Cable & Wireless Communications Plc (“CWC”) today announced that it has reached agreement on the terms of a recommended acquisition for the entire issued share capital of CWC by Liberty Global. The Recommended Offer delivers 86.821 pence per share to free float shareholders comprising shares in Liberty Global and a 3 pence per share Special Dividend and represents a premium of approximately 50 per cent, CWC said.

John Malone’s Liberty Global Plc agreed to buy Cable & Wireless Communications Plc in a cash-and-stock transaction valued at 3.5 billion pounds ($5.3 billion). Including the Special Dividend, the transaction values CWC at approximately $8.2 billion, including debt CWC Plc said in a release on the deal. The transaction is expected to complete by the calendar second quarter of 2016.

“The deal represents a multiple of 10.7 times Cable & Wireless Communications’ adjusted annual earnings before interest, depreciation, taxes and amortization, (EBITDA) after taking into consideration cost synergies, according to a statement. Cable & Wireless’ shareholders will get a special 3 pence a share dividend at the deal’s close,” Bloomberg Business reported.

The report did not indicate what is planned with the Jamaican company Cable & Wireless Jamaica with nearly 20 percent minority ownership. IC Insider.com Has earlier suggested that the local operation could be valued around $3 using (EBITDA) measure.

Liberty Global strikes C&WC Plc deal

November 16, 2015 by IC Insider.com

Filed Under: Breaking News, Company News, General Business News Tagged With: Bloomberg Business, John Malone, Liberty Global

C&W shares may fetch over $3 in a takeover

October 25, 2015 by IC Insider.com

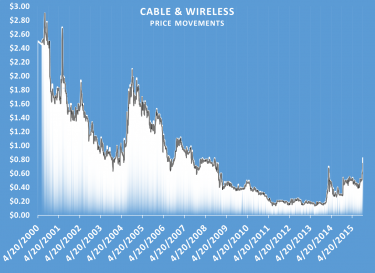

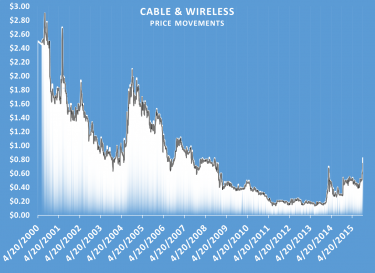

Shares of Cable & Wireless Jamaica (C&W) shot up 22 percent on Friday October 23 to 82 cents, in response to an announcement that Liberty Global, a UK based company was in discussions with CWC Communications PLC (CWC) to acquire it for a consideration in cash and shares, worth US$5.5 billion.

Cable and Wireless shares had become scarce in recent weeks, with one investor IC Insider sources indicated, was seeking 7 million shares to buy, earlier last week at 60 cents each. From as far back as the 8th of October, there were only 4 million units on offer between 55 cents and $1.21. By Thursday the supply dropped even more with trading taking place as high as 67 cents. At 12.30 on October 22, there were 453,964 shares on offer at 67 cents, with 5,000 units sold out of this amount by the close of the market. A total of 305,850 units were on offer at 70 cents, with the next at 90 cents, with 5,000 units. At 99 cents there were 233,730 units, at $1 one block of 877,723 units with the next lot of 10,000 at $1.71, the next 130,169 shares at $2 and 1.66 million units at $3.75. That not a lot for a stock that usually trade in millions of units.

Only 5,850 shares traded on Friday at 82 cents and demand swelled to more than 5 million units at the close to buy at 82 cents. Supply disappeared with only 4 offers listed, ranging for 10,000 units each at $1.20, $1.21 and $1.70 and then 2.66 million units at $3.75.

The question on investors’ minds, is where will the price settle? One broker indicated that it will trade at $1 on Monday if there is supply. With the imbalance between supply and demand, a higher price than that seems imminent. Some Investors are wondering why some buying on the buyout news of the parent when there is uncertainty if the Jamaican shareholders will be bought out as well if the deal goes through. Some are looking at the Diageo transaction with Desnoes & Geddes and speculating that the same could happen here.

IC Insider.com has the stock as BUY RATED from February 2014 on the basis of a turnaround in the financial fortunes of the company. Based on what’s happening locally the current price can be justified as the company is now in a position to be reporting profits, with rising revenues and falling cost. If the deal with CWC goes through, (that does not seem likely at the stated price) and the minority shareholders in C&W were to be bought out, IC Insider went to work to see how high the price could be, in a takeover.

C&W had major improvement in earnings in the June quarter, with EBITDA rising a very strong 82 percent. Net results saw a sharp fall to a loss of just $303 million, from a loss of $712 million in 2014 as revenues grew 13 percent to $5.45 billion, aided by a 17 percent growth in mobile subscribers and 27 percent increased mobile revenues. Operating expenses were static at $4 billion but finance cost rose to $1.1 billion from $962 million in 2014, depreciation was down and amortization up. Revenues should climbed close to $6 billion in the September quarter and is likely to result in a profit around $200 million before any allowance for tax.

C&W had major improvement in earnings in the June quarter, with EBITDA rising a very strong 82 percent. Net results saw a sharp fall to a loss of just $303 million, from a loss of $712 million in 2014 as revenues grew 13 percent to $5.45 billion, aided by a 17 percent growth in mobile subscribers and 27 percent increased mobile revenues. Operating expenses were static at $4 billion but finance cost rose to $1.1 billion from $962 million in 2014, depreciation was down and amortization up. Revenues should climbed close to $6 billion in the September quarter and is likely to result in a profit around $200 million before any allowance for tax.

In March 2015, CWC completed the purchase of Columbus International, a fibre-based telecommunications and technology services provider operating in the Caribbean, Central America and the Andean region, for a consideration comprising US$708 million in cash and 1,558 million CWC shares. This resulted in an increase in share capital of US$78 million and the formation of a merger reserve of US$1,209 million. The total consideration, $2 billion for the CWC acquisition resulted in a multiple of 7.8 times EBITDA.

The proposed price of US$5.5 billion being proposed for CWC with EBITDA of US$840 for the combined entities at March, would be 6.55 times EBITDA. Applying this ratio, puts C&W value based on EBITDA for the current fiscal year around $3.30 each. CWC communications paid much higher multiple for Columbus only a year ago which would make it difficult for CWC management to justify to their shareholders a deal that reduced the value of the group with the full benefit of the merger of the Flow operation not yet visible. The proposed buyout price would, however, be more than the market value of CWC, worth 2.6 billion pounds, or about $4 billion, based on its market capitalization on Thursday. John Malone the major owner of Liberty Global already has a 13 percent stake in CWC.

Cable and Wireless shares had become scarce in recent weeks, with one investor IC Insider sources indicated, was seeking 7 million shares to buy, earlier last week at 60 cents each. From as far back as the 8th of October, there were only 4 million units on offer between 55 cents and $1.21. By Thursday the supply dropped even more with trading taking place as high as 67 cents. At 12.30 on October 22, there were 453,964 shares on offer at 67 cents, with 5,000 units sold out of this amount by the close of the market. A total of 305,850 units were on offer at 70 cents, with the next at 90 cents, with 5,000 units. At 99 cents there were 233,730 units, at $1 one block of 877,723 units with the next lot of 10,000 at $1.71, the next 130,169 shares at $2 and 1.66 million units at $3.75. That not a lot for a stock that usually trade in millions of units.

Only 5,850 shares traded on Friday at 82 cents and demand swelled to more than 5 million units at the close to buy at 82 cents. Supply disappeared with only 4 offers listed, ranging for 10,000 units each at $1.20, $1.21 and $1.70 and then 2.66 million units at $3.75.

The question on investors’ minds, is where will the price settle? One broker indicated that it will trade at $1 on Monday if there is supply. With the imbalance between supply and demand, a higher price than that seems imminent. Some Investors are wondering why some buying on the buyout news of the parent when there is uncertainty if the Jamaican shareholders will be bought out as well if the deal goes through. Some are looking at the Diageo transaction with Desnoes & Geddes and speculating that the same could happen here.

IC Insider.com has the stock as BUY RATED from February 2014 on the basis of a turnaround in the financial fortunes of the company. Based on what’s happening locally the current price can be justified as the company is now in a position to be reporting profits, with rising revenues and falling cost. If the deal with CWC goes through, (that does not seem likely at the stated price) and the minority shareholders in C&W were to be bought out, IC Insider went to work to see how high the price could be, in a takeover.

C&W had major improvement in earnings in the June quarter, with EBITDA rising a very strong 82 percent. Net results saw a sharp fall to a loss of just $303 million, from a loss of $712 million in 2014 as revenues grew 13 percent to $5.45 billion, aided by a 17 percent growth in mobile subscribers and 27 percent increased mobile revenues. Operating expenses were static at $4 billion but finance cost rose to $1.1 billion from $962 million in 2014, depreciation was down and amortization up. Revenues should climbed close to $6 billion in the September quarter and is likely to result in a profit around $200 million before any allowance for tax.

C&W had major improvement in earnings in the June quarter, with EBITDA rising a very strong 82 percent. Net results saw a sharp fall to a loss of just $303 million, from a loss of $712 million in 2014 as revenues grew 13 percent to $5.45 billion, aided by a 17 percent growth in mobile subscribers and 27 percent increased mobile revenues. Operating expenses were static at $4 billion but finance cost rose to $1.1 billion from $962 million in 2014, depreciation was down and amortization up. Revenues should climbed close to $6 billion in the September quarter and is likely to result in a profit around $200 million before any allowance for tax.In March 2015, CWC completed the purchase of Columbus International, a fibre-based telecommunications and technology services provider operating in the Caribbean, Central America and the Andean region, for a consideration comprising US$708 million in cash and 1,558 million CWC shares. This resulted in an increase in share capital of US$78 million and the formation of a merger reserve of US$1,209 million. The total consideration, $2 billion for the CWC acquisition resulted in a multiple of 7.8 times EBITDA.

The proposed price of US$5.5 billion being proposed for CWC with EBITDA of US$840 for the combined entities at March, would be 6.55 times EBITDA. Applying this ratio, puts C&W value based on EBITDA for the current fiscal year around $3.30 each. CWC communications paid much higher multiple for Columbus only a year ago which would make it difficult for CWC management to justify to their shareholders a deal that reduced the value of the group with the full benefit of the merger of the Flow operation not yet visible. The proposed buyout price would, however, be more than the market value of CWC, worth 2.6 billion pounds, or about $4 billion, based on its market capitalization on Thursday. John Malone the major owner of Liberty Global already has a 13 percent stake in CWC.

Filed Under: Buy Rated, Company News, Feature Stories Tagged With: C&WJ, Columbus Telecommunication, CWC communications, Desnoes & Geddes, Jamaican Stock, John Malone, Liberty Global