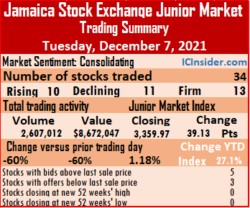

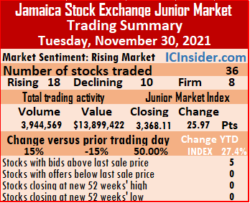

Trading closed on Tuesday, with the volume and value of stocks trading down 60 percent, respectively, from Monday levels on the Jamaica Stock Exchange Junior Market. Market activity led to advancing stocks just edged out by decliners. Yet, the market index ended the day with a robust gain that reverses the majority of the losses of the previous three days.

Market activity led to 34 securities trading as was the case on Monday and ended with ten rising, 11 declining and 13, closing unchanged. The Junior Market Index increased 39.13 points to settle at 3,359.97.

Market activity led to 34 securities trading as was the case on Monday and ended with ten rising, 11 declining and 13, closing unchanged. The Junior Market Index increased 39.13 points to settle at 3,359.97.

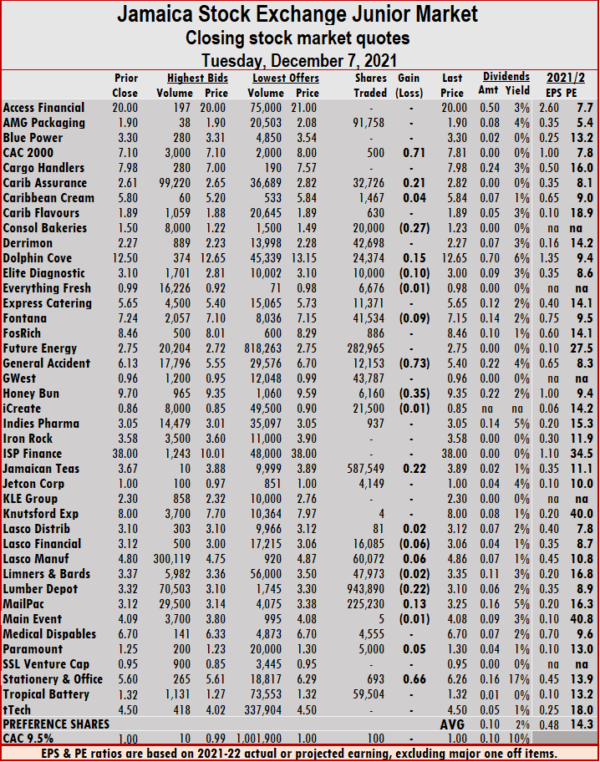

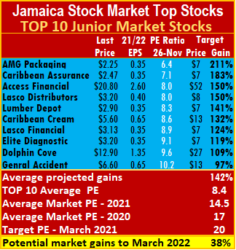

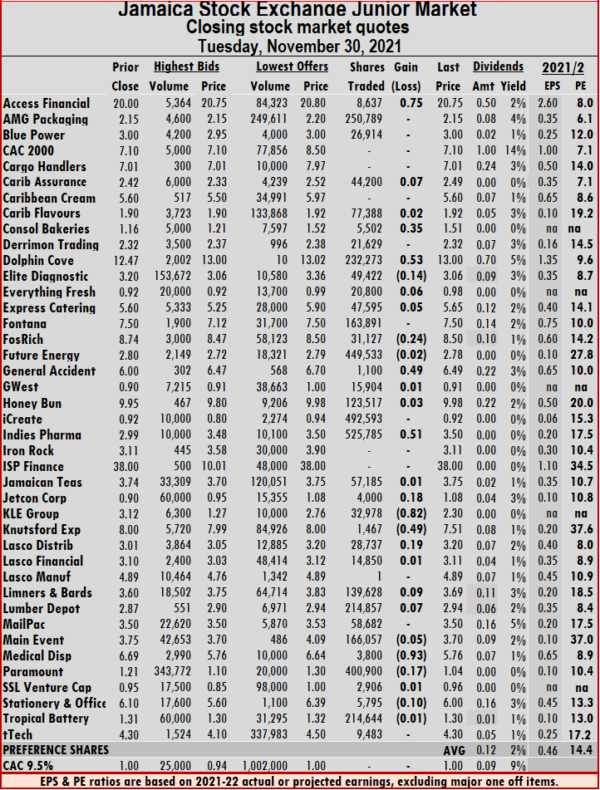

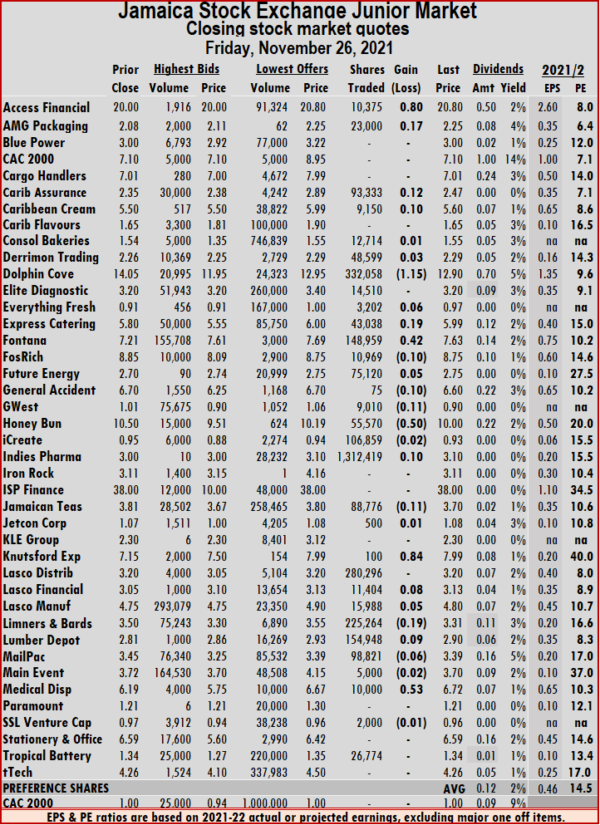

The PE Ratio, a measure used to compute appropriate stock values, averages 14.3. The PE ratio of each stock is shown in the chart below, is based on earnings forecasted by ICInsider.com for companies with their financial year ending up to August 2022.

Trading ended with 2,607,012 shares changing hands for $8,672,047 compared to 6,562,086 units at $21,893,075 on Monday. Lumber Depot led trading with 943,890 shares for 36.2 percent of total volume, followed by Jamaican Teas with 587,549 units for 22.5 percent of the day’s trade and Future Energy Source with 282,965 units for 10.9 percent market share.

Trading averaged 76,677 shares at $255,060 down from 193,003 shares at $643,914 on Monday and trading month to date, ended with an average of 903,146 units at $2,611,225, down from 1,101,032 units at $3,175,499 on Monday. November closed with an average of 160,358 units at $581,730.

Trading averaged 76,677 shares at $255,060 down from 193,003 shares at $643,914 on Monday and trading month to date, ended with an average of 903,146 units at $2,611,225, down from 1,101,032 units at $3,175,499 on Monday. November closed with an average of 160,358 units at $581,730.

Investor’s Choice bid-offer indicator shows five stocks ended, with bids higher than their last selling prices and three with lower offers.

At the close, CAC 2000 rose 71 cents to $7.81 while exchanging 500 shares, Caribbean Assurance Brokers spiked 21 cents to $2.82 in exchanging 32,726 stock units, Caribbean Cream gained 4 cents in closing at $5.84 after trading 1,467 stocks. Consolidated Bakeries dropped 27 cents to close at $1.23, trading 20,000 units, Dolphin Cove increased 15 cents to end at $12.65, with 24,374 units clearing the market, Elite Diagnostic lost 10 cents in ending at $3 in an exchange of 10,000 stock units. Fontana shed 9 cents to end at $7.15, with 41,534 stocks changing hands, General Accident declined 73 cents to $5.40, with 12,153 shares crossing the exchange, Honey Bun fell 35 cents to $9.35 after 6,160 shares changed hands.  Jamaican Teas advanced 22 cents to close at $3.89 after exchanging 587,549 units. Lasco Financial shed 6 cents to $3.06, with 16,085 stock units crossing the market. Lasco Manufacturing popped 6 cents to end at $4.86 after trading 60,072 stocks. Lumber Depot lost 22 cents to close at $3.10 with an exchange of 943,890 shares, Mailpac Group rallied 13 cents in closing at $3.25, with 225,230 stocks crossing the exchange, Paramount Trading climbed 5 cents to $1.30 with the swapping of 5,000 units and Stationery and Office Supplies spiked 66 cents to close at $6.26 in switching ownership of 693 stock units.

Jamaican Teas advanced 22 cents to close at $3.89 after exchanging 587,549 units. Lasco Financial shed 6 cents to $3.06, with 16,085 stock units crossing the market. Lasco Manufacturing popped 6 cents to end at $4.86 after trading 60,072 stocks. Lumber Depot lost 22 cents to close at $3.10 with an exchange of 943,890 shares, Mailpac Group rallied 13 cents in closing at $3.25, with 225,230 stocks crossing the exchange, Paramount Trading climbed 5 cents to $1.30 with the swapping of 5,000 units and Stationery and Office Supplies spiked 66 cents to close at $6.26 in switching ownership of 693 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

ICTOP10 CaribAssurance jumps 21%, AMG drops 16%

Caribbean Assurance Brokers rose 21 percent to close at a 52 weeks’ high of $2.98 for the week, while AMG Packaging fell 16 percent in closing at $1.90, with most Junior Market stocks declining for the week. Main Market stocks were pretty steady, with movements not exceeding 4 percent for the week even as the market indices fell just over 6,500 points or 1.5 percent. On the other hand, the Junior Market gave up 31 points or one percent.

The other notable large TOP10 movers this week are; AMG Packaging, with a loss of 16 percent in closing at $1.90 from $2.25 at the previous week’s close after it fell from $2.40 at the end prior week and Caribbean Cream rose 2 percent to $5.70. Access Financial Services slipped 6 percent to $19.50, Elite Diagnostic dropped 7 percent on top of the 8 percent fall last week to $2.97 and General Accident lost 9 percent in closing at $6, Lasco Distributors and Lumber Depot lost 5 percent each. On Friday, the latter declined as Mayberry Jamaica Equities sold off their holdings to Stony Hill Investments.

The other notable large TOP10 movers this week are; AMG Packaging, with a loss of 16 percent in closing at $1.90 from $2.25 at the previous week’s close after it fell from $2.40 at the end prior week and Caribbean Cream rose 2 percent to $5.70. Access Financial Services slipped 6 percent to $19.50, Elite Diagnostic dropped 7 percent on top of the 8 percent fall last week to $2.97 and General Accident lost 9 percent in closing at $6, Lasco Distributors and Lumber Depot lost 5 percent each. On Friday, the latter declined as Mayberry Jamaica Equities sold off their holdings to Stony Hill Investments.

In the Main Market, Caribbean Producers added another 3 percent to the 15 percent increase last week to close at $10.36 and Proven Investments was up 4 percent. PanJam Investment dropped from $73 9 to $68 to reenter the TOP10, with Carreras dropping out of the Main Market TOP10. In the Junior Market, the price of Medical Disposables slipped from $6.72 last week to $6.30 this past week and swapped back its spot with Dolphin Cove, with the price of the latter closing at $13, up marginally from $12.90.

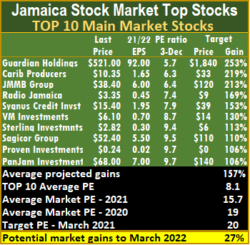

The top three Main Market stocks are Guardian Holdings, Caribbean Producers and JMMB Group, projected to gain between 213 to 253 percent expected versus last weeks’ 214 to 254 percent.

The top three Main Market stocks are Guardian Holdings, Caribbean Producers and JMMB Group, projected to gain between 213 to 253 percent expected versus last weeks’ 214 to 254 percent.

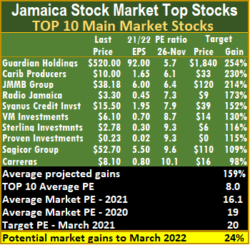

The top three stocks in the Junior Market are AMG Packaging, followed by Access Financial Services and Lasco Distributors. All three can gain between 162 and 268 percent, up from 150 percent and 211 percent previously.

This week’s focus: Lumber Depot stock was under pressure since the release of the first quarter results in September, with price slipping from $3.18 days after the release to below $3. Now that Mayberry sold off their holdings, the stock may be allowed to move up unless other top holders resume selling. The stocks have the potential to record strong price appreciation and the company has good long term prospects for growth and expansion. With earnings per share projected at 35 cents for the current year and the price under $3 with a PE of just 8, there is much upside potential in the short term.

The average gains projected for the TOP 10 Junior Market stocks moved from 142 percent last week to 151 percent and Main Market stocks moved from 159 percent to this weeks’ 157 percent.

The Junior Market closed the week with an average PE of 14.3 based on ICInsider.com’s 2021-22 earnings and currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 43 percent discount to that market’s average PE.

The Junior Market closed the week with an average PE of 14.3 based on ICInsider.com’s 2021-22 earnings and currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 43 percent discount to that market’s average PE.

The Junior Market can gain 40 percent to March next year, based on an average PE of 20 and 9percent based on an average PE of 17. Ten stocks representing 25 percent of all Junior Market stocks with positive earnings are trading at or above this level, down from seven last week, indicating that many others will rise towards the 17 mark in the weeks ahead.

The average PE for the JSE Main Market is 15.7, which is 21 percent less than the PE of 19 at the end of March and 27 percent below the target of 20 to March 2022.  The Main Market TOP 10 average PE is 8.1, representing a 51 percent discount to the market and well below the potential of 20. A total of 17 stocks or 36 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

The Main Market TOP 10 average PE is 8.1, representing a 51 percent discount to the market and well below the potential of 20. A total of 17 stocks or 36 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

This stock is a must for Xmas buy list

Profit after taxation surged 455 percent to $21.5 million for the second quarter to September from a loss of $6 million in 2020 at Medical Disposables. For the year to date, profit after tax spiked 458 percent to $47 million, up from a loss of $13 million in 2020.

Income from sales jumped 49 percent to $936 million for the September quarter, up from $630 million in 2020 and climbed 42 percent for the six months ended September 2021 to $1.62 billion, from $1.14 billion in the prior year.

Income from sales jumped 49 percent to $936 million for the September quarter, up from $630 million in 2020 and climbed 42 percent for the six months ended September 2021 to $1.62 billion, from $1.14 billion in the prior year.

The increase in sales in the second quarter “is due to increased business activity as well as the consolidation of the operations of the new subsidiary Cornwall Enterprises Limited. There has been a significant improvement in the movement of pharmaceutical and medical disposable items, especially with fewer lock-down periods when compared to last year,” Kurt Boothe, Chief Executive Officer, reported to shareholders in the report accompanying the financials.

Gross profit after selling and distribution expenses jumped 74 percent in the quarter to $184 million, up from $106 million in 2020 and climbed 85 percent for the half year to $303 million from $164 million in the prior year. The period’s gross profit percentage rose to 25 percent compared to 23 percent in 2020 for the six months and from 24 percent in 2020 to 25 percent for the September quarter.

Finance and other income added $8 million to profit in the September 2021 quarter versus $1.5 million in 2020 and for the half year $10 million versus $3 million in 2020.

Selling and promotional expenses increased 26 percent from $46 million in the 2020 second quarter to $59 million and rose 14 percent from $103 million in 2020 to $117 million for the six month period.

Medical Disposables.

Administrative expenses jumped 80 percent from $63 million in the 2020 second quarter to $112 million and surged 55 percent from $113 million in 2020 to $175 million for the six months. Depreciation charge moved 90 percent from $7 million for the September 2020 quarter to $13 million in 2021 and rose 45 percent for the half year from $14 million to $20 million.

Finance cost fell 26 percent from $38 million to $28 million in the quarter and dipped 9 percent to $45 million $50 million for the half year. Foreign exchange losses amount to $1.75 million in the latest quarter from $4 million in 2020 and $5.4 million for the year to date versus a slight loss of $76,823 in 2020.

Gross cash flow generated $75 million for the six months, but growth in working capital drove it down to a negative $119 million versus negative $190 million in 2020. The cash flow deficit was financed by net loan inflows of $225 million. The company paid a dividend of $18.4 million during the half year. At the end of the quarter, Current assets ended with $1.79 billion, including cash of $95 million, inventories of $944 million and receivables of $745 million. Current Liabilities amounts to $1.24 billion and includes Payables of $741 million and short term loans of $486 million. Net current assets ended the period $549 million. Shareholders’ equity stands at $1.05 million, with long term borrowings at just $284 million.

Earnings per share came out at 8 cents for the quarter and 18 cents for the half year. ICInsider.com forecasts earnings of 70 cents per share for the current year and $1.50 per share for 2023. The stock traded at $5.62 on the Jamaica Stock Exchange Junior Market on Wednesday with a PE ratio of 8 times, current earnings well below the average of 14.5 currently for the Junior Market. The stock gets the coveted ICInsider.com BUY RATED seal.

Two changes to ICTOP10 listings

The two major Jamaica Stock Exchange markets meandered all week, closing the past week with the Junior Market rising moderately and the Main Market recovering 5,228 points of the more than 12,000 lost on the last two trading days in the previous week as prices of Caribbean Cement, NCB Financial and Scotia Group rose.

The two major Jamaica Stock Exchange markets meandered all week, closing the past week with the Junior Market rising moderately and the Main Market recovering 5,228 points of the more than 12,000 lost on the last two trading days in the previous week as prices of Caribbean Cement, NCB Financial and Scotia Group rose.

Against the above backdrop, there were few changes to the ICTOP10 stocks at the week’s close. Scotia Group jumped 9 percent to end at $37.97 for the week and gave way to Carreras to return to the Main Market TOP10 after a long absence, with the price at $8.10 and projected earnings at 80 cents. The Junior Market lost Medical Disposables with the price closing at $6.72, up 29 percent for the week, allowing General Accident came in to replace it with the price at $6.60 and just edging out Fontana, with both having similar potential gains of 97 percent.

Big TOP10 movers for the week are AMG Packaging lost 6 percent in closing at $2.25 from $2.40 last week, Caribbean Cream fell 4 percent to $5.60, Elite Diagnostic dropped 8 percent to $3.20, Caribbean Assurance Brokers rose 6 percent to $2.47 and Dolphin Cove rose 3 percent to land at $12.90 after it a 52 weeks’ high of $14 on Thursday, new coronavirus making the news seemed to have induced selling on Friday. In the Main Market, Caribbean Producers jumped 15 percent to close at $10, up from $8.61 and Radio Jamaica gained 8 percent to $3.30.

Big TOP10 movers for the week are AMG Packaging lost 6 percent in closing at $2.25 from $2.40 last week, Caribbean Cream fell 4 percent to $5.60, Elite Diagnostic dropped 8 percent to $3.20, Caribbean Assurance Brokers rose 6 percent to $2.47 and Dolphin Cove rose 3 percent to land at $12.90 after it a 52 weeks’ high of $14 on Thursday, new coronavirus making the news seemed to have induced selling on Friday. In the Main Market, Caribbean Producers jumped 15 percent to close at $10, up from $8.61 and Radio Jamaica gained 8 percent to $3.30.

The top three Main Market stocks are Guardian Holdings, Caribbean Producers and JMMB Group, projected to gain between 214 to 254 percent expected versus last weeks’ 212 to 283 percent.

The top three stocks in the Junior Market are AMG Packaging, followed by Caribbean Assurance Brokers and Access Financial Services. All three can gain between 150 and 211 percent, down from 154 percent and 207 percent previously.

The top three stocks in the Junior Market are AMG Packaging, followed by Caribbean Assurance Brokers and Access Financial Services. All three can gain between 150 and 211 percent, down from 154 percent and 207 percent previously.

There are many undervalued stocks in the market, with the average gains projected for the TOP 10 Junior Market stocks moved from 145 percent last week to 142percent and Main Market stocks moved from 163 percent to this week’s 159 percent.

The Junior Market closed the week with an average PE 14.5 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the March 2020 historical average of 17, based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.4, with a 42 percent discount to that market’s average PE.

The Junior Market can gain 38 percent to March next year, based on an average PE of 20 and 17 percent based on an average PE of 17. Ten stocks representing 25 percent of all Junior Market stocks with positive earnings are trading at or above this level, down from seven last week, indicating that many others will rise towards the 17 mark in the weeks ahead.

The Junior Market can gain 38 percent to March next year, based on an average PE of 20 and 17 percent based on an average PE of 17. Ten stocks representing 25 percent of all Junior Market stocks with positive earnings are trading at or above this level, down from seven last week, indicating that many others will rise towards the 17 mark in the weeks ahead.

The average PE for the JSE Main Market is 16.1, which is 18 percent less than the PE of 19 at the end of March and 24 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 50 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average PE of 25.5, suggesting that the accepted multiple could be around 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

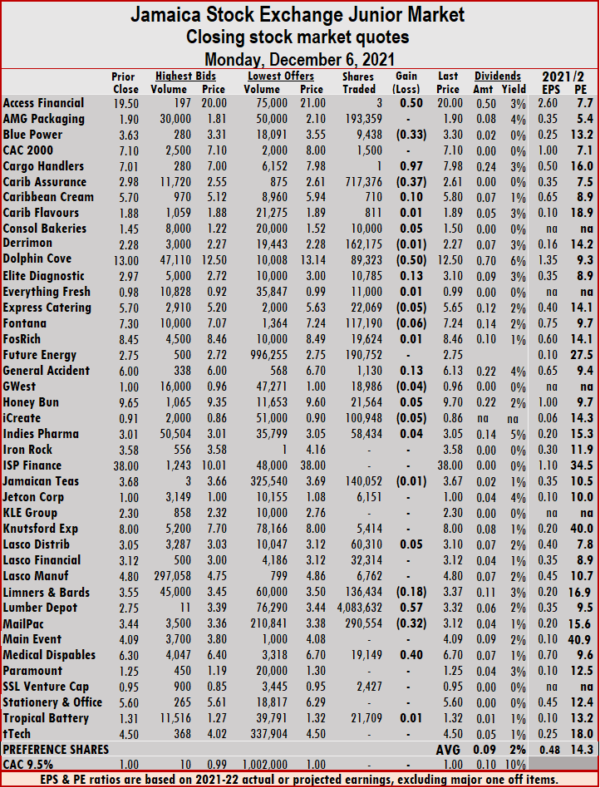

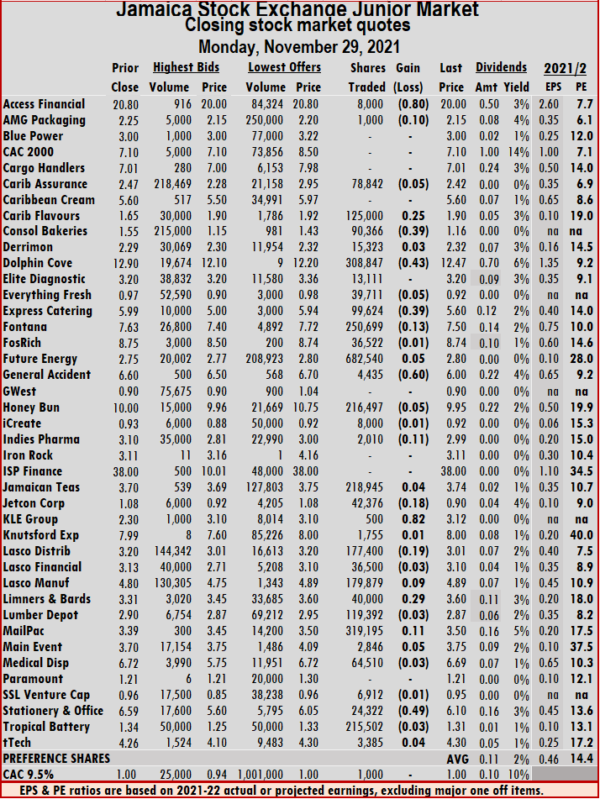

Market activity led to 34 securities trading as was the case on Friday and ended with 15 rising, 11 declining and eight, closing unchanged.

Market activity led to 34 securities trading as was the case on Friday and ended with 15 rising, 11 declining and eight, closing unchanged. Investor’s Choice bid-offer indicator shows six stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows six stocks ending with bids higher than their last selling prices and four with lower offers. iCreate fell 5 cents in closing at 86 cents, with 100,948 stocks changing hands, Lasco Distributors spiked 5 cents to $3.10, with 60,310 stock units crossing the market, Limners and Bards lost 18 cents in ending at $3.37 after trading 136,434 units. Lumber Depot increased 57 cents in closing at $3.32 in an exchange of 4,083,632 shares, Mailpac Group declined 32 cents to $3.12 after exchanging 290,554 shares and Medical Disposables advanced 40 cents to end at $6.70, trading 19,149 stock units.

iCreate fell 5 cents in closing at 86 cents, with 100,948 stocks changing hands, Lasco Distributors spiked 5 cents to $3.10, with 60,310 stock units crossing the market, Limners and Bards lost 18 cents in ending at $3.37 after trading 136,434 units. Lumber Depot increased 57 cents in closing at $3.32 in an exchange of 4,083,632 shares, Mailpac Group declined 32 cents to $3.12 after exchanging 290,554 shares and Medical Disposables advanced 40 cents to end at $6.70, trading 19,149 stock units.

Trading averaged 4,232,879 shares at $11,695,845 in contrast to 84,664 shares at $568,851 on Thursday and month to date, averaging 1,386,894 units at $3,972,320, compared to 79,279 units at $423,673 previously. November closed with an average of 160,358 units at $581,730.

Trading averaged 4,232,879 shares at $11,695,845 in contrast to 84,664 shares at $568,851 on Thursday and month to date, averaging 1,386,894 units at $3,972,320, compared to 79,279 units at $423,673 previously. November closed with an average of 160,358 units at $581,730. Jetcon Corporation lost 8 cents in ending at $1 with the swapping of 1,200 stocks, Knutsford Express rose 30 cents to finish at $8 with 112 stock units changing hands, Lasco Distributors lost 5 cents in closing at $3.05 with the transfer of 60,265 shares. Limners and Bards popped 10 cents to $3.55 in exchanging 15,000 stocks, Lumber Depot shed 15 cents to close at $2.75 with 141,232,699 shares clearing the market, Medical Disposables jumped 68 cents to $6.30 in trading 8,678 stock units and tTech gained 40 cents to end at $4.50 with 11,077 shares changing hands.

Jetcon Corporation lost 8 cents in ending at $1 with the swapping of 1,200 stocks, Knutsford Express rose 30 cents to finish at $8 with 112 stock units changing hands, Lasco Distributors lost 5 cents in closing at $3.05 with the transfer of 60,265 shares. Limners and Bards popped 10 cents to $3.55 in exchanging 15,000 stocks, Lumber Depot shed 15 cents to close at $2.75 with 141,232,699 shares clearing the market, Medical Disposables jumped 68 cents to $6.30 in trading 8,678 stock units and tTech gained 40 cents to end at $4.50 with 11,077 shares changing hands. The day ended with 38 securities trading compared to 36 on Tuesday and ended with 12 rising, 15 declining and 11, closing unchanged. The Junior Market Index advanced 8.09 points to settle at 3,376.20.

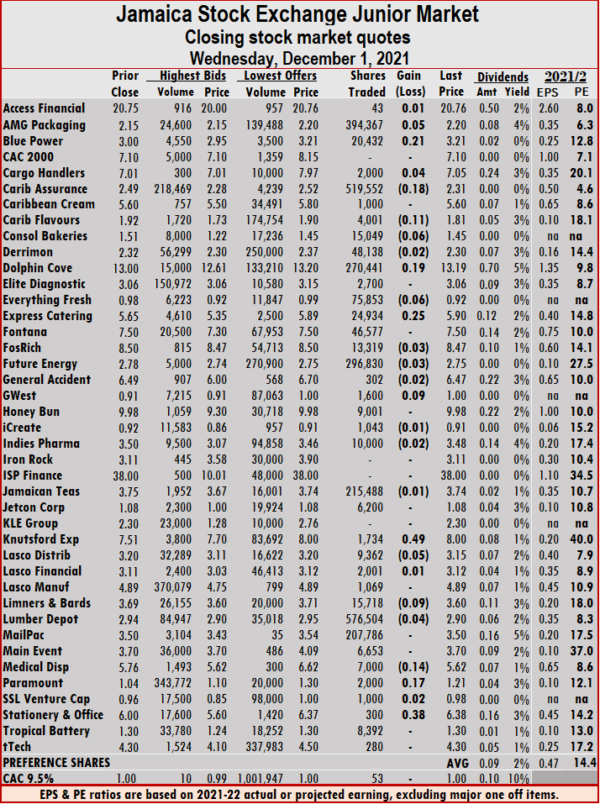

The day ended with 38 securities trading compared to 36 on Tuesday and ended with 12 rising, 15 declining and 11, closing unchanged. The Junior Market Index advanced 8.09 points to settle at 3,376.20. At the close, AMG Packaging popped 5 cents after closing at $2.20 with the swapping of 394,367 shares, Blue Power rose 21 cents to $3.21, with 20,432 stocks crossing the market, Cargo Handlers climbed 4 cents to end at $7.05 after exchanging 2,000 stock units. Caribbean Assurance Brokers shed 18 cents to $2.31, with 519,552 units crossing the market, Caribbean Flavours fell 11 cents to $1.81 with 4,001 stocks changing hands, Consolidated Bakeries declined 6 cents in closing at $1.45 in exchanging 15,049 units. Dolphin Cove popped 19 cents to $13.19 after trading 270,441 shares, Everything Fresh fell 6 cents to 92 cents with an exchange of 75,853 stock units, Express Catering increased 25 cents to close at $5.90 in exchanging 24,934 units. Fosrich dropped 3 cents to end at $8.47 after trading 13,319 stocks, Future Energy Source slipped 3 cents to $2.75, with 296,830 shares changing hands, GWest Corporation rallied 9 cents to close at $1 in switching ownership of 1,600 stock units.

At the close, AMG Packaging popped 5 cents after closing at $2.20 with the swapping of 394,367 shares, Blue Power rose 21 cents to $3.21, with 20,432 stocks crossing the market, Cargo Handlers climbed 4 cents to end at $7.05 after exchanging 2,000 stock units. Caribbean Assurance Brokers shed 18 cents to $2.31, with 519,552 units crossing the market, Caribbean Flavours fell 11 cents to $1.81 with 4,001 stocks changing hands, Consolidated Bakeries declined 6 cents in closing at $1.45 in exchanging 15,049 units. Dolphin Cove popped 19 cents to $13.19 after trading 270,441 shares, Everything Fresh fell 6 cents to 92 cents with an exchange of 75,853 stock units, Express Catering increased 25 cents to close at $5.90 in exchanging 24,934 units. Fosrich dropped 3 cents to end at $8.47 after trading 13,319 stocks, Future Energy Source slipped 3 cents to $2.75, with 296,830 shares changing hands, GWest Corporation rallied 9 cents to close at $1 in switching ownership of 1,600 stock units.  Knutsford Express gained 49 cents in ending at $8 after trading 1,734 units, Lasco Distributors fell 5 cents in closing at $3.15 after exchanging 9,362 stocks, Limners and Bards dropped 9 cents to end at $3.60, with 15,718 shares crossing the exchange. Lumber Depot shed 4 cents to $2.90 while exchanging 576,504 stock units, Medical Disposables lost 14 cents to end at $5.62, with 7,000 stocks clearing the market, Paramount Trading advanced 17 cents in closing at $1.21 after exchanging 2,000 units and Stationery and Office Supplies popped 38 cents to $6.38 in an exchange of 300 stock units.

Knutsford Express gained 49 cents in ending at $8 after trading 1,734 units, Lasco Distributors fell 5 cents in closing at $3.15 after exchanging 9,362 stocks, Limners and Bards dropped 9 cents to end at $3.60, with 15,718 shares crossing the exchange. Lumber Depot shed 4 cents to $2.90 while exchanging 576,504 stock units, Medical Disposables lost 14 cents to end at $5.62, with 7,000 stocks clearing the market, Paramount Trading advanced 17 cents in closing at $1.21 after exchanging 2,000 units and Stationery and Office Supplies popped 38 cents to $6.38 in an exchange of 300 stock units. Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer. Limners and Bards advanced 9 cents to end at $3.69 after 139,628 stocks crossed the market, Lumber Depot popped 7 cents to close at $2.94, trading 214,857 stock units, Medical Disposables declined 93 cents in closing at $5.76, with 3,800 shares changing hands. Paramount Trading fell 17 cents to $1.04 in an exchange of 400,900 units and Stationery and Office Supplies declined 10 cents to $6, with 5,795 stocks clearing the market.

Limners and Bards advanced 9 cents to end at $3.69 after 139,628 stocks crossed the market, Lumber Depot popped 7 cents to close at $2.94, trading 214,857 stock units, Medical Disposables declined 93 cents in closing at $5.76, with 3,800 shares changing hands. Paramount Trading fell 17 cents to $1.04 in an exchange of 400,900 units and Stationery and Office Supplies declined 10 cents to $6, with 5,795 stocks clearing the market. A total of 34 securities traded, up from 31 on Friday, ending with 11 rising, 21 declining and two closing unchanged.

A total of 34 securities traded, up from 31 on Friday, ending with 11 rising, 21 declining and two closing unchanged. Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers. Jetcon Corporation declined 18 cents to 90 cents in an exchange of 42,376 stock units, KLE Group spiked 82 cents in closing at $3.12 in trading just 500 stocks, Lasco Distributors shed 19 cents to end at $3.01 with the swapping of 177,400 units. Lasco Manufacturing climbed 9 cents to $4.89, with 179,879 shares changing hands, Limners and Bards advanced 29 cents to $3.60 after trading 40,000 stocks, Mailpac Group popped 11 cents to close at $3.50, with 319,195 units crossing the market and Stationery and Office Supplies dropped 49 cents to end at $6.10, with 24,322 stock units changing hands.

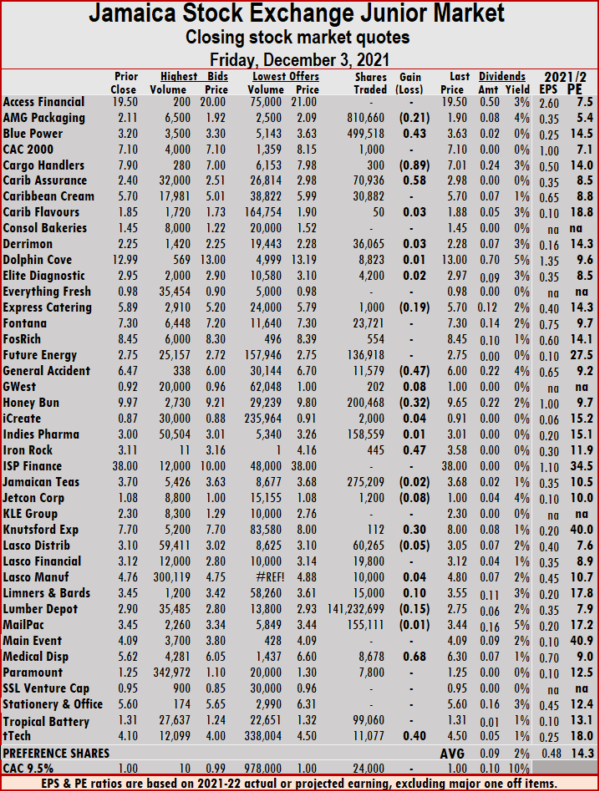

Jetcon Corporation declined 18 cents to 90 cents in an exchange of 42,376 stock units, KLE Group spiked 82 cents in closing at $3.12 in trading just 500 stocks, Lasco Distributors shed 19 cents to end at $3.01 with the swapping of 177,400 units. Lasco Manufacturing climbed 9 cents to $4.89, with 179,879 shares changing hands, Limners and Bards advanced 29 cents to $3.60 after trading 40,000 stocks, Mailpac Group popped 11 cents to close at $3.50, with 319,195 units crossing the market and Stationery and Office Supplies dropped 49 cents to end at $6.10, with 24,322 stock units changing hands. Trading closed on Friday, with the volume of stocks dropping 71 percent and the value falling 43 percent below Thursday’s trades at the close of the Jamaica Stock Exchange Junior Market as the market index rose.

Trading closed on Friday, with the volume of stocks dropping 71 percent and the value falling 43 percent below Thursday’s trades at the close of the Jamaica Stock Exchange Junior Market as the market index rose. Trading averaged 104,156 shares at $447,073, down from 296,376 shares at $662,091 on Thursday and month to date an average of 165,619 units at $596,109, compared to 168,340 units at $602,709 on Thursday. October ended with an average of 162,777 units at $557,275.

Trading averaged 104,156 shares at $447,073, down from 296,376 shares at $662,091 on Thursday and month to date an average of 165,619 units at $596,109, compared to 168,340 units at $602,709 on Thursday. October ended with an average of 162,777 units at $557,275. Jamaican Teas dropped 11 cents to close at $3.70 in trading 88,776 shares, Knutsford Express climbed 84 cents to $7.99 in an exchange of 100 stock units, Lasco Financial rose 8 cents to $3.13 after finishing trading 11,404 stocks, Limners and Bards shed 19 cents in ending at $3.31 while exchanging 225,264 units, Lumber Depot climbed 9 cents to end at $2.90 in an exchange of 154,948 stock units and Medical Disposables popped 53 cents to $6.72 after exchanging 10,000 stocks.

Jamaican Teas dropped 11 cents to close at $3.70 in trading 88,776 shares, Knutsford Express climbed 84 cents to $7.99 in an exchange of 100 stock units, Lasco Financial rose 8 cents to $3.13 after finishing trading 11,404 stocks, Limners and Bards shed 19 cents in ending at $3.31 while exchanging 225,264 units, Lumber Depot climbed 9 cents to end at $2.90 in an exchange of 154,948 stock units and Medical Disposables popped 53 cents to $6.72 after exchanging 10,000 stocks.