Cable & Wireless HQ – The company’s stock traded at a high of $1.87 in November 2014.

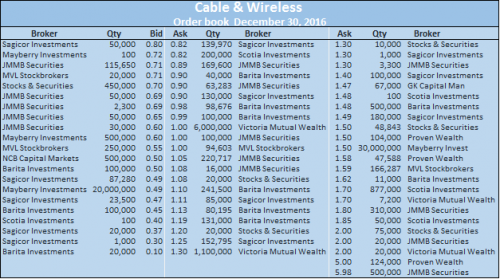

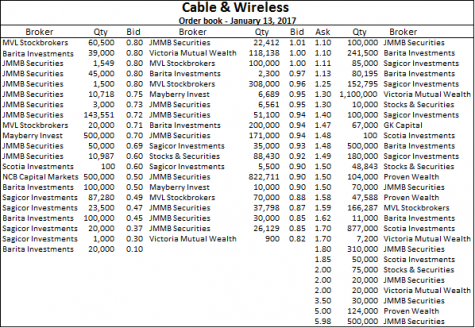

On Friday last, the stock traded 603,857 units between 92 cents and $1.08. The order book for the stock changed markedly, from a bearish posture to a more aggressive one. Unlike the end of January when sell orders dominated buyers, the situation at the close on Friday was reversed, with buyers almost twice the number of sellers. Importantly, Mayberry’s 30 million units sell order at $1.50 for own account, is removed.

The market activity, suggests that something major is in the offing. In 2015, a group of large minority shareholders approached Cable & Wireless PLC to buy their shares. The Liberty Global takeover of the London listed company intervened. Local investors were expecting that the local company’s minority shareholders would have been made an offer for their shares. After not seeing an offer, interest in the stock fell and took the price with it, down to 65 cents. IC Insiders’ source indicates that a potential offer is likely to be in the making.

Cable and Wireless struggled for years as Digicel, its main rival, clobbered it in the Cell phone market, but the company has been making big strides in reversing the trend.

In addition C&W that focused attention on data service, is seeing that strategy paying rich dividends. The company reported just a small loss of $200 million in the September quarter and seemed to be on the way to making positive profit for 2017 onwards, with revenues growing 15 percent in the quarter and 13 percent for the six months. On the other hand Digicel is struggling as the market has moved towards data than voice and C&W grabs a larger share of the mobile market locally, leading Digicel to be looking at a sharp cut in staff numbers in the not too distant future.

In addition C&W that focused attention on data service, is seeing that strategy paying rich dividends. The company reported just a small loss of $200 million in the September quarter and seemed to be on the way to making positive profit for 2017 onwards, with revenues growing 15 percent in the quarter and 13 percent for the six months. On the other hand Digicel is struggling as the market has moved towards data than voice and C&W grabs a larger share of the mobile market locally, leading Digicel to be looking at a sharp cut in staff numbers in the not too distant future.With revenues likely to continue to grow for a while, around $3 billion per year, C&W seems on target to make huge profits down the road, with the prospects of big gains in the stock price ahead.

Not many investors seem to see this picture, instead they focus on the short term developments, raising foolish questions about dividend payments and debt, when the two can’t be avoided. Under the companies Act dividends can’t be paid based on the large accumulated losses that have to be cleared first, while debt has been used to support the operations while it went through restructuring. The company is now cash flow positive and that should lead to debt reduction going forward subject to any large acquisition. Some minority shareholders who sought legal advice indicates that there were transactions that were effected that were not in the interest of the company.

Not many investors seem to see this picture, instead they focus on the short term developments, raising foolish questions about dividend payments and debt, when the two can’t be avoided. Under the companies Act dividends can’t be paid based on the large accumulated losses that have to be cleared first, while debt has been used to support the operations while it went through restructuring. The company is now cash flow positive and that should lead to debt reduction going forward subject to any large acquisition. Some minority shareholders who sought legal advice indicates that there were transactions that were effected that were not in the interest of the company.