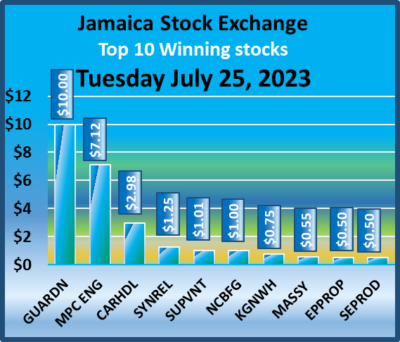

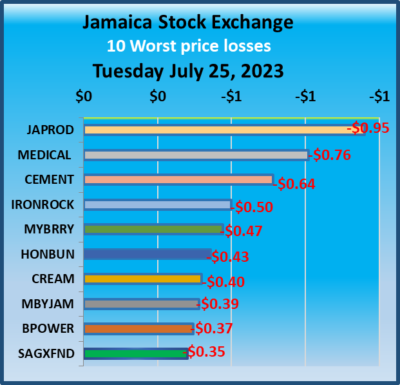

The Main Market of the Jamaica Stock Exchange dipped on Tuesday but the USD Market closed moderately higher at the end of trading with the volume and value of stocks traded increasing over Monday trades.

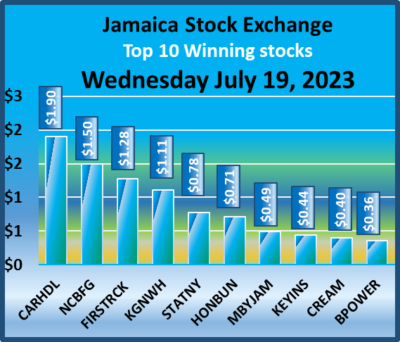

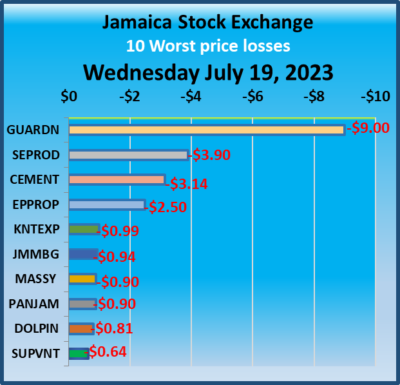

At the close, the JSE Combined Market Index dropped 1,264.67 points to 341,903.42, the All Jamaican Composite Index rallied 114.21 points to 365,552.78, the JSE Main Index fell 1,300.23 points to 328,046.78, while the Junior Market Index slipped 5.61 points to 3,912.36 and the JSE USD Market Index added 3.25 points to settle at 248.02.

At the close, the JSE Combined Market Index dropped 1,264.67 points to 341,903.42, the All Jamaican Composite Index rallied 114.21 points to 365,552.78, the JSE Main Index fell 1,300.23 points to 328,046.78, while the Junior Market Index slipped 5.61 points to 3,912.36 and the JSE USD Market Index added 3.25 points to settle at 248.02.

Trading of Preference shares with notable price changes are Productive Business 10.50% preference share shed $150 to end at $1,100, Jamaica Public Service 9.5% dropped $297 to close at $2,803, 138 Student Living preference share fell $15.39 to $87.24 and Transjamaican Highway 8% preference shares rallied 60 cents to $3.

At the close, investors exchanged 25,471,611 shares, in all three markets, compared with 20,410,245 stocks on Monday. The value of stocks trading in the Junior and Main Markets was $192.9 million, up from $143.54 million on Monday. Trading on the JSE USD market ended with investors exchanging 329,260 shares for US$12,513 up from 199,644 units at US$11,531 on Monday.

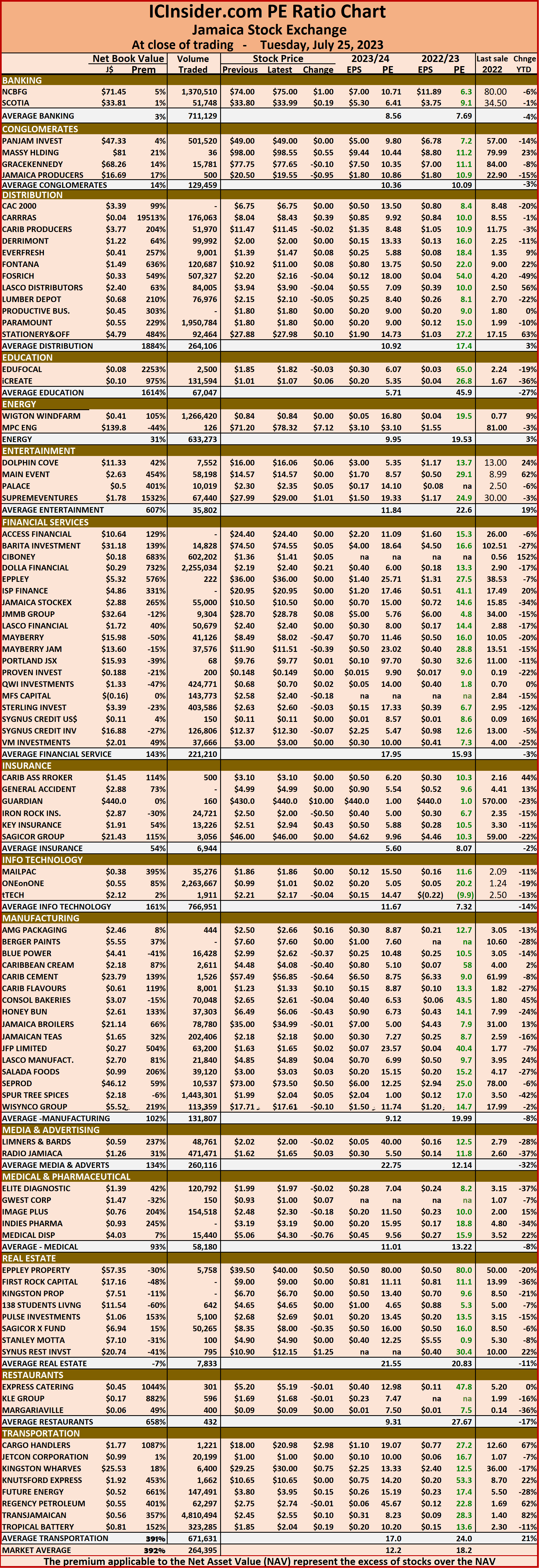

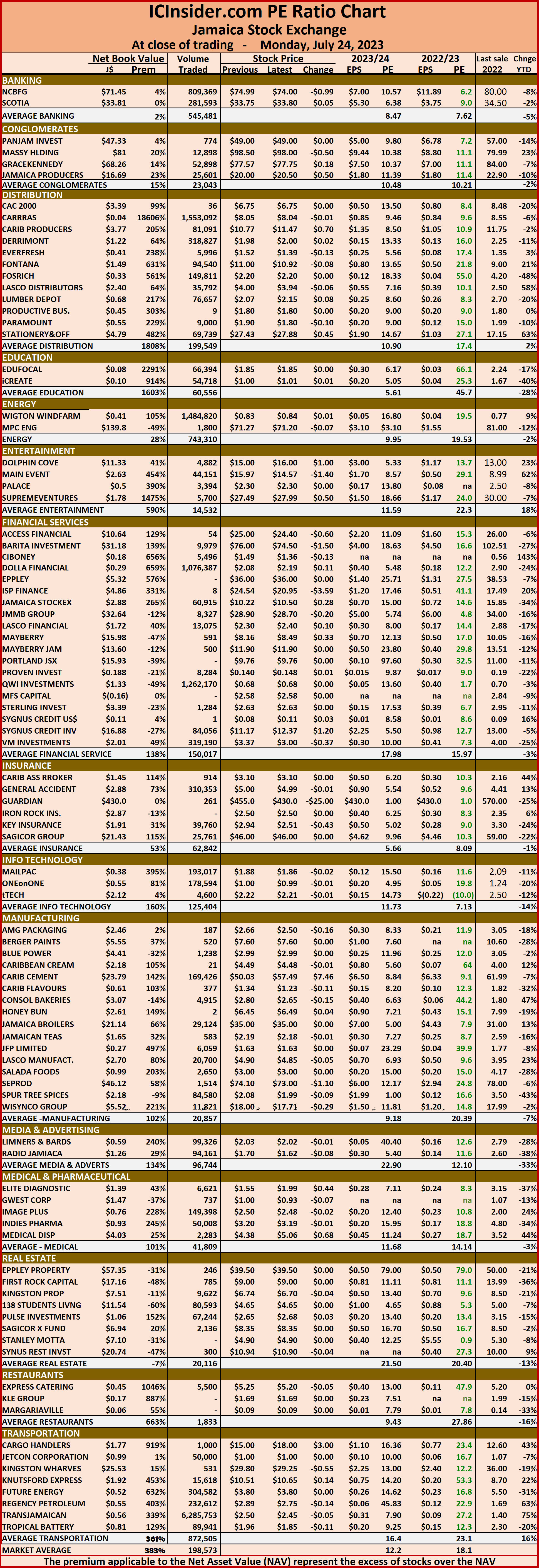

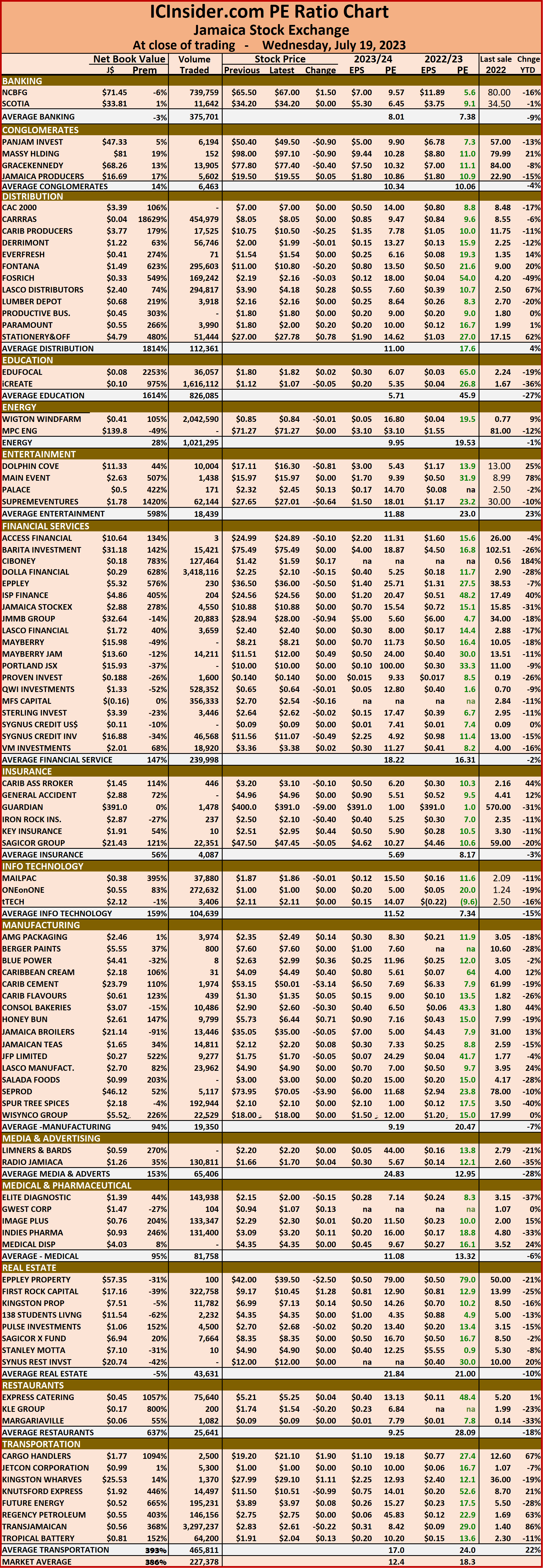

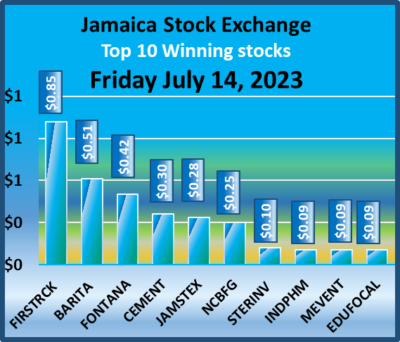

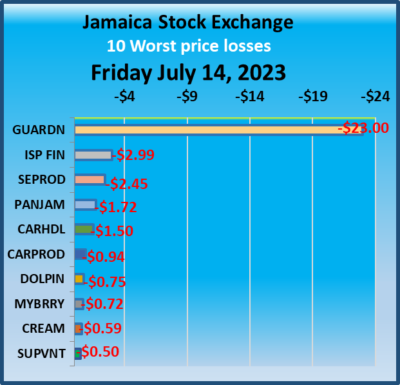

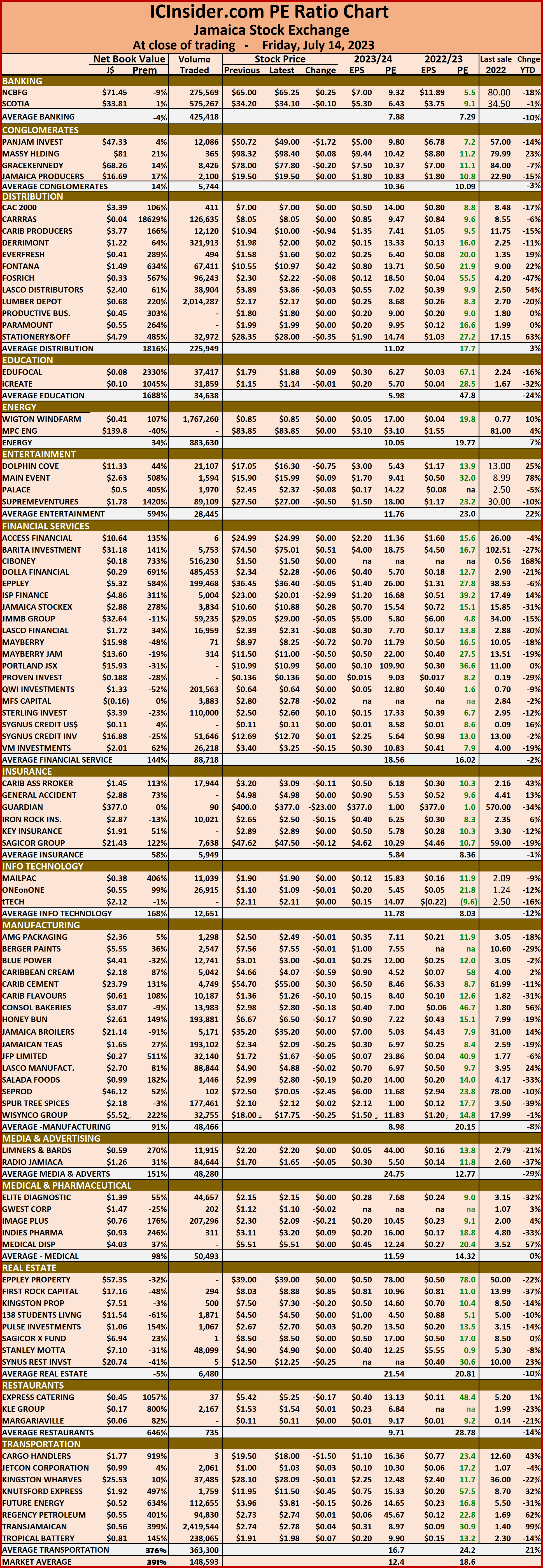

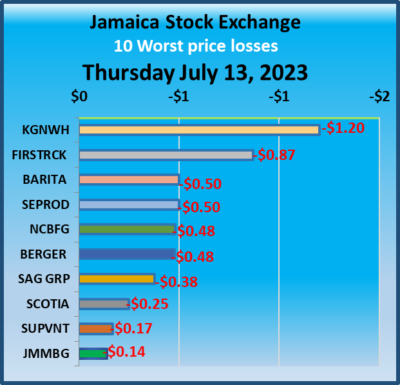

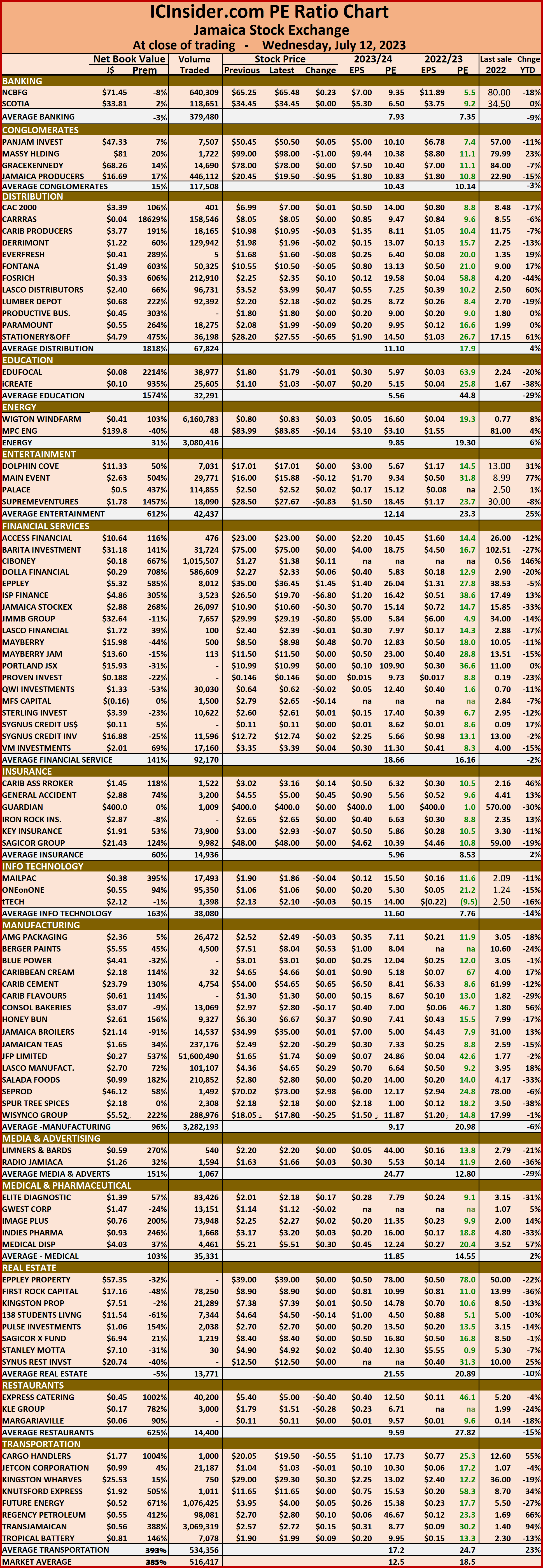

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.2 on 2022-23 earnings and 12.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.2 on 2022-23 earnings and 12.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Main and Junior Markets fell and JSE USD rose

Main & JSE USD Markets rally Juniors fall

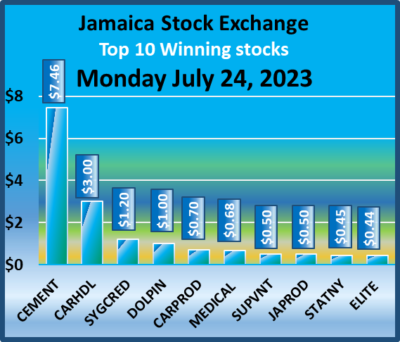

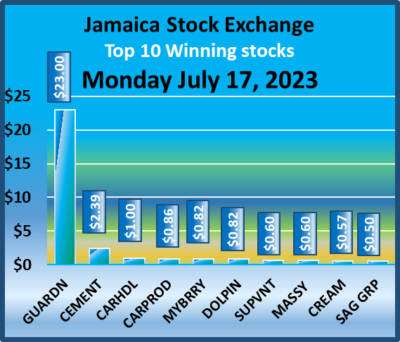

The Main Market of the Jamaica Stock Exchange jumped sharply on Monday and the USD Market closed moderately higher at the end of trading but the Junior Market could not hold on to early morning gains and slipped lower to close out the day, following a decline in the volume of stocks traded at an increased value compared to Friday.

The JSE Combined Market Index climbed 1,279.08 points in ending at 343,168.10, while the All Jamaican Composite Index jumped 2,921.07 points to 365,438.57, the JSE Main Index popped 1,479.39 points to 329,347.0, the Junior Market Index slipped 11.07 points to end at 3,917.98 and the JSE USD Market Index added 5.89 points to settle at 244.77.

The JSE Combined Market Index climbed 1,279.08 points in ending at 343,168.10, while the All Jamaican Composite Index jumped 2,921.07 points to 365,438.57, the JSE Main Index popped 1,479.39 points to 329,347.0, the Junior Market Index slipped 11.07 points to end at 3,917.98 and the JSE USD Market Index added 5.89 points to settle at 244.77.

Preference shares with notable price movements are Productive 10.50% preference share that jumped $272.50 to $1250, Jamaica Public Service 7% dropping $8.80 to close at $61.20, Productive Business Solutions 9.75% preference share shedding $2 and to end at $100 and Transjamaican Highway 8% fell that fell 65 cents to $2.40.

At the close, investors exchanged 20,410,245 shares, in all three markets, compared with 26,925,878 stocks on Friday. The value of stocks trading in the Junior and Main Markets was $143.54 million, up from $133.9 million on Friday. Trading on the JSE USD market ended with investors exchanging 199,644 shares for US$11,531 from 584,142 units at US$30,721 on Friday.

Trading on the JSE USD market ended with investors exchanging 199,644 shares for US$11,531 from 584,142 units at US$30,721 on Friday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.1 on 2022-23 earnings and 12.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Main Market rallies others fall

The Main Market of the Jamaica Stock Exchange rose moderately on Friday, but the Junior Market and the USD Market slipped lower following a rise in the volume of stocks traded but with a lower value than Thursday as the markets continue to consolidate.

At the close, the JSE Combined Market Index climbed 535.15 points to 341,889.02, the All Jamaican Composite Index rose 91.12 points to 362,517.50, the JSE Main Index rose 906.61 points to 327,867.62 while the Junior Market Index lost 33.95 points to end at 3,929.05 and the JSE USD Market Index fell 4.07 points to settle at 238.88.

At the close, the JSE Combined Market Index climbed 535.15 points to 341,889.02, the All Jamaican Composite Index rose 91.12 points to 362,517.50, the JSE Main Index rose 906.61 points to 327,867.62 while the Junior Market Index lost 33.95 points to end at 3,929.05 and the JSE USD Market Index fell 4.07 points to settle at 238.88.

Trading of Preference shares with notable price movements are Eppley 7.50% preference share rallied 91 cents in closing at $6.12, Jamaica Public Service 7% dipped $1 to $70 and 138 Student Living preference share jumped $13.39 to close at $102.63.

At the close, investors exchanged 26,925,878 shares, in all three markets, compared with 18,916,750 stocks on Thursday. The value of stocks trading in the Junior and Main markets was $133.9 million, down from $217 million on Thursday. Trading on the JSE USD market ended with investors exchanging 584,142 shares for US$30,721 from 477,710 units at US$21,075 on Thursday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.1 on 2022-23 earnings and 12.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.1 on 2022-23 earnings and 12.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Sharp jump for the JSE Main Market

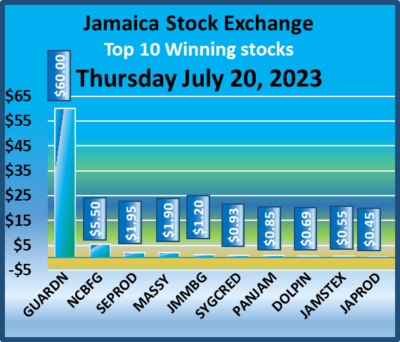

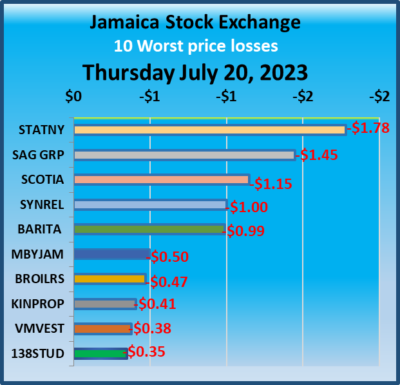

The Main Market of the Jamaica Stock Exchange jumped on Thursday after the heavily weighted NCB Financial rallied $5.50 to $72.50 and Guardian Holdings jumped $60 to close at $451. The JSE USD markets popped slightly higher and the Junior Market slipped moderately lower following a rise in the volume and value of stocks traded in the overall market compared to Wednesday, with the market continuing its consolidation mode in early summer.

The JSE Combined Market Index surged 3,204.39 points to 341,353.87, the All Jamaican Composite Index climbed 1,736.10 points to 362,426.38, the JSE Main Index powered 3,614.85 points higher to settle at 326,961.01, while the Junior Market Index fell 18.41 points to 3,963.00 and the JSE USD Market Index popped 0.95 points to 242.95.

The JSE Combined Market Index surged 3,204.39 points to 341,353.87, the All Jamaican Composite Index climbed 1,736.10 points to 362,426.38, the JSE Main Index powered 3,614.85 points higher to settle at 326,961.01, while the Junior Market Index fell 18.41 points to 3,963.00 and the JSE USD Market Index popped 0.95 points to 242.95.

Trading of Preference shares ended with no notable price movements on Thursday.

At the close, 18,916,750 shares were traded, in all three markets, compared with 18,521,121 stocks on Wednesday. The value of stocks trading in the Junior and Main markets was $217 million compared to $98.8 million on Wednesday. Trading on the JSE USD market ended with investors exchanging 477,710 shares for US$21,075 from 372,527 units at US$9,733 on Wednesday.

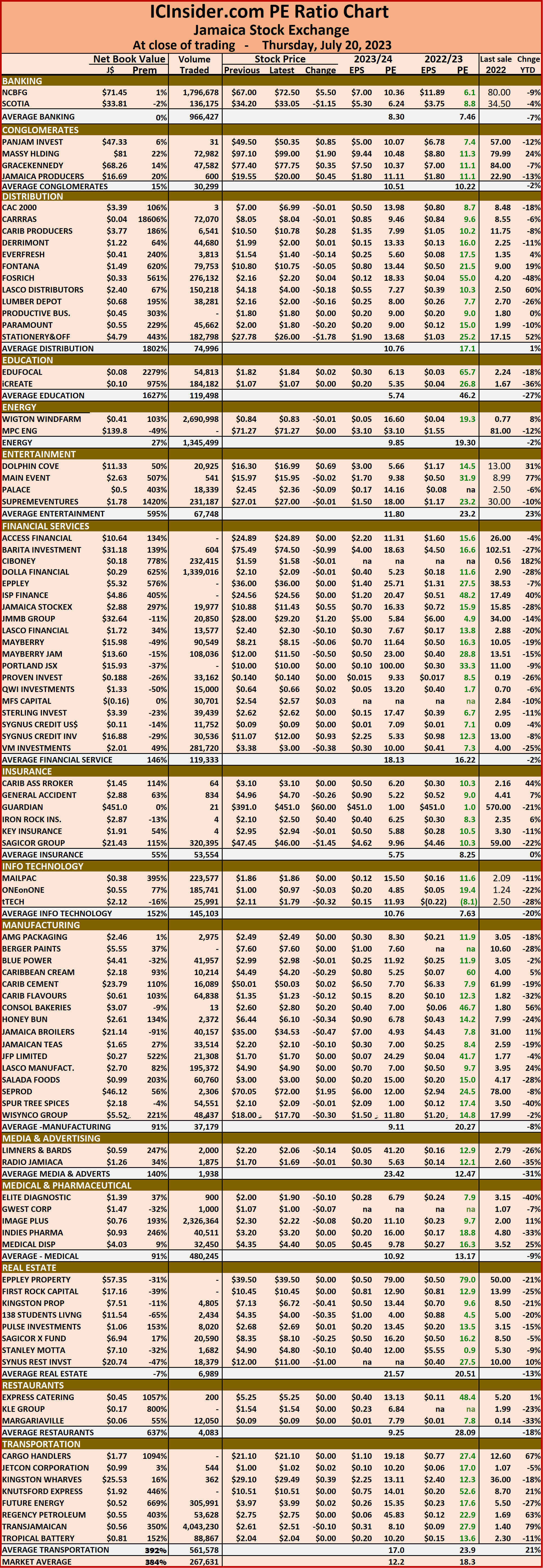

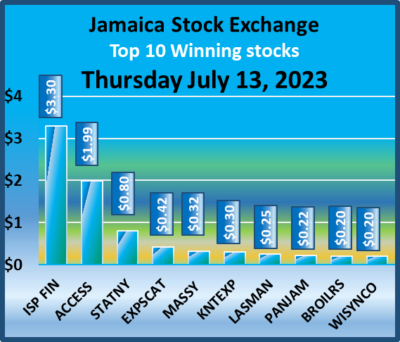

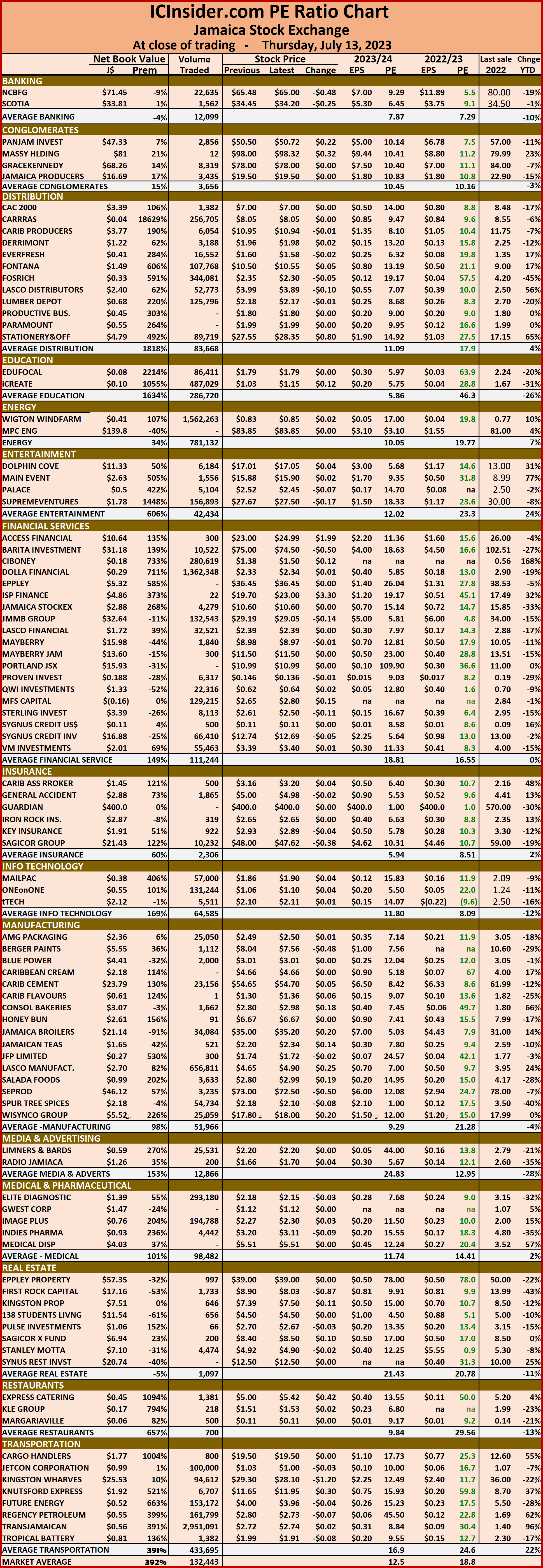

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 18.3 on 2022-23 earnings and 12.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options in the local stock market successfully. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly.  The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume about the highest bid and the lowest offer for each company.

Junior Market rallies other markets fall

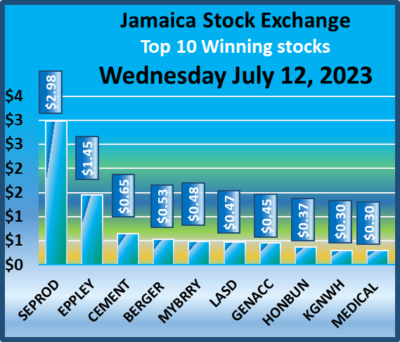

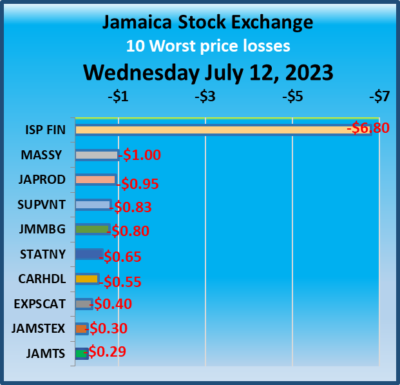

The Junior Market of the Jamaica Stock Exchange climbed on Wednesday, but the Main and JSE USD markets slipped with the volume and value of stocks traded falling from Tuesday’s outturn as the market continue to consolidate in the summer months.

At the close, the JSE Combined Market Index lost 380.40 points to end at 338,149.48, the All Jamaican Composite Index declined by 708.51 points to 360,690.28, the JSE Main Index fell 676.97 points to 323,346.16, the Junior Market Index rose 27.45 points to 3,981.41 and the JSE USD Market Index slipped 10.38 points to 241.99.

At the close, the JSE Combined Market Index lost 380.40 points to end at 338,149.48, the All Jamaican Composite Index declined by 708.51 points to 360,690.28, the JSE Main Index fell 676.97 points to 323,346.16, the Junior Market Index rose 27.45 points to 3,981.41 and the JSE USD Market Index slipped 10.38 points to 241.99.

Trading of Preference shares with notable price movements not included in the TOP10 graphs are Productive Business 10.50% preference share lost $232.50 to $977.50, Jamaica Public Service 7% gained $7.75 to close at $71 and Jamaica Public Service 9.5% climbed $125 in closing at $3,100.

At the close, investors exchanged 18,521,121 shares, in all three markets, compared with 72,010,160 stocks on Tuesday. The value of stocks trading in the Junior and Main markets was $98.8 million, in comparison to $201.4 million on Tuesday. Trading on the JSE USD market ended with investors exchanging 372,527 shares for US$9,733 from 934,611 units at US$22,159 on Tuesday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.3 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.3 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

JSE Main Market rallies others falter

The Main market of the Jamaica Stock Exchange climbed on Tuesday, but the Junior and JSE USD Markets slipped with the volume and value of stocks traded climbing sharply over Monday’s outturn as Image Plus Consultants led trading with 56.39 million shares.

as Image Plus Consultants led trading with 56.39 million shares.

At the close, the JSE Combined Market Index rose 767.66 points to 338,529.88, the All Jamaican Composite Index rallied 1,640.94 points to 361,398.79, the JSE Main Index increased by 915.36 points to 324,023.13, while the Junior Market Index slipped 9.45 points to end at 3,953.96 and the JSE USD Market Index declined 3.59 points to 252.37.

Trading of Preference shares with notable price movements not included in the TOP10 graphs are Productive Business 10.50% preference share advanced $60 and ended at $1210 and Eppley 7.50% preference share fell 95 cents to close at $6.12.

At the close, investors exchanged 72,010,160 shares, in all three markets, compared with 17,713,805 stocks on Monday. The value of stocks trading in the Junior and Main markets was $201.4 million, in comparison to $104.07 million on Monday. Trading on the JSE USD market ended with investors exchanging 934,611 shares for US$22,159 from 258,699 units at US$6.551 on Monday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.4 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.4 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Rally for Jamaica Stock Exchange

All three Jamaica Stock Exchange markets popped moderately higher on Monday, resulting from a rise in the volume and value of stocks traded compared to trading on Friday.

At the close, the JSE Combined Market Index rose 853.16 points to end at 337,762.22, the All Jamaican Composite Index dipped 160.74 points to 359,757.85, the JSE Main Index gained 837.98 points to finish at 323,107.77, while the Junior Market Index recovered just 7.79 points of 61.50 points drop on Friday to close at 3,963.41 and the JSE USD Market Index rose 3.47 points to settle at 255.96.

At the close, the JSE Combined Market Index rose 853.16 points to end at 337,762.22, the All Jamaican Composite Index dipped 160.74 points to 359,757.85, the JSE Main Index gained 837.98 points to finish at 323,107.77, while the Junior Market Index recovered just 7.79 points of 61.50 points drop on Friday to close at 3,963.41 and the JSE USD Market Index rose 3.47 points to settle at 255.96.

Trading of Preference shares with notable price movements not included in the TOP10 graphs are Productive Business 10.50% preference share that rose $25 to close at $1150 Jamaica Public Service 7% advancing $8.25 to $63.25, while Jamaica Public Service 9.5% dived $792.17 to $2975.

At the close, investors exchanged 17,713,805 shares, in all three markets, compared with 12,429,324 stocks on Friday. The value of stocks trading in the Junior and Main markets was $104.07 million compared to $78.5 million on Friday. Trading on the JSE USD market ended with investors exchanging 258,699 shares for US$6.551 from 112,148 units at US$3,750 on Friday.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 18.6 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 18.6 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options in the local stock market successfully. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Bloodletting on the Jamaica Stock Exchange

All three Jamaica Stock Exchange markets dropped on Friday, with the Junior Market even as the volume and value of stocks traded jumped compared to that of Thursday.

At the close, the JSE Combined Market Index dived 2,496.96 points to 336,909.06, the All Jamaican Composite Index dropped 1,694.92 points to close at 359,918.59, the JSE Main Index declined 2,072.71 points to 322,269.79, while the Junior Market Index plunged 61.50 points to close at 3,955.62 and the JSE USD Market Index dipped 3.33 points to 252.49.

At the close, the JSE Combined Market Index dived 2,496.96 points to 336,909.06, the All Jamaican Composite Index dropped 1,694.92 points to close at 359,918.59, the JSE Main Index declined 2,072.71 points to 322,269.79, while the Junior Market Index plunged 61.50 points to close at 3,955.62 and the JSE USD Market Index dipped 3.33 points to 252.49.

The only Preference share with a notable price movement but not in the TOP10 graphs is Jamaica Public Service 7% rose $9.31 to end at $55.

At the close, investors traded 12,429,324 shares in all three markets, compared with 13,544,737 stocks on Thursday. The value of stocks trading in the Junior and Main markets was $78.5 million, in comparison to $47.8 million on Thursday. Trading on the JSE USD market ended with investors exchanging shares for US$3,750 from 112,148 units at US$10,192 on Thursday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.6 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.6 on 2022-23 earnings and 12.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Juniors & JSE USD markets jump Main Market falls

Investors pushed the Junior and the JSE USD markets much higher at the close of trading on Thursday but left the Main market languishing for support with the market sliding at the close to lower landing following a sharp fall in the volume and value of stocks traded compared to that of Wednesday.

At the close, the JSE Combined Market Index fell 286.71 points to close at 339,406.02, the All Jamaican Composite Index shed 1,227.06 points to close at 361,613.51, the JSE Main Index dropped 863.88 points to close at 324,342.50, while the Junior Market Index jumped 56.73 points to close at 4,017.12 and the JSE USD Market Index added 8.38 points to settle at 255.82.

At the close, the JSE Combined Market Index fell 286.71 points to close at 339,406.02, the All Jamaican Composite Index shed 1,227.06 points to close at 361,613.51, the JSE Main Index dropped 863.88 points to close at 324,342.50, while the Junior Market Index jumped 56.73 points to close at 4,017.12 and the JSE USD Market Index added 8.38 points to settle at 255.82.

Preference shares with notable price movements but are in the TOP10 graphs are Productive Business 10.50% preference share that jumped $24.99 to $1125 while Jamaica Public Service 7% rose $4.15 to end at $45.69.

At the close, investors exchanged 13,544,737 shares in all three markets, up from 71,109,240 stocks on Wednesday. The value of stocks trading in the Junior and Main markets was a mere $47.8 million, down from $190.27 million on Wednesday. Trading on the JSE USD market ended with investors exchanging 112,148 shares for US$10,192 from 929,491 units at US$16,864 on Wednesday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.8 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.8 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Modest movement in all JSE market indices

All markets fell at the close of trading on Wednesday with modest movements in all three market indices following a sharp rise in the volume and value of stocks traded compared to that of Tuesday.

At the close, the JSE Combined Market Index added 17.26 points to close at 339,692.73, the All Jamaican Composite Index slipped 41.48 points to conclude trading at 362,840.57, the JSE Main Index fell 77.50 points to finish at 325,206.38, while the Junior Market Index popped 9.79 points to end at 3,960.39 and the JSE USD Market Index added 0.41 points to settle at 247.44.

At the close, the JSE Combined Market Index added 17.26 points to close at 339,692.73, the All Jamaican Composite Index slipped 41.48 points to conclude trading at 362,840.57, the JSE Main Index fell 77.50 points to finish at 325,206.38, while the Junior Market Index popped 9.79 points to end at 3,960.39 and the JSE USD Market Index added 0.41 points to settle at 247.44.

Preference shares with notable price movements but are not in the TOP10 graphs are Eppley 5% preference share that popped $1 in closing at $21, Eppley 7.25% preference share rising $2.33 to $18.52, Jamaica Public Service 7% fell 96 cents to end at $41.54, Jamaica Public Service 9.5% rallied $342.47 to a record high of $3767.17 and 138 Student Living preference share dropped $15.75 to end at $89.24.

At the close, investors exchanged 71,109,240 shares in all three markets, up from 16,768,963 stocks on Tuesday.  The value of stocks trading in the Junior and Main markets was a mere $190.27 million, from $45.2 million on Tuesday. Trading on the JSE USD market ended with investors exchanging 929,491 shares for US$16,864 from 965,788 units at US$23,655 on Tuesday.

The value of stocks trading in the Junior and Main markets was a mere $190.27 million, from $45.2 million on Tuesday. Trading on the JSE USD market ended with investors exchanging 929,491 shares for US$16,864 from 965,788 units at US$23,655 on Tuesday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.5 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

- « Previous Page

- 1

- …

- 19

- 20

- 21

- 22

- 23

- …

- 56

- Next Page »