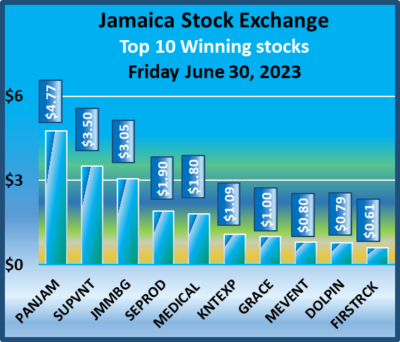

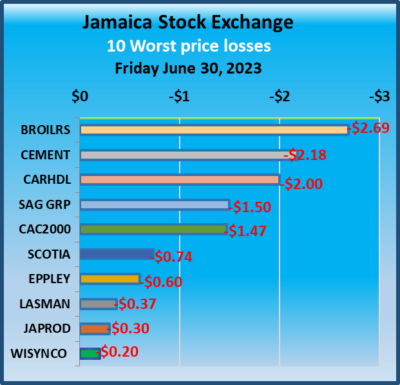

Stocks closed higher on Jamaica Stock Exchange on Friday, with all three markets recording moderate gains following a decline in the volume and the value of stocks trading on the final day of June.

In closing, the JSE Combined Market Index climbed 1,755.88 points to end trading at 346,282.53, at the same time, the All Jamaican Composite Index jumped 2,559.69 points to 370,573.93 and the JSE Main Index popped 1,645.95 points to end at 332,034.93. The Junior Market Index rose 24.04 points to 3,984.23, with all the gains coming within a few minutes of closing as the market ended at the highest point since the first day in February this year and is now down a mere 0.01 percent for the year to date. The JSE USD Market Index rose 9.49 points to 256.40.

In closing, the JSE Combined Market Index climbed 1,755.88 points to end trading at 346,282.53, at the same time, the All Jamaican Composite Index jumped 2,559.69 points to 370,573.93 and the JSE Main Index popped 1,645.95 points to end at 332,034.93. The Junior Market Index rose 24.04 points to 3,984.23, with all the gains coming within a few minutes of closing as the market ended at the highest point since the first day in February this year and is now down a mere 0.01 percent for the year to date. The JSE USD Market Index rose 9.49 points to 256.40.

Preference shares with notable price change but not in the Main Market TOP10 graphs are Eppley 7.50% preference share gained 47 cents to close at $7.17, Jamaica Public Service 7% advanced $9.50 to close at $67 and 138 Student Living preference share rallied $10.20 ended at $85.

At the close, investors exchanged 48,899,684 shares, in all three markets, down sharply from 141,130,337 stocks on Thursday.  The value of stocks trading in the Junior and Main markets was $307.37 million, down from $415.4 million on Thursday. Trading on the JSE USD market ended with investors exchanging 179,896 shares for US$10,636 down from 323,116 units at US$20,789 on Thursday.

The value of stocks trading in the Junior and Main markets was $307.37 million, down from $415.4 million on Thursday. Trading on the JSE USD market ended with investors exchanging 179,896 shares for US$10,636 down from 323,116 units at US$20,789 on Thursday.

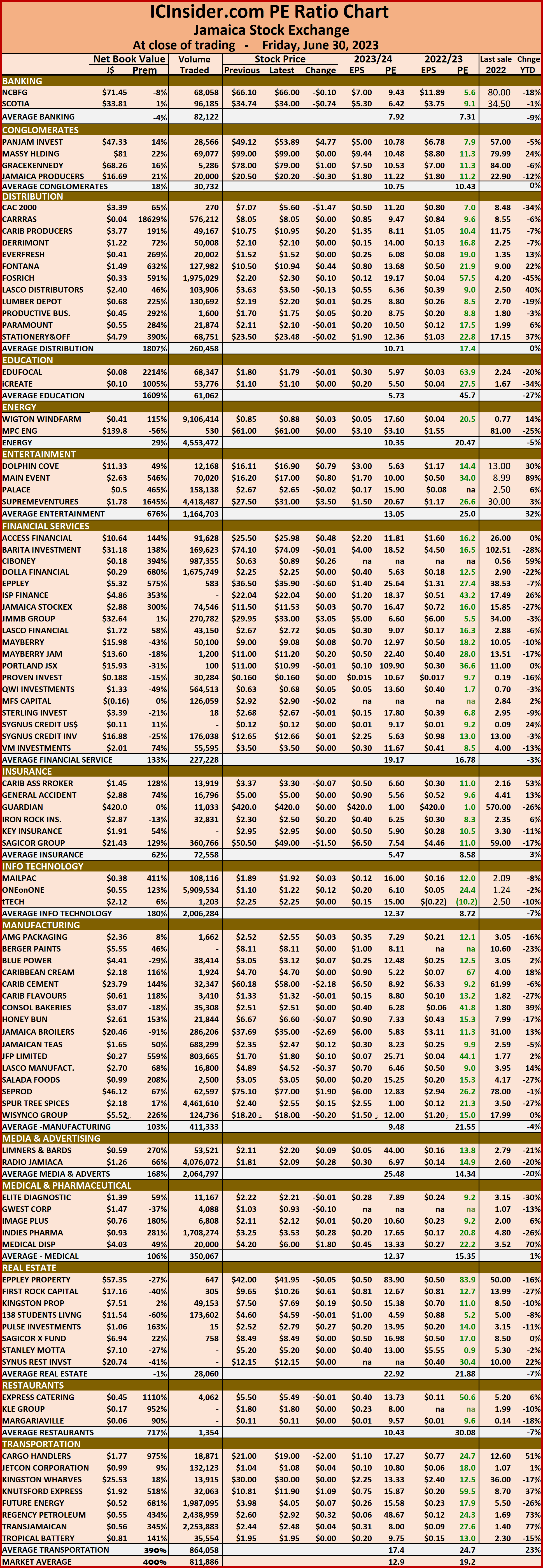

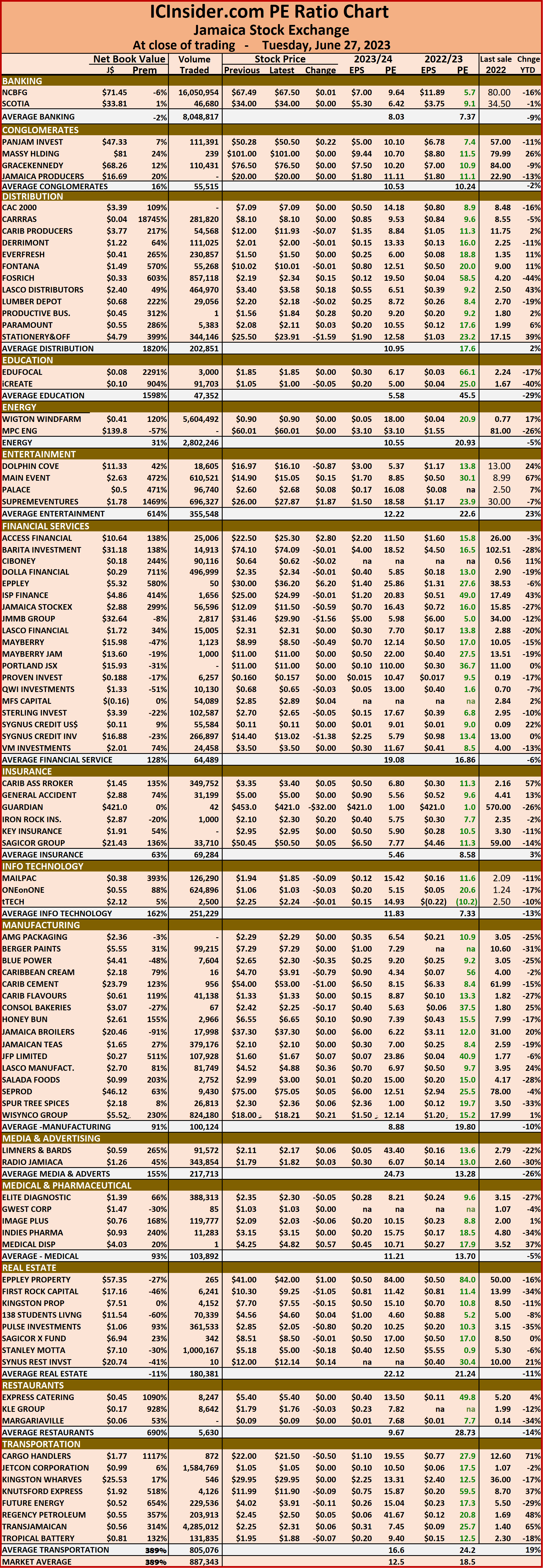

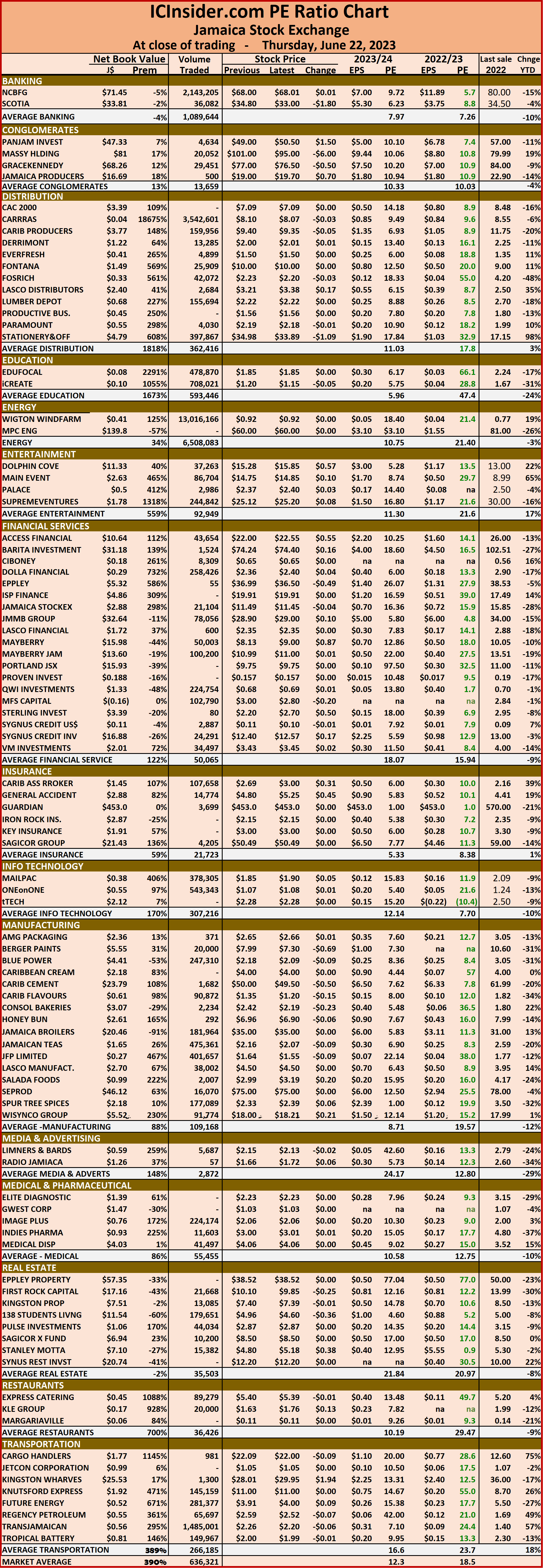

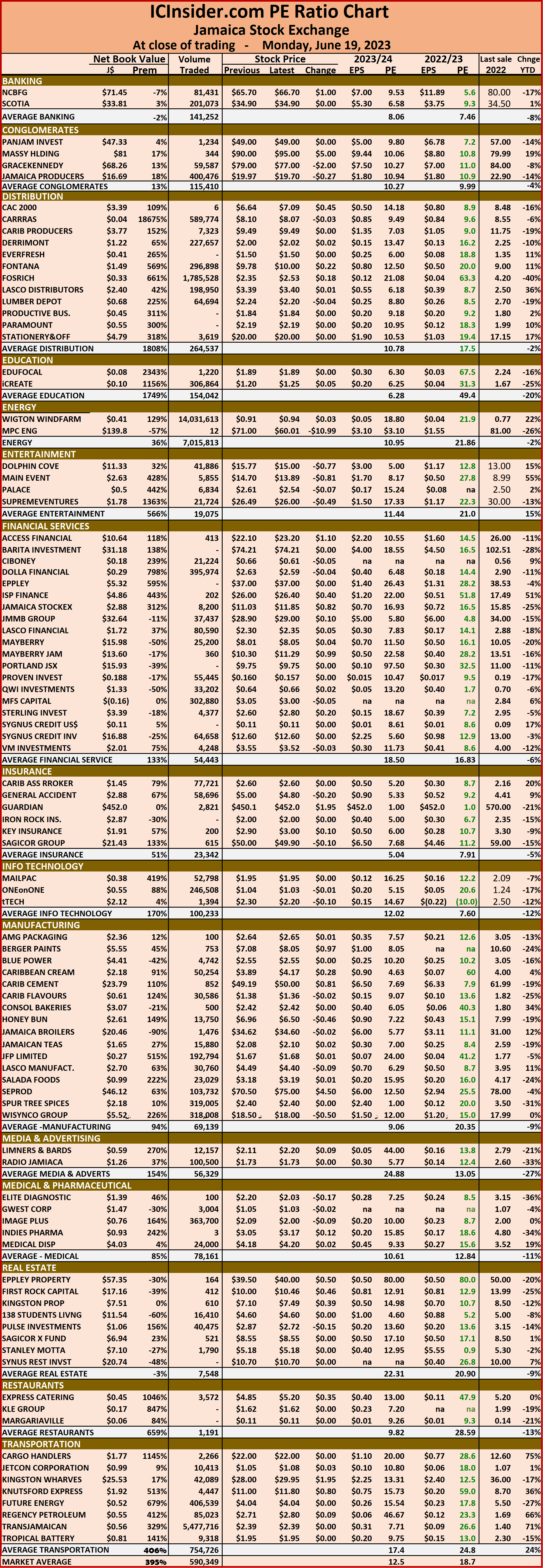

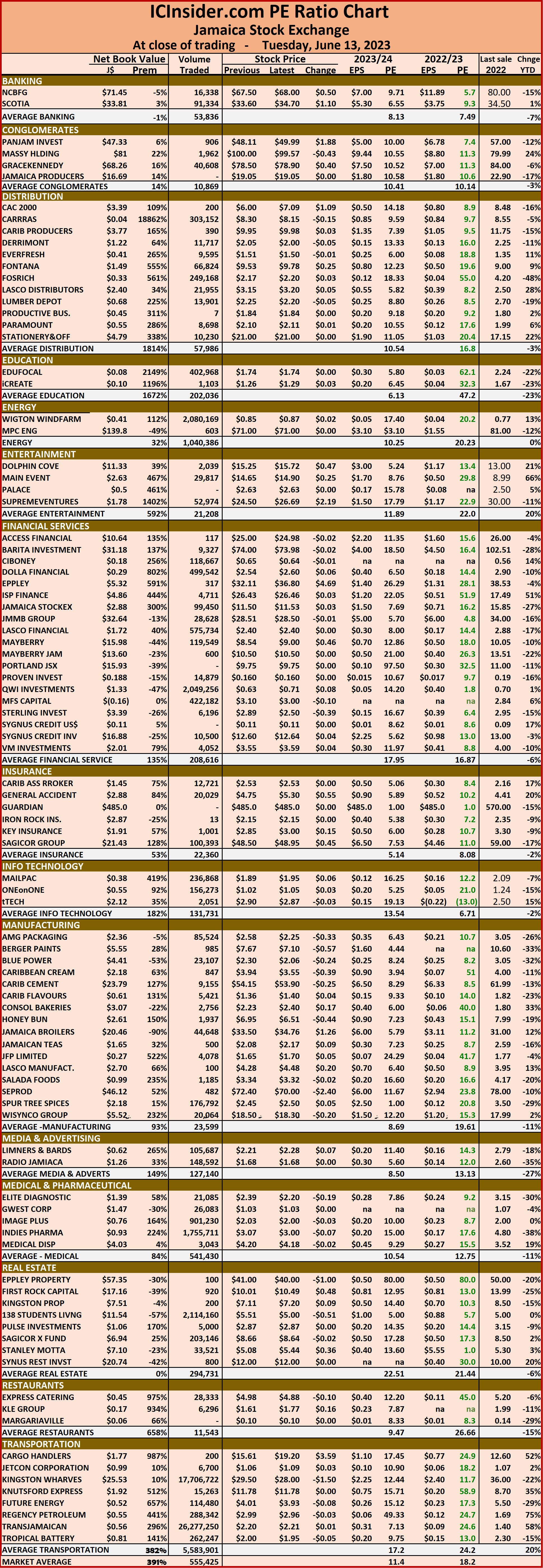

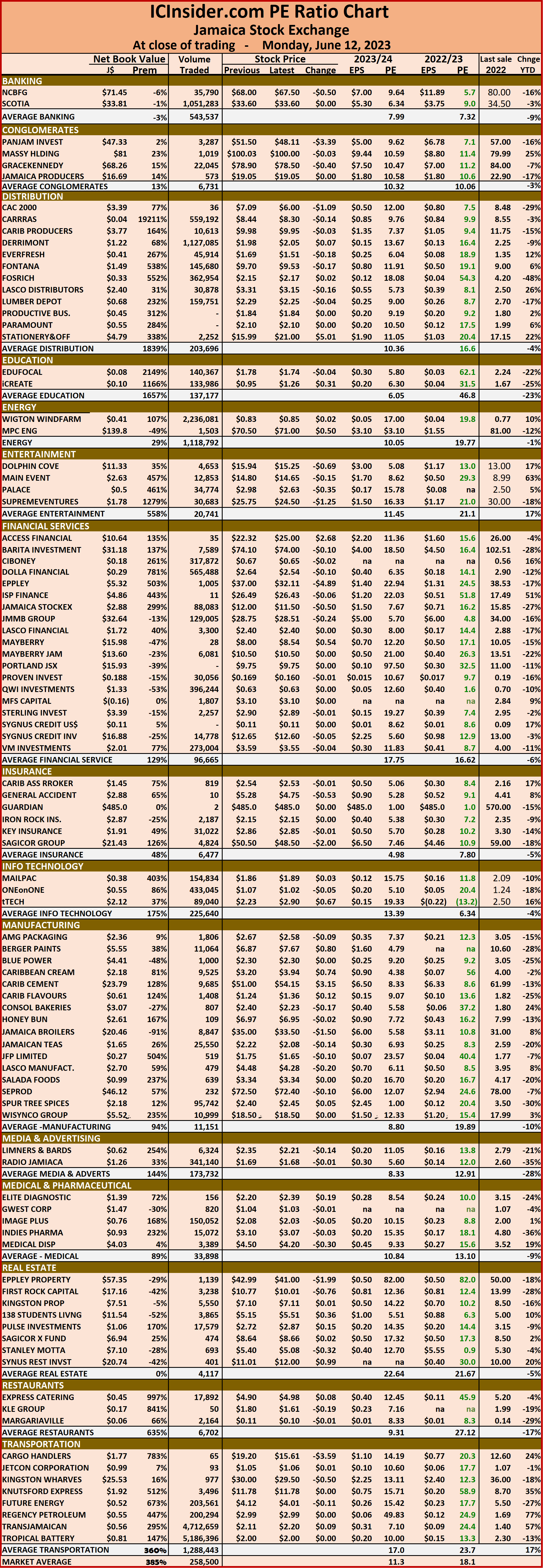

The market’s PE ratio ended at 19.2 on 2022-23 earnings and 12.9 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped per industry, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Trading drops as the JSE rises to close June

Gains in all 3 JSE markets

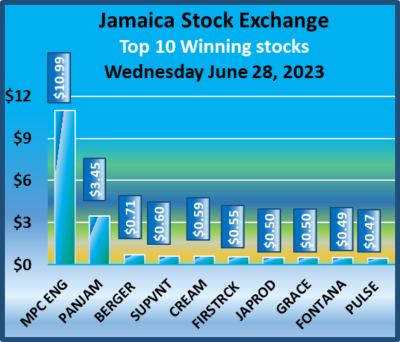

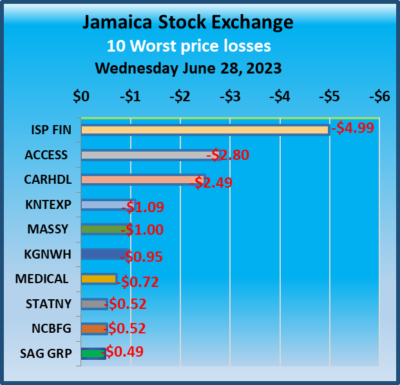

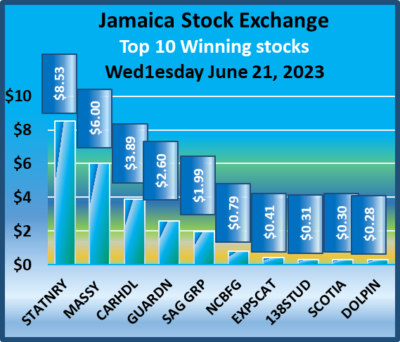

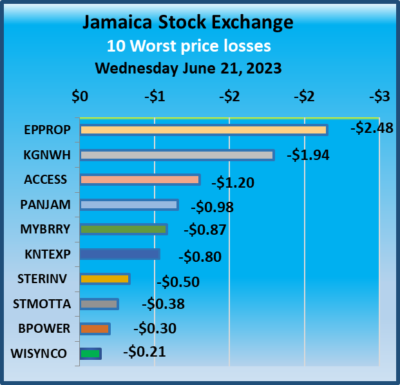

Stocks gained in all three Jamaica Stock Exchange markets on Wednesday but the Junior Market failed to make major inroads into the sharp fall on Tuesday. Trading dropped back from the previous day’s heightened trades that were boosted by the above average daily trade in NCB Financial of 16.05 million shares for $1.06 billion.

At the close, the JSE Combined Market Index climbed 869.73 points to close at 343,451.29, the All Jamaican Composite Index rose 2,113.23 points to 367,304.17, the JSE Main Index popped 902.81 points to 329,758.18, the Junior Market Index inched 2.98 points higher to 3,907.00, while the JSE USD Market Index jumped 7.05 points to finish at 248.42.

At the close, the JSE Combined Market Index climbed 869.73 points to close at 343,451.29, the All Jamaican Composite Index rose 2,113.23 points to 367,304.17, the JSE Main Index popped 902.81 points to 329,758.18, the Junior Market Index inched 2.98 points higher to 3,907.00, while the JSE USD Market Index jumped 7.05 points to finish at 248.42.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are Productive Business 10.50% preference share lost $50 to close at $1200, Eppley 7.25% preference share dropped $2.81 to $16.19, Eppley 7.50% preference share lost $1.08 in closing at $6.09 and Jamaica Public Service 7% advanced $10.57 to close at $50.

At the close, investors exchanged 33,998,142 shares in all three markets, down from 41,956,342 stocks on Tuesday. The value of stocks trading in the Junior and Main markets was $253.9 million, up from $1.18 billion on Tuesday.  Trading on the JSE USD market resulted in investors exchanging 490,501 shares for US$293,958 up from 183,070 units at US$17,969 on Tuesday.

Trading on the JSE USD market resulted in investors exchanging 490,501 shares for US$293,958 up from 183,070 units at US$17,969 on Tuesday.

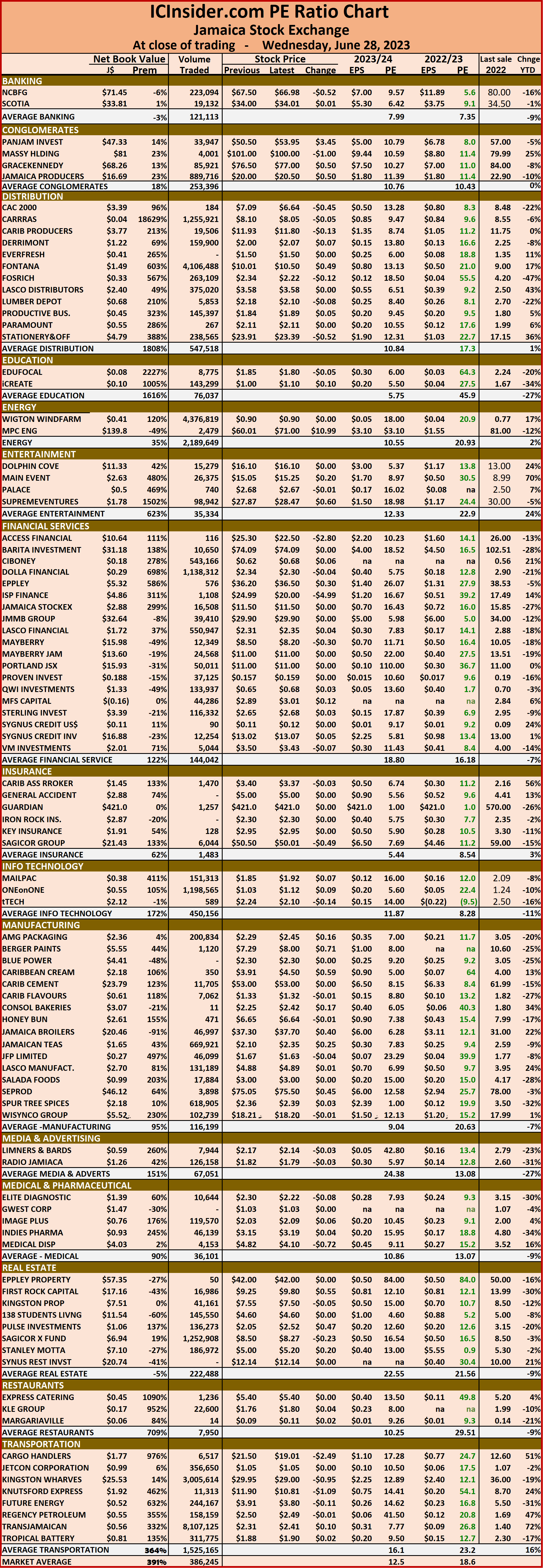

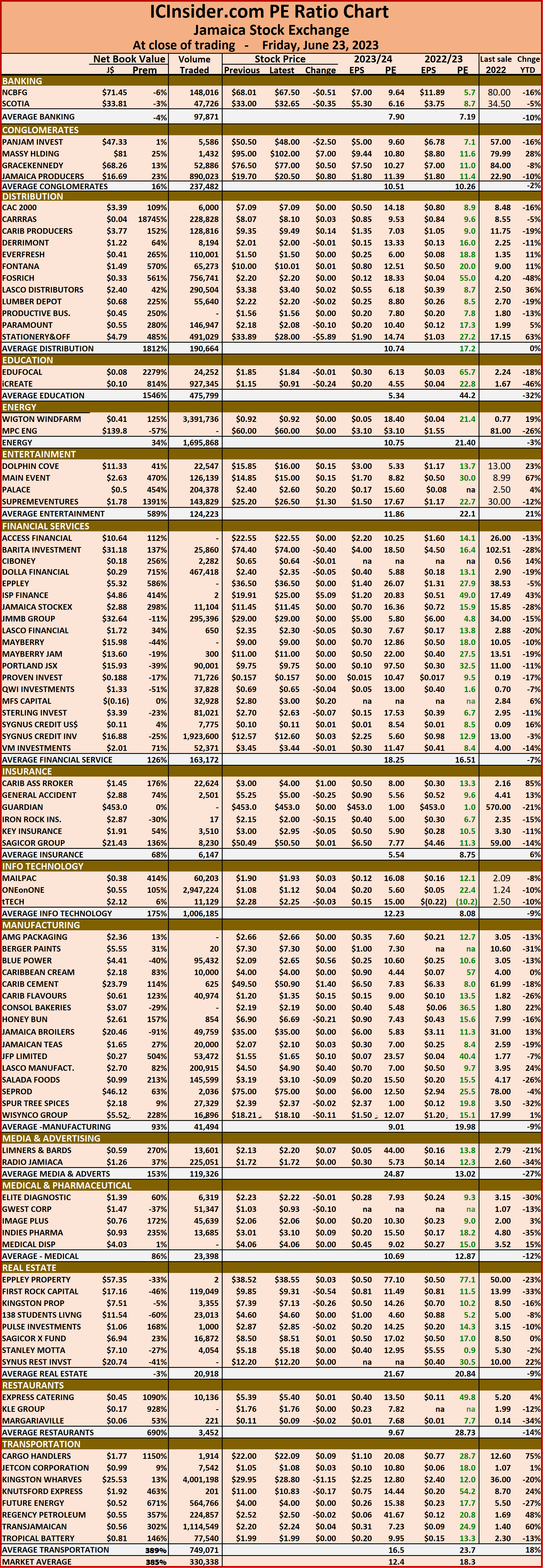

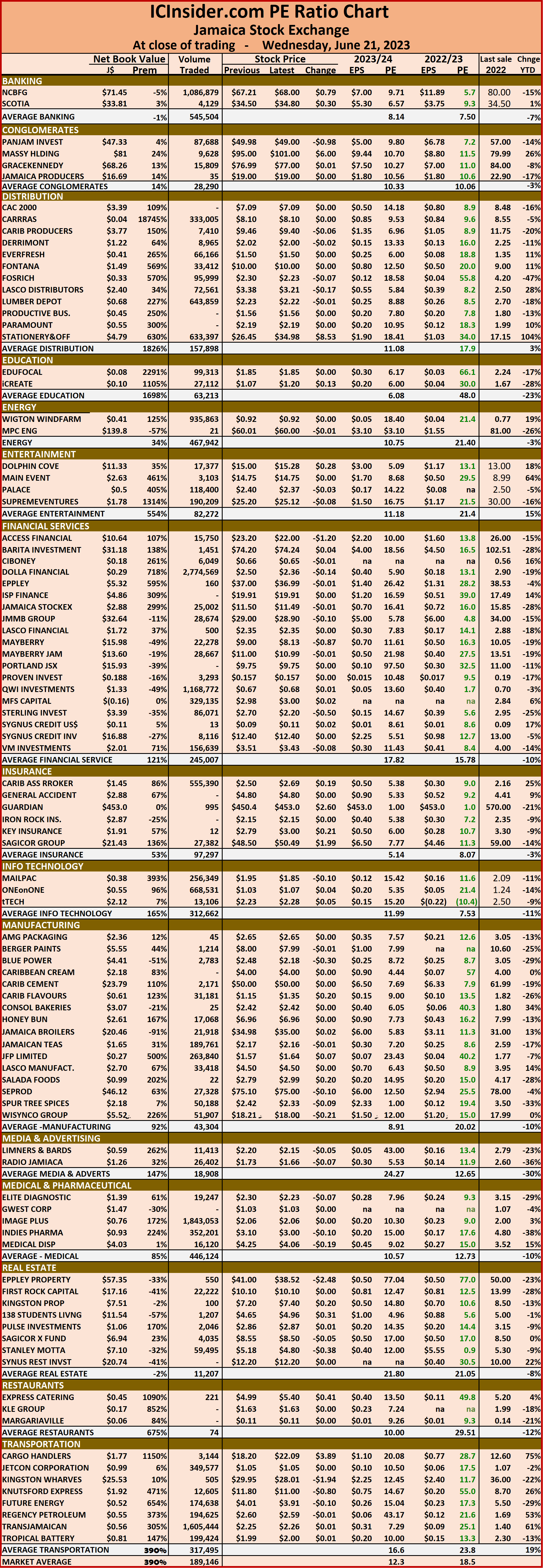

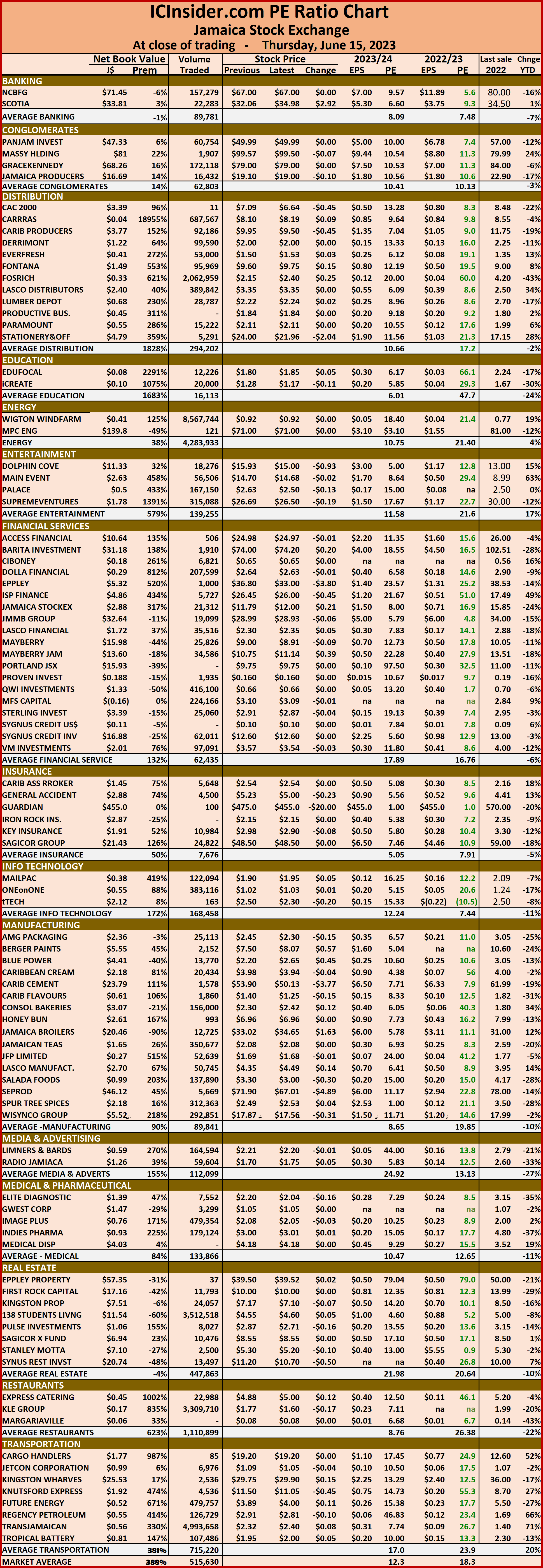

The market’s PE ratio ended at 18.6 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped per industry, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

NCB pushes trading on JSE

The Jamaica stock market failed to hold on to Monday’s gains as the Junior Market had a big fall, while the Main Market slipped but the JSE USD Market jumped sharply as trading picked up considerably compared with that on Monday with NCB Financial swelling trading with 16.05 million shares, with a value of $1.06 billion.

At the close, the JSE Combined Market Index fell 958.7points to 342,581.56, the All Jamaican Composite Index rose 772.25 points to end at 365,190.94, the JSE Main Index shed 518.40 points to settle at 328,855.37, the Junior Market Index dropped 51.89 points to settle at 3,904.02, while the JSE USD Market Index jumped 1.07 points to finish at 241.37.

At the close, the JSE Combined Market Index fell 958.7points to 342,581.56, the All Jamaican Composite Index rose 772.25 points to end at 365,190.94, the JSE Main Index shed 518.40 points to settle at 328,855.37, the Junior Market Index dropped 51.89 points to settle at 3,904.02, while the JSE USD Market Index jumped 1.07 points to finish at 241.37.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are

Eppley 7.75% preference share advanced $1.02 to $20.02, Jamaica Public Service 7% declined $6.96 to $39.43, JMMB Group 7.25% preference share dipped 53 cents to $3.53 and 138 Student Living preference share shed $6.20 in closing at $74.80.

At the close, investors exchanged 41,956,342 shares in all three markets, up from 22,226,900 stocks on Monday. The value of stocks trading in the Junior and Main markets was $1.18 billion, up from $158.6 million on Monday. Trading on the JSE USD market resulted in investors exchanging 183,070 shares for US$17,969 compared to 261,038 units at US$25,992 on Monday.

The market’s PE ratio ended at 18.5 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio ended at 18.5 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Rally for Main & Junior Market

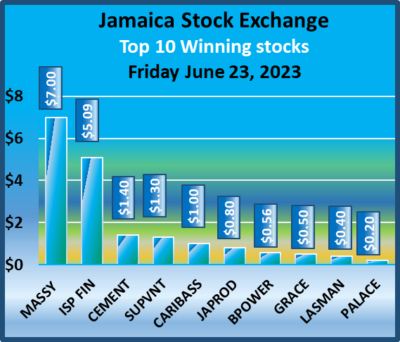

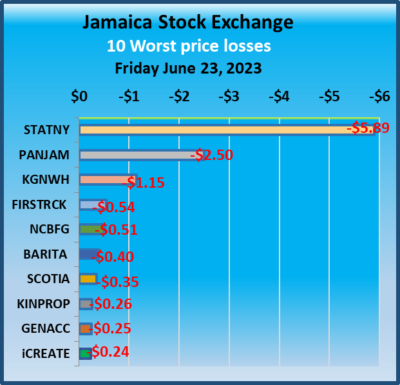

Profit taking pushed the price of Stationery and Office Supplies down to $27 on Friday but the Junior and the Main markets closed higher than on Thursday the JSE USD Market slipped modestly as trading in the overall market fell from Thursday’s levels.

At the close, the JSE Combined Market Index climbed 2,654.49 points to 342,091.21, the All Jamaican Composite Index popped 45.77 points to 361,653.63, the JSE Main Index rallied 2,594.54 points to 327,952.63, the Junior Market Index rose 25.52 points to 3,942.47, while the JSE USD Market Index slipped 0.40 points to 221.67.

At the close, the JSE Combined Market Index climbed 2,654.49 points to 342,091.21, the All Jamaican Composite Index popped 45.77 points to 361,653.63, the JSE Main Index rallied 2,594.54 points to 327,952.63, the Junior Market Index rose 25.52 points to 3,942.47, while the JSE USD Market Index slipped 0.40 points to 221.67.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are Eppley 7.75% preference share dropping $1 to $19, Jamaica Public Service 7% declining $7.33 to $48.67 and JMMB Group 7.25% preference share increased 53 cents to close at $4.06.

At the close, investors exchanged 22,079,185 shares in all three markets, up from 30,664,504 shares on Thursday. The value of stocks trading in the Junior and Main markets was $235.7 million, down from $246 million on Thursday. Trading on the JSE USD market resulted in investors exchanging 216,689 shares for US$14,393 compared to 77,890 units at US$1,414 on Thursday.

The market’s PE ratio ended at 18.3 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio ended at 18.3 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Profit taking for SOS as JSE trading rises

Profit taking cooled the flight of Stationery and Office Supplies, with the price falling to the day’s low of $29.77 but closing down at $33.89, as investors traded just under 400,000 shares as the Junior and Main Markets closed lower and the JSE USD Market closed moderately higher.

At the close, the JSE Combined Market Index gave back 1,996.90 points to end at 339,436.72, the All Jamaican Composite Index shed 993.11 points to end at 361,607.86, the JSE Main Index fell 1,951.96 points to 325,358.09, the Junior Market Index dropped 19.18 points to 3,916.95, while the JSE USD Market Index popped 0.08 points to 222.07.

At the close, the JSE Combined Market Index gave back 1,996.90 points to end at 339,436.72, the All Jamaican Composite Index shed 993.11 points to end at 361,607.86, the JSE Main Index fell 1,951.96 points to 325,358.09, the Junior Market Index dropped 19.18 points to 3,916.95, while the JSE USD Market Index popped 0.08 points to 222.07.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are Jamaica Public Service 7% declined $8.80 to $56 and Productive Business Solutions 9.75% preference share shed $1.99 to close at $90.01.

At the close, investors exchanged 30,664,504 shares in all three markets, up from 18,247,148 shares on Wednesday. The value of stocks trading in the Junior and Main markets was $246 million, down from $147.3 million on Wednesday.  Trading on the JSE USD market resulted in investors exchanging 77,890 shares for US$1,414 compared to 393,412 units at US$6,625 on Wednesday.

Trading on the JSE USD market resulted in investors exchanging 77,890 shares for US$1,414 compared to 393,412 units at US$6,625 on Wednesday.

The market’s PE ratio ended at 18.5 on 2022-23 earnings and 12.3 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

SOS hits $34.98 as all JSE markets rise

Stationery and Office Supplies raced to another new record high with a closing price of $34.98, as investors responded aggressively to an announcement that directors would be considering a stock split that pushed to price up 75 percent since and just over 100 percent for the year to date, the move helped the Junior market to solidify its grip on the 3,900 mark elsewhere the Main Market and the JSE USD Market closed higher at the end of trading.

At the close, the JSE Combined Market Index gained 2,428.83 points to close at 341,433.62, the All Jamaican Composite Index rose 1,549.13 points to finish at 362,600.97, the JSE Main Index increased 2,357.50 points to 327,310.05, the Junior Market Index rallied 25.03 points to 3,936.13 while the JSE USD Market Index gained 1.36 points to end at 221.99.

At the close, the JSE Combined Market Index gained 2,428.83 points to close at 341,433.62, the All Jamaican Composite Index rose 1,549.13 points to finish at 362,600.97, the JSE Main Index increased 2,357.50 points to 327,310.05, the Junior Market Index rallied 25.03 points to 3,936.13 while the JSE USD Market Index gained 1.36 points to end at 221.99.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are Jamaica Public Service 7% popped $8.45 in closing at $64.80 and Productive Business Solutions 9.75% preference share popped $1 to end at $92.

At the close, investors exchanged 18,247,148 shares in all three markets down from 41,191,210 shares on Tuesday. The value of stocks trading in the Junior and Main markets was $146.3 million, down from $645 million on Tuesday. Trading on the JSE USD market resulted in investors exchanging 393,412. shares for US$ 6,625 compared to 934,268 units at US$32,448 on Tuesday.

The market’s PE ratio ended at 18.5 on 2022-23 earnings and 12.3 times those for 2023-24 at the close of trading.

The market’s PE ratio ended at 18.5 on 2022-23 earnings and 12.3 times those for 2023-24 at the close of trading.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Junior Market reclaims 3,900 others fall

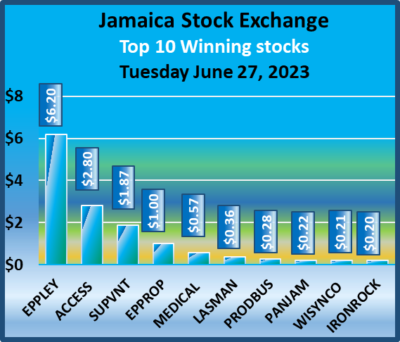

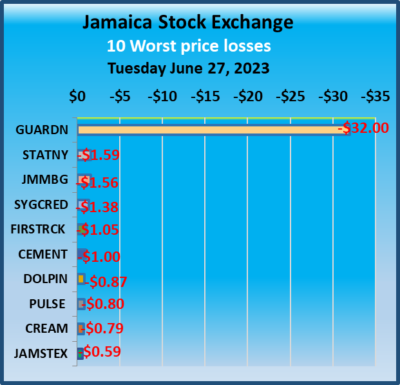

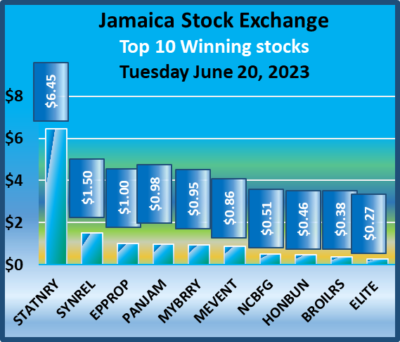

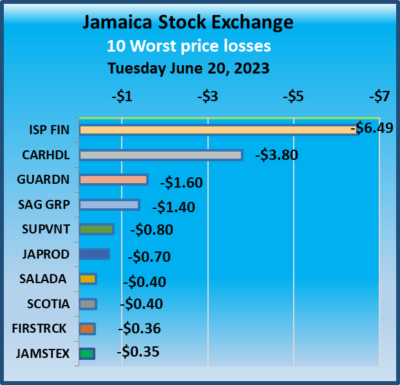

The highlight on the Jamaica Stock Exchange on Tuesday is the sharp increase in demand for shares of Stationery and Office Supplies, with the price hitting a record high of $26.45 and closing with bids at $26.45 to buy 220,709 units and 114,415 shares at $26 compared to moderate selling, starting at $30.50, and follows an announcement of a directors’ meeting to discuss a stock split.

Elsewhere, the Main Market declined, but the Junior Market closed above the 3,900 mark for the first time since the middle of February this year, the JSE USD Market closed lower at the end of increased trading.

Elsewhere, the Main Market declined, but the Junior Market closed above the 3,900 mark for the first time since the middle of February this year, the JSE USD Market closed lower at the end of increased trading.

At the close, the JSE Combined Market Index fell 2,015.29 points to close at 339,004.79, the All Jamaican Composite Index dropped 3,269.39 points to 361,051.84, the JSE Main Index declined 2,465.86 points to 324,952.55, the Junior Market Index popped 31.19 points to 3,911.10, while the JSE USD Market Index shed 20.38 points to close at 220.63.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are Jamaica Public Service 7%, which climbed $7.35 to $56.35 and Productive Business Solutions 9.75%, preference share declined 50 cents and ended at $91.

At the close, investors exchanged 41,191,210 shares in all three markets up from 30,498,415 shares on Monday. The value of stocks trading in the Junior and Main markets was $645 million, up from $95.3 million on Monday.  Trading on the JSE USD market resulted in investors exchanging 934,268 shares for US$32,448 compared to 764,260 units at US$20,272 on Monday.

Trading on the JSE USD market resulted in investors exchanging 934,268 shares for US$32,448 compared to 764,260 units at US$20,272 on Monday.

The market’s PE ratio ended at 18.3 on 2022-23 earnings and 12.3 times those for 2023-24 at the close of trading.

Investors need pertinent information to navigate numerous investment options in the local stock market successfully. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume about the highest bid and the lowest offer for each company.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume about the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Trading drops back on the JSE

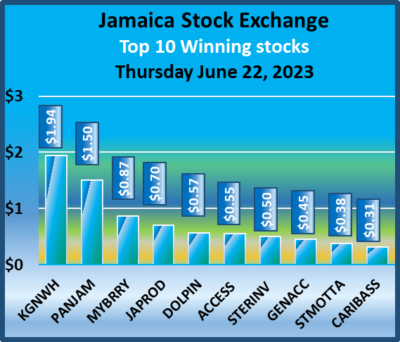

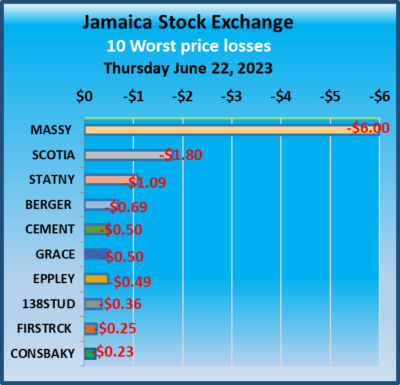

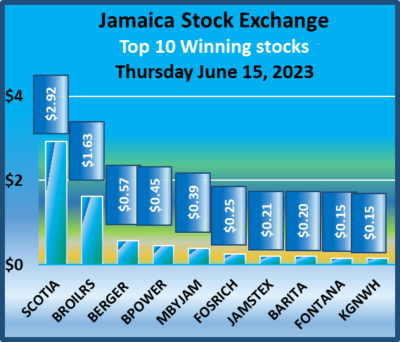

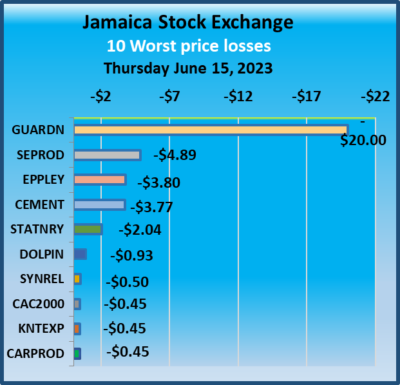

Trading ended on Thursday with the market indices of all three of the Jamaica Stock Exchange declining at the close of trading, with the volume and the value of stocks trading declining from Wednesday, even as Transjamaican Highway continues to hit new 52 weeks’ highs.

At the close of trading, the JSE Combined Market Index declined 3,732.68 points to 336,908.50, the All Jamaican Composite Index shed 333.53 points to end at 360,648.61, the JSE Main Index dropped 3,765.05 points to 323,374.27, the Junior Market Index fell 23.99 points to 3,842.97, while the JSE USD Market Index slipped 2.75 points to close at 237.27.

At the close of trading, the JSE Combined Market Index declined 3,732.68 points to 336,908.50, the All Jamaican Composite Index shed 333.53 points to end at 360,648.61, the JSE Main Index dropped 3,765.05 points to 323,374.27, the Junior Market Index fell 23.99 points to 3,842.97, while the JSE USD Market Index slipped 2.75 points to close at 237.27.

Preference shares with notable price changes but not in the Main Market TOP10 graphs are Productive Business 10.50% preference share that popped $50 to $1,250 and Jamaica Public Service 7% gaining $5.99 in closing at $56.

At the close, investors exchanged 30,404,886 shares in all three markets on Thursday compared to 41,085,482 shares on Wednesday. The value of stocks trading in the Junior and Main markets was $115.16 million, up sharply from $752.6 million on Wednesday. Trading on the JSE USD market resulted in investors exchanging 32,918 shares for US$5,796 compared to 289,060 units at US$34,073 on Wednesday.

The market’s PE ratio ended at 18.3 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading.

The market’s PE ratio ended at 18.3 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Kingston Wharves dominates JSE trading

Trading surged on the Jamaica Stock Exchange on Tuesday Kingston Wharves traded 17.7 million shares valued at $496 million and swelled the overall trade for the day sharply higher than on Monday with all three markets rising at the close with Transjamaican Highway continuing to hit record highs and closed at $2.21.

Trading ended with the JSE Combined Market Index popping 826.66 points to 342,175.85, while the All Jamaican Composite Index rallied 810.40 points to 362,087.53, the JSE Main Index climbed 469.12 points to 329,000.52. The Junior Market Index jumped 42.50 points to close at 3,844.90 and seems to be breaking out from wedge-shaped chart formation, while the JSE USD Market Index popped 4.19 points to 238.13.

Trading ended with the JSE Combined Market Index popping 826.66 points to 342,175.85, while the All Jamaican Composite Index rallied 810.40 points to 362,087.53, the JSE Main Index climbed 469.12 points to 329,000.52. The Junior Market Index jumped 42.50 points to close at 3,844.90 and seems to be breaking out from wedge-shaped chart formation, while the JSE USD Market Index popped 4.19 points to 238.13.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are Eppley 7.25% preference share declined $2.85 in closing at $16.15, Eppley 7.50% preference share added $1.19 to end at $7.39, Jamaica Public Service 7% gained $2 in closing at $52, Jamaica Public Service 9.5% fell $22 to close at $2978. 138 Student Living preference share rose $6.99 and ended at $87.99 and Productive Business Solutions 9.75% preference share dipped $14.50 to $91.50.

At the close, investors exchanged 60,867,391 shares in all three markets on Tuesday compared to 22,548,034 shares on Tuesday. The value of stocks trading in the Junior and main markets was $609.18 million, up sharply from $90.9 million on Tuesday. Trading on the JSE USD market resulted in investors exchanging 132,703 shares for US$3,992 compared to 2,048,216 units at US$53,374 on Tuesday.

At the close, investors exchanged 60,867,391 shares in all three markets on Tuesday compared to 22,548,034 shares on Tuesday. The value of stocks trading in the Junior and main markets was $609.18 million, up sharply from $90.9 million on Tuesday. Trading on the JSE USD market resulted in investors exchanging 132,703 shares for US$3,992 compared to 2,048,216 units at US$53,374 on Tuesday.

The market’s PE ratio ended at 18.2 on 2022-23 earnings and 11.4 times those for 2023-24 at the close of trading.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

JSE Main Market rises Juniors & JSE USD fall

The Main Market of the Jamaica Stock Exchange broke its losing streak after closing moderately higher than Friday and Transjamaican Highway continues to hit record closing highs and closed at $2.20, but the Junior and the JSE USD Markets slipped below Friday’s close after six Junior Market stocks triggered the exchange circuit breaker at varying times during the trading session.

At the close, the JSE Combined Market Index rose 1,083.75 points to end at 341.349.19, the All Jamaican Composite Index lost 325.98 points to close at 361,277.13, the JSE Main Index popped 1,197.20 points to 328,531.40, the Junior Market Index dipped 3.64 points to 3,802.40 and the JSE USD Market Index dipped 4.97 points to 233.94.

At the close, the JSE Combined Market Index rose 1,083.75 points to end at 341.349.19, the All Jamaican Composite Index lost 325.98 points to close at 361,277.13, the JSE Main Index popped 1,197.20 points to 328,531.40, the Junior Market Index dipped 3.64 points to 3,802.40 and the JSE USD Market Index dipped 4.97 points to 233.94.

Preference shares with notable price movements but are not in the Main Market TOP10 graphs are Eppley 7.50% preference share shed $1.28 to close at $6.20, Jamaica Public Service 7% fell $10.48 in closing at $50. 138 Student Living preference share declined $6.99 and ended at $81, Productive Business 10.50% preference share dropped $50 to $1200 and Productive Business Solutions 9.75% preference share lost 94 cents to close at $106.

At the close, investors exchanged 22,548,034 shares in all three markets on Monday compared to 52,143,554 shares on Friday. The value of stocks trading in the Junior and main markets was $90.9 million, down from $1.637 billion on Friday. Trading on the JSE USD market resulted in an exchange of 2,048,216 shares for US$53,374 compared to 857,775 units at US$11,684 on Friday.

The market’s PE ratio ended at 18.1 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading.

The market’s PE ratio ended at 18.1 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 11

- Next Page »