On Monday 24 of January, the Junior Market index reached to 3,700 mark for the first time and went on to record seven consecutive days of record closing highs, with the close on the 27 at 3,669.73 and peaking for that week at 3,717.45 on Friday, January 28, by Friday last week, the market which hit an intraday record high of 4,051.04 ended at a new closing high of 3,985.87 to be up 16.3 percent for the year to date and up just 37 percent from the pre-pandemic crash and 96 percent from the low in March 2020.

On the surface, the Junior Market has had a full recovery from the 2020 Covid-19 induced collapse that saw the index collapsing from 2,900 points at the end of February to 2,534 points on March 6 and bottoming out at 2,031.79 points on March 18 for a plunge of 39 percent from the start of 2020, and much more after peaking at 3,662 points in mid-August 2019.

On the surface, the Junior Market has had a full recovery from the 2020 Covid-19 induced collapse that saw the index collapsing from 2,900 points at the end of February to 2,534 points on March 6 and bottoming out at 2,031.79 points on March 18 for a plunge of 39 percent from the start of 2020, and much more after peaking at 3,662 points in mid-August 2019.

A closer look at the market indicates there are elements of the market that are not back, with many stocks still trading below their pre-covid-19 levels. This group includes Access Financial that was at $32.94, just before the collapse, and is now at $25, Blue Power at $4.52 then and is now at $3.20, CAC2000 ordinary share then at $12.50, now $8.25, Consolidated Bakeries at $1.79, and now trading at $1.05, Jetcon Corporation at a $1.31, currently 94 cents, Knutsford Express at $11 in 2020, presently at $8, Main Event at $5.79 and now trades at $4 and Stationery and Office Supplies $8.86 it last traded at to be $6.

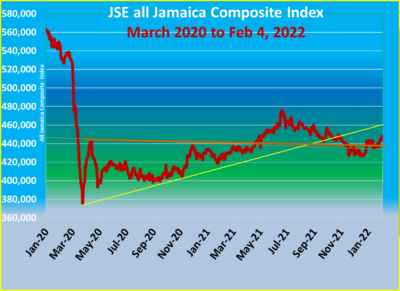

While the Junior Market has made great strides since hitting the 2020 low, the same is not the case for the heavily financially weighted Main Market that continues to be mired in depression following the initial sharp fall in March 2020 when the market fell precipitously to 375,091.09 points on the All Jamaican Composite Index from 529,722.22 at the end of February, for a 29.2 percent decline. As o Friday last the market is only up 20 percent from the March 2020 market bottom and 15 percent below the end of February 2020 level, and still well below the all-time high of 584,697.71 it closed on August 8, 2019. The major reason for the prolonged decline is primarily due to falling in stocks such as a Jamaica Stock Exchange, Kingston Wharves, NCB Financial, PanJam Investment, Proven Investments, Palace Amusement, Sagicor Group, Sagicor Select Funds, Scotia Group, Supreme Ventures, Sygnus Credit Investments, Wighton Windfarm. Strong gains in Barita Investments, Grace Kennedy, Caribbean Cement, Caribbean Producers, Salada Foods, Seprod and Radio Jamaica could not negate the effect of the big decliners.

While the Junior Market has made great strides since hitting the 2020 low, the same is not the case for the heavily financially weighted Main Market that continues to be mired in depression following the initial sharp fall in March 2020 when the market fell precipitously to 375,091.09 points on the All Jamaican Composite Index from 529,722.22 at the end of February, for a 29.2 percent decline. As o Friday last the market is only up 20 percent from the March 2020 market bottom and 15 percent below the end of February 2020 level, and still well below the all-time high of 584,697.71 it closed on August 8, 2019. The major reason for the prolonged decline is primarily due to falling in stocks such as a Jamaica Stock Exchange, Kingston Wharves, NCB Financial, PanJam Investment, Proven Investments, Palace Amusement, Sagicor Group, Sagicor Select Funds, Scotia Group, Supreme Ventures, Sygnus Credit Investments, Wighton Windfarm. Strong gains in Barita Investments, Grace Kennedy, Caribbean Cement, Caribbean Producers, Salada Foods, Seprod and Radio Jamaica could not negate the effect of the big decliners.

Juniors recover from covid Main Market suffering

February 7, 2022 by IC Insider.com

Filed Under: JSE Combined, Stock Market Tagged With: Barita Investments, Caribbean Cement, Caribbean Producers, Emerging markets, Emerging Stock, Grace Kennedy, Jamaica Stock Exchange, Jamaican stocks, junior market, Kingston Wharves, Knutsford Express, NCB Financial Group, PANJAM Investment, Proven Investments, Radio Jamaica, Sagicor Group, Salada Foods, Scotia Group, Seprod, Supreme Ventures

About IC Insider.com