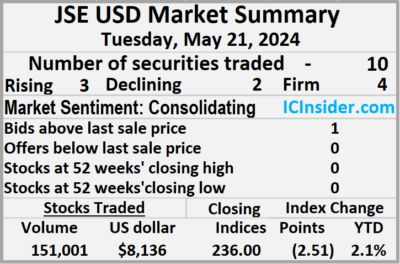

Rising stocks edged out those declining at the close of trading on the Jamaica Stock Exchange US dollar market on Tuesday, following a 54 percent rise in the volume of stocks that changed hands after 11 percent fewer funds were swapped than on Monday and resulting in trading in 10 securities, up from five on Monday with prices of three rising, two declining and five ending unchanged.

The market closed with an exchange of 151,001 shares for US$8,136 compared to 98,295 units at US$9,105 on Monday.

The market closed with an exchange of 151,001 shares for US$8,136 compared to 98,295 units at US$9,105 on Monday.

Trading averaged 15,100 units at US$814 compared with 19,659 shares at US$1,821 on Monday, with a month to date average of 32,471 shares at US$2,771 compared with 34,445 units at US$2,994 on the previous day and April that ended with an average of 35,401 units for US$2,453.

The US Denominated Equities Index dropped 2.51 points to 236.00.

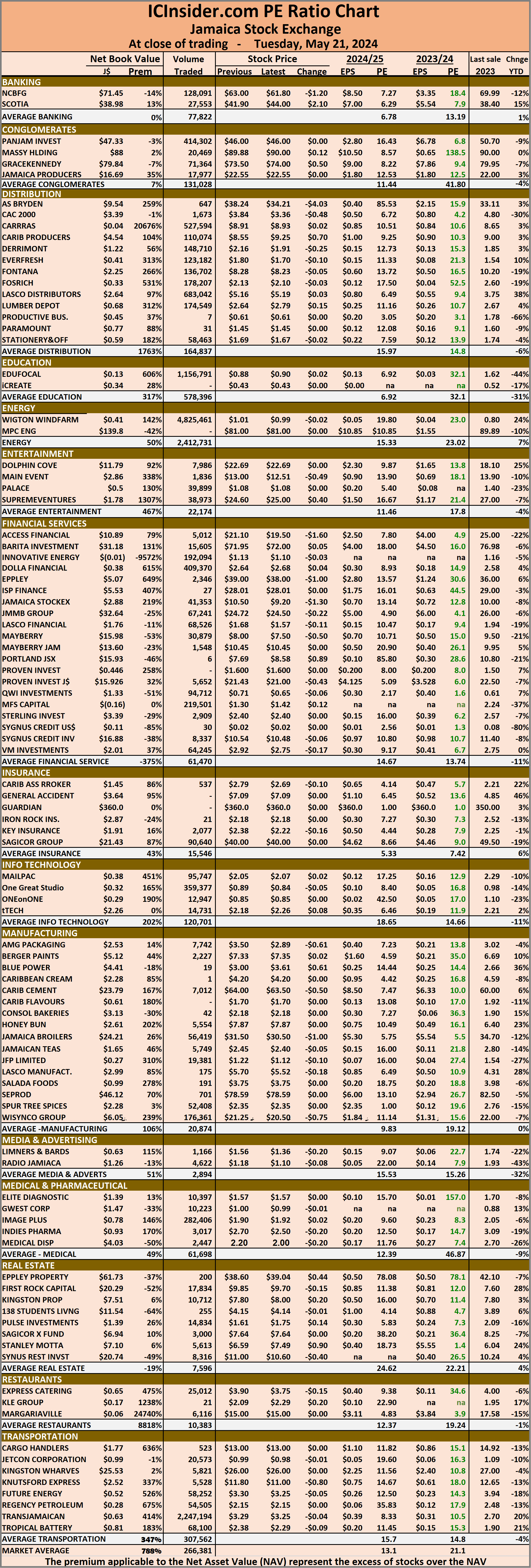

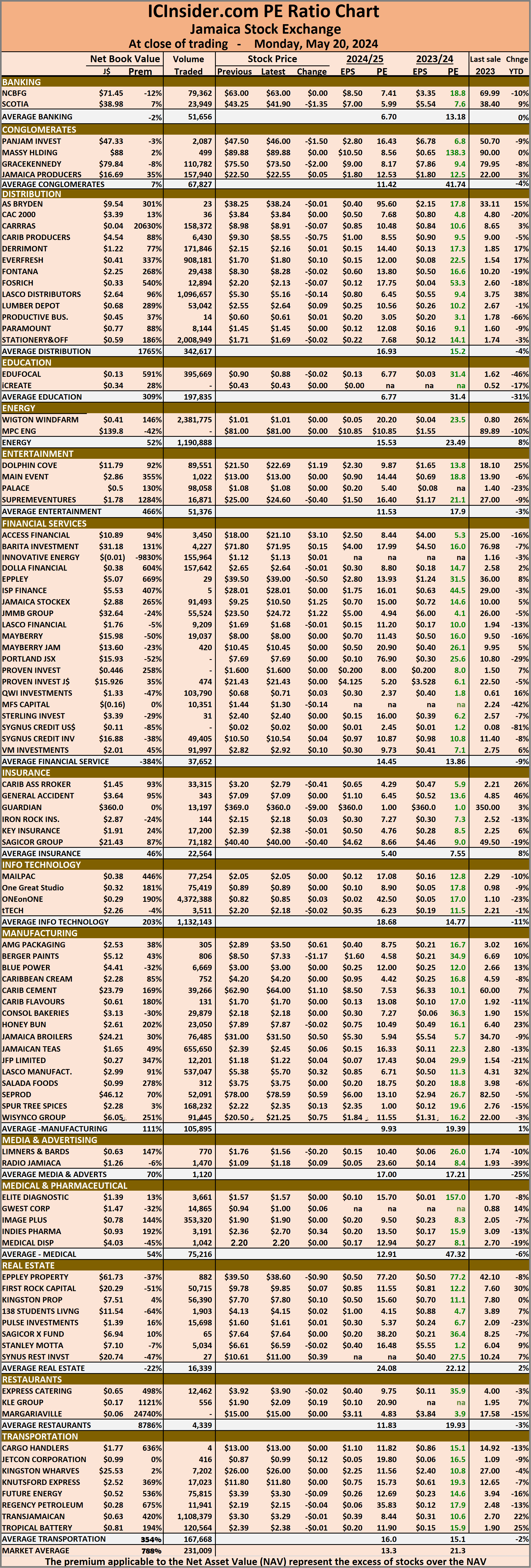

The PE Ratio, a measure used in computing appropriate stock values, averages 9.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Real Estate USD share fell 0.58 of one cent to end at 4.11 US cents, with 6,116 shares crossing the market, MPC Caribbean Clean Energy ended at 61 US cents with a transfer of 7 stock units, Proven Investments remained at 13.08 US cents, with 2,369 stocks crossing the exchange. Sterling Investments rose 0.07 of a cent to close at 1.6 US cents with traders dealing in 30 units, Sygnus Credit Investments declined 1 cent to finish at 9 US cents, with 38,346 stocks changing hands, Sygnus Real Estate Finance USD share remained at 8.8 US cents in trading 2,665 units and Transjamaican Highway ended at 2.1 US cents after an exchange of 101,316 shares.

Sygnus Credit Investments declined 1 cent to finish at 9 US cents, with 38,346 stocks changing hands, Sygnus Real Estate Finance USD share remained at 8.8 US cents in trading 2,665 units and Transjamaican Highway ended at 2.1 US cents after an exchange of 101,316 shares.

In the preference segment, Productive Business Solutions 9.25% preference share advanced 44 cents in closing at US$11.49 with investors transferring 101 stock units, Sygnus Credit Investments US 8% popped 40 cents to end at US$11 in an exchange of a mere one share and Sygnus Credit Investments E8.5% ended at US$10.40 with investors swapping 50 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rising stocks on top in JSE USD trading

Trading drops on JSE USD Market

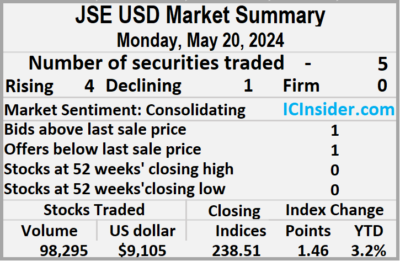

The Jamaica Stock Exchange US dollar market ended trading on Monday, with a 65 percent decline in the volume of stocks exchanged having a 72 percent lower value than on Friday, after trading in five securities, similar to Friday and ended with prices of four rising, one declining leaving none unchanged.

The market closed with an exchange of 98,295 shares for US$9,105 compared to 280,988 units at US$32,878 on Friday.

The market closed with an exchange of 98,295 shares for US$9,105 compared to 280,988 units at US$32,878 on Friday.

Trading averaged 19,659 units at US$1,821 versus 56,198 shares at US$6,576 on Friday, with a month to date average of 34,445 shares at US$2,994 compared with 35,336 units at US$3,065 on the previous day and April that ended with an average of 35,401 units for US$2,453.

The US Denominated Equities Index gained 1.51 points to end at 238.56.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and one with a lower offer.

At the close, Margaritaville rose 0.2 of a cent to 10.01 US cents after exchanging 97 stock units, MPC Caribbean Clean Energy rose 1 cent to 61 US cents after 14 shares were traded, Proven Investments dropped 0.01 of a cent to close at 13.08 US cents after 12,602 stock units were exchanged. Sygnus Credit Investments popped 1.52 cents to end at 10 US cents, with 76,442 stocks changing hands and Transjamaican Highway climbed 0.05 of a cent in closing at 2.1 US cents after an exchange of 9,140 shares.

At the close, Margaritaville rose 0.2 of a cent to 10.01 US cents after exchanging 97 stock units, MPC Caribbean Clean Energy rose 1 cent to 61 US cents after 14 shares were traded, Proven Investments dropped 0.01 of a cent to close at 13.08 US cents after 12,602 stock units were exchanged. Sygnus Credit Investments popped 1.52 cents to end at 10 US cents, with 76,442 stocks changing hands and Transjamaican Highway climbed 0.05 of a cent in closing at 2.1 US cents after an exchange of 9,140 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Jump in trading on JSE USD market

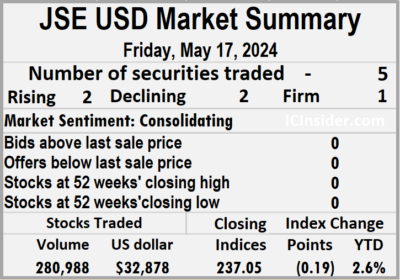

Increased market activity ended Friday on the Jamaica Stock Exchange US dollar market ended, with a 175 percent rising the volume of stocks exchanged, with a value of 199 percent more than on Thursday, resulting in trading in five securities, the same as on Thursday with prices of two rising, two declining and one ending unchanged.

The market closed with an exchange of 280,988 shares for US$32,878 compared to 102,017 units at US$10,991 on Thursday.

The market closed with an exchange of 280,988 shares for US$32,878 compared to 102,017 units at US$10,991 on Thursday.

Trading averaged 56,198 units at US$6,576 versus 20,403 shares at US$2,198 on Thursday, with a month to date average of 35,336 shares at US$3,065 compared with 33,999 units at US$2,839 on the previous day and April that ended with an average of 35,401 units for US$2,453.

The US Denominated Equities Index gained 0.19 points to wrap up trading at 237.05.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows no stock ended with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Real Estate USD share slipped 0.01 of a cent to 4.69 US cents with 106 shares crossing the market, Proven Investments lost 0.79 of one cent in closing at 13.09 US cents with investors trading 242,886 stock units and Transjamaican Highway rose 0.02 of a cent to end at 2.05 US cents after 37,951 shares passed through the market.

At the close, First Rock Real Estate USD share slipped 0.01 of a cent to 4.69 US cents with 106 shares crossing the market, Proven Investments lost 0.79 of one cent in closing at 13.09 US cents with investors trading 242,886 stock units and Transjamaican Highway rose 0.02 of a cent to end at 2.05 US cents after 37,951 shares passed through the market.

In the preference segment, JMMB Group US8.5% preference share rallied 6 cents to close at US$1.26 with investors swapping 20 stock units and Sygnus Credit Investments E8.5% ended at US$10.40 and closed with an exchange of 25 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

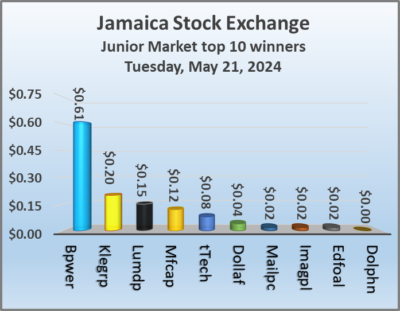

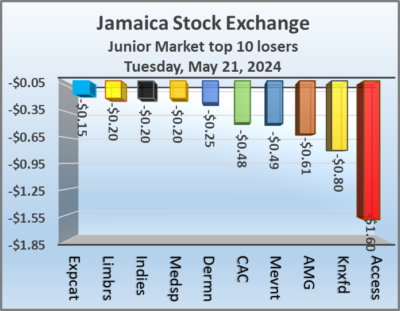

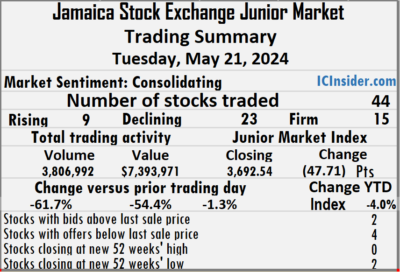

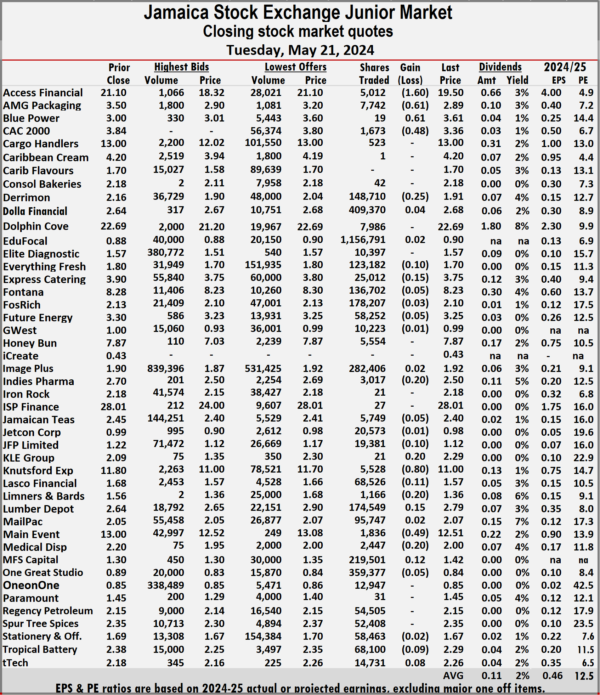

The market closed with an exchange of 3,806,992 shares at $7,393,971 compared with 9,933,959 units at $16,224,087 on Monday.

The market closed with an exchange of 3,806,992 shares at $7,393,971 compared with 9,933,959 units at $16,224,087 on Monday. Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers.

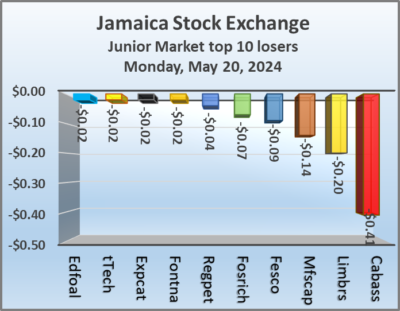

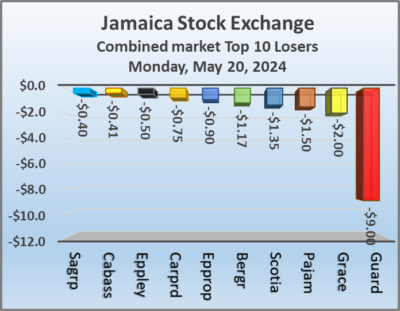

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers. Lasco Financial dropped 11 cents and ended at $1.57, with 68,526 shares crossing the market, Limners and Bards fell 20 cents to $1.36 after a transfer of 1,166 stock units, Lumber Depot climbed 15 cents to close at $2.79 with an exchange of 174,549 units. Main Event skidded 49 cents in closing at a 52 weeks’ low of $12.51 with 1,836 stocks changing hands, Medical Disposables lost 20 cents to end at $2 with investors swapping 2,447 units, MFS Capital Partners gained 12 cents to finish at $1.42 with an exchange of 219,501 stocks. Tropical Battery dipped 9 cents and ended at $2.29, with 68,100 shares crossing the market and tTech popped 8 cents to $2.26 with traders dealing in 14,731 stock units.

Lasco Financial dropped 11 cents and ended at $1.57, with 68,526 shares crossing the market, Limners and Bards fell 20 cents to $1.36 after a transfer of 1,166 stock units, Lumber Depot climbed 15 cents to close at $2.79 with an exchange of 174,549 units. Main Event skidded 49 cents in closing at a 52 weeks’ low of $12.51 with 1,836 stocks changing hands, Medical Disposables lost 20 cents to end at $2 with investors swapping 2,447 units, MFS Capital Partners gained 12 cents to finish at $1.42 with an exchange of 219,501 stocks. Tropical Battery dipped 9 cents and ended at $2.29, with 68,100 shares crossing the market and tTech popped 8 cents to $2.26 with traders dealing in 14,731 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

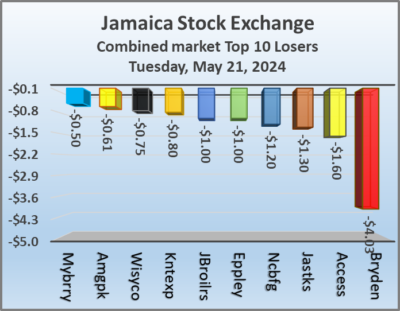

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index declined 1,567.79 points to 331,742.67, the All Jamaican Composite Index slipped 361.32 points to end at 357,487.01, the JSE Main Index skidded 1,288.58 points to close trading at 319,217.40. The Junior Market Index dropped 47.71 points to finish at 3,692.54 and the JSE USD Market Index declined 2.56 points to conclude trading at 236.00.

At the close of trading, the JSE Combined Market Index declined 1,567.79 points to 331,742.67, the All Jamaican Composite Index slipped 361.32 points to end at 357,487.01, the JSE Main Index skidded 1,288.58 points to close trading at 319,217.40. The Junior Market Index dropped 47.71 points to finish at 3,692.54 and the JSE USD Market Index declined 2.56 points to conclude trading at 236.00. In the preference segment, Eppley 7.75% preference share dropped $2.95 to close at $17.05.

In the preference segment, Eppley 7.75% preference share dropped $2.95 to close at $17.05. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

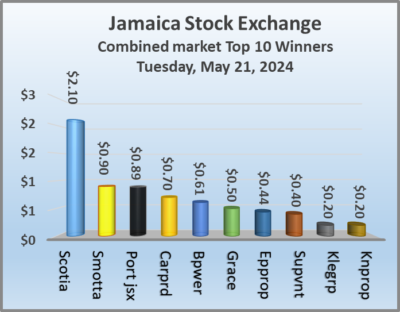

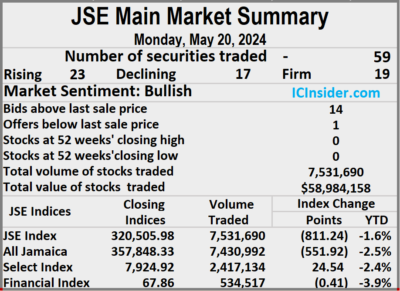

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Trading accounted for an exchange of 7,531,690 shares for $58,984,158 down from 26,822,609 stock units at $484,009,143 on Friday.

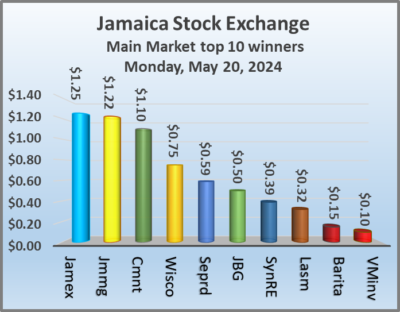

Trading accounted for an exchange of 7,531,690 shares for $58,984,158 down from 26,822,609 stock units at $484,009,143 on Friday. Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and one with a lower offer.

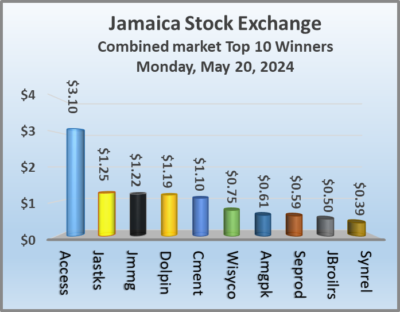

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and one with a lower offer. Lasco Manufacturing advanced 32 cents to finish at $5.70 as investors exchanged 537,047 stocks, Pan Jamaica sank $1.50 to close at $46 in trading 2,087 stock units. Sagicor Group dipped 40 cents to $40 after an exchange of 71,182 shares, Scotia Group dropped $1.35 to close at $41.90 with investors dealing in 23,949 units, Seprod gained 59 cents to finish at $78.59 after exchanging 52,091 stocks. Supreme Ventures shed 40 cents and ended at $24.60 with investors trading 16,871 stock units, Sygnus Real Estate Finance rallied 39 cents in closing at $11 in an exchange of 27 shares and Wisynco Group increased 75 cents to end at $21.25 with traders dealing in 91,445 stocks.

Lasco Manufacturing advanced 32 cents to finish at $5.70 as investors exchanged 537,047 stocks, Pan Jamaica sank $1.50 to close at $46 in trading 2,087 stock units. Sagicor Group dipped 40 cents to $40 after an exchange of 71,182 shares, Scotia Group dropped $1.35 to close at $41.90 with investors dealing in 23,949 units, Seprod gained 59 cents to finish at $78.59 after exchanging 52,091 stocks. Supreme Ventures shed 40 cents and ended at $24.60 with investors trading 16,871 stock units, Sygnus Real Estate Finance rallied 39 cents in closing at $11 in an exchange of 27 shares and Wisynco Group increased 75 cents to end at $21.25 with traders dealing in 91,445 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

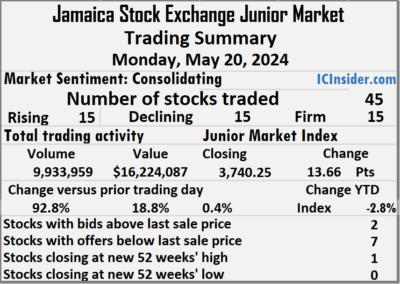

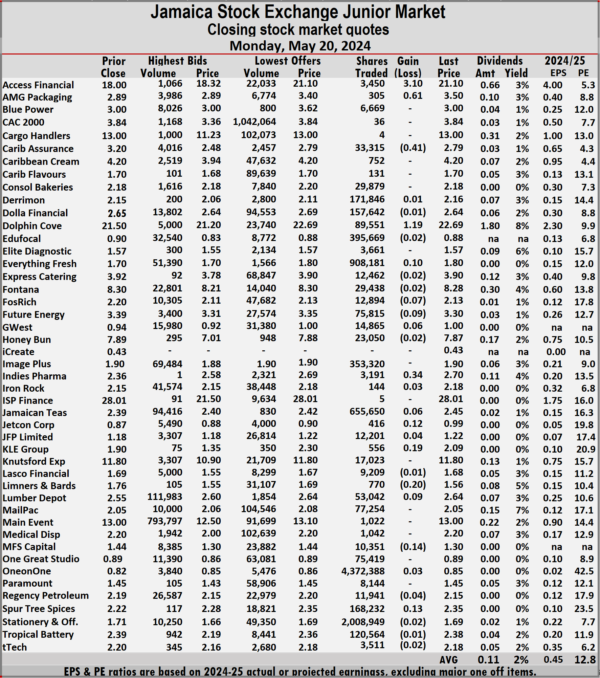

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading closed with 9,933,959 shares for $16,224,087 up from 5,151,901 units at $13,657,450 on Friday.

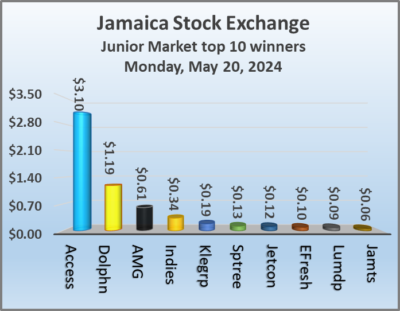

Trading closed with 9,933,959 shares for $16,224,087 up from 5,151,901 units at $13,657,450 on Friday. The Junior Market ended trading with an average PE Ratio of 12.8, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.8, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025. Future Energy shed 9 cents to close at $3.30 in an exchange of 75,815 units, Indies Pharma rose 34 cents and ended at $2.70 with 3,191 stocks clearing the market, Jetcon Corporation advanced 12 cents to close at 99 cents with an exchange of 416 units. KLE Group rallied 19 cents to finish at $2.09, with 556 stocks crossing the market, Limners and Bards declined 20 cents to end at $1.56 with investors trading 770 shares, Lumber Depot rose 9 cents in closing at $2.64 after a transfer of 53,042 stock units. MFS Capital Partners lost 14 cents to end at $1.30 as investors exchanged 10,351 shares and Spur Tree Spices gained 13 cents in closing at $2.35 with a transfer of 168,232 units.

Future Energy shed 9 cents to close at $3.30 in an exchange of 75,815 units, Indies Pharma rose 34 cents and ended at $2.70 with 3,191 stocks clearing the market, Jetcon Corporation advanced 12 cents to close at 99 cents with an exchange of 416 units. KLE Group rallied 19 cents to finish at $2.09, with 556 stocks crossing the market, Limners and Bards declined 20 cents to end at $1.56 with investors trading 770 shares, Lumber Depot rose 9 cents in closing at $2.64 after a transfer of 53,042 stock units. MFS Capital Partners lost 14 cents to end at $1.30 as investors exchanged 10,351 shares and Spur Tree Spices gained 13 cents in closing at $2.35 with a transfer of 168,232 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index climbed 682.46 points to 333,310.47 and the All Jamaican Composite Index fell 551.92 points to 357,848.33. The JSE Main Index shed 811.24 points to settle at 320,505.98. The Junior Market Index rose 13.66 points to 3,740.25 and the JSE USD Market Index gained 1.51 points to close at 238.56.

At the close of trading, the JSE Combined Market Index climbed 682.46 points to 333,310.47 and the All Jamaican Composite Index fell 551.92 points to 357,848.33. The JSE Main Index shed 811.24 points to settle at 320,505.98. The Junior Market Index rose 13.66 points to 3,740.25 and the JSE USD Market Index gained 1.51 points to close at 238.56. In the preference segment, Sygnus Credit Investments C10.5% gained $1 to end at $109.

In the preference segment, Sygnus Credit Investments C10.5% gained $1 to end at $109. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

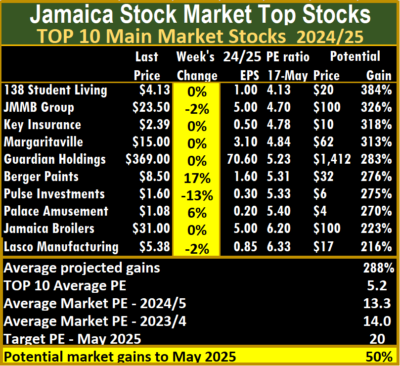

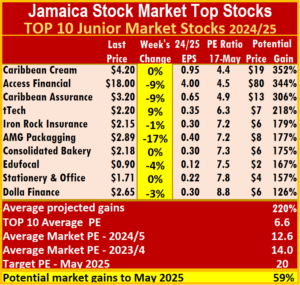

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Dropping from the ICTOP10 this week are ISP Finance from the Junior Market and from the Main Market General Accident and Scotia Group. Earnings for ISP Finance were adjusted to $1.60 per share to reflect what the first quarter results suggest. Prices of General Accident and Scotia Group moved up slightly and were replaced by stocks that had lower prices by the end of the week.

Dropping from the ICTOP10 this week are ISP Finance from the Junior Market and from the Main Market General Accident and Scotia Group. Earnings for ISP Finance were adjusted to $1.60 per share to reflect what the first quarter results suggest. Prices of General Accident and Scotia Group moved up slightly and were replaced by stocks that had lower prices by the end of the week. Dolla Financial is the only new listing for the ICTOP10 Junior Market for the week. In the Main Market, Pulse Investments and Lasco Manufacturing which dropped out of the list last week, are now in the ICTOP10.

Dolla Financial is the only new listing for the ICTOP10 Junior Market for the week. In the Main Market, Pulse Investments and Lasco Manufacturing which dropped out of the list last week, are now in the ICTOP10. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The market closed with 26,822,609 shares trading for $484,009,143 up from just 6,147,676 units for a mere $35,957,977 on Thursday.

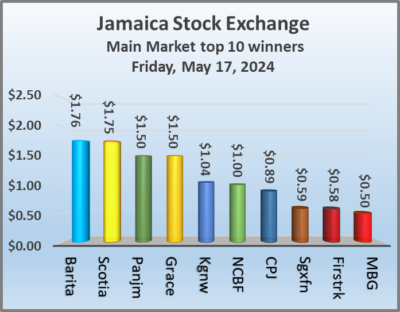

The market closed with 26,822,609 shares trading for $484,009,143 up from just 6,147,676 units for a mere $35,957,977 on Thursday. The All Jamaican Composite Index climbed 1,282.66 points to 358,400.25, the JSE Main Index increased 854.69 points to end trading at 321,317.22 and the JSE Financial Index rose 0.34 points to settle at 68.27.

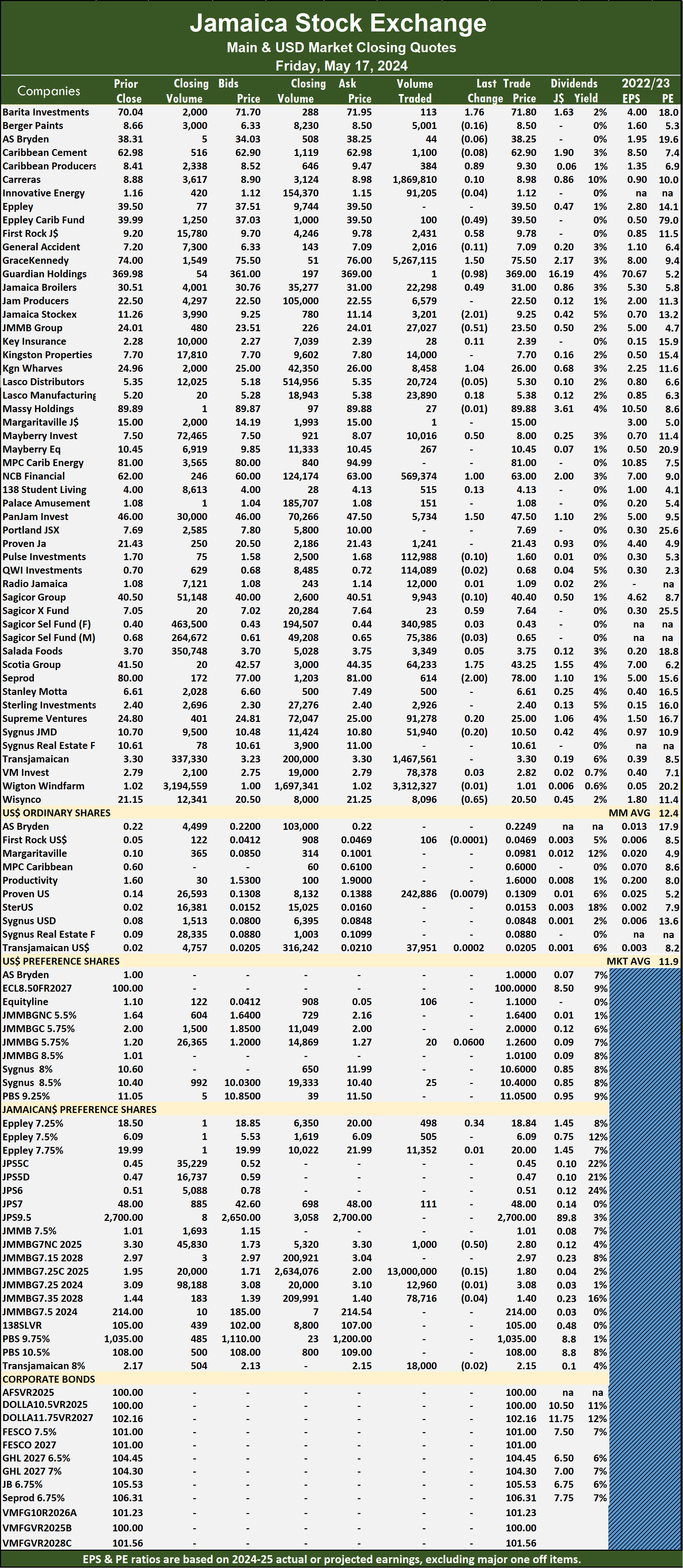

The All Jamaican Composite Index climbed 1,282.66 points to 358,400.25, the JSE Main Index increased 854.69 points to end trading at 321,317.22 and the JSE Financial Index rose 0.34 points to settle at 68.27. Jamaica Broilers popped 49 cents to close at $31 after 22,298 units crossed the market, Jamaica Stock Exchange sank $2.01 to close at $9.25 after an exchange of 3,201 stocks, JMMB Group shed 51 cents to end at $23.50 after 27,027 units were traded. Kingston Wharves advanced $1.04 to close at $26 with an exchange of 8,458 stocks, Mayberry Group gained 50 cents in closing at $8 as 10,016 shares passed through the market, NCB Financial rose $1 to end at $63 as investors exchanged 569,374 stock units. Pan Jamaica gained $1.50 to close at $47.50 with a transfer of 5,734 shares, Sagicor Real Estate Fund popped 59 cents to close at $7.64 after an exchange of 23 stocks, Scotia Group rallied $1.75 in closing at $43.25 with investors transferring 64,233 units. Seprod declined $2 to end at $78, with 614 stock units changing hands and Wisynco Group lost 65 cents to finish at $20.50 after an exchange of 8,096 shares.

Jamaica Broilers popped 49 cents to close at $31 after 22,298 units crossed the market, Jamaica Stock Exchange sank $2.01 to close at $9.25 after an exchange of 3,201 stocks, JMMB Group shed 51 cents to end at $23.50 after 27,027 units were traded. Kingston Wharves advanced $1.04 to close at $26 with an exchange of 8,458 stocks, Mayberry Group gained 50 cents in closing at $8 as 10,016 shares passed through the market, NCB Financial rose $1 to end at $63 as investors exchanged 569,374 stock units. Pan Jamaica gained $1.50 to close at $47.50 with a transfer of 5,734 shares, Sagicor Real Estate Fund popped 59 cents to close at $7.64 after an exchange of 23 stocks, Scotia Group rallied $1.75 in closing at $43.25 with investors transferring 64,233 units. Seprod declined $2 to end at $78, with 614 stock units changing hands and Wisynco Group lost 65 cents to finish at $20.50 after an exchange of 8,096 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.