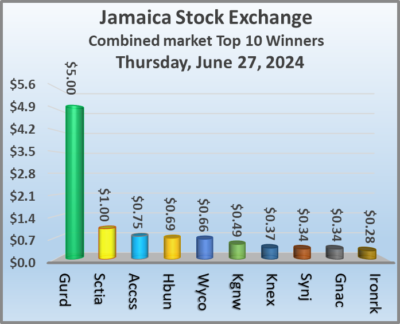

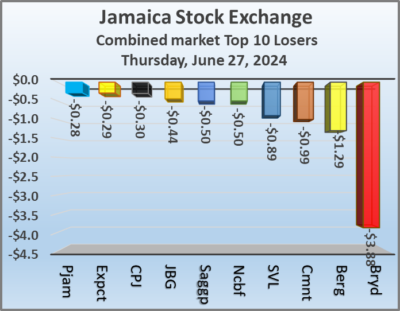

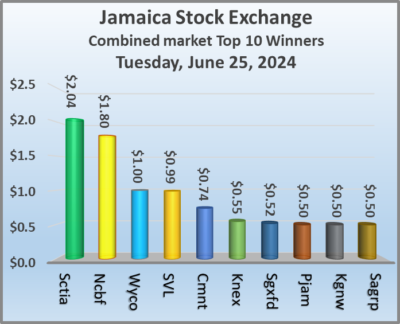

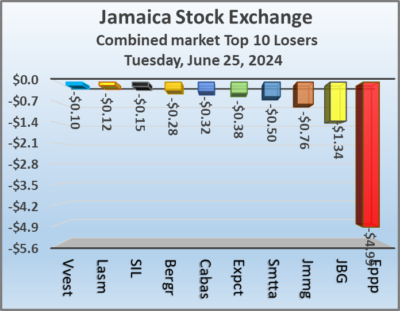

Junior Market jumped over the 3,800 mark for the first time since the end of May and the third time since March this year, the Main Market of the Jamaica Stock Exchange and the JSE USD market declined at the close of the market on a day when trading levels exceeded that on Wednesday in volume and value and resulted in an almost even advance decline ration with prices of 36 shares rose and 35 declined.

At the close of trading, the JSE Combined Market Index climbed 1,917.96 points to 330,802.68, the All Jamaican Composite Index skidded 2,566.82 points to 354,970.18, the JSE Main Index fell 2,262.58 points to conclude trading at 317,393.96. The Junior Market Index advanced by 34.92 points to 3,806.11 and the JSE USD Market Index dipped 1.23 points to wrap up trading at 234.97.

At the close of trading, the JSE Combined Market Index climbed 1,917.96 points to 330,802.68, the All Jamaican Composite Index skidded 2,566.82 points to 354,970.18, the JSE Main Index fell 2,262.58 points to conclude trading at 317,393.96. The Junior Market Index advanced by 34.92 points to 3,806.11 and the JSE USD Market Index dipped 1.23 points to wrap up trading at 234.97.

At the close of trading, 33,319,433 shares were exchanged in all three markets, up from 26,869,332 units on …day, with the value of stocks traded on the Junior and Main markets amounted to $189.89 million, well over the $135.02 million on the previous trading day and the JSE USD market closed with an exchange of 245,101 shares for US$5,275 compared to 137,354 units at US$22,495 on Wednesday.

In Main Market activity, Wigton Windfarm led trading with 3.88 million shares followed by Transjamaican Highway with 3.12 million stock units and Sagicor Select Financial Fund with 2.96 million units.

In Junior Market trading, Honey Bun led trading with 8.08 million shares followed by ONE on ONE Educational with 2.95 million units, Derrimon Trading ended with 2.01 million stocks, EduFocal chipped in with 1.42 million stock units and Mailpac Group with 1.13 million shares.

In the preference segment, Jamaica Public Service 7% sank $6.49 to close at $41.50. JMMB Group 7% preference share slipped 90 cents to $2.34 and 138 Student Living preference share rallied $44.71 in closing at $180.45.

In the preference segment, Jamaica Public Service 7% sank $6.49 to close at $41.50. JMMB Group 7% preference share slipped 90 cents to $2.34 and 138 Student Living preference share rallied $44.71 in closing at $180.45.

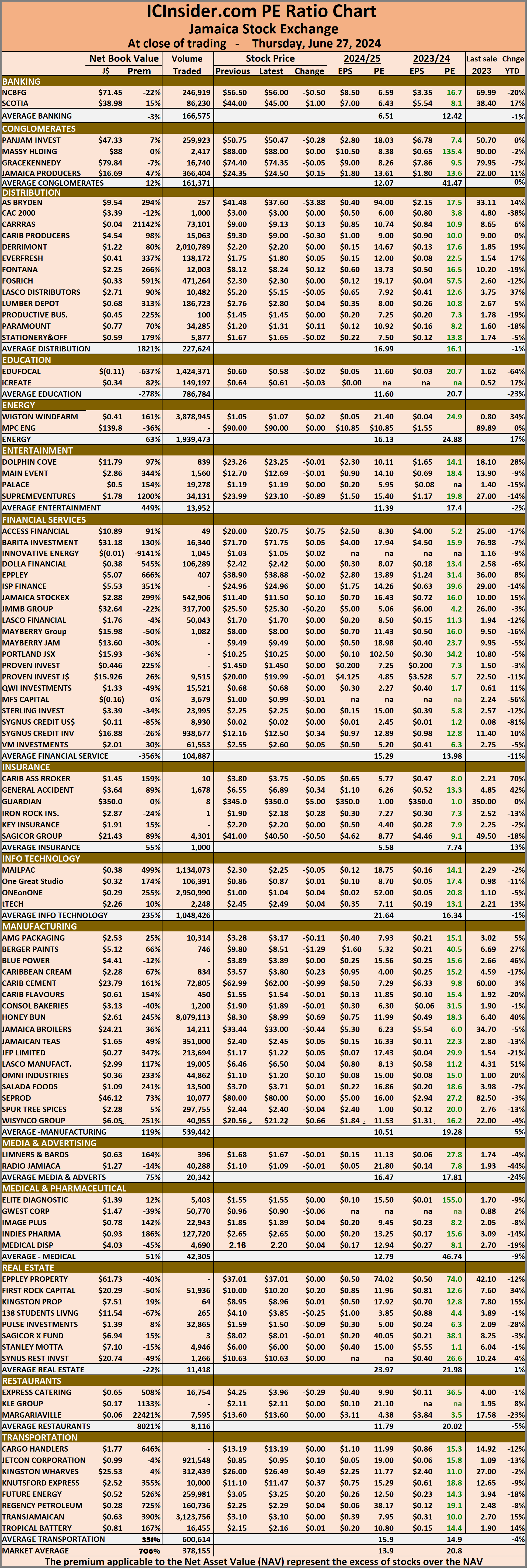

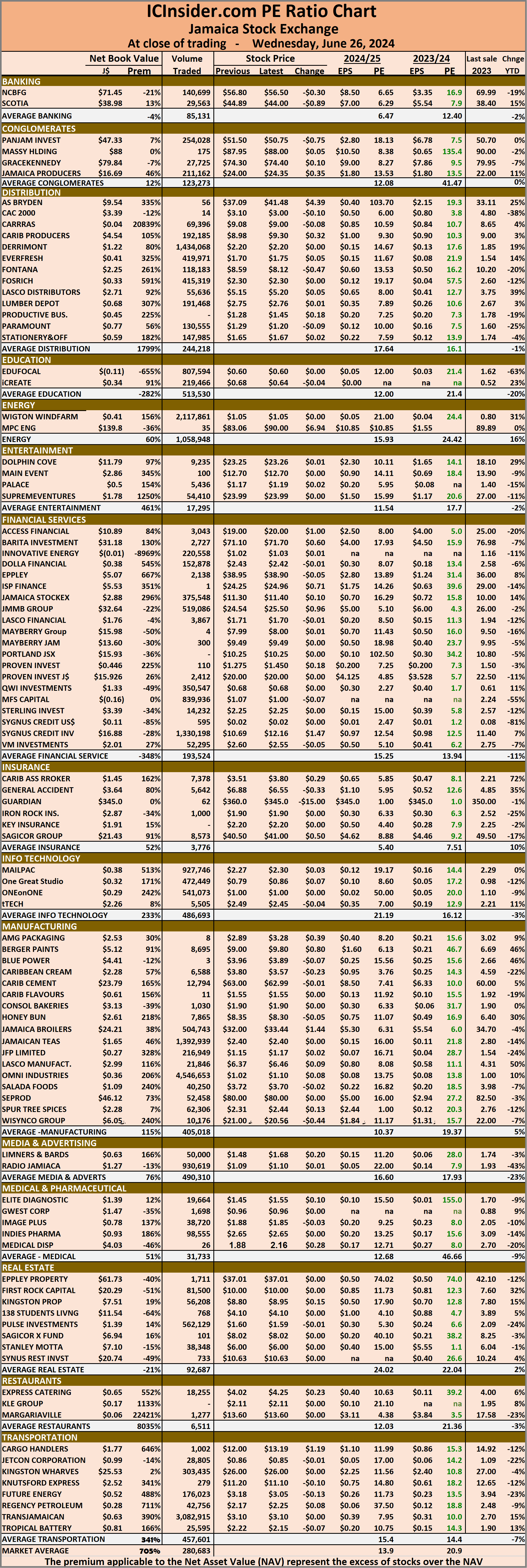

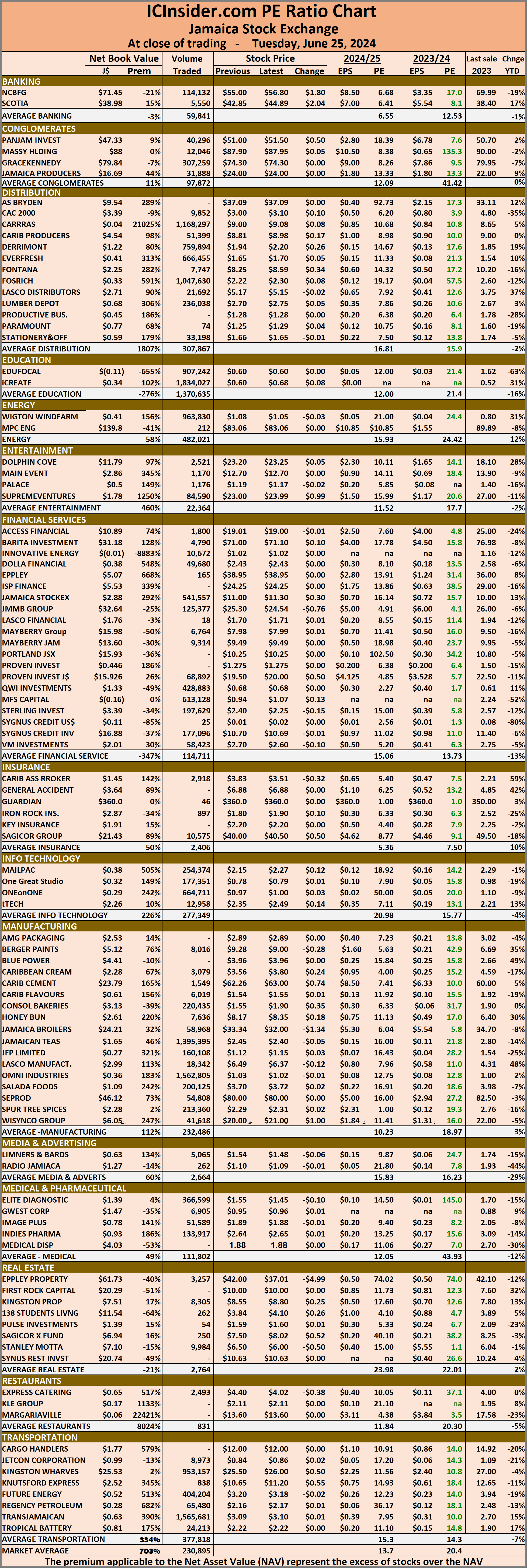

The market’s PE ratio, the most popular measure used to value stocks, ended at 20.8 on 2023-24 earnings and 13.9 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart includes all of the Jamaica Stock Exchange ordinary shares and are grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Junior Market rallies others fell

JSE Main Market bounces with increased trades

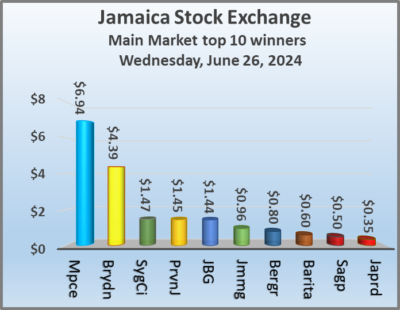

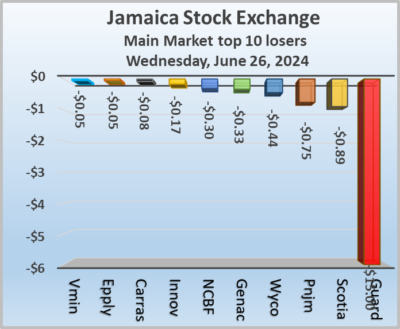

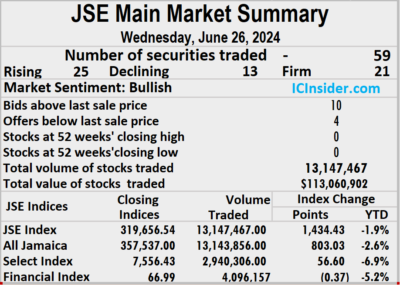

The Jamaica Stock Exchange Main Market closed higher on Wednesday, with a 16 percent rise in the volume of stocks traded with a 10 percent higher value than on Tuesday, following trading in 59 securities up from 54 on Tuesday, and ended with prices of 25 rising, 13 declining and 21 ending unchanged.

The Main Market closed with trading of 13,147,467 shares for $113,060,902 up from 11,380,554 units at $102,771,663 on Tuesday.

The Main Market closed with trading of 13,147,467 shares for $113,060,902 up from 11,380,554 units at $102,771,663 on Tuesday.

Trading finished with an average of 222,838 shares at $1,916,286 up from 210,751 stock units at $1,903,179 on Tuesday. Trading for the month to date, averages 234,765 units at $1,861,801, marginally more than 235,480 stocks at $1,858,534 on the previous day and May with an average of 336,947 units at $2,177,110.

Transjamaican Highway led trading with 3.08 million shares for 23.4 percent of total volume followed by Wigton Windfarm with 2.12 million units for 16.1 percent of the day’s trade and Sygnus Credit Investments with 1.33 million units for 10.1 percent of the day’s trade.

The All Jamaican Composite Index popped 803.03 points to 357,537.00, the JSE Main Index advanced 1,434.43 points to end trading at 319,656.54 and the JSE Financial Index fell 0.37 points to close trading at 66.99.

The Main Market ended trading with an average PE Ratio of 14.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 14.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and four with lower offers.

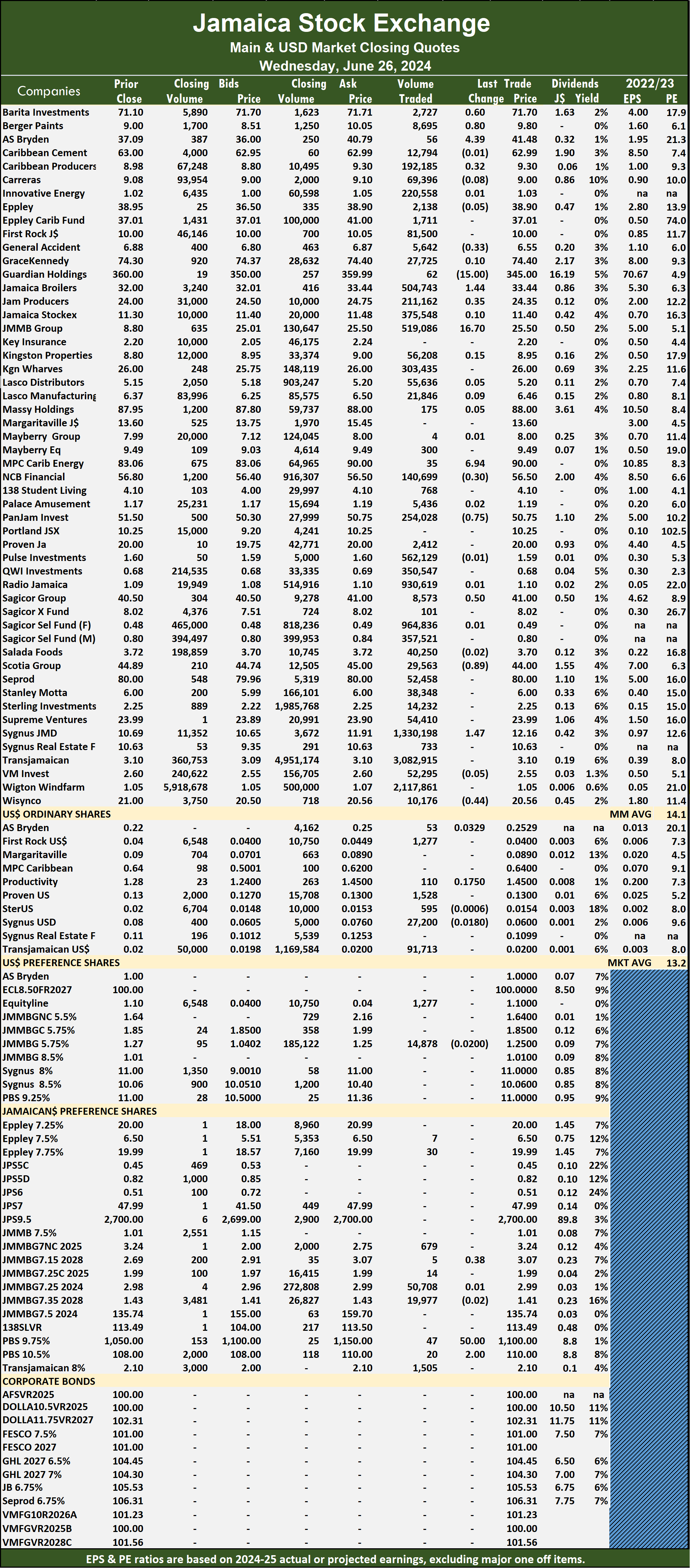

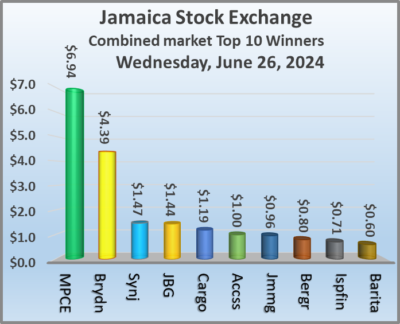

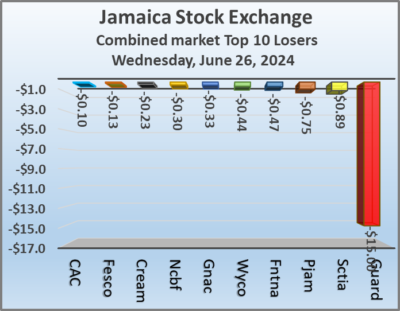

At the close of the market, AS Bryden jumped $4.39 to $41.48 with an exchange of 56 stock units, Barita Investments rallied 60 cents and ended at $71.70 with 2,727 shares clearing the market, Berger Paints rose 80 cents in closing at $9.80 with investors trading 8,695 stocks. Guardian Holdings dropped $15 to end at $345 after a transfer of 62 units, Jamaica Broilers gained $1.44 to close at $33.44 in trading 504,743 shares, JMMB Group advanced 96 cents to finish at $25.50, with 519,086 units changing hands.  MPC Caribbean Clean Energy jumped $6.94 to $90 with a transfer of 35 stocks, Pan Jamaica fell 75 cents to finish at $50.75 after traders swapped 254,028 stocks, Sagicor Group climbed 50 cents and ended at $41 in an exchange of 8,573 shares. Scotia Group slipped 89 cents to close at $44 with investors trading 29,563 units, Sygnus Credit Investments popped $1.47 to end at $12.16 after shareholders traded 1,330,198 stocks and Wisynco Group lost 44 cents in closing at $20.56 with investors dealing in 10,176 stock units.

MPC Caribbean Clean Energy jumped $6.94 to $90 with a transfer of 35 stocks, Pan Jamaica fell 75 cents to finish at $50.75 after traders swapped 254,028 stocks, Sagicor Group climbed 50 cents and ended at $41 in an exchange of 8,573 shares. Scotia Group slipped 89 cents to close at $44 with investors trading 29,563 units, Sygnus Credit Investments popped $1.47 to end at $12.16 after shareholders traded 1,330,198 stocks and Wisynco Group lost 44 cents in closing at $20.56 with investors dealing in 10,176 stock units.

In the preference segment, Productive Business Solutions 10.5% preference share rallied $50 to $1,100 with 47 shares crossing the market and Sygnus Credit Investments C10.5% rose $2 to end at $110 as traders exchanged 20 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market adds 118 points in 3 days

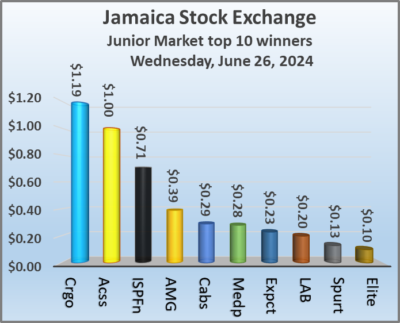

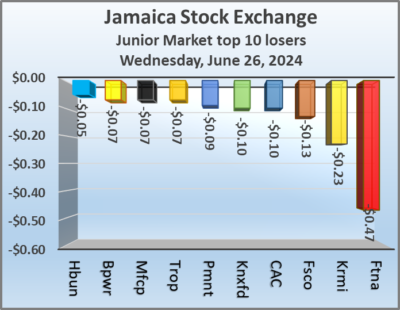

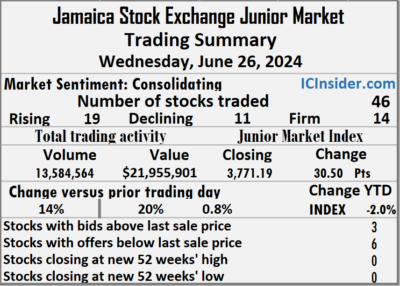

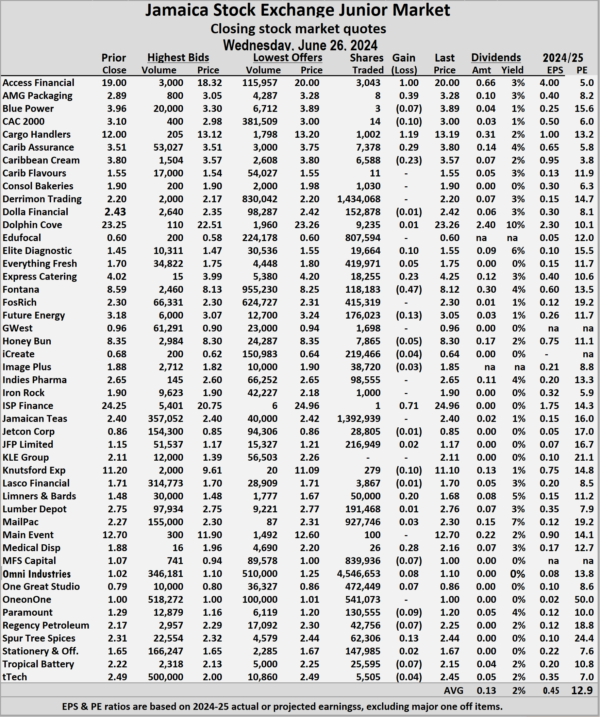

The Junior Market Index climbed 30.50 points to close at 3,771.19.and in the process added nearly 118 points in just three days as trading activity closed on the Junior Market of the Jamaica Stock Exchange Wednesday, with trading in 46 securities up from 41 on Tuesday and ending with prices of 19 rising, 16 declining and 11 closing unchanged following a 14 percent rise in the volume of stocks traded, with a 20 percent higher value than Tuesday.

The Junior Market closed trading of 13,584,564 shares for $21,955,901 up from 11,922,796 units at $18,343,744 on Tuesday.

The Junior Market closed trading of 13,584,564 shares for $21,955,901 up from 11,922,796 units at $18,343,744 on Tuesday.

Trading averaged 295,317 shares at $477,302 slightly more than 290,800 units at $447,408 trading on Tuesday with the month to date, averaging 260,492 units at $500,089, with little change from 258,164 stock units at $501,613 on the previous day and May with an average of 451,257 units at $953,021.

Omni Industries led trading with 4.55 million shares for 33.5 percent of total volume followed by Derrimon Trading with 1.43 million units for 10.6 percent of the day’s trade and Jamaican Teas with 1.39 million units for 10.3 percent of the day’s trade.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and six with lower offers.

At the close of the market on Wednesday, Access Financial climbed $1 to close at $20 after 3,043 stock units passed through the market, AMG Packaging increased 39 cents to $3.28 with investors swapping 8 shares, Blue Power skidded 7 cents and ended at $3.89 after an exchange of a mere 3 stocks. CAC 2000 lost 10 cents to finish at $3 in trading 14 units, Cargo Handlers popped $1.19 in closing at $13.19, with 1,002 stocks clearing the market, Caribbean Assurance Brokers rallied 29 cents to $3.80 as stakeholders exchanged 7,378 units. Caribbean Cream declined 23 cents in closing at $3.57 with a transfer of 6,588 shares, Elite Diagnostic rose 10 cents to $1.55 after an exchange of 19,664 stock units, Express Catering gained 23 cents to end at $4.25 with traders transferring 18,255 shares. Fontana shed 47 cents and ended at $8.12 in an exchange of 118,183 stock units, Future Energy dropped 13 cents to finish at $3.05 with dealings in 176,023 units, ISP Finance advanced 71 cents to close at $24.96 after a transfer of just one stock unit.  Knutsford Express fell 10 cents to $11.10, with 279 shares crossing the exchange, Limners and Bards rose 20 cents to finish at $1.68 with 50,000 stocks changing hands, Medical Disposables rose 28 cents to $2.16 after an exchange of 26 units. MFS Capital Partners slipped 7 cents to close at $1 after stakeholders traded 839,936 stocks, Omni Industries popped 8 cents in closing at $1.10 after an exchange of 4,546,653 shares, One Great Studio added 7 cents to end at 86 cents and closed with 472,449 stocks being traded. Paramount Trading sank 9 cents to $1.20 in switching ownership of 130,555 stocks, Regency Petroleum climbed 8 cents and ended at $2.25, with 42,756 stock units crossing the market, Spur Tree Spices advanced 13 cents to end at $2.44 with investors trading 62,306 shares and Tropical Battery dipped 7 cents in closing at $2.15 with 25,595 units crossing the market.

Knutsford Express fell 10 cents to $11.10, with 279 shares crossing the exchange, Limners and Bards rose 20 cents to finish at $1.68 with 50,000 stocks changing hands, Medical Disposables rose 28 cents to $2.16 after an exchange of 26 units. MFS Capital Partners slipped 7 cents to close at $1 after stakeholders traded 839,936 stocks, Omni Industries popped 8 cents in closing at $1.10 after an exchange of 4,546,653 shares, One Great Studio added 7 cents to end at 86 cents and closed with 472,449 stocks being traded. Paramount Trading sank 9 cents to $1.20 in switching ownership of 130,555 stocks, Regency Petroleum climbed 8 cents and ended at $2.25, with 42,756 stock units crossing the market, Spur Tree Spices advanced 13 cents to end at $2.44 with investors trading 62,306 shares and Tropical Battery dipped 7 cents in closing at $2.15 with 25,595 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

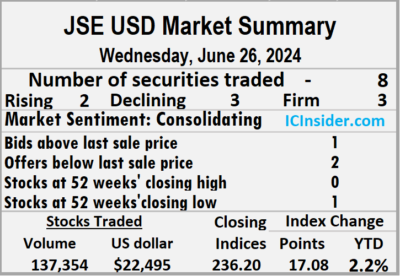

8% jump for JSE USD stocks

The US Denominated Equities Index surged 17.10 points or 7.8 percent in closing at 236.20 at the close of trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, following an 89 percent drop in the volume of stocks exchanged and an 80 percent drop in value than on Tuesday, resulting from trading in eight securities, up from five on Tuesday with prices of two rising, three declining and three ending unchanged.

The market closed with an exchange of 137,354 shares for US$22,495, down from 1,221,116 units at US$112,024 on Tuesday.

The market closed with an exchange of 137,354 shares for US$22,495, down from 1,221,116 units at US$112,024 on Tuesday.

Trading averaged 17,169 units at US$2,812 versus 244,223 shares at US$22,405 on Tuesday, with a month to date average of 45,696 shares at US$3,434 compared with 47,790 units at US$3,480 on the previous day and May that ended with an average of 32,077 units for US$3,201.

The PE Ratio, a measure used in computing appropriate stock values, averages 7.7. The PE ratio is based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and two with lower offers.

At the close of trading, AS Bryden increased 3.29 cents to end at 25.29 US cents with an exchange of 53 stocks, First Rock Real Estate USD share ended at 4 US cents with traders dealing in 1,277 units, Productive Business Solutions climbed 17.5 cents to US$1.45 after 110 shares passed through the market.  Proven Investments ended at 13 US cents after an exchange of 1,528 stock units, Sterling Investments dipped 0.06 of a cent to 1.54 US cents after it closed with an exchange of 595 shares, Sygnus Credit Investments sank 1.8 cent in closing at a 52 weeks’ low 6 US cents in switching ownership of 27,200 stocks and Transjamaican Highway ended at 2 US cents as investors exchanged 91,713 units.

Proven Investments ended at 13 US cents after an exchange of 1,528 stock units, Sterling Investments dipped 0.06 of a cent to 1.54 US cents after it closed with an exchange of 595 shares, Sygnus Credit Investments sank 1.8 cent in closing at a 52 weeks’ low 6 US cents in switching ownership of 27,200 stocks and Transjamaican Highway ended at 2 US cents as investors exchanged 91,713 units.

In the preference segment, JMMB Group US8.5% preference share slipped 2 cents in closing at US$1.25 in trading 14,878 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

All JSE markets rose

More stocks were traded on the Main Market of the Jamaica Stock Exchange than was the case on Wednesday, with the value of stocks traded rising above Tuesday’s levels as all the major market indices closed higher, as prices of 38 stocks gained and 30 declined.

At the close of the market, the JSE Combined Market Index climbed 1,589.37 points to 332720.64, the All Jamaican Composite Index rose 803.03 points to 357,537.00, the JSE Main Index rallied 1,434.43 points to close at 319,656.54. The Junior Market Index rallied 30.50 points to end the day at 3,771.19 and the JSE USD Market Index jumped 17.10 points to wrap-up trading at 236.20.

At the close of the market, the JSE Combined Market Index climbed 1,589.37 points to 332720.64, the All Jamaican Composite Index rose 803.03 points to 357,537.00, the JSE Main Index rallied 1,434.43 points to close at 319,656.54. The Junior Market Index rallied 30.50 points to end the day at 3,771.19 and the JSE USD Market Index jumped 17.10 points to wrap-up trading at 236.20.

At the close of trading, 26,869,332 shares were exchanged in all three markets, up from 24,524,466 units on Tuesday, with the value of stocks traded on the Junior and Main markets amounted to $135.02 million, more than the $121.12 million on the previous trading day and the JSE USD market closed with an exchange of 137,354 shares for US$22,495 compared to 1,221,116 units at US$112,024 on Tuesday.

In Main Market activity, Transjamaican Highway led trading with 3.08 million shares followed by Wigton Windfarm with 2.12 million units and Sygnus Credit Investments with 1.33 million stocks.

In Junior Market trading, Omni Industries led trading with 4.55 million shares followed by Derrimon Trading with 1.43 million stock units and Jamaican Teas with 1.39 million stocks.

In the preference segment, Productive Business Solutions 10.5% preference share rallied $50 to $1,100 and Sygnus Credit Investments C10.5% rose $2 to end at $110.

In the preference segment, Productive Business Solutions 10.5% preference share rallied $50 to $1,100 and Sygnus Credit Investments C10.5% rose $2 to end at $110.

The market’s PE ratio, the most popular measure used to value stocks, ended at 20.9 on 2023-24 earnings and 13.9 times those for 2024-25 at the close of trading. The ICInsider.com PE ratio chart along with the more detailed daily charts provide investors with updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so.  This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

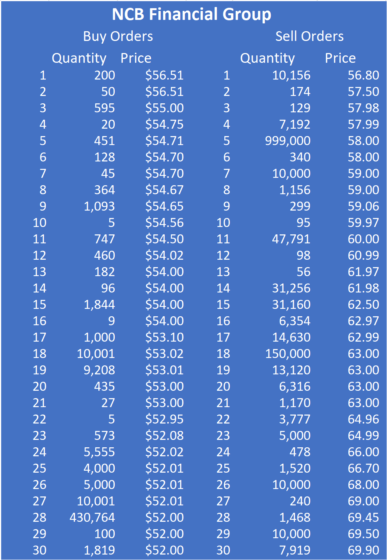

NCB at 11 year low is it a buy yet?

Investors buying into the public offer of NCB Financial Group stock at $65 each in May are hugging up an 18 percent loss on their investment since, with the stock hitting a 52 weeks’ low of $54.66 on Monday and ending at a closing low of $55 after more than 1.5 million shares were traded, following a sizable 3 million share trade on June 17, when the stock closed at $59.

Investors buying into the public offer of NCB Financial Group stock at $65 each in May are hugging up an 18 percent loss on their investment since, with the stock hitting a 52 weeks’ low of $54.66 on Monday and ending at a closing low of $55 after more than 1.5 million shares were traded, following a sizable 3 million share trade on June 17, when the stock closed at $59.

Investors in the stock whether new or not are taking the beating following the public offer that came when the stock was trading at an eleven year low going back to February 2013. The question for investors is whether the price has reached a bottom and when will a consistent rebound commence. The accompanying chart will help in partially answering the questions.

NCB is a diversified financial group, providing services in general insurance, life insurance, banking and investments management. The group is also geographically diversified with operations in Trinidad, Bermuda and Jamaica. It has a solid base that it can use to produce increased revenues and profits in the future.

NCB is a diversified financial group, providing services in general insurance, life insurance, banking and investments management. The group is also geographically diversified with operations in Trinidad, Bermuda and Jamaica. It has a solid base that it can use to produce increased revenues and profits in the future.

Currently, the stock trades at a PE ratio of just 6.5, at a steep discount to the Main Market with an average valuation of 14, but higher than Scotia Group at a mere 6.

The major issue is whether the stock price is at or near the bottom. The attached chart offers some clues, with the stock trading at the bottom of a downward sloping channel.

30 highest bids and offers for NCB shares mid morning on Wednesday.

It may take some time for the added pressure brought on by the issue of the additional shares for which there was inadequate demand, to abate.

The price seems to have reached support at the channel bottom. The lower channel line goes back to July last year. The trend shown by the channel, between the green and the orange lines is negative, sloping downwards, suggesting that the price downturn could continue awhile longer. The stock will probably bounce off the low reached on Monday, but the demand shown by the order book is thin, suggesting the price could go lower. It would not be surprising to see the stock hitting $50 before bottoming out. If it rebounds from where it is now it’s likely to get back to $65 and probably resume its decline towards the $50 mark as buyers at $65 try to get out. Although undervalued, investors should be cautious in buying the stock around the recent price. They should probably await clearer signals that it is at the bottom.

Trading drops on JSE Main Market

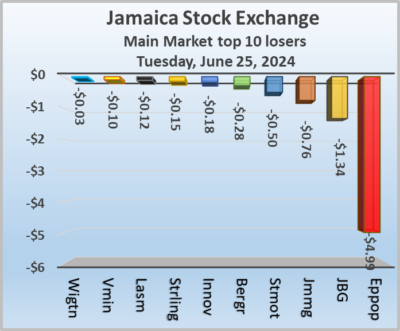

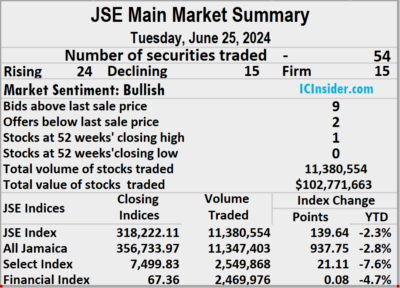

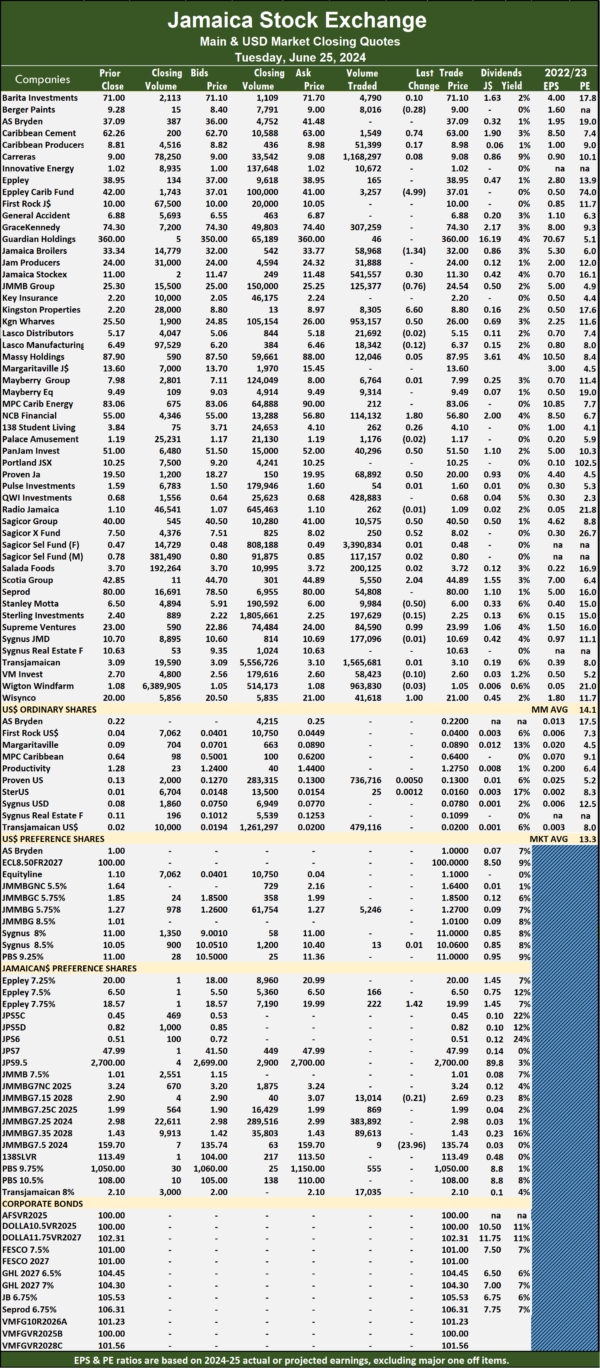

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 17 percent and the value 40 percent lower than on Monday, with trading in 54 securities compared with 60 on Monday, with prices of 24 stocks rising, 15 declining and 15 ending unchanged.

Investors traded 11,380,554 shares at $102,771,663 down from 13,700,341 units at $172,344,664 on Monday.

Investors traded 11,380,554 shares at $102,771,663 down from 13,700,341 units at $172,344,664 on Monday.

Trading averaged 210,751 shares at $1,903,179 compared to 228,339 units at $2,872,411 on Monday and month to date, an average of 235,480 units at $1,858,534 compared with 236,916 units at $1,855,942 on the previous day and May with an average of 336,947 units at $2,177,110.

Sagicor Select Financial Fund led trading with 3.39 million shares for 29.8 percent of total volume followed by Transjamaican Highway with 1.57 million units for 13.8 percent of the day’s trade and Carreras with 1.17 million units for 10.3 percent of the day’s trade.

The All Jamaican Composite Index rallied 937.75 points to close at 356,733.97, the JSE Main Index popped 139.64 points to culminate at 318,222.11 and the JSE Financial Index advanced 0.08 points to conclude trading at 67.36.

The Main Market ended trading with an average PE Ratio of 14.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 14.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and two with lower offers.

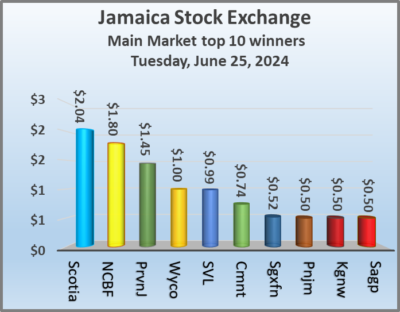

At the close of trading, Caribbean Cement gained 74 cents to end at $63 with investors trading 1,549 shares, Eppley Caribbean Property Fund lost $4.99 in closing at $37.01 in an exchange of 3,257 stocks, Jamaica Broilers sank $1.34 to $32 with investors dealing in 58,968 shares. JMMB Group declined 76 cents to close at $24.54 in an exchange of 125,377 stock units, Kingston Wharves popped 50 cents and ended at $26 with 953,157 shares clearing the market, NCB Financial rallied $1.80 to finish at $56.80 after a transfer of 114,132 stocks.  Pan Jamaica increased 50 cents to $51.50 after an exchange of 40,296 units, Proven Investments climbed 50 cents to end at $20 with investors transferring 68,892 stock units, Sagicor Group rose 50 cents to $40.50, with 10,575 shares crossing the market. Sagicor Real Estate Fund advanced 52 cents to finish at $8.02 after exchanging 250 stock units, Scotia Group rose $2.04 and ended at $44.89 with investors swapping 5,550 stocks, Stanley Motta fell 50 cents to close at $6, with 9,984 stock units changing hands. Supreme Ventures rallied 99 cents to $23.99 with 84,590 shares changing hands and Wisynco Group increased $1 to end at $21 in trading 41,618 units.

Pan Jamaica increased 50 cents to $51.50 after an exchange of 40,296 units, Proven Investments climbed 50 cents to end at $20 with investors transferring 68,892 stock units, Sagicor Group rose 50 cents to $40.50, with 10,575 shares crossing the market. Sagicor Real Estate Fund advanced 52 cents to finish at $8.02 after exchanging 250 stock units, Scotia Group rose $2.04 and ended at $44.89 with investors swapping 5,550 stocks, Stanley Motta fell 50 cents to close at $6, with 9,984 stock units changing hands. Supreme Ventures rallied 99 cents to $23.99 with 84,590 shares changing hands and Wisynco Group increased $1 to end at $21 in trading 41,618 units.

In the preference segment, Eppley 7.75% preference share climbed $1.42 in closing at $19.99 after an exchange of 222 stocks and 138 Student Living preference share dropped $23.96 to finish at $135.74 after trading 9 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market surges 61 points

Prices of 27 rose, with only 10 declining and four closing unchanged and pushed the market index up nearly 61 points, following Monday’s 27 points rise resulting from trading in 41 securities compared with 42 on Monday at the close of the Junior Market of the Jamaica Stock Exchange on Tuesday, resulting in a 73 percent decline in the volume of stocks traded, with a 77 percent lower value than on Monday.

Trading ended with 11,922,796 shares for $18,343,744 down from 44,365,992 units at $81,000,955 on Monday.

Trading ended with 11,922,796 shares for $18,343,744 down from 44,365,992 units at $81,000,955 on Monday.

Trading averaged 290,800 shares at $447,408 compared to 1,056,333 units at $1,928,594 on Monday with the month to date, averaging 258,164 stock units at $501,613 compared to 256,096 units at $505,047 on the previous day and May with an average of 451,257 units at $953,021.

iCreate led trading with 1.83 million shares for 15.4 percent of total volume followed by Omni Industries with 1.56 million stocks for 13.1 percent of the day’s trade, Jamaican Teas contributed 1.40 million units for 11.7 percent market share and Fosrich ended with 1.05 million shares for 8.8 percent of total volume. Edufocal traded at an intraday 52 weeks’ low of 53 cents before rebounding back to 60 cents at the close while Omni Industries traded at the lowest price of $1.02 since listing.

At the close of trading, the Junior Market Index surged 60.76 points to close trading at 3,740.69.

At the close of trading, the Junior Market Index surged 60.76 points to close trading at 3,740.69.

The Junior Market ended trading with an average PE Ratio of 12.7, based on last traded prices in conjunction with earnings projected by ICInsider.com for financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

At the close of trading on Tuesday, CAC 2000 rallied 10 cents in closing at $3.10 after 9,852 stocks passed through the market, Caribbean Assurance Brokers shed 32 cents to close at $3.51 in an exchange of 2,918 units, Caribbean Cream rose 24 cents to finish at $3.80 with traders dealing in 3,079 shares. Consolidated Bakeries gained 35 cents and ended at $1.90 after a transfer of 220,435 stock units, Derrimon Trading popped 26 cents to end at $2.20 with investors swapping 759,894 shares, Elite Diagnostic sank 10 cents to close at $1.45 after an exchange of 366,599 units.  Express Catering dipped 38 cents to $4.02 in trading 2,493 stocks, Fontana advanced 34 cents and ended at $8.59 with 7,747 stock units changing hands, Fosrich increased 8 cents to end at $2.30 as investors exchanged 1,047,630 shares. Honey Bun climbed 18 cents in closing at $8.35 in switching ownership of 7,636 stock units, iCreate rose 8 cents to finish at 68 cents with trading of 1,834,027 stocks, Iron Rock Insurance rallied 10 cents to close at $1.90 after a mere 897 units crossed the market. Knutsford Express gained 55 cents to $11.20 with an exchange of 838 shares, Mailpac Group climbed 12 cents to close at $2.27 and closed with an exchange of 254,374 stocks, MFS Capital Partners popped 13 cents and ended at $1.07 with investors trading 613,128 units and tTech gained 14 cents to finish at $2.49 in an exchange of 12,958 stock units.

Express Catering dipped 38 cents to $4.02 in trading 2,493 stocks, Fontana advanced 34 cents and ended at $8.59 with 7,747 stock units changing hands, Fosrich increased 8 cents to end at $2.30 as investors exchanged 1,047,630 shares. Honey Bun climbed 18 cents in closing at $8.35 in switching ownership of 7,636 stock units, iCreate rose 8 cents to finish at 68 cents with trading of 1,834,027 stocks, Iron Rock Insurance rallied 10 cents to close at $1.90 after a mere 897 units crossed the market. Knutsford Express gained 55 cents to $11.20 with an exchange of 838 shares, Mailpac Group climbed 12 cents to close at $2.27 and closed with an exchange of 254,374 stocks, MFS Capital Partners popped 13 cents and ended at $1.07 with investors trading 613,128 units and tTech gained 14 cents to finish at $2.49 in an exchange of 12,958 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market surges as Main Market pops

The Junior Market closed with a big jump of nearly 61 points at the end of trading on the Jamaica Stock Exchange on Tuesday, the Main Market Index popped marginally higher as well as the JSE USD market with trading ended with the number and value of stocks changing hands falling, compared with the previous trading day, resulting in prices of 48 shares rising and 24 declining.

At the close of trading, the JSE Combined Market Index climbed 564.71 points to 331,131.27, the All Jamaican Composite Index rallied 937.75 points to 356,733.97, the JSE Main Index advanced 139.64 points to 318,222.11. The Junior Market Index jumped 60.76 points to 3,740.69 and the JSE USD Market Index rose 0.42 points to 219.10.

At the close of trading, the JSE Combined Market Index climbed 564.71 points to 331,131.27, the All Jamaican Composite Index rallied 937.75 points to 356,733.97, the JSE Main Index advanced 139.64 points to 318,222.11. The Junior Market Index jumped 60.76 points to 3,740.69 and the JSE USD Market Index rose 0.42 points to 219.10.

At the close of trading, 24,524,466 shares were exchanged in all three markets, down from 58,069,711 units on Monday, with the value of stocks traded on the Junior and Main markets amounted to $121.12 million, well below the $253.35 million on the previous trading day and the JSE USD market closed with an exchange of 1,221,116 shares for US$112,024 compared to 3,378 units at US$273 on Monday.

In Main Market activity, Sagicor Select Financial Fund led trading with 3.39 million shares followed by Transjamaican Highway with 1.57 million stock units and Carreras with 1.17 million units.

In Junior Market trading, iCreate led trading with 1.83 million shares followed by Omni Industries with 1.56 million stock units, Jamaican Teas with 1.40 million shares and Fosrich with 1.05 million units.

In the preference segment, Eppley 7.75% preference share climbed $1.42 in closing at $19.99 and 138 Student Living preference share slipped $23.96 to finish at $135.74.

The market’s PE ratio, the most popular measure used to value stocks, ended at 20.4 on 2023-24 earnings and 13.7 times those for 2024-25 at the close of trading. The ICInsider.com PE ratio chart and detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to value stocks, ended at 20.4 on 2023-24 earnings and 13.7 times those for 2024-25 at the close of trading. The ICInsider.com PE ratio chart and detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and a more detailed daily charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

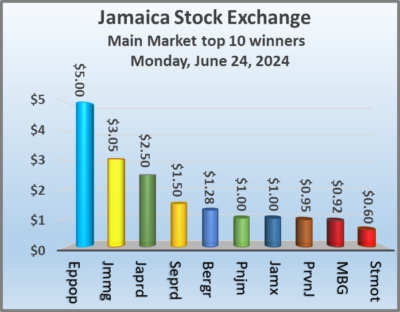

Surge in JSE Main Market value

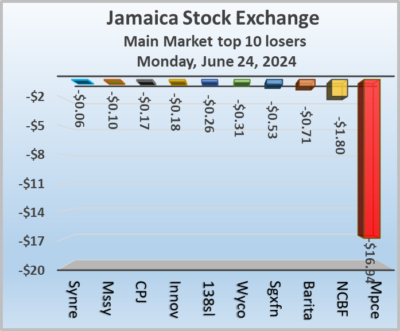

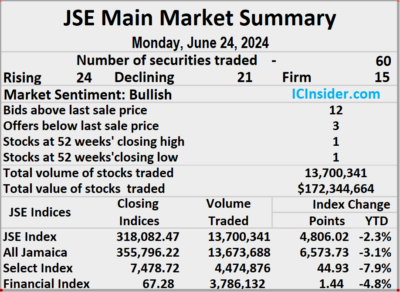

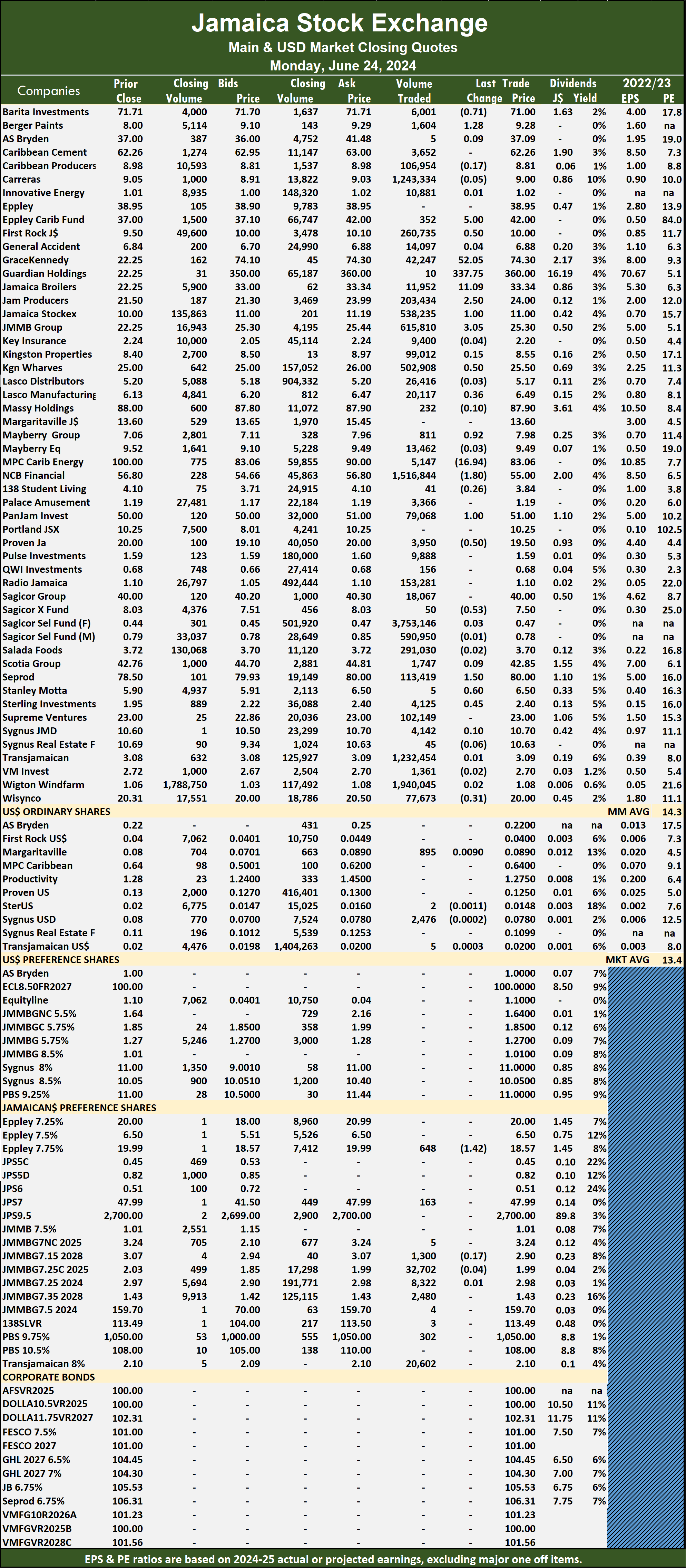

Rising stocks pushed the Main Market of Jamaica Stock Exchange sharply higher at the close on Monday, with the All Jamaican Composite Index surging 6,573.73 points to 355,796.22, the JSE Main Index jumped 4,806.02 points to 318,082.47 and the JSE Financial Index rose 1.44 points to 67.28, following a 25 percent drop in the volume of stocks traded after an 18 percent decline in value compared to Friday.

Trading ended with an exchange of 60 securities up from 58 on Friday, with prices of 24 stocks rising, 21 declining and 15 ending unchanged.

Trading ended with an exchange of 60 securities up from 58 on Friday, with prices of 24 stocks rising, 21 declining and 15 ending unchanged.

The market closed with 13,700,341 shares trading for $172,344,664 from 18,284,634 units at $210,425,299 on Friday.

Trading averaged 228,339 shares at $2,872,411 compared with 315,252 units at $3,628,022 on Friday and month to date, an average of 236,916 units at $1,855,942 versus 237,508 units at $1,785,841 on the previous day and May that closed with an average of 336,947 units at $2,177,110.

Sagicor Select Financial Fund led trading with 3.75 million shares for 27.4 percent of total volume followed by Wigton Windfarm with 1.94 million units for 14.2 percent of the day’s trade, NCB Financial ended with 1.52 million units for 11.1 percent of market share, Carreras followed with 1.24 million units for 9.1 percent trading and Transjamaican Highway with 1.23 million units for 9 percent of total volume.

The Main Market ended trading with an average PE Ratio of 14.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments skidded 71 cents to $71 with traders dealing in 6,001 stock units, Berger Paints jumped $1.28 to $9.28 after trading 1,604 shares, Eppley Caribbean Property Fund rose $5 to close at $42 with investors trading 352 units. First Rock Real Estate climbed 50 cents to $10 after 260,735 stocks were traded, Jamaica Producers rallied $2.50 to finish at $24 with an exchange of 203,434 shares, Jamaica Stock Exchange popped $1 and ended at $ 11 with 538,235 units crossing the market. JMMB Group advanced $3.05 to $25.30 with investors dealing in 615,810 stocks, Kingston Wharves rallied 50 cents and ended at $25.50 after an exchange of 502,908 stock units, Mayberry Group increased 92 cents to finish at $7.98 with investors trading 811 shares. MPC Caribbean Clean Energy lost $16.94 in closing at $83.06 with 5,147 stock units crossing the market,

NCB Financial shed $1.80 to close at a 52 weeks’ low of $55 as investors exchanged 1,516,844 units, with the price coming close to a level of support, but a price as low as $50 may not be out of place, with a PE ratio of 7 times this year’s earnings. Pan Jamaica popped $1 to end at $51, with 79,068 stocks changing hands, Proven Investments fell 50 cents in closing at $19.50 in trading 3,950 shares, Sagicor Real Estate Fund dipped 53 cents to $7.50 after a transfer of 50 units. Seprod rallied $1.50 and ended at $80 with 113,419 stocks clearing the market, Stanley Motta rose 60 cents to finish at $6.50 after an exchange of 5 stock units and Sterling Investments climbed 45 cents to close at $2.40 and closed with 4,125 shares being traded.

NCB Financial shed $1.80 to close at a 52 weeks’ low of $55 as investors exchanged 1,516,844 units, with the price coming close to a level of support, but a price as low as $50 may not be out of place, with a PE ratio of 7 times this year’s earnings. Pan Jamaica popped $1 to end at $51, with 79,068 stocks changing hands, Proven Investments fell 50 cents in closing at $19.50 in trading 3,950 shares, Sagicor Real Estate Fund dipped 53 cents to $7.50 after a transfer of 50 units. Seprod rallied $1.50 and ended at $80 with 113,419 stocks clearing the market, Stanley Motta rose 60 cents to finish at $6.50 after an exchange of 5 stock units and Sterling Investments climbed 45 cents to close at $2.40 and closed with 4,125 shares being traded.

In the preference segment, Eppley 7.75% preference share sank $1.42 to end at $18.57 with a transfer of 648 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 25

- 26

- 27

- 28

- 29

- …

- 638

- Next Page »