Discovery

Onko leipä pahaksi vartalolle: mikä on kaikkein ravitsemuksellisinta ja kuinka paljon sitä voi syödä päivässä

Ilmava kuin pörrö: miten valita hiiva pääsiäiseksi

Pitäisikö sinun irrottaa kaikki laitteet yön yli: 7 laitetta, joiden pistokkeet kannattaa irrottaa

Miten putket puhdistetaan turvallisesti: päästä eroon tukoksista nopeasti ja oikein

Ei sieniä, ei hometta, ei hometta, ei mössöä: vinkkejä, miten päästä eroon kosteudesta kylpyhuoneessa

Voit tehdä sen muutamassa minuutissa: Näin poistat tarraliiman miltä tahansa pinnalta

Kokeneet emännät ovat tehneet tätä jo pitkään: lifehack siihen, miten kutistunut pusero saadaan takaisin kuntoon

Miten parantaa reitittimen signaalia: 3 todistettua tapaa

Millä voit tiskata astiat, jos sinulla ei ole pesuainetta: Top 5 luonnontuotetta

Miten puhdistaa tuulilasi kertymistä ja hyttysistä: 3 parasta pennin korjaustoimenpidettä

Älä häpäise pyhää paikkaa: mitä ruokia ei saa pyhittää pääsiäisenä

Pennosilla ja vaivattomasti: Näin puhdistat linoleumin kellastumisesta ja liasta

Kuinka pakastaa marjoja astiassa tai pussissa talven varalle: vinkkejä emännille

Miten saat ilmaista polttopuuta: säännöt ja ohjeet

Kuinka kuoria ja leikata avokado nopeasti: alkuperäinen lifehack

Miten päästä eroon bedbugs: tehokkaita tapoja kotiäidille huomata

Siitä tulee kuin uusi: Top 3 tapaa poistaa keltaiset tahrat T-paidasta

Kuinka puhdistaa termospullo ja poistaa haju: kokeneiden retkeilijöiden vinkit

Miten voit eristää asunnon, jos siellä ei ole lämmitystä: 9 vaihtoehtoa

Parempi kuin kaupassa: Näin suolaa punainen kala maukkaasti

Miksi lisäät aspiriinia pyykkiin: 4 ei-selvää syytä

Kumpi paistetaan ensin: sipulit vai porkkanat

Miten silittää ryppyiset vaatteet ilman silitysrautaa: top 5 odottamatonta lifehackia

Kalvon poistaminen ja hajun poistaminen: miten maksa käsitellään ennen ruoanlaittoa

Näin saat selville, mikä pesukoneessasi on rikki: yleisimmät viat

Mitkä kynttilät palavat pisimpään eivätkä sammu: Valokatkon elämänturvallisuusvinkit

Miten jäätyä vähemmän pommisuojassa: perussäännöt

Miten juoda vettä laihtua: laihtuminen nopeasti ilman liikuntaa

Maukkaimmat mansikat: Näin pakastat mansikat talven varalle

Kuinka sulattaa liesi raa’alla puulla ja tehdä tuli: alkeellinen lifehack

Mitä vihanneksia ei saa istuttaa vierekkäin: pilaat koko sadon

Mitä istuttaa valkosipulin ja sipulin viereen: parhaat ja huonoimmat naapurit

Miten päästä eroon valkoisista ötököistä kukissasi: puutarhureiden flyhack

Kaapissa olevien tavaroiden tuoksuttaminen: kalliiden hotellien käyttämä menetelmä

Miksi lisätä kanelia kukkaruukkuun: kokeneiden emäntien salainen elämänohje

Jos tuli paha helle: lääkäri kertoi, miten selvitä +35:ssa

Miten korvata Nimesil: analogit ilman reseptiä

Kuinka paljon ja minne laitat puuteria ja hoitoaineita: lifehackit rahan säästämiseen

Miksi suolakurkut kutistuvat ja pehmenevät: virheiden erittely

Sano hyvästit rakoille: lifehackit kenkien venyttämiseen

Työnnä ilmapallo vessanpönttöön: tulos hämmästyttää sinua

Miksi kissat työntävät takapuolensa ihmisten kasvoihin: Syy tähän käytökseen saattaa yllättää sinut

Kiiltävän puhdas 5 minuutissa: Näin valkaiset muovisen ikkunalaudan

Miten keittää mannasuurimot maidon kanssa ja ilman kokkareita: 3 vinkkiä ukrainalaisilta kotiäideiltä

Näin pidät kurkut tuoreina pidempään: 5 parasta kokeiltua vinkkiä

Olet valmis kahdessa minuutissa: nopea niksi siihen, miten maitojauhe laimennetaan oikein

Mikä hillo on terveellisin: maukas apu keholle talvella

Milloin tomaatit korjataan puutarhalla ja voiko ne nyppiä vihreinä

Milloin ja miten kurkut korjataan oikein, jotta sato ei vahingoitu

Tulet yllättymään, ettet tiennyt tätä aiemmin: miten saat tietää sukan koon mittaamatta

Nämä kasvit karkottavat torakoita: laita niitä kotiisi ja hyönteiset lähtevät pois

8 istuttamisen arvoista kasvia syyskuussa: älä missaa tätä tilaisuutta

Milloin on paras aika istuttaa valkosipulia keväällä: mitä puutarhurit ja kansanperinne neuvovat

Kerran viikossa tai kahdessa on virhe: kuinka usein vuodevaatteet pitäisi vaihtaa

Miksi et voi oikeasti toivoa miellyttävää ruokahalua: aiheutat ongelmia

Milloin on paras aika purkittaa kurkkuja ja tomaatteja: suotuisia päivämääriä ja hyväksi havaittuja reseptejä

Älä koskaan huuhtele tätä alas lavuaarista: yksityiskohtainen luettelo

Ei borssia tai vinaigretteä: yksinkertaisia punajuuriruokia

Dlaczego mądre gospodynie domowe myją cytrynę w skarpetce: sprytna sztuczka uratuje duży problem

Pozostaw jajka w opakowaniu kupionym w sklepie: dlaczego nie można przechowywać ich w drzwiach lodówki

Wymieszaj sodę oczyszczoną z czosnkiem – będziesz zaskoczony, co stanie się w ciągu 15 minut

Roskachestvo odkrył najlepszą czerwoną rybę idealną na kanapki noworoczne

Zjesz mniej: lekarz sportowy wymienia nieoczekiwane zalety pikantnych potraw

W przeciwnym razie nie można uniknąć wzdęć w samolocie: lekarz mówi, jak jeść przed lotem

Napełnij łóżka mlekiem – będziesz skakać i piszczeć z powodu rezultatu: tajna wskazówka

Dowiedz się, jak zrobić 'kudraniki’: soczyste i delikatne danie, które zostanie natychmiast zmiecione ze stołu

Wystarczą 3 minuty: naukowcy ujawnili, w jaki sposób mężczyźni mogą zwiększyć podniecenie

Przyklej zakrętkę od butelki do szafki: oczy ci się zaszklą na widok rezultatu

Oto dlaczego łysiejesz na załamaniach grzywki: trycholog wyjaśnia, jak to naprawić

Zachowanie koloru i zadowolenie z ceny: 10 najlepszych szamponów do włosów farbowanych w 2023 r

Główne niebezpieczeństwo wakacji na Morzu Azowskim jest nazwane – zdecydowanie nie chcesz tam jechać

Zamrażanie płynu do mycia naczyń: tylko kilka osób wie, jak to się kończy

Leczy przeziębienia, depresję i choroby serca: przepis na uzdrawiające 'złote mleko’

Zachowaj najsilniejsze: agronom wyjaśnił hodowcom dacz, jak i kiedy przerzedzać buraki

Nie będziesz chciał wracać do miasta: Jakie rzeczy zdecydowanie powinieneś zabrać na wieś

Spodziewaj się dużych zmian: Polacy byli zszokowani cenami chleba tego lata

Zachowaj ciepłe dłonie nawet przy minus 40: dzięki tym dwóm prostym sztuczkom Twoje dłonie będą bezpieczne na mrozie

Roskachestvo wymieniło najsmaczniejsze mandarynki, które można bezpiecznie kupić na Nowy Rok: lista została opublikowana

Chwyć go – jest pierwszym, który zostanie zmieciony: Roskachestvo nazwał najlepsze mleko – tylko ono może być używane w naleśnikach

Głupcy uciekają: co jest nie tak z wakacjami w Turcji – Polacy wściekli z powodu nędznych wakacji za granicą

Zapisz w zeszycie i zapamiętaj: główne sygnały kierowców na drodze

Rozciągnij gumkę na szklance: tylko kilka osób wie, dlaczego jest to konieczne

Albo z cebulką, albo z dżemem – przepis na pyszne pierogi leniwe od popularnej blogerki kulinarnej

Czy to karma, czy co? Dlaczego dzieci powtarzają los swoich rodziców i jak to naprawić

Przepis na puszysty bułgarski omlet: sekret tkwi w tym produkcie – dodaj tylko 100 g

Wygląda krzykliwie i bez smaku: zabronione jest łączenie tych kolorów w ubraniach

Rosół będzie krystalicznie czysty: wrzuć to warzywo do garnka i bądź zaskoczony rezultatem

Grymas bólu: nie waż się jeść tej niebezpiecznej zieleni – rosnącej w każdym łóżku

Czas poszukać nowego: jak zdać sobie sprawę, że trzeba w pośpiechu uciec od manikiurzystki

Zmarszczki zostaną wygładzone bez śladu: te trzy kremy do rąk pozostawiają skórę miękką i delikatną

Najpopularniejszy tatuaż w ZSRR: co oznaczał wschód słońca na pędzlu

Połóż torebkę herbaty na kaloryferze – będziesz zaskoczony niesamowitym efektem

Jak chronić porzeczki przed chorobami, gdy jagody są dojrzałe: rustykalna cudowna metoda

Przeciągnij brzytwą po starej parze dżinsów: będziesz zaskoczony tym, co się potem stanie

Pozostaw tę część kapusty po ścięciu – za kilka tygodni uzyskasz drugi plon

Przechodnie będą piszczeć z zachwytu: najmodniejsze kurtki puchowe tej jesieni – kula do sklepu

Ten jednoskładnikowy dressing z pewnością zapewni ci super plony – wypróbuj sekretny przepis już teraz

Będziesz musiał zrezygnować ze znanego święta: jak poważnie zaoszczędzić pieniądze na Wielkanoc

Ten delikatny kwiat nie wymaga przesadzania przez 20 lat: wyrośnie z niego dywan i oczaruje sąsiadów

Rosja jest gotowa na historyczną decyzję: oto, co zrobią z przeterminowanymi produktami

Usuwanie zmarszczek, cieni i opuchlizny: te 3 kremy pod oczy czynią cuda

Buraki i pół puszki groszku: obłędnie pyszna sałatka – żaden winegret nie może się z nią równać

Tylko kilka tabletek: przyklejona sadza odpadnie na twoich oczach – opłacalny sposób na 'ożywienie’ garnków

Rosnąć jak na drożdżach bez chemii: które warzywa warto sadzić na pryzmie kompostowej?

Goście będą oblizywać widelce jeszcze przez dwa dni: prosty przepis na danie z ryżu na Sylwestra

Ten wspaniały krzew w mgnieniu oka wyrośnie na żywopłot: kwitnie w taki sposób, że nie można oderwać od niego wzroku

Upiecz dowolną część kurczaka w Coca-Coli: tylko kilka osób wie, co się stanie

Wlej jodynę do kociej kuwety – oczy ci się zaszklą

Dugult a WC, ami nem folyik le? Ne hívjon vízvezeték-szerelőt, egy egyszerű PET-palack megmenti

A burgonya így két évig eláll.Egyszerű

A kúszónövényeknek szánt szerkezetek télen is elkészíthetők

Hogyan készítsük el a fűszernövényeket télre?

Kertészkedés a Holdnál december utolsó hetében és egész évben

Hogyan tartsuk melegen magunkat természetes módon: 3 kulcsfontosságú ősi trükk, hogy melegen tartsuk magunkat és spóroljunk

Hogyan készítsünk gombócokat tojással? Egy kis trükkel mesterművé varázsolhatjuk őket

Hetekig frissen tartja a gyümölcsöt.Az élelmiszerboltok speciális csomagolást kínálnak

Tök: hogyan használjuk és tároljuk a legjobban?

Konténerek kültéri termesztéshez vagy cserép vagy doboz?

S Napégés: Az elsősegély nyújt néhány alapvető élelmiszert

Mi történik, ha az alufóliát golyóvá gyűröd és beledobod a WC-tartályba.Ezt nézd meg!

A következő élelmiszervásárlás máris több száz koronával olcsóbb lehet

Tegye a tablettát a mosógépbe, és kapcsolja be.Az eredmény meg fogja lepni

Vetőuborka: hagyja, hogy a termés megérjen a magszedéshez

Hogyan kell szaporítani a tormát? Az őszi betakarítás során készítsük elő a tavaszi palántákat

A díszágyások slágere a sárkányvirág.Neked is van ilyen a kertedben?

Hogyan választják ki a kutyák a kedvenc emberüket.Meglepőek a szempontjaik

Az élelmiszerek hűtőben való tárolásának 5 halálos bűne.Te is elköveted őket?

Házi spagettiszósz az üvegekhez: semmi sem veri az olasz sült paradicsomszószt

Villámmártás grillezett húsokhoz Pohlreich szerint: Pohlreich: Finom és szupergyors

Üres adagoló: Ismerjük az okokat, amiért a madarak nem repülnek hozzád

A levelek lehullottak a mikulásvirágodról: Valószínűleg a kártevők a hibásak

Colourful tavaszi dobozok: amely növények megbirkózni a fickle időjárás?

A sütőállvány tisztítása: Tegye egy zacskóba, és készítsen mosogatószeres tablettát

Hogyan tanítsuk meg a kutyát, hogy ásson a virágágyásokban? Tedd a kezed a pofájához

Egy egyszerű trükk elég ahhoz, hogy a málna ne nőjön.Mindenféle munka nélkül elvégezhető!

A megmaradt sütemények és kalácsok nem tartoznak a kukába: Így használhatod fel őket a konyhában

Ne vidd ki a kutyákat az esőbe: A lehulló cseppek károsíthatják ezt a fontos érzékszervet

Hogyan tároljuk a fokhagymát: A fagyasztás remek módszer, de jól kell csinálni

Mit mond neked egy kutya, amikor megnyal téged? Meg fogsz lepődni

Január: ideális időszak a kerti gépek kisebb javításainak elvégzésére

Akár tízezreket is megspórolhatunk a lombhullató fák metszésével és hibridizálásával: hogyan kell csinálni?

Fanfű: hogyan kell megfelelően trágyázni, hogy maximalizáljuk bőséges virágzását?

Az orchidea gyökerei kilógnak a tálból? Cselekedj, különben nem fog újra virágozni

A tapasztalt háziasszonyok a rizshez a vízbe teszik a héjat, amit általában kidobnak.Fantasztikus íze van

Milyen zöldségeket ültethetsz most, és milyen gazdag termésed lesz? Próbáld ki a földi almát

Egy olcsó és hatékony trükk a hangyák ellen: használj babaport

Megyek érte és megyek: Felejtsd el a káoszt a szekrényben.Praktikus tippek a ruhák rendben tartásához

Úgy érzed, szükséged van egy vitaminbombára? Kezdj el gyümölcslevet facsarni!

Inspiráció: Mit és hogyan ültessük a virágtartókat, hogy a legszebbek legyenek az utcán

Hogyan neveljünk rózsát cserépben: 3 tipp, ami jól fog jönni

Hagyományos osztrák mandulakerék

Érett szeder: kényeztesse magát egy finom méregtelenítő kéreggel a kertből

Nagyszerű áttekintés azokról a magvakról, amelyeket május végére már ideje elvetni

Tavaszi életépítő orchideák számára: A fokhagymakivonat a virágzást a maximumra tolja

Hogyan készítsük elő a magágyat a vetéshez: lépésről lépésre

Kert novemberben

Asztalra állítás a madárvendégek számára.A madáretető örömet hoz a téli napokra

A töklevél szürke bevonata komoly problémát jelenthet.A sütőpor segít

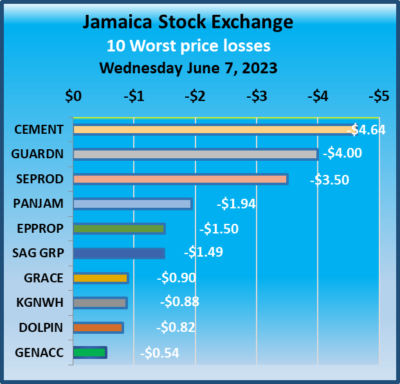

At the close of trading, the JSE Combined Market Index fell 2,224.20 points to 346,165.48, the All Jamaican Composite Index declined 2,652.86 points to close at 368,523.48, the JSE Main Index shed 2,552.97 points to close at 333,631.41, the Junior Market Index rose 17.25 points to end at 3,808.69 and the JSE USD Market Index dipped 11.81 points to close at 229.59.

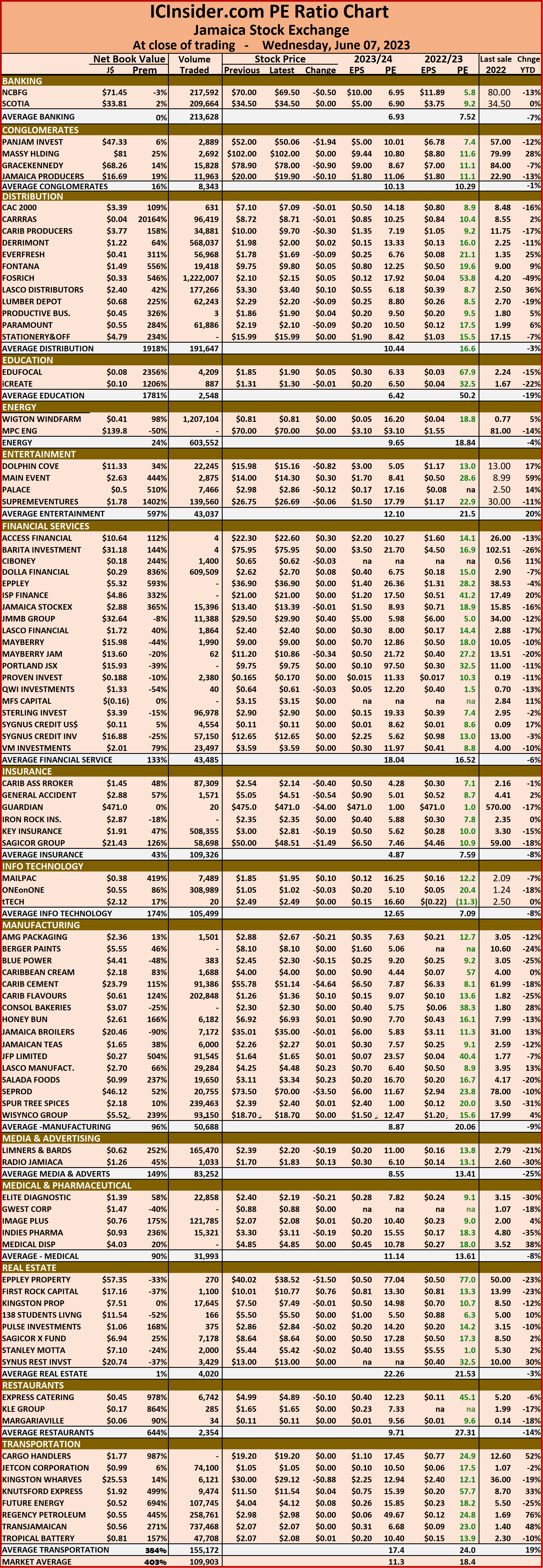

At the close of trading, the JSE Combined Market Index fell 2,224.20 points to 346,165.48, the All Jamaican Composite Index declined 2,652.86 points to close at 368,523.48, the JSE Main Index shed 2,552.97 points to close at 333,631.41, the Junior Market Index rose 17.25 points to end at 3,808.69 and the JSE USD Market Index dipped 11.81 points to close at 229.59. The market’s PE ratio ended at 18.4 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading.

The market’s PE ratio ended at 18.4 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading. Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.