“In the Third Quarter we have continued to build momentum through our investment-led Project Marlin and we are continuing to deliver top line growth” Phil Bentley, Chief Executive of CW Communications, commented in a release of the group’s third quarter results today.

“In the Third Quarter we have continued to build momentum through our investment-led Project Marlin and we are continuing to deliver top line growth” Phil Bentley, Chief Executive of CW Communications, commented in a release of the group’s third quarter results today.

“Investments in our mobile networks have improved coverage and reliability and we saw mobile data grow a further 23 percent with traffic carried on our networks increasing by over 35 percent. Fibre investments have focussed on our Caribbean markets and are key to generating growth in the Broadband & TV segments. We continue to work with Governments and Regulators to gain the required approvals for completion of the Columbus acquisition and are on track to close before our fiscal year end” Bentley stated.

The groups CEO went on to say “Mobile revenue (53 percent of Group revenue) was up 4 percent in the Third Quarter driven by growth in LIME and Panama, up 10 percent and 4 percent respectively. LIME growth was driven by continued subscriber additions in Jamaica, 18 percent where investment in our 4G mobile network led to constant currency revenue growth of 27 percent and an NPS gain of 11 points, whilst in Barbados our “Upgrade Barbados” marketing campaign led to 6 percent revenue growth and our market-leading LTE service in Cayman drove revenue growth of 3 percent. Panama mobile growth followed a strong increase in subscribers, primarily within prepaid, as a result of increased promotions leading up to and through the holiday season.”

C&WJ revenues up 27% in Q3

C&W trades 1m units at 54c

Cable & Wireless traded 1 million units at 54 cents as Scotia Investments sold the stock which was bought by NCB Capital Markets.

Cable & Wireless traded 1 million units at 54 cents as Scotia Investments sold the stock which was bought by NCB Capital Markets.

The trade leaves 275,995 units on the bid at 54 cents, just below are bids for 600,000 sahres at 50 cents, 1,064,000, 27,360, 300,000 and 2,975,000 units at 47 cents. the closest offer is 500,000 units at 60 cents.

The stock has gained 93 percent since it last traded on Wednesday last week at 28 cents, after Cable & Wireless Plc announced the acquisition of Columbus Communications and that the local company added 125,000 cell customers between April and September.

Is $1.65 too high for C&WJ shares by 2015?

Cable & Wireless (C&W), an IC Insider BUY RATED stock, traded 7,481,913 shares closing at 32 cents on Thursday, following the release of the announced acquisition of Columbus International operation and news of continued strong growth in new cell customers.

Trading on Wednesday, resulted in 5,310,349, units changing hands, between 25 and 28 cents while there were 5 million units on offer at 28 cents, with the bid at 25 cents, to buy 5,794,204 units. With all the news fully disclosed, 8 brokers had bids to buy almost 10 million shares at 36 cents each on Friday. Trading was attempted at 37 cents, but the 15 percent limit resulted in cancelation of the trades.

Trading on Wednesday, resulted in 5,310,349, units changing hands, between 25 and 28 cents while there were 5 million units on offer at 28 cents, with the bid at 25 cents, to buy 5,794,204 units. With all the news fully disclosed, 8 brokers had bids to buy almost 10 million shares at 36 cents each on Friday. Trading was attempted at 37 cents, but the 15 percent limit resulted in cancelation of the trades.

What is clear is that the price will most likely close on Monday above the bid price of 36 cents, with 41 cents, the maximum possible it can trade, likely to be the close. The big question to be answered is, what price will the stock reach to induce fair stability in the price. Without earnings or even positive net asset value that could be used to value the stock, investors either has to use future estimated earnings or income per share or some other such method to value the stock. But other calculations would be needed to arrive at an approximate level. The other approach is the use of technical assessment. Below the likely price levels are stated before some form of resistance to buying takes place. The present supply demand scenario suggest that the recent high of 70 cents will be taken out sooner than later.

CWC Communication has not yet disclosed how they will treat with Flow within the group. One can speculate as to what may happen sometime in the future, one possibility is that Cable & Wireless will collapse the Flow operations into the local Cable & Wireless entities, thus cutting cost. What is more important, for investors, is what is taking place at C&W locally. With continued strong growth in cellular customers, the company has around 830,000 cell customers and could reach around 900,000 by year end. At this level and the possibility of further growth, the company should be making decent profit, between this fiscal year and the 2016. IC Insider is expecting the September results to show a reduced operating loss, than the $600 million incurred in 2013, with the possibility to either break even or making a small profit for the year to March 2015.

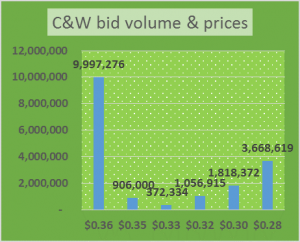

Heavy buying| At the end of trading on Friday, C&W had 9,997,276 units to buy at 36 cents and just under 232,000 units to sell at 50 cents and only 4,849,062 in total is on offer between 50 and $1. Earlier this year there was not much volume that was available before the price got to 70 cents and then selling came in, more importantly buying thinned out above 50 cents.

Earlier this year| The current bid offer position is pretty similar to that of February 21 this year, when the bid was at 32 cents. Then there were only 56,766 units on the bid at 32 cents and a small 2.7 million on the offer between 38 cents and 45 cents, with the next offer after that at $3.50. That was weeks before the price shot up to 70 cents on limited volume. This time around, buying is more board based with higher volume on the buy side and the supply just a little more than in February. Clearing the way for continued bullishness, is that supply was taken out below 70 cents although some purchases could be sold back to the market in profit taking having been recently bought at relatively low prices.

Earlier this year| The current bid offer position is pretty similar to that of February 21 this year, when the bid was at 32 cents. Then there were only 56,766 units on the bid at 32 cents and a small 2.7 million on the offer between 38 cents and 45 cents, with the next offer after that at $3.50. That was weeks before the price shot up to 70 cents on limited volume. This time around, buying is more board based with higher volume on the buy side and the supply just a little more than in February. Clearing the way for continued bullishness, is that supply was taken out below 70 cents although some purchases could be sold back to the market in profit taking having been recently bought at relatively low prices.

Technically, 70 cents looks like the first serious barrier to upward price movement. The next possible resistance would be 80 cents and then $1, $1.35 and $1.60. With supply tight, if the September or December results show much improvement in the bottom-line, there could be sufficient buying interest to move through the lower points between now and the first half of 2015.

A D&G and Cable & Wireless market

Desnoes & Geddes (D&G) with more than 27.3 million shares and Cable & Wireless (C&W) with 7.5 million units trading, dominated Thursday’s activity, on the Jamaica Stock Exchange. Except for less than a few thousand unit virtually all of D&G shares traded, were crosses done by NCB Capital Market. The C&W trade, flowed from increased buying, following the announcement of the takeover of Flow by CWC Communications plc.

Desnoes & Geddes (D&G) with more than 27.3 million shares and Cable & Wireless (C&W) with 7.5 million units trading, dominated Thursday’s activity, on the Jamaica Stock Exchange. Except for less than a few thousand unit virtually all of D&G shares traded, were crosses done by NCB Capital Market. The C&W trade, flowed from increased buying, following the announcement of the takeover of Flow by CWC Communications plc.

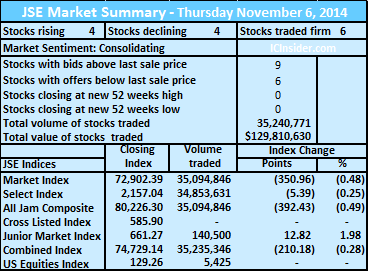

At the close of trading, the prices of 4 stocks gained and 4 declined as only 14 securities changed hands, ending in 35,240,771 units trading, valued at $129,810,630, in all market segments.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator had 9 stocks with bids higher than their last selling prices and 6 stocks with offers that were lower.

Main Market| The JSE Market Index fell 350.96 points to 72,902.39, the JSE All Jamaican Composite index declined 392.43 points to close at 80,226.30 and the JSE combined index lost 210.18 points to close at 74,729.14.

Gains| IC Insider BUY RATED Cable & Wireless, finished trading with 7,481,913 units and put on 4 cents to end at 32 cents, to be the sole stock to gain at the end of trading, in the main market. The stock which was responding to news of a takeover of Columbus International, operators of Flow, enjoyed very strong bids at the close with 1,389,745 units to buy at 32 cents at the top of the bids, 2,954,100 units on the bid at 30 cents and 3,658,619 units at 28 cents. There are 2,288,839 on offer between 35 to 50 cents, an almost certain recipe for further gains to come.

Firm| The stocks in the main market to close without a change in the last traded prices are, Jamaica Broilers closing with 24,819 shares at $4, Jamaica Money Market Brokers finished trading with 487 shares at $7, Proven Investments with 5,425 shares at 18 US cents, Radio Jamaica ended with 3,615 units to close at $1.18 and Sagicor Group closed with 50,000 shares at $9.65.

Declines| The last traded prices of stocks with losses at the end of trading, in the main market are, Caribbean Cement, ended with 105,000 units, to close 5 cents lower at $2.60, Desnoes & Geddes closed with 27,346,412 shares, valued at $125.8 million to end 35 cents down, at $4.60, Sagicor Real Estate Fund finished trading with 82,100 shares changing hands, lost 15 cents at $6.60 and Scotia Investments with 500 shares fell 9 cents, to $21.51.

Declines| The last traded prices of stocks with losses at the end of trading, in the main market are, Caribbean Cement, ended with 105,000 units, to close 5 cents lower at $2.60, Desnoes & Geddes closed with 27,346,412 shares, valued at $125.8 million to end 35 cents down, at $4.60, Sagicor Real Estate Fund finished trading with 82,100 shares changing hands, lost 15 cents at $6.60 and Scotia Investments with 500 shares fell 9 cents, to $21.51.