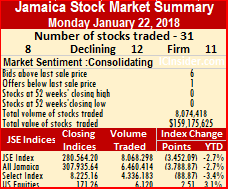

Prices mostly tumbled on the Main Market of the Jamaica Stock Exchange on Monday leading to the JSE All Jamaican Composite Index dived 3,788.87 points to 307,935.64 and the JSE Index dropped 3,452.09 points to 280,564.20.

Prices mostly tumbled on the Main Market of the Jamaica Stock Exchange on Monday leading to the JSE All Jamaican Composite Index dived 3,788.87 points to 307,935.64 and the JSE Index dropped 3,452.09 points to 280,564.20.

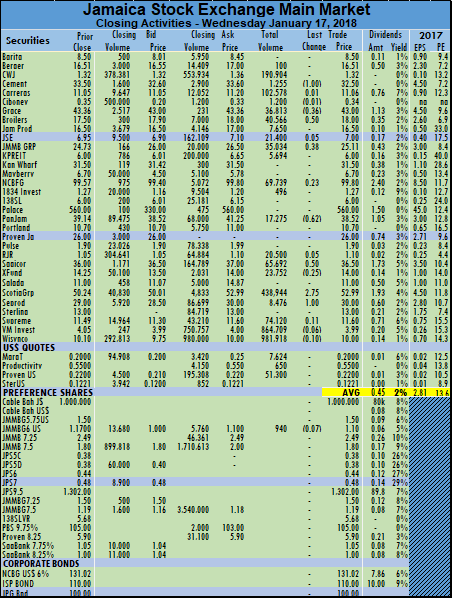

Main and US market activities ended with 8 stocks rising, 12 declining and 11 trading firm as 27 securities traded versus 22 on Friday in the main market and 4 in the US market.

Market activity ended with 8,068,298 shares valued at $158,749,884, in contrast to 5,850,045 shares valued at $76,630,033 on Friday.

Trading in the US dollar market ended with 6,120 units changing hands with a value of US$11,012. The JSE US Equities Index closed with a gain of 2.51 points to end at 171.26 with 1 ordinary stock rising and 1 in the preference market declining.

Market activity resulted from JMMB 6% preference shares falling 2 cents in ending at US$1.08 with 2,000 stock units, Margaritaville rose 5 cents, concluding trading of 1,750 units at 25 US cents, Productivity Business finished trading at 55 US cents with 870 shares and Proven Investments trading 1,500 ordinary shares at 22 US cents.

Market activity resulted from JMMB 6% preference shares falling 2 cents in ending at US$1.08 with 2,000 stock units, Margaritaville rose 5 cents, concluding trading of 1,750 units at 25 US cents, Productivity Business finished trading at 55 US cents with 870 shares and Proven Investments trading 1,500 ordinary shares at 22 US cents.

Trading ended with an average of 298,826 units for an average of $5,879,625 in contrast to 265,911 units for an average of $3,483,183 on Friday. The average volume and value for the month to date amounts to 256,686 units valued at $6,288,571 and previously 256,118 units valued at $6,475,597. December closed with average of 686,156 units valued at an average of $8,654,832 for each security traded.

IC bid-offer Indicator| At the end of trading in the main and the US dollar markets,

Caribbean Cement dropped $4.50 to $30.50 on Monday.

the Investor’s Choice bid-offer indicator reading shows 6 stocks ended with bids higher than their last selling prices and 1 with a lower offer.

The major movers at the close of the market are, Cable & Wireless with 1.2 million units, Jamaica Producers with 2 million shares and Wisynco Group exchanged 1.1 million units.

Price changes saw, Caribbean Cement dropped $4.50 to $30.50, JMMB Group falling $1.50 to close at $24.50, Kingston Wharves dropped $3 to $30.50, Sagicor Group gained $1 to end at $36 and Seprod fell $1.19 to close at $28.81.

For more details of market activities see – Trading picks up on JSE but prices dip.

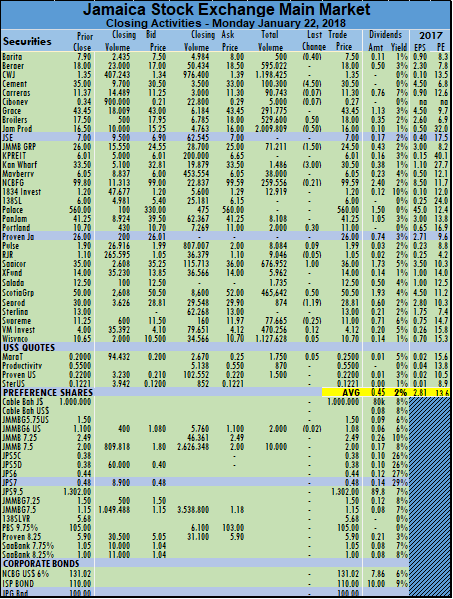

Radio Jamaica settled with a loss of 5 cents at $1.05, with 9,046 shares, Sagicor Group ended trading $1 higher at $36, with 676,952 stock units, Sagicor Real Estate Fund ended trading at $14, with 5,962 shares, Salada Foods traded at $12.50, with 1,735 units, Scotia Group finished trading 50 cents higher at $50.50, with 465,642 shares. Seprod closed with a loss of $1.19 at $28.81, with 874 shares, Supreme Ventures concluded trading with a loss of 25 cents at $11, with 77,665 stock units, VM Investments Limited finished 12 cents higher at $4.12, with 470,256 units and Wisynco Group settled 5 cents higher at $10.70, with 1,127,628 shares. In the main market preference segment, Jamaica Money Market traded at $2, with 10,000 stock units changing hands.

Radio Jamaica settled with a loss of 5 cents at $1.05, with 9,046 shares, Sagicor Group ended trading $1 higher at $36, with 676,952 stock units, Sagicor Real Estate Fund ended trading at $14, with 5,962 shares, Salada Foods traded at $12.50, with 1,735 units, Scotia Group finished trading 50 cents higher at $50.50, with 465,642 shares. Seprod closed with a loss of $1.19 at $28.81, with 874 shares, Supreme Ventures concluded trading with a loss of 25 cents at $11, with 77,665 stock units, VM Investments Limited finished 12 cents higher at $4.12, with 470,256 units and Wisynco Group settled 5 cents higher at $10.70, with 1,127,628 shares. In the main market preference segment, Jamaica Money Market traded at $2, with 10,000 stock units changing hands.

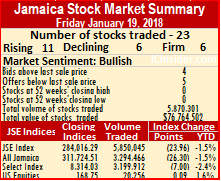

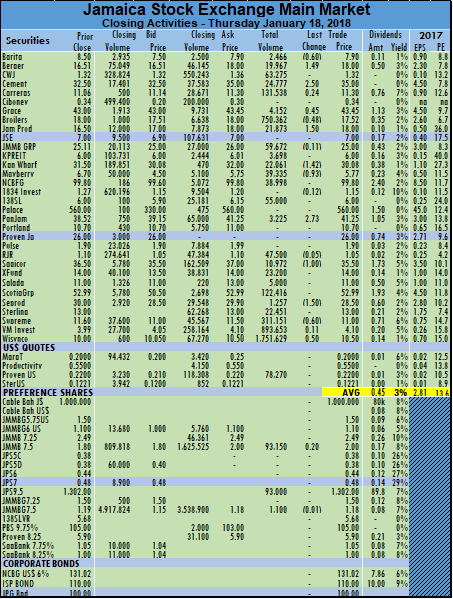

Caribbean Cement settled at $35, with 1,500 shares, Grace Kennedy traded at $43.45, with 3,391 stock units, Jamaica Broilers finished trading with a loss of 2 cents at $17.50, with 230,169 units. Jamaica Producers closed with a loss of $1.50 at $16.50, with 12,700 shares, Jamaica Stock Exchange ended at $7, with 24,145 shares,

Caribbean Cement settled at $35, with 1,500 shares, Grace Kennedy traded at $43.45, with 3,391 stock units, Jamaica Broilers finished trading with a loss of 2 cents at $17.50, with 230,169 units. Jamaica Producers closed with a loss of $1.50 at $16.50, with 12,700 shares, Jamaica Stock Exchange ended at $7, with 24,145 shares, NCB Financial Group traded at $99.80, with 59,009 shares, 1834 Investments finished trading 5 cents higher at $1.20, with 4,504 shares. Radio Jamaica rose 5 cents to close at $1.10, with 5,000 shares, Sagicor Group ended trading with a loss of 50 cents at $35, with 311,149 stock units, Salada Foods traded $1.50 higher at $12.50, with 220 units, Scotia Group finished trading with a loss of $2.99 to close at $50, with 637,638 shares. Seprod closed with a rise of $1.50 to $30, with 6,597 shares, Supreme Ventures concluded trading 25 cents higher at $11.25, with 1,101,640 stock units, VM Investments Limited finished with a loss of 10 cents at $4, with 462,166 units and Wisynco Group settled 15 cents higher at $10.65, with 433,313 shares. In the main market preference segment, JMMB Group 7.5% closed with a loss of 3 cents at $1.15, with 1,660,100 shares.

NCB Financial Group traded at $99.80, with 59,009 shares, 1834 Investments finished trading 5 cents higher at $1.20, with 4,504 shares. Radio Jamaica rose 5 cents to close at $1.10, with 5,000 shares, Sagicor Group ended trading with a loss of 50 cents at $35, with 311,149 stock units, Salada Foods traded $1.50 higher at $12.50, with 220 units, Scotia Group finished trading with a loss of $2.99 to close at $50, with 637,638 shares. Seprod closed with a rise of $1.50 to $30, with 6,597 shares, Supreme Ventures concluded trading 25 cents higher at $11.25, with 1,101,640 stock units, VM Investments Limited finished with a loss of 10 cents at $4, with 462,166 units and Wisynco Group settled 15 cents higher at $10.65, with 433,313 shares. In the main market preference segment, JMMB Group 7.5% closed with a loss of 3 cents at $1.15, with 1,660,100 shares.

IC bid-offer Indicator| At the end of trading in the main and the US dollar markets, the Investor’s Choice bid-offer indicator reading shows 2 stocks ended with bids higher than their last selling prices and 4 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and the US dollar markets, the Investor’s Choice bid-offer indicator reading shows 2 stocks ended with bids higher than their last selling prices and 4 with lower offers.

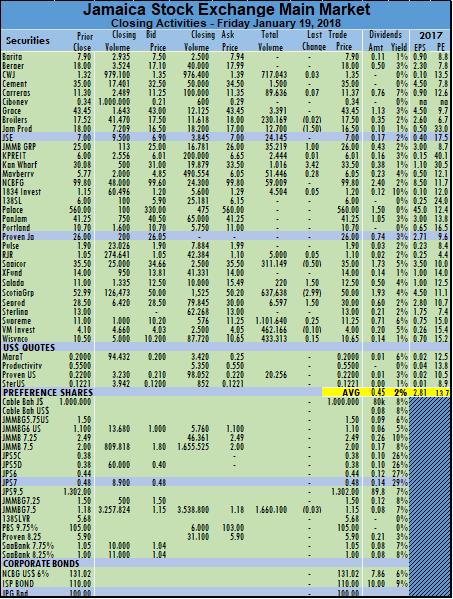

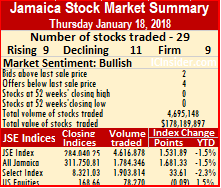

Salada Foods traded at $11, with 5,000 units, Scotia Group finished trading at $52.99, with 122,416 shares, Seprod concluded trading with a loss of $1.50 at $28.50, with 1,257 stock units, Sterling Investments finished at $13, with 22,451 units. Supreme Ventures settled with a loss of 60 cents at $11, with 311,151 shares, VM Investments Limited ended trading 11 cents higher at $4.10, with 893,653 shares, Wisynco Group traded 50 cents higher at $10.50, with 1,751,629 shares and In the main market preference segment, Jamaica Public Service finished at $1,302, with 93,000 shares, Jamaica Money Market traded 93,150 stock units 20 cents higher at $ and JMMB Group closed with a loss of 1 cent at $1.18, trading 1,100 shares.

Salada Foods traded at $11, with 5,000 units, Scotia Group finished trading at $52.99, with 122,416 shares, Seprod concluded trading with a loss of $1.50 at $28.50, with 1,257 stock units, Sterling Investments finished at $13, with 22,451 units. Supreme Ventures settled with a loss of 60 cents at $11, with 311,151 shares, VM Investments Limited ended trading 11 cents higher at $4.10, with 893,653 shares, Wisynco Group traded 50 cents higher at $10.50, with 1,751,629 shares and In the main market preference segment, Jamaica Public Service finished at $1,302, with 93,000 shares, Jamaica Money Market traded 93,150 stock units 20 cents higher at $ and JMMB Group closed with a loss of 1 cent at $1.18, trading 1,100 shares. Victoria Mutual Investments and Wisynco Group dominated trading with nearly 1 million shares trading for each company on the main market of the Jamaica Stock Exchange as investor cnt seem to get enough of these companies.

Victoria Mutual Investments and Wisynco Group dominated trading with nearly 1 million shares trading for each company on the main market of the Jamaica Stock Exchange as investor cnt seem to get enough of these companies.  Caribbean Cement settled with a loss of 1 cent at $32.50, with 1,255 shares, Ciboney Group ended trading with a loss of 1 cent at 34 cents, with 1,200 shares. Grace Kennedy traded with a loss of 36 cents at $43, with 36,813 stock units, Jamaica Broilers finished trading 50 cents higher at $18, with 40,566 units, Jamaica Producers closed at $16.50, with 7,650 shares, Jamaica Stock Exchange ended 5 cents higher at $7, with 21,400 shares. JMMB Group concluded trading 38 cents higher at $25.11, with 35,034 shares, Kingston Properties finished at $6, with 5,694 stock units, NCB Financial Group traded 23 cents higher at $99.80, with 69,739 shares, 1834 Investments finished trading at $1.27, with 496 shares. PanJam Investment ended with a loss of 62 cents at $38.52, with 17,275 units,

Caribbean Cement settled with a loss of 1 cent at $32.50, with 1,255 shares, Ciboney Group ended trading with a loss of 1 cent at 34 cents, with 1,200 shares. Grace Kennedy traded with a loss of 36 cents at $43, with 36,813 stock units, Jamaica Broilers finished trading 50 cents higher at $18, with 40,566 units, Jamaica Producers closed at $16.50, with 7,650 shares, Jamaica Stock Exchange ended 5 cents higher at $7, with 21,400 shares. JMMB Group concluded trading 38 cents higher at $25.11, with 35,034 shares, Kingston Properties finished at $6, with 5,694 stock units, NCB Financial Group traded 23 cents higher at $99.80, with 69,739 shares, 1834 Investments finished trading at $1.27, with 496 shares. PanJam Investment ended with a loss of 62 cents at $38.52, with 17,275 units,  Radio Jamaica settled 5 cents higher at $1.10, with 20,500 shares, Sagicor Group ended trading 50 cents higher at $36.50, with 65,692 stock units, Scotia Group finished trading $2.75 higher at $52.99, with 438,944 shares. Seprod closed $1 higher at $30, with 8,476 shares, Supreme Ventures concluded trading 11 cents higher at $11.60, with 74,120 stock units, VM Investments Limited finished with a loss of 6 cents at $3.99, with 864,709 units, Wisynco Group settled with a loss of 10 cents at $10, with 981,918 shares and Sagicor Real Estate Fund ended trading with a loss of 25 cents at $14, with 23,752 shares.

Radio Jamaica settled 5 cents higher at $1.10, with 20,500 shares, Sagicor Group ended trading 50 cents higher at $36.50, with 65,692 stock units, Scotia Group finished trading $2.75 higher at $52.99, with 438,944 shares. Seprod closed $1 higher at $30, with 8,476 shares, Supreme Ventures concluded trading 11 cents higher at $11.60, with 74,120 stock units, VM Investments Limited finished with a loss of 6 cents at $3.99, with 864,709 units, Wisynco Group settled with a loss of 10 cents at $10, with 981,918 shares and Sagicor Real Estate Fund ended trading with a loss of 25 cents at $14, with 23,752 shares.

Scotia Group finished trading with a loss of 26 cents at $50.24, with 41,045 shares. Sagicor Real Estate Fund ended trading at $14.25, with 874,293 shares, Seprod closed at $29, with 1,920 shares, Supreme Ventures concluded trading with a loss of 21 cents at $11.49, with 2,060 stock units, VM Investments Limited finished with a loss of 5 cents at $4.05, with 541,728 units and Wisynco Group settled 35 cents higher at $10.10, with 470,131 shares. In the main market preference segment, JMMB Group closed 3 cents higher at $1.19, with 100 shares and in the bond market 4,910 units of ISP Finance corporate bonds traded at $110 each.

Scotia Group finished trading with a loss of 26 cents at $50.24, with 41,045 shares. Sagicor Real Estate Fund ended trading at $14.25, with 874,293 shares, Seprod closed at $29, with 1,920 shares, Supreme Ventures concluded trading with a loss of 21 cents at $11.49, with 2,060 stock units, VM Investments Limited finished with a loss of 5 cents at $4.05, with 541,728 units and Wisynco Group settled 35 cents higher at $10.10, with 470,131 shares. In the main market preference segment, JMMB Group closed 3 cents higher at $1.19, with 100 shares and in the bond market 4,910 units of ISP Finance corporate bonds traded at $110 each. The Main Market of the Jamaica Stock Exchange lost ground in moderate trading on Tuesday with an averse advance to decline ratio of almost 2 to 1.

The Main Market of the Jamaica Stock Exchange lost ground in moderate trading on Tuesday with an averse advance to decline ratio of almost 2 to 1.