The leading Main Market ICInsider.com TOP10 listed Radio Jamaica stuns the market this week with blow out first quarter profit of $110 million that compares well with $171 million reported in the last fiscal year, profit could be higher but for a near $70 million provision for bad debt and would have put the result close to our first quarter profit forecast of it beating 2021 full year results.

The bad news is that many persons ignore ICInnsider.com’s forecast of great things to come from the company, with many chasing after it on Friday after the release of the results on Thursday. Some readers bought into the vision but not all. The good news is that, with projected earnings of 45 cents per share, there is much room for this stock to run. The other good news is that there is much more to be gained by owning the stock as the company completes projects that will boost revenues and grow profits in the years to come.

The bad news is that many persons ignore ICInnsider.com’s forecast of great things to come from the company, with many chasing after it on Friday after the release of the results on Thursday. Some readers bought into the vision but not all. The good news is that, with projected earnings of 45 cents per share, there is much room for this stock to run. The other good news is that there is much more to be gained by owning the stock as the company completes projects that will boost revenues and grow profits in the years to come.

The last dividend paid was 2 cents in July of 2019; before that, 2 cents in September 2016 and 10 cents in September 2015, although profit was only 9 cents per share. A dividend seems due for September this year, and with profits up in the 2021 fiscal year and year to date, shareholders could be looking at an early Christmas present.

The RJR results came close to the end of earning season for the June quarter and stimulated strong buying in the stock, with 9.2 million shares changing hands on Friday, the highest since 8.25 million units were traded on the 19 of July, the second trading day after the company released full year’s results to March. Interest has been building in the stock from the full year release and could get stronger as ICInsider.com gathers that there is good buying interest in it.

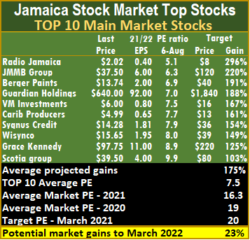

With those strong results and the promise of 45 cents per share to be earned for this year and 80 cents in the next year, one would be forgiven if they felt that RJR should be dislodged from the ICTOP10 listing. Well, the top three Main Market stocks are headed again by Radio Jamaica, but the potential gains rose from 296 percent to 300 percent, even as the price moved up to a 52 weeks’ closing high of $2.25 from $2.02 last week, due to upgrading in the earnings to 45 cents per share or $1.1 billion. RJR is followed by Berger Paints, with earnings per share upgraded to $2.45 and JMMB Group, with expected gains of 200 to 300 percent for the three, versus last weeks’ 191 to 296 percent.

With those strong results and the promise of 45 cents per share to be earned for this year and 80 cents in the next year, one would be forgiven if they felt that RJR should be dislodged from the ICTOP10 listing. Well, the top three Main Market stocks are headed again by Radio Jamaica, but the potential gains rose from 296 percent to 300 percent, even as the price moved up to a 52 weeks’ closing high of $2.25 from $2.02 last week, due to upgrading in the earnings to 45 cents per share or $1.1 billion. RJR is followed by Berger Paints, with earnings per share upgraded to $2.45 and JMMB Group, with expected gains of 200 to 300 percent for the three, versus last weeks’ 191 to 296 percent.

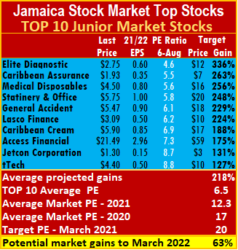

CAC2000, a stock with little focus from investors replaces Jetcon Corporation in the Junior Market ICTOP10. Investors should keep watch on CAC2000, with the strong growth in the construction sector that could benefit them.

The PE Ratio of the TOP 10 Junior Market stocks trade at a 44 percent discount to the market average and Main Market stocks 54 percent, indicating the potential gains in these stocks compared with many of those outsides of them.

The PE Ratio of the TOP 10 Junior Market stocks trade at a 44 percent discount to the market average and Main Market stocks 54 percent, indicating the potential gains in these stocks compared with many of those outsides of them.

The top three stocks in the Junior Market, are Elite Diagnostic, followed by General Accident and Medical Disposables, with the potential to gain between 221 percent and 295 percent compared to 256 and 336 percent, last week. Medical Disposables reported vastly improved revenues and profit for the June quarter even without reporting any income from acquiring the 60 percent majority ownership in Cornwall Enterprises. The price of General Accident has languished from last year, even as expansion pointed to improved results for them. They reported a profit of $166 million for the June quarter and $202 million for the half year with EPS of 16 cents and 20 cents respectively, putting them in line to exceed 60 cents for the full year with the last quarter usually the period with highest profits. Caribbean Brokers recorded increased revenues as well as increased expenses, some to promote products. Losses increased in the June quarter and half year, but late 2020 was the period that profit was reported. JMMB Group reported improved June results that more than doubled over 2020 even as cost rose faster than revenues.

This past week, the average gains projected for the Junior Market moved from 218 percent to 193 percent and Main Market stocks to 180 percent from 175 percent.

This past week, the average gains projected for the Junior Market moved from 218 percent to 193 percent and Main Market stocks to 180 percent from 175 percent.

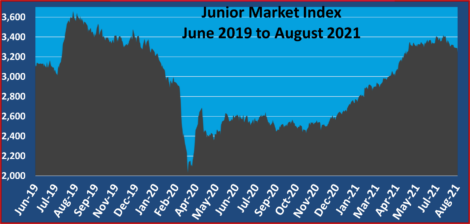

The Junior Market closed the week with an average PE 12.6 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17, for the period to March this year based on 2020 earnings.

The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 46 percent discount to the PE of that market, well off the potential of 20.

For the Junior Market to trade at the historical average, the PE Ratio would have to rise 38 percent and requires a rise of 63 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 17 percent to hit a PE of 19 and 23 percent to get to the target of 20.  The Junior Market Top 10 stocks average PE is a mere 6.9, just 54 percent of the market average, indicating substantial gains ahead.

The Junior Market Top 10 stocks average PE is a mere 6.9, just 54 percent of the market average, indicating substantial gains ahead.

The TOP10 stocks are not always the best in the market but are most likely to be the best winners within a fifteen-month period. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

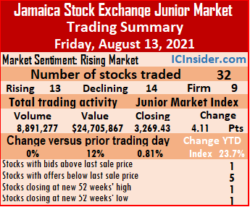

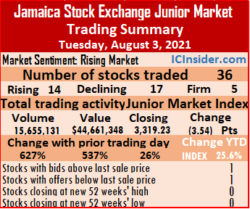

Trading closed on the Jamaica Stock Exchange Junior Market on Friday, with trading levels mirroring Thursday’s performance and resulted in a minor rise in the Market Index of 4.11 points to settle at 3,269.43 after

Trading closed on the Jamaica Stock Exchange Junior Market on Friday, with trading levels mirroring Thursday’s performance and resulted in a minor rise in the Market Index of 4.11 points to settle at 3,269.43 after  Trading averaged 277,852 units at $772,058 up on the 246,304 at $612,986 on Thursday. Trading month to date, averages 211,185 units at $580,096, upon the 202,259 units at $554,394 on Thursday. July closed with an average of 163,918 units at $481,755.

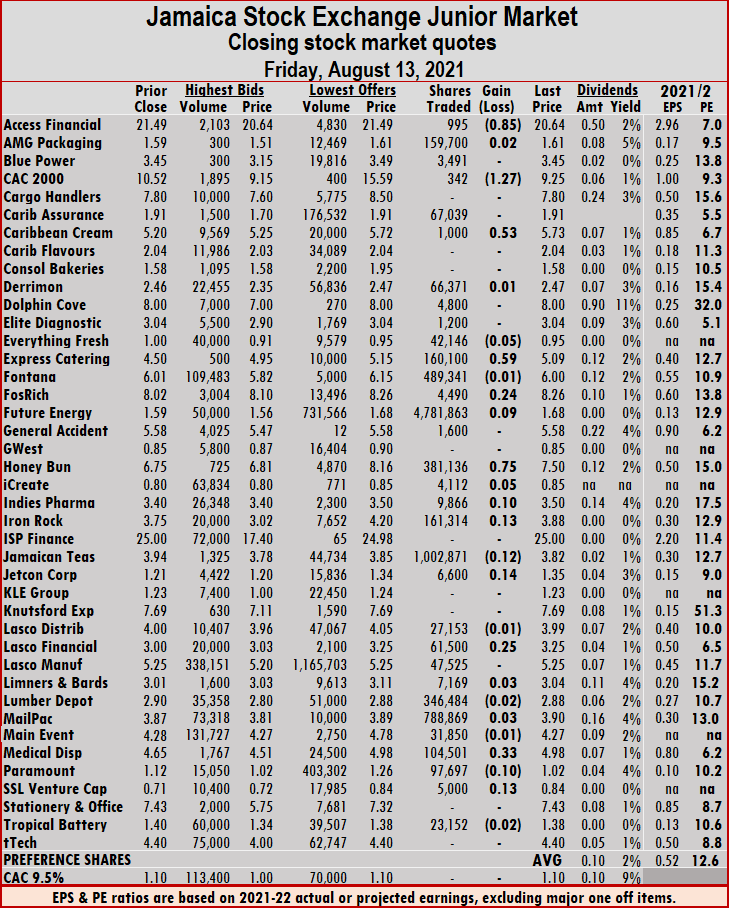

Trading averaged 277,852 units at $772,058 up on the 246,304 at $612,986 on Thursday. Trading month to date, averages 211,185 units at $580,096, upon the 202,259 units at $554,394 on Thursday. July closed with an average of 163,918 units at $481,755. Indies Pharma popped 10 cents to $3.50 with an exchange of 9,866 stocks, Iron Rock Insurance rose 13 cents to $3.88 with a transfer of 161,314 stock units, Jamaican Teas fell 12 cents to $3.82 with investors switching ownership of 1,002,871 shares after the company posted a moderate increase in its Q3 profit. Jetcon Corporation rallied 14 cents to $1.35 with 6,600 units passing through the market, Lasco Financial popped 25 cents to $3.25 with 61,500 stock units traded, Medical Disposables climbed 33 cents to $4.98 with a transfer of 104,501 stocks. Paramount Trading dropped 10 cents to close at a 52 weeks’ low of $1.02 with 97,697 units changing hands and SSL Venture gained 13 cents to close at 84 cents with 5,000 shares crossing the exchange.

Indies Pharma popped 10 cents to $3.50 with an exchange of 9,866 stocks, Iron Rock Insurance rose 13 cents to $3.88 with a transfer of 161,314 stock units, Jamaican Teas fell 12 cents to $3.82 with investors switching ownership of 1,002,871 shares after the company posted a moderate increase in its Q3 profit. Jetcon Corporation rallied 14 cents to $1.35 with 6,600 units passing through the market, Lasco Financial popped 25 cents to $3.25 with 61,500 stock units traded, Medical Disposables climbed 33 cents to $4.98 with a transfer of 104,501 stocks. Paramount Trading dropped 10 cents to close at a 52 weeks’ low of $1.02 with 97,697 units changing hands and SSL Venture gained 13 cents to close at 84 cents with 5,000 shares crossing the exchange. Stocks bounced quite sharply on Thursday to record 3,295 points in the market index shortly after the market opened, ending the day with the volume of stocks increasing 75 percent at 38 percent greater value than Wednesday on the Jamaica Stock ExchangeJunior Market.

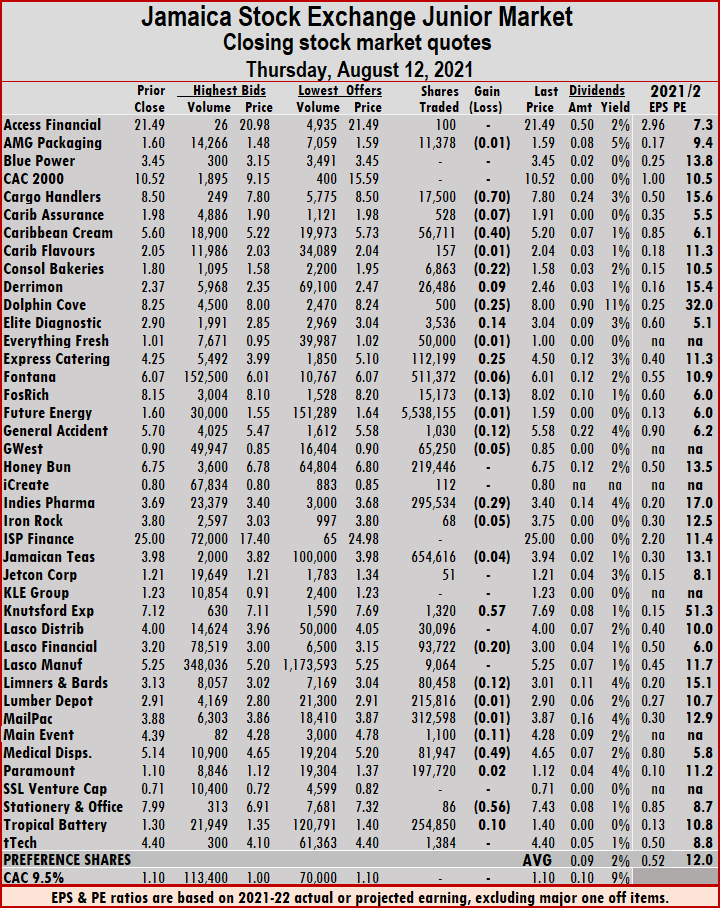

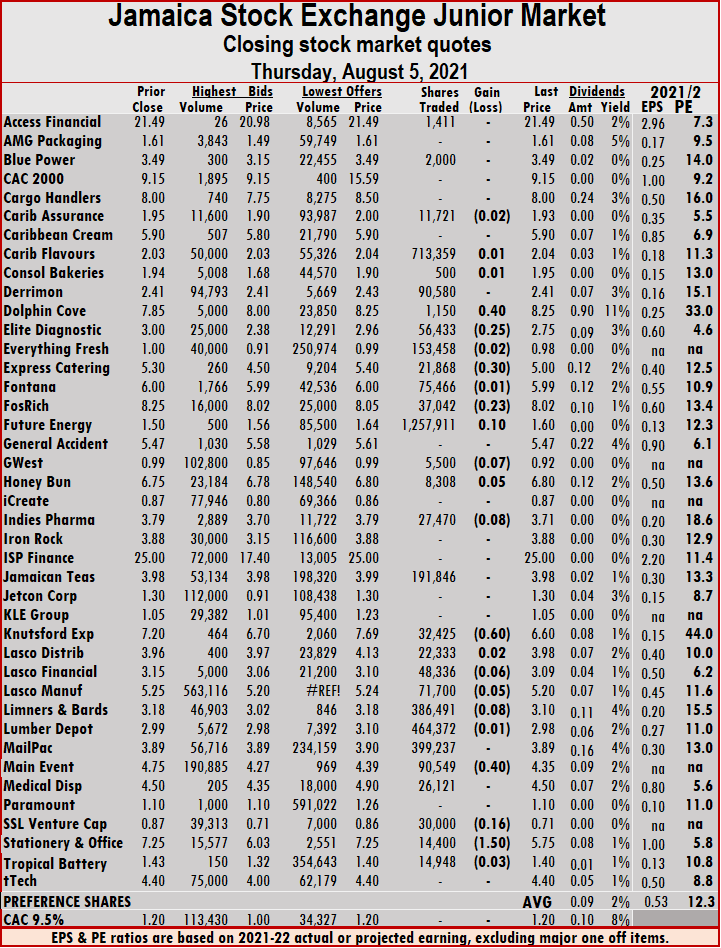

Stocks bounced quite sharply on Thursday to record 3,295 points in the market index shortly after the market opened, ending the day with the volume of stocks increasing 75 percent at 38 percent greater value than Wednesday on the Jamaica Stock ExchangeJunior Market. At the close, Cargo Handlers dropped 70 cents to $7.80 with 17,500 shares traded, Caribbean Assurance Brokers slipped 7 cents to $1.91 with 528 units changing hands, Caribbean Cream shed 40 cents to $5.20 with an exchange of 56,711 stock units. Consolidated Bakeries fell 22 cents to $1.58 with 6,863 shares passing through the market, Derrimon Trading rose 9 cents to $2.46 with investors switching ownership of 26,486 stock units, Dolphin Cove dropped 25 cents to $8 with 500 stocks traded. Elite Diagnostic popped 14 cents to $3.04 with 3,536 shares changing hands, Express Catering climbed 25 cents to $4.50, with 112,199 stock units crossing the market, Fosrich lost 13 cents to $8.02 with 15,173 stocks changing hands. General Accident dropped 12 cents to $5.58 with an exchange of 1,030 units, Indies Pharma shed 29 cents to close at $3.40 with 295,534 shares traded, Knutsford Express jumped 57 cents to $7.69 with 1,320 stock units trading.

At the close, Cargo Handlers dropped 70 cents to $7.80 with 17,500 shares traded, Caribbean Assurance Brokers slipped 7 cents to $1.91 with 528 units changing hands, Caribbean Cream shed 40 cents to $5.20 with an exchange of 56,711 stock units. Consolidated Bakeries fell 22 cents to $1.58 with 6,863 shares passing through the market, Derrimon Trading rose 9 cents to $2.46 with investors switching ownership of 26,486 stock units, Dolphin Cove dropped 25 cents to $8 with 500 stocks traded. Elite Diagnostic popped 14 cents to $3.04 with 3,536 shares changing hands, Express Catering climbed 25 cents to $4.50, with 112,199 stock units crossing the market, Fosrich lost 13 cents to $8.02 with 15,173 stocks changing hands. General Accident dropped 12 cents to $5.58 with an exchange of 1,030 units, Indies Pharma shed 29 cents to close at $3.40 with 295,534 shares traded, Knutsford Express jumped 57 cents to $7.69 with 1,320 stock units trading. Lasco Financial fell 20 cents to $3 with 93,722 shares changing hands, Limners and Bards lost 12 cents to finish at $3.01 with an exchange of 80,458 units, Main Event slipped 11 cents to $4.28 with 1,100 stock units passing through the exchange. Medical Disposables shed 49 cents to $4.65 with 81,947 shares traded, Stationery and Office Supplies dropped 56 cents to $7.43 with 86 stocks changing hands and Tropical Battery rallied 10 cents to $1.40 with 254,850 stock units crossing the exchange.

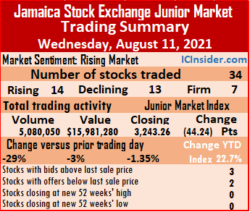

Lasco Financial fell 20 cents to $3 with 93,722 shares changing hands, Limners and Bards lost 12 cents to finish at $3.01 with an exchange of 80,458 units, Main Event slipped 11 cents to $4.28 with 1,100 stock units passing through the exchange. Medical Disposables shed 49 cents to $4.65 with 81,947 shares traded, Stationery and Office Supplies dropped 56 cents to $7.43 with 86 stocks changing hands and Tropical Battery rallied 10 cents to $1.40 with 254,850 stock units crossing the exchange. Market activity ended, with 14 stocks rising, 13 declining and seven closing unchanged. The PE Ratio, a measure used to compute appropriate stock values, averages 12.5 based on ICInsider.com’s 2021-22 earnings forecast.

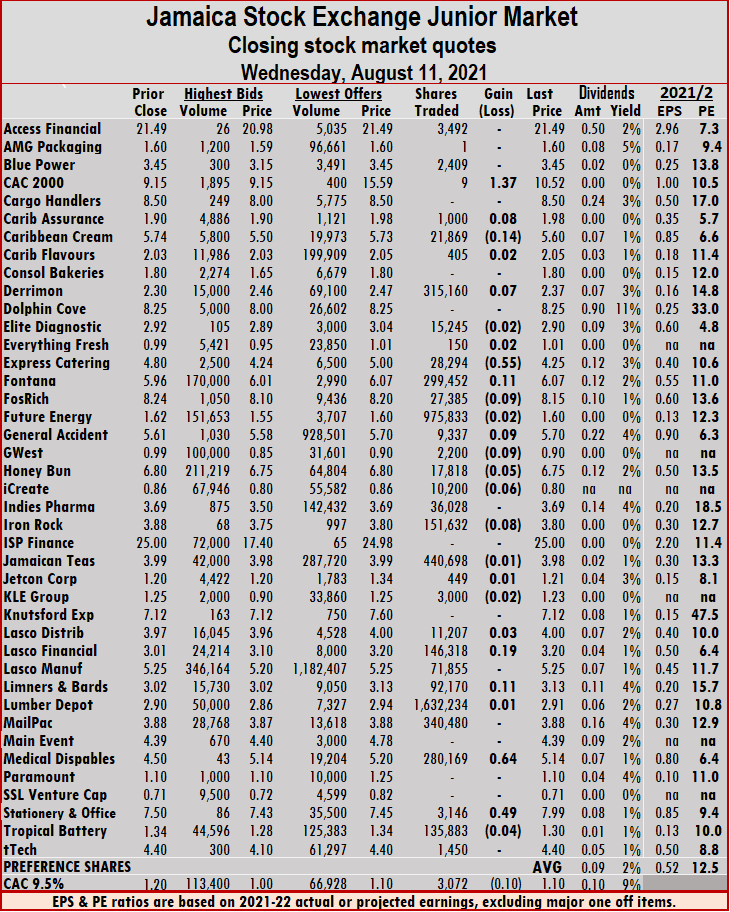

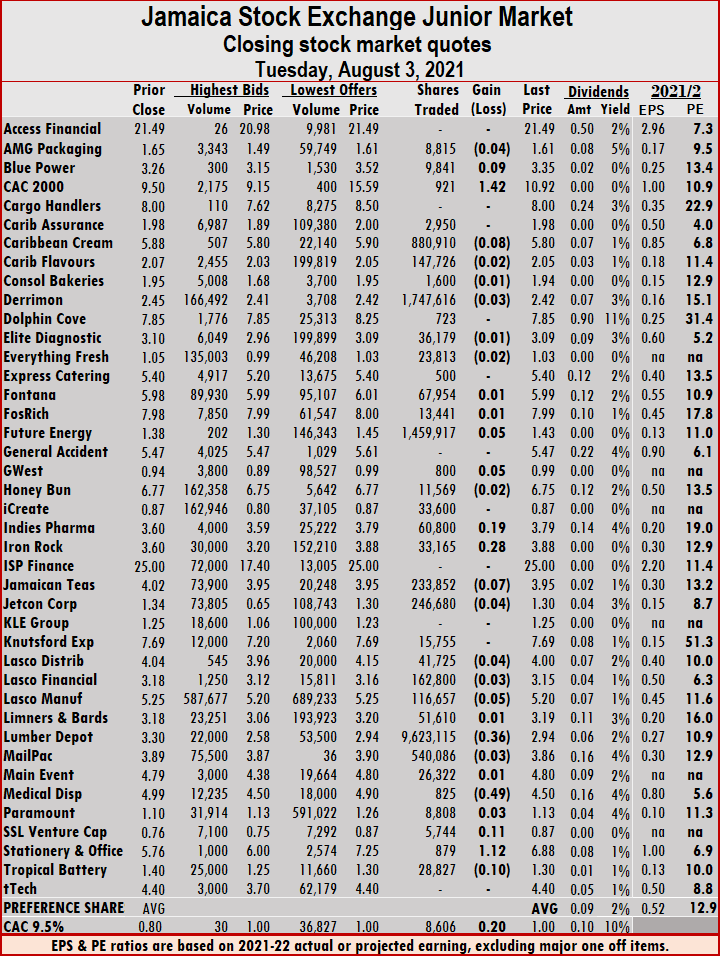

Market activity ended, with 14 stocks rising, 13 declining and seven closing unchanged. The PE Ratio, a measure used to compute appropriate stock values, averages 12.5 based on ICInsider.com’s 2021-22 earnings forecast. At the close, CAC 2000 jumped $1.37 to $10.52 with the exchange of 9 shares, Caribbean Assurance Brokers rose 8 cents to $1.98, with 1,000 stocks changing hands, Caribbean Cream dropped 14 cents to $5.60 with 21,869 units passing through the market. Derrimon Trading gained 7 cents to end at $2.37 with a transfer of 315,160 stock units, Express Catering shed 55 cents to close at $4.25 with 28,294 shares traded, Fontana gained 11 cents to finish at $6.07 with investors switching ownership of 299,452 stocks. Fosrich slipped 9 cents to $8.15 with 27,385 stock units, changing hands, General Accident rose 9 cents to $5.70 as 9,337 units changed hands, GWest Corporation lost 9 cents to settle at 90 cents with 2,200 shares passing through the market. Honey Bun slipped 5 cents to $6.75 with a transfer of 17,818 units, iCreate fell 6 cents to 80 cents with 10,200 stocks traded, Iron Rock Insurance declined by 8 cents to $3.80, with investors switching ownership of 151,632 stock units. Lasco Distributors climbed 3 cents to $4 11,207, with shares crossing the exchange, Lasco Financial rallied 19 cents to $3.20 with an exchange of 146,318 shares, Limners and Bards advanced 11 cents to $3.13 with 92,170 units changing hands,

At the close, CAC 2000 jumped $1.37 to $10.52 with the exchange of 9 shares, Caribbean Assurance Brokers rose 8 cents to $1.98, with 1,000 stocks changing hands, Caribbean Cream dropped 14 cents to $5.60 with 21,869 units passing through the market. Derrimon Trading gained 7 cents to end at $2.37 with a transfer of 315,160 stock units, Express Catering shed 55 cents to close at $4.25 with 28,294 shares traded, Fontana gained 11 cents to finish at $6.07 with investors switching ownership of 299,452 stocks. Fosrich slipped 9 cents to $8.15 with 27,385 stock units, changing hands, General Accident rose 9 cents to $5.70 as 9,337 units changed hands, GWest Corporation lost 9 cents to settle at 90 cents with 2,200 shares passing through the market. Honey Bun slipped 5 cents to $6.75 with a transfer of 17,818 units, iCreate fell 6 cents to 80 cents with 10,200 stocks traded, Iron Rock Insurance declined by 8 cents to $3.80, with investors switching ownership of 151,632 stock units. Lasco Distributors climbed 3 cents to $4 11,207, with shares crossing the exchange, Lasco Financial rallied 19 cents to $3.20 with an exchange of 146,318 shares, Limners and Bards advanced 11 cents to $3.13 with 92,170 units changing hands,  Medical Disposables jumped 64 cents to $5.14 with 280,169 stocks traded after the company release its first quarter results with earnings per share of 10 cents, Stationery and Office Supplies climbed 49 cents to $7.99 with 3,146 shares crossing the exchange and Tropical Battery slipped 4 cents to $1.30, with 135,883 stocks clearing the market.

Medical Disposables jumped 64 cents to $5.14 with 280,169 stocks traded after the company release its first quarter results with earnings per share of 10 cents, Stationery and Office Supplies climbed 49 cents to $7.99 with 3,146 shares crossing the exchange and Tropical Battery slipped 4 cents to $1.30, with 135,883 stocks clearing the market. The Jamaica Stock Exchange Junior Market suffered a big reversal in the market index, pushing it down 64 points in early trading to 3,223.96 from the close on Tuesday at 3,287.50, with the fall of Express Catering from $5 close Tuesday to $3.65 this morning that led to an automatic freeze in the stock at 9.35 am.

The Jamaica Stock Exchange Junior Market suffered a big reversal in the market index, pushing it down 64 points in early trading to 3,223.96 from the close on Tuesday at 3,287.50, with the fall of Express Catering from $5 close Tuesday to $3.65 this morning that led to an automatic freeze in the stock at 9.35 am. Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and three with lower offers.

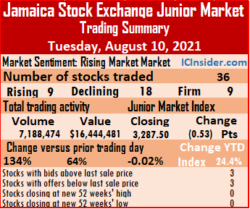

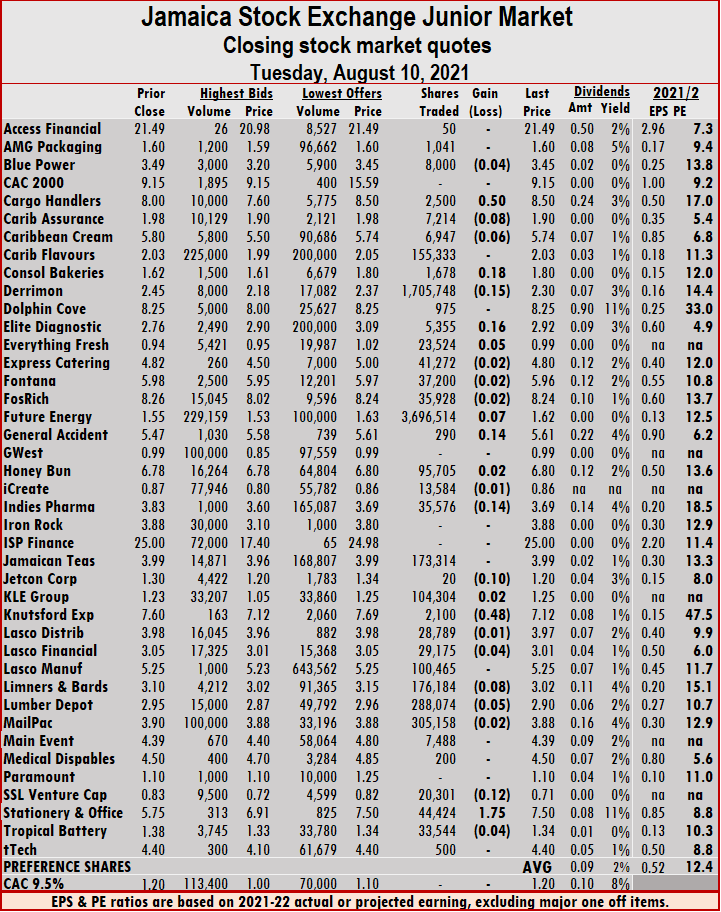

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and three with lower offers. Jetcon Corporation slipped 10 cents to $1.20 in trading 20 shares, Knutsford Express dropped 48 cents in closing at $7.12 after 2,100 stock units crossed the market, Lasco Financial lost 4 cents in closing at $3.01 after trading 29,175 units. Limners and Bards dropped 8 cents to $3.02 in exchanging 176,184 stocks, Lumber Depot fell 5 cents to $2.90 trading 288,074 shares, SSL Venture dropped 12 cents to 71 cents, with 20,301 units crossing the exchange, Stationery and Office Supplies popped $1.75 to $7.50 with 44,424 stock units clearing the market and Tropical Battery lost 4 cents to close at $1.34 while exchanging 33,544 stocks.

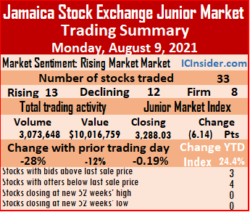

Jetcon Corporation slipped 10 cents to $1.20 in trading 20 shares, Knutsford Express dropped 48 cents in closing at $7.12 after 2,100 stock units crossed the market, Lasco Financial lost 4 cents in closing at $3.01 after trading 29,175 units. Limners and Bards dropped 8 cents to $3.02 in exchanging 176,184 stocks, Lumber Depot fell 5 cents to $2.90 trading 288,074 shares, SSL Venture dropped 12 cents to 71 cents, with 20,301 units crossing the exchange, Stationery and Office Supplies popped $1.75 to $7.50 with 44,424 stock units clearing the market and Tropical Battery lost 4 cents to close at $1.34 while exchanging 33,544 stocks. Trading closed on Monday with the volume of stocks trading dropping 28 percent, with 12 percent less the value than on Thursday prior to the close for the Independence holiday on Friday last and ended with a slight fall in the Junior Market the index, with rising stocks just edging out those declining.

Trading closed on Monday with the volume of stocks trading dropping 28 percent, with 12 percent less the value than on Thursday prior to the close for the Independence holiday on Friday last and ended with a slight fall in the Junior Market the index, with rising stocks just edging out those declining. Trading averaged 93,141 units at $303,538 from 146,791 at $393,767 on Thursday. Trading month to date, averages 204,544 units at $586,518, compared to 241,307 units at $679,902 on Thursday. July closed with an average of 163,918 units at $481,755.

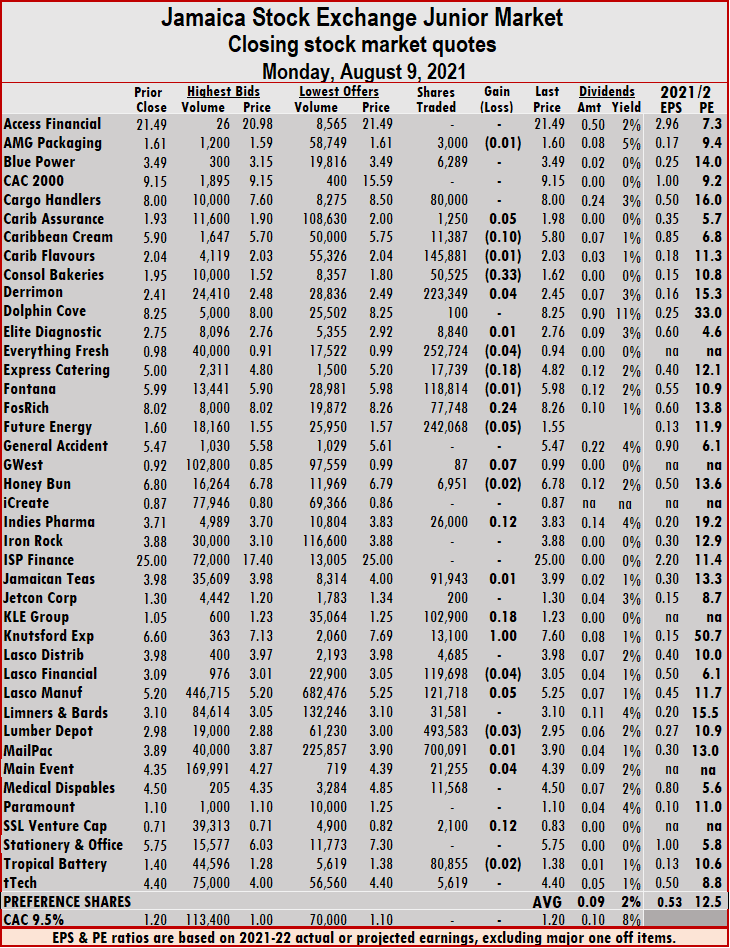

Trading averaged 93,141 units at $303,538 from 146,791 at $393,767 on Thursday. Trading month to date, averages 204,544 units at $586,518, compared to 241,307 units at $679,902 on Thursday. July closed with an average of 163,918 units at $481,755. Knutsford Express jumped $1 to $7.60 with an exchange of 13,100 stocks. Lasco Financial slipped 4 cents to $3.05 with an exchange of 119,698 units, Lasco Manufacturing rose 5 cents to $5.25 with 121,718 stock units traded, Lumber Depot dipped 3 cents to $2.95 while exchanging 493,583 shares. Main Event climbed 4 cents to $4.39 with the swapping of 21,255 stock units and SSL Venture advanced 12 cents to 83 cents with 2,100 shares crossing the exchange.

Knutsford Express jumped $1 to $7.60 with an exchange of 13,100 stocks. Lasco Financial slipped 4 cents to $3.05 with an exchange of 119,698 units, Lasco Manufacturing rose 5 cents to $5.25 with 121,718 stock units traded, Lumber Depot dipped 3 cents to $2.95 while exchanging 493,583 shares. Main Event climbed 4 cents to $4.39 with the swapping of 21,255 stock units and SSL Venture advanced 12 cents to 83 cents with 2,100 shares crossing the exchange.

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele.

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele. The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week.

The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week. The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks. Just 29 securities traded on Thursday, down a bit from the 35 stocks trading on Wednesday, at the close only price movements were lopsided with just six stocks rising, while 17 declined and six closed without a change as trading on the Junior Market ended for the week shortened by two separate holidays, one at the start and the other at the end.

Just 29 securities traded on Thursday, down a bit from the 35 stocks trading on Wednesday, at the close only price movements were lopsided with just six stocks rising, while 17 declined and six closed without a change as trading on the Junior Market ended for the week shortened by two separate holidays, one at the start and the other at the end.  Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers. Lasco Financial slipped 6 cents to $3.09 with investors swapping 48,336 units, Lasco Manufacturing lost 5 cents to close at $5.20 with an exchange of 71,700 stock units, Limners and Bards dropped 8 cents to $3.10, with 386,491 shares passing through the market. Main Event declined by 40 cents to $4.35 with 90,549 units traded, SSL Venture fell 16 cents to 71 cents, with a transfer of 30,000 stocks and Stationery and Office Supplies shed $1.50 to close at $5.75 with 14,400 shares crossing the exchange.

Lasco Financial slipped 6 cents to $3.09 with investors swapping 48,336 units, Lasco Manufacturing lost 5 cents to close at $5.20 with an exchange of 71,700 stock units, Limners and Bards dropped 8 cents to $3.10, with 386,491 shares passing through the market. Main Event declined by 40 cents to $4.35 with 90,549 units traded, SSL Venture fell 16 cents to 71 cents, with a transfer of 30,000 stocks and Stationery and Office Supplies shed $1.50 to close at $5.75 with 14,400 shares crossing the exchange.

for $44,661,348 compared to 2,153,858 units at $7,010,164 on Friday.

for $44,661,348 compared to 2,153,858 units at $7,010,164 on Friday. Lumber Depot fell 36 cents to $2.94 with a transfer of 9,623,115 stock units, Medical Disposables shed 49 cents to finish at $4.50 with 825 units changing hands, SSL Venture popped 11 cents to 87 cents, in switching ownership of 5,744 shares. Stationery and Office Supplies rallied $1.12 to $6.88 with 879 stock units traded and Tropical Battery lost 10 cents to close at $1.30 with 28,827 units crossing the exchange.

Lumber Depot fell 36 cents to $2.94 with a transfer of 9,623,115 stock units, Medical Disposables shed 49 cents to finish at $4.50 with 825 units changing hands, SSL Venture popped 11 cents to 87 cents, in switching ownership of 5,744 shares. Stationery and Office Supplies rallied $1.12 to $6.88 with 879 stock units traded and Tropical Battery lost 10 cents to close at $1.30 with 28,827 units crossing the exchange.