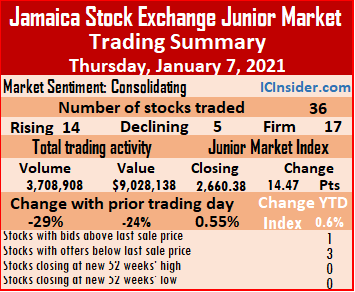

Investors’ confidence in stocks is returning, with three times as many shares rising at the close of trading on Thursday than those declining on the Junior Market of the Jamaica Stock Exchange.

The market index gained 14.47 points to 2,660.38, just 27 points below the close April 14th last year of 2,686.90 but still below the previous higher close of 2758.76 on March 4.

The market index gained 14.47 points to 2,660.38, just 27 points below the close April 14th last year of 2,686.90 but still below the previous higher close of 2758.76 on March 4.

Trading ended with 36 securities changing hands, up from 33 on Wednesday, ending with the prices of 14 rising, five declining and 17 remaining unchanged.

The average PE Ratio ended at 14 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading ended with 3,708,908 shares for $9,028,138 versus 5,219,009 units at $11,861,927 on Wednesday. Derrimon Trading led trading with 13.8 percent of total volume or 513,583 shares, followed by Mailpac Group accounted for 13 percent with a transfer of 482,322 units and Jamaican Teas with 12.8 percent with an exchange of 474,028 units.

Trading averaged 103,025 units at $250,782 in contrast to 158,152 at $359,452 on Wednesday. The month to date averaged 121,661 units at $286,293 compared to 128,304 units at $298,951 on Wednesday, which remains well below trading in December with an average of 263,428 units at $638,694.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than its last selling price and three with lower offers.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than its last selling price and three with lower offers.

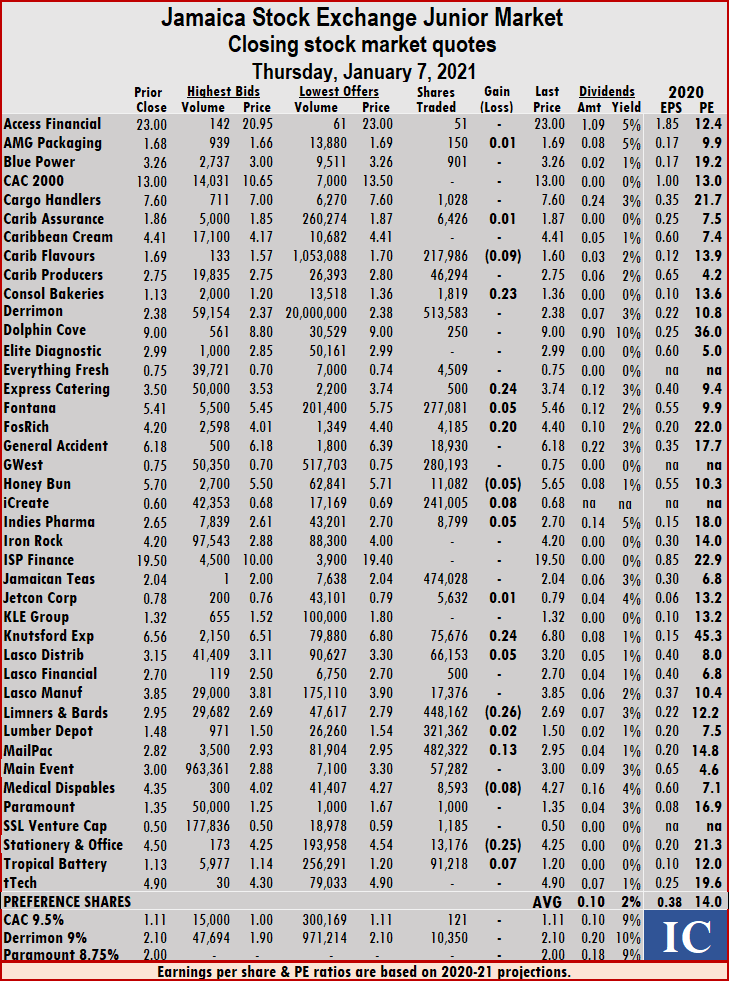

At the market close, Caribbean Flavours fell 9 cents to $1.60 with 217,986 shares changing hands. Consolidated Bakeries advanced 23 cents to $1.36 with 1,819 stock units traded, Express Catering climbed 24 cents to $3.74 with 500 shares passing through the market, Fontana increased by 5 cents to $5.46 with a transfer of 277,081 stocks. Fosrich climbed 20 cents to $4.40 with an exchange of 4,185 units, Honey Bun slipped 5 cents to $5.65 with 11,082 stock units changing hands iCreate gained 8 cents to finish at 68 cents with 241,005 shares traded. Indies Pharma rose 5 cents to $2.70 with 8,799 units passing through the market, Knutsford Express climbed 24 cents, exchanging 75,676 units at $6.80.  Lasco Distributors increased 5 cents to $3.20 with 66,153 stock units changing hands, Limners and Bards dropped 26 cents to $2.69 trading 448,162 shares, Mailpac Group had an exchange of 482,322 stocks and gained 13 cents to end at $2.95, Medical Disposables slipped 8 cents to $4.27 with a transfer of 8,593 stock units. Stationery and Office Supplies shed 25 cents to settle at $4.25 with 13,176 stocks changing hands and Tropical Battery rose 7 cents to $1.20 with 91,218 shares crossing the exchange.

Lasco Distributors increased 5 cents to $3.20 with 66,153 stock units changing hands, Limners and Bards dropped 26 cents to $2.69 trading 448,162 shares, Mailpac Group had an exchange of 482,322 stocks and gained 13 cents to end at $2.95, Medical Disposables slipped 8 cents to $4.27 with a transfer of 8,593 stock units. Stationery and Office Supplies shed 25 cents to settle at $4.25 with 13,176 stocks changing hands and Tropical Battery rose 7 cents to $1.20 with 91,218 shares crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The markets may have been due for a correction anyway, based on their history. Prior to this period, the Main Market had only risen on two other occasions equalling or exceeding six years. Surprisingly, the market went on to move higher during a period of economic turbulence, from 1978 to 1987, nine years of annual gains and again between 1996 and 2004 for another nine-year spell. On the other hand, the Junior Market, for the first time, recorded five consecutive years of increases from 2015 to 2019.

The markets may have been due for a correction anyway, based on their history. Prior to this period, the Main Market had only risen on two other occasions equalling or exceeding six years. Surprisingly, the market went on to move higher during a period of economic turbulence, from 1978 to 1987, nine years of annual gains and again between 1996 and 2004 for another nine-year spell. On the other hand, the Junior Market, for the first time, recorded five consecutive years of increases from 2015 to 2019. The number of new IPOs coming to market in the past three years pulled liquidity from the Junior Market, which depends extensively on the involvement of individual investors. In 2018 and 2019, the Junior Market under-performed the Main Market, measured by way of the market indices. In 2020, both markets were down, with the Junior Market just edging out the Main Market index with a lower decline of 21 percent versus 22.6 percent. Even though 2020 was not a great year, some investors made money by buying some stocks at rock bottom prices when many investors were dumping.

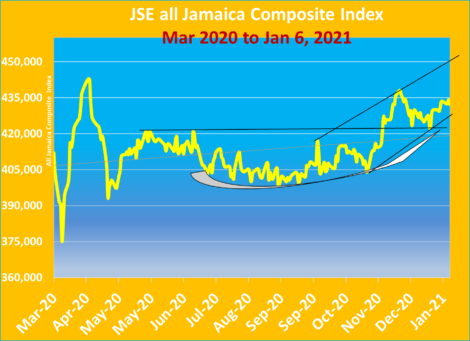

The number of new IPOs coming to market in the past three years pulled liquidity from the Junior Market, which depends extensively on the involvement of individual investors. In 2018 and 2019, the Junior Market under-performed the Main Market, measured by way of the market indices. In 2020, both markets were down, with the Junior Market just edging out the Main Market index with a lower decline of 21 percent versus 22.6 percent. Even though 2020 was not a great year, some investors made money by buying some stocks at rock bottom prices when many investors were dumping. The Main Market is undergoing a bullish signal with short term moving average line crossing over the medium-term Moving Average a bullish signal. The Main Market is within an ascending channel that points to the All Jamaican index heading towards the 460,000 points range.

The Main Market is undergoing a bullish signal with short term moving average line crossing over the medium-term Moving Average a bullish signal. The Main Market is within an ascending channel that points to the All Jamaican index heading towards the 460,000 points range. The local economy is currently down sharply, compared to 2019, but information released by

The local economy is currently down sharply, compared to 2019, but information released by  This year 2021, seems set to be the year of surprises as many stocks that suffered badly in 2020 could be making a major turnaround in revenues and profit, while some that may not fully recover could start showing good signs of returning to normalcy.

This year 2021, seems set to be the year of surprises as many stocks that suffered badly in 2020 could be making a major turnaround in revenues and profit, while some that may not fully recover could start showing good signs of returning to normalcy.

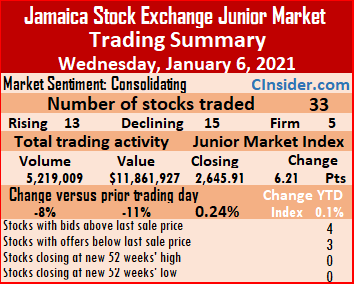

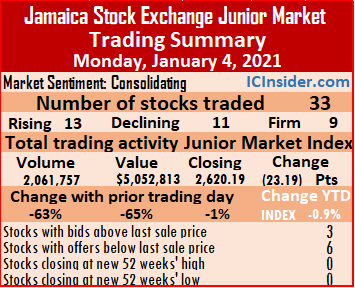

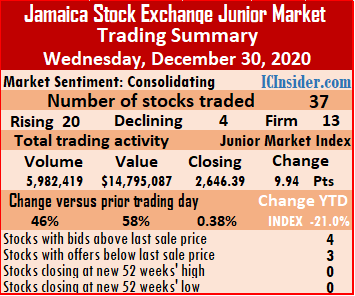

Trading ended with 33 securities changing hands compared to 35 on Tuesday and closed with the prices of 13 stocks rising, 15 declining and five remaining unchanged.

Trading ended with 33 securities changing hands compared to 35 on Tuesday and closed with the prices of 13 stocks rising, 15 declining and five remaining unchanged. Investor’s Choice bid-offer indicator reading shows four stocks ending with bids higher than their last selling prices and three with lower offers.

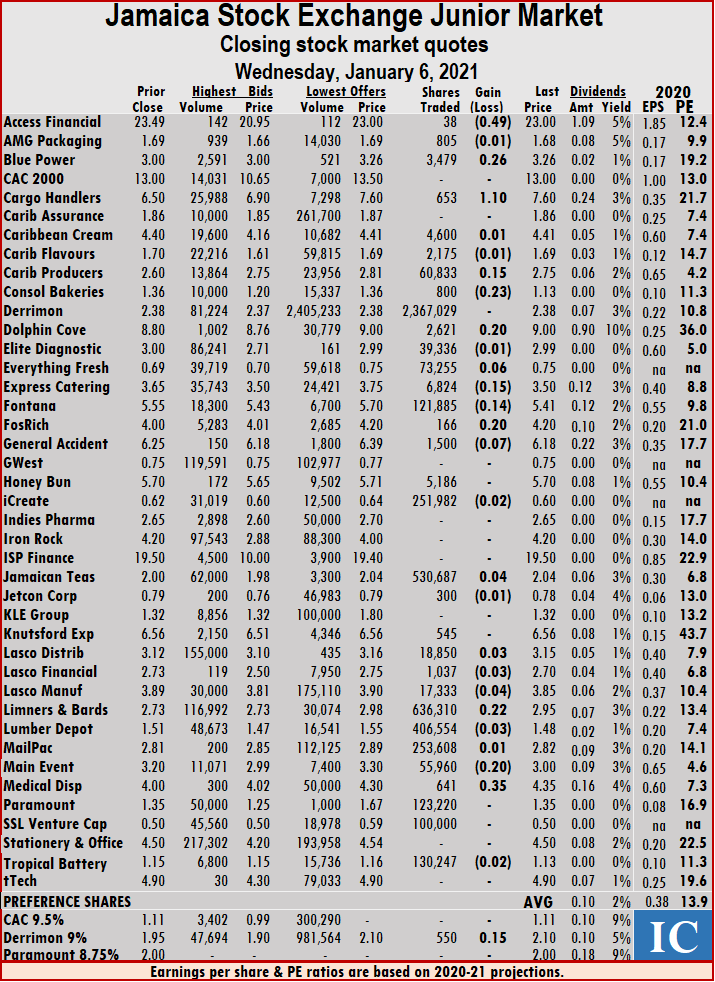

Investor’s Choice bid-offer indicator reading shows four stocks ending with bids higher than their last selling prices and three with lower offers. Limners and Bards gained 22 cents to close at $2.95, with a transfer of 636,310 shares, Lumber Depot lost 3 cents to close at $1.48, after exchanging 406,554 hares, Main Event declined by 20 cents to $3, in transferring 55,960 stock units and Medical Disposables gained 35 cents to end at $4.35 after exchanging 641 units.

Limners and Bards gained 22 cents to close at $2.95, with a transfer of 636,310 shares, Lumber Depot lost 3 cents to close at $1.48, after exchanging 406,554 hares, Main Event declined by 20 cents to $3, in transferring 55,960 stock units and Medical Disposables gained 35 cents to end at $4.35 after exchanging 641 units. Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers.

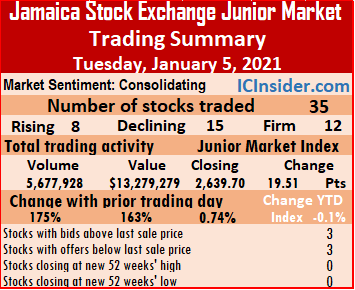

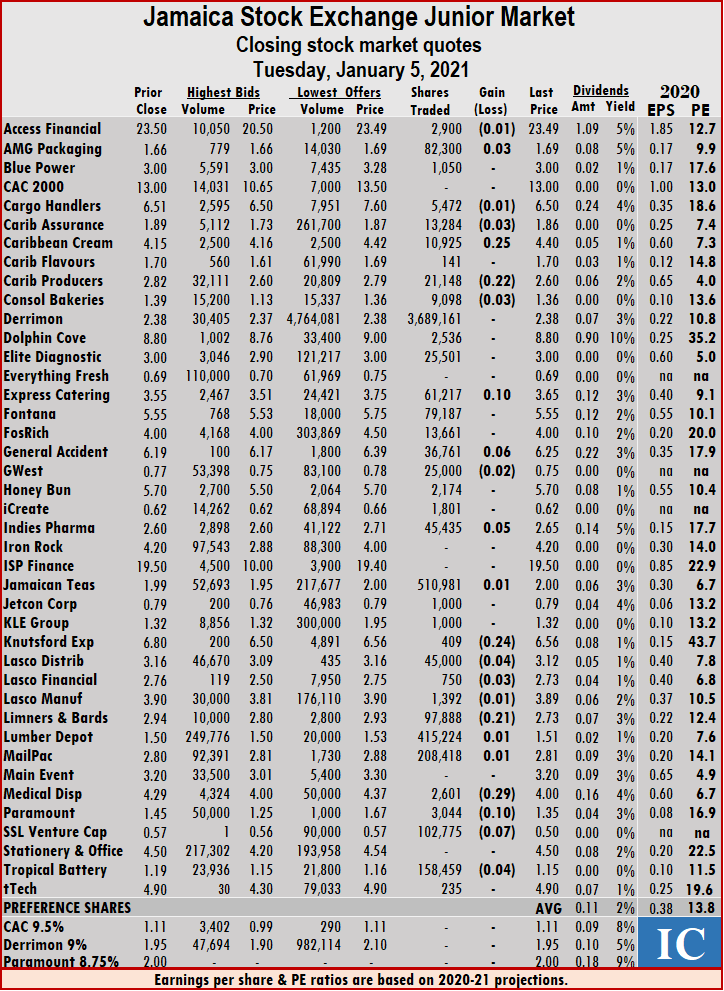

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers. Lasco Manufacturing lost 1 cent to end at $3.89 with a transfer of 1,392 stock units, Limners and Bards dropped 21 cents to $2.73 with 97,888 shares traded, Lumber Depot exchanged 415,224 units and gained 1 cent to close at $1.51. Mailpac Group rose 1 cent to $2.81 with 208,418 stocks passing through the market, Medical Disposables fell 29 cents to $4 with 2,601 stock units changing hands, Paramount Trading lost 10 cents to finish at $1.35 with a transfer of 3,044 shares. SSL Venture declined by 7 cents to 50 cents trading 102,775 stocks and Tropical Battery slipped 4 cents to $1.15 with 158,459 units crossing the exchange.

Lasco Manufacturing lost 1 cent to end at $3.89 with a transfer of 1,392 stock units, Limners and Bards dropped 21 cents to $2.73 with 97,888 shares traded, Lumber Depot exchanged 415,224 units and gained 1 cent to close at $1.51. Mailpac Group rose 1 cent to $2.81 with 208,418 stocks passing through the market, Medical Disposables fell 29 cents to $4 with 2,601 stock units changing hands, Paramount Trading lost 10 cents to finish at $1.35 with a transfer of 3,044 shares. SSL Venture declined by 7 cents to 50 cents trading 102,775 stocks and Tropical Battery slipped 4 cents to $1.15 with 158,459 units crossing the exchange. Trading ended with 33 securities changing hands compared to 38 on Thursday and ended with prices of 13 stocks rising, 11 declining and nine unchanged.

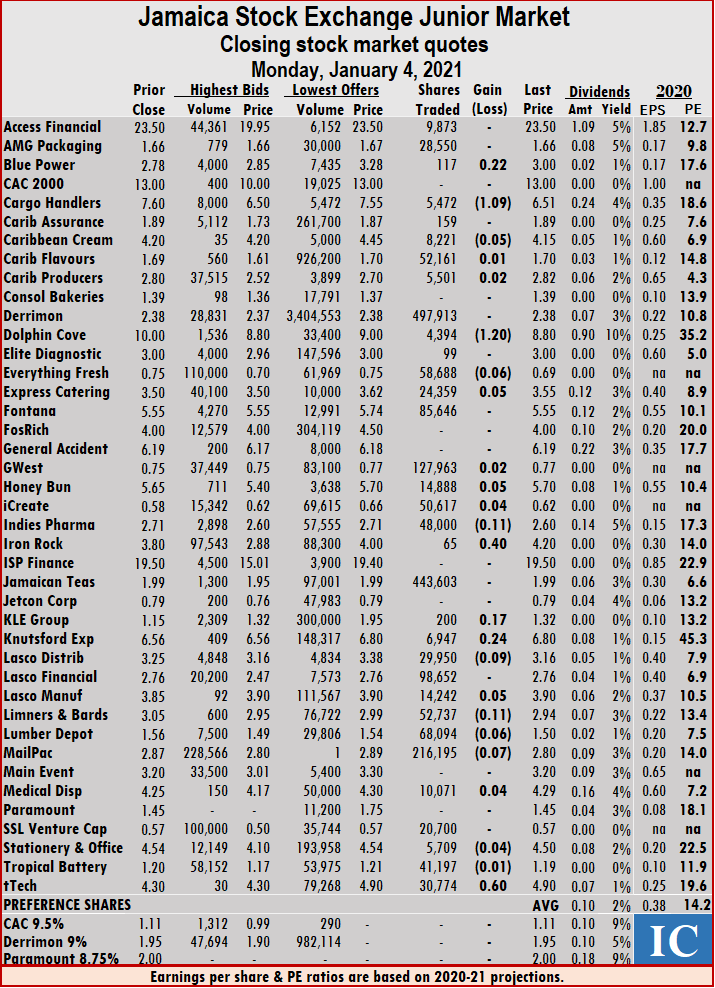

Trading ended with 33 securities changing hands compared to 38 on Thursday and ended with prices of 13 stocks rising, 11 declining and nine unchanged. At the close, Blue Power rose 22 cents to end at $3 in trading 117 shares, Cargo Handlers fell $1.09 to close at $6.51 after exchanging 5,472 units, Caribbean Cream carved out a loss of 5 cents to $4.15 after crossing the exchange, with 8,221 stocks. Caribbean Flavours advanced 1 cent to end at $1.70 in exchanging 52,161 stock units, Caribbean Producers advanced 2 cents to settle at $2.82 after trading 5,501 shares, Dolphin Cove shed $1.20 to close at $8.80 with investors swapping 4,394 stocks. Everything Fresh declined 6 cents to 69 cents with 58,688 shares changing hands, Express Catering rose 5 cents in closing at $3.55 exchanging 24,359 stock units, Gwest Corporation advanced 2 cents to 77 cents with an exchange of 127,963 stocks. Honey Bun climbed 5 cents to $5.70 in switching ownership of 14,888 shares, iCreate gained 4 cents to end at 62 cents trading 50,617 stock units, Indies Pharma carved out a loss of 11 cents to end at $2.60 and clearing the market with 48,000 shares. Iron Rock Insurance rose 40 cents to $4.20, with 65 stock units crossing the market, KLE Group increased 17 cents to $1.32 in trading 200 shares, Knutsford Express climbed 24 cents to $6.80 in exchanging 6,947 stock units. Lasco Distributors fell 9 cents to end at $3.16, after trading 29,950 shares, Lasco Manufacturing rose 5 cents to end at $3.90 with 14,242 stocks changing hands, Limners and Bards dropped 11 cents to $2.94 after 52,737 shares crossed the market.

At the close, Blue Power rose 22 cents to end at $3 in trading 117 shares, Cargo Handlers fell $1.09 to close at $6.51 after exchanging 5,472 units, Caribbean Cream carved out a loss of 5 cents to $4.15 after crossing the exchange, with 8,221 stocks. Caribbean Flavours advanced 1 cent to end at $1.70 in exchanging 52,161 stock units, Caribbean Producers advanced 2 cents to settle at $2.82 after trading 5,501 shares, Dolphin Cove shed $1.20 to close at $8.80 with investors swapping 4,394 stocks. Everything Fresh declined 6 cents to 69 cents with 58,688 shares changing hands, Express Catering rose 5 cents in closing at $3.55 exchanging 24,359 stock units, Gwest Corporation advanced 2 cents to 77 cents with an exchange of 127,963 stocks. Honey Bun climbed 5 cents to $5.70 in switching ownership of 14,888 shares, iCreate gained 4 cents to end at 62 cents trading 50,617 stock units, Indies Pharma carved out a loss of 11 cents to end at $2.60 and clearing the market with 48,000 shares. Iron Rock Insurance rose 40 cents to $4.20, with 65 stock units crossing the market, KLE Group increased 17 cents to $1.32 in trading 200 shares, Knutsford Express climbed 24 cents to $6.80 in exchanging 6,947 stock units. Lasco Distributors fell 9 cents to end at $3.16, after trading 29,950 shares, Lasco Manufacturing rose 5 cents to end at $3.90 with 14,242 stocks changing hands, Limners and Bards dropped 11 cents to $2.94 after 52,737 shares crossed the market. Lumber Depot shed 6 cents to end at $1.50 with an exchange of 68,094 stocks, Mailpac Group lost 7 cents in closing at $2.80 after exchanging 216,195 units, Medical Disposables carved out a gain of 4 cents in closing at $4.29, with 10,071 units crossing the exchange. Stationery and Office Supplies fell 4 cents ending at $4.50 and crossing the exchange with 5,709 stocks, Tropical Battery fell 1 cent to settle at $1.19 after exchanging 41,197 stock units and tTech gained 60 cents to close at $4.90 after exchanging 30,774 stock units.

Lumber Depot shed 6 cents to end at $1.50 with an exchange of 68,094 stocks, Mailpac Group lost 7 cents in closing at $2.80 after exchanging 216,195 units, Medical Disposables carved out a gain of 4 cents in closing at $4.29, with 10,071 units crossing the exchange. Stationery and Office Supplies fell 4 cents ending at $4.50 and crossing the exchange with 5,709 stocks, Tropical Battery fell 1 cent to settle at $1.19 after exchanging 41,197 stock units and tTech gained 60 cents to close at $4.90 after exchanging 30,774 stock units. It was a brutal year for the fledgling companies as only seven recording gains during the year as the vast majority of prices tumbled.

It was a brutal year for the fledgling companies as only seven recording gains during the year as the vast majority of prices tumbled.

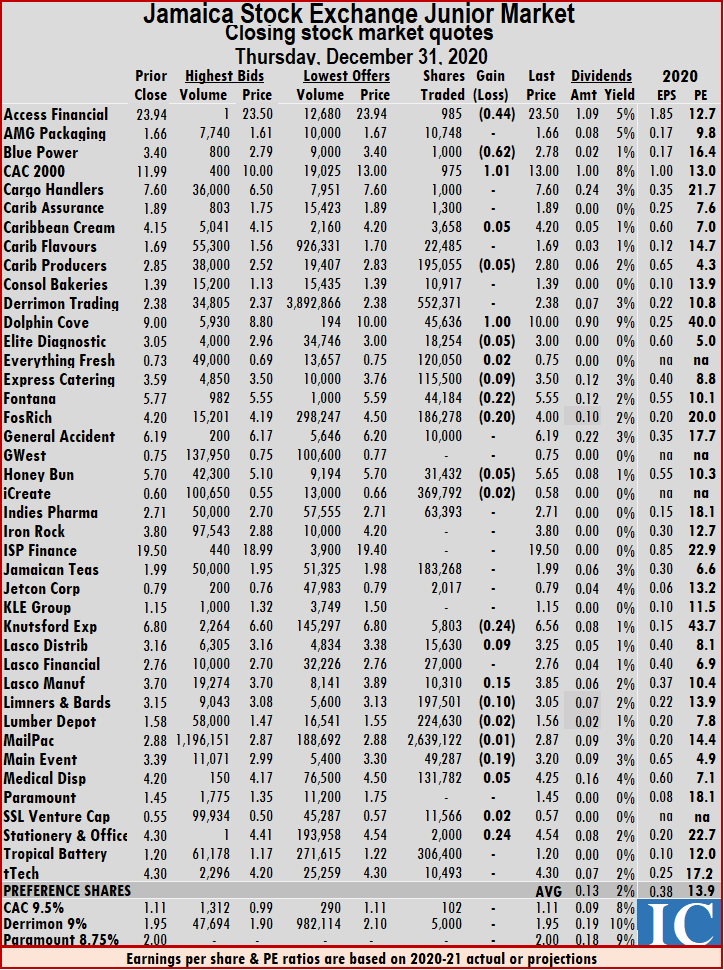

Lasco Manufacturing advanced 15 cents to $3.85 with 10,310 stock units traded, Limners and Bards lost 10 cents to close at $3.05 with a transfer of 197,501 shares, Lumber Depot slipped 2 cents to $1.56 with 224,630 stocks passing through the market. Mailpac Group exchanged 2,639,122 units and declined by 1 cent to end at $2.87, Main Event dropped 19 cents to $3.20 with investors switching ownership of 49,287 stock units, Medical Disposables rose 5 cents to $4.25 with 131,782 units changing hands. SSL Venture gained 2 cents to close at 57 cents with 11,566 stocks traded and Stationery and Office Supplies advanced 24 cents to $4.54 with 2,000 shares crossing the exchange.

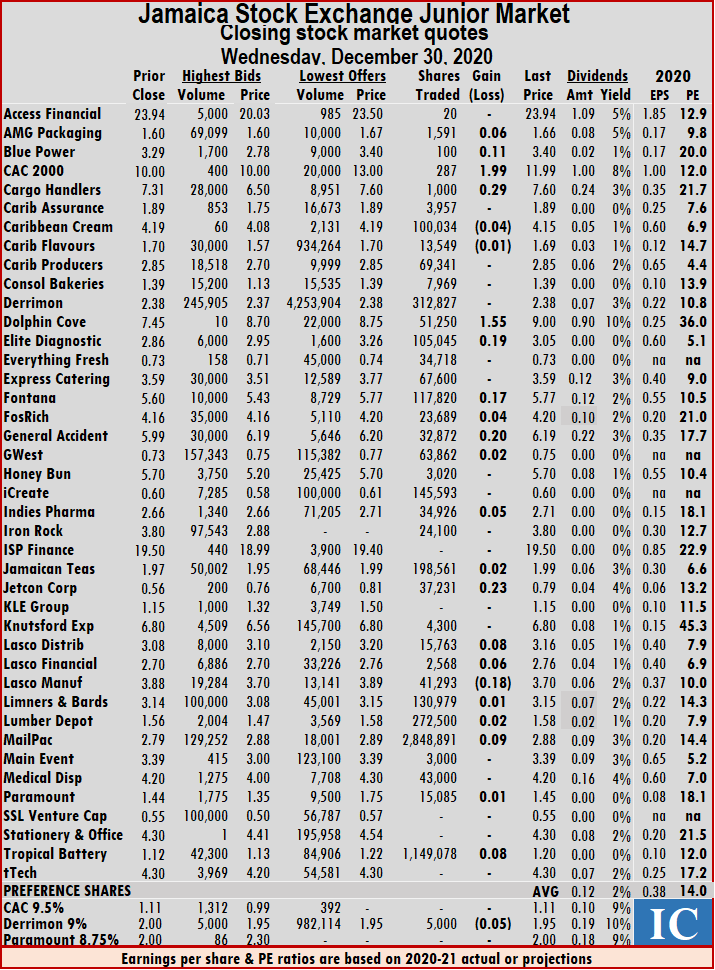

Lasco Manufacturing advanced 15 cents to $3.85 with 10,310 stock units traded, Limners and Bards lost 10 cents to close at $3.05 with a transfer of 197,501 shares, Lumber Depot slipped 2 cents to $1.56 with 224,630 stocks passing through the market. Mailpac Group exchanged 2,639,122 units and declined by 1 cent to end at $2.87, Main Event dropped 19 cents to $3.20 with investors switching ownership of 49,287 stock units, Medical Disposables rose 5 cents to $4.25 with 131,782 units changing hands. SSL Venture gained 2 cents to close at 57 cents with 11,566 stocks traded and Stationery and Office Supplies advanced 24 cents to $4.54 with 2,000 shares crossing the exchange. At the close, 46 percent more shares were traded than on Tuesday, with 5,982,419 units changing hands for $14,795,087 compared to 4,103,575 units at $9,392,768 on Tuesday. The PE Ratio averages 14 based on ICInsider.com’s forecast of 2020-21 earnings.

At the close, 46 percent more shares were traded than on Tuesday, with 5,982,419 units changing hands for $14,795,087 compared to 4,103,575 units at $9,392,768 on Tuesday. The PE Ratio averages 14 based on ICInsider.com’s forecast of 2020-21 earnings. Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers. Lasco Distributors rose by 8 cents to $3.16 trading 15,763 shares, Lasco Financial climbed 6 cents to $2.76 with 2,568 stocks changing hands, Lasco Manufacturing dropped 18 cents to $3.70 with investors switching ownership of 41,293 units. Limners and Bards rose 1 cent to $3.15 with 130,979 stock units traded, Lumber Depot gained 2 cents to end at $1.58 with a transfer of 272,500 shares, Mailpac Group exchanged 2,848,891 units and increased 9 cents to $2.88. Paramount Trading closed 1 cent higher at $1.45 with 15,085 stocks changing hands and Tropical Battery gained 8 cents to finish at $1.20 with 1,149,078 shares trading.

Lasco Distributors rose by 8 cents to $3.16 trading 15,763 shares, Lasco Financial climbed 6 cents to $2.76 with 2,568 stocks changing hands, Lasco Manufacturing dropped 18 cents to $3.70 with investors switching ownership of 41,293 units. Limners and Bards rose 1 cent to $3.15 with 130,979 stock units traded, Lumber Depot gained 2 cents to end at $1.58 with a transfer of 272,500 shares, Mailpac Group exchanged 2,848,891 units and increased 9 cents to $2.88. Paramount Trading closed 1 cent higher at $1.45 with 15,085 stocks changing hands and Tropical Battery gained 8 cents to finish at $1.20 with 1,149,078 shares trading. Trading ended with 39 securities changing hands compared to 38 on Monday and concluded with the prices of 12 stocks rising, 16 declining and 11 unchanged.

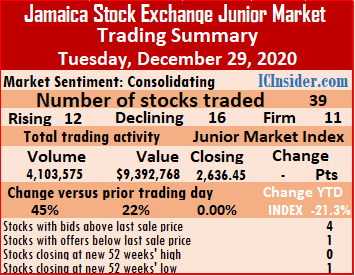

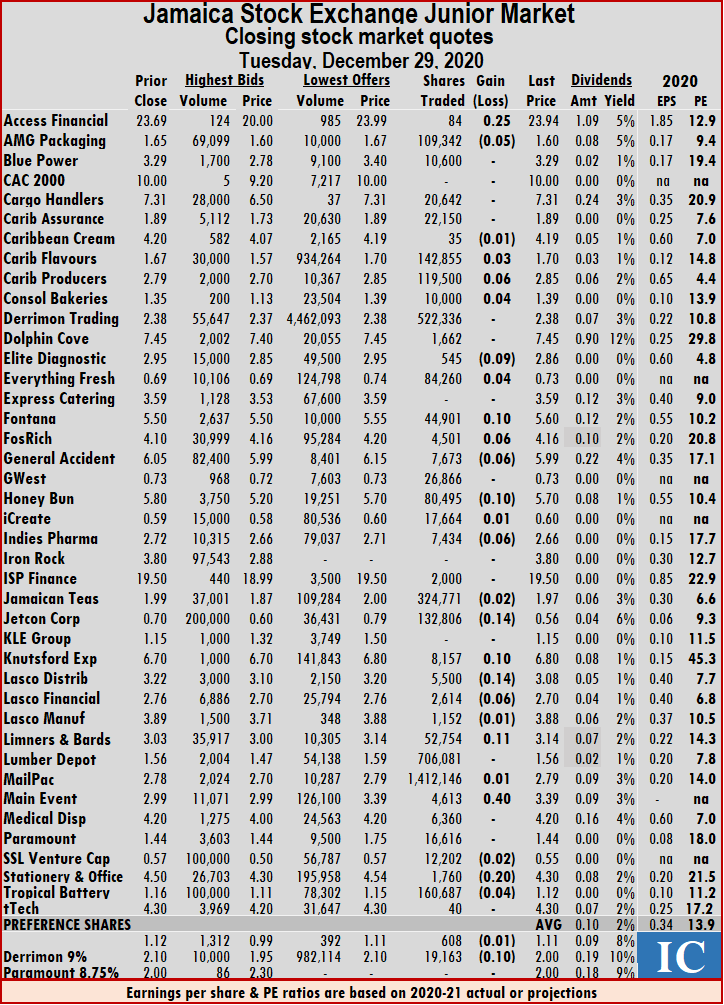

Trading ended with 39 securities changing hands compared to 38 on Monday and concluded with the prices of 12 stocks rising, 16 declining and 11 unchanged. Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer. Mailpac Group exchanged 1,412,146 stocks and gained 1 cent to settle at $2.79, Main Event climbed 40 cents to $3.39 with a transfer of 4,613 units, SSL Venture declined by 2 cents to 55 cents with 12,202 stock units changing hands. Stationery and Office Supplies shed 20 cents to finish at $4.30 with 1,760 stocks traded and Tropical Battery slipped 4 cents to $1.12 with 160,687 shares crossing the exchange.

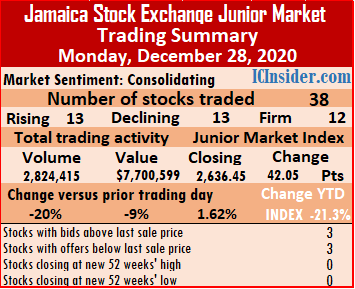

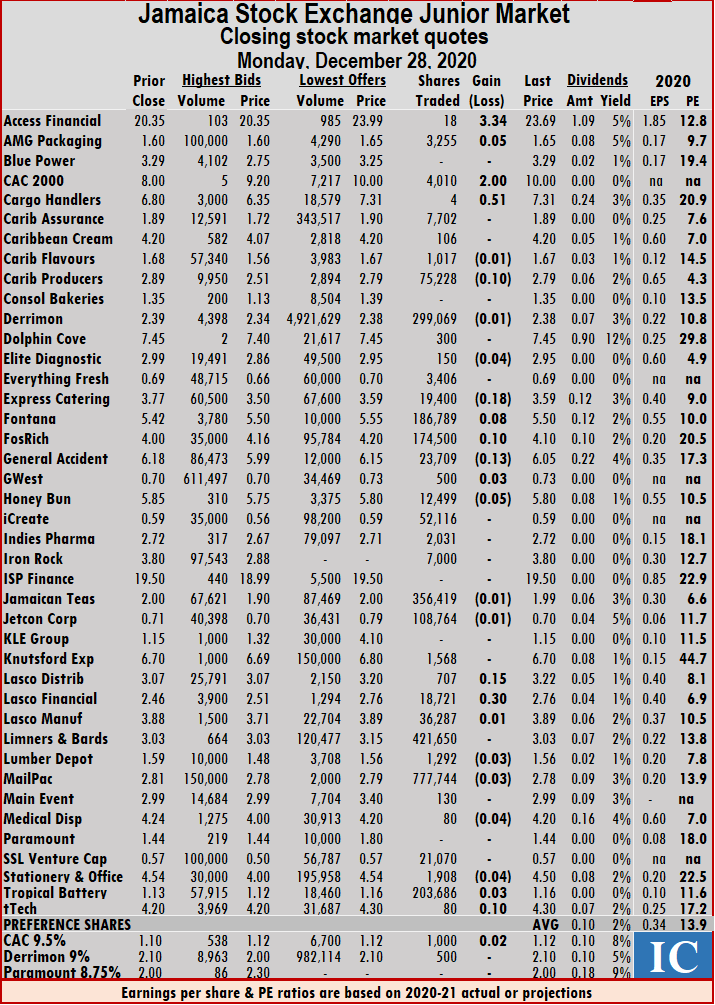

Mailpac Group exchanged 1,412,146 stocks and gained 1 cent to settle at $2.79, Main Event climbed 40 cents to $3.39 with a transfer of 4,613 units, SSL Venture declined by 2 cents to 55 cents with 12,202 stock units changing hands. Stationery and Office Supplies shed 20 cents to finish at $4.30 with 1,760 stocks traded and Tropical Battery slipped 4 cents to $1.12 with 160,687 shares crossing the exchange. At the market close, Access Financial jumped $3.34 to $23.69 trading 18 shares, AMG Packaging rose 5 cents to $1.65 with 3,255 units changing hands, CAC 2000 climbed $2 to $10 with an exchange of 4,010 stocks. Cargo Handlers advanced 51 cents to $7.31 with a transfer of just four shares, Caribbean Flavours slipped 1 cent to $1.67 with 1,017 stock units traded, Caribbean Producers fell 10 cents to $2.79 with 75,228 units passing through the market. Derrimon Trading lost 1 cent to finish at $2.38 with 299,069 stocks changing hands, Elite Diagnostic lost 4 cents to close at $2.95 in exchanging 150 shares, Express Catering dropped 18 cents to $3.59 with a transfer of 19,400 stock units. Fontana gained 8 cents to end at $5.50 with 186,789 units traded, Fosrich rose 10 cents to $4.10, with investors switching 174,500 stock units, General Accident fell 13 cents to $6.05 with 23,709 shares changing hands. GWest rose 3 cents to 73 cents, trading 500 stock units, Honey Bun slipped 5 cents to $5.80 with a transfer of 12,499 units, Jamaican Teas lost 1 cent, trading 356,419 stocks at $1.99. Jetcon Corporation dipped 1 cent to 70 cents with investors switching 108,764 shares, Lasco Distributors advanced 15 cents to $3.22 with 707 units changing hands, Lasco Financial climbed 30 cents to $2.76 with 18,721 stocks passing through the market.

At the market close, Access Financial jumped $3.34 to $23.69 trading 18 shares, AMG Packaging rose 5 cents to $1.65 with 3,255 units changing hands, CAC 2000 climbed $2 to $10 with an exchange of 4,010 stocks. Cargo Handlers advanced 51 cents to $7.31 with a transfer of just four shares, Caribbean Flavours slipped 1 cent to $1.67 with 1,017 stock units traded, Caribbean Producers fell 10 cents to $2.79 with 75,228 units passing through the market. Derrimon Trading lost 1 cent to finish at $2.38 with 299,069 stocks changing hands, Elite Diagnostic lost 4 cents to close at $2.95 in exchanging 150 shares, Express Catering dropped 18 cents to $3.59 with a transfer of 19,400 stock units. Fontana gained 8 cents to end at $5.50 with 186,789 units traded, Fosrich rose 10 cents to $4.10, with investors switching 174,500 stock units, General Accident fell 13 cents to $6.05 with 23,709 shares changing hands. GWest rose 3 cents to 73 cents, trading 500 stock units, Honey Bun slipped 5 cents to $5.80 with a transfer of 12,499 units, Jamaican Teas lost 1 cent, trading 356,419 stocks at $1.99. Jetcon Corporation dipped 1 cent to 70 cents with investors switching 108,764 shares, Lasco Distributors advanced 15 cents to $3.22 with 707 units changing hands, Lasco Financial climbed 30 cents to $2.76 with 18,721 stocks passing through the market.  Lasco Manufacturing closed 1 cent higher at $3.89, trading 36,287 stock units, Lumber Depot declined by 3 cents to settle at $1.56 with a transfer of 1,292 shares, Mailpac Group traded 777,744 shares and lost 3 cents to end at $2.78. Medical Disposables fell 4 cents to $4.20 with investors switching ownership of 80 units, Stationery and Office Supplies slipped 4 cents to $4.50 with 1,908 stock units pass ing through the market, Tropical Battery gained 3 cents to finish at $1.16 with a transfer of 203,686 stocks and tTech advanced 10 cents to $4.30 with 80 shares crossing the exchange.

Lasco Manufacturing closed 1 cent higher at $3.89, trading 36,287 stock units, Lumber Depot declined by 3 cents to settle at $1.56 with a transfer of 1,292 shares, Mailpac Group traded 777,744 shares and lost 3 cents to end at $2.78. Medical Disposables fell 4 cents to $4.20 with investors switching ownership of 80 units, Stationery and Office Supplies slipped 4 cents to $4.50 with 1,908 stock units pass ing through the market, Tropical Battery gained 3 cents to finish at $1.16 with a transfer of 203,686 stocks and tTech advanced 10 cents to $4.30 with 80 shares crossing the exchange.

This week’s focus: The long awaited initial public offer of shares by

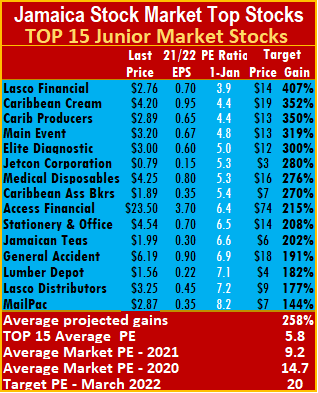

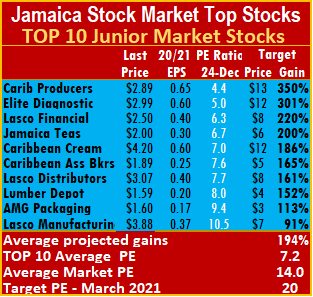

This week’s focus: The long awaited initial public offer of shares by The top three stocks in the Junior Market with the potential to gain between 220 to 350 percent by March 2021 are Caribbean Producers, followed by Elite Diagnostic and

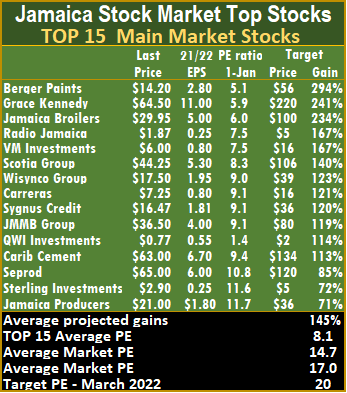

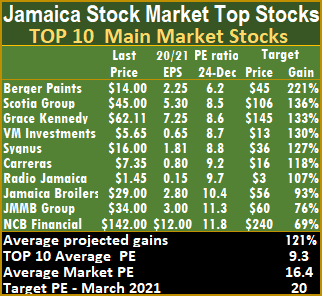

The top three stocks in the Junior Market with the potential to gain between 220 to 350 percent by March 2021 are Caribbean Producers, followed by Elite Diagnostic and  The Main Market TOP 10 stocks trade at a PE of 9.3 or 57 percent of the PE of that market.

The Main Market TOP 10 stocks trade at a PE of 9.3 or 57 percent of the PE of that market.