An impairment charge on its investments in the Barbados’ Arawak Cement Company, hits Trinidad Cement with a $153 million charge.

The impairment was not the only hit to profits for the year, write down of deferred tax assets hit results with $86 million, plunging the group for the full year to December, into a loss of $211 million compared with profit of $67.3 million in the prior year. The company in its report to shareholders just released states, “as a result of deteriorating market conditions the Group has impaired its investment in Arawak”.

The impairment was not the only hit to profits for the year, write down of deferred tax assets hit results with $86 million, plunging the group for the full year to December, into a loss of $211 million compared with profit of $67.3 million in the prior year. The company in its report to shareholders just released states, “as a result of deteriorating market conditions the Group has impaired its investment in Arawak”.

Excluding the impairment and tax asset adjustments, the group would have reported a loss of $19 million before taxation compared with a loss of $9.7 million in 2013 December quarter and a profit of $58 million before tax compare to $39 million in 2013 for the full year.

Group revenues reached $2.1 billion, an increase of $172.5 million or 9.0 percent compared to the year 2013. Management reported that “this improvement was driven by growth in the domestic cement markets in Trinidad and Jamaica, improved concrete sales volume of 14.6 percent, and by price increases which were implemented in Trinidad, Jamaica and Guyana. Additionally, in Jamaica, CCCL was able to supply 155.4k tonnes of clinker (36.6k tonnes in 2013) to Venezuela.”

“The Company has commenced negotiations with the lenders and at the date of approval of the financial statements by the Board of Directors of the Company, the TCL Group and the majority of the lenders had reached agreement in principle on features of the loan restructuring and its key terms. In addition the Board has embarked upon a comprehensive financial and operational review of the TCL Group, which is in progress, and an overall restructuring plan for the TCL Group which seeks to secure the long-term viability of the Company is being implemented. This Plan includes the completion of the loan restructuring with the lenders, settlement of all back-pay payments to employees in Trinidad and Tobago and the injection of equity capital from the shareholders. This overall restructuring is expected to be completed by the second quarter of 2015,” the management in their reported stated.

The company rights issue which is to be priced at TT$2.90 per share is to commence on March 5 for shareholders on record as of the March 3. The stock traded at $2.50 on Monday quite some way off the $2.90 rights price.

Arawak $153m impairment hits TCL

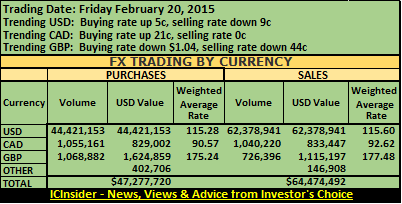

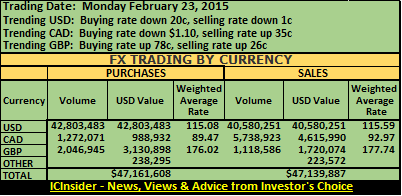

Buoyant foreign exchange flows – Monday

Inflows of foreign exchange into the system was buoyant on Monday with equal buying and selling of foreign currencies by dealers. Purchases of all currencies amounting to US$47,161,608 compared with the US$47,277,720, on Friday. Selling was for the equivalent of US$47,139,887 versus US$64,474,492 sold on Friday.

In US dollar trading, dealers bought US$42,803,483 compared to US$44,421,153 on Friday. The buying rate for the US dollar fell 20 cents to $115.08 and US$40,580,251 was sold versus US$62,378,941 on Friday, the selling rate dropped 1 cent to $115.59. The Canadian dollar buying rate slid $1.10 to $89.47 with dealers buying C$1,272,071, and selling C$5,738,923, at an average rate that rose 35 cents to $92.97. The rate for buying the British Pound climbed 78 cents to $176.02 for the purchase of £2,046,945, while £1,118,586 was sold, at an average rate of $177.74, up by 26 cents. At the end of trading it took J$131.42 to purchase the Euro, 35 cents less than on Friday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$129.09 for 19 cents lower than on Friday.

In US dollar trading, dealers bought US$42,803,483 compared to US$44,421,153 on Friday. The buying rate for the US dollar fell 20 cents to $115.08 and US$40,580,251 was sold versus US$62,378,941 on Friday, the selling rate dropped 1 cent to $115.59. The Canadian dollar buying rate slid $1.10 to $89.47 with dealers buying C$1,272,071, and selling C$5,738,923, at an average rate that rose 35 cents to $92.97. The rate for buying the British Pound climbed 78 cents to $176.02 for the purchase of £2,046,945, while £1,118,586 was sold, at an average rate of $177.74, up by 26 cents. At the end of trading it took J$131.42 to purchase the Euro, 35 cents less than on Friday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$129.09 for 19 cents lower than on Friday.  Other currencies bought, amounted to the equivalent of US$238,295 while the equivalent of US$223,572, was sold.

Other currencies bought, amounted to the equivalent of US$238,295 while the equivalent of US$223,572, was sold.

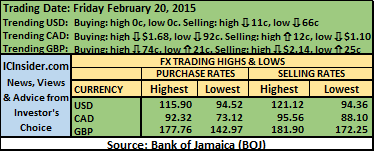

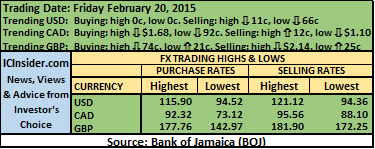

Highs & Lows| The highest buying rate for the US dollar fell 10 cents to $115.80 and the lowest buying rate dropped $5.09 to $89.43. The highest selling rate remained at $121.12. The lowest selling rate rose 16 cents to $94.52. The highest buying rate for the Canadian dollar climbed 38 cents to $92.70, the lowest buying rate was up 44 cents to $73.56. The highest selling rate dipped 65 cents to $94.91 and the lowest selling rate rose 60 cents to $88.70. The highest buying rate for the British Pound, gained $1.64 to $179.40. The lowest buying rate fell 46 cents to $142.51, the highest selling rate jumped $1.82 to $183.72 and the lowest selling rate dipped $2.55 cents to $169.70.

NCB & Scotia push JSE up

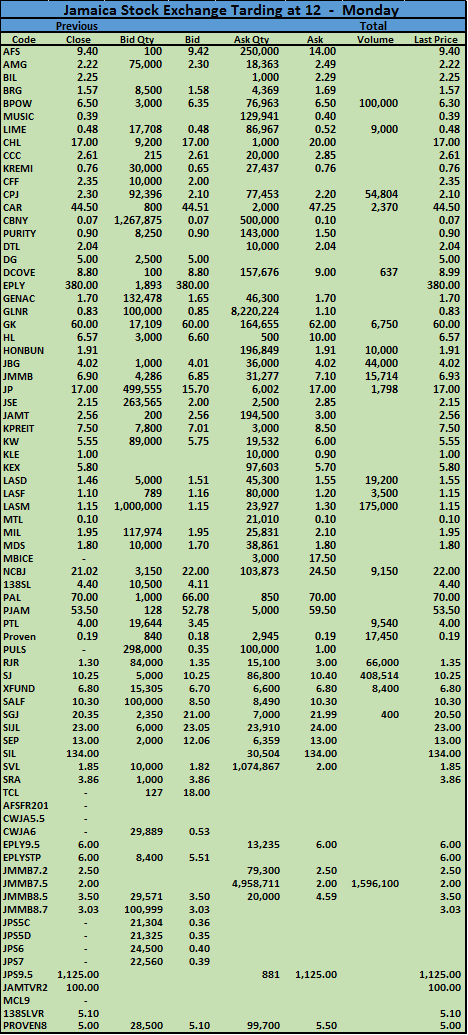

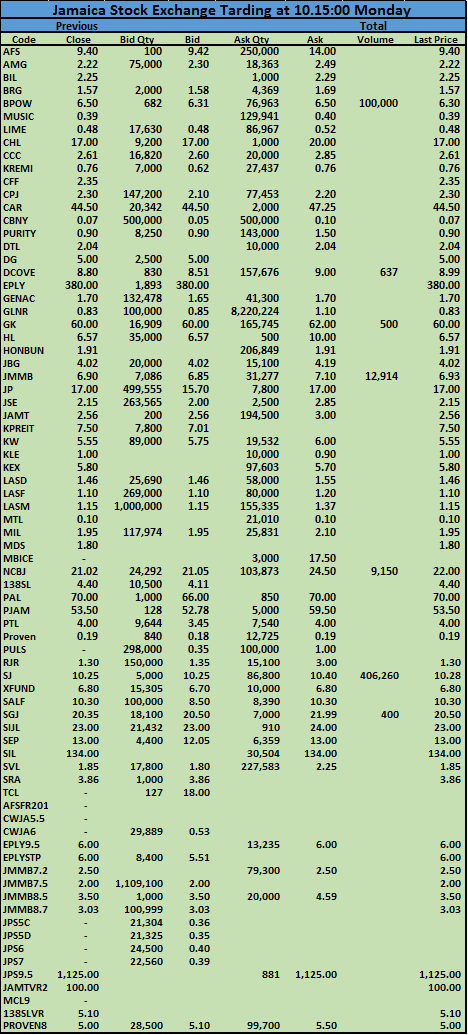

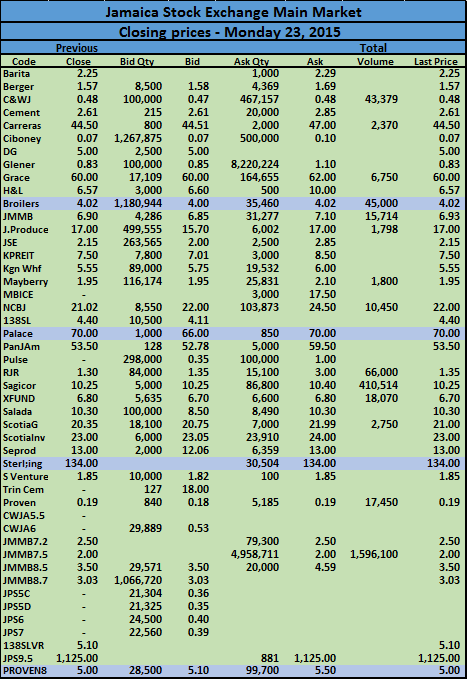

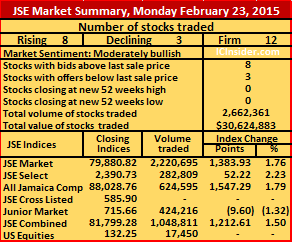

In Monday’s trading, the main market of the Jamaica Stock Exchange climbed sharply, but only 12 securities traded in the market.

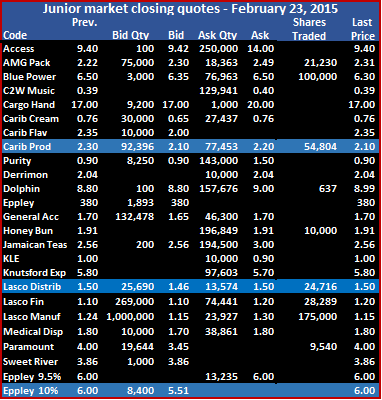

At the close bid prices were strongly in support of the market with some slight upward bias. The attached chart shows the bids and offers at the close of the market, with the volumes at the lowest offers and highest bids. The chart provides investors with much more information than has been shown to the public. Investors can get some indication of supply and demand posted in the market with the immediate volumes on the bid to buy or the amounts on offer, at the disclosed prices. What is shown represents only the stocks on offer to sell and the amounts being purchased at the prices shown. IC Insider will now be posting these daily.

At the close bid prices were strongly in support of the market with some slight upward bias. The attached chart shows the bids and offers at the close of the market, with the volumes at the lowest offers and highest bids. The chart provides investors with much more information than has been shown to the public. Investors can get some indication of supply and demand posted in the market with the immediate volumes on the bid to buy or the amounts on offer, at the disclosed prices. What is shown represents only the stocks on offer to sell and the amounts being purchased at the prices shown. IC Insider will now be posting these daily.

In Tuesday’s trading watch Carreras that closed with a bid of $44.51, Grace Kennedy, bid $60 and National Commercial Bank bid of $22.

Market jumps 1,213 pts on low volume

Main Market| The JSE Market Index gained 1,383.93 points to 79,880.82, the JSE All Jamaican Composite index rose 1,547.29 points to close at 88,028.76 and the JSE combined index gained 1,212.61 points to close at 81,799.28.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 8 stocks with bids higher than their last selling prices and 3 stocks with offers that were lower.

Gains| Stocks gaining with last traded prices, at the end of trading in the main market are, Jamaica Money Market Brokers ending trading 15,714 ordinary shares while gaining 3 cents to $6.93. National Commercial Bank closing with 10,450 shares to end with an increase of 98 cents to $22, Radio Jamaica closing with 66,000 shares, the price inched up 5 cents to $1.35 and Scotia Group finishing with only 2,750 shares to end with an increase of 65 cents at $21.

Firm| The stocks in the main market to close without a change in the last traded prices are, Cable & Wireless with 43,379 shares changing hands, closed at 48 cents. Carreras closing with 2,370 shares trading and ended at $44.50, Grace Kennedy closed with 6,750 units trading at $60, Jamaica Broilers had 45,000 shares changing hands at $4.02, Jamaica Producers ending with 1,798 shares trading at $17, Mayberry Investments finished with 1,800 shares changing hands to close $1.95, Proven Investments ending with 17,450 shares trading, to finish at 18.5 US cents and Sagicor Group finishing with 410,514 units trading at $10.25.

Firm| The stocks in the main market to close without a change in the last traded prices are, Cable & Wireless with 43,379 shares changing hands, closed at 48 cents. Carreras closing with 2,370 shares trading and ended at $44.50, Grace Kennedy closed with 6,750 units trading at $60, Jamaica Broilers had 45,000 shares changing hands at $4.02, Jamaica Producers ending with 1,798 shares trading at $17, Mayberry Investments finished with 1,800 shares changing hands to close $1.95, Proven Investments ending with 17,450 shares trading, to finish at 18.5 US cents and Sagicor Group finishing with 410,514 units trading at $10.25.Declines| The only stocks closing with a loss at the end of trading in the main market is, Sagicor Real Estate Fund closed with 18,070 shares trading lower by 10 cents to $6.70.

Preference| Jamaica Money Market Brokers 7.50% preference share traded 1,596,100 units at $2.

3 stocks gained on TTSE Monday

Trading on the Trinidad Stock Exchange closed with 10 securities changing hands of which 3 advanced, 4 declined and 3 traded firm with a total of 118,492 units, valued at $7,843,551.

At the close of the market, the Composite Index rose 0.07 points to close at 1,148.94, the All T&T Index fell by just 0.47 points to close at 1,980.31 and the Cross Listed Index increased by 0.08 points to end at 41.58.

Gains| Stocks increasing in price at the close are, Agostini’s with 1,650 shares trading, closed up a cent at $17.60, Jamaica Money Market Brokers added 7,426 shares to gain 1 cent to 45 cents and Prestige Holdings with a volume of 20,800 shares traded for $205,920 and gained 20 cents to a new 52 weeks’ high of $9.90.

Gains| Stocks increasing in price at the close are, Agostini’s with 1,650 shares trading, closed up a cent at $17.60, Jamaica Money Market Brokers added 7,426 shares to gain 1 cent to 45 cents and Prestige Holdings with a volume of 20,800 shares traded for $205,920 and gained 20 cents to a new 52 weeks’ high of $9.90.

Declines| The stocks declining at the end of trading are, Massy Holdings trading 108 shares and closed with a loss of 4 cents at $63.64. Republic Bank with 62,721 shares changing hands for a value of $7,431,803, closed with a loss of 10 cents at $118.49 and Trinidad Cement traded 5,000 shares valued to close with a loss of 5 cents at $2.50.

Firm Trades| Stocks closing with prices unchanged at the end of trading are, Clico Investment Fund traded 2,400 shares and remained at $22.50, Grace Kennedy with 7,374 shares, to close at $3.61 followed by Guardian Holdings contributed 2,000 shares with the price closing unchanged at $13.10 and Sagicor Financial Corporation contributed 9,013 shares at $5.25.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 7 stocks with the bid higher than their last selling prices and 4 stocks with offers that were lower.

Trading picked up in junior market

Trading picked up on the Junior Market on Monday with 9 securities traded and ending with 424,216 units changing hands valued at $1,129,181. The JSE Junior Market Index declined 9.60 points to close at 715.66, with the prices of 4 stocks advancing and 2 declining.

At the close of the market, there were 2 stocks with bids higher than their last selling prices and 2 stocks with offers that were lower. The junior market ended with 6 securities closing with no bids to buy and there were 5 securities that had no stocks being offered for sale.

Stocks trading in the junior market are, AMG Packaging ending trading with 21,230 units and gained 9 cents at $2.31, Dolphin Cove closed with 637 shares while gaining 19 cents to $8.99, Lasco Distributors concluding trading with 24,716 shares, the price jumped 4 cents to $1.50, Lasco Financial closing with 28,289 shares while gaining 10 cents to $1.20. Blue Power traded 100,000 shares but lost 20 cents to end at $6.30, Caribbean Producers with 54,804 shares trading lost 20 cents to end at $2.10, Honey Bun trading 10,000 shares as the price ended at $1.91, Lasco Manufacturing closed with 175,000 shares traded at $1.15, Paramount Trading ended with 9,540 shares trading at $4.

Stocks trading in the junior market are, AMG Packaging ending trading with 21,230 units and gained 9 cents at $2.31, Dolphin Cove closed with 637 shares while gaining 19 cents to $8.99, Lasco Distributors concluding trading with 24,716 shares, the price jumped 4 cents to $1.50, Lasco Financial closing with 28,289 shares while gaining 10 cents to $1.20. Blue Power traded 100,000 shares but lost 20 cents to end at $6.30, Caribbean Producers with 54,804 shares trading lost 20 cents to end at $2.10, Honey Bun trading 10,000 shares as the price ended at $1.91, Lasco Manufacturing closed with 175,000 shares traded at $1.15, Paramount Trading ended with 9,540 shares trading at $4.

All Jamaica index up 1,182.71 pts

All Jamaica index up 1,117.39 pts

Carib economies pressure T&T companies

Trinidadian companies are facing challenging times, the recent fall in the price of oil and gas on the world market has not made things any easier, in fact it is likely to make it worse.

Trinidadian companies are facing challenging times, the recent fall in the price of oil and gas on the world market has not made things any easier, in fact it is likely to make it worse.

Even before the collapse of energy prices profits of Trinidadian companies were pressured with little or just moderate growth. The challenges are not only in energy. Inflation in the twin island state has been running at high levels for some time with the latest figures showing 8 percent at the same time the country’s currency remained stable during the period of high price gains. While a lot of the increase was in the food category, it nevertheless would feed somewhat into general prices. While efficiencies could compensate for the higher prices, it seems unlikely with employment reaching very low levels placing pressure on labour cost as some businesses find it difficult to get persons to employ.

Against this back ground, it is not surprising that of 4 companies reporting for the December quarter, all show virtually profits.

First Citizens Bank could only turn a 2.8 percent growth in assets since December 2013 and 3.5 percent increase in loans into a 2 percent increase in profit after tax of TT$178 million from net revenues that were up to $430 from $428 million in 2013. Assets grew by 6.2 percent over September last year and loans are up 5.2 percent for the same period.

Expenses were flat at $210 million for the quarter. Earnings per share ended at 71 cents. For 2013 fiscal year, the bank earned $2.49. The stock price is now at $35.75 for a PE ratio of 14.

Massy Holdings reported a 20.6 percent jump in revenue but profit after tax rose only 6.5 percent to TT$144, that is well down on the 23 percent in the final fiscal quarter, to September last year.

Massy Holdings reported a 20.6 percent jump in revenue but profit after tax rose only 6.5 percent to TT$144, that is well down on the 23 percent in the final fiscal quarter, to September last year.

Jamaica contributed less profits than in 2013 and so did Guyana but Barbados and Eastern Caribbean reported higher profits while T&T was flat and Columbia recorded profit. The business was acquired after the December quarter in 2013.

Segment profit before saw growth in Automotive and Industrial Equipment increasing by 30 percent, Integrated Retail gaining 8.8 percent, Insurance up by 14.8 percent, Energy and Industrial Gases fell 6 percent, Information, Technology and Communications declined 37.6 percent and Other Investments down 14 percent. The largest contributors to revenues and profits are Automotive and Industrial Equipment, Integrated Retail, Energy and Industrial Gases and other investments.

Earnings per share for the quarter amounts to $1.47 versus $1.39 in 2013, for the full year to September 2014, the company reported $5.69. Earnings should end around $6 for 2015. The stock price closed on Friday at $63.64, having peaked at $69.60 last year. The PE of the stock is around 11.

Republic Bank could not turn its 3.7 percent growth in assets into more than a 2 percent increase in after tax profit for the December quarter last year over the prior year even as loans grew by 9 percent over the same period. Net income grew by 4.5 percent to TT$899 million but operating expenses climbed a large 12 percent thus negating the increase in net revenues. The banking group saw a sharp reduction in the tax payable from$118 million to $97 million leaving $297 million for shareholders versus $291 million in 2013. The lower tax rate is partially due to a reduction in pretax profit from $423 million down to $408 million.

Republic Bank could not turn its 3.7 percent growth in assets into more than a 2 percent increase in after tax profit for the December quarter last year over the prior year even as loans grew by 9 percent over the same period. Net income grew by 4.5 percent to TT$899 million but operating expenses climbed a large 12 percent thus negating the increase in net revenues. The banking group saw a sharp reduction in the tax payable from$118 million to $97 million leaving $297 million for shareholders versus $291 million in 2013. The lower tax rate is partially due to a reduction in pretax profit from $423 million down to $408 million.

Earnings per share for the quarter ended at $1.84 versus $1.80 in the prior year and for the full year to September Republic reported $7.39 per share. The stock peaked at $122.05 last year, and has since retreated to close at $118.59 and looks set to decline some more. The stock carries a PE of 16.

Agostini’s reported profit of TT$27 million for the first quarter to December 2014 from revenues of TT$408 million compared with profit of $27 million from revenues of $378 million in the 2013 period. For the year to September 2014 revenues came in at $1.36 billion resulting on full year’s profit of $80.5 million. Earnings per share for the quart was 46 cents and $1.36 for the full year. The stock last traded at $17.60 at a PE of 13. Agostini’s is involved in pharmaceutical, personal care, food and construction product distribution.