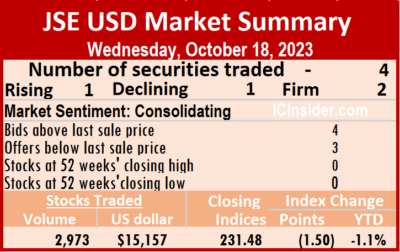

Trading plunged on the Jamaica Stock Exchange US dollar market on Wednesday, with a mere 2,973 shares traded for US$15,157 compared to 34,722 units at US$2,213 on Tuesday after a 91 percent in the volume traded and 585 percent dive in value compared with Tuesday, resulting from trading in four securities down from seven on Tuesday with one rising, one declining and two ending unchanged.

Trading averaged 743 units at US$3,789, versus 4,960 shares at US$316 on Tuesday, well below the month to date average of 43,847 shares at US$1,495 compared and 46,276 units at US$1,365 on the previous day and. September with an average of 73,281 units for US$5,102.

Trading averaged 743 units at US$3,789, versus 4,960 shares at US$316 on Tuesday, well below the month to date average of 43,847 shares at US$1,495 compared and 46,276 units at US$1,365 on the previous day and. September with an average of 73,281 units for US$5,102.

The US Denominated Equities Index dipped 1.50 points to 231.48.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Sterling Investments advanced 0.4 of one cent and ended at 1.9 US cents after 1,060 shares passed through the market and  Transjamaican Highway lost 0.05 of a cent to end at 1.63 US cents after an exchange of 500 stocks.

Transjamaican Highway lost 0.05 of a cent to end at 1.63 US cents after an exchange of 500 stocks.

In the preference segment, JMMB Group 5.75% ended at US$2 with traders dealing in 118 units and Productive Business Solutions 9.25% preference share remained at US$11.50 in trading 1,295 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading plunged on the JSE USD Market

JSE USD Market drops 10% on Tuesday

The US Denominated Equities Index dropped nearly 10 percent after skidding 10.61 points on Tuesday to 232.98 and wiping all the gains recorded for the year to date after trading on the Jamaica Stock Exchange US dollar market ended, with the volume of stocks changing hands plunging 62 percent with the value 29 percent lower than on Friday, resulting in the trading of seven securities, similar to Friday and ended with prices of just two rising, five declining.

A total of 34,722 shares were traded for US$2,213 compared with 91,370 units at US$3,137 on Friday.

A total of 34,722 shares were traded for US$2,213 compared with 91,370 units at US$3,137 on Friday.

Trading averaged 4,960 units at US$316 compared with 13,053 shares at US$448 on Friday, with a month to date average of 46,276 shares at US$1,365 compared with 50,795 units at US$1,480 on the previous trading day, well below trading in September that ended with an average of 73,281 units for US$5,102.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share climbed 0.37 of a cent to close at 4.87 US cents in an exchange of 2,866 shares, Margaritaville lost 1.98 cents to end at 11.02 US cents, with trading of 839 units,  Productive Business Solutions declined 20 cents in closing at US$1.60 after trading 220 stock units. Proven Investments popped 0.04 of a cent to 14.69 US cents with investors transferring 373 stocks, Sterling Investments dipped 0.29 of a cent to 1.5 US cents after a transfer of 2,000 units and Transjamaican Highway skidded 0.04 of a cent to 1.68 US cents with a transfer of 27,893 shares.

Productive Business Solutions declined 20 cents in closing at US$1.60 after trading 220 stock units. Proven Investments popped 0.04 of a cent to 14.69 US cents with investors transferring 373 stocks, Sterling Investments dipped 0.29 of a cent to 1.5 US cents after a transfer of 2,000 units and Transjamaican Highway skidded 0.04 of a cent to 1.68 US cents with a transfer of 27,893 shares.

In the preference segment, JMMB Group 5.75% fell 17 cents in closing at US$2 in switching ownership of 531 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on the JSE USD Market

Trading plunged on the Jamaica Stock Exchange US dollar market ended on Friday, with an 89 percent fall in the volume of stocks changing hands valued 85 percent less than on Thursday, resulting in the trading of seven securities compared to six on Thursday with three rising, two declining and two ending unchanged.

Overall, 91,370 shares were traded, for US$3,137 compared to 866,262 units at US$20,932 on Thursday.

Overall, 91,370 shares were traded, for US$3,137 compared to 866,262 units at US$20,932 on Thursday.

Trading averaged 13,053 units at US$448, versus 144,377 shares at US$3,489 on Thursday, with a month to date average of 50,795 shares at US$1,480 compared with 55,430 units at US$1,607 on the previous day. September ended with an average of 73,281 units for US$5,102.

The US Denominated Equities Index gained 3.42 points to 243.59.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9 based on the last traded price divided by projected earnings computed by ICInsider.comfor companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, First Rock Real Estate USD share shed 0.37 of one cent in closing at 4.5 US cents with traders dealing in 2,967 shares,  Proven Investments rose 0.65 of one cent to 14.65 US cents with a transfer of 7,676 stock units, Sterling Investments gained 0.1 of a cent to end at 1.79 US cents with an exchange of 12,723 stocks. Sygnus Credit Investments declined by 0.4 of one cent and ended at 8.6 US cents after an exchange of 5,250 shares, Sygnus Real Estate Finance USD share climbed 0.1 of a cent to close at 10 US cents as investors exchanged 500 stock units and Transjamaican Highway remained at 1.72 US cents, with 62,199 shares crossing the exchange.

Proven Investments rose 0.65 of one cent to 14.65 US cents with a transfer of 7,676 stock units, Sterling Investments gained 0.1 of a cent to end at 1.79 US cents with an exchange of 12,723 stocks. Sygnus Credit Investments declined by 0.4 of one cent and ended at 8.6 US cents after an exchange of 5,250 shares, Sygnus Real Estate Finance USD share climbed 0.1 of a cent to close at 10 US cents as investors exchanged 500 stock units and Transjamaican Highway remained at 1.72 US cents, with 62,199 shares crossing the exchange.

In the preference segment, JMMB Group 5.75% ended at US$2.17 after exchanging 55 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Slippage for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with a 581 percent rise in the volume of stocks changing hands valued 67 percent more than on Wednesday and resulting in trading of six securities, compared to seven on Wednesday with three rising, one declining and two ending unchanged.

Overall, 866,262 shares were traded for US$20,932 compared with 127,251 units at US$12,519 on Wednesday.

Overall, 866,262 shares were traded for US$20,932 compared with 127,251 units at US$12,519 on Wednesday.

Trading averaged 144,377 units at US$3,489, compared with 18,179 shares at US$1,788 on Wednesday, with a month to date average of 55,430 shares at US$1,607 compared to 44,965 units at US$1,386 on the previous day and September with an average of 73,281 units for US$5,102.

The US Denominated Equities Index dropped 5.30 points to close at 240.17.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share increased 0.67 of one cent to end at 4.87 US cents with a transfer of 80 shares,  MPC Caribbean Clean Energy ended at 54 US cents with an exchange of 1,264 stock units, Sterling Investments dipped 0.06 of a cent to close at 1.69 US cents with stakeholders exchanging 294 stocks. Sygnus Credit Investments rose 0.19 of a cent and ended at 9 US cents as investors exchanged 119 units and Transjamaican Highway remained at 1.72 US cents with 858,720 stock units clearing the market.

MPC Caribbean Clean Energy ended at 54 US cents with an exchange of 1,264 stock units, Sterling Investments dipped 0.06 of a cent to close at 1.69 US cents with stakeholders exchanging 294 stocks. Sygnus Credit Investments rose 0.19 of a cent and ended at 9 US cents as investors exchanged 119 units and Transjamaican Highway remained at 1.72 US cents with 858,720 stock units clearing the market.

In the preference segment, JMMB Group 6% gained 7.4 cents to end at US$1.076 with investors transferring 5,785 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, with the volume of stocks changing hands slipping modestly with the value climbing 195 percent compared with trading on Tuesday and resulting in trading in seven securities, compared to five on Tuesday and ended with two rising, two declining and three ending unchanged.

Overall, 127,251 shares were traded, for US$12,519 compared to 129,260 units at US$4,240 on Tuesday.

Overall, 127,251 shares were traded, for US$12,519 compared to 129,260 units at US$4,240 on Tuesday.

Trading averaged 18,179 units at US$1,788, versus 25,852 shares at US$848 on Tuesday, with a month to date average of 44,965 shares at US$1,386 compared with 49,227 units at US$1,322 on the previous day. September ended with an average of 73,281 units for US$5,102.

The US Denominated Equities Index rose 2.54 points to finish at 245.54.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Margaritaville gained 0.65 of one cent to end at 13 US cents with an exchange of one share, Proven Investments skidded 0.1 of a cent to close at 14 US cents with shareholders swapping 48,320 units,  Sterling Investments shed 0.04 of a cent and ended at 1.75 US cents after an exchange of 24 stock units. Sygnus Credit Investments remained at 8.81 US cents in trading 16,005 stocks and Transjamaican Highway advanced 0.02 of a cent to 1.72 US cents with 61,251 stocks clearing the market.

Sterling Investments shed 0.04 of a cent and ended at 1.75 US cents after an exchange of 24 stock units. Sygnus Credit Investments remained at 8.81 US cents in trading 16,005 stocks and Transjamaican Highway advanced 0.02 of a cent to 1.72 US cents with 61,251 stocks clearing the market.

In the preference segment, JMMB Group 6% ended at US$1.002 after a transfer of 1,500 stock units and Productive Business Solutions 9.25% preference share ended at US$11.50 while 150 shares were traded.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD trading slips on Tuesday

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the volume of stocks changing hands declining 78 percent valued 63 percent lower than on Monday, resulting in trading of five securities, compared to six on Monday with one rising, four declining.

Trading concluded with an exchange of 129,260 shares at US$4,240 down from 576,968 units at US$11,519 on Monday.

Trading concluded with an exchange of 129,260 shares at US$4,240 down from 576,968 units at US$11,519 on Monday.

Trading averaged 25,852 units for US$848, down from 96,161 shares at US$1,920 on Monday, with a month to date average of 49,227 shares at US$1,322 compared to 52,224 units at US$1,382 on the previous day. September ended with an average of 73,281 units for US$5,102.

The US Denominated Equities Index dropped 0.85 points to finish at 243.00.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

At close of trading, Margaritaville climbed 2.84 cents to 12.35 US cents with investors trading just one share, Sterling Investments dropped 0.04 of a cent to 1.79 US cents with 578 units clearing the market, Sygnus Credit Investments lost 0.14 of a cent in closing at 8.81 US cents with investors trading 12,478 units and Transjamaican Highway dipped 0.01 of a cent and ended at 1.7 US cents in switching ownership of 116,103 stocks.

At close of trading, Margaritaville climbed 2.84 cents to 12.35 US cents with investors trading just one share, Sterling Investments dropped 0.04 of a cent to 1.79 US cents with 578 units clearing the market, Sygnus Credit Investments lost 0.14 of a cent in closing at 8.81 US cents with investors trading 12,478 units and Transjamaican Highway dipped 0.01 of a cent and ended at 1.7 US cents in switching ownership of 116,103 stocks.

In the preference segment, Productive Business Solutions 9.25% preference share shed 50 cents to close at US$11.50 after 100 stock units crossed the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

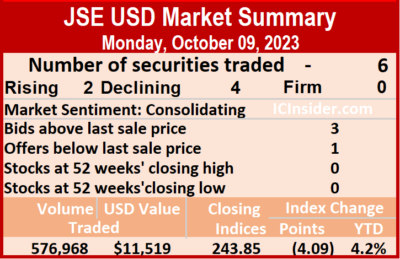

Trading picks up on the JSE USD Market

Trading picked up on the Jamaica Stock Exchange US dollar market ended on Monday, with a 296 percent jump in the volume of stocks changing hands valued 183 percent more than on Friday, resulting from trading in six securities, compared to just three on Friday and ended with prices of two rising, four declining.

A total of 576,968 shares were exchanged for US$11,519, up from 145,630 units at US$4,064 on Friday.

A total of 576,968 shares were exchanged for US$11,519, up from 145,630 units at US$4,064 on Friday.

Trading ended with an average of 96,161 shares at US$1,920 up from 48,543 shares at US$1,355 on Friday. Trading for the month to date averages 52,224 stocks at US$1,382 compared to 44,235 units at US$1,284 on the previous trading day. September ended with an average of 73,281 units for US$5,102.

The US Denominated Equities Index dropped 4.09 points to end at 243.85.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share dipped 0.2 of a cent in closing at 4.2 US cents with stakeholders exchanging 3,100 shares, Proven Investments shed 0.59 of one cent to end at 14.1 US cents, with 2,377 stocks traded, Sterling Investments rallied 0.03 of a cent and ended at 1.83 US cents with 1,033 stock units crossing the market. Sygnus Credit Investments declined 0.05 of a cent to 8.95 US cents, with investors trading 15,080 units, Sygnus Real Estate Finance USD sharepopped 0.4 of a cent to close at 9.9 US cents after investor traded 1,000 stocks and Transjamaican Highway dropped 0.05 of a cent to 1.71 US cents after 554,378 shares crossed the exchange.

At the close, First Rock Real Estate USD share dipped 0.2 of a cent in closing at 4.2 US cents with stakeholders exchanging 3,100 shares, Proven Investments shed 0.59 of one cent to end at 14.1 US cents, with 2,377 stocks traded, Sterling Investments rallied 0.03 of a cent and ended at 1.83 US cents with 1,033 stock units crossing the market. Sygnus Credit Investments declined 0.05 of a cent to 8.95 US cents, with investors trading 15,080 units, Sygnus Real Estate Finance USD sharepopped 0.4 of a cent to close at 9.9 US cents after investor traded 1,000 stocks and Transjamaican Highway dropped 0.05 of a cent to 1.71 US cents after 554,378 shares crossed the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on JSE USD Market

Trading plunged with a 72 percent lower volume of stocks changing hands valued 75 percent less than on Thursday at the close of the Jamaica Stock Exchange US dollar market on Friday and resulting in just three securities traded, compared to 10 on Thursday with one rising, one declining and one ending unchanged.

Overall, 145,630 shares were traded, for US$4,064 down compared with 526,142 units at US$16,546 on Thursday.

Overall, 145,630 shares were traded, for US$4,064 down compared with 526,142 units at US$16,546 on Thursday.

Trading averaged 48,543 units at US$1,355 compared with 52,614 shares at US$1,655 on Thursday, with a month to date average of 44,235 shares at US$1,284 compared with 43,804 units at US$1,277 on the previous day and September with an average of 73,281 units for US$5,102.

The US Denominated Equities Index declined 0.78 points to settle at 247.94.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.6. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share gained 0.2 of a cent to end at 4.4 US cents with investors dealing in 1,000 shares, Proven Investments ended at 14.69 US cents with traders dealing in 11,024 stock units and Transjamaican Highway declined 0.11 of a cent to 1.76 US cents as investors exchanged 133,606 units.

At the close, First Rock Real Estate USD share gained 0.2 of a cent to end at 4.4 US cents with investors dealing in 1,000 shares, Proven Investments ended at 14.69 US cents with traders dealing in 11,024 stock units and Transjamaican Highway declined 0.11 of a cent to 1.76 US cents as investors exchanged 133,606 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading jumps on JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with a 96 percent jump in the volume of stocks changing hands valued at percent more than Wednesday’s trade, resulting from trading in 10 securities, up from five on Wednesday and ended, with three rising, five declining and two ending unchanged.

Investors traded 526,142 shares for US$16,546 compared with 268,786 units at US$4,988 on Wednesday.

Investors traded 526,142 shares for US$16,546 compared with 268,786 units at US$4,988 on Wednesday.

Trading averaged 52,614 shares at US$1,655 versus 53,757 units at US$998 on Wednesday, with a month to date average of 43,804 shares at US$1,277 compared to 39,399 units at US$1,089 on the previous day. September ended with an average of 73,281 units for US$5,102.

The US Denominated Equities Index lost 5.33 points to close at 248.72.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.6. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share remained at 4.2 US cents and closed with an exchange of 6,876 shares, Margaritaville lost 1.29 cents to end at 9.51 US cents with stakeholders exchanging 2,695 stock units, MPC Caribbean Clean Energy ended at 54 US cents with investors dealing in 492 units.  Productive Business Solutions shed 15 cents in closing at US$1.80 with traders dealing in 22 stocks, Proven Investments rose 0.92 of one cent to 14.69 US cents after 23,066 stocks passed through the market, Sterling Investments gained 0.1 of a cent and ended at 1.8 US cents with an exchange of 25,000 units. Sygnus Credit Investments dipped 0.02 of a cent in closing at 9 US cents with shareholders swapping 18,018 shares, Sygnus Real Estate Finance USD share declined 0.5 of one cent to close at 9.5 US cents with 150 stock units clearing the market and Transjamaican Highway popped 0.17 of a cent to end at 1.87 US cents after an exchange of 447,823 stocks.

Productive Business Solutions shed 15 cents in closing at US$1.80 with traders dealing in 22 stocks, Proven Investments rose 0.92 of one cent to 14.69 US cents after 23,066 stocks passed through the market, Sterling Investments gained 0.1 of a cent and ended at 1.8 US cents with an exchange of 25,000 units. Sygnus Credit Investments dipped 0.02 of a cent in closing at 9 US cents with shareholders swapping 18,018 shares, Sygnus Real Estate Finance USD share declined 0.5 of one cent to close at 9.5 US cents with 150 stock units clearing the market and Transjamaican Highway popped 0.17 of a cent to end at 1.87 US cents after an exchange of 447,823 stocks.

In the preference segment, JMMB Group 6% fell 6.8 cents to US$1.002 with a transfer of 2,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading falls on the JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, with the volume of stocks changing hands rising 6 percent but with a 52 percent lower value than on Tuesday, resulting in trading of five securities, compared to 10 on Tuesday with one rising, two declining and two ending unchanged.

Overall, 268,786 shares were traded, for US$4,988 compared to 252,693 units at US$10,412 on Tuesday.

Overall, 268,786 shares were traded, for US$4,988 compared to 252,693 units at US$10,412 on Tuesday.

Trading averaged 53,757 units at US$998, versus 25,269 shares at US$1,041 on Tuesday, with a month to date average of 39,399 shares at US$1,089 compared with 34,613 units at US$1,119 on the previous day, down from September with an average of 73,281 units for US$5,102.

The US Denominated Equities Index fell 1.83 points to conclude trading at 254.05.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.6. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share climbed 0.12 of a cent to 4.2 US cents in an exchange of 5,383 shares, Sterling Investments dipped 0.05 of a cent to close at 1.7 US cents in an exchange of 8,900 units. Sygnus Credit Investments remained at 9.02 US cents in an exchange of 22 stocks, Sygnus Real Estate Finance USD share ended at 10 US cents after exchanging 990 stock units and Transjamaican Highway lost 0.1 of a cent and ended at 1.7 US cents after 253,491 shares passed through the market.

At the close, First Rock Real Estate USD share climbed 0.12 of a cent to 4.2 US cents in an exchange of 5,383 shares, Sterling Investments dipped 0.05 of a cent to close at 1.7 US cents in an exchange of 8,900 units. Sygnus Credit Investments remained at 9.02 US cents in an exchange of 22 stocks, Sygnus Real Estate Finance USD share ended at 10 US cents after exchanging 990 stock units and Transjamaican Highway lost 0.1 of a cent and ended at 1.7 US cents after 253,491 shares passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.