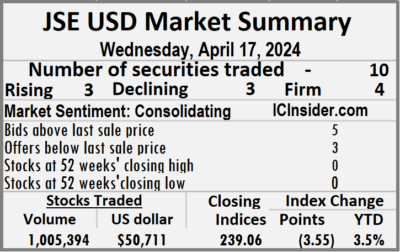

Trading surged on the Jamaica Stock Exchange US dollar market ended on Wednesday, with a 1,060 percent jump in the volume of stocks exchanged following a 244 percent pop in value compared with market activity on Tuesday and resulting in trading in 10 securities, compared to 12 on Tuesday with prices of three rising, three declining and four ending unchanged.

The market closed with an exchange of 1,005,394 shares for US$50,711 compared to 86,667 units at US$14,748 on Tuesday.

The market closed with an exchange of 1,005,394 shares for US$50,711 compared to 86,667 units at US$14,748 on Tuesday.

Trading averaged 100,539 units at US$5,071 versus 7,222 shares at US$1,229 on Tuesday, with a month to date average of 36,785 shares at US$2,318 compared with 29,371 units at US$1,998 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index declined 3.55 points to end at 239.06.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close of the market, First Rock Real Estate USD share dipped 0.58 of one cent to end at 4.02 US cents closing, with 4,258 units being traded, Margaritaville ended at 10 US cents with 600 stocks crossing the market, Productive Business Solutions remained at US$1.59 after investors ended trading 36 shares. Proven Investments fell 1.68 cents to finish at 13.02 US cents with investors transferring 186,935 stock units, Sterling Investments remained at 1.7 US cents after 117 shares crossed the exchange,  Sygnus Credit Investments gained 0.01 of a cent to close at 7.95 US cents with traders dealing in 5,475 stocks and Transjamaican Highway rose 0.08 of a cent to 2.19 US cents in switching ownership of 806,663 units.

Sygnus Credit Investments gained 0.01 of a cent to close at 7.95 US cents with traders dealing in 5,475 stocks and Transjamaican Highway rose 0.08 of a cent to 2.19 US cents in switching ownership of 806,663 units.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.19, with 700 stock units crossing the market, Productive Business Solutions 9.25% preference share declined 50 cents to close at US$11 in trading 250 shares and Sygnus Credit Investments E8.5% advanced 10 cents in closing at US$10.70, with 360 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big jump in trading for the USD Market

More funds enters JSE USD Market

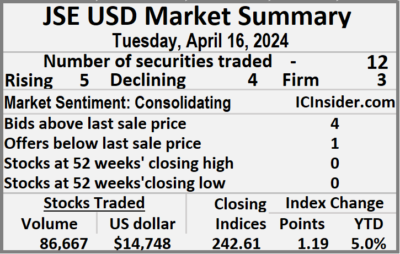

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with a 43 percent decline in the volume of stocks changing hands after a 166 percent jump in value compared with Monday, and resulting from trading in 12 securities, compared to 10 on Monday with prices of five rising, four declining and three ending unchanged.

The market closed with an exchange of 86,667 shares for US$14,748 compared to 152,339 units at US$5,545 on Monday.

The market closed with an exchange of 86,667 shares for US$14,748 compared to 152,339 units at US$5,545 on Monday.

Trading averaged 7,222 units at US$1,229 versus 15,234 shares at US$554 on Monday, with a month to date average of 29,371 shares at US$1,998 compared with 32,963 units at US$2,123 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index gained 1.19 points to end the day at 242.61.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden climbed 0.51 of one cent in closing at 23 US cents after an exchange of 200 units, First Rock Real Estate USD share rose 0.58 of one cent to 4.6 US cents with investors transferring 1,080 stocks, Margaritaville remained at 10 US cents in an exchange of 80 shares. Productive Business Solutions ended at US$1.59, with 27 stock units changing hands, Proven Investments advanced 0.97 of one cent to close at 14.7 US cents in an exchange of 7,992 shares, Sterling Investments popped 0.19 of a cent to end at 1.7 US cents after trading 36 stock units.  Sygnus Credit Investments rallied 0.34 of a cent in closing at 7.94 US cents with a transfer of 11,059 stocks, Sygnus Real Estate Finance USD share ended at 9 US cents and closed after 65 units were traded and Transjamaican Highway declined 0.09 of a cent to finish at 2.11 US cents with an exchange of 59,749 stocks.

Sygnus Credit Investments rallied 0.34 of a cent in closing at 7.94 US cents with a transfer of 11,059 stocks, Sygnus Real Estate Finance USD share ended at 9 US cents and closed after 65 units were traded and Transjamaican Highway declined 0.09 of a cent to finish at 2.11 US cents with an exchange of 59,749 stocks.

In the preference segment, JMMB Group US8.5% preference share shed 0.85 of one cent and ended at US$1.19, with 6,000 units crossing the market, Productive Business Solutions 9.25% preference share dropped 85 cents to close at US$11.50 with investors dealing in 259 shares and Sygnus Credit Investments E8.5% lost 10 cents to end at US$10.60, with 120 stock units crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE USD Market

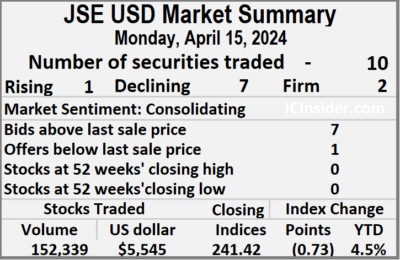

Trading jumped sharply on Monday over the miniscule amounts traded on Friday on the Jamaica Stock Exchange US dollar market, with the volume of stocks exchanged rising 1,470 percent after 223 percent more US dollars entered the market than on Friday, resulting in trading in 10 securities, compared to six on Friday with prices of one rising, seven declining and two ending unchanged.

The market closed with an exchange of 152,339 shares for US$5,545 compared to 9,705 units at US$1,717 on Friday.

The market closed with an exchange of 152,339 shares for US$5,545 compared to 9,705 units at US$1,717 on Friday.

Trading averaged 15,234 units at US$554 up from 1,618 shares at US$286 on Friday, with a month to date average of 32,963 shares at US$2,123 compared with 35,733 units at US$2,368 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index sank 0.73 points to conclude trading at 241.42.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden rose 0.47 of a cent to end at 22.49 US cents after an exchange of 2,250 shares, First Rock Real Estate USD share declined 0.08 of a cent in closing at 4.02 US cents after 1,946 stocks passed through the market,  MPC Caribbean Clean Energy fell 1 cent to 61 US cents with an exchange of 16 shares. Productive Business Solutions remained at US$1.59, with one stock unit crossing the market, Proven Investments dipped 0.18 of a cent to end at 13.73 US cents in swapping 3,455 shares, Sterling Investments lost 0.09 of a cent to close at 1.51 US cents with 301 stocks clearing the market. Sygnus Credit Investments slipped 0.27 of one cent to 7.6 US cents with investors swapping 7,851 units, Sygnus Real Estate Finance USD share ended at 9 US cents after a transfer of 540 stock units and Transjamaican Highway slipped 0.02 cent in closing at 2.2 US cents, with 135,904 shares changing hands.

MPC Caribbean Clean Energy fell 1 cent to 61 US cents with an exchange of 16 shares. Productive Business Solutions remained at US$1.59, with one stock unit crossing the market, Proven Investments dipped 0.18 of a cent to end at 13.73 US cents in swapping 3,455 shares, Sterling Investments lost 0.09 of a cent to close at 1.51 US cents with 301 stocks clearing the market. Sygnus Credit Investments slipped 0.27 of one cent to 7.6 US cents with investors swapping 7,851 units, Sygnus Real Estate Finance USD share ended at 9 US cents after a transfer of 540 stock units and Transjamaican Highway slipped 0.02 cent in closing at 2.2 US cents, with 135,904 shares changing hands.

In the preference segment, Sygnus Credit Investments E8.5% skidded 10 cents to finish at US$10.70 in an exchange of 75 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on the JSE USD market

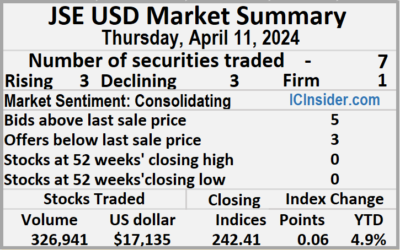

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks changing hands rising 40 percent after 167 percent more US dollars were exchanged than on Wednesday, resulting in trading in seven securities, compared to four on Wednesday with prices of three rising, three declining and one ending unchanged.

The market closed with an exchange of 326,941 shares for US$17,135 compared to 233,494 units at US$6,425 on Wednesday.

The market closed with an exchange of 326,941 shares for US$17,135 compared to 233,494 units at US$6,425 on Wednesday.

Trading averaged 46,706 units at US$2,448 versus 58,374 shares at US$1,606 on Wednesday, with a month to date average of 39,263 shares at US$2,583 compared with 38,241 units at US$2,602 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index popped 0.06 points to close at 242.41.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, First Rock Real Estate USD share rallied 0.83 of one cent to close at 4.9 US cents in switching ownership of 1,000 stock units,  Proven Investments skidded 0.76 of one cent to 14 US cents as investors exchanged 3,588 shares, Sterling Investments ended at 1.6 US cents with trading taking place in 14,440 units. Sygnus Credit Investments popped 0.86 of one cent in closing at 7.96 US cents crossing the market 100 stocks and Transjamaican Highway increased 0.02 cent to finish at 2.25 US cents in an exchange of 303,149 shares.

Proven Investments skidded 0.76 of one cent to 14 US cents as investors exchanged 3,588 shares, Sterling Investments ended at 1.6 US cents with trading taking place in 14,440 units. Sygnus Credit Investments popped 0.86 of one cent in closing at 7.96 US cents crossing the market 100 stocks and Transjamaican Highway increased 0.02 cent to finish at 2.25 US cents in an exchange of 303,149 shares.

In the preference segment, JMMB Group 5.75% fell 2 cents and ended at US$2.10 after closing with an exchange of 4,650 units and Sygnus Credit Investments E8.5% declined 30 cents to US$10.50 after an exchange of 14 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

3 up 3 down for JSE USD market

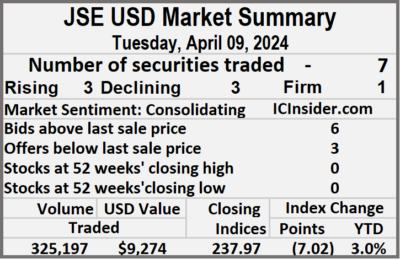

Winners and losers shared the spoils in trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, resulting from trading in seven securities, down from nine on Monday with prices of three rising, three declining and one ending firm, following a 149 percent rise in the number of stocks that were exchanged valued moderately more than on Monday.

The market closed with an exchange of 325,197 shares for US$9,274 up from 130,853 units at US$9,068 on Monday.

The market closed with an exchange of 325,197 shares for US$9,274 up from 130,853 units at US$9,068 on Monday.

Trading averaged 46,457 units at US$1,325 versus 14,539 shares at US$1,008 on Monday, with a month to date average of 36,527 shares at US$2,687 compared with 34,790 units at US$2,925 on the previous day and March with an average of 49,394 units for US$3,593.

The US Denominated Equities Index fell 7.02 points to 237.97.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, MPC Caribbean Clean Energy gained 8 cents in closing at 62 US cents with 15 shares crossing the exchange, Productive Business Solutions skidded 11 cents to US$1.59 with investors trading 214 stocks,  Proven Investments fell 0.11 of a cent to close at 14.76 US cents after a transfer of 324 shares. Sterling Investments ended at 1.6 US cents in switching ownership of 3,466 stocks and Transjamaican Highway dipped 0.17 of a cent to 2 US cents after exchanging 320,975 shares.

Proven Investments fell 0.11 of a cent to close at 14.76 US cents after a transfer of 324 shares. Sterling Investments ended at 1.6 US cents in switching ownership of 3,466 stocks and Transjamaican Highway dipped 0.17 of a cent to 2 US cents after exchanging 320,975 shares.

In the preference segment, Productive Business Solutions 9.25% preference share popped 25 cents to end at US$12.35 with investors swapping 95 stock units and Sygnus Credit Investments E8.5% increased 10 cents in closing at US$10.80 with 108 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

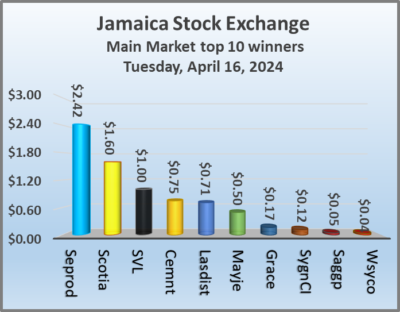

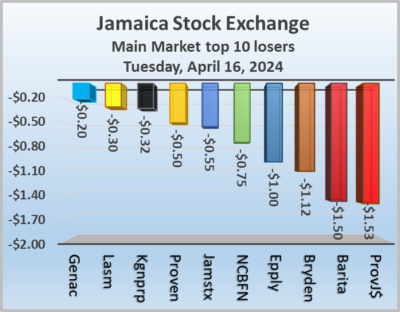

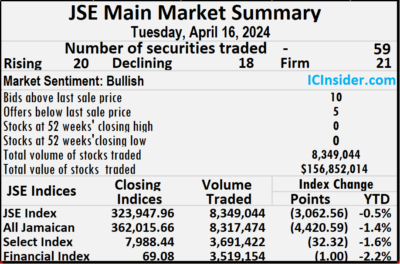

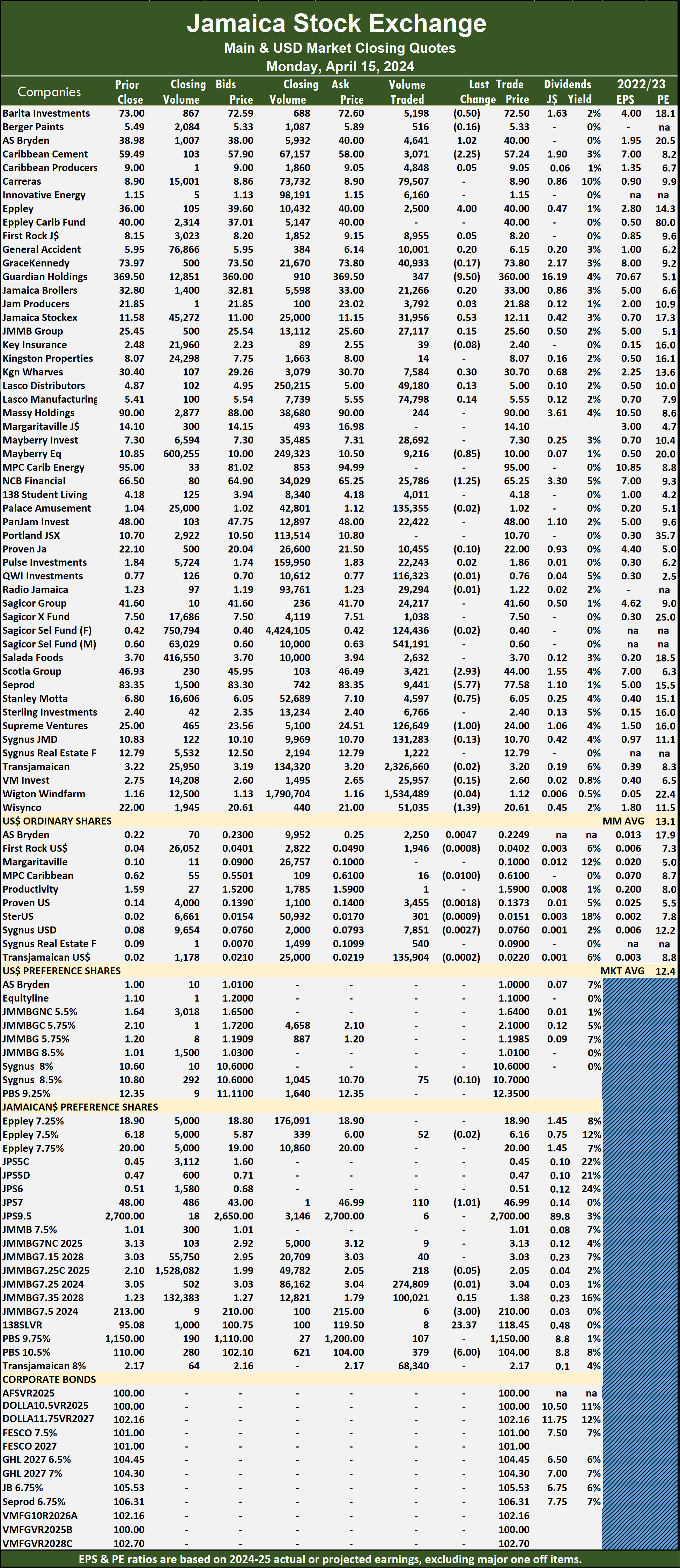

The market closed with 8,349,044 shares trading for $156,852,014 up from 6,145,603 units at $29,633,029 on Monday.

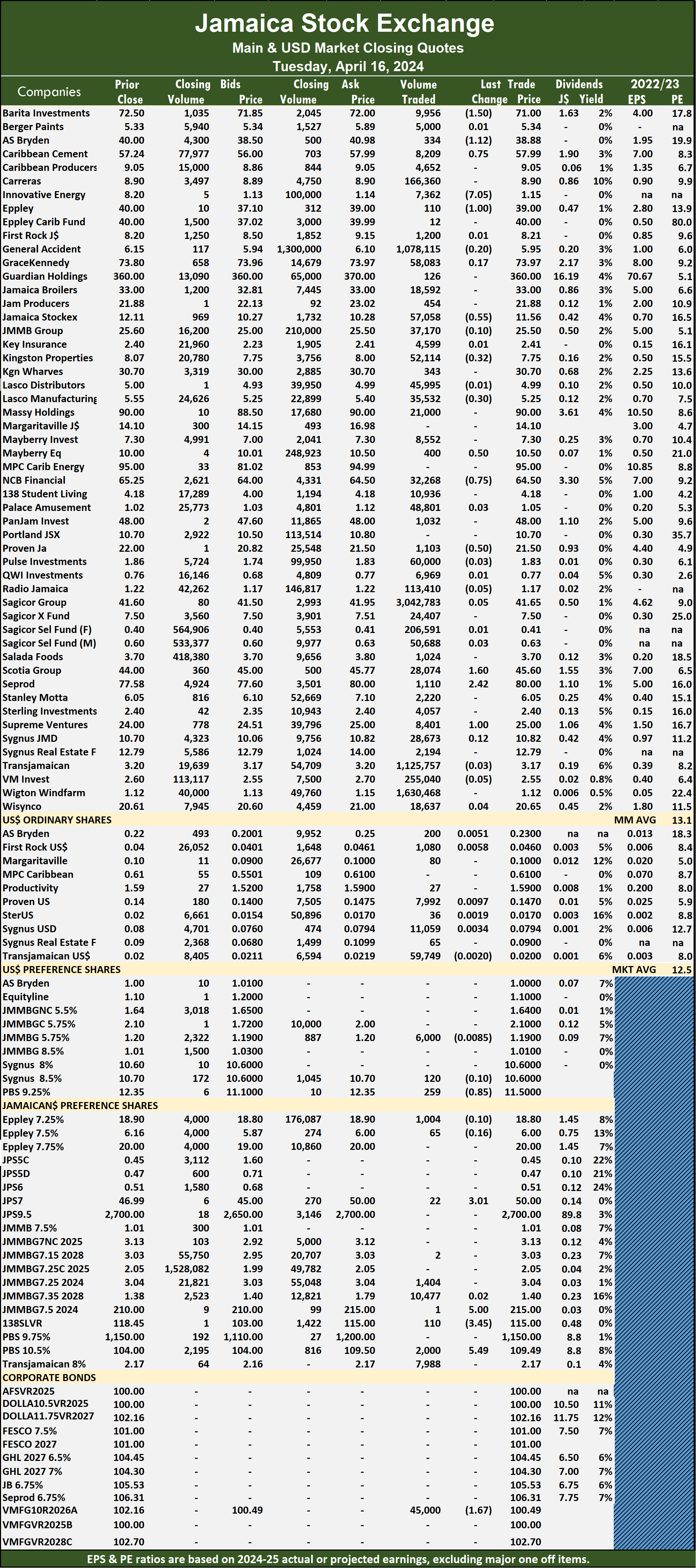

The market closed with 8,349,044 shares trading for $156,852,014 up from 6,145,603 units at $29,633,029 on Monday. The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

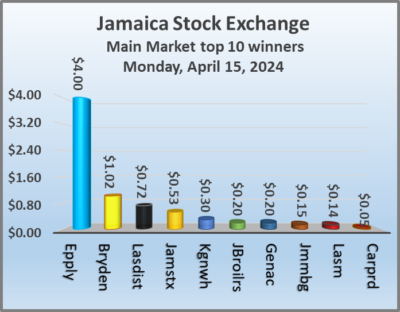

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. NCB Financial fell 75 cents to end at $64.50 with an exchange of 32,268 shares. Proven Investments dipped 50 cents to close at $21.50 after investors traded 1,103 stock units, Scotia Group rallied $1.60 to finish at $45.60 after an exchange of 28,074 stocks, Seprod increased $2.42 to end at $80 with traders dealing in 1,110 units and Supreme Ventures popped $1 to $25, with 8,401 stocks crossing the exchange.

NCB Financial fell 75 cents to end at $64.50 with an exchange of 32,268 shares. Proven Investments dipped 50 cents to close at $21.50 after investors traded 1,103 stock units, Scotia Group rallied $1.60 to finish at $45.60 after an exchange of 28,074 stocks, Seprod increased $2.42 to end at $80 with traders dealing in 1,110 units and Supreme Ventures popped $1 to $25, with 8,401 stocks crossing the exchange. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

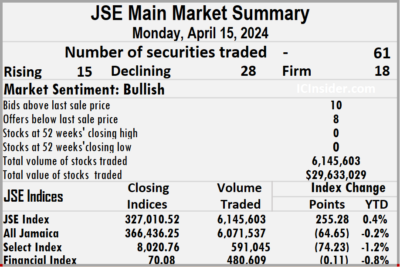

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market ended trading of 6,145,603 shares at $29,633,029 compared to 10,926,398 units at $160,297,742 on Friday.

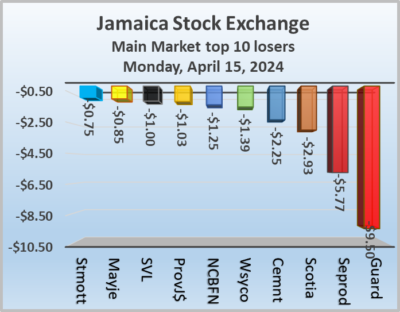

The market ended trading of 6,145,603 shares at $29,633,029 compared to 10,926,398 units at $160,297,742 on Friday. The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Scotia Group declined $2.93 to end at $44 in an exchange of 3,421 units, Seprod dipped $5.77 in closing at $77.58 with 9,441 stocks clearing the market, Stanley Motta slipped 75 cents to close at $6.05 with an exchange of 4,597 stock units. Supreme Ventures skidded $1 to $24 after 126,649 shares crossed the market and Wisynco Group dropped $1.39 to finish at $20.61 as investors exchanged 51,035 units.

Scotia Group declined $2.93 to end at $44 in an exchange of 3,421 units, Seprod dipped $5.77 in closing at $77.58 with 9,441 stocks clearing the market, Stanley Motta slipped 75 cents to close at $6.05 with an exchange of 4,597 stock units. Supreme Ventures skidded $1 to $24 after 126,649 shares crossed the market and Wisynco Group dropped $1.39 to finish at $20.61 as investors exchanged 51,035 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

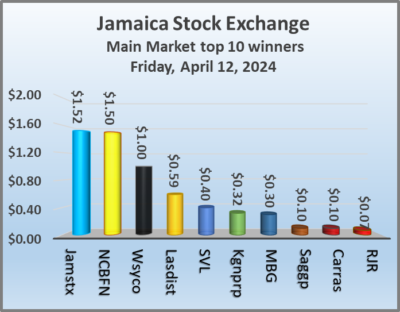

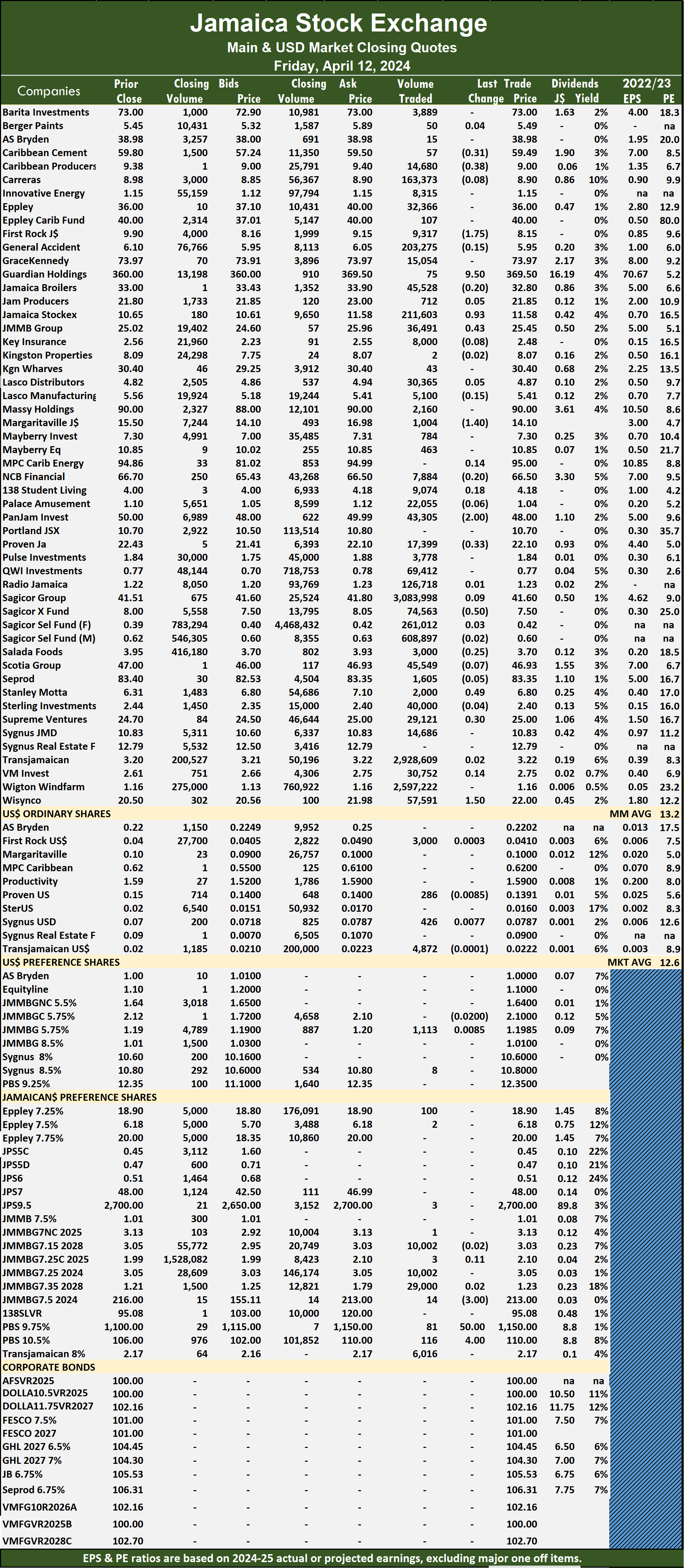

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading closed with an exchange of 10,926,398 shares for $160,297,742 compared to 16,091,472 units at just $32,718,333 on Thursday.

Trading closed with an exchange of 10,926,398 shares for $160,297,742 compared to 16,091,472 units at just $32,718,333 on Thursday. The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Mayberry Group popped 30 cents to end at $7.30 as investors traded 784 shares. NCB Financial climbed $1.50 to $66.50 in switching ownership of 7,884 units, Proven Investments declined by 33 cents to $22.10, with 17,399 stock units crossing the market, Sagicor Real Estate Fund skidded 52 cents to finish at $7.50 in an exchange of 74,563 stock units. Stanley Motta slipped 30 cents to end at $6.80 with investors dealing in 2,000 shares, Supreme Ventures rose 40 cents to finish at $25 with a transfer of 29,121 stocks and Wisynco Group climbed $1 and ended at $22, with 57,591 units changing hands.

Mayberry Group popped 30 cents to end at $7.30 as investors traded 784 shares. NCB Financial climbed $1.50 to $66.50 in switching ownership of 7,884 units, Proven Investments declined by 33 cents to $22.10, with 17,399 stock units crossing the market, Sagicor Real Estate Fund skidded 52 cents to finish at $7.50 in an exchange of 74,563 stock units. Stanley Motta slipped 30 cents to end at $6.80 with investors dealing in 2,000 shares, Supreme Ventures rose 40 cents to finish at $25 with a transfer of 29,121 stocks and Wisynco Group climbed $1 and ended at $22, with 57,591 units changing hands. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

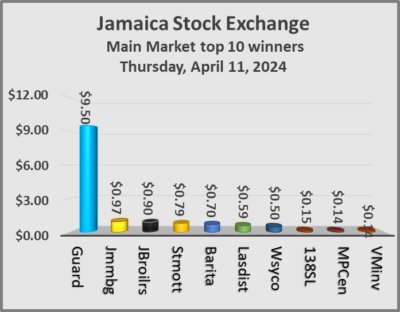

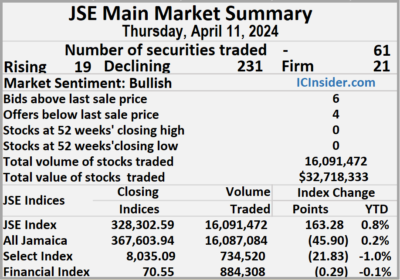

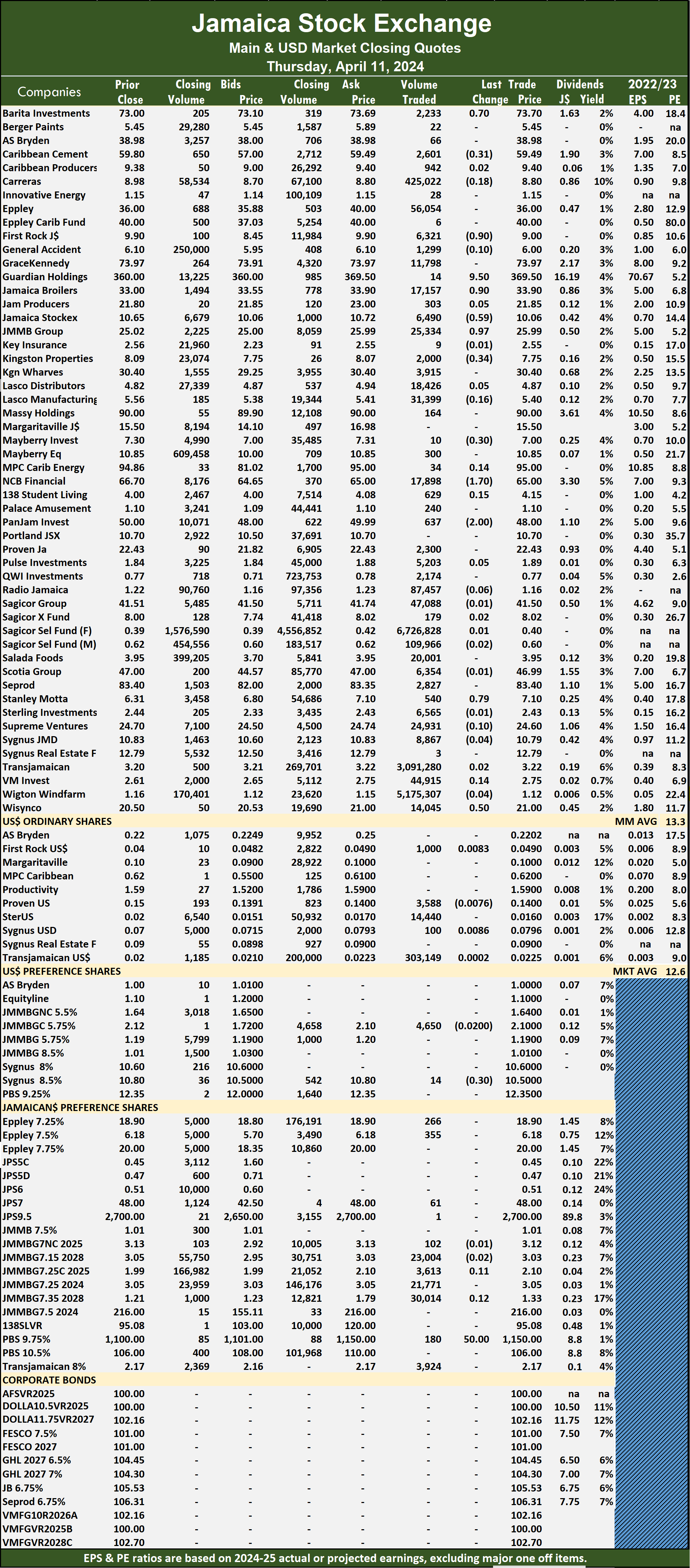

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with trading of 16,091,472 shares for $32,718,333 up from 8,771,865 units at $27,969,713 on Wednesday.

The market closed with trading of 16,091,472 shares for $32,718,333 up from 8,771,865 units at $27,969,713 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

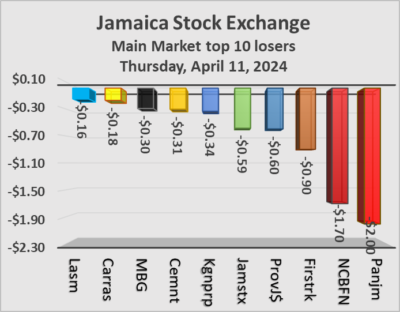

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. JMMB Group rose 97 cents to $25.99 after a transfer of 25,334 stocks, Kingston Properties skidded 34 cents in closing at $7.75 after 2,000 stock units passed through the market, Mayberry Group fell 30 cents to end at $7, with 10 shares changing hands. NCB Financial declined by $1.70 and ended at $65 in an exchange of 17,898 stocks, Pan Jamaica lost $2 to finish at $48 with investors transferring 637 units, Stanley Motta advanced 79 cents to close at $7.10 after closing with an exchange of 540 stock units and Wisynco Group increased 50 cents to $21 with a transfer of 14,045 shares.

JMMB Group rose 97 cents to $25.99 after a transfer of 25,334 stocks, Kingston Properties skidded 34 cents in closing at $7.75 after 2,000 stock units passed through the market, Mayberry Group fell 30 cents to end at $7, with 10 shares changing hands. NCB Financial declined by $1.70 and ended at $65 in an exchange of 17,898 stocks, Pan Jamaica lost $2 to finish at $48 with investors transferring 637 units, Stanley Motta advanced 79 cents to close at $7.10 after closing with an exchange of 540 stock units and Wisynco Group increased 50 cents to $21 with a transfer of 14,045 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

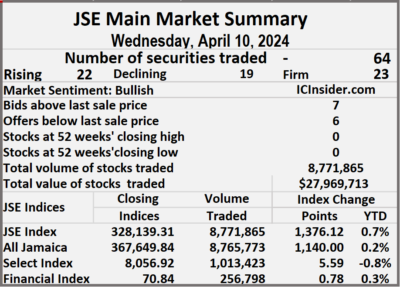

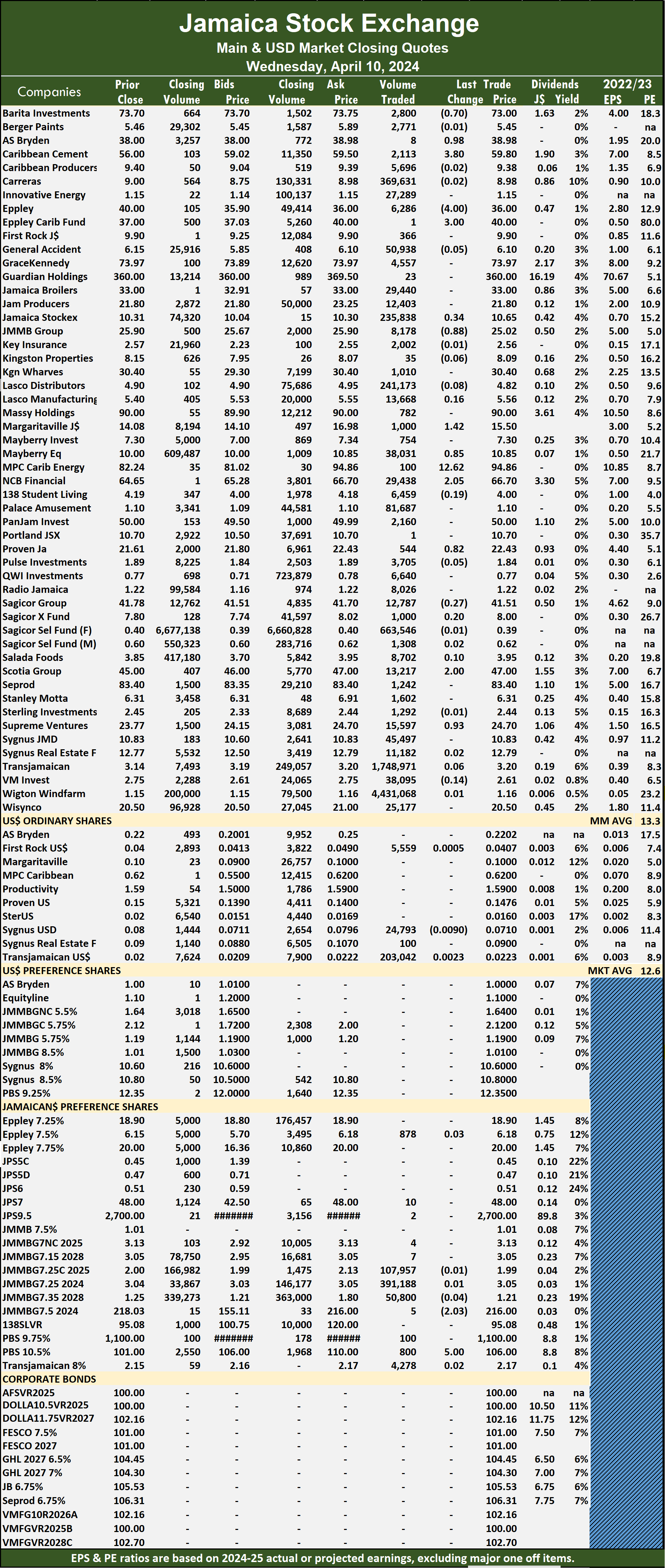

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed after 8,771,865 shares were traded for $27,969,713 compared with 10,147,599 units at $42,871,556 on Tuesday.

The market closed after 8,771,865 shares were traded for $27,969,713 compared with 10,147,599 units at $42,871,556 on Tuesday. The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2025.

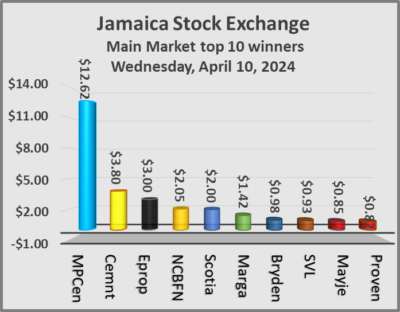

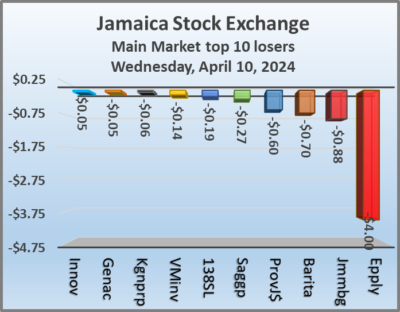

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2025. JMMB Group dropped 88 cents to close trading at $25.02 in swapping 8,178 stocks, Margaritaville rose $1.42 to close at $15.50 with investors trading 1,000 stock units, Mayberry Jamaican Equities advanced 85 cents to finish at $10.85 in an exchange of 38,031 shares. MPC Caribbean Clean Energy rallied $12.62 and ended at $94.86, with 100 units crossing the market, NCB Financial popped $2.05 to end at $66.70 after an exchange of 29,438 stocks, Proven Investments advanced 82 cents to close at $22.43 with a transfer of 544 stock units. Scotia Group rose $2 to $47, with 13,217 shares crossing the exchange and Supreme Ventures rallied 93 cents to end at $24.70 with investors dealing in 15,597 units.

JMMB Group dropped 88 cents to close trading at $25.02 in swapping 8,178 stocks, Margaritaville rose $1.42 to close at $15.50 with investors trading 1,000 stock units, Mayberry Jamaican Equities advanced 85 cents to finish at $10.85 in an exchange of 38,031 shares. MPC Caribbean Clean Energy rallied $12.62 and ended at $94.86, with 100 units crossing the market, NCB Financial popped $2.05 to end at $66.70 after an exchange of 29,438 stocks, Proven Investments advanced 82 cents to close at $22.43 with a transfer of 544 stock units. Scotia Group rose $2 to $47, with 13,217 shares crossing the exchange and Supreme Ventures rallied 93 cents to end at $24.70 with investors dealing in 15,597 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.