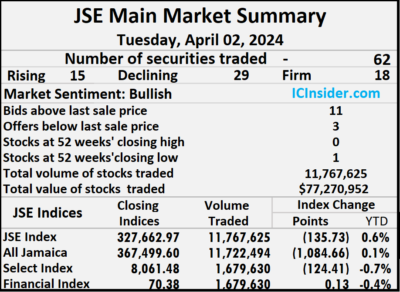

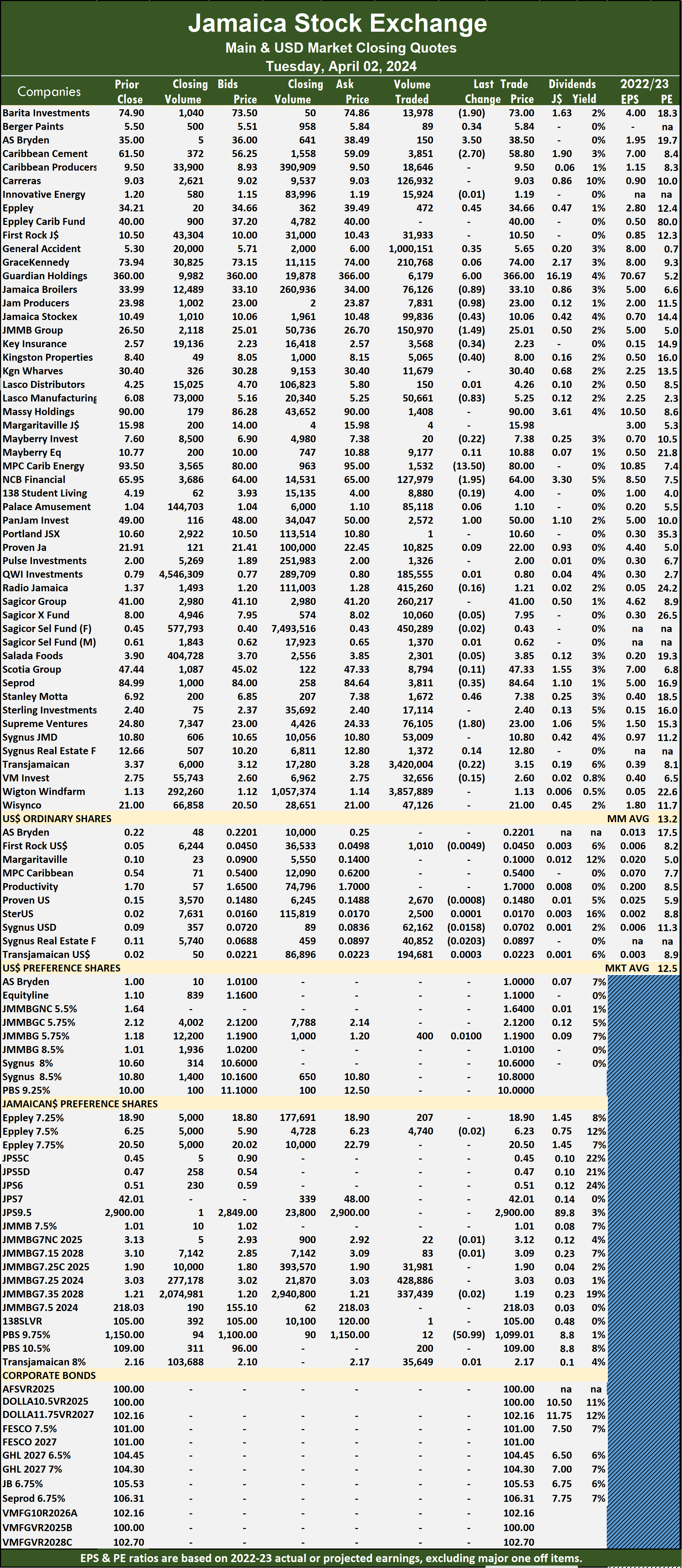

Following the closure of trading for the long Easter weekend, the Jamaica Stock Exchange Main Market ended on Tuesday, with declining stocks overpowering winning two to one following a 25 percent fall in the volume of stocks traded declining with a 54 percent drop in value compared to Thursday, with trading in 62 securities compared with 60 on Thursday, with prices of 15 stocks rising, 29 declining and 18 ending unchanged as Radio Jamaica closed at a 52 weeks’ low of $1.20.

The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday.

The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday.

Trading averaged 189,800 shares at $1,246,306 compared to 260,752 units at $2,789,538 on Thursday compared to March that closed with an average of 828,473 units at $2,341,254.

Wigton Windfarm led trading with 3.86 million shares for 32.8 percent of the overall volume followed by Transjamaican Highway with 3.42 million units for 29.1 percent of the day’s trade and General Accident with 1.0 million units for 8.5 percent of market share.

The All Jamaican Composite Index sank 1,084.66 points to close trading at 367,499.60, the JSE Main Index declined 135.73 points to settle at 327,662.97 and the JSE Financial Index rallied 0.13 points to 70.38.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

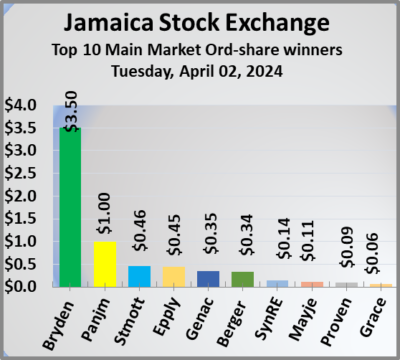

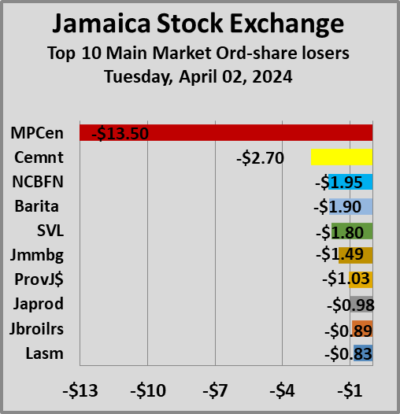

At the close, AS Bryden jumped $3.50 and ended at $38.50 in an exchange of 150 stocks, Barita Investments lost $1.90 to close at $73 with investors swapping 13,978 units, Berger Paints popped 34 cents to end at $5.84 after 89 shares passed through the market. Caribbean Cement sank $2.70 in closing at $58.80 after an exchange of 3,851 stock units, Eppley rallied 45 cents to close at $34.66 in switching ownership of 472 shares, General Accident increased 35 cents to $5.65 after a transfer of 1,000,151 stock units. Guardian Holdings climbed $6 to close at $366, with 6,179 units changing hands, Jamaica Broilers declined 89 cents to $33.10 in an exchange of 76,126 units. Jamaica Producers fell 98 cents to end at $23 with investors dealing in 7,831 stocks, Jamaica Stock Exchange skidded 43 cents to $10.06, with 99,836 shares crossing the market, JMMB Group dropped $1.49 and ended at $25.01 in trading 150,970 stock units. Key Insurance shed 34 cents to close at $2.23 after an exchange of 3,568 shares, Kingston Properties dipped 40 cents in closing at $8 after 5,065 stock units passed through the market,  Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares.

Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares.

In the preference segment, Productive Business Solutions 10.5% preference share dropped $50.99 to end at $1,099.01 with a transfer of 12 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market slips into April

Trading drops & prices fall on Main Market

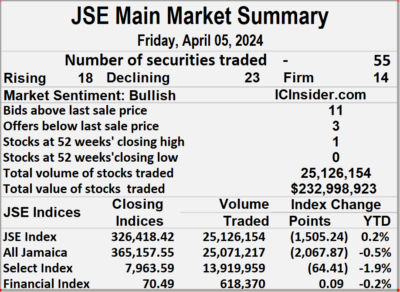

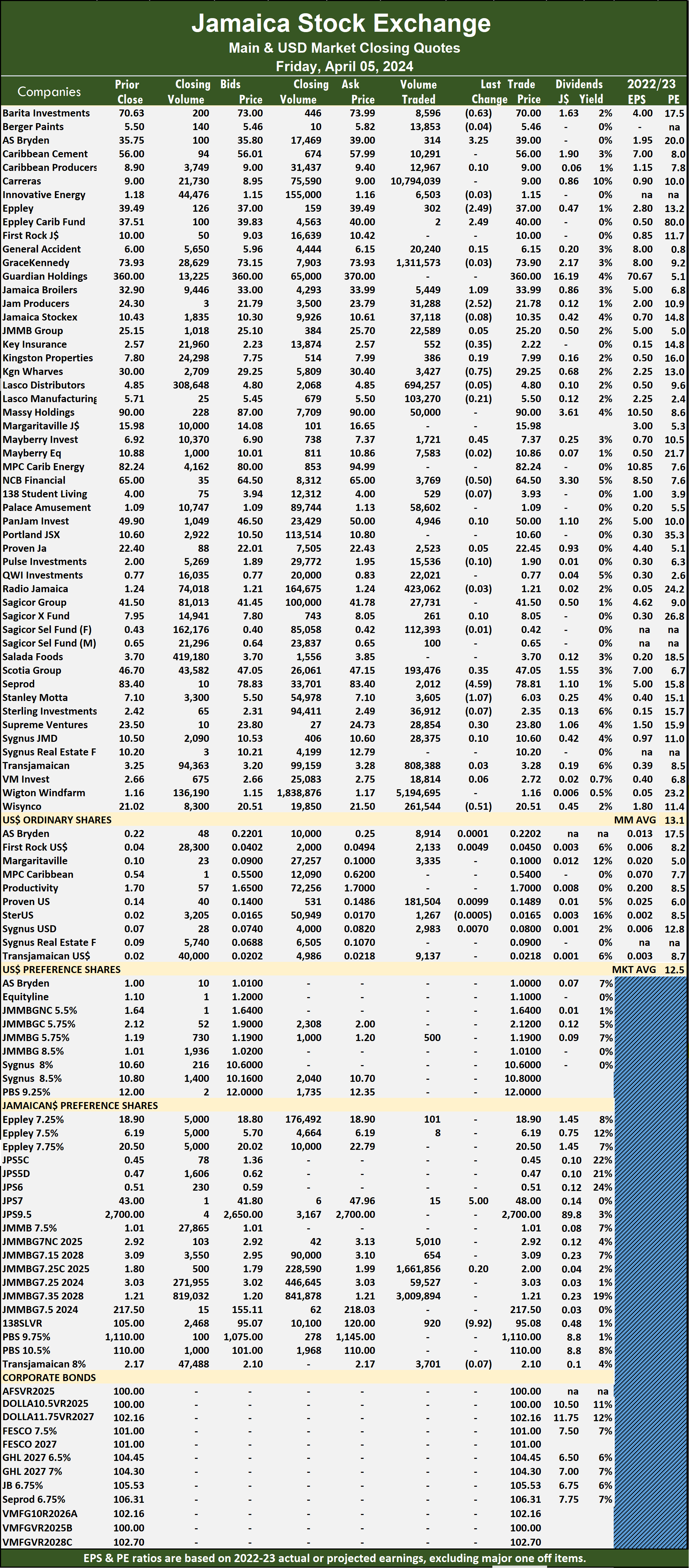

Trading slipped on the Jamaica Stock Exchange Main Market ended on Friday and pulled the Market indices with it after a 95 percent drop in the volume of stocks traded and an 87 percent fall in value compared with that on Thursday, with trading in 55 securities compared with 61 on Thursday and resulted in prices of 18 stocks rising, 23 declining and 14 ending unchanged.

The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday.

The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday.

Trading averaged 456,839 shares at $4,237,456 compared to 9,043,959 units at $29,487,446 on Thursday and month to date, an average of 2,585,174 units at $9,516,984 compared with 3,224,837 units at $11,103,727 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

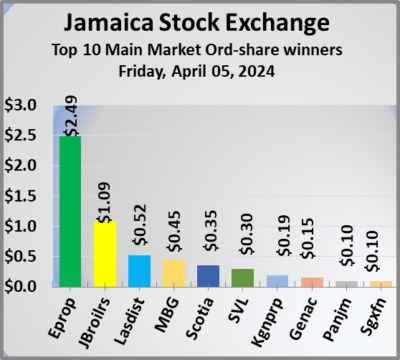

Carreras led trading with 10.79 million shares for 43 percent of total volume followed by Wigton Windfarm with 5.19 million units for 20.7 percent of the day’s trade, JMMB 9.5% preference share chipped in with 3.01 million units for 12 percent market share, as JMMB Group 7.25% preference share due 2024 ended with 1.66 million units for 6.6 percent total shares traded and GraceKennedy with 1.31 million units for 5.2 percent of the overall volume.

The All Jamaican Composite Index slipped 2,067.87 points to conclude trading at 365,157.55, the JSE Main Index skidded 1,505.24 points to wrap up trading at 326,418.42 and the JSE Financial Index rallied 0.09 points to 70.49.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

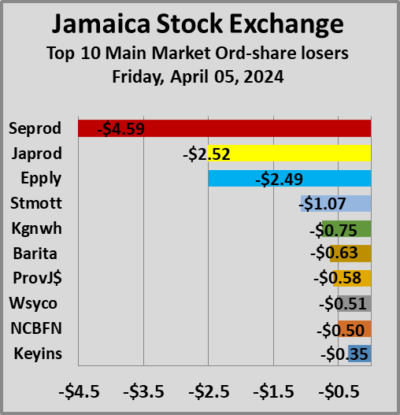

At the close, AS Bryden gained $3.25 in closing at $39 with an exchange of 314 stock units, Barita Investments lost 63 cents to end at $70, with 8,596 shares crossing the market, Eppley shed $2.49 to end at $37 with a transfer of 302 units. Eppley Caribbean Property Fund rose $2.49 to close at $40 after investors ended trading just two stocks, Jamaica Broilers rallied $1.09 and ended at $33.99 in an exchange of 5,449 shares, Jamaica Producers fell $2.52 to finish at $21.78 with 31,288 stock units clearing the market. Key Insurance dipped 35 cents and ended at $2.22 in trading 552 stocks, Kingston Wharves sank 75 cents to $29.25, with 3,427 units crossing the market, Mayberry Group increased 45 cents to close at $7.37 in an exchange of 1,721 shares.  NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks.

NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks.

In the preference segment, Jamaica Public Service 7% advanced $5 to end at $48 with 15 units crossing the exchange and Productive Business Solutions 9.75% preference share fell $9.92 in closing at $95.08 with traders dealing in 920 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Transjamaican steals Main Market spotlight

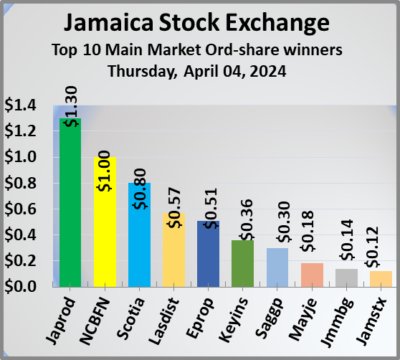

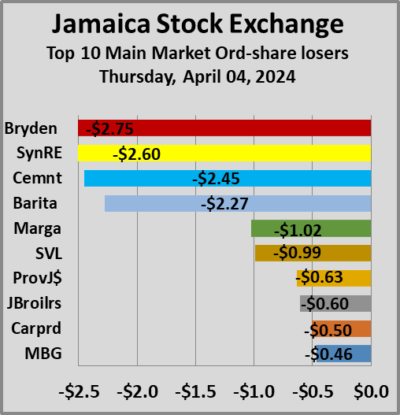

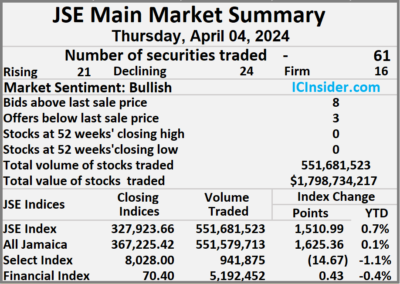

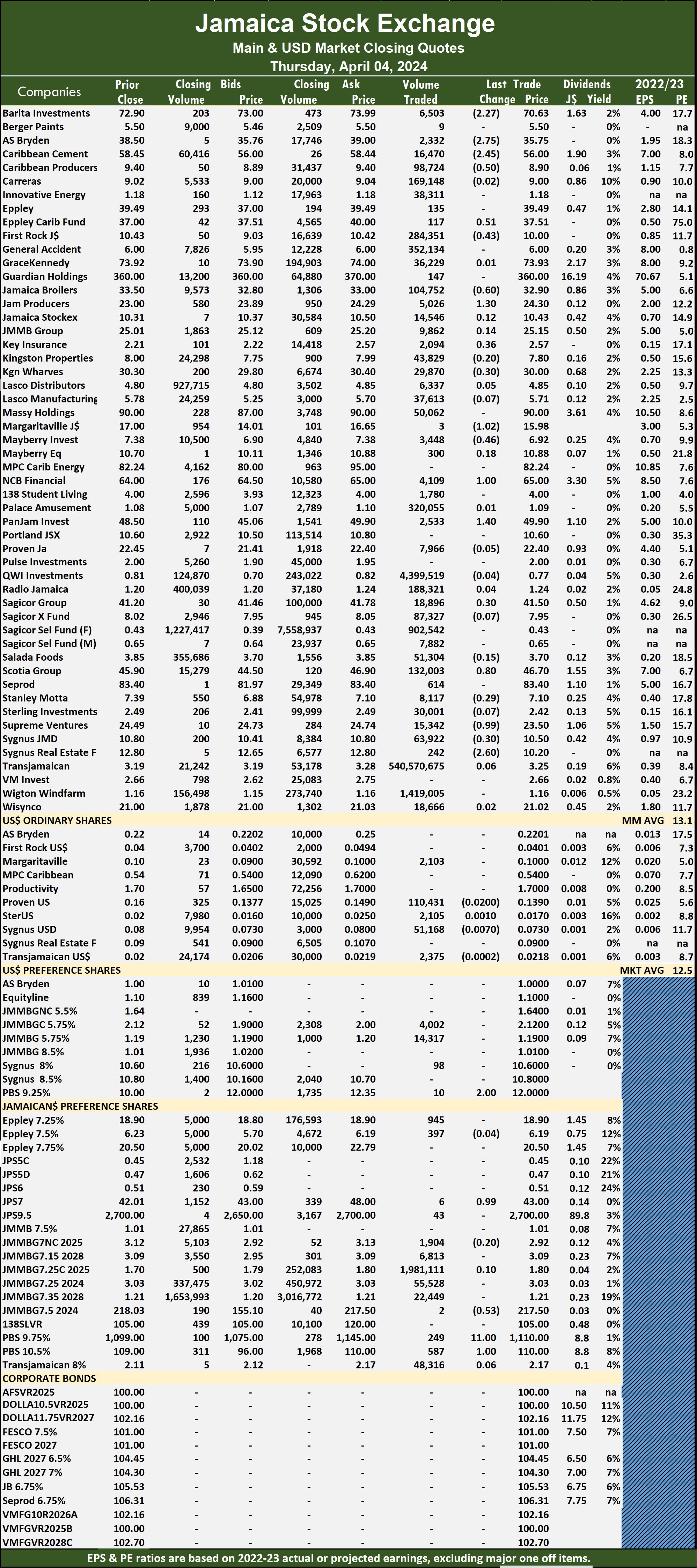

Trading surged on the Jamaica Stock Exchange Main Market ended on Thursday, with Transjamaican Highway dominating with more than 540 million shares worth $1.756 billion, sending the volume of stocks traded up by a solid 1,967 percent with the value jumping 1,053 percent more than on Wednesday, with trading in 61 securities compared with 60 on Wednesday, with prices of 21 stocks rising, 24 declining and 16 ending unchanged.

The market closed after 551,681,523 shares were traded for $1,798,734,217 compared with 26,696,028 units at $155,976,938 on Wednesday.

The market closed after 551,681,523 shares were traded for $1,798,734,217 compared with 26,696,028 units at $155,976,938 on Wednesday.

Trading averaged 9,043,959 shares at $29,487,446 compared to 444,934 stocks at $2,599,616 on Wednesday. Trading for the month to date, ended with an average of 3,224,837 units at $11,103,727, compared with 315,276 units at $1,911,868 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

Transjamaican Highway led trading with 540.57 million shares for 98 percent of total volume followed by QWI Investments with 4.40 million units for 0.8 percent of the day’s trade, JMMB Group 7.25% preference share due 2024 closed with 1.98 million units for 0.4 percent market share and Wigton Windfarm with 1.42 million units for 0.3 percent of total volume.

The All Jamaican Composite Index climbed 1,625.36 points to lock up trading at 367,225.42, the JSE Main Index jumped 1,510.99 points to close at 327,923.66 and the JSE Financial Index popped 0.43 points to end the day at 70.40.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden shed $2.75 to close at $35.75 with investors trading 2,332 units, Barita Investments fell $2.27 in closing at $70.63, with 6,503 stocks changing hands, Caribbean Cement declined $2.45 and ended at $56 as investors exchanged 16,470 shares. Caribbean Producers shed 50 cents to finish at $8.90 in trading 98,724 stock units, Eppley Caribbean Property Fund climbed 51 cents to close at $37.51 after an exchange of 117 shares, First Rock Real Estate dropped 43 cents to end at $10 with investors swapping 284,351 stock units. Jamaica Broilers sank 60 cents to $32.90 in an exchange of 104,752 units, Jamaica Producers increased $1.30 to close at $24.30 with investors dealing in 5,026 stocks, Key Insurance popped 36 cents and ended at $2.57 with 2,094 shares clearing the market. Kingston Wharves skidded 30 cents to finish at $30 with investors transferring 29,870 units, Margaritaville lost $1.02 to end at $15.98 in switching ownership of 3 stocks, Mayberry Group slipped 46 cents in closing at $6.92 after 3,448 stock units passed through the market. NCB Financial advanced $1 to $65 in an exchange of 4,109 shares, Pan Jamaica rose $1.40 and ended at $49.90, with 2,533 stock units crossing the market, Sagicor Group gained 30 cents to finish at $41.50 after a transfer of 18,896 stocks. Scotia Group rallied 80 cents to end at $46.70 after 132,003 units were traded, Supreme Ventures sank 99 cents in closing at $23.50 with a transfer of 15,342 stocks, Sygnus Credit Investments skidded 30 cents to close at $10.50, with 63,922 units crossing the exchange and Sygnus Real Estate Finance fell $2.60 to $10.20 with traders dealing in 242 shares.

Kingston Wharves skidded 30 cents to finish at $30 with investors transferring 29,870 units, Margaritaville lost $1.02 to end at $15.98 in switching ownership of 3 stocks, Mayberry Group slipped 46 cents in closing at $6.92 after 3,448 stock units passed through the market. NCB Financial advanced $1 to $65 in an exchange of 4,109 shares, Pan Jamaica rose $1.40 and ended at $49.90, with 2,533 stock units crossing the market, Sagicor Group gained 30 cents to finish at $41.50 after a transfer of 18,896 stocks. Scotia Group rallied 80 cents to end at $46.70 after 132,003 units were traded, Supreme Ventures sank 99 cents in closing at $23.50 with a transfer of 15,342 stocks, Sygnus Credit Investments skidded 30 cents to close at $10.50, with 63,922 units crossing the exchange and Sygnus Real Estate Finance fell $2.60 to $10.20 with traders dealing in 242 shares.

In the preference segment, Jamaica Public Service 7% rose 99 cents in closing at $43, with 6 stock units crossing the market, 138 Student Living preference share dipped 53 cents to close at $217.50 after exchanging 2 shares. Productive Business Solutions 10.5 % preference share advanced $11 to finish at $1110 and closed with an exchange of 249 stock units and Sygnus Credit Investments C10.5% popped $1 and ended at $110 with an exchange of 587 units.

In the preference segment, Jamaica Public Service 7% rose 99 cents in closing at $43, with 6 stock units crossing the market, 138 Student Living preference share dipped 53 cents to close at $217.50 after exchanging 2 shares. Productive Business Solutions 10.5 % preference share advanced $11 to finish at $1110 and closed with an exchange of 249 stock units and Sygnus Credit Investments C10.5% popped $1 and ended at $110 with an exchange of 587 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

More declines for Main Market

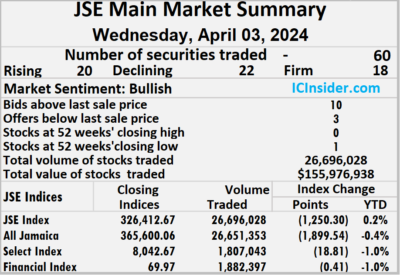

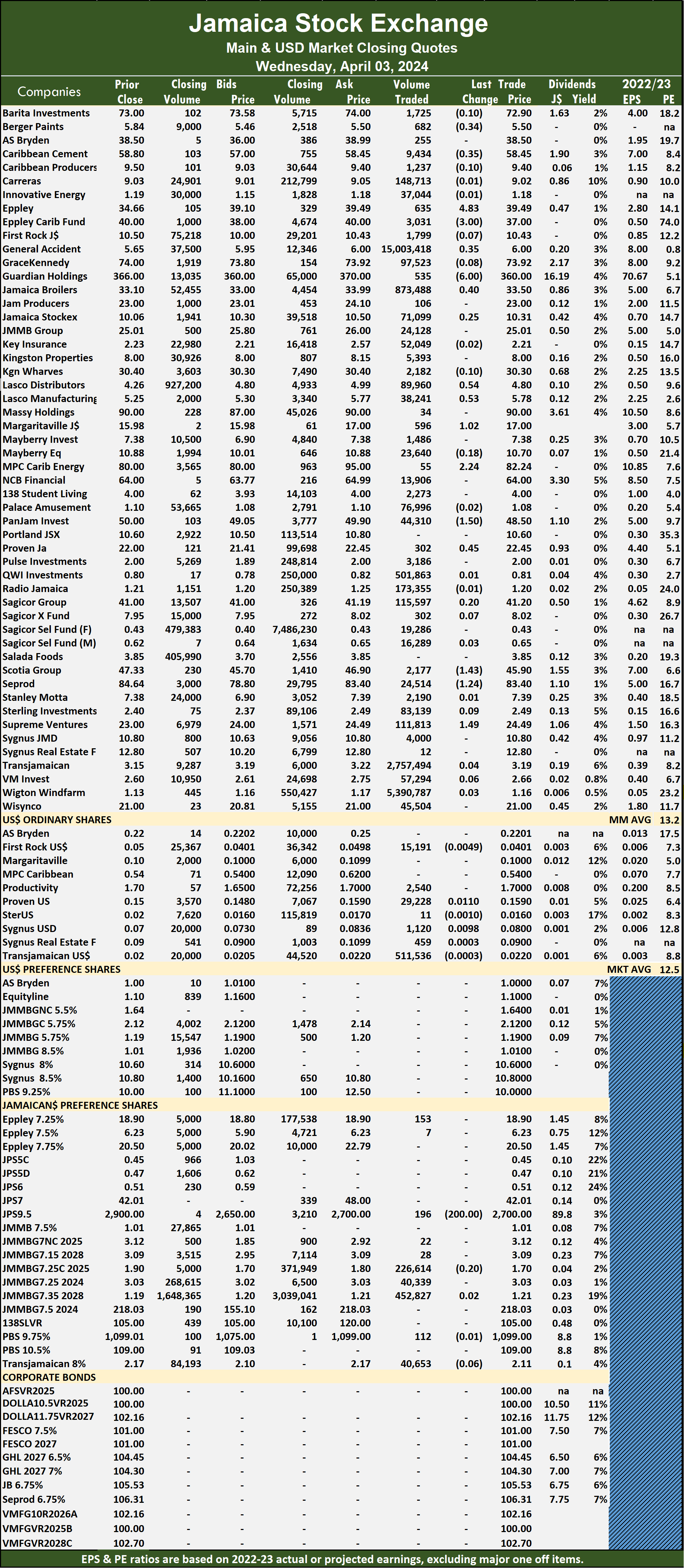

Falling stocks just edged out those rising in trading on the Main Market of the Jamaica Stock Exchange on Wednesday, with trading in 60 securities compared with 62 on Tuesday, with prices of 20 stocks rising, 22 declining and 18 ending unchanged, with a surge of 127 percent in the volume of stocks traded and 102 percent greater value than on Tuesday.

The market closed with an exchange of 26,696,028 shares at $155,976,938 from 11,767,625 units at $77,270,952 on Tuesday.

The market closed with an exchange of 26,696,028 shares at $155,976,938 from 11,767,625 units at $77,270,952 on Tuesday.

Trading averaged 444,934 shares at $2,599,616 compared to 189,800 units at $1,246,306 on Tuesday and month to date, an average of 315,276 units at $1,911,868 compared with March that closed with an average of 828,473 units at $2,341,254.

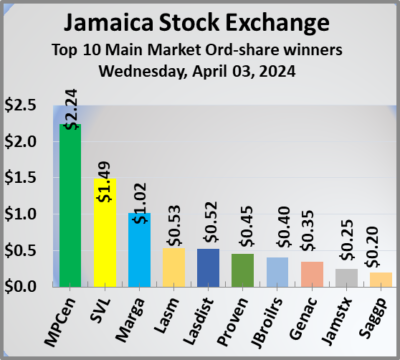

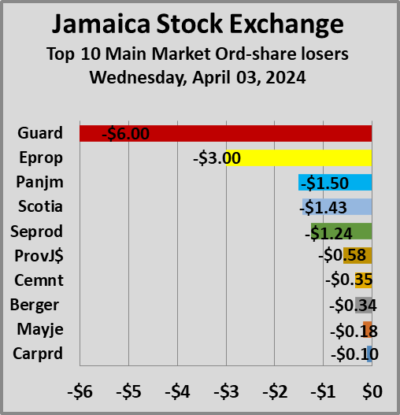

General Accident led trading with 15.0 million shares for 56.2 percent of total volume followed by Wigton Windfarm with 5.39 million units for 20.2 percent of the day’s trade and Transjamaican Highway with 2.76 million stock units for 10.3 percent market share.

The All Jamaican Composite Index lost 1,899.54 points to end trading at 365,600.06, the JSE Main Index fell 1,250.30 points to 326,412.67 and the JSE Financial Index skidded 0.41 points to settle at 69.97.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Berger Paints declined 34 cents and ended at $5.50 with investors trading 682 shares, Caribbean Cement lost 35 cents to close at $58.45 in an exchange of 9,434 stocks, Eppley gained $4.83 in closing at $39.49 as investors traded 635 units. Eppley Caribbean Property Fund fell $3 to end at $37 after investors ended trading 3,031 stock units, General Accident popped 35 cents to $6, with 15,003,418 shares crossing the market, Guardian Holdings skidded $6 to $360 in an exchange of 535 stock units. Jamaica Broilers advanced 40 cents and ended at $33.50 with investors dealing in 873,488 stocks, Lasco Distributors rose 54 cents to $4.80 with a transfer of 89,960 units,  Lasco Manufacturing rallied 53 cents to close at $5.78, with 38,241 shares crossing the exchange. Margaritaville gained $1.02 to end at $17 in trading 596 stock units, MPC Caribbean Clean Energy rose $2.24 to $82.24 after an exchange of 55 units, Pan Jamaica sank $1.50 and ended at $48.50 with investors trading 44,310 stocks. Proven Investments popped 45 cents in closing at $22.45 in switching ownership of 302 units, Scotia Group dropped $1.43 to $45.90 with traders dealing in 2,177 shares, Seprod shed $1.24 to close at $83.40 while exchanging 24,514 stock units and Supreme Ventures increased $1.49 to $24.49 after a transfer of 111,813 stocks.

Lasco Manufacturing rallied 53 cents to close at $5.78, with 38,241 shares crossing the exchange. Margaritaville gained $1.02 to end at $17 in trading 596 stock units, MPC Caribbean Clean Energy rose $2.24 to $82.24 after an exchange of 55 units, Pan Jamaica sank $1.50 and ended at $48.50 with investors trading 44,310 stocks. Proven Investments popped 45 cents in closing at $22.45 in switching ownership of 302 units, Scotia Group dropped $1.43 to $45.90 with traders dealing in 2,177 shares, Seprod shed $1.24 to close at $83.40 while exchanging 24,514 stock units and Supreme Ventures increased $1.49 to $24.49 after a transfer of 111,813 stocks.

In the preference segment, Jamaica Public Service 9.5% dropped $200 to close at 52 weeks’ low of $2700 with 196 shares clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

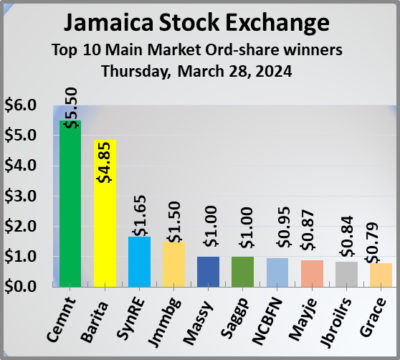

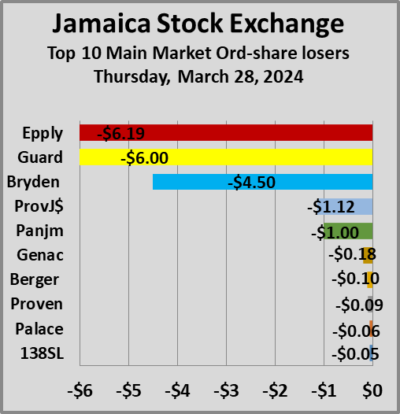

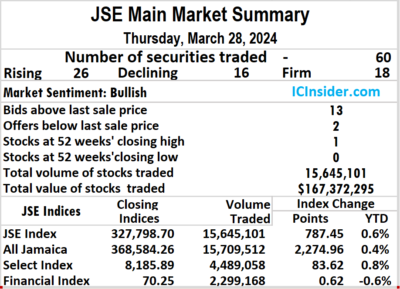

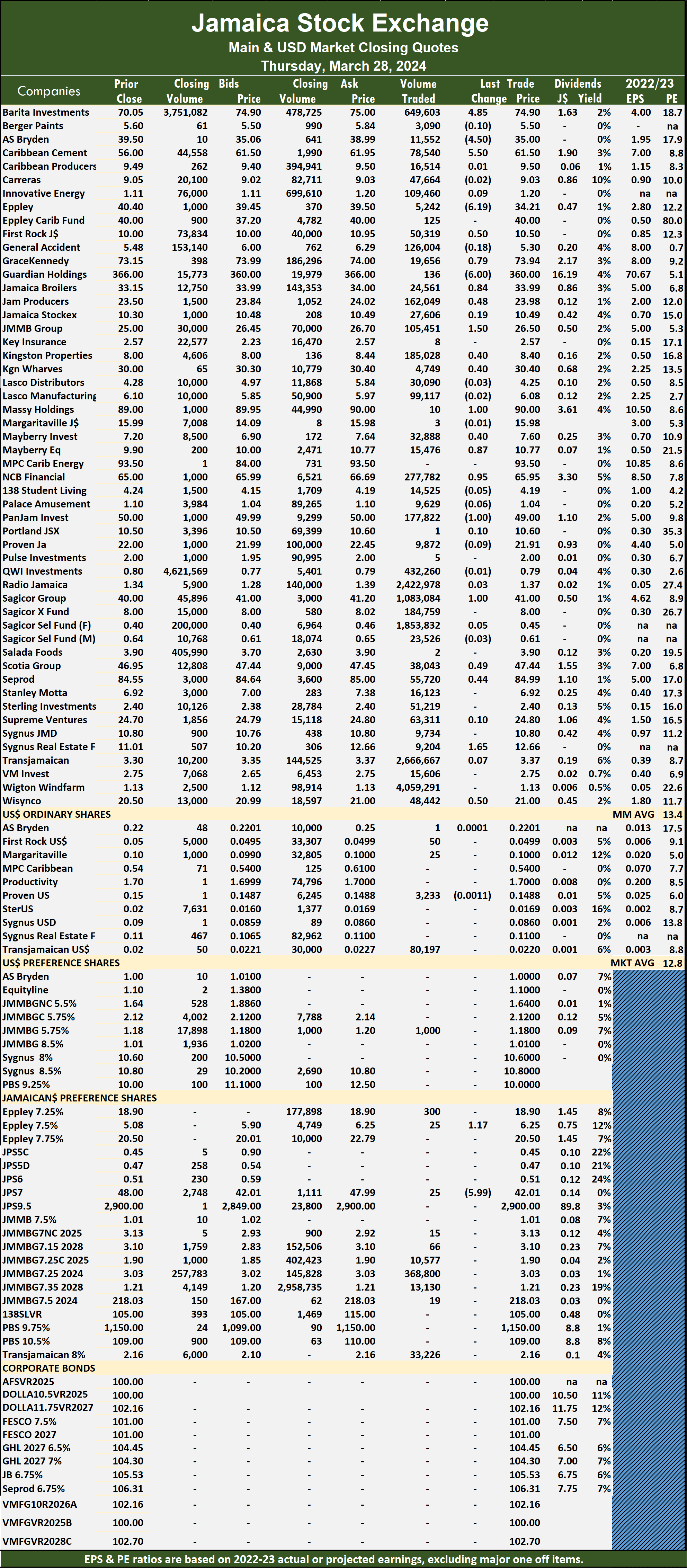

Main Market rallies into month end

Trading on the Jamaica Stock Exchange Main Market ended on Thursday, with the volume of stocks traded rising 93 percent and the value 88 percent more than on Wednesday, with trading in 60 securities compared with 63 on Wednesday, with prices of 26 stocks rising, 16 declining and 18 ending unchanged.

The market closed after 15,645,101 shares were traded for $167,372,295 compared with 8,091,866 units at $89,053,515, on Wednesday.

The market closed after 15,645,101 shares were traded for $167,372,295 compared with 8,091,866 units at $89,053,515, on Wednesday.

Trading averaged 260,752 shares at $2,789,538 compared to 130,514 units at $1,436,347 on Wednesday and month to date, an average of 846,359 units at $2,376,538, in comparison with 878,131 units at $2,354,246 on the previous day and February that closed with an average of 387,306 units at $3,375,928.

Wigton Windfarm led trading with 4.06 million shares for 25.9 percent of total volume followed by Transjamaican Highway with 2.67 million units for 17 percent of the day’s trade, Radio Jamaica added 2.42 million stock units for 15.5 percent market share, Sagicor Select Financial Fund ended with 1.85 million units for 11.8 percent of trading and Sagicor Group with 1.08 million units for 6.9 percent of total volume.

The All Jamaican Composite Index advanced 2,274.96 points to 368,584.26, the JSE Main Index popped 787.45 points to end at 327,798.70 and the JSE Financial Index rose 0.62 points to wrap up trading for March at 70.25.

The Main Market ended trading with an average PE Ratio of 13.4. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.4. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, AS Bryden dropped $4.50 in closing at $35 with investors dealing in 11,552 shares, Barita Investments climbed $4.85 to close at $74.90, with 649,603 stocks crossing the exchange, Caribbean Cement increased $5.50 and ended at $61.50 with investors swapping 78,540 shares. Eppley shed $6.19 to close at $34.21 with an exchange of 5,242 stock units, First Rock Real Estate popped 50 cents to end at $10.50 after trading 50,319 shares, GraceKennedy advanced 79 cents in closing at $73.94 after an exchange of 19,656 stock units. Guardian Holdings fell $6 to $360 in switching ownership of 136 stocks, Jamaica Broilers rose 84 cents to end at $33.99 after a transfer of 24,561 units, Jamaica Producers rallied 48 cents to close at $23.98, with 162,049 stocks changing hands.  JMMB Group gained $1.50 and ended at $26.50 with investors trading 105,451 shares, Kingston Properties popped 40 cents to $8.40 with 185,028 stock units clearing the market, Kingston Wharves advanced 40 cents and ended at $30.40 after an exchange of 4,749 units. Massy Holdings rose $1 in closing at $90 in trading 10 shares, Mayberry Group gained 40 cents to end at $7.60 after an exchange of 32,888 units, Mayberry Jamaican Equities climbed 87 cents to close at $10.77 after 15,476 stocks passed through the market. NCB Financial increased 95 cents to $65.95 in an exchange of 277,782 stock units, Pan Jamaica skidded $1 and ended at $49 with 177,822 shares crossing the market, Sagicor Group rallied $1 to end at $41 while exchanging 1,083,084 stock units. Scotia Group rose 49 cents in closing at a 52 weeks’ high of $47.44 with traders dealing in 38,043 stocks, Seprod climbed 44 cents to close at $84.99 in an exchange of 55,720 units,

JMMB Group gained $1.50 and ended at $26.50 with investors trading 105,451 shares, Kingston Properties popped 40 cents to $8.40 with 185,028 stock units clearing the market, Kingston Wharves advanced 40 cents and ended at $30.40 after an exchange of 4,749 units. Massy Holdings rose $1 in closing at $90 in trading 10 shares, Mayberry Group gained 40 cents to end at $7.60 after an exchange of 32,888 units, Mayberry Jamaican Equities climbed 87 cents to close at $10.77 after 15,476 stocks passed through the market. NCB Financial increased 95 cents to $65.95 in an exchange of 277,782 stock units, Pan Jamaica skidded $1 and ended at $49 with 177,822 shares crossing the market, Sagicor Group rallied $1 to end at $41 while exchanging 1,083,084 stock units. Scotia Group rose 49 cents in closing at a 52 weeks’ high of $47.44 with traders dealing in 38,043 stocks, Seprod climbed 44 cents to close at $84.99 in an exchange of 55,720 units,  Sygnus Real Estate Finance increased $1.65 to $12.66 with investors trading 9,204 shares and Wisynco Group popped 50 cents to end at $21, with 48,442 stock units crossing the market.

Sygnus Real Estate Finance increased $1.65 to $12.66 with investors trading 9,204 shares and Wisynco Group popped 50 cents to end at $21, with 48,442 stock units crossing the market.

In the preference segment, Eppley 7.50% preference share advanced $1.17 in closing at $6.25 as investors exchanged 25 stocks and Jamaica Public Service 7% sank $5.99 and ended at $42.01 with a transfer of 25 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Stocks lost ground on the JSE Main Market

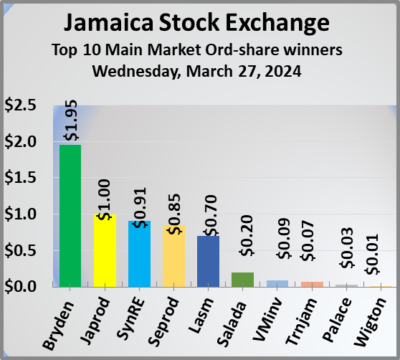

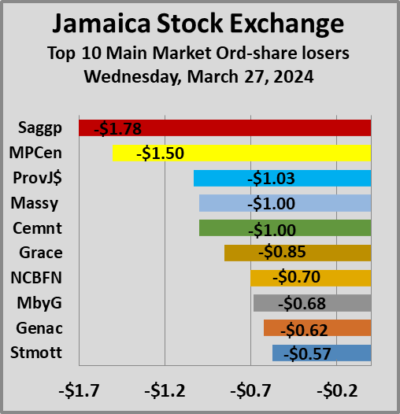

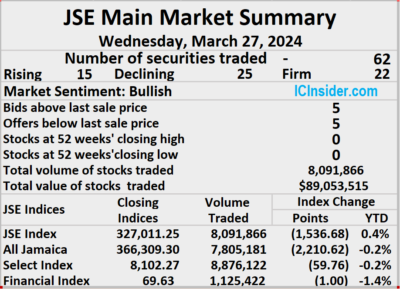

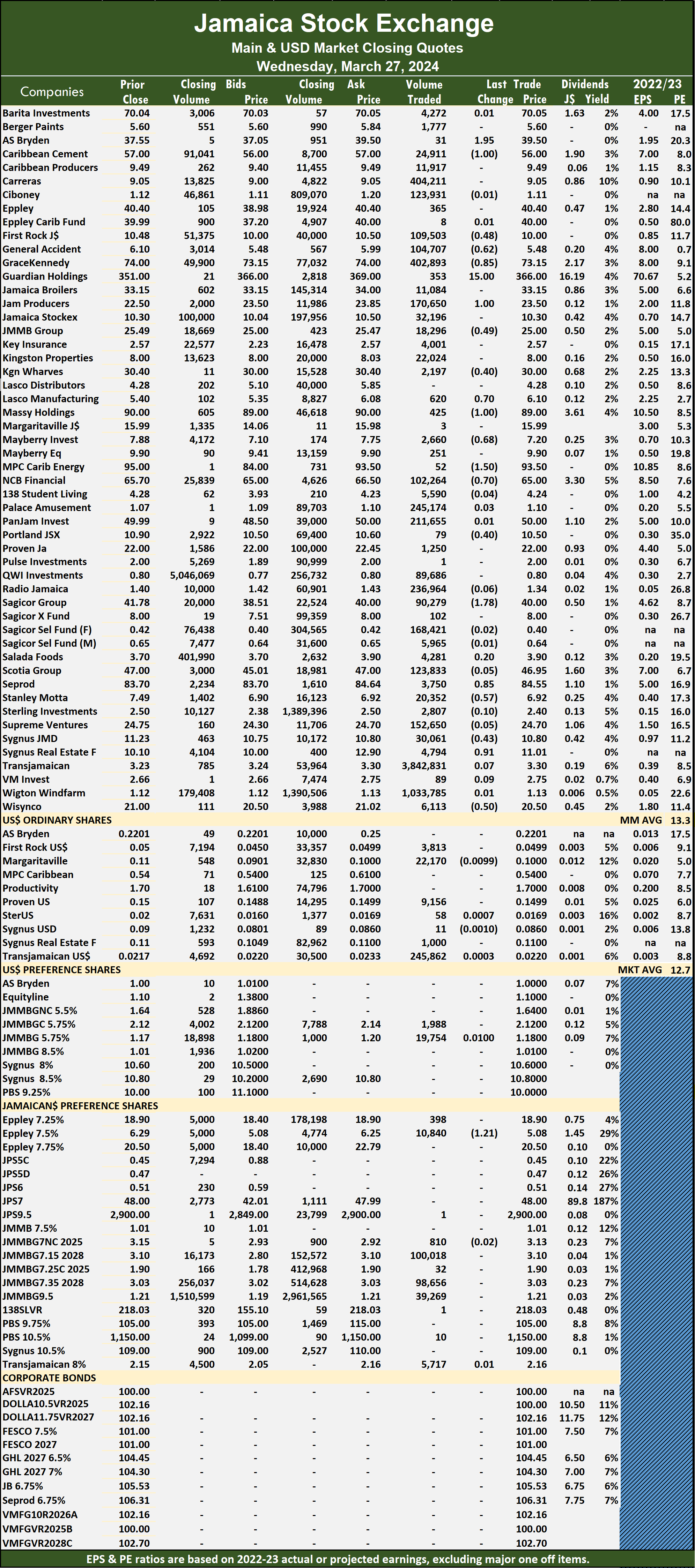

Trading on the Jamaica Stock Exchange Main Market ended on Wednesday, with a 43 percent fall in the volume of stocks traded at a 38 percent lower value than on Tuesday, with trading in 62 securities compared with 60 on Tuesday, with prices of 15 stocks rising, 25 declining and 22 ending unchanged.

The market closed with 8,091,866 shares being traded for $89,053,515 compared with 13,924,449 units at $141,822,725 on Tuesday.

The market closed with 8,091,866 shares being traded for $89,053,515 compared with 13,924,449 units at $141,822,725 on Tuesday.

Trading averaged 130,514 shares at $1,436,347 compared to 240,077 units at $2,408,705 on Tuesday and month to date, an average of 878,131 units at $2,354,246 compared to 922,487 units at $2,408,705 on the previous day and February with an average of 387,306 units at $3,375,928.

Transjamaican Highway led trading with 3.84 million shares for 47.5 percent of total volume followed by Wigton Windfarm with 1.03 million units for 12.8 percent of the day’s trade and Carreras with 404,211 units for 5 percent market share.

The All Jamaican Composite Index shed 2,210.62 points to close at 366,309.30, the JSE Main Index dipped 1,536.68 points to settle at 327,011.25 and the JSE Financial Index sank 1.00 points to settle at 69.63.

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, AS Bryden advanced $1.95 in closing at $39.50 with an exchange of 31 shares, Caribbean Cement dipped $1 to $56 with an exchange of 24,911 units, First Rock Real Estate fell 48 cents and ended at $10 with investors dealing in 109,503 shares. General Accident skidded 62 cents to end at $5.48 in an exchange of 104,707 stock units, GraceKennedy lost 85 cents to close at $73.15 with traders dealing in 402,893 shares, Guardian Holdings popped $15 to $366 as investors exchanged 353 stock units. Jamaica Producers climbed $1 and ended at $23.50 with a transfer of 170,650 stocks, JMMB Group shed 49 cents to close at $25 while exchanging 18,296 units, Kingston Wharves declined 40 cents in closing at $30 with investors trading 2,197 stocks.  Lasco Manufacturing migrated to the Main market on Wednesday and rose 70 cents to end at $6.10 in an exchange of a mere 620 units, following an absence of meaningful offers to sell. Massy Holdings sank $1 in closing at $89, with 425 shares changing hands, Mayberry Group dropped 68 cents to $7.20 with an exchange of 2,660 stock units. MPC Caribbean Clean Energy sank $1.50 and ended at $93.50, with investors trading 52 shares, NCB Financial declined 70 cents to close at $65 with a transfer of 102,264 stocks, Portland JSX fell 40 cents to end at $10.50 after exchanging 79 units. Sagicor Group skidded $1.78 in closing at $40 with investors swapping 90,279 stock units, Seprod rallied 85 cents to $84.55 with 3,750 shares clearing the market, Stanley Motta lost 57 cents to close at $6.92 in switching ownership of 20,352 stock units. Sygnus Credit Investments shed 43 cents to end at $10.80, with 30,061 stocks crossing the market,

Lasco Manufacturing migrated to the Main market on Wednesday and rose 70 cents to end at $6.10 in an exchange of a mere 620 units, following an absence of meaningful offers to sell. Massy Holdings sank $1 in closing at $89, with 425 shares changing hands, Mayberry Group dropped 68 cents to $7.20 with an exchange of 2,660 stock units. MPC Caribbean Clean Energy sank $1.50 and ended at $93.50, with investors trading 52 shares, NCB Financial declined 70 cents to close at $65 with a transfer of 102,264 stocks, Portland JSX fell 40 cents to end at $10.50 after exchanging 79 units. Sagicor Group skidded $1.78 in closing at $40 with investors swapping 90,279 stock units, Seprod rallied 85 cents to $84.55 with 3,750 shares clearing the market, Stanley Motta lost 57 cents to close at $6.92 in switching ownership of 20,352 stock units. Sygnus Credit Investments shed 43 cents to end at $10.80, with 30,061 stocks crossing the market,  Sygnus Real Estate Finance increased 91 cents and ended at $11.01 in trading 4,794 units and Wisynco Group dropped 50 cents to $20.50 after a transfer of 6,113 stocks.

Sygnus Real Estate Finance increased 91 cents and ended at $11.01 in trading 4,794 units and Wisynco Group dropped 50 cents to $20.50 after a transfer of 6,113 stocks.

In the preference segment, Eppley 7.50% preference share dipped $1.21 to end at $5.08, with 10,840 shares crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Stocks record big gains on JSE Main Market

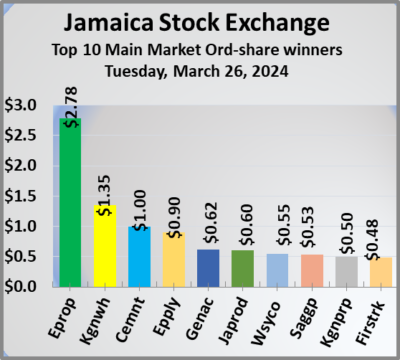

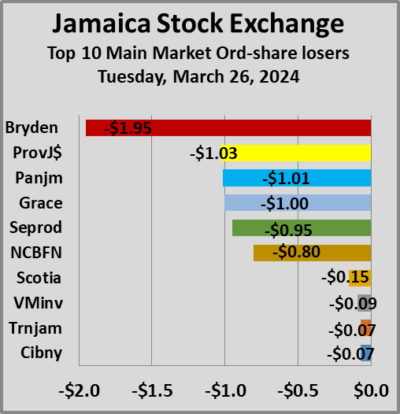

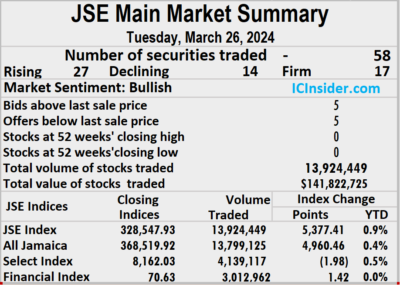

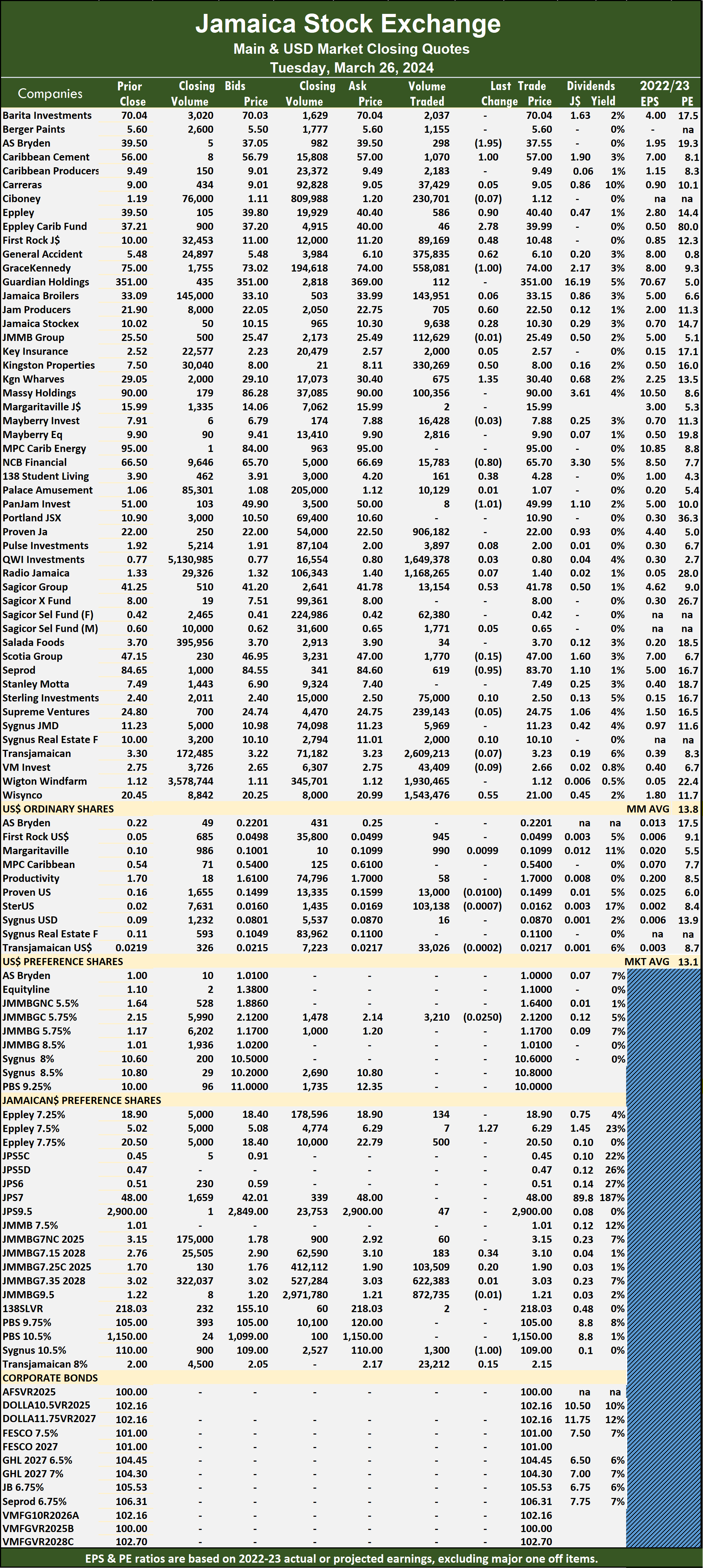

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 46 percent and the value 31 percent lower than on Monday, following trading in 58 securities compared with 55 on Monday, with prices of 27 stocks rising, 14 declining and 17 ending unchanged.

The market closed on Tuesday with the trading of 13,924,449 shares with a value of $141,822,725 compared with 25,850,445 units at $206,255,781 on Monday.

The market closed on Tuesday with the trading of 13,924,449 shares with a value of $141,822,725 compared with 25,850,445 units at $206,255,781 on Monday.

Trading averaged 240,077 shares at $2,445,219 compared to 470,008 units at $3,750,105 on Monday and month to date, an average of 922,487 units at $2,408,707, in comparison to 962,588 units at $2,406,562 on the previous day and February with an average of 385,143 units at $3,418,046.

Transjamaican Highway led trading with 2.61 million shares for 18.7 percent of total volume followed by Wigton Windfarm with 1.93 million units for 13.9 percent of the day’s trade, QWI Investments ended with 1.65 million units for 11.8 percent of market share, Wisynco Group closed with 1.54 million units for 11.1 percent of shares trading and Radio Jamaica with 1.17 million units for 8.4 percent of total volume.

The All Jamaican Composite Index climbed 4,960.46 points to culminate at 368,519.92, the JSE Main Index jumped 5,377.41 points to 328,547.93 and the JSE Financial Index popped 1.42 points to lock up trading at 70.63.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, AS Bryden fell $1.95 in closing at $37.55 after 298 stock units cleared the market, Caribbean Cement gained $1 to $57 after exchanging 1,070 shares, Eppley rose 90 cents and ended at $40.40 with a transfer of 586 units. Eppley Caribbean Property Fund climbed $2.78 to end at $39.99 with investors dealing in 46 stocks, First Rock Real Estate popped 48 cents to close at $10.48 with 89,169 units crossing the market, General Accident rallied 62 cents to $6.10 with investors transferring 375,835 stocks. GraceKennedy lost $1 and ended at $74 trading 558,081 shares, Jamaica Producers increased 60 cents to close at $22.50 in switching ownership of 705 stock units, Kingston Properties advanced 50 cents to end at $8 with investors swapping 330,269 shares. Kingston Wharves rose $1.35 in closing at $30.40, with 675 units crossing the exchange, NCB Financial shed 80 cents to end at $65.70 after a transfer of 15,783 stocks, 138 Student Living gained 38 cents to end at $4.28 after 161 stock units passed through the market. Pan Jamaica declined $1.01 in closing at $49.99 while exchanging 8 shares, Sagicor Group popped 53 cents to close at $41.78 with investors trading 13,154 units, Seprod sank 95 cents and ended at $83.70 with an exchange of 619 stocks and Wisynco Group increased 55 cents to $21, with 1,543,476 stock units changing hands.

NCB Financial shed 80 cents to end at $65.70 after a transfer of 15,783 stocks, 138 Student Living gained 38 cents to end at $4.28 after 161 stock units passed through the market. Pan Jamaica declined $1.01 in closing at $49.99 while exchanging 8 shares, Sagicor Group popped 53 cents to close at $41.78 with investors trading 13,154 units, Seprod sank 95 cents and ended at $83.70 with an exchange of 619 stocks and Wisynco Group increased 55 cents to $21, with 1,543,476 stock units changing hands.

In the preference segment, Eppley 7.50% preference share climbed $1.27 to end at $6.29 in an exchange of 7 shares, JMMB Group 7.15% – 2028 rallied 34 cents in closing at $3.10 after 183 stock units passed through the exchange and Sygnus Credit Investments C10.5% skidded $1 to close at $109 as investors exchanged 1,300 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market plunged

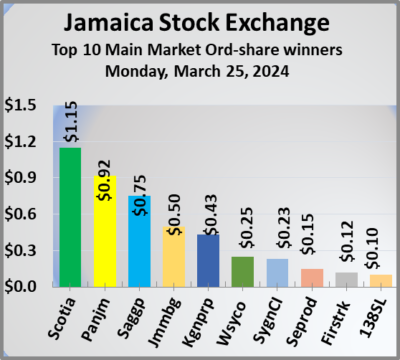

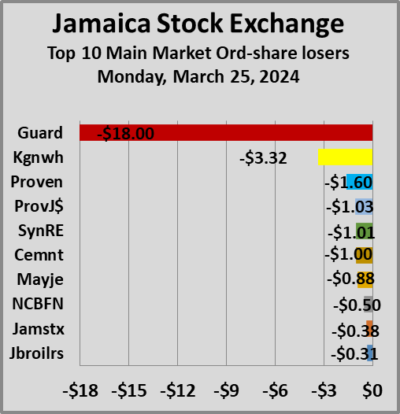

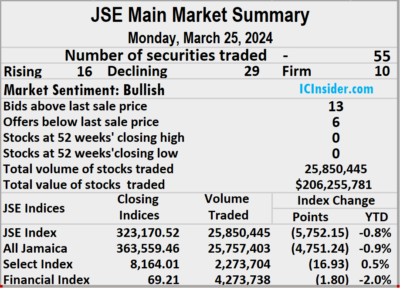

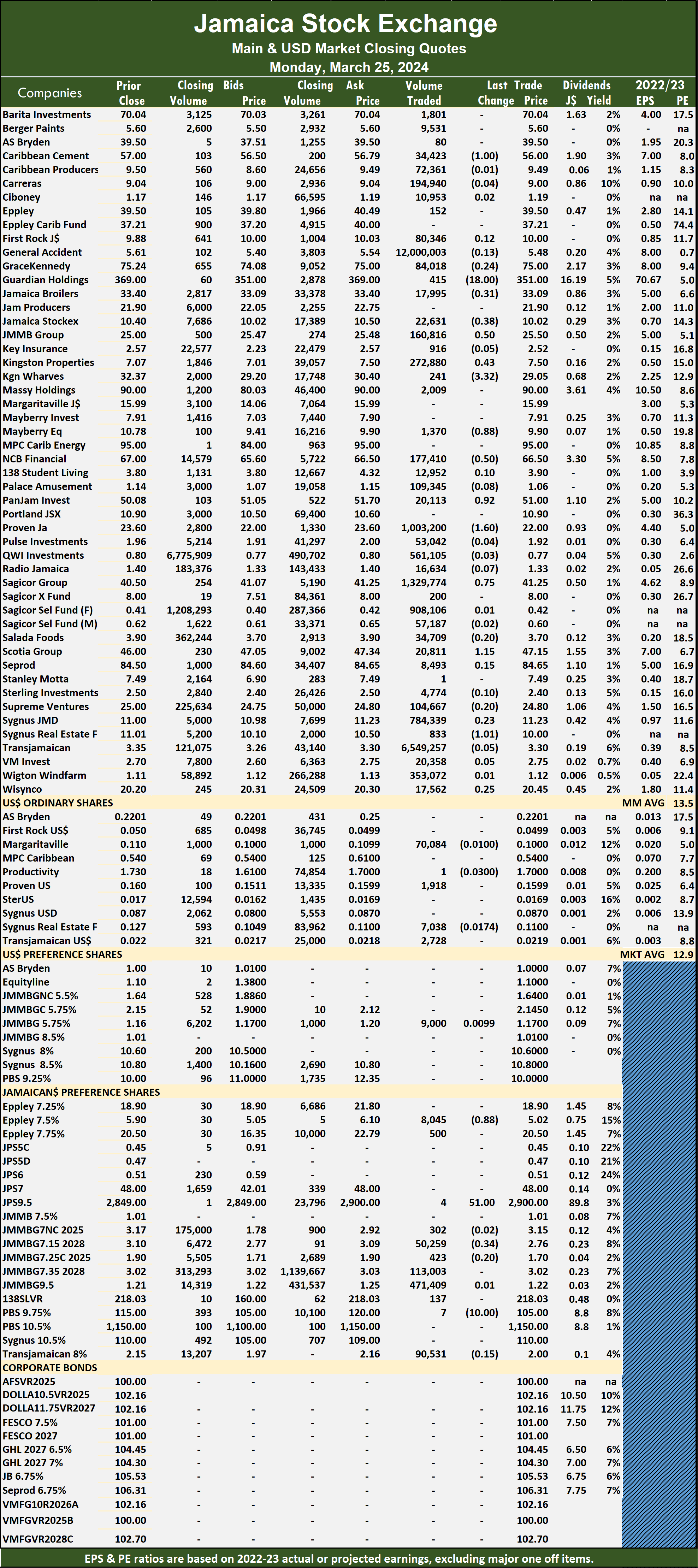

Stocks plunged on Jamaica Stock Exchange Main Market on Monday, sending the market indices sharply lower by the close after the volume of stocks traded rose 174 percent and the value surged 587 percent over Friday’s levels, with trading in 55 securities compared with 57 on Friday, ending with prices of 16 stocks rising, 29 declining and 10 ending unchanged.

The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday.

The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday.

Trading averaged 470,008 shares at $3,750,105 compared to 165,678 units at $527,048 on Friday and month to date, an average of 962,588 units at $2,406,562 compared with 991,657 units at $2,327,275 on the previous trading day and February that closed with an average of 385,143 units at $3,418,046.

General Accident led trading with 12.0 million shares for 46.4 percent of total volume followed by Transjamaican Highway with 6.55 million units for 25.3 percent of the day’s trade, Sagicor Group chipped in with 1.33 million stocks for 5.1 percent of market share and Proven Investments with 1.0 million units for 3.9 percent of total volume.

The All Jamaican Composite Index dropped 4,751.24 points to 363,559.46, the JSE Main Index sank 5,752.15 points to end at 323,170.52 and the JSE Financial Index lost 1.80 points to 69.21.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, Caribbean Cement fell $1 to close at $56 after34,423 stocks passed through the market, Guardian Holdings skidded $18 to $351 with an exchange of 415 units, Jamaica Broilers lost 31 cents to end at $33.09, with 17,995 shares crossing the market. Jamaica Stock Exchange shed 38 cents in closing at $10.02 with traders dealing in 22,631 stock units, JMMB Group popped 50 cents and ended at $25.50 in switching ownership of 160,816 shares, Kingston Properties climbed 43 cents to $7.50, with 272,880 units crossing the exchange. Kingston Wharves dropped $3.32 and ended at $29.05 with investors swapping 241 stocks, Mayberry Jamaican Equities sank 88 cents in closing at $9.90, with 1,370 stock units crossing the market, NCB Financial declined 50 cents to close at $66.50 with trading of 177,410 shares.  Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units.

Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units.

In the preference segment, Eppley 7.50% preference share skidded 88 cents and ended at $5.02 while exchanging 8,045 stocks. Jamaica Public Service 9.5% increased $51 to $2,900 with investors transferring 4 stock units, JMMB Group 7.15% – 2028 sank 34 cents to close at $2.76 in an exchange of 50,259 shares and Productive Business Solutions 9.75% preference share dropped $10 in closing at $105 after 7 stocks changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading dropped prices rise on JSE Main Market

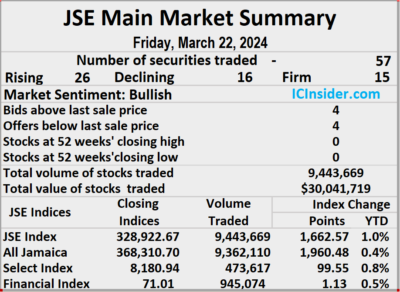

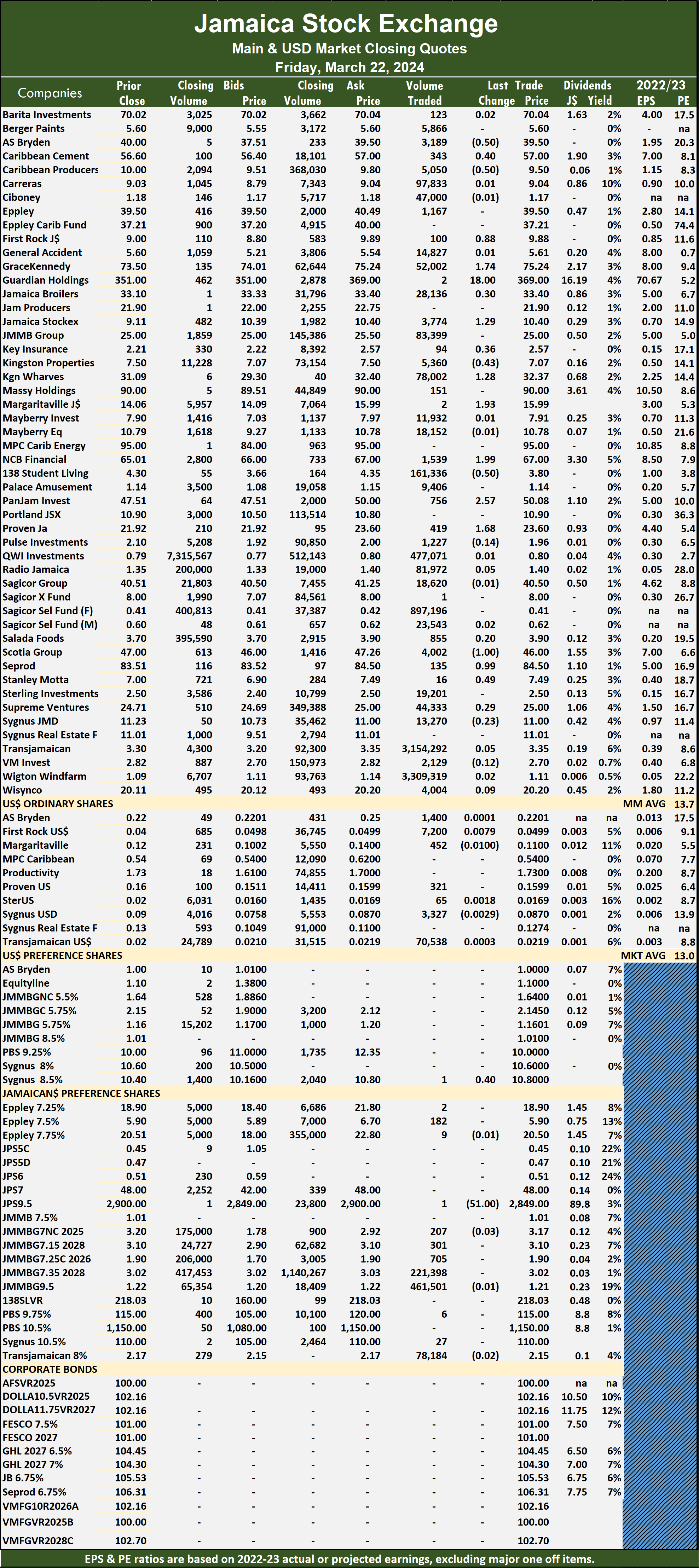

Trading dropped on the Jamaica Stock Exchange Main Market on Friday, with the volume of stocks traded plunging 63 percent and the value 61 percent lower, compared with market activity on Thursday, ending with trading in 57 securities as was the case on Thursday, with prices of 26 stocks rising, 16 declining and 15 ending unchanged.

The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday.

The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday.

Trading averaged 165,678 shares at $527,048 compared to 445,362 units at $1,335,486 on Thursday and month to date, an average of 991,657 stocks at $2,327,275 compared to 1,045,463 units at $2,444,547 on the previous day and February that closed with an average of 385,143 stock units at $3,418,046.

Wigton Windfarm led trading with 3.31 million shares for 35 percent of total volume followed by Transjamaican Highway with 3.15 million units for 33.4 percent of the day’s trade and Sagicor Select Financial Fund with 897,196 units for 9.5 percent market share.

The All Jamaican Composite Index increased 1,960.48 points to conclude trading at 368,310.70, the JSE  Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01.

Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

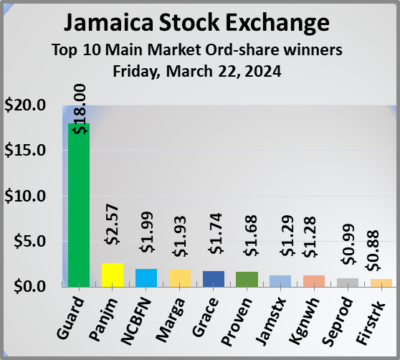

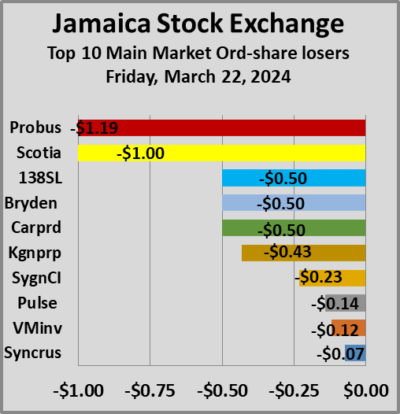

At the close, AS Bryden dropped 50 cents to $39.50 while exchanging 3,189 stock units, Caribbean Cement gained 40 cents to close at $57 in trading 343 shares, Caribbean Producers fell 50 cents in closing at $9.50 with 5,050 stocks clearing the market. First Rock Real Estate rose 88 cents and ended at $9.88 after exchanging 100 units, GraceKennedy advanced $1.74 to end at $75.24 with investors swapping 52,002 shares, Guardian Holdings popped $18 to $369 with an exchange of just two units. Jamaica Broilers increased 30 cents and ended at $33.40, with 28,136 stocks crossing the market,  Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units.

Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units.

In the preference segment, Jamaica Public Service 9.5% declined $51 in closing at $2849 with investors trading just one stock.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main market lost altitude

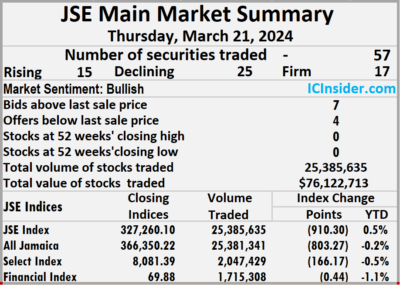

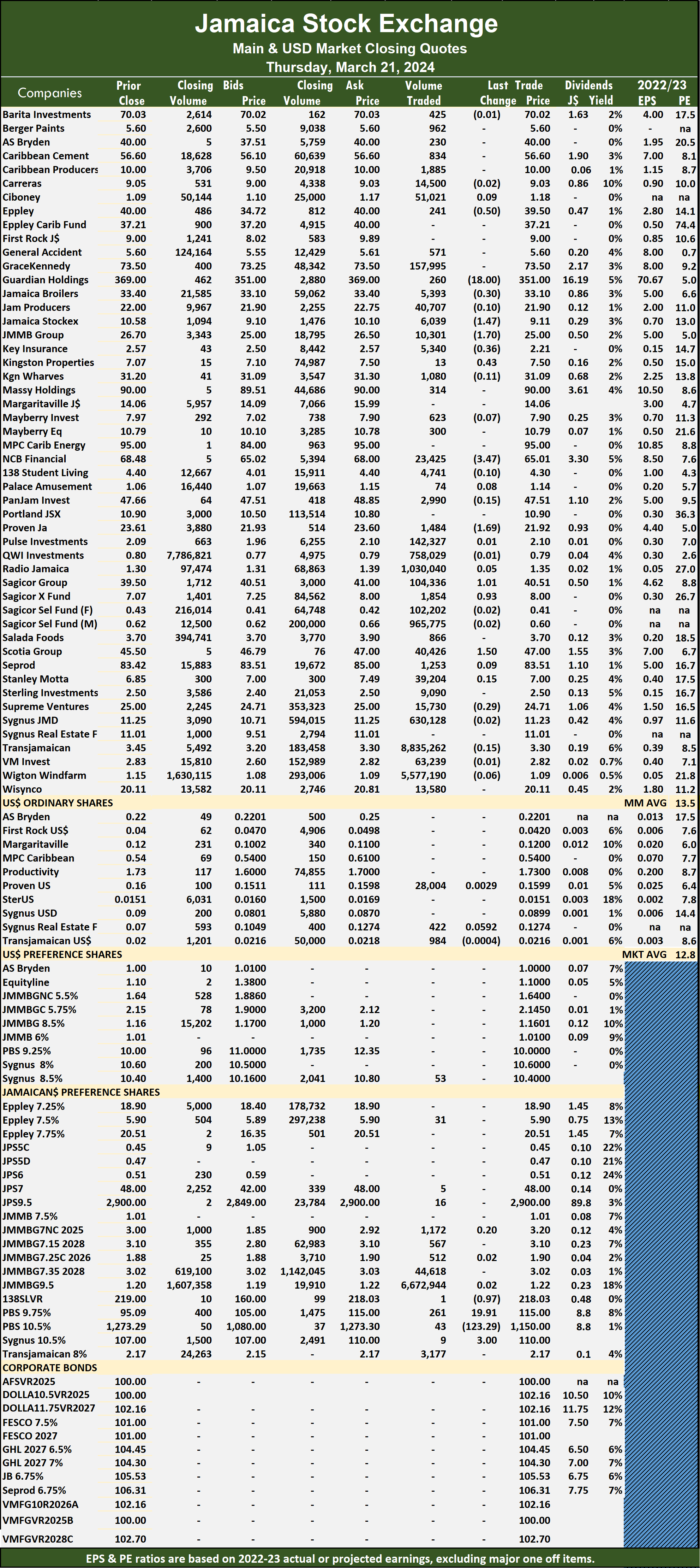

Trading on the Jamaica Stock Exchange Main Market ended on Thursday, with the volume of stocks traded rising 112 percent with a marginally greater value than on Wednesday, with trading in 57 securities compared with 58 on Wednesday, with prices of 15 stocks rising, 25 declining and 17 ending unchanged.

The market closed with 25,385,635 shares being traded for $76,122,713 compared with 11,956,313 units at $74,815,722 on Wednesday.

The market closed with 25,385,635 shares being traded for $76,122,713 compared with 11,956,313 units at $74,815,722 on Wednesday.

Trading averaged 445,362 shares at $1,335,486 compared with 206,143 units at $1,289,926 on Wednesday and for the month to date, an average of 1,045,463 units at $2,444,547 compared with 1,087,279 units at $2,521,829 on the previous day and February that closed with an average of 385,143 units at $3,418,046.

Transjamaican Highway led trading with 8.84 million shares for 34.8 percent of total volume followed by JMMB 9.5% preference share with 6.67 million units for 26.3 percent of the day’s trade, Wigton Windfarm chipped in with 5.58 million units for 22 percent market share and Radio Jamaica ended with 1.03 million units for 4.1 percent of total volume.

The All Jamaican Composite Index shed 803.27 points to end at 366,350.22, the JSE Main Index sank 910.30 points to end at 327,260.10 and the JSE Financial Index declined 0.44 points to close at 69.88.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers.

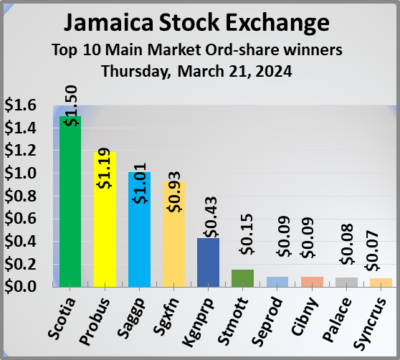

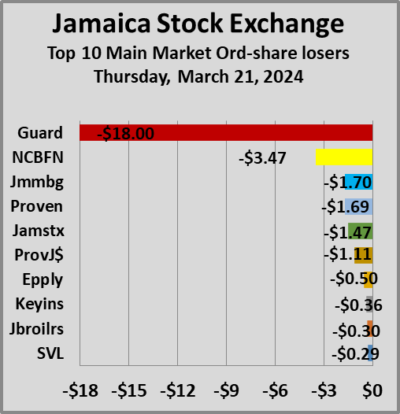

At the close, Eppley declined 50 cents to end at $39.50 with 241 stocks clearing the market, Guardian Holdings fell $18 to $351 in an exchange of 260 units, Jamaica Broilers shed 30 cents and ended at $33.10 after 5,393 shares passed through the market. Jamaica Stock Exchange sank $1.47 to close at $9.11, with 6,039 stock units changing hands, JMMB Group skidded $1.70 in closing at $25 after an exchange of 10,301 shares, Key Insurance lost 36 cents to $2.21 with traders dealing in 5,340 units. Kingston Properties rose 43 cents to end at $7.50 with 13 stocks crossing the market, NCB Financial dipped $3.47 in closing at $65.01 after exchanging 23,425 stock units, Proven Investments dropped $1.69 and ended at $21.92 with a transfer of 1,484 shares.  Sagicor Group gained $1.01 to close at $40.51 as investors exchanged 104,336 stock units, Sagicor Real Estate Fund popped 93 cents to $8 after a transfer of 1,854 units and Scotia Group climbed $1.50 to end at $47 in trading 40,426 stocks.

Sagicor Group gained $1.01 to close at $40.51 as investors exchanged 104,336 stock units, Sagicor Real Estate Fund popped 93 cents to $8 after a transfer of 1,854 units and Scotia Group climbed $1.50 to end at $47 in trading 40,426 stocks.

In the preference segment, 138 Student Living preference share shed 97 cents in closing at $218.03 with just one share passing through the exchange, Productive Business Solutions 10.5 % preference share lost $123.29 to close at $1150 with investors trading 43 stock units, Productive Business Solutions 9.75% preference share increased $19.91 and ended at $115 in an exchange of 261 units and Sygnus Credit Investments C10.5% rallied $3 to $110, with a mere 9 stocks crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.