The PE is the most common measure of valuing stocks and understanding it’s use is critical to successful investing. It is computed by dividing the price of a stock by the earnings for each share.

The PE is the most common measure of valuing stocks and understanding it’s use is critical to successful investing. It is computed by dividing the price of a stock by the earnings for each share.

This is important since various companies have different earnings and number of issued share. Why is the measure important? Investors are buying an intangible which is future income, the PE tells how many years of profit or earnings investors have price into a company’s stock. For example, take the hottest stock around now – NCB Financial, this publication projects the group to generate earnings next year of $17.5 billion after tax or $12.50 per share. Based on the above price, the stock now sells for 12.7 times 2019 earnings. If the profit stagnates at these levels then it will take 12.5 years to recover an investment in the stock assuming all profits were paid out to shareholders.

Investors will compare this PE ratio of 12.7 with the overall market which is now at 16 as well as against other stocks. If other stocks are selling below the value of NCB then it may be better to go after those, all things being equal, they should provide a better return on investments.

While the PE is best used in the stock market it can be used in the money and real estate markets as well.

Archives for December 2018

PE ratio most critical investment tool

PE ratios continue to rise

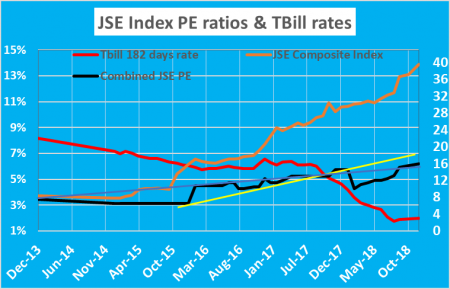

Treasury bills rates bottomed and have moved back closer in line with the Bank of Jamaica’s overnight rate of 2 percent.

Treasury bills rates bottomed and have moved back closer in line with the Bank of Jamaica’s overnight rate of 2 percent.

IC Insider.com is forecasting a further increase in T-bill rates to move above 2 percent, this could happen with the December Treasury bill auction.

In the mean time the main market of the Jamaica Stock Exchange has moved on the new record highs, with NCB Financial being the primary mover with the stock closing at $159.05 on Friday. The Junior Market that peaked at an all-time high in October has pulled back with no new price sensitive news to encourage aggressive buying.

The above developments are happening as the PE ratio of the market continues to inch higher. The ratio climbed slowly until June but moved much sharper thereafter, to better reflect the sharp fall in interest rates. The recent inching up of Treasury bill rates appears to have slowed the upward movement in the average PE ratio of the over all market that sits just under 16 currently. The average PE is now ahead of the longer term trend that goes back to 2013, but well below the trend, from late 2015 that suggests that the average PE is headed for 18, that will require a 15 percent rise in stock prices to get there. December is usually a bullish month and so the PE of 18 may be reached by year end or early in 2019.