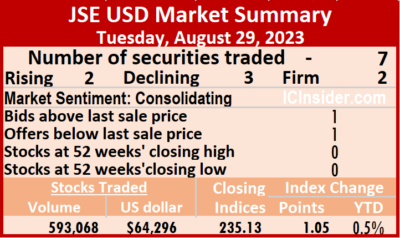

The volume of stocks trading declined 33 percent, but the value jumped 291 percent more than on Monday at the close of the Jamaica Stock Exchange US dollar market on Tuesday, resulting in seven securities being traded, up from three on Monday and ended with two rising, three declining and two unchanged.

Overall, 593,068 shares were traded for US$64,296 compared with 884,498 units at US$16,456 on Monday.

Overall, 593,068 shares were traded for US$64,296 compared with 884,498 units at US$16,456 on Monday.

Trading averaged 84,724 shares at US$9,185 compared to 294,833 units at US$5,485 on Monday. Trading for the month to date averaged 58,949 shares at US$4,079 compared to 57,529 units at US$3,798 on the previous day. Trading in July ended with an average of 95,306 units for US$2,965.

The US Denominated Equities Index advanced 1.05 points to conclude trading at 235.13.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.6. The PE ratio is calculated based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and one with a lower offer.

At the close, Margaritaville dipped 0.01 of a cent to 11.49 US cents after 3,909 shares changed hands, Productive Business Solutions ended at US$1.70 after 45 units were traded, Proven Investments fell 0.1 of a cent to close at 14.55 US cents in trading 409,526 stocks. Sterling Investments rallied 0.04 of a cent to end at 1.98 US cents, with trading in 91,000 shares, Sygnus Credit Investments rose 0.04 of a cents to 9.1 US cents after a transfer of 1,001 units and Transjamaican Highway skidded 0.08 of a cent to end at 1.61 US cents with an exchange of 87,500 shares.

At the close, Margaritaville dipped 0.01 of a cent to 11.49 US cents after 3,909 shares changed hands, Productive Business Solutions ended at US$1.70 after 45 units were traded, Proven Investments fell 0.1 of a cent to close at 14.55 US cents in trading 409,526 stocks. Sterling Investments rallied 0.04 of a cent to end at 1.98 US cents, with trading in 91,000 shares, Sygnus Credit Investments rose 0.04 of a cents to 9.1 US cents after a transfer of 1,001 units and Transjamaican Highway skidded 0.08 of a cent to end at 1.61 US cents with an exchange of 87,500 shares.

In the preference segment, JMMB Group 6% remained at US$1 and closed with 87 stock units being traded.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.