Everything Fresh is seeking to raise $390 million from the issue of 156 million shares at $2.50 each, with the offer opening on Thursday May 17, but everything is not right for all investors in this issue.

Everything Fresh is seeking to raise $390 million from the issue of 156 million shares at $2.50 each, with the offer opening on Thursday May 17, but everything is not right for all investors in this issue.

The stock is richly valued and not priced to deliver much in short term gains for new investors. On the assumption that sales would continue to grow at the pace 2017 over 2016 then profit could reach around $65 million excluding the impact of the IPO capital injection could have. At this level, earnings per share would be around 10 cents and would put the PE ratio at a rich 25 times this year’s earnings. Net asset value is just 40 cents per share with the stock priced at 6.5 times book value that is higher than a large number of listings on the Junior Market and is being sold at a premium to the average listing, by a big margin. The added capital could help lift the company’s performance to new levels delivering strong future earnings.

Up to 129,700,000 of the shares are reserved for selected applicants, leaving 26.3 million units for the general public. The proceed of the offer is to provide working capital support to its operations to allow for increase its customer base and stock levels thereby increasing revenues and build warehousing facilities and purchasing of equipment for storage and delivery of goods. The company intends to install solar system to reduce it energy costs. The company sees the opportunity to expand its to other Caribbean countries.

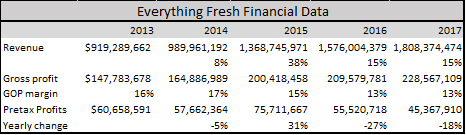

Operations started in 2008, data provided indicates that revenues hit $919 million in 2013 and generated pretax profit of $61 million. Revenues grew each year reaching $1.8 billion in 2017 with profit of $45 million before taxation of $8 million. The fall in profit for 2017 is due mainly to increase in payment for management team that was previously nominally paid, bringing it more in line with what more normal levels and foreign exchange losses of $4 million. Revenues and profit growth slowed but in 2015 revenues started to rise but lower profit margins resulted in a reduction in profits.

Operations started in 2008, data provided indicates that revenues hit $919 million in 2013 and generated pretax profit of $61 million. Revenues grew each year reaching $1.8 billion in 2017 with profit of $45 million before taxation of $8 million. The fall in profit for 2017 is due mainly to increase in payment for management team that was previously nominally paid, bringing it more in line with what more normal levels and foreign exchange losses of $4 million. Revenues and profit growth slowed but in 2015 revenues started to rise but lower profit margins resulted in a reduction in profits.

Many junior listings were constrained by inadequate capital restricting their ability to grow as market demand dictates. The same seems true for Everything Fresh. No doubt the added capital will provide funds for expansion that should boost revenues and hopefully profit going forward. Based on the need for more warehouse space the payoff will not be immediate as such, newer investors may have to wait for the pay day.

It imports and distributes food products such as dairy products, delicatessen meats, assorted dry and canned goods, fruits, vegetables, seafood and meats to various locally based supermarkets and hotels.

While the company has been profitable for several years, the prospectus does not carry information on the 2018 operations, leaving investors in the dark about what is happening in 2018 with more than four months having elapsed. Analytically, this is a dark sign suggesting that the results for the period is not inspiring. Investors deserve better than this.

The board of directors are Jennifer Elice Lewis, Vivette Elana Miller, Stephen Greig, Garret Samuel Gardner, Nesha Ann-Marie Carby, Donovan Hugh Perkins, Mark Hugh Arscott Croskery, Gregory Lancelot Pullen, Courtney Lancelot Pullen and Melene Rose Pullen.

New IPO set for mid-April

Investors in Jamaica will get another opportunity to vote come mid April, on the merits of a new public share offer.

Investors in Jamaica will get another opportunity to vote come mid April, on the merits of a new public share offer.

IC Insider.com has confirmed that Everything Fresh is set to issue their prospectus around the middle of April. Brokers for the issue is stocks and Securities. The company imports and distributes products including diary, seafood and meats with the hotel sector a major customers. The business operates from 78 Marcus Garvey Drive, but he hopes to acquire additional premises, to be financed from the initial public offering (IPO) of shares, the chairman Gregory Pullen was quoted as saying in 2017.

“You have to expand the warehouse after a while, and I see us getting a bigger place for storage, but I don’t believe in these super-huge warehouses where you store goods forever,” he said,” Pullen was reported as saying last year.

The company has a large nine-member board chaired by Gregory Pullen, Courtney Pullen, Melene Pullen, Garret Gardener, Nesha Carby, financier Mark Croskery, ex-banker Donovan Perkins, attorney-at-law Vivette Miller and Chartered Accountant Jennifer Lewis.

The company has a large nine-member board chaired by Gregory Pullen, Courtney Pullen, Melene Pullen, Garret Gardener, Nesha Carby, financier Mark Croskery, ex-banker Donovan Perkins, attorney-at-law Vivette Miller and Chartered Accountant Jennifer Lewis.

Everything Fresh seems set to be the second initial Public offer to hit the market in 2018, and is one of about nine that is expected to go public this year. Sygnus Credit is expected to come to market within weeks having sent the prospectus to the authorities for vetting in February.