Carib Cement dropped sharply from record close on Monday.

Caribbean Cement dropped $8.90 to lead four stocks declining $2.50 or more, on the Jamaica Stock Exchange ended on Tuesday and helped to send the market index into a fall.

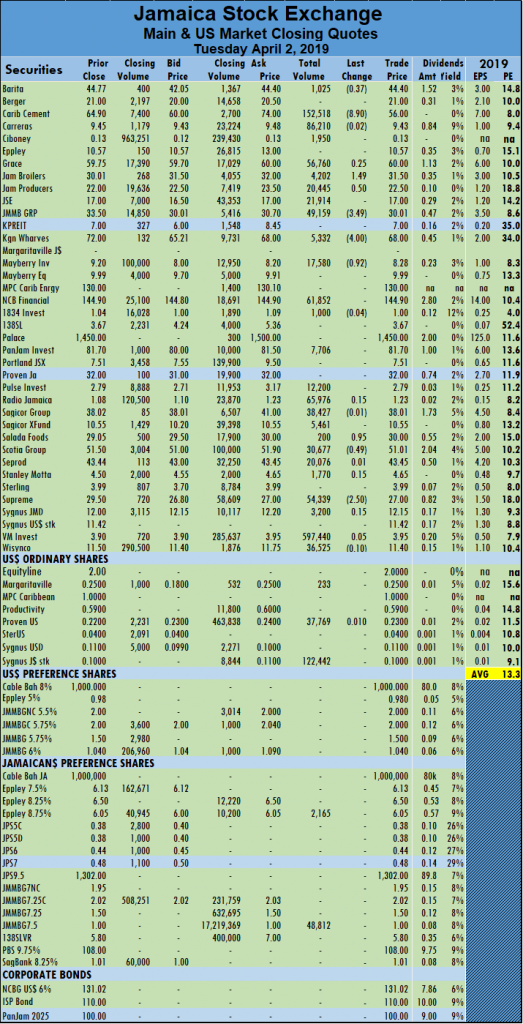

Investors pushed Cement to $67 in early trading but some selling came in to move the price lower to $56, but the stock closed with the bid at $60. Supreme Ventures that closed at a record high of $29.50 fell by $2.50 at the close. JMMB Group lost $3.49 and Kingston Wharves was down $4 at the close.

At the end of trading the Jamaica Stock Exchange main market retreated a bit from its upward climb to the record high of November last year and is now within 8,000 points away.

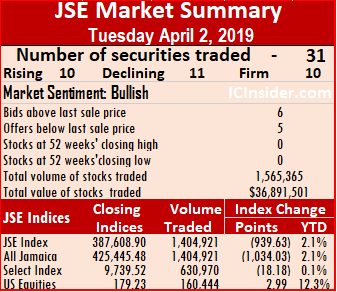

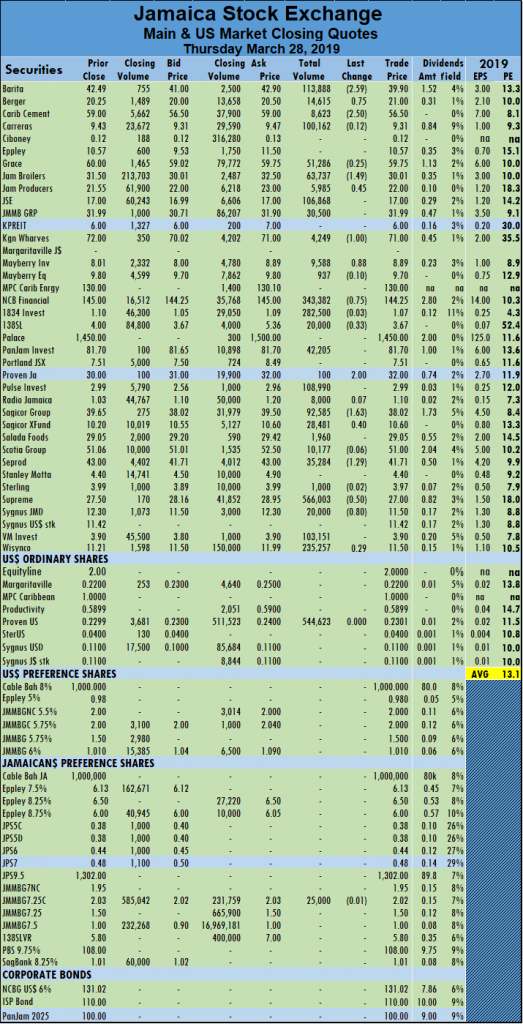

The JSE All Jamaican Composite Index lost 1,034.03 points to end at 425,445.48 and the JSE Index declined by 939.63 points to 387,608.90.

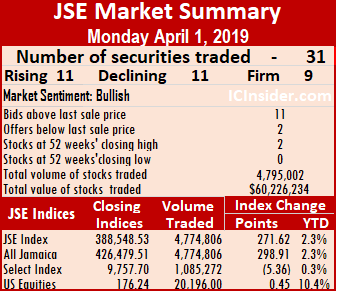

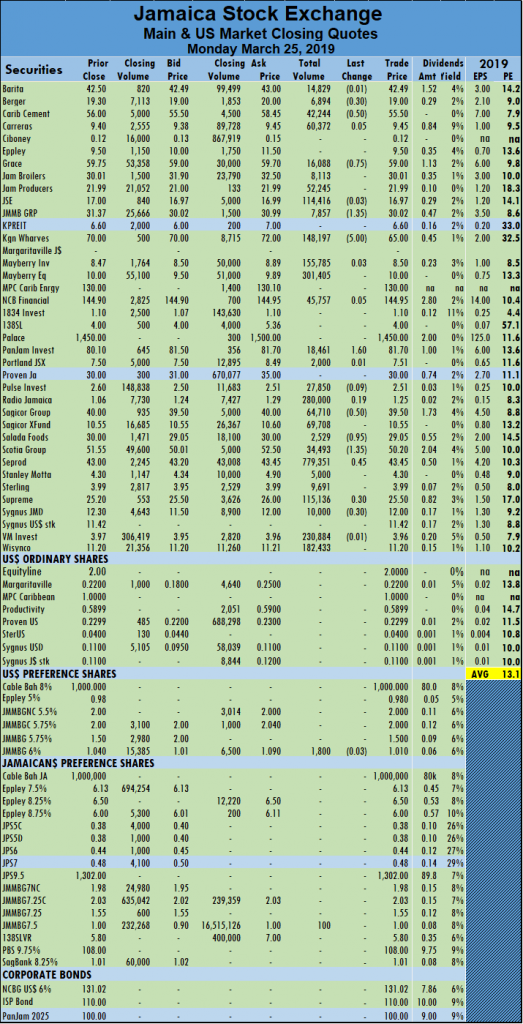

At the close of the main and US markets, 31 securities traded, compared to 35 on Monday and leading to 11 advancing, 11 declining and 9 closing unchanged.

Trading ended with 1,404,921 units at just $34,225,857 crossing the exchange, compared to 4,774,806 units valued at $58,420,189 changing hands on Monday.

On a day of low volumes, Victoria Mutual Investments led trading with 597,440 shares, and no other stock came close.

Market activity ended with an average of 50,176 units valued at an average of $1,222,352 for each security traded. In contrast to 170,529 units for an average of $2,086,435 on Monday. The average volume and value for the month to date amounts to 110,352 units valued at $1,654,394. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 6 stocks ending with bids higher than their last selling prices and 4 closing with lower offers.

In main market activity, Barita Investments fell 37 cents to $44.40, with an exchange of 1,025 shares, Caribbean Cement dropped $8.90 to close at $56, with 152,518 shares changing hands, Jamaica Broilers rose $1.49 in trading 4,202 units to close at $31.50, Jamaica Producers gained 50 cents to close at $22.50, with 20,445 shares changing hands. JMMB Group dropped $3.49 and concluded trading of 49,159 shares at $30.01, Kingston Wharves sank $4 to settle at $68, trading 5,332 units,  Mayberry Investments lost 92 cents trading 17,500 shares to close at $8.28, Salada Foods rose 95 cents in closing at $30, with 200 shares changing hands. Scotia Group dropped 49 cents trading 30,677 shares at $51.01, Seprod rose $1.29 to close at $43.44 in trading 2,351 shares, Supreme Ventures dropped $2.50 to finish at a record high of $27, with an exchange of 111,448 units.

Mayberry Investments lost 92 cents trading 17,500 shares to close at $8.28, Salada Foods rose 95 cents in closing at $30, with 200 shares changing hands. Scotia Group dropped 49 cents trading 30,677 shares at $51.01, Seprod rose $1.29 to close at $43.44 in trading 2,351 shares, Supreme Ventures dropped $2.50 to finish at a record high of $27, with an exchange of 111,448 units.

Trading in the US dollar market resulted in 160,444 units valued at over $20,989 changing hands. Margaritaville closed 25 US cents while trading with 233 shares, Proven Investments gained 1 cents trading 37,769 at 23 US cents and Sygnus Credit Investments exchanged 122,442 shares at 10 US cents. The JSE USD Equities Index gained 2.99 points to close at 179.23.

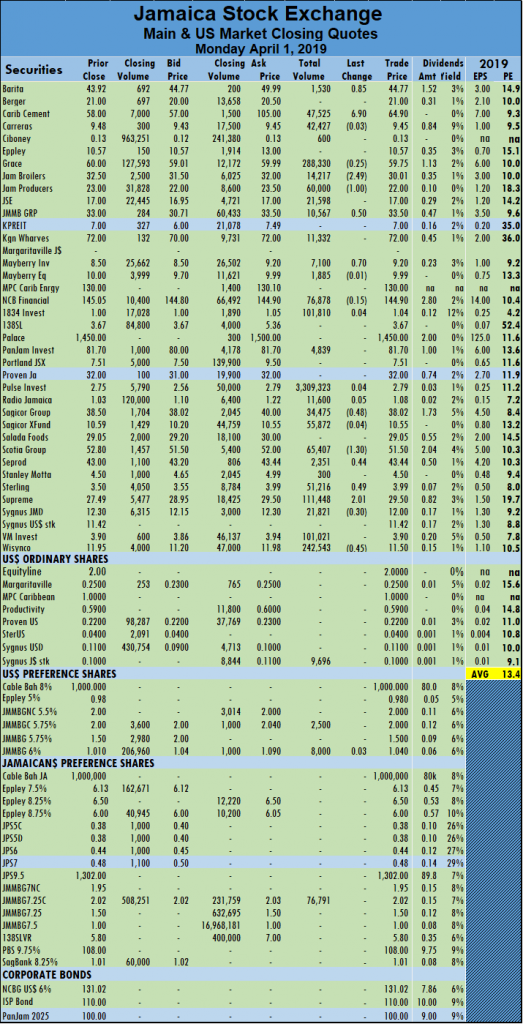

trading 7,100 shares to close at $9.20, Sagicor Group declined 48 cents to settle at $38.02, with 34,475 shares changing hands. Scotia Group dropped $1.30 trading 65,407 shares at $51.50, Seprod rose 44 cents to close at $43.44 in trading 2,351 shares, Sterling Investments rose 49 cents and concluded trading at $3.99, with 51,216 stock units. Supreme Ventures rose $2.01 to finish at a record high of $29.50, with an exchange of 111,448 units, Sygnus Credit Investments lost 30 cents in trading 21,821 units, to end at $12 and Wisynco Group lost 45 cents and ended trading of 242,543 shares to close at $11.50.

trading 7,100 shares to close at $9.20, Sagicor Group declined 48 cents to settle at $38.02, with 34,475 shares changing hands. Scotia Group dropped $1.30 trading 65,407 shares at $51.50, Seprod rose 44 cents to close at $43.44 in trading 2,351 shares, Sterling Investments rose 49 cents and concluded trading at $3.99, with 51,216 stock units. Supreme Ventures rose $2.01 to finish at a record high of $29.50, with an exchange of 111,448 units, Sygnus Credit Investments lost 30 cents in trading 21,821 units, to end at $12 and Wisynco Group lost 45 cents and ended trading of 242,543 shares to close at $11.50.

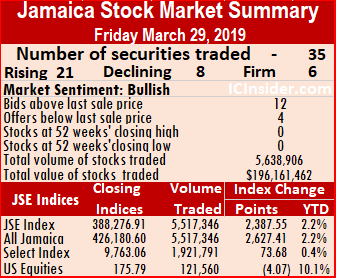

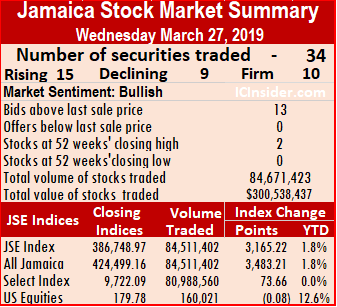

The main market of the Jamaica Stock Exchange in another drive to take out the record high of November last year closed March within 7,000 points of the record high.

The main market of the Jamaica Stock Exchange in another drive to take out the record high of November last year closed March within 7,000 points of the record high.  Mayberry Jamaican Equities with 701,614 shares amounting to 13 percent of the overall volume.

Mayberry Jamaican Equities with 701,614 shares amounting to 13 percent of the overall volume. $38.50, with 57,957 shares changing hands. Scotia Group climbed $1.80 trading 87,138 shares at $52.80, Seprod rose $1.29 to close at $43 in trading 49,920 shares, Sterling Investments lost 47 cents and concluded trading at $3.50, with 41,000 stock units. Supreme Ventures rose 49 cents to finish at $27.49, with an exchange of 173,445 units, Sygnus Credit Investments rose 80 cents with 24,000 units trading, to end at $12.30 and Wisynco Group gained 45 cents and ended trading of 58,584 shares to close at $11.95.

$38.50, with 57,957 shares changing hands. Scotia Group climbed $1.80 trading 87,138 shares at $52.80, Seprod rose $1.29 to close at $43 in trading 49,920 shares, Sterling Investments lost 47 cents and concluded trading at $3.50, with 41,000 stock units. Supreme Ventures rose 49 cents to finish at $27.49, with an exchange of 173,445 units, Sygnus Credit Investments rose 80 cents with 24,000 units trading, to end at $12.30 and Wisynco Group gained 45 cents and ended trading of 58,584 shares to close at $11.95. Jamaican stocks pulled in trading on the main market of the Jamaica Stock Exchange on Thursday with the market falling under 1,000 points was the volume and value declined sharply from Wednesday’s level.

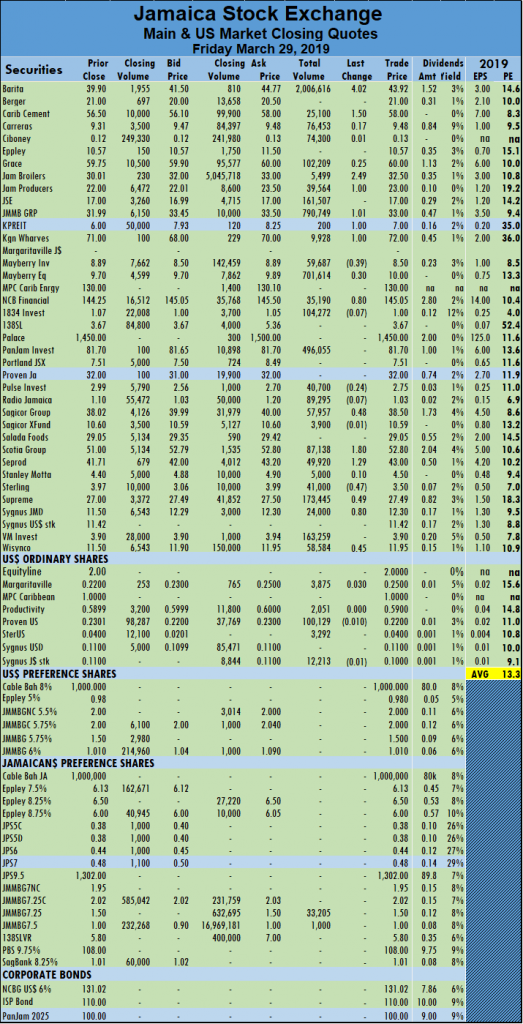

Jamaican stocks pulled in trading on the main market of the Jamaica Stock Exchange on Thursday with the market falling under 1,000 points was the volume and value declined sharply from Wednesday’s level.  $10,473,147 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded.

$10,473,147 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded. Jamaica Producers rose 45 cents to close at $22, with 5,985 shares changing hands, Kingston Wharves fell $1 and finished at $71, with an exchange of 4,249 stock units. Mayberry Investments gained 88 cents trading 9,588 shares to close at $8.89, NCB Financial Group lost 75 cents trading 343,382 shares at $144.25, Proven Investments traded 100 units and rose $2 to end at $32, Sagicor Group lost $1.63 to settle at $38.02, with 92,585 shares changing hands. Sagicor Real Estate Fund traded 28,481 shares after rising 40 cents at $10.60, Scotia Group finished trading at $52.80, with 87,138 shares, Seprod fell $1.29 to close at $41.71 in trading 35,284 shares, Supreme Ventures lost 50 cents to finish at $27, with an exchange of 566,003 units and Sygnus Credit Investments lost 80 cents with 20,000 units trading, to end at $11.50.

Jamaica Producers rose 45 cents to close at $22, with 5,985 shares changing hands, Kingston Wharves fell $1 and finished at $71, with an exchange of 4,249 stock units. Mayberry Investments gained 88 cents trading 9,588 shares to close at $8.89, NCB Financial Group lost 75 cents trading 343,382 shares at $144.25, Proven Investments traded 100 units and rose $2 to end at $32, Sagicor Group lost $1.63 to settle at $38.02, with 92,585 shares changing hands. Sagicor Real Estate Fund traded 28,481 shares after rising 40 cents at $10.60, Scotia Group finished trading at $52.80, with 87,138 shares, Seprod fell $1.29 to close at $41.71 in trading 35,284 shares, Supreme Ventures lost 50 cents to finish at $27, with an exchange of 566,003 units and Sygnus Credit Investments lost 80 cents with 20,000 units trading, to end at $11.50.

hands, JMMB Group rose 99 cents trading of 342,433 shares to close at $31.99. Kingston Properties lost 60 cents to settle at $6, trading 1,673 units, Kingston Wharves jumped $1.99 and finished at $72, with an exchange of 80,966 stock units, Mayberry Investments lost 49 cents trading 287,560 shares to close at $8.01, NCB Financial Group gained 30 cents trading 416,046 shares at $145. Pulse Investments gained 49 cents to finish at $2.99, with 183,602 shares trading, Sagicor Group rose 65 cents to settle at $39.65, with 334,231 shares changing hands. Seprod fell 45 cents to close at $43 in trading 53,653 shares and Supreme Ventures rose $1.50 to finish at a 52 weeks’ closing high of $27.50, with an exchange of 945,125 units.

hands, JMMB Group rose 99 cents trading of 342,433 shares to close at $31.99. Kingston Properties lost 60 cents to settle at $6, trading 1,673 units, Kingston Wharves jumped $1.99 and finished at $72, with an exchange of 80,966 stock units, Mayberry Investments lost 49 cents trading 287,560 shares to close at $8.01, NCB Financial Group gained 30 cents trading 416,046 shares at $145. Pulse Investments gained 49 cents to finish at $2.99, with 183,602 shares trading, Sagicor Group rose 65 cents to settle at $39.65, with 334,231 shares changing hands. Seprod fell 45 cents to close at $43 in trading 53,653 shares and Supreme Ventures rose $1.50 to finish at a 52 weeks’ closing high of $27.50, with an exchange of 945,125 units. Trading on the main market of the Jamaica Stock Exchange ended on Tuesday with JSE All Jamaican Composite Index recovered 2,246.27 points it lost on Monday to reach 421,015.95 and the JSE Index regained 2,041.20 points to end at 383,583.75.

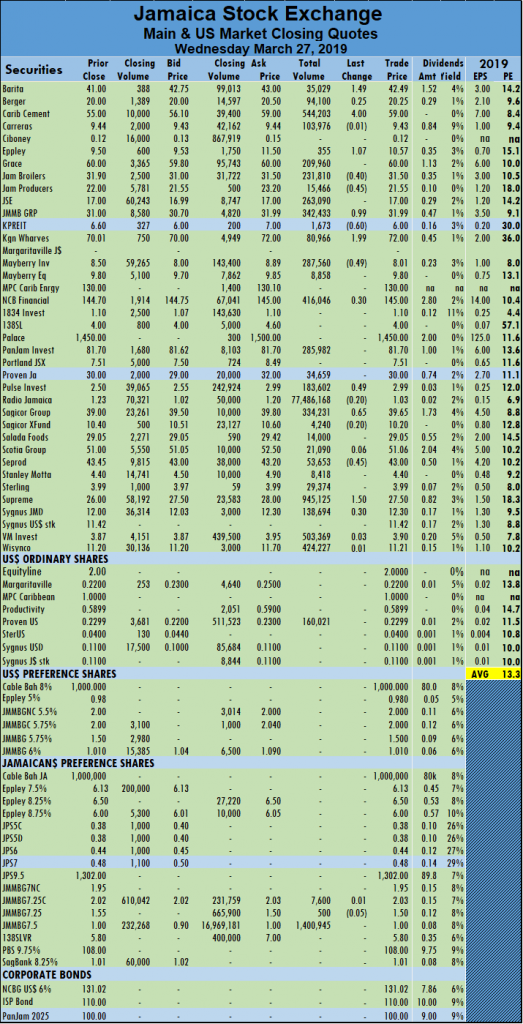

Trading on the main market of the Jamaica Stock Exchange ended on Tuesday with JSE All Jamaican Composite Index recovered 2,246.27 points it lost on Monday to reach 421,015.95 and the JSE Index regained 2,041.20 points to end at 383,583.75. and Victoria Mutual Investments with 367,668 shares amounting to 10 percent of the overall volume.

and Victoria Mutual Investments with 367,668 shares amounting to 10 percent of the overall volume. 50 cents to close at $55, with 41,992 shares changing hands. Grace Kennedy gained $1 trading 1,667,776 stock units, to close at $59, Jamaica Broilers climbed $1.89 and finished trading 4,783 units at $31.90, JMMB Group rose 98 cents trading of 57,316 shares to close at $31. Kingston Wharves jumped $5.01 and finished at $70.01, with an exchange of 2,179 stock units, NCB Financial Group lost 25 cents and ended trading 85,329 shares at $144.70, Sagicor Group lost 50 cents to settle at $39, with 10,211 shares changing hands. Scotia Group gained 80 cents, trading 1,672 shares, to close at $51, Supreme Ventures rose 50 cents to finish at a 52 weeks’ closing high of $26, with an exchange of 120,455 units.

50 cents to close at $55, with 41,992 shares changing hands. Grace Kennedy gained $1 trading 1,667,776 stock units, to close at $59, Jamaica Broilers climbed $1.89 and finished trading 4,783 units at $31.90, JMMB Group rose 98 cents trading of 57,316 shares to close at $31. Kingston Wharves jumped $5.01 and finished at $70.01, with an exchange of 2,179 stock units, NCB Financial Group lost 25 cents and ended trading 85,329 shares at $144.70, Sagicor Group lost 50 cents to settle at $39, with 10,211 shares changing hands. Scotia Group gained 80 cents, trading 1,672 shares, to close at $51, Supreme Ventures rose 50 cents to finish at a 52 weeks’ closing high of $26, with an exchange of 120,455 units.

148,197 stock units, PanJam Investment rose $1.60 to close at $81.70, trading 18,461 units, Sagicor Group lost 50 cents to settle at $39.50, with 64,710 shares changing hands. Salada Foods fell 95 cents in trading 2,529 units at $29.05, Scotia Group dropped $1.35 trading 34,493 shares, to close at $50.20,

148,197 stock units, PanJam Investment rose $1.60 to close at $81.70, trading 18,461 units, Sagicor Group lost 50 cents to settle at $39.50, with 64,710 shares changing hands. Salada Foods fell 95 cents in trading 2,529 units at $29.05, Scotia Group dropped $1.35 trading 34,493 shares, to close at $50.20,

JMMB Group rose 37 cents in concluding trading of 25,478 shares at $31.37. Kingston Wharves dropped $2 and finished at $70, with an exchange of 2,518 stock units, Mayberry Investments lost 53 cents to end trading of 79,692 shares at $8.47, Mayberry Jamaica Equities traded 38,242 shares after rising by 55 cents to close at $10. PanJam Investment fell $1.60 to close at $80.10, trading 70,826 units, Sagicor Group gained 45 cents and settled at $40, with 18,955 shares changing hands, Scotia Group climbed $1.35 trading 1,148,109 shares to close at $51.55 and Sygnus Credit Investments fell $1.05 to close of $12.30, with 180,000 units changing hands.

JMMB Group rose 37 cents in concluding trading of 25,478 shares at $31.37. Kingston Wharves dropped $2 and finished at $70, with an exchange of 2,518 stock units, Mayberry Investments lost 53 cents to end trading of 79,692 shares at $8.47, Mayberry Jamaica Equities traded 38,242 shares after rising by 55 cents to close at $10. PanJam Investment fell $1.60 to close at $80.10, trading 70,826 units, Sagicor Group gained 45 cents and settled at $40, with 18,955 shares changing hands, Scotia Group climbed $1.35 trading 1,148,109 shares to close at $51.55 and Sygnus Credit Investments fell $1.05 to close of $12.30, with 180,000 units changing hands.