Successful investors usually have keen eyes that spot good opportunities from afar before the crowd usually finds out that seems to be the case at the Montego Bay based Caribbean Producers (CPJ).

Caribbean Producers back in TOP 10

We have cut staffing from 450 to 315 and we did a lot of cost containment and some amount of restructuring of the operations, which Mark Hart, chairman of the company, puts at US$600,000 per annum. According to Hart, they believe that the manning levels will be adequate for the immediate future.

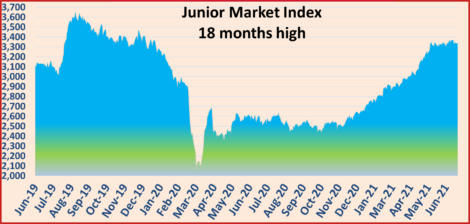

CPJ chalked up losses following the closure of the hotels last year and while the company lost money up to the March quarter this year, the stock price has more than doubled since the end of June last year, moving from $2.06 to $4.74 on Thursday. Most investors missed the train on this one.

The first thing investors ought to have observed was the reopening of the tourist sector with increasing visitor arrivals since travel restrictions were lifted in June last year. The second was a reduction in cost at the company and the strong cash flow since the closure in March last year.

One of the best signals, pointing to improvement, was trading in the stock by insiders and connected parties since the latter part of 2020. Last month, the company advised the Jamaica Stock Exchange that a connected party purchased 470,707 units of the company’s shares on June 29.

On December 23, last year, a connected party purchased 464,765 shares that followed a connected party purchase of 2,930,211 shares at around $2.63 on December 8. On November 25, last year, another connected party purchase took place for 185,002 shares. The only negative message was to the sale by a connected party of 5,500,500 shares on April 20, this year, at approximately $3.74. A deeper review by ICInsider.com indicates that the sale was a specially arranged deal to someone close to the seller. On February 19, the stocks closed, trading at $2.67 with just 12,000 shares traded but on the next day, 752,023 shares traded with the last traded price of $3.20, and then on the next day, 8,622,338 shares traded at $3.50. The above trades are a big vote of confidence that things were on the mend for the company.

Following the above, it should not be surprising to hear two directors speaking glowingly about developments at the company over the past year and plans for expansion for the future. “We have seen quick recovery for our core business,” said Thomas Tyler.

Hart stated that he thinks that the forecast made by Don Theoc of Mayberry Investments of $6 for the company’s shares in the next twelve months is conservative.

“We have expanded our grocery stores in St Lucia from 3,000 to 8,000 square feet in May and we are building out 9,000 square feet grocery store in the centre of Castries and working on breaking ground and should be ready in six to nine months. In the north of St Lucia, we are looking at a 19,000 square foot retail store and in Montego Bay, we are expanding a 1,200 square feet retail store to 6,000 square feet.” “We have identified acquisition candidate in Jamaica and we are exploring,” Thomas Tyler stated; he went on to further state that the plan is “for revenues in St Lucia to move from US$15 million per annum now to $50 million in 3 years.”

“We have expanded our grocery stores in St Lucia from 3,000 to 8,000 square feet in May and we are building out 9,000 square feet grocery store in the centre of Castries and working on breaking ground and should be ready in six to nine months. In the north of St Lucia, we are looking at a 19,000 square foot retail store and in Montego Bay, we are expanding a 1,200 square feet retail store to 6,000 square feet.” “We have identified acquisition candidate in Jamaica and we are exploring,” Thomas Tyler stated; he went on to further state that the plan is “for revenues in St Lucia to move from US$15 million per annum now to $50 million in 3 years.”

The company suffered a loss of US$903,258 for the March quarter, up from US$553780 in the similar period last year and for the nine months to March, the loss ballooned to US$3.6 million from a loss of just US$29,609 in the prior year.

Sale revenues dropped 52 percent for the quarter, to US$12.7 million from US$26.5 million but fell 57 percent for the year to date, to US$37 million from US$86 million in 2020.

The company enjoyed an improved profit margin in the March quarter, with gross profit falling at a slower pace of 56.4 compared to the steeper decline in revenues, but gross profit for the nine months period, slipped by 54 percent.

Selling and administrative expenses fell 37 percent to $3.2 million in the quarter and 42 percent in the nine months period to US$9.4 million from US$16.4 million.

Finance cost declined in the quarter, to $442,000 from $581 million in 2020 and $1.83 million to $1.34 million for the nine months period, while depreciation was fall at US$1 million for the quarter and US$3.2 million for the year to date period.

The rationalization resulted in Inventories falling from US$28 million in March 2020 to US$18.7 million receivables fell from US$18 million down to US$10.5 million, while payables fell from US$15.3 million to US$6.33 million. Some of the declines are due to a lower level of business activity. Amounts borrowed to fund the operations remained at a high US$34 million, with shareholders’ equity of just $14 million.

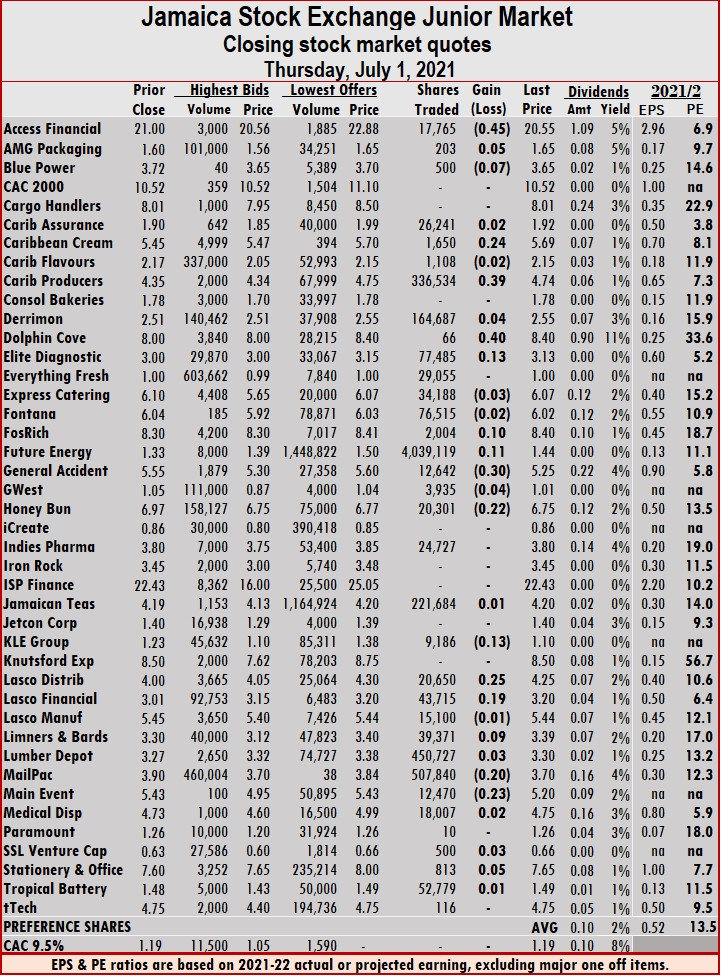

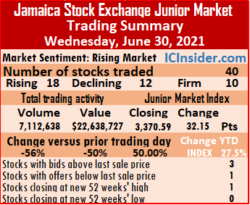

A total of 34 securities traded, down from 40 on Wednesday and ended with 18 rising, 12 declining and four, closing unchanged. Two stocks closed at 52 weeks; highs.

A total of 34 securities traded, down from 40 on Wednesday and ended with 18 rising, 12 declining and four, closing unchanged. Two stocks closed at 52 weeks; highs. At the close of trading Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers.

At the close of trading Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers. Limners and Bards rallied 9 cents to $3.39, with 39,371 shares clearing the market, Mailpac Group declined 20 cents to $3.70 in trading 507,840 stock units, Main Event fell 23 cents to $5.20 with the swapping of 12,470 stocks, SSL Venture added 3 cents to close at 66 cents, with 500 shares crossing the exchange and Stationery and Office Supplies rose 5 cents to close at $7.65 in exchanging 813 shares.

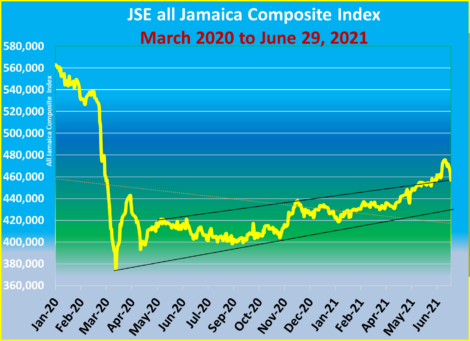

Limners and Bards rallied 9 cents to $3.39, with 39,371 shares clearing the market, Mailpac Group declined 20 cents to $3.70 in trading 507,840 stock units, Main Event fell 23 cents to $5.20 with the swapping of 12,470 stocks, SSL Venture added 3 cents to close at 66 cents, with 500 shares crossing the exchange and Stationery and Office Supplies rose 5 cents to close at $7.65 in exchanging 813 shares. At the close of trading, the All Jamaican Composite Index rose 632.10 points to 463,173.10, the JSE Main Index popped 987.23 points to end at 426,551.38 and the JSE Financial Index popped 0.12 points to 105.19.

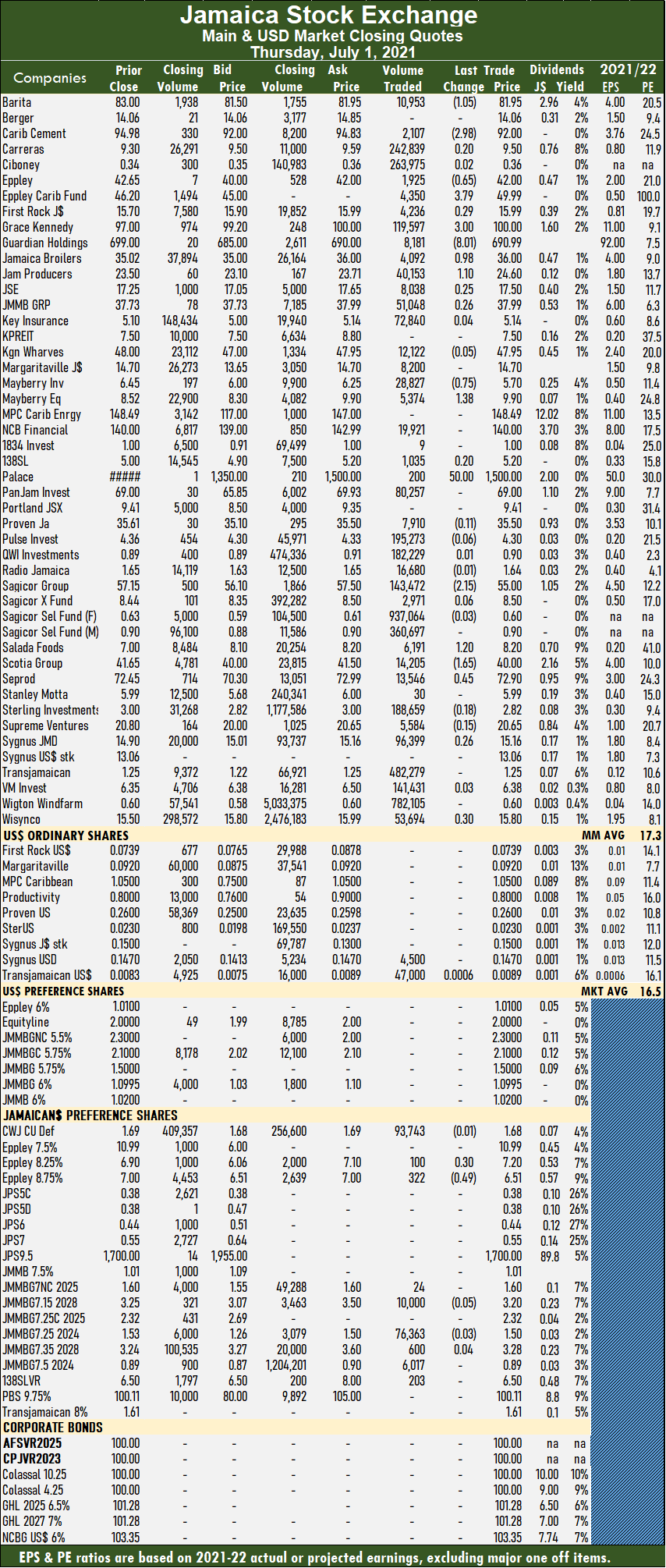

At the close of trading, the All Jamaican Composite Index rose 632.10 points to 463,173.10, the JSE Main Index popped 987.23 points to end at 426,551.38 and the JSE Financial Index popped 0.12 points to 105.19. At the close, Barita Investments fell $1.05 to $81.95 with an exchange of 10,953 shares, Caribbean Cement declined $2.98 to $92 in switching ownership of 2,107 stock units. Carreras rallied 20 cents to $9.50 with a transfer of 242,839 stocks, Eppley shed 65 cents to $42, with 1,925 units clearing the market, Eppley Caribbean Property Fund spiked $3.79 to $49.99 in exchanging 4,350 shares. First Rock Capital gained 29 cents to end at $15.99 with the swapping of 4,236 stock units, Grace Kennedy sprung $3 higher to $100 with 119,597 shares crossing the exchange, Guardian Holdings dropped $8.01 to close at $690.99 with 8,181 stock units changing hands. Jamaica Broilers spiked 98 cents to $36 with the swapping of 4,092 shares, Jamaica Producers rose $1.10 to $24.60 after exchanging 40,153 stock units, Jamaica Stock Exchange gained 25 cents to finish at $17.50 in switching ownership of 8,038 units. JMMB Group picked up 26 cents to end at $37.99 trading 51,048 stocks, Mayberry Investments shed 75 cents to close at $5.70 with the swapping of 28,827 stock units. Mayberry Jamaican Equities popped $1.38 to $9.90 after 5,374 units crossed the market, 138 Student Living rallied 20 cents to $5.20 in exchanging 1,035 stock units, Palace Amusement spiked $50 to $1,500 in trading 200 units, Sagicor Group fell $2.15 to $55 with 143,472 shares changing hands, Salada Foods rallied $1.20 to $8.20 with 6,191 units clearing the market, Scotia Group fell $1.65 to $40 with an exchange of 14,205 stock units.

At the close, Barita Investments fell $1.05 to $81.95 with an exchange of 10,953 shares, Caribbean Cement declined $2.98 to $92 in switching ownership of 2,107 stock units. Carreras rallied 20 cents to $9.50 with a transfer of 242,839 stocks, Eppley shed 65 cents to $42, with 1,925 units clearing the market, Eppley Caribbean Property Fund spiked $3.79 to $49.99 in exchanging 4,350 shares. First Rock Capital gained 29 cents to end at $15.99 with the swapping of 4,236 stock units, Grace Kennedy sprung $3 higher to $100 with 119,597 shares crossing the exchange, Guardian Holdings dropped $8.01 to close at $690.99 with 8,181 stock units changing hands. Jamaica Broilers spiked 98 cents to $36 with the swapping of 4,092 shares, Jamaica Producers rose $1.10 to $24.60 after exchanging 40,153 stock units, Jamaica Stock Exchange gained 25 cents to finish at $17.50 in switching ownership of 8,038 units. JMMB Group picked up 26 cents to end at $37.99 trading 51,048 stocks, Mayberry Investments shed 75 cents to close at $5.70 with the swapping of 28,827 stock units. Mayberry Jamaican Equities popped $1.38 to $9.90 after 5,374 units crossed the market, 138 Student Living rallied 20 cents to $5.20 in exchanging 1,035 stock units, Palace Amusement spiked $50 to $1,500 in trading 200 units, Sagicor Group fell $2.15 to $55 with 143,472 shares changing hands, Salada Foods rallied $1.20 to $8.20 with 6,191 units clearing the market, Scotia Group fell $1.65 to $40 with an exchange of 14,205 stock units.  Seprod gained 45 cents to finish at $72.90 with the swapping of 13,546 shares, Sygnus Credit Investments rose 26 cents to $15.16 after trading 96,399 shares and Wisynco Group spiked 30 cents to $15.80 in switching ownership of 53,694 stocks.

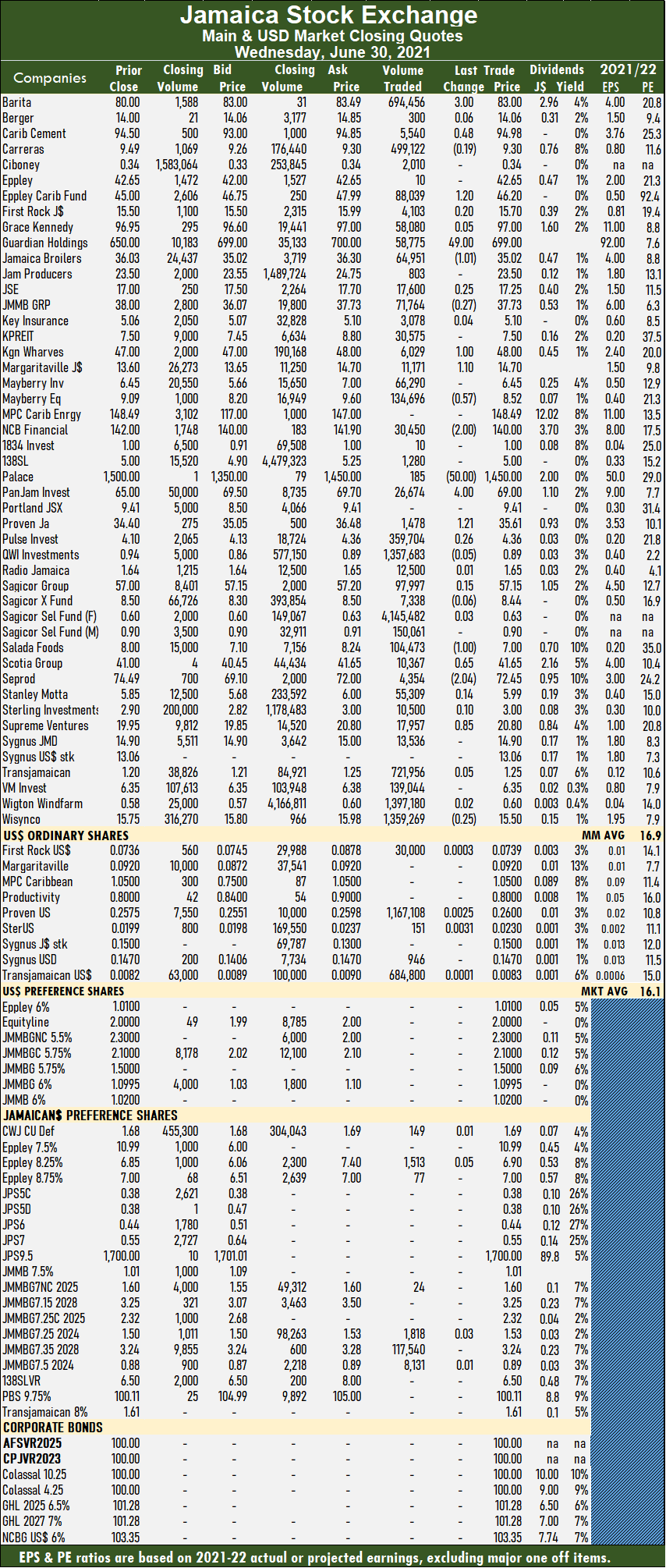

Seprod gained 45 cents to finish at $72.90 with the swapping of 13,546 shares, Sygnus Credit Investments rose 26 cents to $15.16 after trading 96,399 shares and Wisynco Group spiked 30 cents to $15.80 in switching ownership of 53,694 stocks. The second half of the year started on a subdued note after trading volume fell 97 percent from Wednesday’s level, at the close of the Jamaica Stock Exchange US dollar market on Thursday with just two securities trading compared to five on Wednesday and ending with one rising and one closing unchanged.

The second half of the year started on a subdued note after trading volume fell 97 percent from Wednesday’s level, at the close of the Jamaica Stock Exchange US dollar market on Thursday with just two securities trading compared to five on Wednesday and ending with one rising and one closing unchanged. Trading for June ended with an average of 87,444 units for US$6,162.

Trading for June ended with an average of 87,444 units for US$6,162. The All Jamaican Composite Index rallied 5,655.18 points to 462,541.00, the JSE Main Index surged 6,000.74 points to end at 425,564.15 and the JSE Financial Index picked up 1.38 points to end at 105.07.

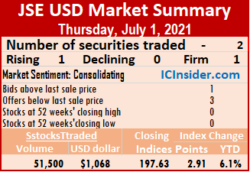

The All Jamaican Composite Index rallied 5,655.18 points to 462,541.00, the JSE Main Index surged 6,000.74 points to end at 425,564.15 and the JSE Financial Index picked up 1.38 points to end at 105.07. At the close, Barita Investments climbed $3 to $83 with 694,456 shares changing hands, Caribbean Cement rallied 48 cents to $94.98 in transferring 5,540 stock units. Eppley Caribbean Property Fund rose by $1.20 to $46.20 with 88,039 shares crossing the market, First Rock Capital gained 20 cents to end at $15.70 with the swapping of 4,103 stock units. Guardian Holdings surged $49 to $699 in switching ownership of 58,775 units, Jamaica Broilers shed $1.01 in closing at $35.02 after trading 64,951 shares. Jamaica Stock Exchange gained 25 cents to close at $17.25 with 17,600 stocks clearing the market, JMMB Group dipped 27 cents to $37.73 with the swapping of 71,764 stock units, Kingston Wharves spiked $1 to $48 in exchanging 6,029 shares, Margaritaville jumped $1.10 to $14.70 with 11,171 units crossing the market, Mayberry Jamaican Equities shed 57 cents to finish at $8.52 in trading 134,696 shares. NCB Financial declined $2 to $140 with a transfer of 30,450 units, Palace Amusement dropped $50 to $1,450 after exchanging 185 units, PanJam Investment rallied $4 to $69 in switching ownership of 26,674 stock units.

At the close, Barita Investments climbed $3 to $83 with 694,456 shares changing hands, Caribbean Cement rallied 48 cents to $94.98 in transferring 5,540 stock units. Eppley Caribbean Property Fund rose by $1.20 to $46.20 with 88,039 shares crossing the market, First Rock Capital gained 20 cents to end at $15.70 with the swapping of 4,103 stock units. Guardian Holdings surged $49 to $699 in switching ownership of 58,775 units, Jamaica Broilers shed $1.01 in closing at $35.02 after trading 64,951 shares. Jamaica Stock Exchange gained 25 cents to close at $17.25 with 17,600 stocks clearing the market, JMMB Group dipped 27 cents to $37.73 with the swapping of 71,764 stock units, Kingston Wharves spiked $1 to $48 in exchanging 6,029 shares, Margaritaville jumped $1.10 to $14.70 with 11,171 units crossing the market, Mayberry Jamaican Equities shed 57 cents to finish at $8.52 in trading 134,696 shares. NCB Financial declined $2 to $140 with a transfer of 30,450 units, Palace Amusement dropped $50 to $1,450 after exchanging 185 units, PanJam Investment rallied $4 to $69 in switching ownership of 26,674 stock units.  Proven Investments spiked $1.21 to $35.61 after an exchange of 1,478 shares, Pulse Investments gained 26 cents to finish at $4.36 with 359,704 stocks changing hands, Salada Foods declined $1 to $7 in exchanging 104,473 shares. Scotia Group rose 65 cents to $41.65 in trading 10,367 units, Seprod declined $2.04 to close at $72.45 with a transfer of 4,354 shares. Supreme Ventures rose 85 cents to $20.80 with 17,957 units changing hands and Wisynco Group lost 25 cents to close at $15.50 with the swapping of 1,359,269 shares,

Proven Investments spiked $1.21 to $35.61 after an exchange of 1,478 shares, Pulse Investments gained 26 cents to finish at $4.36 with 359,704 stocks changing hands, Salada Foods declined $1 to $7 in exchanging 104,473 shares. Scotia Group rose 65 cents to $41.65 in trading 10,367 units, Seprod declined $2.04 to close at $72.45 with a transfer of 4,354 shares. Supreme Ventures rose 85 cents to $20.80 with 17,957 units changing hands and Wisynco Group lost 25 cents to close at $15.50 with the swapping of 1,359,269 shares, Trading averaged 177,816 units at $565,968 in contrast to 417,435 shares at $1,150,844 on Tuesday. The month to date trading averaged 225,705 units at $644,463, compared to 228,139 units at $648,452 on Tuesday. May closed with an average of 318,089 units at $760,337.

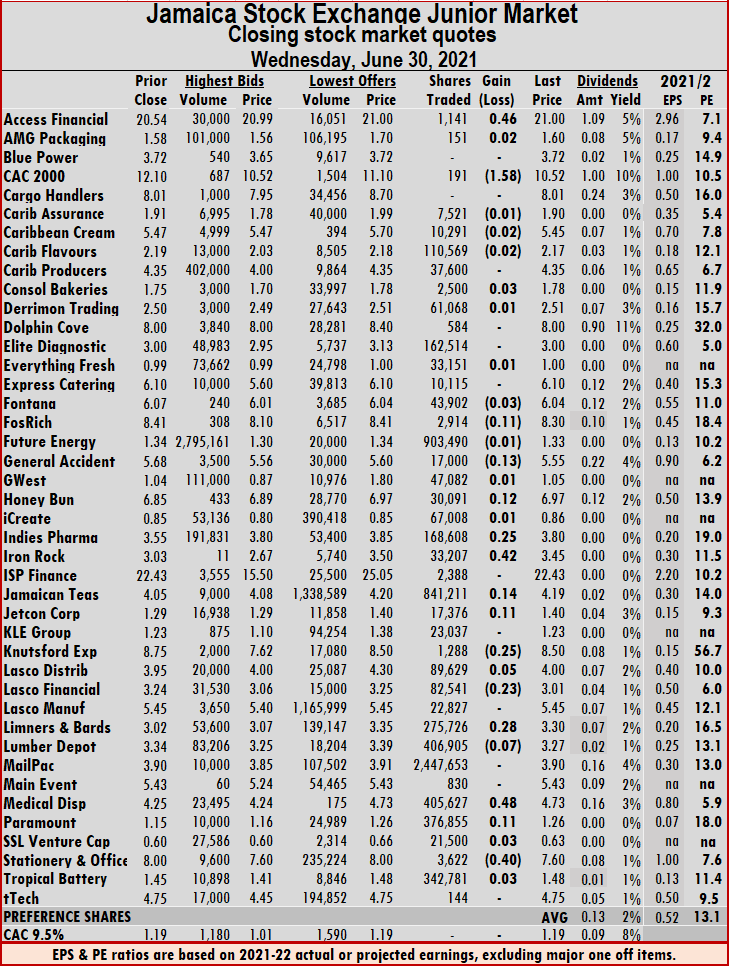

Trading averaged 177,816 units at $565,968 in contrast to 417,435 shares at $1,150,844 on Tuesday. The month to date trading averaged 225,705 units at $644,463, compared to 228,139 units at $648,452 on Tuesday. May closed with an average of 318,089 units at $760,337. Limners and Bards popped 28 cents to $3.30 with an exchange of 275,726 stock units, Lumber Depot dipped 7 cents to $3.27, with 406,905 shares changing hands, Medical Disposables climbed 48 cents to $4.73 with 405,627 units passing through the market, Paramount Trading rose 11 cents to $1.26 with 376,855 stocks traded and Stationery and Office Supplies shed 40 cents to close at $7.60, with 3,622 shares crossing the exchange.

Limners and Bards popped 28 cents to $3.30 with an exchange of 275,726 stock units, Lumber Depot dipped 7 cents to $3.27, with 406,905 shares changing hands, Medical Disposables climbed 48 cents to $4.73 with 405,627 units passing through the market, Paramount Trading rose 11 cents to $1.26 with 376,855 stocks traded and Stationery and Office Supplies shed 40 cents to close at $7.60, with 3,622 shares crossing the exchange.

At the close, the Junior Market Index popped 3.07 points to 3,338.44, after moving as high as just over 3,398 points at the opening of the market. The PE Ratio used to compute the relative value of a stock averages 13 based on ICInsider.com’s forecast of earnings for 2021-22 .

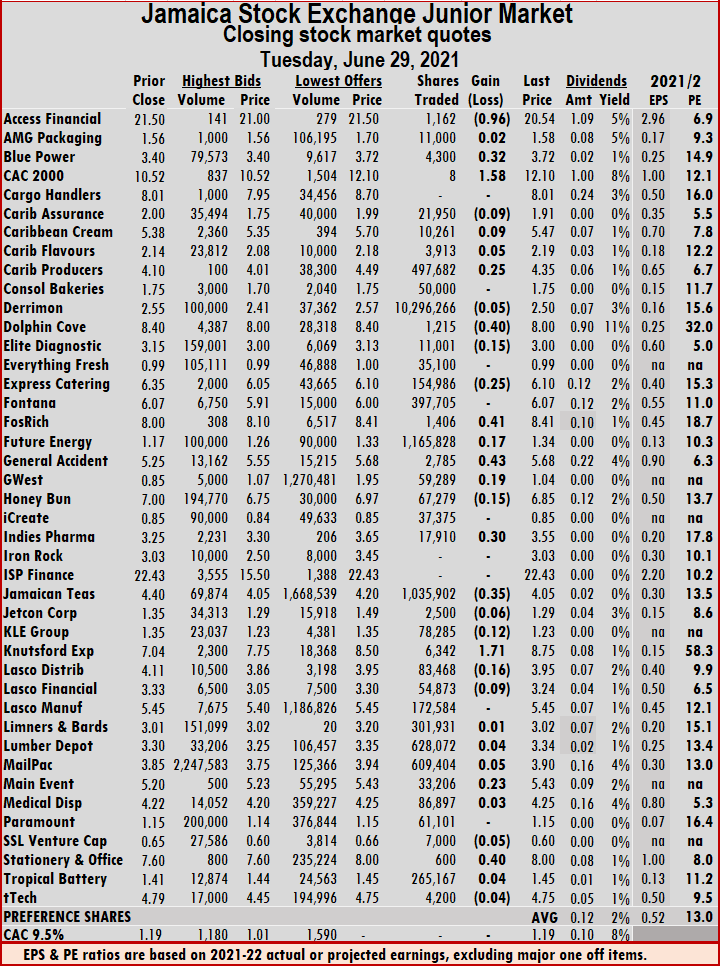

At the close, the Junior Market Index popped 3.07 points to 3,338.44, after moving as high as just over 3,398 points at the opening of the market. The PE Ratio used to compute the relative value of a stock averages 13 based on ICInsider.com’s forecast of earnings for 2021-22 . At the close, Access Financial dropped 96 cents to $20.54 in exchanging 1,162 shares, Blue Power rallied 32 cents to $3.72, with an exchange of 4,300 shares. CAC 2000 spiked $1.58 to $12.10 in trading 8 stock units, Caribbean Assurance Brokers shed 9 cents to close at $1.91, with 21,950 shares clearing the market, Caribbean Cream popped 9 cents to $5.47, with the swapping of 10,261 units. Caribbean Flavours advanced 5 cents to $2.19, trading 3,913 stock units, Caribbean Producers gained 25 cents to end at $4.35 with the swapping of 497,682 units, Derrimon Trading fell 5 cents to $2.50 in exchanging 10,296,266 units. Dolphin Cove dropped 40 cents to $8 after 1,215 units crossed the market, Elite Diagnostic slipped 15 cents to $3, trading 11,001 units, Express Catering dropped 25 cents to $6.10 in exchanging 154,986 shares. Fosrich spiked 41 cents to $8.41 after trading 1,406 units, Future Energy Source gained 17 cents in ending at a 52 weeks’ high of $1.34, with 1,165,828 shares crossing the exchange, General Accident surged 43 cents to $5.68 with an exchange of 2,785 shares. GWest Corporation gained 19 cents ending at a 52 weeks’ high of $1.04 in an exchange of 59,289 units after the company posted audited accounts showing a small profit but with a large portion of income coming from revaluation gains on the investment property. Honey Bun dropped 15 cents to $6.85 after 67,279 units crossed the exchange, Indies Pharma rallied 30 cents to $3.55 in switching ownership of 17,910 units, Jamaican Teas fell 35 cents to $4.05 in trading 1,035,902 units, Jetcon Corporation shed 6 cents to $1.29 trading 2,500 shares.

At the close, Access Financial dropped 96 cents to $20.54 in exchanging 1,162 shares, Blue Power rallied 32 cents to $3.72, with an exchange of 4,300 shares. CAC 2000 spiked $1.58 to $12.10 in trading 8 stock units, Caribbean Assurance Brokers shed 9 cents to close at $1.91, with 21,950 shares clearing the market, Caribbean Cream popped 9 cents to $5.47, with the swapping of 10,261 units. Caribbean Flavours advanced 5 cents to $2.19, trading 3,913 stock units, Caribbean Producers gained 25 cents to end at $4.35 with the swapping of 497,682 units, Derrimon Trading fell 5 cents to $2.50 in exchanging 10,296,266 units. Dolphin Cove dropped 40 cents to $8 after 1,215 units crossed the market, Elite Diagnostic slipped 15 cents to $3, trading 11,001 units, Express Catering dropped 25 cents to $6.10 in exchanging 154,986 shares. Fosrich spiked 41 cents to $8.41 after trading 1,406 units, Future Energy Source gained 17 cents in ending at a 52 weeks’ high of $1.34, with 1,165,828 shares crossing the exchange, General Accident surged 43 cents to $5.68 with an exchange of 2,785 shares. GWest Corporation gained 19 cents ending at a 52 weeks’ high of $1.04 in an exchange of 59,289 units after the company posted audited accounts showing a small profit but with a large portion of income coming from revaluation gains on the investment property. Honey Bun dropped 15 cents to $6.85 after 67,279 units crossed the exchange, Indies Pharma rallied 30 cents to $3.55 in switching ownership of 17,910 units, Jamaican Teas fell 35 cents to $4.05 in trading 1,035,902 units, Jetcon Corporation shed 6 cents to $1.29 trading 2,500 shares.  KLE Group slipped 12 cents to $1.23, in an exchange of 78,285 units, Knutsford Express surged $1.71 to $8.75 after an exchange of 6,342 shares, Lasco Distributors dropped 16 cents to $3.95, trading 83,468 stock units, Lasco Financial dipped 9 cents to $3.24 after exchanging 54,873 stock units. Mailpac Group rose 5 cents to $3.90 with the swapping of 609,404 stock units, Main Event rallied 23 cents to $5.43 in exchanging 33,206 stock units, SSL Venture dipped 5 cents to 60 cents with an exchange of 7,000 stock units and Stationery and Office Supplies rose 40 cents to $8 after an exchange of 600 stocks.

KLE Group slipped 12 cents to $1.23, in an exchange of 78,285 units, Knutsford Express surged $1.71 to $8.75 after an exchange of 6,342 shares, Lasco Distributors dropped 16 cents to $3.95, trading 83,468 stock units, Lasco Financial dipped 9 cents to $3.24 after exchanging 54,873 stock units. Mailpac Group rose 5 cents to $3.90 with the swapping of 609,404 stock units, Main Event rallied 23 cents to $5.43 in exchanging 33,206 stock units, SSL Venture dipped 5 cents to 60 cents with an exchange of 7,000 stock units and Stationery and Office Supplies rose 40 cents to $8 after an exchange of 600 stocks. The JSE USD Equity Index fell 1.75 points to close at 193.78. The PE Ratio, a measure that determines an appropriate relative value of each stock, averaged 12 based on ICInsider.com’s forecast of 2021-22 earnings.

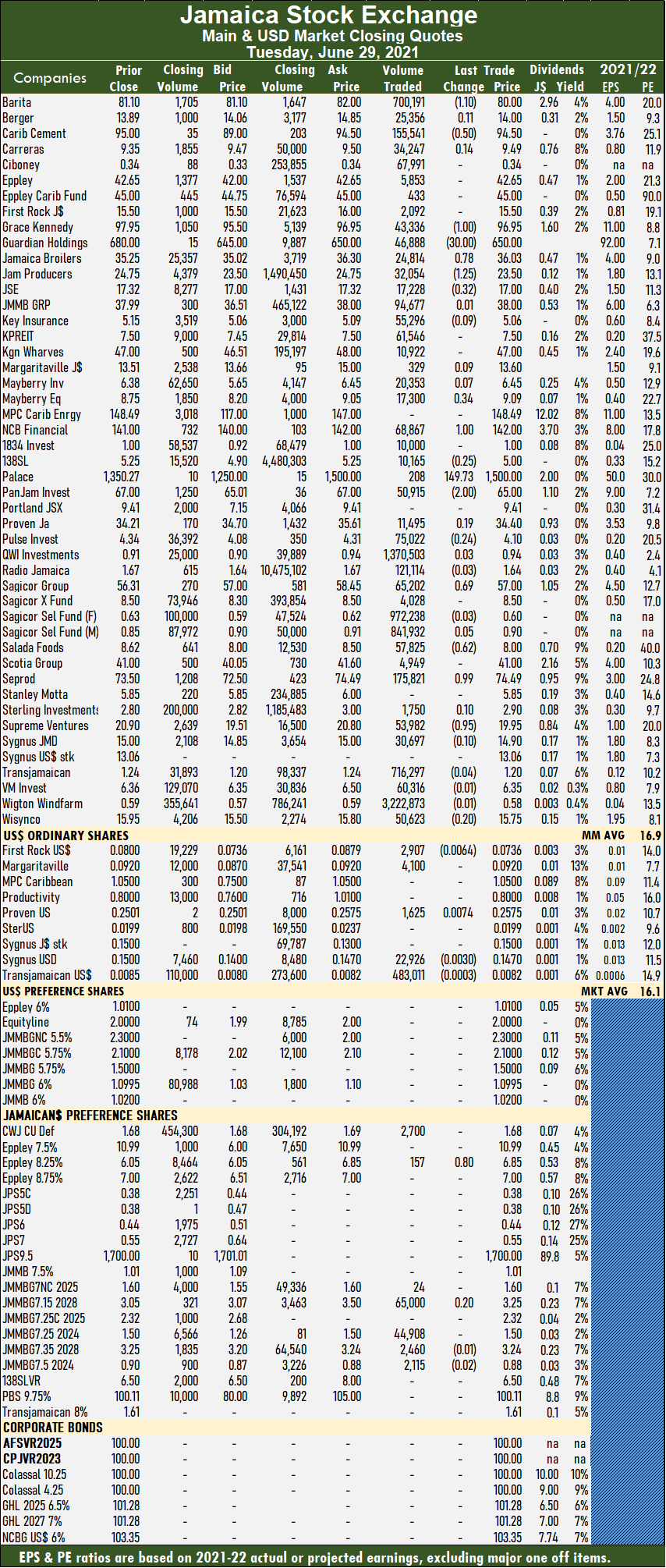

The JSE USD Equity Index fell 1.75 points to close at 193.78. The PE Ratio, a measure that determines an appropriate relative value of each stock, averaged 12 based on ICInsider.com’s forecast of 2021-22 earnings. At the close, First Rock Capital fell 0.64 of a cent to finish at 7.36 US cents with an exchange of 2,907 shares, Margaritaville remained at 9.2 US cents with 4,100 stocks traded, Proven Investments rose 0.74 of a cent to 25.75 US cents with 1,625 stock units changing hands. Sygnus Credit Investments slipped 0.3 of a cent to end at 14.7 US cents with a transfer of 22,926 shares and Transjamaican Highway declined by 0.03 of a cent to close at 0.82 US cents with 483,011 units changing hands.

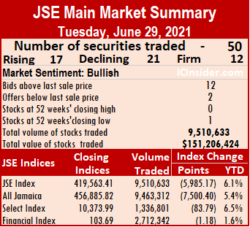

At the close, First Rock Capital fell 0.64 of a cent to finish at 7.36 US cents with an exchange of 2,907 shares, Margaritaville remained at 9.2 US cents with 4,100 stocks traded, Proven Investments rose 0.74 of a cent to 25.75 US cents with 1,625 stock units changing hands. Sygnus Credit Investments slipped 0.3 of a cent to end at 14.7 US cents with a transfer of 22,926 shares and Transjamaican Highway declined by 0.03 of a cent to close at 0.82 US cents with 483,011 units changing hands. Trading ended with 50 securities compared to 51 on Monday, with 17 rising, 21 declining and 12 remaining unchanged. The PE Ratio, a measure that determines an appropriate relative value stocks, averages 16.9 based on ICInsider.com’s forecast of 2021-22 earnings.

Trading ended with 50 securities compared to 51 on Monday, with 17 rising, 21 declining and 12 remaining unchanged. The PE Ratio, a measure that determines an appropriate relative value stocks, averages 16.9 based on ICInsider.com’s forecast of 2021-22 earnings. Investor’s Choice bid-offer indicator reading has 12 stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator reading has 12 stocks ending with bids higher than their last selling prices and two with lower offers. Seprod gained 99 cents to finish at $74.49 with the swapping of 175,821 shares, Supreme Ventures declined 95 cents in closing at $19.95 after an exchange of 53,982 stocks and Wisynco Group lost 20 cents to close at $15.75 in transferring 50,623 units.

Seprod gained 99 cents to finish at $74.49 with the swapping of 175,821 shares, Supreme Ventures declined 95 cents in closing at $19.95 after an exchange of 53,982 stocks and Wisynco Group lost 20 cents to close at $15.75 in transferring 50,623 units.