In a week of the market ups and downs with Scotia Group and Express Catering dropping out of the ICTOP10 listing. Price movements in the TOP10 have been notable, with Express Catering at long last making a move higher in adding 10 percent, to close at $4.45, but the potential of the stock is held back by the company’s poor corporate governance practices highlighted by the fact that loan funding is used to on-lend to related group companies, with no benefit to the company’s to the company, with the company giving up more than US$1 million per year.

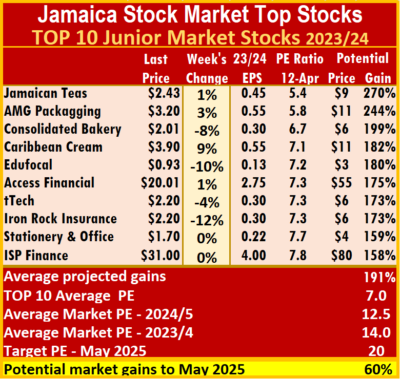

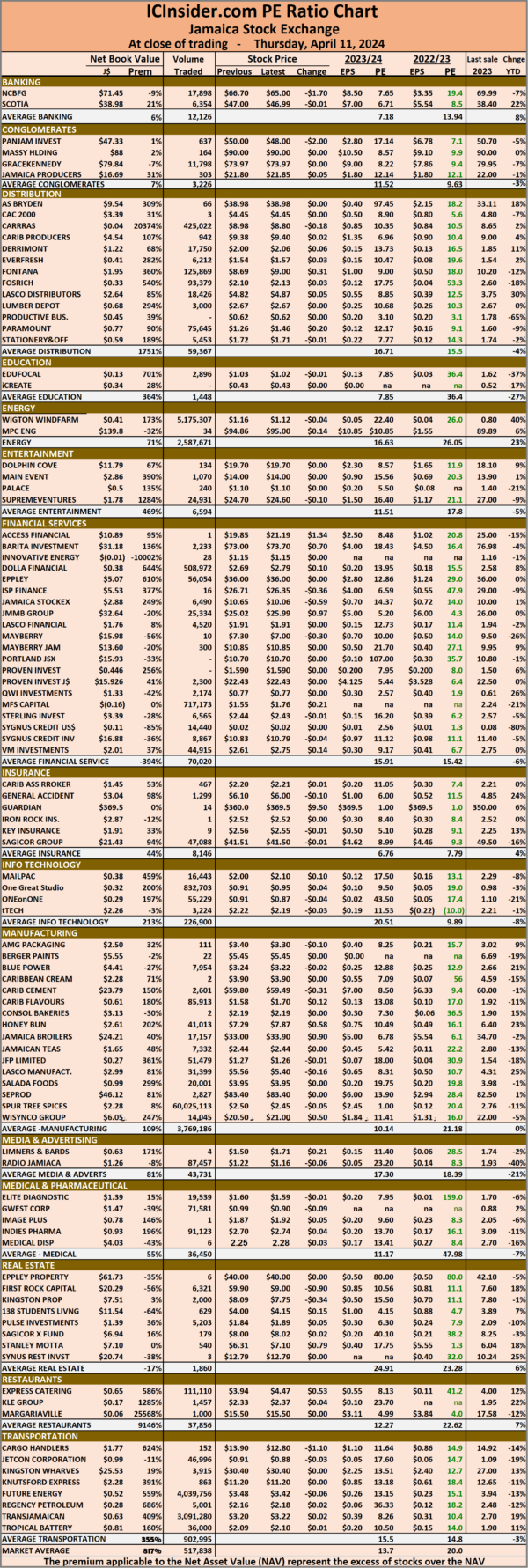

In a review of the ICTOP10, the earnings for the current year were confirmed at 45 cents for AMG Packaging, following the release of six months’ results on Friday, showing profit up 78 percent for the latest quarter and the half year while tTech earnings were projected for the current year at 30 cents per share pushing the stock in the TOP10.

In a review of the ICTOP10, the earnings for the current year were confirmed at 45 cents for AMG Packaging, following the release of six months’ results on Friday, showing profit up 78 percent for the latest quarter and the half year while tTech earnings were projected for the current year at 30 cents per share pushing the stock in the TOP10.

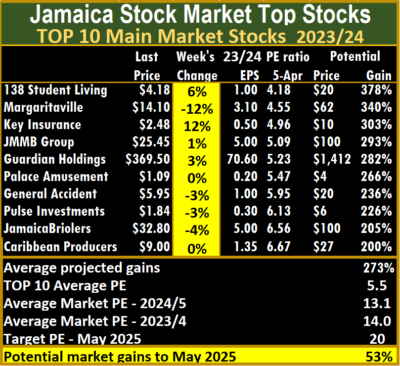

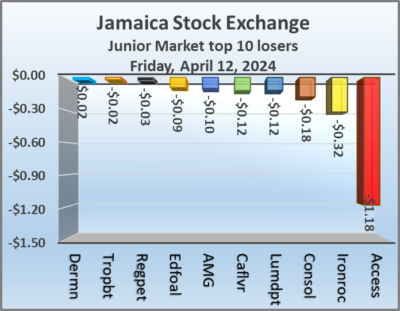

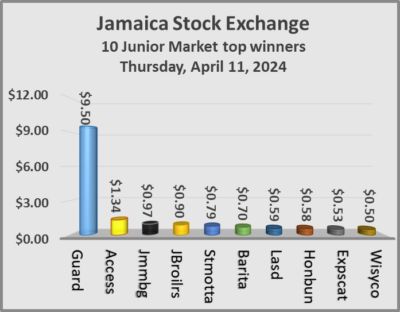

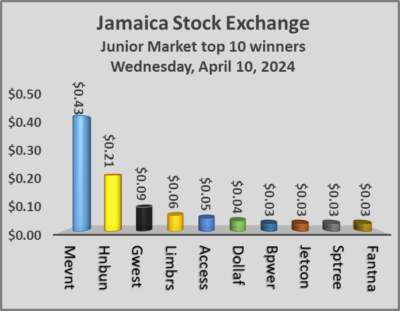

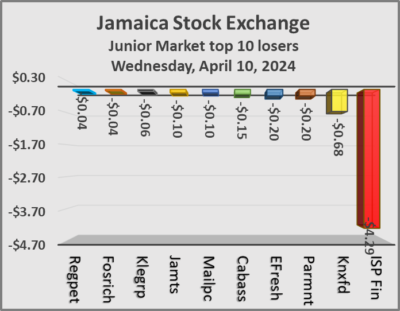

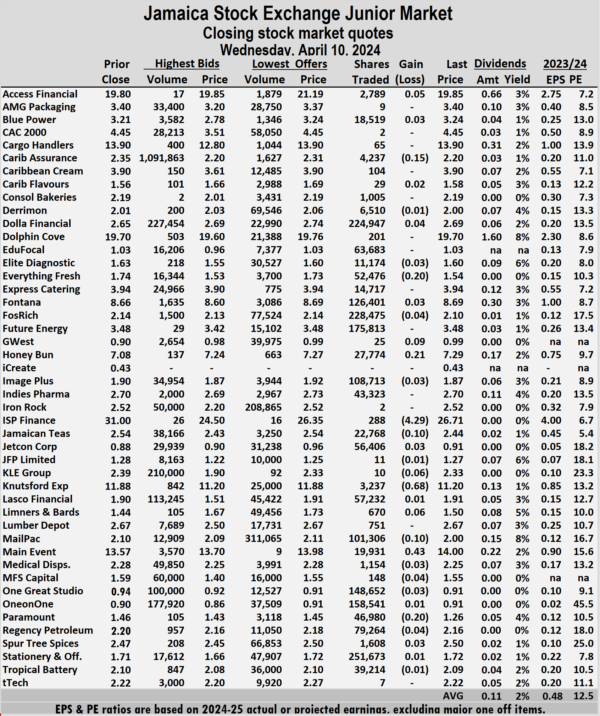

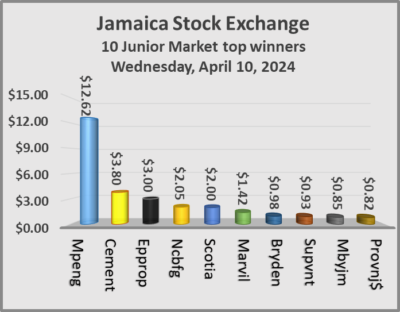

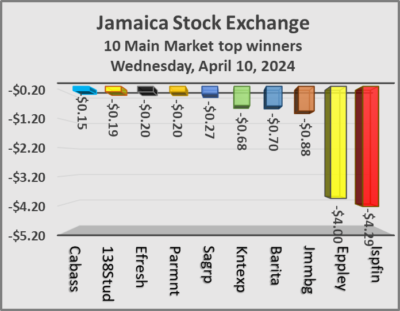

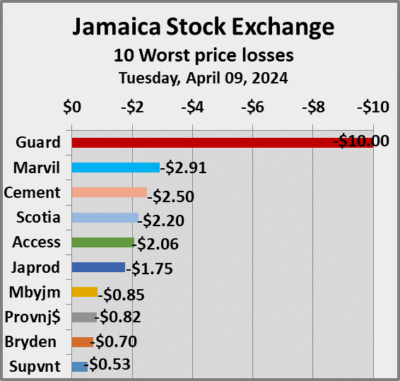

In market activity during the week, Caribbean Cream climbed 9 percent to $3.90, but Iron Rock Insurance fell 12 percent to $2.20 followed by Edufocal, down 10 percent to an all time low of 93 cents while Consolidated Bakeries slipped 8 percent to $2.01. In the Main Market, Key Insurance rose 12 percent to $2.48 and 138 Student Living rose 6 percent to $4.18 while Margaritaville dropped 12 percent to $14.10.

tTech is a new addition to the Junior Market ICTOP10 with the increase in projected earnings for 2024, replacing Express Catering and in Main Market TOP10, Jamaica Broilers returns, edging out the undervalued Scotia Group. Jamaica Broilers another severely undervalued stock with good long term growth prospects returns to the TOP10.

It is worth noting that Honey Bun that was last in the TOP10 in the week ending March 8 and hit a 52 weeks’ high of $7.92 this week to be up 18 percent since it was added to the listing in mid-February at $6.69. The price should continue to increase throughout 2024.

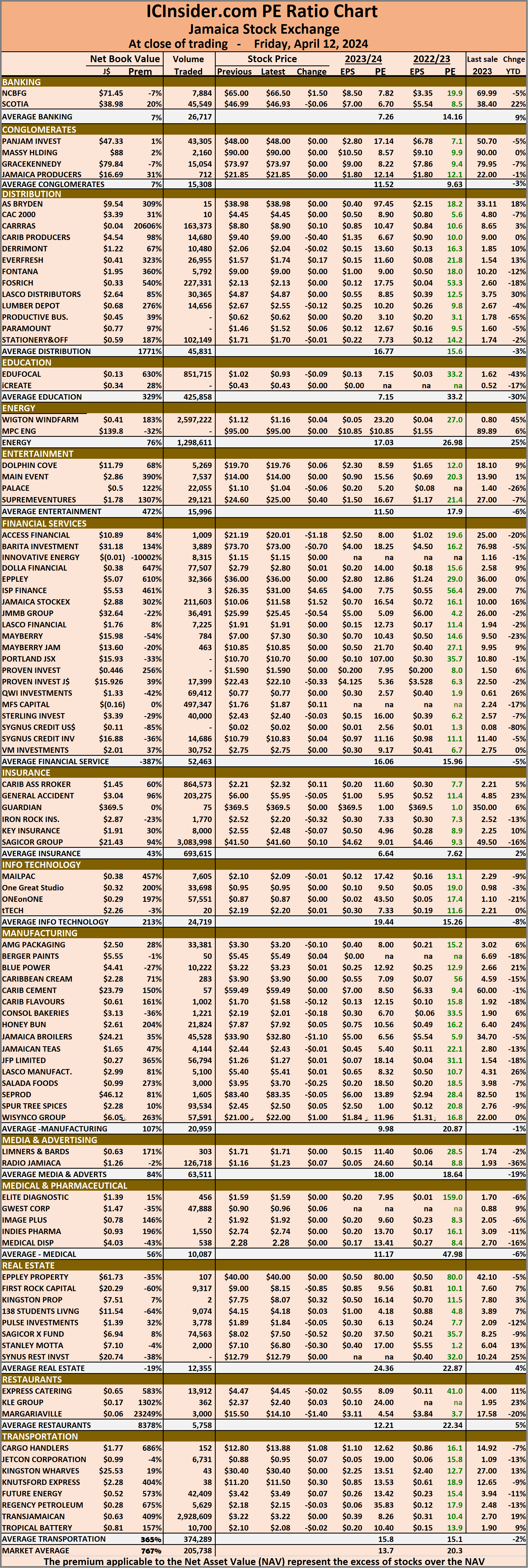

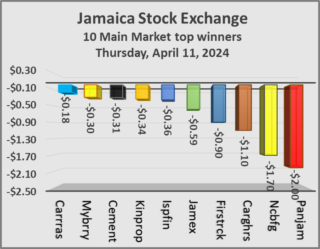

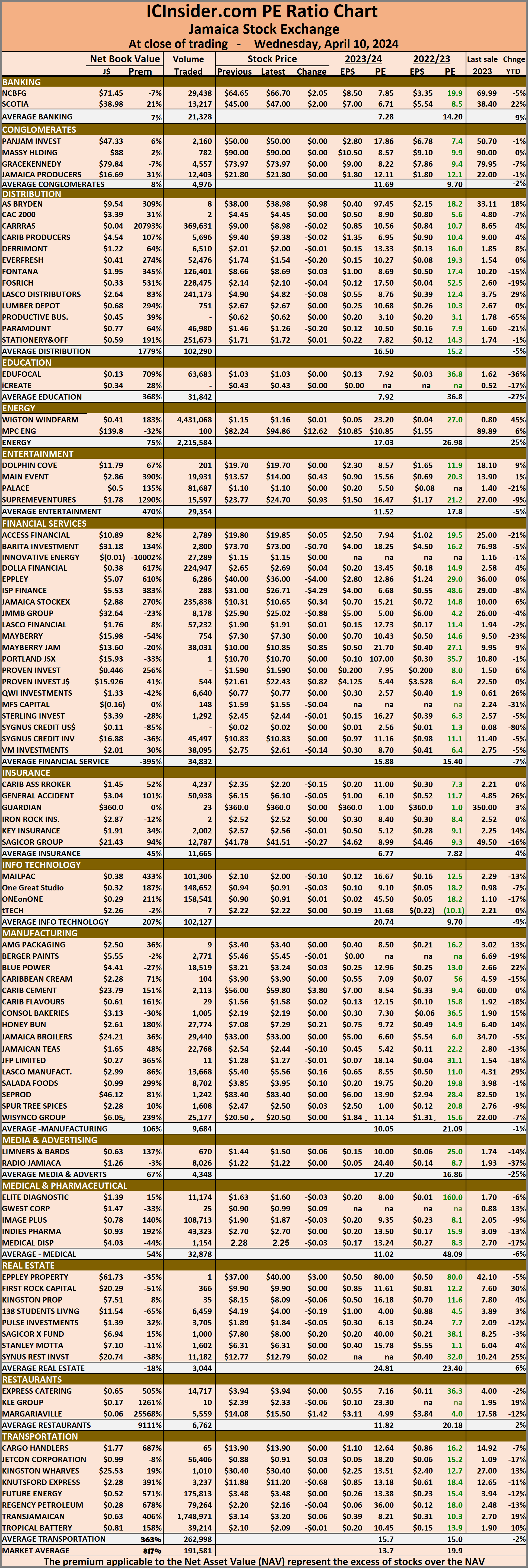

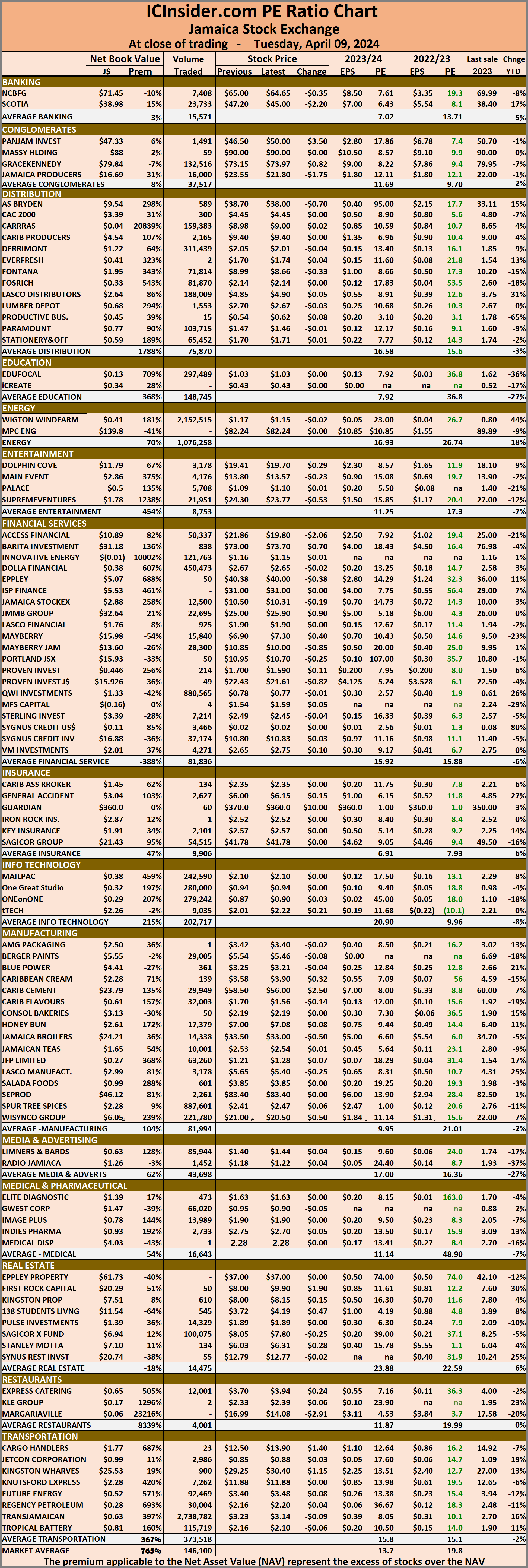

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.2 and the Junior Market TOP10 sits at 7.4 over half of the market, with an average of 12.6.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.2 and the Junior Market TOP10 sits at 7.4 over half of the market, with an average of 12.6.

The Main Market ICTOP10 is projected to gain an average of 273 percent by May 2025, based on 2024 forecasted earnings, providing better values than the Junior Market with the potential to gain 191 percent over the same period.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 107, with an average of 32 and 23 excluding the highest PE ratios, and a PE of 25 for the top half and 19 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 9 stocks, or 20 percent of the market, with PEs ranging from 15 to 44, averaging 22, well above the market’s average. The top half of the market has an average PE of 17, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

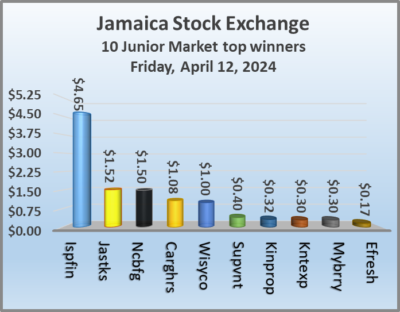

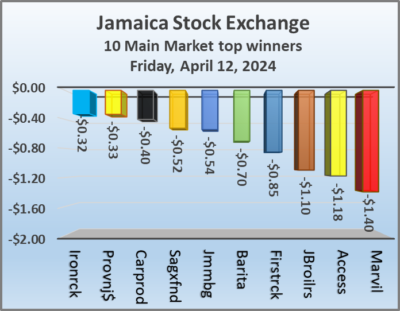

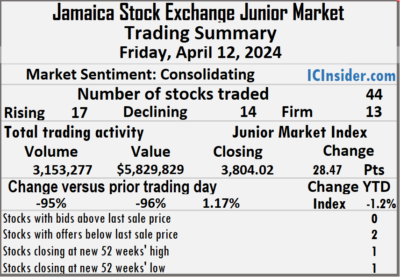

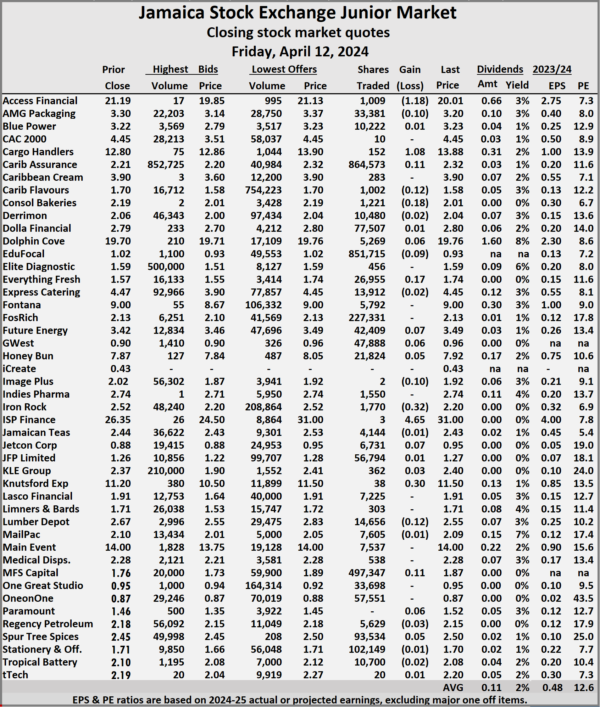

At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15.

At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15. In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110.

In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. At the close of trading, the Junior Market Index climbed 28.47 points to wrap-up trading at 3,804.02.

At the close of trading, the Junior Market Index climbed 28.47 points to wrap-up trading at 3,804.02. Investor’s Choice bid-offer indicator shows no stock ending with a bid higher than the last selling price and two with lower offers.

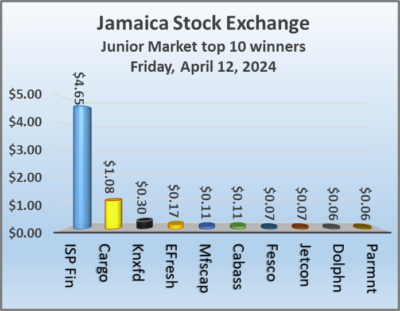

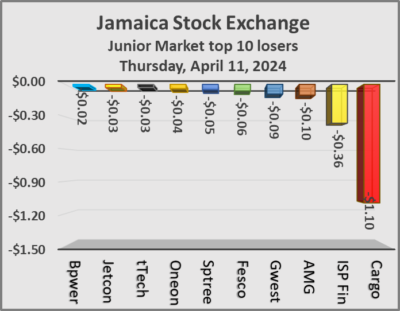

Investor’s Choice bid-offer indicator shows no stock ending with a bid higher than the last selling price and two with lower offers. Honey Bun rose 5 cents and ended at a 52 weeks’ closing high of $7.92 after 21,824 shares were traded, Iron Rock Insurance lost 32 cents to finish at $2.20, with 1,770 units crossing the market, ISP Finance rose $4.65 to end at $31 after a transfer of a mere 3 stock units, Jetcon Corporation advanced 7 cents to close at 95 cents, with 6,731 stock units changing hands. Knutsford Express gained 30 cents to $11.50 in an exchange of 38 shares, Lumber Depot shed 12 cents to end at $2.55, after 14,656 stocks passed through the market and MFS Capital Partners popped 11 cents in closing at $1.87 after an exchange of 497,347 units.

Honey Bun rose 5 cents and ended at a 52 weeks’ closing high of $7.92 after 21,824 shares were traded, Iron Rock Insurance lost 32 cents to finish at $2.20, with 1,770 units crossing the market, ISP Finance rose $4.65 to end at $31 after a transfer of a mere 3 stock units, Jetcon Corporation advanced 7 cents to close at 95 cents, with 6,731 stock units changing hands. Knutsford Express gained 30 cents to $11.50 in an exchange of 38 shares, Lumber Depot shed 12 cents to end at $2.55, after 14,656 stocks passed through the market and MFS Capital Partners popped 11 cents in closing at $1.87 after an exchange of 497,347 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

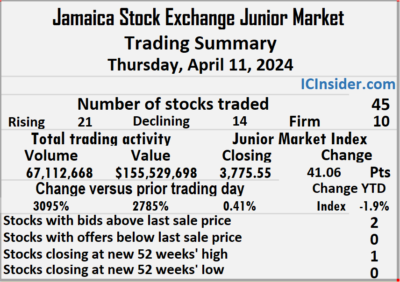

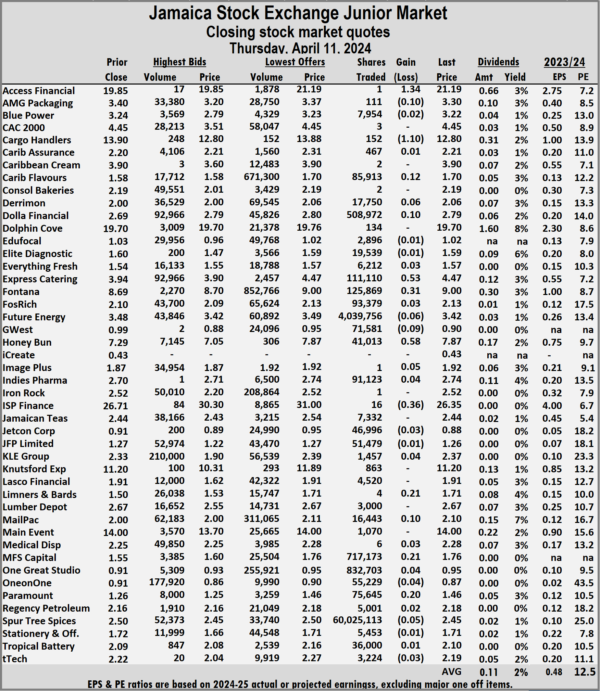

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. following a 2,785 percent jump in value over Wednesday after trading in 45 securities similar to Wednesday and ending with prices of 21 rising, 14 declining and 10 closing unchanged.

following a 2,785 percent jump in value over Wednesday after trading in 45 securities similar to Wednesday and ending with prices of 21 rising, 14 declining and 10 closing unchanged. Energy with 4.04 million units for 6 percent of the day’s trade and One Great Studio with 832,703 units for 1.2 percent market share.

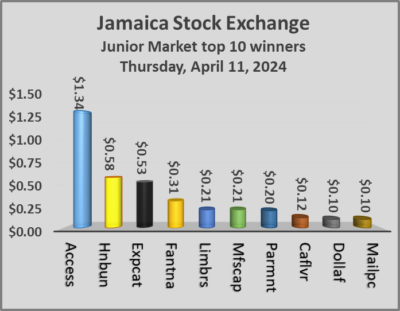

Energy with 4.04 million units for 6 percent of the day’s trade and One Great Studio with 832,703 units for 1.2 percent market share. Caribbean Flavours rallied 12 cents to end at $1.70 with 85,913 stock units crossing the market, Dolla Financial popped 10 cents in closing at $2.79 with an exchange of 508,972 shares, Express Catering gained 53 cents to finish at $4.47 after investors ended trading 111,110 stock units. Fontana increased 31 cents and ended at $9 with the transferring of 125,869 stocks, GWest Corporation sank 9 cents to 90 cents in an exchange of 71,581 units, Honey Bun climbed 58 cents to close at a 52 weeks’ high of $7.87 with investors dealing in 41,013 stocks. ISP Finance slipped 36 cents to finish at $26.35, with 16 units crossing the exchange, Limners and Bards advanced 21 cents in closing at $1.71 in trading a mere 4 shares, Mailpac Group rose 10 cents to end at $2.10, with 16,443 stock units changing hands. MFS Capital Partners gained 21 cents to close at $1.76 with investors trading 717,173 shares and Paramount Trading popped 20 cents to finish at $1.46 in an exchange of 75,645 stocks.

Caribbean Flavours rallied 12 cents to end at $1.70 with 85,913 stock units crossing the market, Dolla Financial popped 10 cents in closing at $2.79 with an exchange of 508,972 shares, Express Catering gained 53 cents to finish at $4.47 after investors ended trading 111,110 stock units. Fontana increased 31 cents and ended at $9 with the transferring of 125,869 stocks, GWest Corporation sank 9 cents to 90 cents in an exchange of 71,581 units, Honey Bun climbed 58 cents to close at a 52 weeks’ high of $7.87 with investors dealing in 41,013 stocks. ISP Finance slipped 36 cents to finish at $26.35, with 16 units crossing the exchange, Limners and Bards advanced 21 cents in closing at $1.71 in trading a mere 4 shares, Mailpac Group rose 10 cents to end at $2.10, with 16,443 stock units changing hands. MFS Capital Partners gained 21 cents to close at $1.76 with investors trading 717,173 shares and Paramount Trading popped 20 cents to finish at $1.46 in an exchange of 75,645 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index rose 442.69 points to close at 341,030.51, the All Jamaican Composite Index slipped 45.90 points to 367,603.94, the JSE Main Index rallied just 163.28 points to close at 328,302.59. The Junior Market Index rallied 41.06 points to end the day at 3,775.55 and the JSE USD Market Index popped 0.06 points to end the day at 242.41.

At the close of trading, the JSE Combined Market Index rose 442.69 points to close at 341,030.51, the All Jamaican Composite Index slipped 45.90 points to 367,603.94, the JSE Main Index rallied just 163.28 points to close at 328,302.59. The Junior Market Index rallied 41.06 points to end the day at 3,775.55 and the JSE USD Market Index popped 0.06 points to end the day at 242.41. In the preference segment, Productive Business Solutions 10.5 % preference share gained $50 to end at $1,150.

In the preference segment, Productive Business Solutions 10.5 % preference share gained $50 to end at $1,150. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

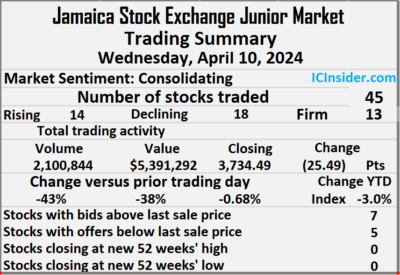

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. decline in the volume of stocks traded, with a 38 percent drop in value compared to Tuesday following trading in 45 securities compared with 44 on Tuesday and ending with prices of 14 rising, 18 declining and 13 closing unchanged.

decline in the volume of stocks traded, with a 38 percent drop in value compared to Tuesday following trading in 45 securities compared with 44 on Tuesday and ending with prices of 14 rising, 18 declining and 13 closing unchanged. On a day of mediocre trading, Stationery and Office Supplies led with just 251,673 shares for 12 percent of total volume followed by Fosrich with 228,475 units for 10.9 percent of the day’s trade and Dolla Financial with 224,947 stock units for 10.7 percent market share.

On a day of mediocre trading, Stationery and Office Supplies led with just 251,673 shares for 12 percent of total volume followed by Fosrich with 228,475 units for 10.9 percent of the day’s trade and Dolla Financial with 224,947 stock units for 10.7 percent market share. Honey Bun popped 21 cents to finish at $7.29 in an exchange of 27,774 stock units, ISP Finance dropped $4.29 and ended at $26.71 with investors dealing in just 288 shares, Jamaican Teas sank 10 cents to close at $2.44 in an exchange of 22,768 stocks. Knutsford Express skidded 68 cents to $11.20 with traders dealing in 3,237 units, Mailpac Group lost 10 cents in closing at $2, 101,306 stock units crossing the market, Main Event increased 43 cents and ended at $14 in trading 19,931 shares and Paramount Trading dipped 20 cents to close at $1.26 after 46,980 units passed through the market.

Honey Bun popped 21 cents to finish at $7.29 in an exchange of 27,774 stock units, ISP Finance dropped $4.29 and ended at $26.71 with investors dealing in just 288 shares, Jamaican Teas sank 10 cents to close at $2.44 in an exchange of 22,768 stocks. Knutsford Express skidded 68 cents to $11.20 with traders dealing in 3,237 units, Mailpac Group lost 10 cents in closing at $2, 101,306 stock units crossing the market, Main Event increased 43 cents and ended at $14 in trading 19,931 shares and Paramount Trading dipped 20 cents to close at $1.26 after 46,980 units passed through the market. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market, the Main and JSE USD markets closed higher but the Junior Market that rose in the morning session continued to decline after a small rise on Tuesday, with trading ended with the number of stocks changing hands falling, with the value of stocks traded jumping sharply over the previous trading day, resulting in prices of 33 shares rising and 33 declining.

At the close of the market, the Main and JSE USD markets closed higher but the Junior Market that rose in the morning session continued to decline after a small rise on Tuesday, with trading ended with the number of stocks changing hands falling, with the value of stocks traded jumping sharply over the previous trading day, resulting in prices of 33 shares rising and 33 declining. In the preference segment, 138 Student Living preference share fell $2.03 in closing at $216 and Sygnus Credit Investments C10.5% increased $5 to finish at $106.

In the preference segment, 138 Student Living preference share fell $2.03 in closing at $216 and Sygnus Credit Investments C10.5% increased $5 to finish at $106. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

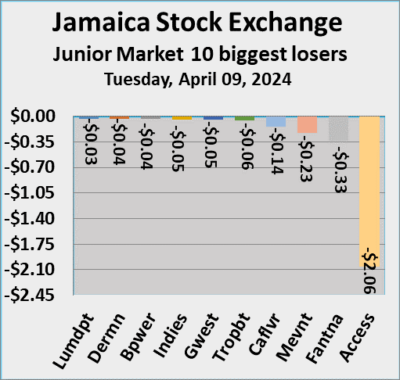

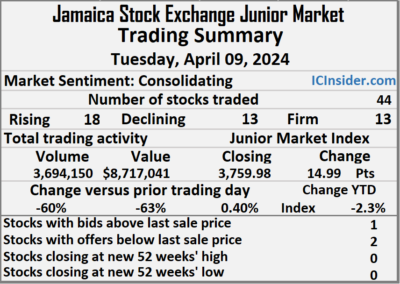

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Rising stocks outnumbered falling ones at the close of trading on the Junior Market of the Jamaica Stock Exchange on Tuesday, with activity in 44 securities compared to 45 on Monday and ending with prices of 18 rising, 13 declining and 13 closed unchanged following a with 60 percent decline in the volume of stocks traded, with 63 percent lower value than on Monday

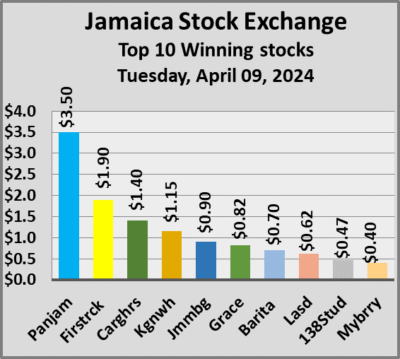

Rising stocks outnumbered falling ones at the close of trading on the Junior Market of the Jamaica Stock Exchange on Tuesday, with activity in 44 securities compared to 45 on Monday and ending with prices of 18 rising, 13 declining and 13 closed unchanged following a with 60 percent decline in the volume of stocks traded, with 63 percent lower value than on Monday Spur Tree Spices led trading with 887,601 shares for 24 percent of total volume followed by Dolla Financial with 450,473 units for 12.2 percent of the day’s trade and Derrimon Trading with 311,439 units for 8.4 percent market share.

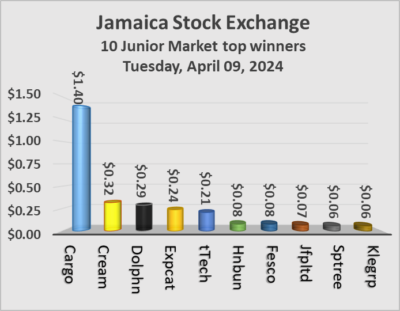

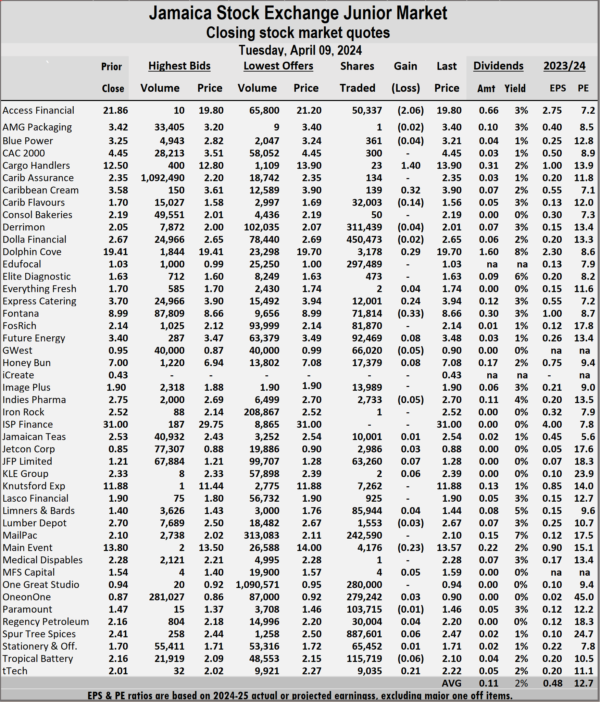

Spur Tree Spices led trading with 887,601 shares for 24 percent of total volume followed by Dolla Financial with 450,473 units for 12.2 percent of the day’s trade and Derrimon Trading with 311,439 units for 8.4 percent market share. Caribbean Flavours fell 14 cents in closing at $1.56 with 32,003 stock units crossing the market, Dolphin Cove gained 29 cents to close at $19.70 with an exchange of 3,178 shares, Express Catering rose 24 cents to finish at $3.94 after 12,001 units passed through the market. Fontana skidded 33 cents to $8.66 as investors exchanged 71,814 stocks, Future Energy climbed 8 cents to end at $3.48 with a transfer of 92,469 stock units, Honey Bun advanced 8 cents in closing at $7.08 after an exchange of 17,379 shares. JFP Ltd rallied 7 cents and ended at $1.28 with investors transferring 63,260 stock units, Main Event sank 23 cents to close at $13.57, with 4,176 stocks changing hands and tTech increased 21 cents to finish at $2.22 with investors trading 9,035 units.

Caribbean Flavours fell 14 cents in closing at $1.56 with 32,003 stock units crossing the market, Dolphin Cove gained 29 cents to close at $19.70 with an exchange of 3,178 shares, Express Catering rose 24 cents to finish at $3.94 after 12,001 units passed through the market. Fontana skidded 33 cents to $8.66 as investors exchanged 71,814 stocks, Future Energy climbed 8 cents to end at $3.48 with a transfer of 92,469 stock units, Honey Bun advanced 8 cents in closing at $7.08 after an exchange of 17,379 shares. JFP Ltd rallied 7 cents and ended at $1.28 with investors transferring 63,260 stock units, Main Event sank 23 cents to close at $13.57, with 4,176 stocks changing hands and tTech increased 21 cents to finish at $2.22 with investors trading 9,035 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index declined by 847.36 points to close at 339,446.27, the All Jamaican Composite Index shed 788.09 points to end trading at 366,509.84, while the JSE Main Index dropped 992.90 points to 326,763.19. The Junior Market Index rallied 14.99 points to 3,759.98 and the JSE USD Market Index skidded 7.02 points to end trading at 237.97.

At the close of trading, the JSE Combined Market Index declined by 847.36 points to close at 339,446.27, the All Jamaican Composite Index shed 788.09 points to end trading at 366,509.84, while the JSE Main Index dropped 992.90 points to 326,763.19. The Junior Market Index rallied 14.99 points to 3,759.98 and the JSE USD Market Index skidded 7.02 points to end trading at 237.97. In the preference segment, Jamaica Public Service 9.5% popped $50 to end at $2,700 and Productive Business Solutions 10.5% preference share fell $10 to $1,100.

In the preference segment, Jamaica Public Service 9.5% popped $50 to end at $2,700 and Productive Business Solutions 10.5% preference share fell $10 to $1,100. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. In their most recent financial report with revenues rising nearly 11 percent a gross profit jumped by $57 million to $594 million, only the majority of owners benefitted from that improvement. Management paid out the increase in gross profit to themselves and other workers in 2023. Minority shareholders received no benefit.

In their most recent financial report with revenues rising nearly 11 percent a gross profit jumped by $57 million to $594 million, only the majority of owners benefitted from that improvement. Management paid out the increase in gross profit to themselves and other workers in 2023. Minority shareholders received no benefit.