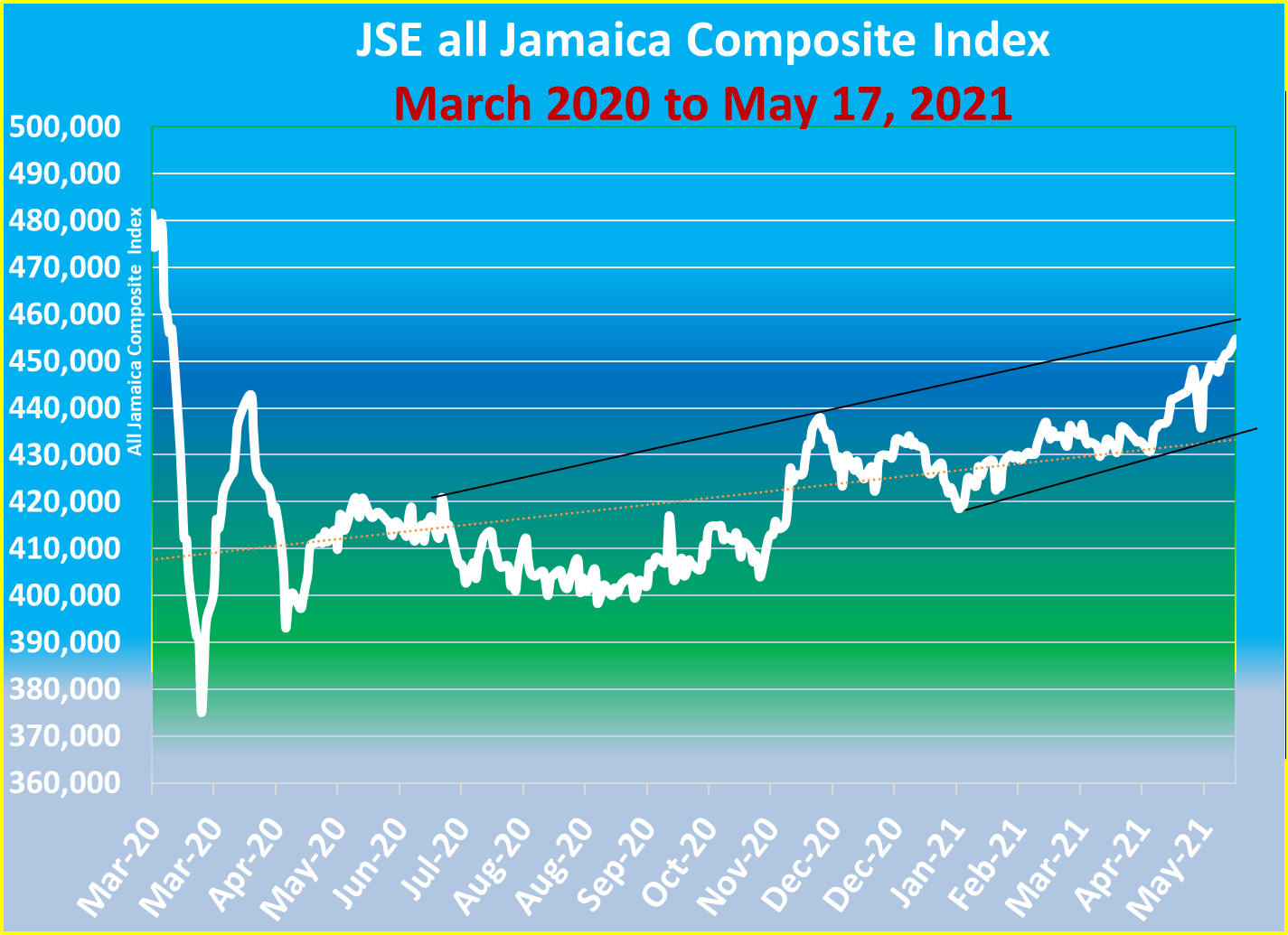

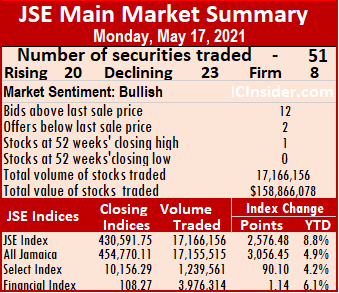

Market activity pushed the All Jamaican Composite Index up 4,686 points in the early morning session to just over 456,400 points and close to resistance level on Monday and the market managed to hold on 3,056.45 points at the close to end at 454,770.11, on the Main Market of Jamaica Stock Exchange, at the same time, the Main Index rose 2,576.48 points to 430,591.75, and the JSE Financial Index gained 1.14 points to settle at 108.27.

At the close, 51 securities traded, up from 49 on Friday, with 20 rising, 23 declining and eight ending unchanged. The PE Ratio averages 16.2 based on ICInsider.com forecast of 2021-22 earnings.

At the close, 51 securities traded, up from 49 on Friday, with 20 rising, 23 declining and eight ending unchanged. The PE Ratio averages 16.2 based on ICInsider.com forecast of 2021-22 earnings.

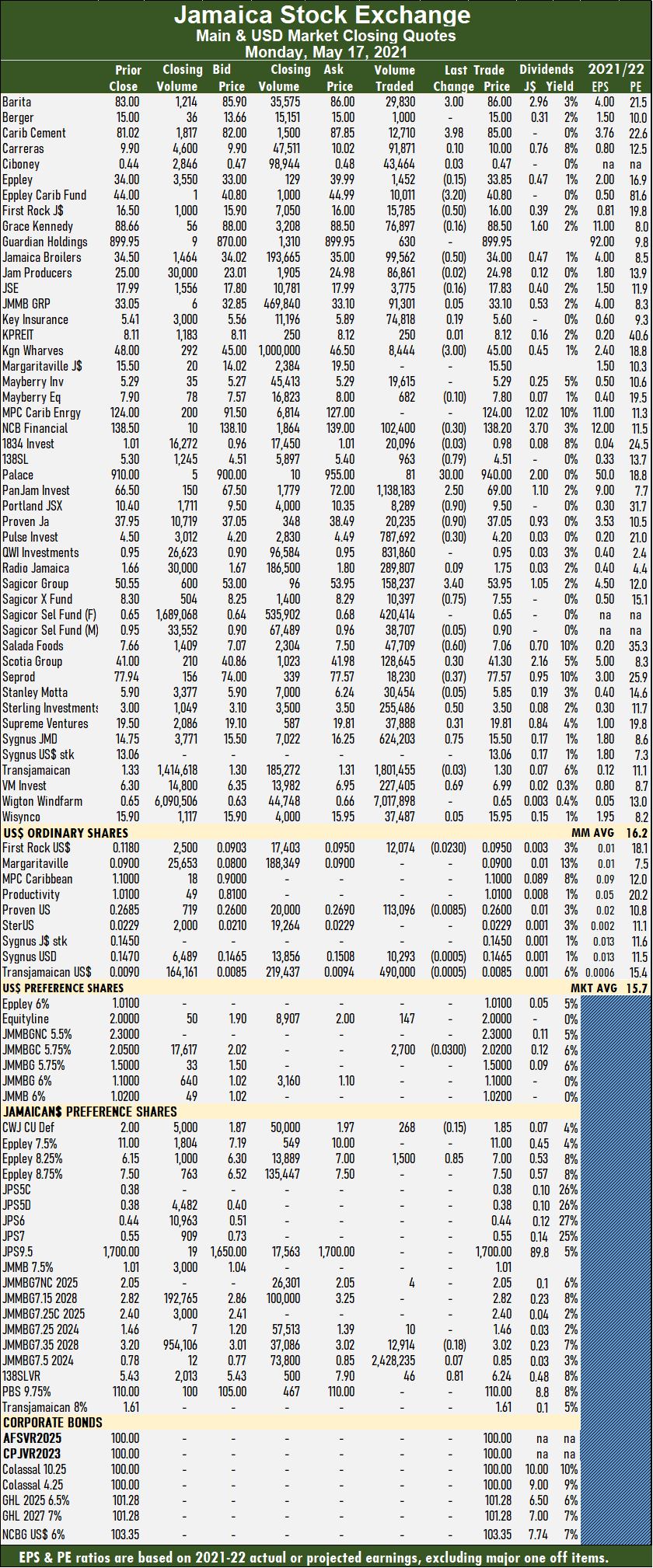

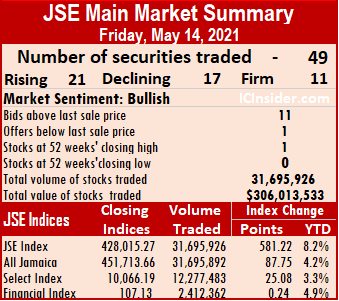

The volume and values of shares traded, fell 46 percent and 48 percent respectively compared to Friday levels, as 17,166,156 shares changed hands for $158,866,078 versus 31,695,926 units at $306,013,533 on Friday. Wigton Windfarm led trading with 40.9 percent of total volume, with 7 million shares followed by JMMB Group 7.5% took 14.1 percent of the market, with 2.43 million units, Transjamaican Highway accounted for 10.5 percent with 1.80 million units and Pan Jam Investment with 7.4 percent after 1.14 million units changed hands.

Trading averaged 336,591 units at $3,115,021, compared to 646,856 shares at $6,245,174 on Friday. Trading month to date averages 325,653 units at $3,484,171, in contrast to 324,542 units at $3,521,674 on Friday. April averaged 234,200 units at $1,772,561.

Investor’s Choice bid-offer indicator reading has 12 stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator reading has 12 stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments advanced $3 to $86, trading 29,830 units, Caribbean Cement climbed $3.98 to $85 with 12,710 stocks changing hands, Eppley Caribbean Property Fund declined $3.20 to end at $40.80, with 10,011 shares clearing the market. First Rock Capital shed 50 cents to end at $16 with an exchange of 15,785 stock units, Jamaica Broilers closed 50 cents lower at $34 with 99,562 units crossing the market, Kingston Wharves declined $3 to $45 in transferring 8,444 shares, NCB Financial Group lost 30 cents to end at $138.20 in exchanging 102,400 stocks, 138 Student Living shed 79 cents to close at $4.51 with 963 stock units crossing the exchange, Palace Amusement climbed $30 to $940 in switching ownership of 81 units, PanJam Investment rose $2.50 to close at $69 with 1,138,183 shares changing hands. Portland JSX skidded 90 cents to $9.50 trading 8,289 stock units, Proven Investments ended 90 cents lower at $37.05 in an exchange of 20,235 shares, Pulse Investments lost 30 cents in closing at $4.20 with the swapping of 787,692 shares. Sagicor Group advanced $3.40 to $53.95, with 158,237 units crossing the market, Sagicor Real Estate Fund shed 75 cents to end at $7.55 in an exchange of 10,397 stocks. Salada Foods slipped 60 cents to $7.06 with a transfer of 47,709 shares, Scotia Group gained 30 cents to end at $41.30 in exchanging 128,645 stocks. Seprod fell 37 cents to close at $77.57 in switching ownership of 18,230 units, Sterling Investments rose 50 cents in closing at $3.50 with 255,486 stock units changing hands.  Supreme Ventures gained 31 cents to settle at $19.81 in switching ownership of 37,888 units, Sygnus Credit Investments closed 75 cents higher at $15.50 in the swapping of 624,203 stock units and Victoria Mutual Investments rose 69 cents to $6.99 after an exchange of 227,405 units.

Supreme Ventures gained 31 cents to settle at $19.81 in switching ownership of 37,888 units, Sygnus Credit Investments closed 75 cents higher at $15.50 in the swapping of 624,203 stock units and Victoria Mutual Investments rose 69 cents to $6.99 after an exchange of 227,405 units.

In the preference segment, 138 Student Living Preference share advanced 81 cents in closing at $6.24 after exchanging 46 shares and Eppley 8.25% gained 85 cents to end at $7 in transferring 1,500 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

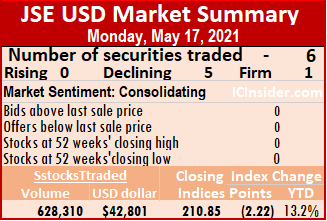

Six securities traded, similar to Friday, with five stocks, declining and one remaining unchanged.

Six securities traded, similar to Friday, with five stocks, declining and one remaining unchanged. Proven Investments lost 0.85 of a cent to close at 26 US cents after the trading of 113,096 stocks, Sygnus Credit Investments fell 0.05 of a cent to settle at 14.65 US cents with 10,293 units changing hands and Transjamaican Highway slipped 0.05 of a cent to 0.85 US cents with 490,000 shares crossing the exchange.

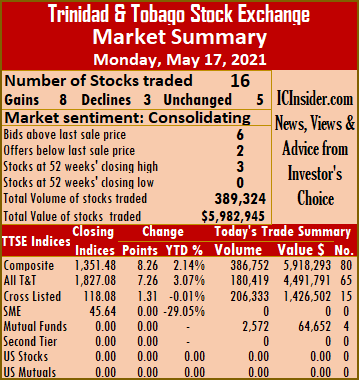

Proven Investments lost 0.85 of a cent to close at 26 US cents after the trading of 113,096 stocks, Sygnus Credit Investments fell 0.05 of a cent to settle at 14.65 US cents with 10,293 units changing hands and Transjamaican Highway slipped 0.05 of a cent to 0.85 US cents with 490,000 shares crossing the exchange. Trading took place in 16 stocks compared to 15 on Friday, with eight rising, three declining and five ending unchanged. The Composite Index gained 8.26 points to settle at 1,351.48, The All T&T Index increased 7.26 points to 1,827.08 and the Cross-Listed Index gained 1.31 points to close at 118.08.

Trading took place in 16 stocks compared to 15 on Friday, with eight rising, three declining and five ending unchanged. The Composite Index gained 8.26 points to settle at 1,351.48, The All T&T Index increased 7.26 points to 1,827.08 and the Cross-Listed Index gained 1.31 points to close at 118.08. Massy Holdings advanced 94 cents to close at a 52 weeks’ high of $66 in trading 10,105 stock units, National Enterprises settled at $3 in switching ownership of 2,372 units, National Flour Mills rose 35 cents to close at $2.30 in an exchange of 60,620 shares. NCB Financial Group stayed at $8.20, with 115,974 shares changing hands, Prestige Holdings climbed 2 cents to $6.53, with 50 units crossing the exchange, Republic Financial Holdings climbed 26 cents to $132.78 in trading 6,333 stocks. Scotiabank gained 25 cents to end at $55 in an exchange of 8,975 stocks, Trinidad & Tobago NGL lost 30 cents to close at $14.50 with an exchange of 50,545 shares and Unilever Caribbean settled at $16.30 while exchanging 500 shares.

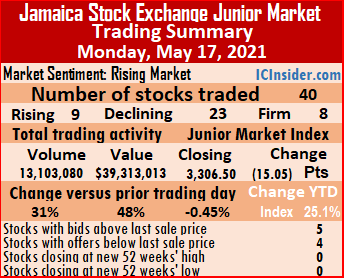

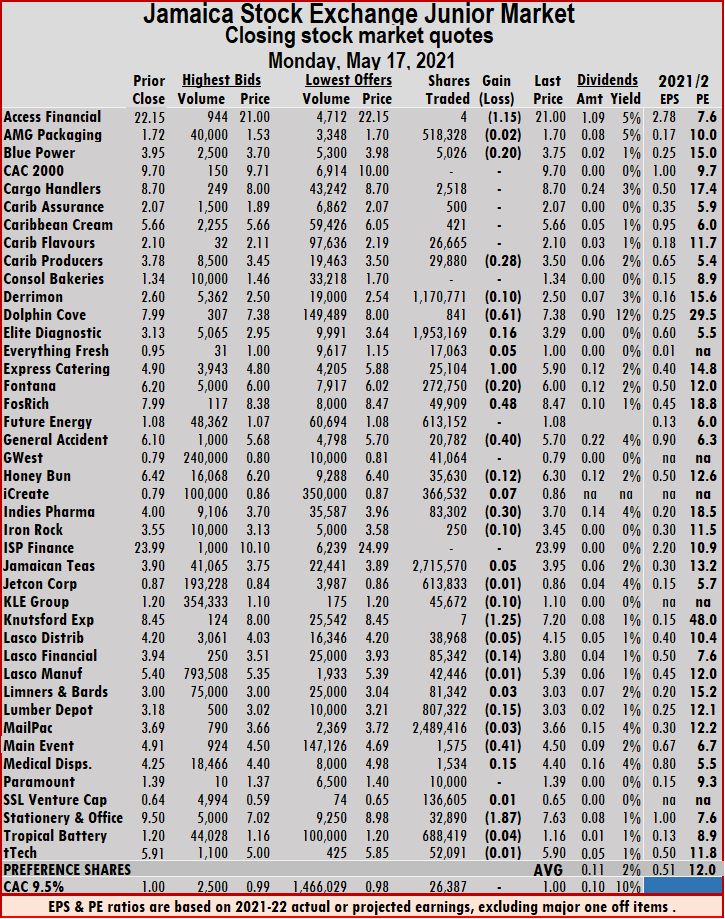

Massy Holdings advanced 94 cents to close at a 52 weeks’ high of $66 in trading 10,105 stock units, National Enterprises settled at $3 in switching ownership of 2,372 units, National Flour Mills rose 35 cents to close at $2.30 in an exchange of 60,620 shares. NCB Financial Group stayed at $8.20, with 115,974 shares changing hands, Prestige Holdings climbed 2 cents to $6.53, with 50 units crossing the exchange, Republic Financial Holdings climbed 26 cents to $132.78 in trading 6,333 stocks. Scotiabank gained 25 cents to end at $55 in an exchange of 8,975 stocks, Trinidad & Tobago NGL lost 30 cents to close at $14.50 with an exchange of 50,545 shares and Unilever Caribbean settled at $16.30 while exchanging 500 shares. Overall 40 securities traded, up from 37 on Friday and ended with the prices of nine stocks rising, 23 declining and eight remaining unchanged. At the close, the PE Ratio based on ICInsider.com’s forecast of 2021-22 earnings averaged 12.

Overall 40 securities traded, up from 37 on Friday and ended with the prices of nine stocks rising, 23 declining and eight remaining unchanged. At the close, the PE Ratio based on ICInsider.com’s forecast of 2021-22 earnings averaged 12. Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and four with lower offers. Lasco Distributors slipped 5 cents to $4.15 with 38,968 shares traded, Lasco Financial fell 14 cents to $3.80 with 85,342 units changing hands, Lumber Depot declined 15 cents to $3.03 with 807,322 stocks passing through the market. Main Event shed 41 cents to end at $4.50 with a transfer of 1,575 stock units, Medical Disposables advanced 15 cents to $4.40 with 1,534 units traded and Stationery and Office Supplies dropped $1.87 to close at $7.63 with 32,890 shares crossing the exchange.

Lasco Distributors slipped 5 cents to $4.15 with 38,968 shares traded, Lasco Financial fell 14 cents to $3.80 with 85,342 units changing hands, Lumber Depot declined 15 cents to $3.03 with 807,322 stocks passing through the market. Main Event shed 41 cents to end at $4.50 with a transfer of 1,575 stock units, Medical Disposables advanced 15 cents to $4.40 with 1,534 units traded and Stationery and Office Supplies dropped $1.87 to close at $7.63 with 32,890 shares crossing the exchange.

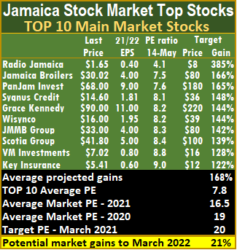

The JSE Main Market is only up 4 percent year to date, but ICTOP15 stock selection saw Carreras and Grace Kennedy rising 37 percent, QWI Investments and Caribbean Cement up 29 percent, Seprod up 20 percent, Jamaica Producers 19 percent and Jamaica Broilers up 15 percent.

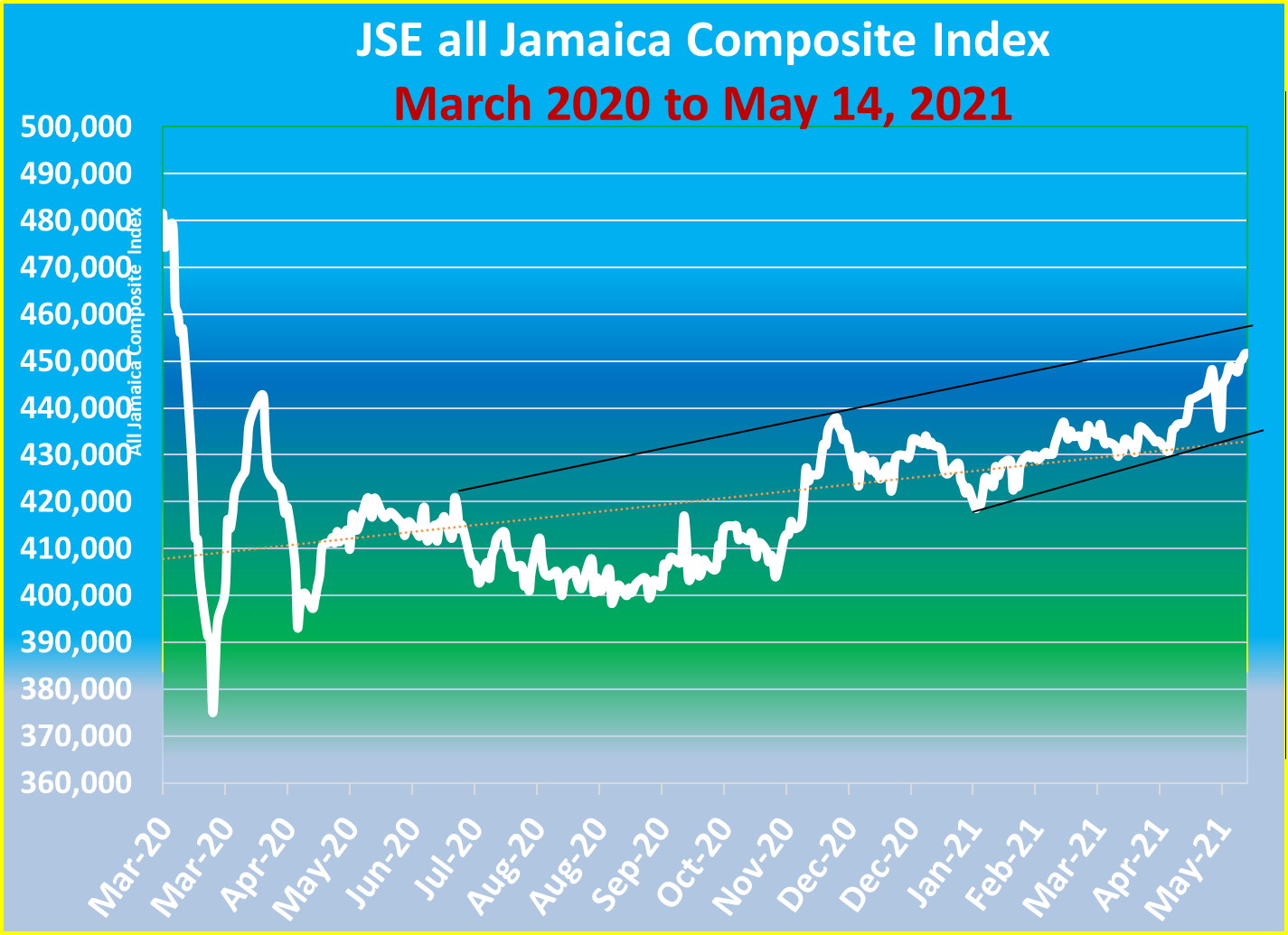

The JSE Main Market is only up 4 percent year to date, but ICTOP15 stock selection saw Carreras and Grace Kennedy rising 37 percent, QWI Investments and Caribbean Cement up 29 percent, Seprod up 20 percent, Jamaica Producers 19 percent and Jamaica Broilers up 15 percent. The targeted PE ratio for the market averages 20 based on profits of companies reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March 2021 with the average PE at 17 for Junior Stocks and 19 times for the Main Market. With interest rates on government paper below 5 percent and likely to remain there for a few years, the likelihood is for the average PE ratios to climb higher during the next twelve months.

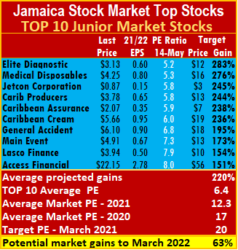

The targeted PE ratio for the market averages 20 based on profits of companies reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March 2021 with the average PE at 17 for Junior Stocks and 19 times for the Main Market. With interest rates on government paper below 5 percent and likely to remain there for a few years, the likelihood is for the average PE ratios to climb higher during the next twelve months. The average projected gain for the Junior Market IC TOP 10 stocks is 220 percent and 168 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 220 percent and 168 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

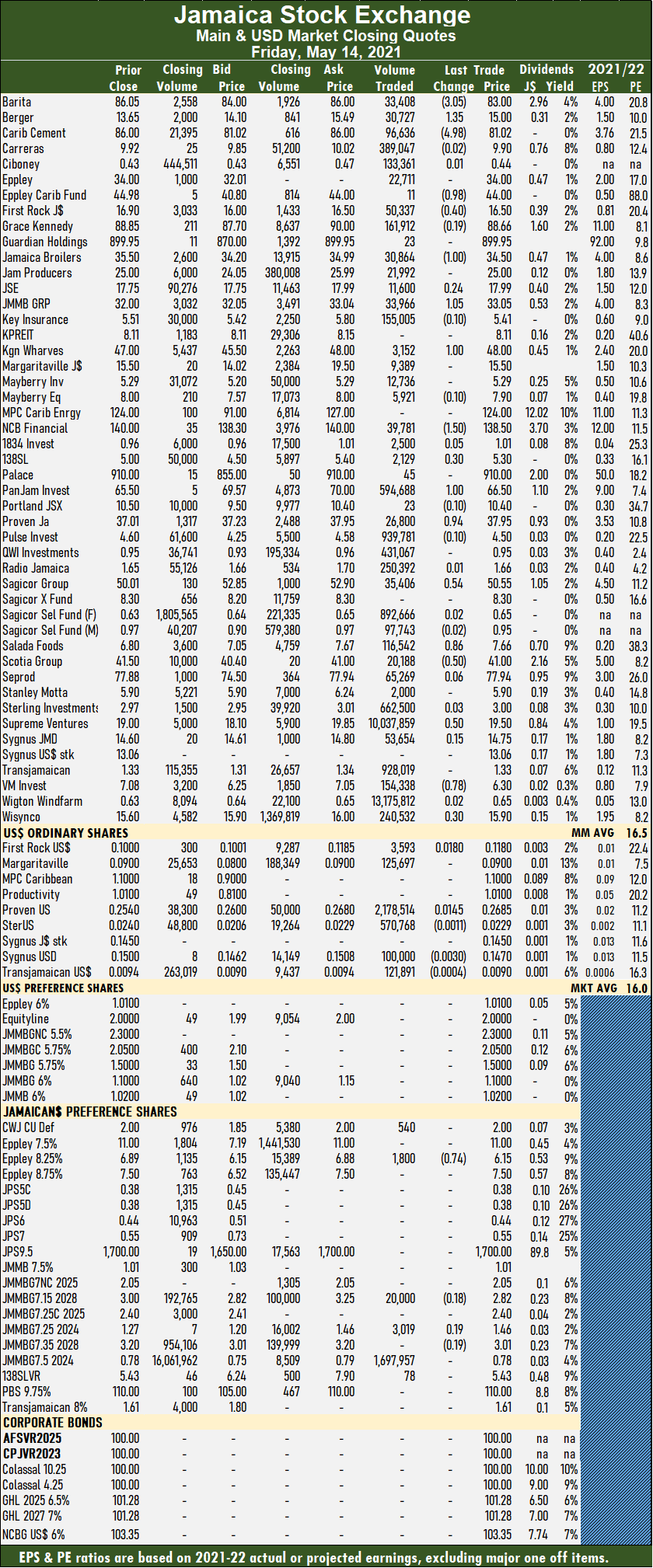

At the close, Barita Investments dropped $3.05 to $83 with 33,408 shares changing hands. Berger Paints advanced $1.35 to close at a 52 weeks’ high of $15 after exchanging 30,727 stock units, Caribbean Cement slid $4.98 to $81.02 with 96,636 shares crossing the exchange. Eppley Caribbean Property Fund shed 98 cents to close at $44 trading 11 units, First Rock Capital fell 40 cents to $16.50 in exchanging 50,337 shares, Grace Kennedy slipped 19 cents to close at $88.66 in switching ownership of 161,912 stocks. Jamaica Broilers ended $1 lower at $34.50 in exchanging 30,864 units, Jamaica Stock Exchange gained 24 cents to close at $17.99 with 11,600 stock units crossing the market, JMMB Group rose $1.05 to $33.05 in trading 33,966 units, Kingston Wharves advanced $1 to end at $48 in an exchange of 3,152 stocks, NCB Financial declined $1.50 to $138.50 after transferring 39,781 units, 138 Student Living gained 30 cents to end at $5.30 in exchanging 2,129 stocks. PanJam Investment rose $1 to close at $66.50 in trading 594,688 units, Proven Investments rose 94 cents to $37.95 in trading 26,800 shares, Sagicor Group closed 54 cents higher at $50.55 in an exchange of 35,406 stocks. Salada Foods rose 86 cents to $7.66 in switching ownership of 116,542 stock units, Scotia Group shed 50 cents to end at $41 in trading 20,188 units, Supreme Ventures picked up 50 cents to close at $19.50 with the swapping of 10,037,859 shares,

At the close, Barita Investments dropped $3.05 to $83 with 33,408 shares changing hands. Berger Paints advanced $1.35 to close at a 52 weeks’ high of $15 after exchanging 30,727 stock units, Caribbean Cement slid $4.98 to $81.02 with 96,636 shares crossing the exchange. Eppley Caribbean Property Fund shed 98 cents to close at $44 trading 11 units, First Rock Capital fell 40 cents to $16.50 in exchanging 50,337 shares, Grace Kennedy slipped 19 cents to close at $88.66 in switching ownership of 161,912 stocks. Jamaica Broilers ended $1 lower at $34.50 in exchanging 30,864 units, Jamaica Stock Exchange gained 24 cents to close at $17.99 with 11,600 stock units crossing the market, JMMB Group rose $1.05 to $33.05 in trading 33,966 units, Kingston Wharves advanced $1 to end at $48 in an exchange of 3,152 stocks, NCB Financial declined $1.50 to $138.50 after transferring 39,781 units, 138 Student Living gained 30 cents to end at $5.30 in exchanging 2,129 stocks. PanJam Investment rose $1 to close at $66.50 in trading 594,688 units, Proven Investments rose 94 cents to $37.95 in trading 26,800 shares, Sagicor Group closed 54 cents higher at $50.55 in an exchange of 35,406 stocks. Salada Foods rose 86 cents to $7.66 in switching ownership of 116,542 stock units, Scotia Group shed 50 cents to end at $41 in trading 20,188 units, Supreme Ventures picked up 50 cents to close at $19.50 with the swapping of 10,037,859 shares,  Victoria Mutual Investments declined 78 cents to $6.30 in trading 154,338 stock units and Wisynco Group gained 30 cents to close at $15.90, with 240,532 shares crossing the exchange.

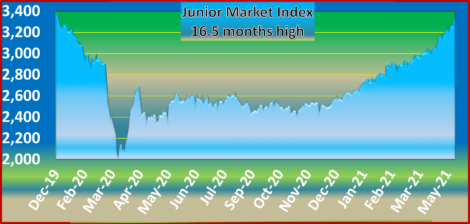

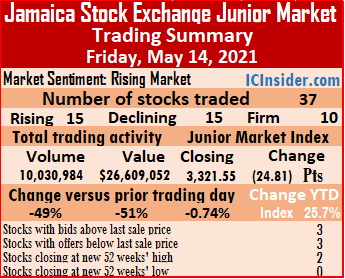

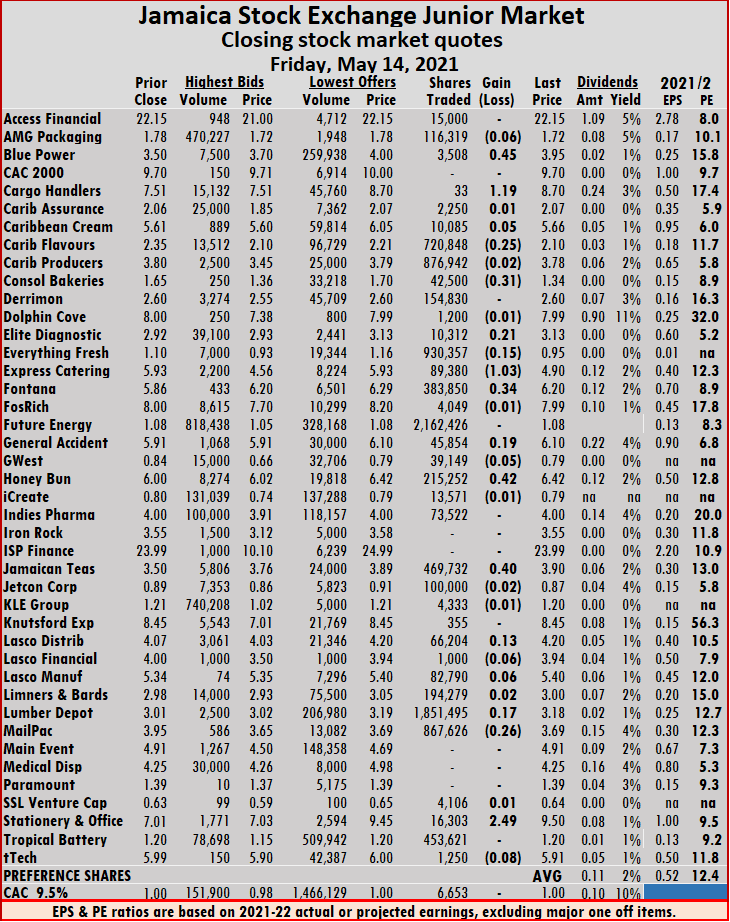

Victoria Mutual Investments declined 78 cents to $6.30 in trading 154,338 stock units and Wisynco Group gained 30 cents to close at $15.90, with 240,532 shares crossing the exchange. Trading ended with 37 securities changing hands up from 35 on Thursday and closed with prices of 15 rising, 15 declining and seven closing unchanged.

Trading ended with 37 securities changing hands up from 35 on Thursday and closed with prices of 15 rising, 15 declining and seven closing unchanged. Investor’s Choice bid-offer indicator reading shows three stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator reading shows three stocks ending with bids higher than their last selling prices and three with lower offers. Lasco Distributors gained 13 cents to close at $4.20 with an exchange of 66,204 units, Lasco Financial ended 6 cents lower at $3.94 with the swapping of 1,000 shares, Lasco Manufacturing gained 6 cents in closing at $5.40 in transferring 82,790 stock units. Lumber Depot gained 17 cents ending at $3.18 after exchanging 1,851,495 units, Mailpac Group shed 26 cents to finish at $3.69 after clearing the market with 867,626 stocks, Stationery and Office Supplies advanced $2.49 to end at a 52 weeks’ high of $9.50 in trading 16,303 shares and tTech dipped 8 cents to end at $5.91 with a transfer of 1,250 stock units.

Lasco Distributors gained 13 cents to close at $4.20 with an exchange of 66,204 units, Lasco Financial ended 6 cents lower at $3.94 with the swapping of 1,000 shares, Lasco Manufacturing gained 6 cents in closing at $5.40 in transferring 82,790 stock units. Lumber Depot gained 17 cents ending at $3.18 after exchanging 1,851,495 units, Mailpac Group shed 26 cents to finish at $3.69 after clearing the market with 867,626 stocks, Stationery and Office Supplies advanced $2.49 to end at a 52 weeks’ high of $9.50 in trading 16,303 shares and tTech dipped 8 cents to end at $5.91 with a transfer of 1,250 stock units. The JSE USD Equity Index added 1.46 points to end at 213.07. The average PE Ratio ends at 13.8 based on ICInsider.com’s forecast of 2021-22 earnings.

The JSE USD Equity Index added 1.46 points to end at 213.07. The average PE Ratio ends at 13.8 based on ICInsider.com’s forecast of 2021-22 earnings. At the close, First Rock Capital gained 1.8 cents to end at 11.8 US cents after trading 3,593 shares, Margaritaville remained at 9 US cents with 125,697 shares changing hands, Proven Investments increased 1.45 cents to 26.85 US cents in exchanging 2,178,514 shares. Sterling Investments dropped 0.11 cents to 2.29 US cents, after trading 570,768 stocks, Sygnus Credit Investments lost 0.3 of a cent in closing at 14.7 US cents, with 100,000 stocks crossing the market and Transjamaican Highway shed 0.04 of a cent to end at 0.9 US cents, after exchanging 121,891 stocks.

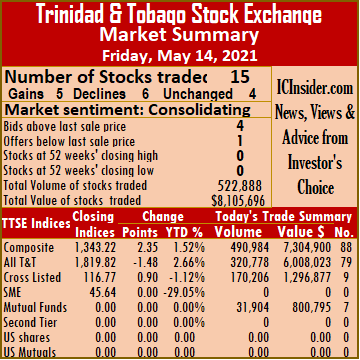

At the close, First Rock Capital gained 1.8 cents to end at 11.8 US cents after trading 3,593 shares, Margaritaville remained at 9 US cents with 125,697 shares changing hands, Proven Investments increased 1.45 cents to 26.85 US cents in exchanging 2,178,514 shares. Sterling Investments dropped 0.11 cents to 2.29 US cents, after trading 570,768 stocks, Sygnus Credit Investments lost 0.3 of a cent in closing at 14.7 US cents, with 100,000 stocks crossing the market and Transjamaican Highway shed 0.04 of a cent to end at 0.9 US cents, after exchanging 121,891 stocks. A total of 15 securities traded, down from 20 on Wednesday, with five rising, six declining and 4 remaining unchanged. The Composite Index added 2.35 points to settle at 1,343.22, the All T&T Index slipped 1.48 points to 1,819.82 and the Cross-Listed Index rose 0.90 points to close at 116.77.

A total of 15 securities traded, down from 20 on Wednesday, with five rising, six declining and 4 remaining unchanged. The Composite Index added 2.35 points to settle at 1,343.22, the All T&T Index slipped 1.48 points to 1,819.82 and the Cross-Listed Index rose 0.90 points to close at 116.77. National Enterprises fell 23 cents to close at $3 in trading 16,300 shares, National Flour Mills declined 35 cents to end at $1.95 with the swapping of 52,900 shares, NCB Financial Group rose 10 cents to $8.20, with 138,482 stocks crossing the market. Republic Financial Holdings traded 5,371 shares after losing 9 cents and closing at $132.52, Scotiabank gained 9 cents to close at $54.75 trading 11,352 stocks, Trinidad & Tobago NGL jumped $1 to close at $14.80, after trading 178,353 stock units, Unilever Caribbean slipped 3 cents to $16.30 after exchanging 156 stocks and West Indian Tobacco added I cent to end at $32.51, with 3,046 units changing hands.

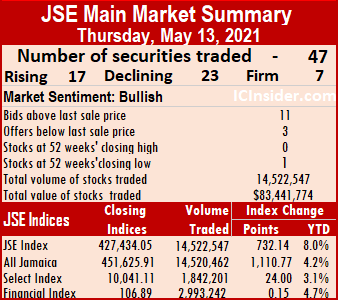

National Enterprises fell 23 cents to close at $3 in trading 16,300 shares, National Flour Mills declined 35 cents to end at $1.95 with the swapping of 52,900 shares, NCB Financial Group rose 10 cents to $8.20, with 138,482 stocks crossing the market. Republic Financial Holdings traded 5,371 shares after losing 9 cents and closing at $132.52, Scotiabank gained 9 cents to close at $54.75 trading 11,352 stocks, Trinidad & Tobago NGL jumped $1 to close at $14.80, after trading 178,353 stock units, Unilever Caribbean slipped 3 cents to $16.30 after exchanging 156 stocks and West Indian Tobacco added I cent to end at $32.51, with 3,046 units changing hands. The All Jamaican Composite Index advanced 1,110.77 points to 451,625.91, the Main Index rose 732.14 points to 427,434.05, and the JSE Financial Index inched 0.15 points up to settle at 106.89.

The All Jamaican Composite Index advanced 1,110.77 points to 451,625.91, the Main Index rose 732.14 points to 427,434.05, and the JSE Financial Index inched 0.15 points up to settle at 106.89. Trading averaged 308,990 units at $1,775,357, compared to 231,986 shares at $2,914,778 on Wednesday. Trading month to date averages 289,678 units at $3,227,079, in contrast to 287,442 units at $3,395,135 on Wednesday. April averaged 234,200 units at $1,772,561.

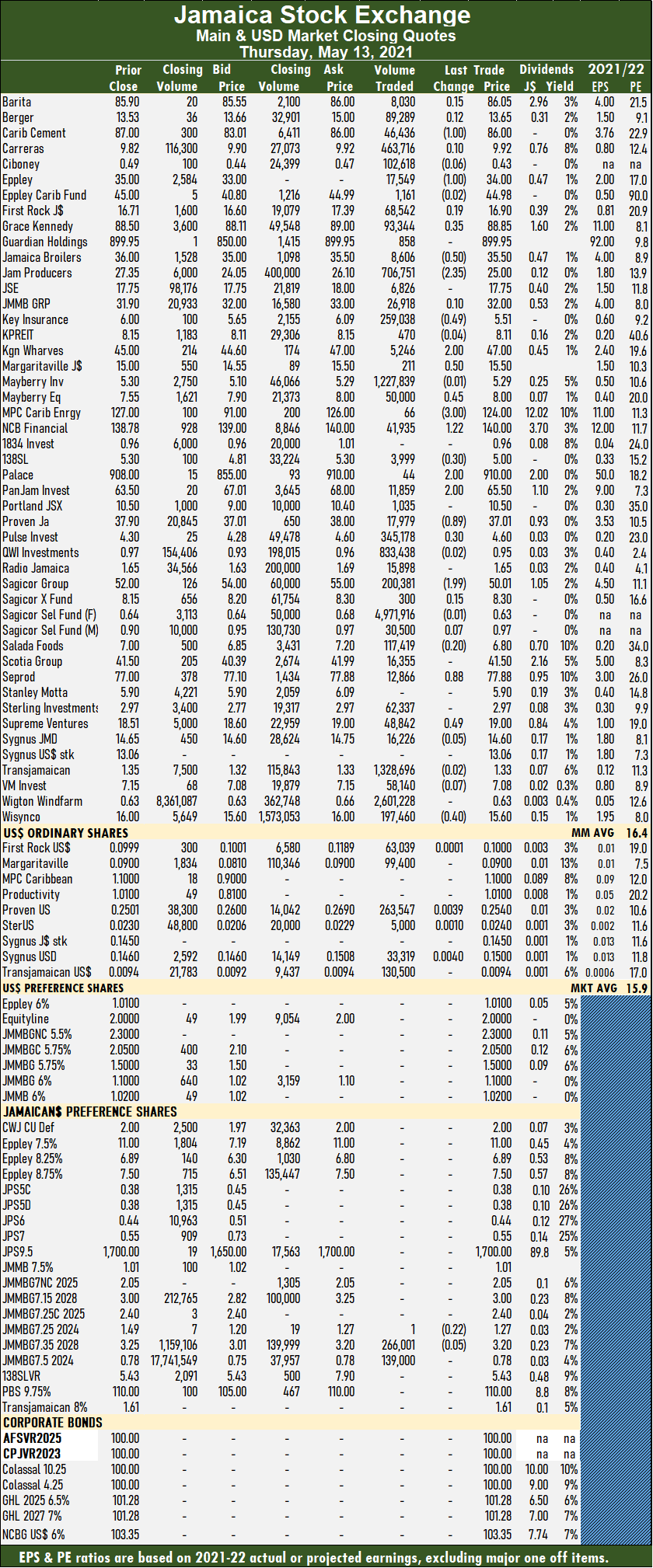

Trading averaged 308,990 units at $1,775,357, compared to 231,986 shares at $2,914,778 on Wednesday. Trading month to date averages 289,678 units at $3,227,079, in contrast to 287,442 units at $3,395,135 on Wednesday. April averaged 234,200 units at $1,772,561. 138 Student Living fell 30 cents to close at $5 with 3,999 stock units crossing the market, Pan Jam Investment rose $2 to close at $65.50 in exchanging 11,859 stocks, Proven Investments fell 89 cents to $37.01 in the swapping of 17,979 stock units, Pulse Investments gained 30 cents to $4.60 in switching ownership of 345,178 shares. Sagicor Group declined $1.99 to $50.01 in an exchange of 200,381 units, Salada Foods lost 20 cents to finish at $6.80 with a transfer of 117,419 stocks, Seprod gained 88 cents to close at $77.88 in trading 12,866 shares, Supreme Ventures gained 49 cents to settle at $19 with the swapping of 48,842 stock units and Wisynco Group lost 40 cents in ending at $15.60 after trading 197,460 stocks.

138 Student Living fell 30 cents to close at $5 with 3,999 stock units crossing the market, Pan Jam Investment rose $2 to close at $65.50 in exchanging 11,859 stocks, Proven Investments fell 89 cents to $37.01 in the swapping of 17,979 stock units, Pulse Investments gained 30 cents to $4.60 in switching ownership of 345,178 shares. Sagicor Group declined $1.99 to $50.01 in an exchange of 200,381 units, Salada Foods lost 20 cents to finish at $6.80 with a transfer of 117,419 stocks, Seprod gained 88 cents to close at $77.88 in trading 12,866 shares, Supreme Ventures gained 49 cents to settle at $19 with the swapping of 48,842 stock units and Wisynco Group lost 40 cents in ending at $15.60 after trading 197,460 stocks.