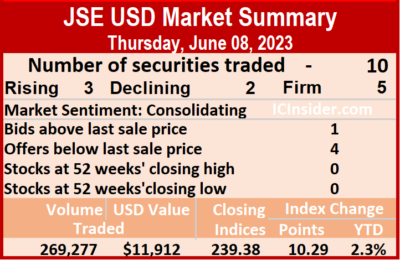

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks changing hands declining 64 percent but valued 13 percent more than on Wednesday, resulting in 10 securities traded, compared to eight on Wednesday with three rising, two declining and five ending unchanged.

A total of 269,277 shares were traded for US$11,912 compared with 757,348 units at US$10,500 on Wednesday.

A total of 269,277 shares were traded for US$11,912 compared with 757,348 units at US$10,500 on Wednesday.

Trading averaged 26,928 units at US$1,191 compared with 94,669 shares at US$1,312 on Wednesday, with a month to date average of 31,656 shares at US$1,273 compared with 32,970 units at US$1,296 on the previous day. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index rose 10.29 points to end at 238.38.

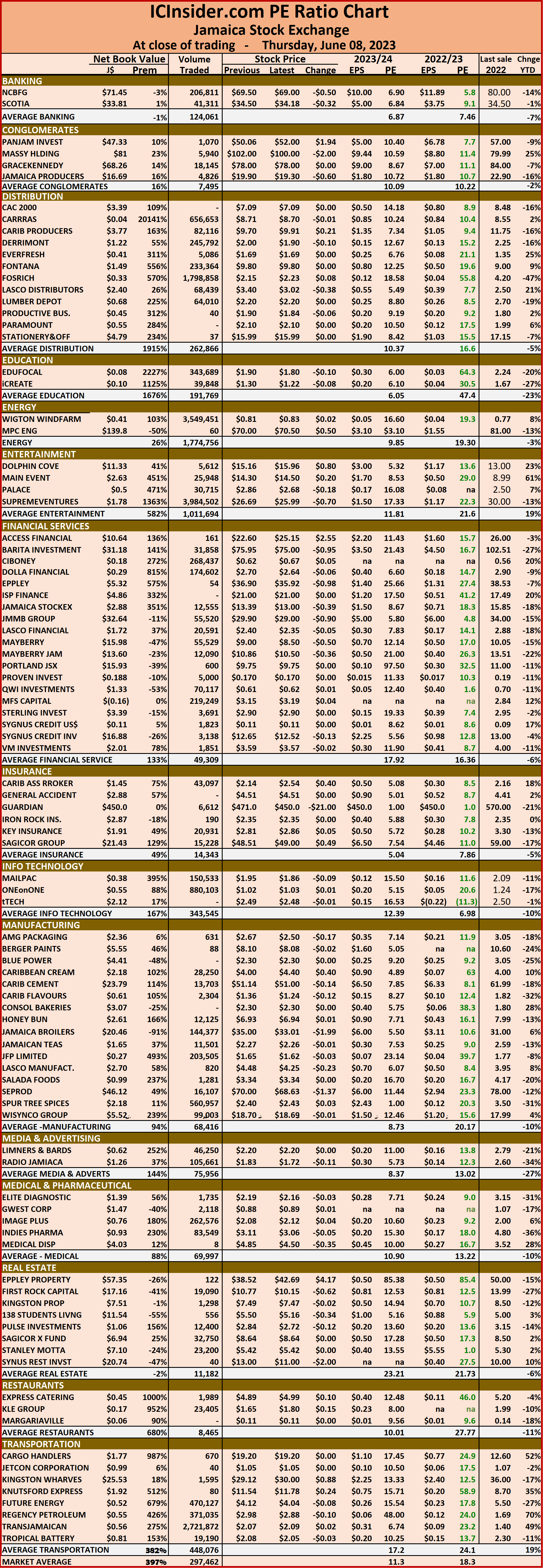

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio is computed based on the last traded price of each stock divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and four with lower offers.

At the close, First Rock Real Estate USD share remained at 5 US cents after 190,635 shares were traded, MPC Caribbean Clean Energy ended at 55 US cents with shareholders swapping 2 stocks, Productive Business Solutions declined 6.3 cents in closing at US$1.837 in an exchange of 40 units.  Proven Investments increased 0.01 of a cent and ended at 17 US cents with investors transferring 5,000 stock units, Sterling Investments popped 0.03 of a cent to close at 1.68 US cents after an exchange of 28,000 stocks, Sygnus Credit Investments remained at 11 US cents in switching ownership of 1,823 units. Sygnus Real Estate Finance USD share climbed 0.12 of a cent to close at 11.12 US cents with 1,550 shares clearing the market and Transjamaican Highway ended at 1.34 US cents with 42,181 shares changing hands.

Proven Investments increased 0.01 of a cent and ended at 17 US cents with investors transferring 5,000 stock units, Sterling Investments popped 0.03 of a cent to close at 1.68 US cents after an exchange of 28,000 stocks, Sygnus Credit Investments remained at 11 US cents in switching ownership of 1,823 units. Sygnus Real Estate Finance USD share climbed 0.12 of a cent to close at 11.12 US cents with 1,550 shares clearing the market and Transjamaican Highway ended at 1.34 US cents with 42,181 shares changing hands.

In the preference segment, Eppley 6% preference share remained at US$1.40 after a transfer of one stock and JMMB Group 6% dipped 1 cent in closing at US$1.19 after an exchange of 45 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD Market rises

Slim trading in JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with an 82 percent fall in the volume of stocks changing hands after a minute decline in value compared with trading on Monday, resulting in 10 securities traded, compared to eight on Monday with three rising, two declining and five ending unchanged.

Overall, 26,137 shares were traded for US$3,700 compared to 144,256 units at US$3,922 on Monday.

Overall, 26,137 shares were traded for US$3,700 compared to 144,256 units at US$3,922 on Monday.

Trading averaged 2,614 shares at US$370 down from 18,032 units at US$490 on Monday, with the month to date averaging 15,341 shares at US$1,303 compared with 22,412 units at US$1,821 on the previous day. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index popped 7.14 points to 241.46.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and three with lower offers.

In trading, First Rock Real Estate USD share ended at 5 US cents after 15,226 shares were traded, Productive Business Solutions popped 1 cent in closing at US$1.86 while exchanging 10 stocks, Proven Investments dipped 0.5 of a cent to close at 16.5 US cents with investors trading 300 units,  Investors exchanged 9,594 shares of Sterling Investments at 1.68 US cents. Sygnus Credit Investments popped 1.03 cents to 11.03 US cents in swapping 330 stocks, Sygnus Real Estate Finance USD share closed at 11 US cents with an exchange of 107 units and Transjamaican Highway rallied 0.05 of a cent to close at 1.25 US cents in an exchange of 364 stock units.

Investors exchanged 9,594 shares of Sterling Investments at 1.68 US cents. Sygnus Credit Investments popped 1.03 cents to 11.03 US cents in swapping 330 stocks, Sygnus Real Estate Finance USD share closed at 11 US cents with an exchange of 107 units and Transjamaican Highway rallied 0.05 of a cent to close at 1.25 US cents in an exchange of 364 stock units.

In the preference segment, Productive Business 9.25% preference share shed 65 cents in closing at US$12.50 after 200 shares were traded, Eppley 6% preference share ended at US$1.40 after a transfer of 1 share and JMMB Group 5.75% ended at US$1.90 in an exchange of 5 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading slips on the JSE USD market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks changing hands rising 29 percent but with an 85 percent drop in value compared with that on Friday and resulted in eight securities trading, compared to seven on Friday with three rising, one declining and four ending unchanged.

A total of 144,256 shares were traded for US$3,922 compared with 112,013 units at US$25,887 on Friday.

A total of 144,256 shares were traded for US$3,922 compared with 112,013 units at US$25,887 on Friday.

Trading averaged 18,032 shares at US$490 compared with 16,002 units at US$3,698 on Friday, with a month to date average of 22,412 shares at US$1,821 compared to 25,916 units at US$2,885 on the previous day. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index slipped 3.84 points to end at 234.33.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.8. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share remained at 5 US cents as 3,324 shares passed through the market,  Productive Business Solutions climbed 0.50 of one cent to US$1.85 in an exchange of 49 stocks, Proven Investments advanced 0.9 of a cent and ended at 17 US cents in exchanging 9,000 stocks, Sygnus Credit Investments ended at 10 US cents in switching ownership of 1,749 units and Transjamaican Highway dipped 0.2 of a cent in closing at 1.2 US cents with 130,011 shares crossing the market.

Productive Business Solutions climbed 0.50 of one cent to US$1.85 in an exchange of 49 stocks, Proven Investments advanced 0.9 of a cent and ended at 17 US cents in exchanging 9,000 stocks, Sygnus Credit Investments ended at 10 US cents in switching ownership of 1,749 units and Transjamaican Highway dipped 0.2 of a cent in closing at 1.2 US cents with 130,011 shares crossing the market.

In the preference segment, Productive Business 9.25% preference share rallied 65 cents to end at US$13.15, with 15 stock units crossing the market, Eppley 6% preference share remained at US$1.40, with 4 units changing hands and JMMB Group 5.75% ended at US$1.90 in an exchange of 104 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

At the close of trading, the JSE Combined Market Index dropped 3,572.73 points to 342,592.8, the All Jamaican Composite Index dived 4,628.88 points to 363,894.60, the JSE Main Index plunged 3,811.14 points to 329,820.27, the Junior Market Index dipped 1.81 points to settle at 3,806.88 and the JSE USD Market Index rose 9.27 points to close at 238,86.

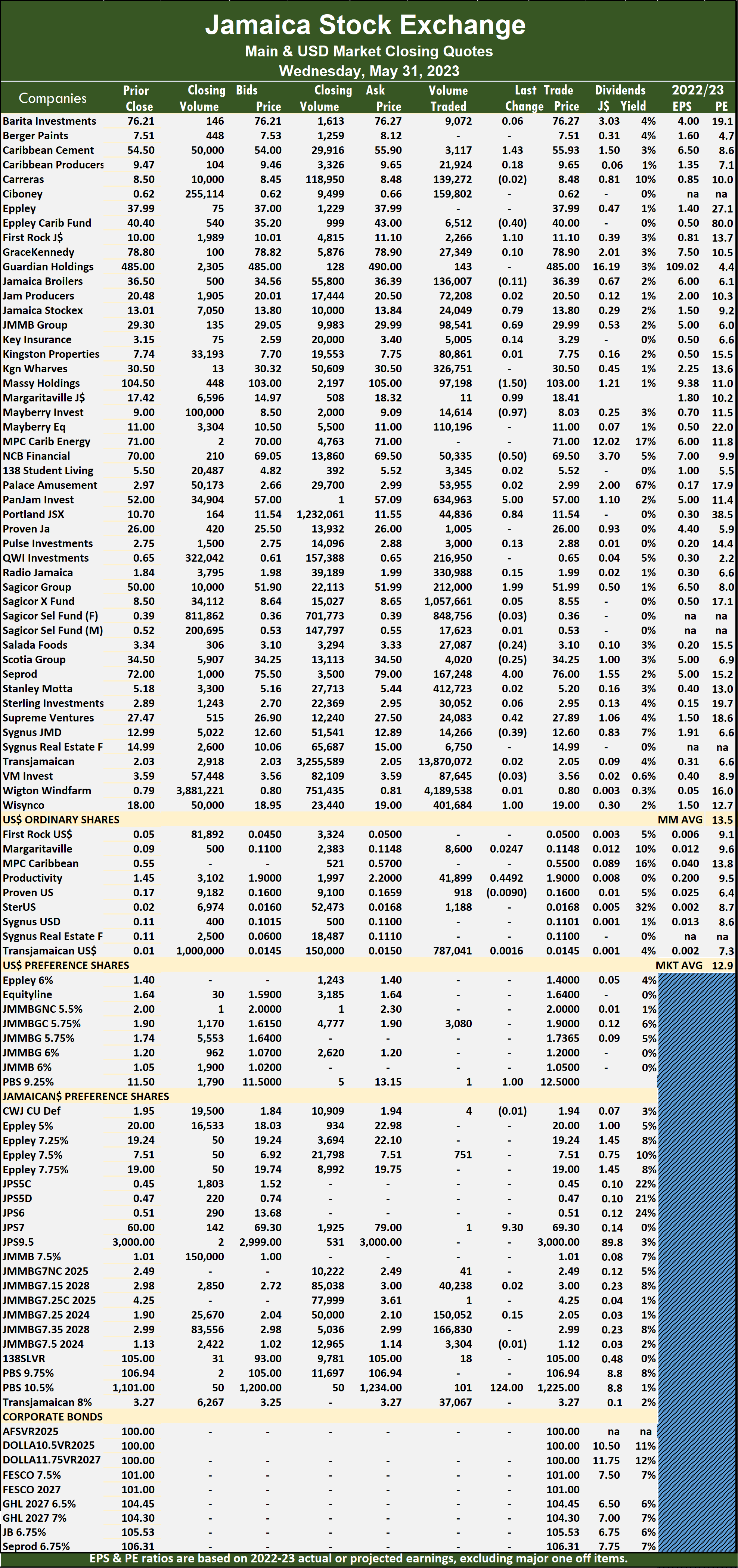

At the close of trading, the JSE Combined Market Index dropped 3,572.73 points to 342,592.8, the All Jamaican Composite Index dived 4,628.88 points to 363,894.60, the JSE Main Index plunged 3,811.14 points to 329,820.27, the Junior Market Index dipped 1.81 points to settle at 3,806.88 and the JSE USD Market Index rose 9.27 points to close at 238,86. The market’s PE ratio ended at 18.3 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading.

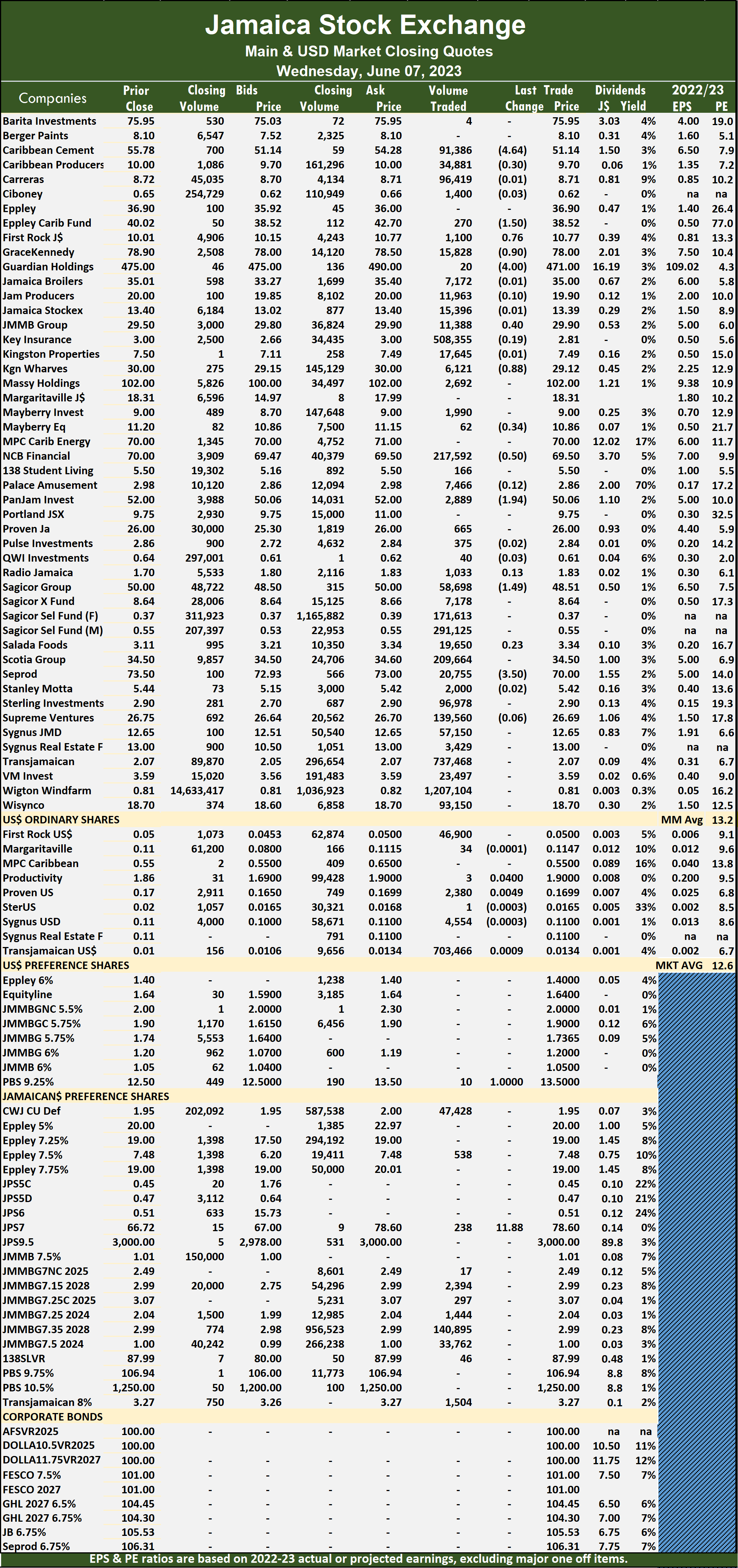

The market’s PE ratio ended at 18.3 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading. Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

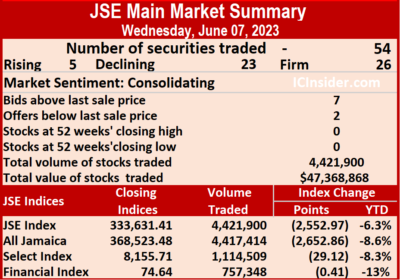

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company. Trading occurred in 54 securities down from 57 on Tuesday, with five rising, 23 declining and 26 left unchanged.

Trading occurred in 54 securities down from 57 on Tuesday, with five rising, 23 declining and 26 left unchanged. The All Jamaican Composite Index dipped 2,652.86 points to end trading at 368,523.48, the JSE Main Index shed 2,552.97 points to close at 333,631.41 and the JSE Financial Index dropped 0.41 points to 74.64.

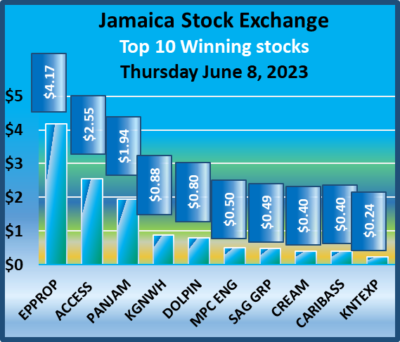

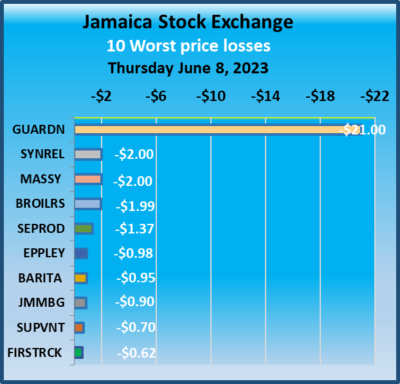

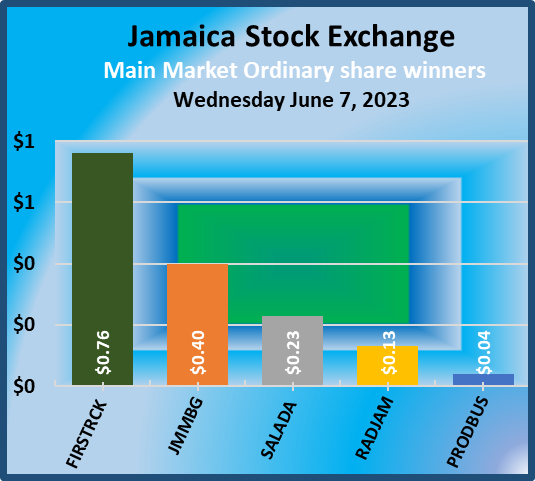

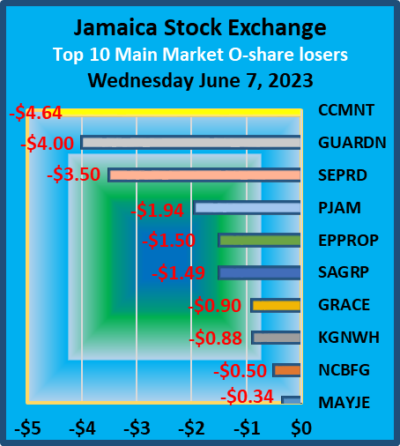

The All Jamaican Composite Index dipped 2,652.86 points to end trading at 368,523.48, the JSE Main Index shed 2,552.97 points to close at 333,631.41 and the JSE Financial Index dropped 0.41 points to 74.64. First Rock Real Estate gained 76 cents to close at $10.77 after 1,100 shares were traded. GraceKennedy shed 90 cents in closing at $78, with 15,828 stocks changing hands, Guardian Holdings fell $4 to $471 in switching ownership of 20 shares. JMMB Group increased 40 cents to close at $29.90, with 11,388 units crossing the market, Kingston Wharves dropped 88 cents and ended at $29.12 in an exchange of 6,121 stock units, Mayberry Jamaican Equities dipped 34 cents to $10.86 with 62 units clearing the market. NCB Financial declined 50 cents in closing at $69.50 after 217,592 stock units were traded, Pan Jamaica Group lost $1.94 to close at $50.06 with an exchange of 2,889 shares, Sagicor Group shed $1.49 and ended at $48.51 while exchanging 58,698 stocks and Seprod fell $3.50 to end at $70 after exchanging 20,755 units.

First Rock Real Estate gained 76 cents to close at $10.77 after 1,100 shares were traded. GraceKennedy shed 90 cents in closing at $78, with 15,828 stocks changing hands, Guardian Holdings fell $4 to $471 in switching ownership of 20 shares. JMMB Group increased 40 cents to close at $29.90, with 11,388 units crossing the market, Kingston Wharves dropped 88 cents and ended at $29.12 in an exchange of 6,121 stock units, Mayberry Jamaican Equities dipped 34 cents to $10.86 with 62 units clearing the market. NCB Financial declined 50 cents in closing at $69.50 after 217,592 stock units were traded, Pan Jamaica Group lost $1.94 to close at $50.06 with an exchange of 2,889 shares, Sagicor Group shed $1.49 and ended at $48.51 while exchanging 58,698 stocks and Seprod fell $3.50 to end at $70 after exchanging 20,755 units. In the preference segment, Jamaica Public Service 7% preference share rallied $11.88 in closing at $78.60 with investors transferring 238 stocks.

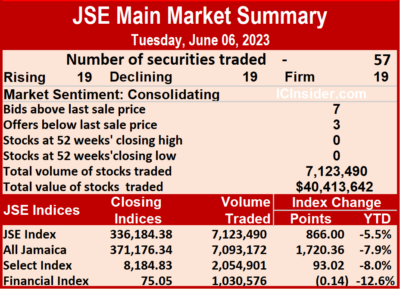

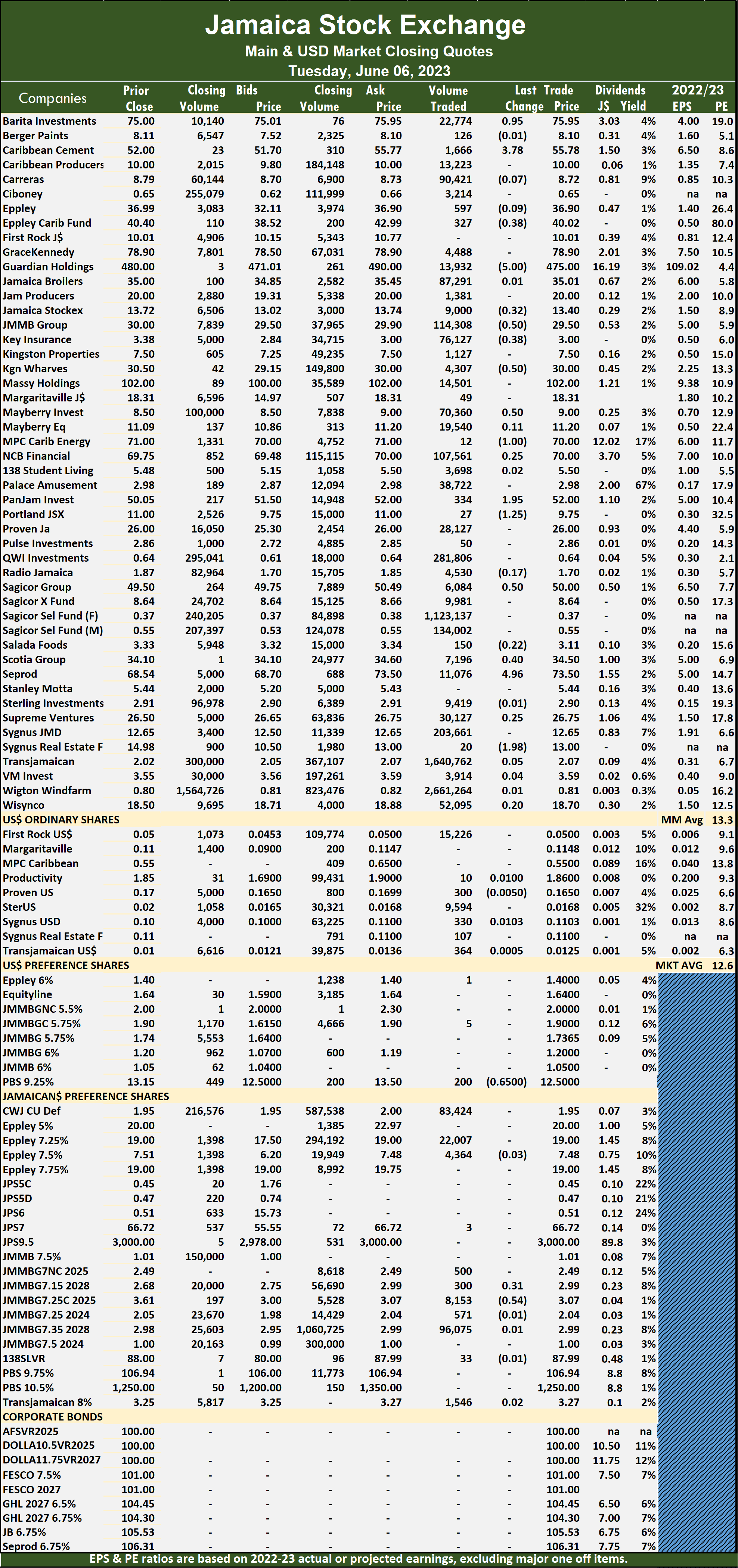

In the preference segment, Jamaica Public Service 7% preference share rallied $11.88 in closing at $78.60 with investors transferring 238 stocks. A total of 7,123,490 shares were traded for $40,413,642 compared to 9,529,184 units at $38,472,860 on Monday.

A total of 7,123,490 shares were traded for $40,413,642 compared to 9,529,184 units at $38,472,860 on Monday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

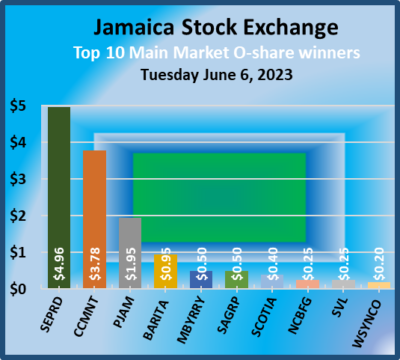

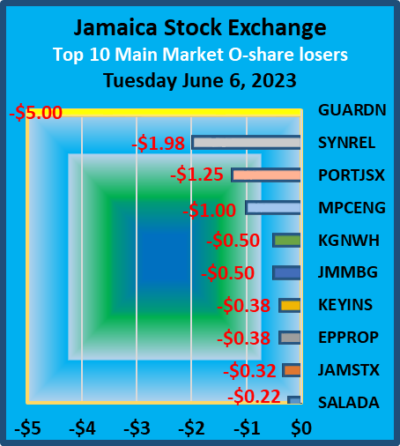

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. JMMB Group fell 50 cents to end at $29.50, with 114,308 units changing hands, Key Insurance declined 38 cents and ended at $3, with 76,127 stocks crossing the exchange, Kingston Wharves dipped 50 cents to $30 with a transfer of 4,307 stocks, Mayberry Investments gained 50 cents to close at $9 with an exchange of 70,360 shares, MPC Caribbean Clean Energy fell $1 in closing at $70 with investors trading 12 stock units, Pan Jamaica Group rallied $1.95 to close at $52 after an exchange of 334 units, Portland JSX lost $1.25 to end at $9.75 as 27 stocks passed through the market, Sagicor Group rose 50 cents in closing at $50 and closed with an exchange of 6,084 shares, Scotia Group popped 40 cents to $34.50 while 7,196 units were traded, Seprod rose $4.96 and ended at $73.50 in switching ownership of 11,076 stock units and Sygnus Real Estate Finance dipped $1.98 to $13 in trading 20 stocks.

JMMB Group fell 50 cents to end at $29.50, with 114,308 units changing hands, Key Insurance declined 38 cents and ended at $3, with 76,127 stocks crossing the exchange, Kingston Wharves dipped 50 cents to $30 with a transfer of 4,307 stocks, Mayberry Investments gained 50 cents to close at $9 with an exchange of 70,360 shares, MPC Caribbean Clean Energy fell $1 in closing at $70 with investors trading 12 stock units, Pan Jamaica Group rallied $1.95 to close at $52 after an exchange of 334 units, Portland JSX lost $1.25 to end at $9.75 as 27 stocks passed through the market, Sagicor Group rose 50 cents in closing at $50 and closed with an exchange of 6,084 shares, Scotia Group popped 40 cents to $34.50 while 7,196 units were traded, Seprod rose $4.96 and ended at $73.50 in switching ownership of 11,076 stock units and Sygnus Real Estate Finance dipped $1.98 to $13 in trading 20 stocks. In the preference segment, JMMB Group 7.15% due 2028, popped 31 cents and ended at $2.99 in an exchange of 300 stocks and JMMB Group 7.25% preference share shed 54 cents to end at $3.07 as investors exchanged 8,153 shares.

In the preference segment, JMMB Group 7.15% due 2028, popped 31 cents and ended at $2.99 in an exchange of 300 stocks and JMMB Group 7.25% preference share shed 54 cents to end at $3.07 as investors exchanged 8,153 shares. A total of 9,529,184 shares were traded for $38,472,860 compared with 24,040,809 units at $81,535,879 on Friday.

A total of 9,529,184 shares were traded for $38,472,860 compared with 24,040,809 units at $81,535,879 on Friday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

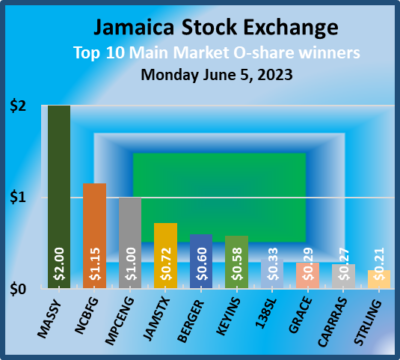

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. MPC Caribbean Clean Energy rallied $1 to $71 in an exchange of 84 stocks. NCB Financial rose $1.15 to $69.75 with 40,595 stock units changing hands, 138 Student Living rallied 33 cents to $5.48 as investors traded 1,033 units, Pan Jamaica Group lost $4.04 in closing at $50.05 after 2,252 shares were traded, Sagicor Group shed $1 to end $49.50, with 16,683 stocks changing hands. Scotia Group dropped 65 cents to end at $34.10, with 36,625 stock units crossing the market, Seprod shed $1.46 to close at $68.54 with a transfer of 22,768 units, Supreme Ventures declined 30 cents to $26.50 as 111,196 shares passed through the market and Wisynco Group lost 39 cents and ended at $18.50 in switching ownership of 6,227 shares.

MPC Caribbean Clean Energy rallied $1 to $71 in an exchange of 84 stocks. NCB Financial rose $1.15 to $69.75 with 40,595 stock units changing hands, 138 Student Living rallied 33 cents to $5.48 as investors traded 1,033 units, Pan Jamaica Group lost $4.04 in closing at $50.05 after 2,252 shares were traded, Sagicor Group shed $1 to end $49.50, with 16,683 stocks changing hands. Scotia Group dropped 65 cents to end at $34.10, with 36,625 stock units crossing the market, Seprod shed $1.46 to close at $68.54 with a transfer of 22,768 units, Supreme Ventures declined 30 cents to $26.50 as 111,196 shares passed through the market and Wisynco Group lost 39 cents and ended at $18.50 in switching ownership of 6,227 shares. In the preference segment, Jamaica Public Service 7% fell $11.78 to close at $66.72 with investors transferring 191 stock units and JMMB Group 7.15% due 2028, dipped 32 cents in closing at $2.68 after an exchange of 20,041 units.

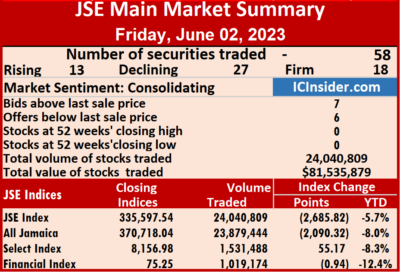

In the preference segment, Jamaica Public Service 7% fell $11.78 to close at $66.72 with investors transferring 191 stock units and JMMB Group 7.15% due 2028, dipped 32 cents in closing at $2.68 after an exchange of 20,041 units. A total of 24,040,809 shares changed hands amounting to $81,535,879 up from 8,887,886 units at $52,849,273 on Thursday.

A total of 24,040,809 shares changed hands amounting to $81,535,879 up from 8,887,886 units at $52,849,273 on Thursday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. JMMB Group advanced $1.24 to close at $29.99 in an exchange of 4,998 stocks, Key Insurance dipped 49 cents to $2.80, with 24,924 shares changing hands, Massy Holdings lost $4.50 to end at $100 after an exchange of 105,204 stock units, MPC Caribbean Clean Energy fell $1 to $70 in switching ownership of 6 shares, NCB Financial lost $1.39 in closing at $68.60 with shareholders swapping 124,916 units, 138 Student Living dipped 36 cents to close at $5.15 after an exchange of 4,229 stocks, Pan Jamaica Group declined $2.90 ended at $54.09 while 12,829 units were exchanged, Portland JSX shed 54 cents to close at $11 with a transfer of 1,603 shares, Sagicor Group climbed $2.25 to end at $50.50 with an exchange of 8,854 stock units and Stanley Motta popped 30 cents to $5.40, with 15,163 stocks crossing the market.

JMMB Group advanced $1.24 to close at $29.99 in an exchange of 4,998 stocks, Key Insurance dipped 49 cents to $2.80, with 24,924 shares changing hands, Massy Holdings lost $4.50 to end at $100 after an exchange of 105,204 stock units, MPC Caribbean Clean Energy fell $1 to $70 in switching ownership of 6 shares, NCB Financial lost $1.39 in closing at $68.60 with shareholders swapping 124,916 units, 138 Student Living dipped 36 cents to close at $5.15 after an exchange of 4,229 stocks, Pan Jamaica Group declined $2.90 ended at $54.09 while 12,829 units were exchanged, Portland JSX shed 54 cents to close at $11 with a transfer of 1,603 shares, Sagicor Group climbed $2.25 to end at $50.50 with an exchange of 8,854 stock units and Stanley Motta popped 30 cents to $5.40, with 15,163 stocks crossing the market. In the preference segment, Productive Business 10.50% preference share rose $25 to $1250 as investors exchanged 300 stocks, JMMB Group 7.25% preference share fell 64 cents to close at $3.61 in an exchange of 12,880 stock units and 138 Student Living preference share dropped $1.25 to end at $88 with 83 shares clearing the market.

In the preference segment, Productive Business 10.50% preference share rose $25 to $1250 as investors exchanged 300 stocks, JMMB Group 7.25% preference share fell 64 cents to close at $3.61 in an exchange of 12,880 stock units and 138 Student Living preference share dropped $1.25 to end at $88 with 83 shares clearing the market. A total of 8,887,886 shares were traded for $52,849,273 compared to 4,443,891 units at $149,369,888 on Wednesday.

A total of 8,887,886 shares were traded for $52,849,273 compared to 4,443,891 units at $149,369,888 on Wednesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

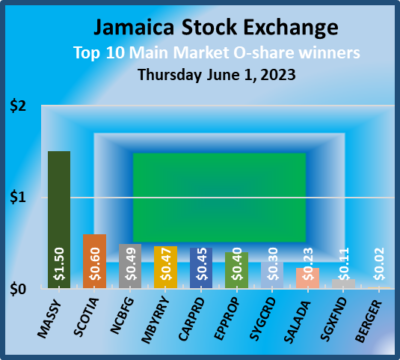

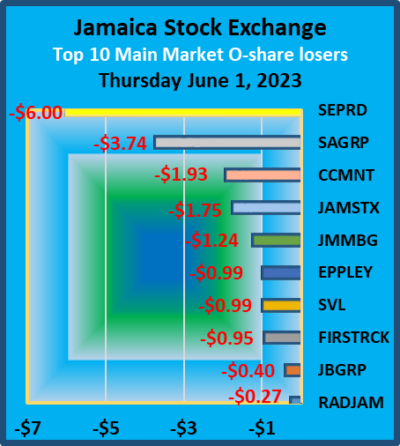

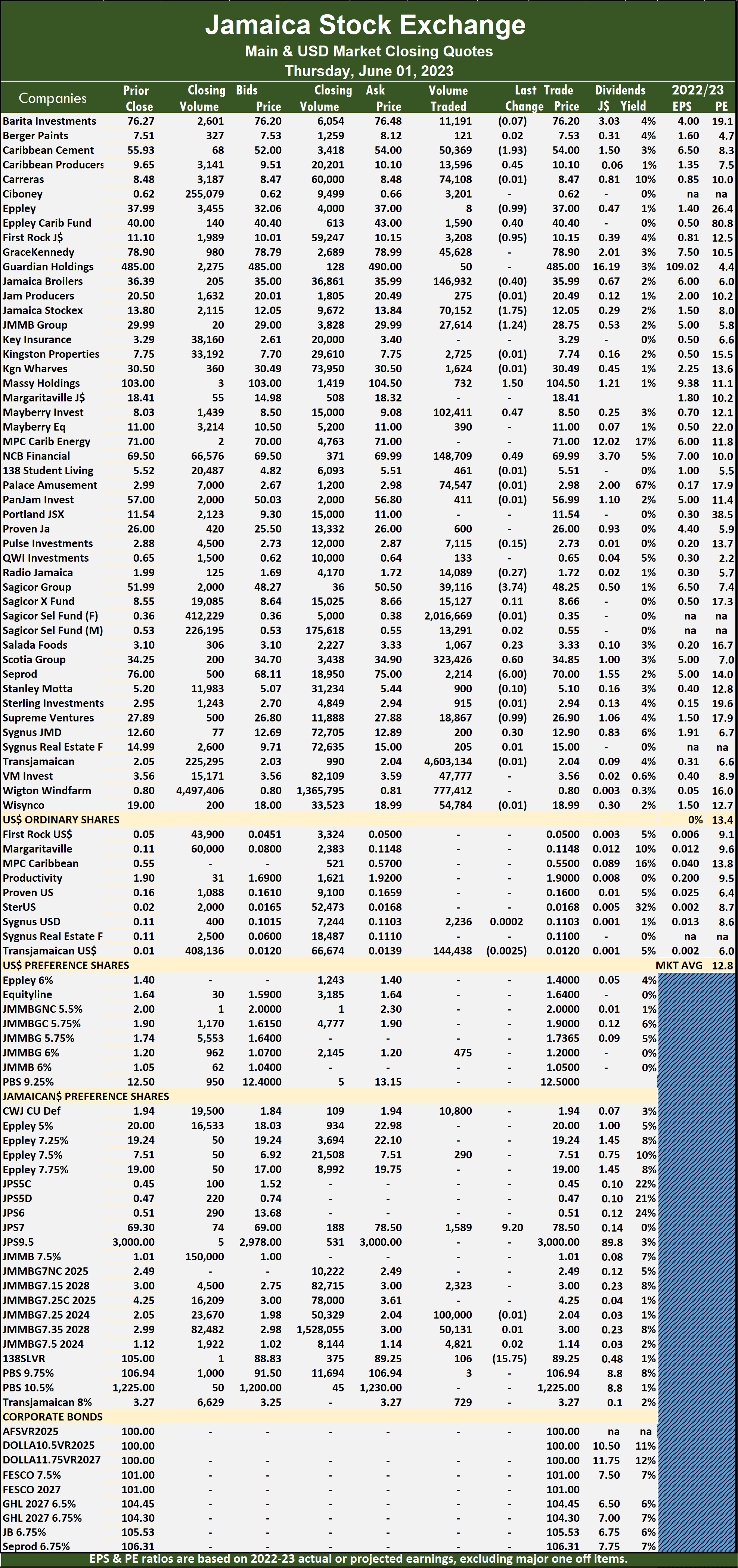

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Massy Holdings climbed $1.50 to $104.50 with investors transferring 732 shares. Mayberry Investments rallied 47 cents to end at $8.50, with 102,411 units crossing the market, NCB Financial popped 49 cents to $69.99 as 148,709 stock units passed through the market, Sagicor Group dipped $3.74 and ended at $48.25 after investors ended trading of 39,116 stocks. Scotia Group advanced 60 cents to close at $34.85 while exchanging 323,426 shares, Seprod declined $6 to $70 with an exchange of 2,214 units, Supreme Ventures fell 99 cents to end at $26.90 with shareholders swapping 18,867 stock units and Sygnus Credit Investments rallied 30 cents to $12.90 with a transfer of 200 stocks.

Massy Holdings climbed $1.50 to $104.50 with investors transferring 732 shares. Mayberry Investments rallied 47 cents to end at $8.50, with 102,411 units crossing the market, NCB Financial popped 49 cents to $69.99 as 148,709 stock units passed through the market, Sagicor Group dipped $3.74 and ended at $48.25 after investors ended trading of 39,116 stocks. Scotia Group advanced 60 cents to close at $34.85 while exchanging 323,426 shares, Seprod declined $6 to $70 with an exchange of 2,214 units, Supreme Ventures fell 99 cents to end at $26.90 with shareholders swapping 18,867 stock units and Sygnus Credit Investments rallied 30 cents to $12.90 with a transfer of 200 stocks. In the preference segment, Jamaica Public Service 7% advanced $9.20 and ended at $78.50 after a transfer of 1,589 units and 138 Student Living preference share shed $15.75 to close at $89.25 with 106 stock units clearing the market.

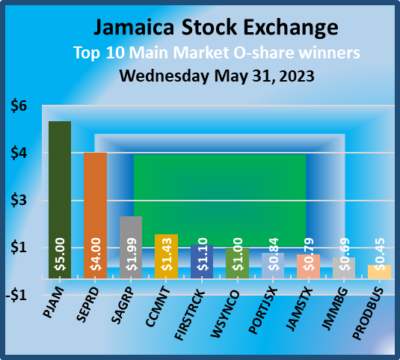

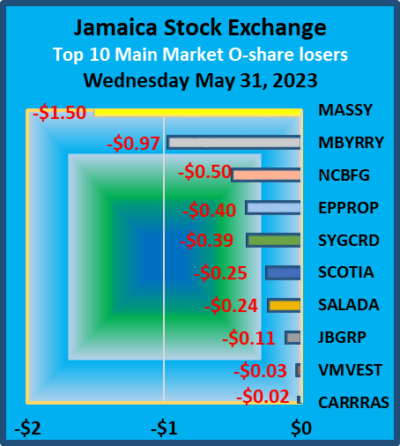

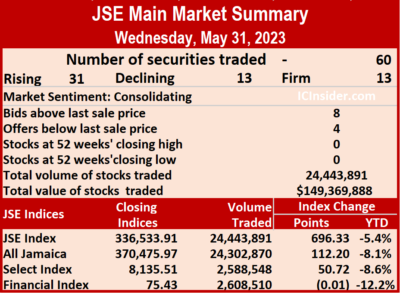

In the preference segment, Jamaica Public Service 7% advanced $9.20 and ended at $78.50 after a transfer of 1,589 units and 138 Student Living preference share shed $15.75 to close at $89.25 with 106 stock units clearing the market. A total of 24,443,891 shares were traded for $149,369,888 compared to 8,501,678 units at $53,413,585 on Tuesday.

A total of 24,443,891 shares were traded for $149,369,888 compared to 8,501,678 units at $53,413,585 on Tuesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Margaritaville rose 99 cents to close at $18.41 with shareholders swapping 11 stocks, Massy Holdings dipped $1.50 and ended at $103 while exchanging 97,198 stock units. Mayberry Investments shed 97 cents to close at $8.03 after exchanging 14,614 shares, NCB Financial lost 50 cents in closing at $69.50 with investors trading 50,335 shares, Pan Jamaica Group climbed $5 to $57 with 634,963 stocks crossing the exchange, Portland JSX increased 84 cents to $11.54 after 44,836 stock units passed through the market, Sagicor Group gained $1.99 in closing at $51.99, with 212,000 units crossing the market, Seprod rallied $4 to $76 in an exchange of 167,248 units, Supreme Ventures advanced 42 cents to end at $27.89 with 24,083 shares clearing the market, Sygnus Credit Investments fell 39 cents to close at $12.60 with a transfer of 14,266 stocks and Wisynco Group climbed $1 to close at $19, with 401,684 stock units crossing the market.

Margaritaville rose 99 cents to close at $18.41 with shareholders swapping 11 stocks, Massy Holdings dipped $1.50 and ended at $103 while exchanging 97,198 stock units. Mayberry Investments shed 97 cents to close at $8.03 after exchanging 14,614 shares, NCB Financial lost 50 cents in closing at $69.50 with investors trading 50,335 shares, Pan Jamaica Group climbed $5 to $57 with 634,963 stocks crossing the exchange, Portland JSX increased 84 cents to $11.54 after 44,836 stock units passed through the market, Sagicor Group gained $1.99 in closing at $51.99, with 212,000 units crossing the market, Seprod rallied $4 to $76 in an exchange of 167,248 units, Supreme Ventures advanced 42 cents to end at $27.89 with 24,083 shares clearing the market, Sygnus Credit Investments fell 39 cents to close at $12.60 with a transfer of 14,266 stocks and Wisynco Group climbed $1 to close at $19, with 401,684 stock units crossing the market. In the preference segment, Productive Business 10.50% preference share popped $124 to $1225 in an exchange of 101 stocks and Jamaica Public Service 7% increased by $9.30 and ended at $69.30 with one stock unit changing hands.

In the preference segment, Productive Business 10.50% preference share popped $124 to $1225 in an exchange of 101 stocks and Jamaica Public Service 7% increased by $9.30 and ended at $69.30 with one stock unit changing hands.