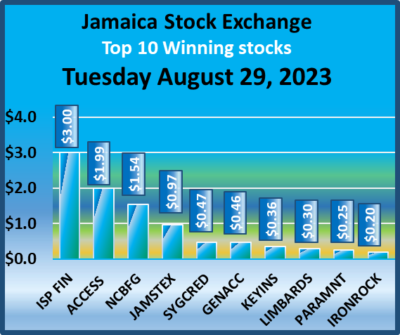

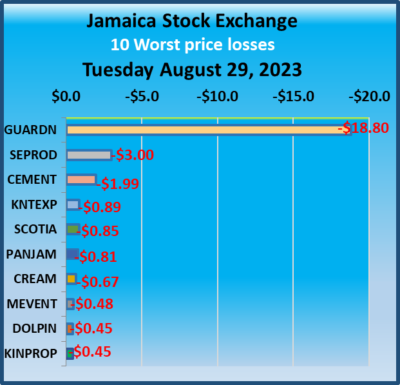

Trading surged on Tuesday on the Jamaica Stock Exchange compared with Monday after robust activity in Carreras, Jamaica Broilers, Stanley Motta in the Main Market and Dolphin Cove in the Junior Market and resulted in a jump in value and volume of stocks traded in all markets of the exchange compared with Monday.

At the close, the JSE Combined Market Index rose 502.75 points to 331,355.08, the All Jamaican Composite Index rallied 1,999.27 points to 351,449.14, the JSE Main Index climbed 881.84 points to 317,871.56, the Junior Market Index dropped 34.97 points to settle at 3,797.20, while the JSE USD Market Index popped 1.09 points to end at 235.13.

At the close, the JSE Combined Market Index rose 502.75 points to 331,355.08, the All Jamaican Composite Index rallied 1,999.27 points to 351,449.14, the JSE Main Index climbed 881.84 points to 317,871.56, the Junior Market Index dropped 34.97 points to settle at 3,797.20, while the JSE USD Market Index popped 1.09 points to end at 235.13.

Trading of Preference shares ended, with Jamaica Public Service 7% rallied $8.86 in closing at $58.86.

At the close, investors traded 23,495,915 shares in all three markets, down from 10,494,639 stocks on Monday. The value of stocks traded on the Junior and Main markets ended at $235 million, compared to $71.6 million on Monday. Trading on the JSE USD market ended with investors exchanging 593,068 shares for US$64,296, up from 884,498 units at US$16,456 on Monday.

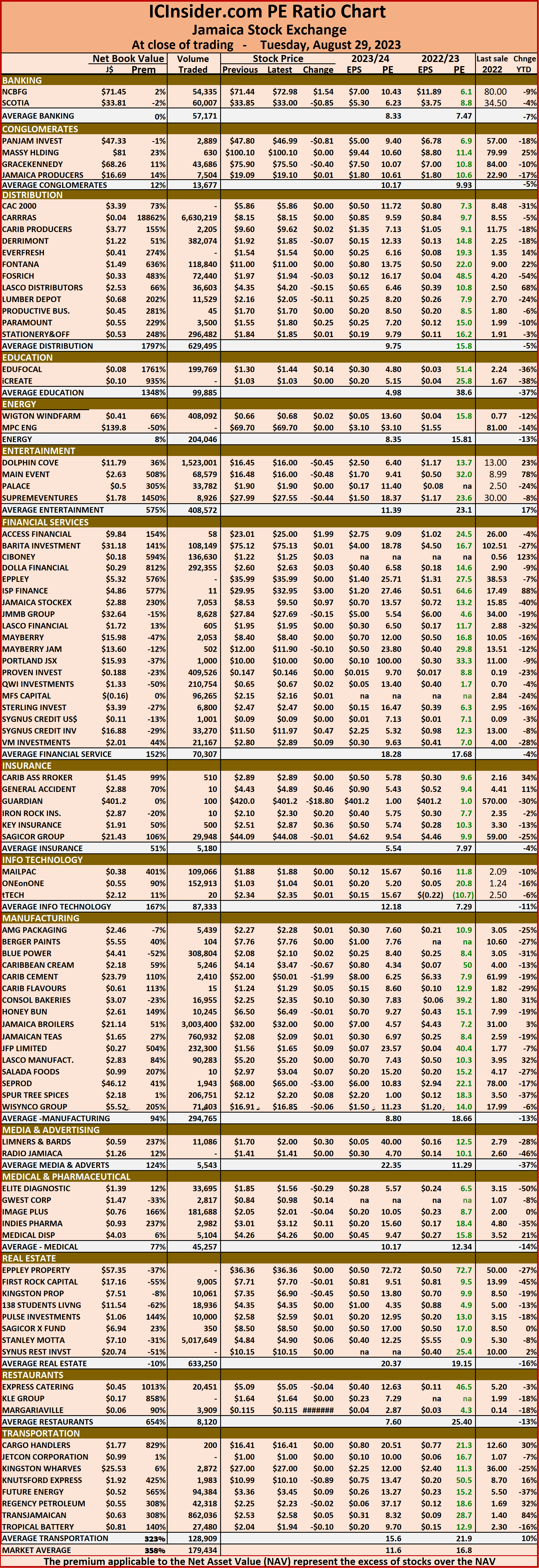

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 16.8 on 2022-23 earnings and 11.6 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 16.8 on 2022-23 earnings and 11.6 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one time items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Trading surged on the Jamaica Stock Exchange

August 29, 2023 by IC Insider.com

Filed Under: Feature Stories, JSE Combined, Stock Market Tagged With: Carreras, Daily Trading, Dolphin Cove, Emerging market, Jamaica Broilers, Jamaica Stock Exchange, Jamaica Stock Exchange Combined Index, Jamaican stocks, JPS, JSE Main Index, junior market, Junior Market index, Net asset Value of Jamaican stocks, PE Ratio of Jamaican stocks, Stanley Motta, Trading Activity

About IC Insider.com