Jamaican Composite Index dropped 2,129.59 points to 304,965.84 and the JSE Index dipped by 1,940.29 points to 277,858.36.

In the main market activity, Berger Paints ended with a loss of 40 cents at $16.50, with 30,792 shares trading, Cable & Wireless settled 1 cent higher at $1.06, with 41,500 shares, Caribbean Cement ended trading 20 cents higher at $31.70, with 8,300 stock units, Carreras traded at $11.40, with 29,391 units, Ciboney Group finished trading at 35 cents, with 22,900 shares. Grace Kennedy closed at $43, with 132,187 shares, Jamaica Broilers ended 50 cents higher at $18, with 26,918 stock units, Jamaica Producers concluded trading with a loss of 6 cents at $15.10, with 20,000 units, Jamaica Stock Exchange finished 25 cents higher at $7.30, with 77,425 shares. JMMB Group ended trading with a loss of 90 cents at $23, with 1,905,342 stock units,  Kingston Wharves finished trading 25 cents higher at $32.25, with 3,640 shares, Mayberry Investments closed 20 cents higher at $5.60, with 100,000 shares. NCB Financial Group ended with a loss of $1.49 at $98.51, with 224,896 stock units, PanJam Investment settled at $43, with 51,064 shares, Pulse Investments traded at $1.78, with 500 units. Radio Jamaica finished trading at $1.03, with 20,000 shares, Sagicor Group closed at $36, with 2,285 shares, Sagicor Real Estate Fund ended 50 cents higher at $15, with 7,820 stock units, Salada Foods Jamaica concluded trading at $9.95, with 4,000 units. Scotia Group finished $3.74 higher at $53.94, with 168,006 shares and Supreme Ventures traded 20 cents higher at $10.70, with 168,705,372 units.

Kingston Wharves finished trading 25 cents higher at $32.25, with 3,640 shares, Mayberry Investments closed 20 cents higher at $5.60, with 100,000 shares. NCB Financial Group ended with a loss of $1.49 at $98.51, with 224,896 stock units, PanJam Investment settled at $43, with 51,064 shares, Pulse Investments traded at $1.78, with 500 units. Radio Jamaica finished trading at $1.03, with 20,000 shares, Sagicor Group closed at $36, with 2,285 shares, Sagicor Real Estate Fund ended 50 cents higher at $15, with 7,820 stock units, Salada Foods Jamaica concluded trading at $9.95, with 4,000 units. Scotia Group finished $3.74 higher at $53.94, with 168,006 shares and Supreme Ventures traded 20 cents higher at $10.70, with 168,705,372 units.

Prices of securities trading for the day are those at which the last trade took place. For more details of market activities, see “Gains ecxceed losses but indices drop.”

JSE makes big gains on Wednesday

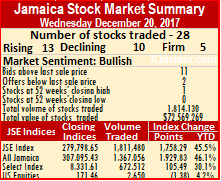

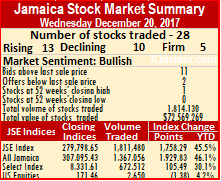

Trading on the Main Market of the Jamaica Stock Exchange led to sharp gains in the market indices, with the JSE All Jamaican Composite Index surging 1,929.83 points to 307,095.43 and the JSE Index climbing 1,758.29 points to close at 279,798.65 as the year-end rally continues.

Trading on the Main Market of the Jamaica Stock Exchange led to sharp gains in the market indices, with the JSE All Jamaican Composite Index surging 1,929.83 points to 307,095.43 and the JSE Index climbing 1,758.29 points to close at 279,798.65 as the year-end rally continues.

At the close of trading, Main market activity ended with 27 securities changing hands, 12 advanced, 9 declined and 3 traded firm with 1,811,480 units valued at $72,434,801 compared to 2,309,034 units valued at $75,261,191 on Tuesday from 20 securities changing hands. At the close 138 Student Living ended at a 52 weeks’ high of $6.08.

Trading ended with an average of 67,092 units for an average of $2,682,770 in contrast to 109,954 units for an average of $3,583,866 on Tuesday. The average volume and value for the month to date amounts to 290,793 units valued at 5,669,323 and previously, 310,531 units valued at $5,955,270. In contrast, November closed with average of 349,084 units at an average of $5,801,440 for each security traded.

IC bid-offer Indicator| At the end of trading in the main and the US dollar markets, the Investor’s Choice bid-offer indicator reading shows 11 stocks ended with bids higher than their last selling prices and 2 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and the US dollar markets, the Investor’s Choice bid-offer indicator reading shows 11 stocks ended with bids higher than their last selling prices and 2 with lower offers.

Traded in the US dollar market ended with Productivity Business Solutions US ordinary share having 2,650 units changing hands valued at US$1,471 in closing at 55 US cents, after falling by 2 cents, with the JSE USD Equities Index closing 1.38 points down at 171.46.

The major movers at the close, are Berger Paints rising 90 cents Jamaica Broilers ending with a fall of 90 cents, JMMB Group dropping by $1.10, Kingston Wharves gaining $1 and NCB Financial Group closing $1.01 higher.

For more details of market activities see – “Rising JSE stocks edged out decliners.”

Rising JSE’s stocks edged out decliners

NCB Financial trades back at $100.

Trading on the Main Market of the Jamaica Stock Exchange concluded on Tuesday with 27 securities changing hands, 13 advanced, 9 declined and 5 traded firm with 1,811,480 units valued at $72,434,801 changing hands, with NCB Financial trades back at $100.

In the market activity, the JSE All Jamaican Composite Index advanced by 1,929.83 points to close at 307,095.43 and the JSE Index advanced by 1,758.29 points to close at 279,798.65.

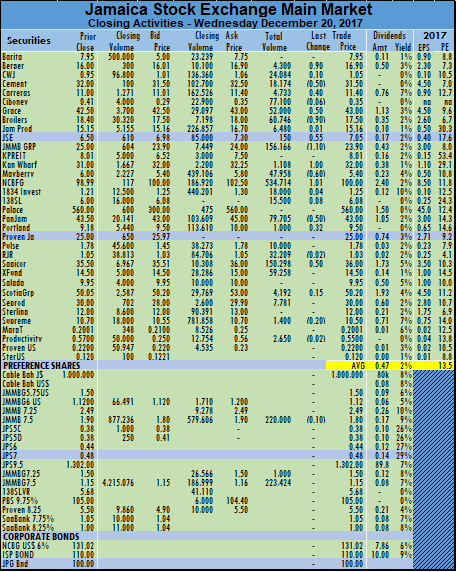

In the main market activity, Berger Paints finished 90 cents higher at $16.90, with 4,300 shares, Cable & Wireless settled 10 cents higher at $1.05, with 24,084 shares, Caribbean Cement ended trading with a loss of 50 cents at $31.50, with 18,174 stock units changing hands. Carreras traded 40 cents higher at $11.40, with 4,733 units, Ciboney Group finished trading with a loss of 6 cents at 35 cents, with 77,100 shares, Grace Kennedy closed 50 cents higher at $43, with 52,000 shares, Jamaica Broilers ended with a loss of 90 cents at $17.50, with 60,746 stock units.  Jamaica Producers concluded trading 1 cent higher at $15.16, with 6,480 units, Jamaica Stock Exchange finished 55 cents higher at $7.05, with 150 shares, JMMB Group settled with a loss of 1.1 cents at $23.90, with 156,166 shares, Kingston Wharves traded $1 higher at $32, with 1,108 units. Mayberry Investments finished trading with a loss of 60 cents at $5.40, with 47,958 shares, NCB Financial Group closed $1.01 higher at $100, with 534,714 shares, 138 Student Living closed 8 cents higher at $6.08, with 15,500 shares, 1834 Investments ended 4 cents higher at $1.25, with 18,000 stock units, PanJam Investment concluded trading with a loss of 50 cents at $43, with 79,705 units, Portland JSX finished 32 cents higher at $9.50, with 1,000 shares. Pulse Investments settled at $1.78, with 10,000 shares, Radio Jamaica ended trading with a loss of 2 cents at $1.03, with 32,209 stock units,

Jamaica Producers concluded trading 1 cent higher at $15.16, with 6,480 units, Jamaica Stock Exchange finished 55 cents higher at $7.05, with 150 shares, JMMB Group settled with a loss of 1.1 cents at $23.90, with 156,166 shares, Kingston Wharves traded $1 higher at $32, with 1,108 units. Mayberry Investments finished trading with a loss of 60 cents at $5.40, with 47,958 shares, NCB Financial Group closed $1.01 higher at $100, with 534,714 shares, 138 Student Living closed 8 cents higher at $6.08, with 15,500 shares, 1834 Investments ended 4 cents higher at $1.25, with 18,000 stock units, PanJam Investment concluded trading with a loss of 50 cents at $43, with 79,705 units, Portland JSX finished 32 cents higher at $9.50, with 1,000 shares. Pulse Investments settled at $1.78, with 10,000 shares, Radio Jamaica ended trading with a loss of 2 cents at $1.03, with 32,209 stock units,  Sagicor Group traded 50 cents higher at $36, with 150,298 units, Sagicor Real Estate Fund finished trading at $14.50, with 59,258 shares. Scotia Group ended 15 cents higher at $50.20, with 4,192 stock units, Seprod concluded trading at $30, with 7,781 units and Supreme Ventures settled with a loss of 20 cents at $10.50, with 1,400 shares. In the main market preference segment. In the main market preference segment, Jamaica Money Market Brokers 7.5% traded 220,000 shares with a loss of 10 cents at $1.80, JMMB Group 7.25% closed trading at $1.50, with 1,000 units and JMMB Group 7.5% ended trading at $1.15, with 223,424 stock units trading.

Sagicor Group traded 50 cents higher at $36, with 150,298 units, Sagicor Real Estate Fund finished trading at $14.50, with 59,258 shares. Scotia Group ended 15 cents higher at $50.20, with 4,192 stock units, Seprod concluded trading at $30, with 7,781 units and Supreme Ventures settled with a loss of 20 cents at $10.50, with 1,400 shares. In the main market preference segment. In the main market preference segment, Jamaica Money Market Brokers 7.5% traded 220,000 shares with a loss of 10 cents at $1.80, JMMB Group 7.25% closed trading at $1.50, with 1,000 units and JMMB Group 7.5% ended trading at $1.15, with 223,424 stock units trading.

Prices of securities trading for the day are those at which the last trade took place. For more details of market activities, see “JSE makes big gains on Wednesday.”

Outdated JSE rule blocks FosRich trades

Investors cant get their money out of FosRich stock as JSE rules preventing trading.

For the second consecutive day, what is clearly an outdated circuit breaker rule of the Jamaica Stock Exchange, prevented trading in shares of FosRich, after it listed on the Junior Market of the on Tuesday, following a successful IPO.

Attempts were made to trade shares at $3 and $4 on Tuesday and again at $4 on Wednesday but the prices exceeded the 30 percent daily limit permitted by the exchange on both days. So even as there are clear signs of demand at $4, no trading can take place at that level as the 30 percent daily price movement limitation, puts the maximum price at $3.89.

Having had similar problems when Express Catering and Stationery and Office Supplies listed in the summer months this year, investors would be forgiven if they were of the view that the JSE had moved speedily to correct what is clearly a problem when IPOs start trading.

Trading in the wider market on Wednesday only 11 securities changed hands, resulting in an exchange of just 393,186 units valued at $1,610,823 trading down sharply from the 3,645,919 units valued at $16,409,735 on Tuesday from trading in 19 securities.

Trading in the wider market on Wednesday only 11 securities changed hands, resulting in an exchange of just 393,186 units valued at $1,610,823 trading down sharply from the 3,645,919 units valued at $16,409,735 on Tuesday from trading in 19 securities.

At the close of market activities, the prices of 6 securities advanced, 2 declined and 3 remained unchanged, leading to the Junior Market Index gaining just 3.01 points to close at 2,703.75.

Trading ended with an average of 35,744 units for an average of $146,438 in contrast to 191,890 units for an average of $863,670 on Tuesday. The average volume and value for the month to date, amounts to 600,336 units valued at $2,793,615 and previously, 625,999 units valued at $2,913,941. In contrast, November closed with average of 107,477 units valued at $545,989 for each security traded.

IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading shows 4 stocks ending with bids higher than the last selling prices and 9 with lower offers.

At the close of the market, Cargo Handlers ended trading 2 cents higher at $10.87, with 101 stock units trading,  Caribbean Producers closed at $3.80, with 111,700 shares changing hands, Dolphin Cove finished 50 cents higher at $17, with 1,157 shares, Jamaican Teas concluded trading with a loss of 35 cents at $3.65, with 6,206 units, Jetcon Corporation finished at $4.40, with 3,000 shares. Lasco Distributors ended trading 14 cents higher at $3.99, with 107,138 shares, Lasco Financial closed 18 cents higher at $5.18, with 2,400 shares, Lasco Manufacturing ended with a loss of 14 cents at $3.51, with 75,281 stock units, Main Event concluded trading at $5.30, with 4,869 units, Paramount Trading settled 2 cents higher at $3.02, with 400 shares and Stationery and Office ended trading 14 cents higher at $4.99, with 80,934 stock units.

Caribbean Producers closed at $3.80, with 111,700 shares changing hands, Dolphin Cove finished 50 cents higher at $17, with 1,157 shares, Jamaican Teas concluded trading with a loss of 35 cents at $3.65, with 6,206 units, Jetcon Corporation finished at $4.40, with 3,000 shares. Lasco Distributors ended trading 14 cents higher at $3.99, with 107,138 shares, Lasco Financial closed 18 cents higher at $5.18, with 2,400 shares, Lasco Manufacturing ended with a loss of 14 cents at $3.51, with 75,281 stock units, Main Event concluded trading at $5.30, with 4,869 units, Paramount Trading settled 2 cents higher at $3.02, with 400 shares and Stationery and Office ended trading 14 cents higher at $4.99, with 80,934 stock units.

Prices of securities trading for the day are those at which the last trade took place.

- « Previous Page

- 1

- …

- 375

- 376

- 377

- 378

- 379

- …

- 488

- Next Page »