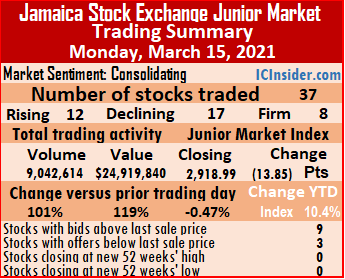

Investors continue to drive the prices higher at the closed of trading on Monday, pushing the market to a thirteen-month high on the Junior Market of the Jamaica Stock Exchange, with the market index closing just below the close of 2,947.43 points on February 21 last year.

The junior market now at 13 months high.

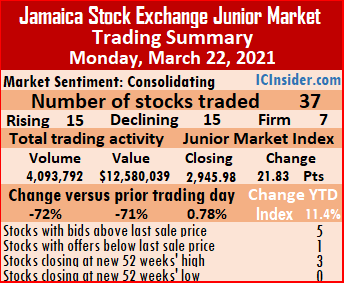

The market closed after an even number of stocks advanced as declined and four stocks traded at 52 weeks’ high and the Market Index advanced 21.83 points to settle at 2,945.98. The PE Ratio averaged 16.9 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading ended with 37 securities changing hands up from 34 on Friday and closed with prices of 15 rising, 15 declining and seven remaining unchanged. Indies Pharma surged 27 percent to a record high, Blue Power traded at a 52 weeks’ high of $4.47 but ended lower at the close. Lasco Distributors and CAC2000 preference share ended at 52 weeks’ high.

Market activity ended with 72 percent fewer shares trading, valued 71 percent less than on Friday as 4,093,792 shares traded for $12,580,039 versus 14,753,485 units at $42,656,041 on Friday. Derrimon Trading led with 19.2 percent of total volume for an exchange of 784,647 shares, followed by Limners and Bards 13.2 percent with 540,986 units and Caribbean Producers with 11.3 percent of the day’s trade for 464,245 units.

Trading averaged 110,643 units at $340,001, versus 433,926 at $1,254,589 on Friday. The month to date averaged 244,206 units at $708,404, compared to 253,478 units at $733,977 on Friday. February averaged 365,365 units at $881,118.

Investor’s Choice bid-offer indicator reading shows five stocks ending with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator reading shows five stocks ending with bids higher than their last selling prices and one with a lower offer.

At the close, Access Financial shed 50 cents to close at $20.01, with 5,836 stock units crossing the exchange, AMG Packaging lost 8 cents to end at $2.02 with the swapping of 600 stocks, Blue Power slipped 10 cents to finish at $4 in exchanging 49,000 units after trading at a 52 weeks’ high of $4.47. Caribbean Assurance Brokers fell 18 cents to $2.01, with 18,675 shares crossing the market, Caribbean Flavours dipped 10 cents to $2.20 trading 76,427 stock units, Caribbean Producers gained 7 cents to close at $3.17 in transferring 464,245 shares. Consolidated Bakeries declined 39 cents to $1.25, with 100,000 units changing hands, Elite Diagnostic picked up 10 cents to close at $3.09 in trading 88,981 units. Everything Fresh closed 10 cents higher at $1.05, with 58,259 stock units crossing the market, Express Catering fell 24 cents to end at $3.50 after an exchange of 51,311 shares, Fontana lost 10 cents to close at $5.80 with the swapping of 87,437 stocks. Fosrich shed 20 cents in closing at $5.20 with an exchange of 35,133 shares, General Accident advanced 34 cents to $5.84 in switching ownership of 7,590 stocks, iCreate lost 8 cents in ending at 74 cents, with 55,770 stock units crossing the market.  Indies Pharma advanced 90 cents to a 52 weeks’ high of $4.20 with 427,490 shares clearing the market. Knutsford Express rose 45 cents to $5.55, with 2,437 shares crossing the exchange, Lasco Distributors picked up 7 cents to close at to end at 52 weeks’ high of $4.15 in switching ownership of 125,573 stock units, Lasco Financial rose 5 cents to $2.64, after transferring 3,146 shares. Lasco Manufacturing climbed 12 cents to $4.46, with 23,948 units changing hands, Lumber Depot dipped 13 cents to $2.45, after clearing the market with 176,529 stocks, Main Event ended 6 cents higher at $3.12 in an exchange of 50,000 units. Paramount Trading gained 12 cents to settle at $1.43 trading 1,000 stock units, Stationery and Office Supplies climbed 96 cents to $5.58 trading 106 units and tTech gained 9 cents to close at $4.84, transferring 21,683 stocks.

Indies Pharma advanced 90 cents to a 52 weeks’ high of $4.20 with 427,490 shares clearing the market. Knutsford Express rose 45 cents to $5.55, with 2,437 shares crossing the exchange, Lasco Distributors picked up 7 cents to close at to end at 52 weeks’ high of $4.15 in switching ownership of 125,573 stock units, Lasco Financial rose 5 cents to $2.64, after transferring 3,146 shares. Lasco Manufacturing climbed 12 cents to $4.46, with 23,948 units changing hands, Lumber Depot dipped 13 cents to $2.45, after clearing the market with 176,529 stocks, Main Event ended 6 cents higher at $3.12 in an exchange of 50,000 units. Paramount Trading gained 12 cents to settle at $1.43 trading 1,000 stock units, Stationery and Office Supplies climbed 96 cents to $5.58 trading 106 units and tTech gained 9 cents to close at $4.84, transferring 21,683 stocks.

In the preference segment, CAC 2000 9.5% preference share advanced 30 cents to end at 52 weeks’ high of $1.50 after an exchange of 25,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market stocks kept above the 2,900 mark of the market index only slipping below that level just one day during the week, as the market continues to consolidate in the move higher. Main Market stocks made attempts to break clear of the consolidation zone but the market is awaiting some strong profit results to move prices and that will not come until late April.

Junior Market stocks kept above the 2,900 mark of the market index only slipping below that level just one day during the week, as the market continues to consolidate in the move higher. Main Market stocks made attempts to break clear of the consolidation zone but the market is awaiting some strong profit results to move prices and that will not come until late April.

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued, these include, JMMB Group, Jamaica Broilers,

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued, these include, JMMB Group, Jamaica Broilers,  This week’s focus:

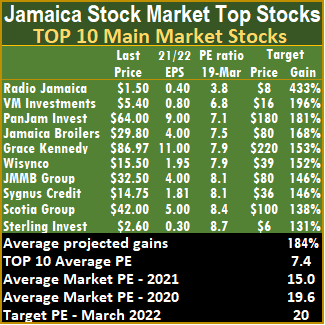

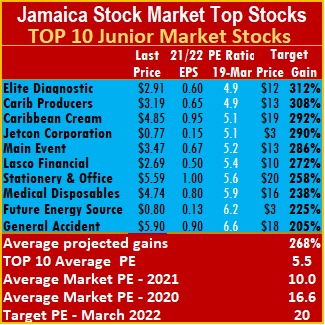

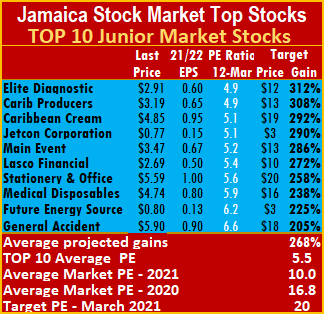

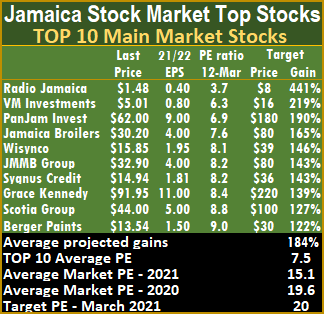

This week’s focus: The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 49 percent of the PE of that market.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 49 percent of the PE of that market. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

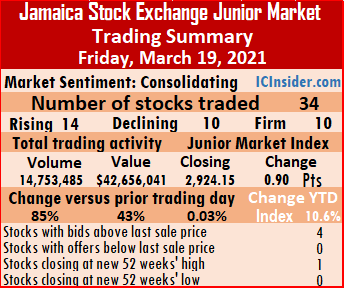

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information. At the close, 34 securities traded, down from 38 on Thursday, with prices of 14 rising, 10 declining and 10 remaining unchanged.

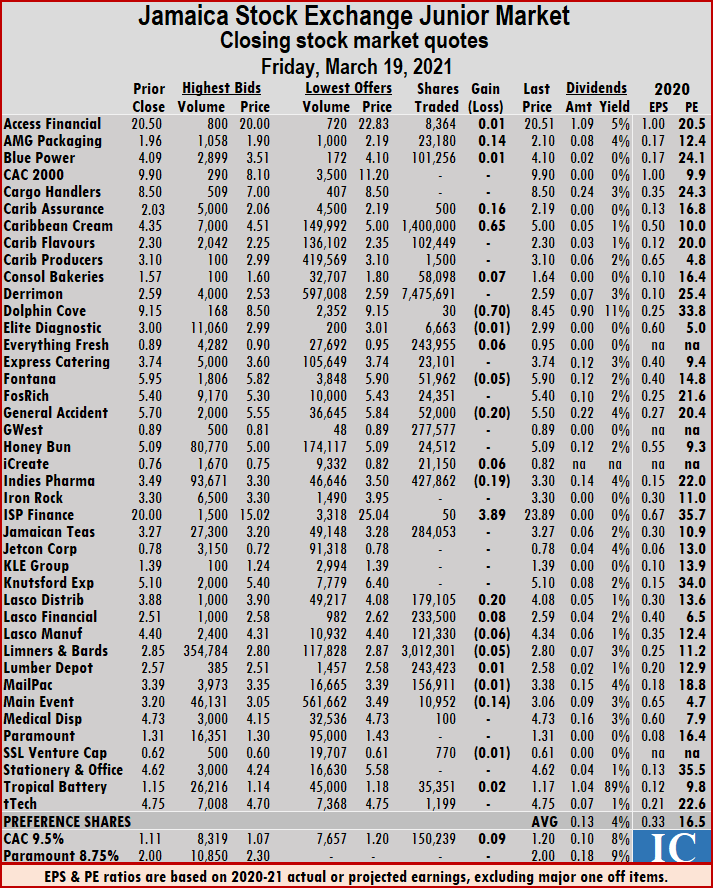

At the close, 34 securities traded, down from 38 on Thursday, with prices of 14 rising, 10 declining and 10 remaining unchanged. The month to date averaged 253,478 units at $733,977, up from 241,183 units at $698,505 on Thursday. February averaged 365,365 units at $881,118.

The month to date averaged 253,478 units at $733,977, up from 241,183 units at $698,505 on Thursday. February averaged 365,365 units at $881,118. Lasco Financial rose 8 cents to $2.59, trading 233,500 shares, Lasco Manufacturing lost 6 cents at $4.34 trading 121,330 units, Limners and Bards slipped 5 cents to $2.80 after an exchange of 3,012,301 stock units and Main Event shed 14 cents to close at $3.06 with the swapping of 10,952 units.

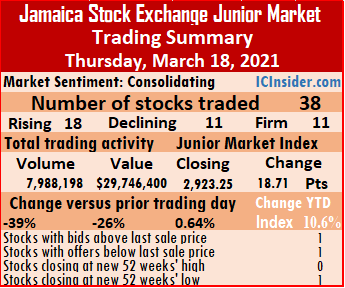

Lasco Financial rose 8 cents to $2.59, trading 233,500 shares, Lasco Manufacturing lost 6 cents at $4.34 trading 121,330 units, Limners and Bards slipped 5 cents to $2.80 after an exchange of 3,012,301 stock units and Main Event shed 14 cents to close at $3.06 with the swapping of 10,952 units. At the close, 38 securities traded, up from 33 on Wednesday, with prices of 18 rising, 11 declining and nine remaining unchanged.

At the close, 38 securities traded, up from 33 on Wednesday, with prices of 18 rising, 11 declining and nine remaining unchanged. Trading averaged 210,216 units at $782,800, versus 394,569 at $1,213,758 on Wednesday. The month to date, averaged 241,183 units at $698,505, compared to 243,736 units at $691,556 on Wednesday. February averaged 365,365 units at $881,118.

Trading averaged 210,216 units at $782,800, versus 394,569 at $1,213,758 on Wednesday. The month to date, averaged 241,183 units at $698,505, compared to 243,736 units at $691,556 on Wednesday. February averaged 365,365 units at $881,118. Lasco Financial dropped 13 cents to $2.51 with 31,375 stocks changing hands, Limners and Bards climbed 30 cents to $2.85, with 1,105,667 units traded, Lumber Depot rose 7 cents to $2.57 with a transfer of 384,692 shares. Main Event gained 5 cents to close at $3.20 with an exchange of 1,018,764 stocks, Paramount Trading fell 12 cents to $1.31 with 7,206 stock units changing hands, Tropical Battery lost 5 cents to end at $1.15 with 150,083 units traded and tTech rose 5 cents to $4.75 with 3,677 shares crossing the exchange.

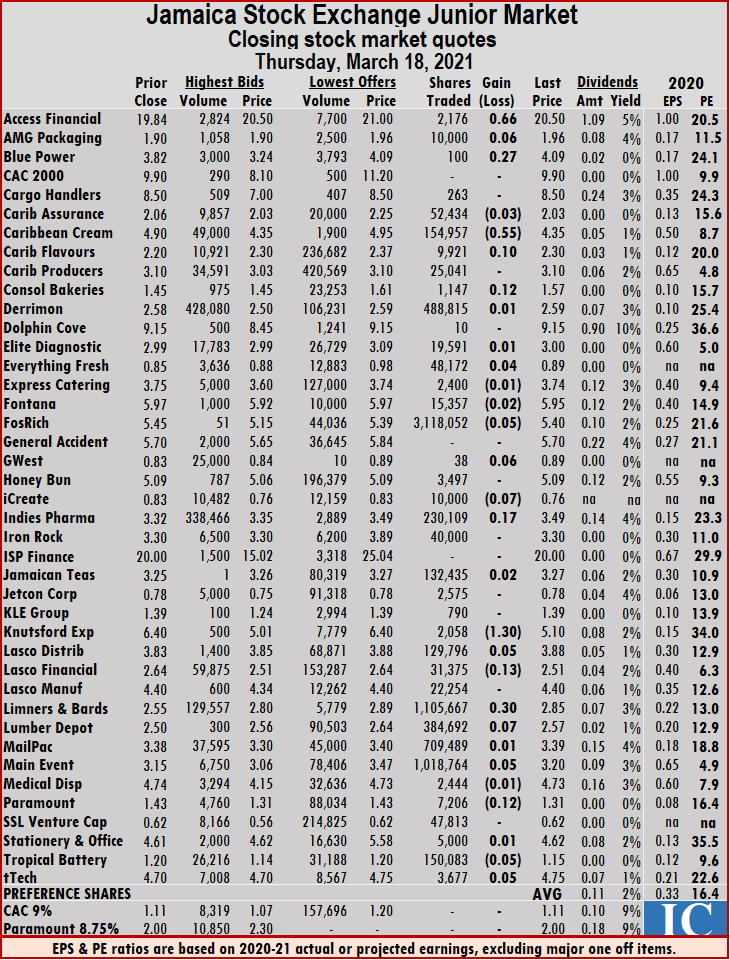

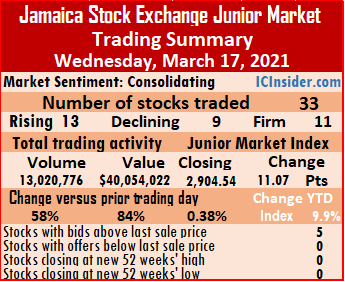

Lasco Financial dropped 13 cents to $2.51 with 31,375 stocks changing hands, Limners and Bards climbed 30 cents to $2.85, with 1,105,667 units traded, Lumber Depot rose 7 cents to $2.57 with a transfer of 384,692 shares. Main Event gained 5 cents to close at $3.20 with an exchange of 1,018,764 stocks, Paramount Trading fell 12 cents to $1.31 with 7,206 stock units changing hands, Tropical Battery lost 5 cents to end at $1.15 with 150,083 units traded and tTech rose 5 cents to $4.75 with 3,677 shares crossing the exchange. In the end, 33 securities traded, up from 31 on Tuesday, with prices of 13 rising, nine declining and 11 remaining unchanged.

In the end, 33 securities traded, up from 31 on Tuesday, with prices of 13 rising, nine declining and 11 remaining unchanged. Trading month to date averaged 243,736 units at $691,556, up from 232,106 units at $651,293 on Tuesday. February averaged 365,365 units at $881,118.

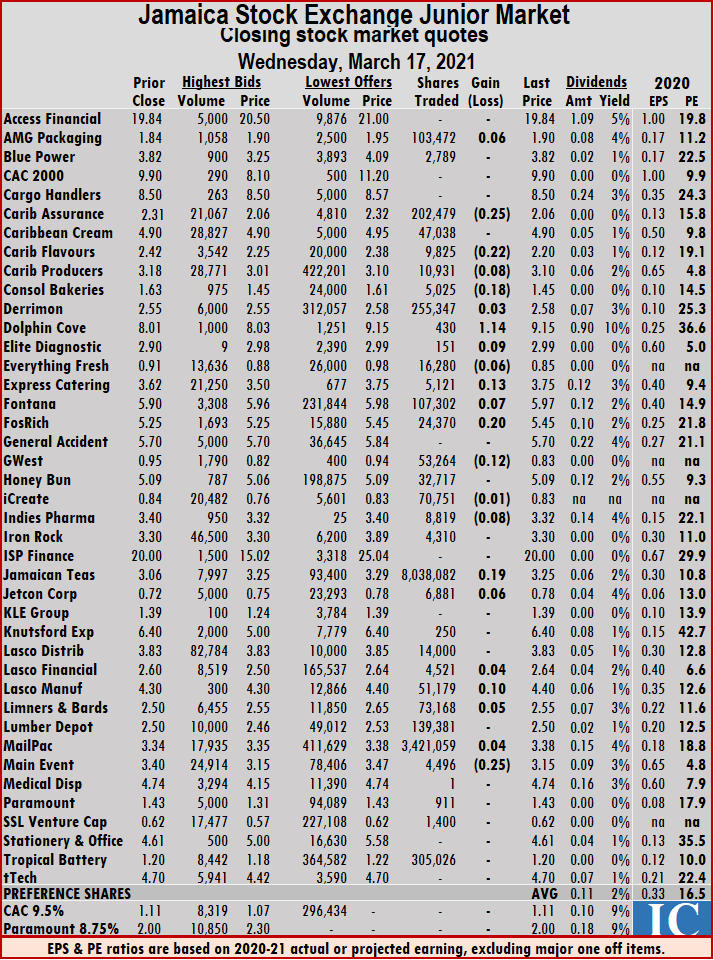

Trading month to date averaged 243,736 units at $691,556, up from 232,106 units at $651,293 on Tuesday. February averaged 365,365 units at $881,118. Indies Pharma lost 8 cents to close at $3.32 with a transfer of 8,819 shares, Jetcon Corporation rose 6 cents to 78 cents with 6,881 stock units passing through the market. Lasco Manufacturing gained 10 cents to end at $4.40 with 51,179 shares changing hands, Limners and Bards added 5 cents to end at $2.55 with a transfer of 73,168 stock units and Main Event fell 25 cents to $3.15 with 4,496 units crossing the exchange.

Indies Pharma lost 8 cents to close at $3.32 with a transfer of 8,819 shares, Jetcon Corporation rose 6 cents to 78 cents with 6,881 stock units passing through the market. Lasco Manufacturing gained 10 cents to end at $4.40 with 51,179 shares changing hands, Limners and Bards added 5 cents to end at $2.55 with a transfer of 73,168 stock units and Main Event fell 25 cents to $3.15 with 4,496 units crossing the exchange. Trading ended with 31 securities changing hands, down from 37 on Monday and closed with 14 stocks rising, 10 declining and seven remaining unchanged. The average PE Ratio ended at 16.5 based on ICInsider.com’s forecast of 2020-21 earnings.

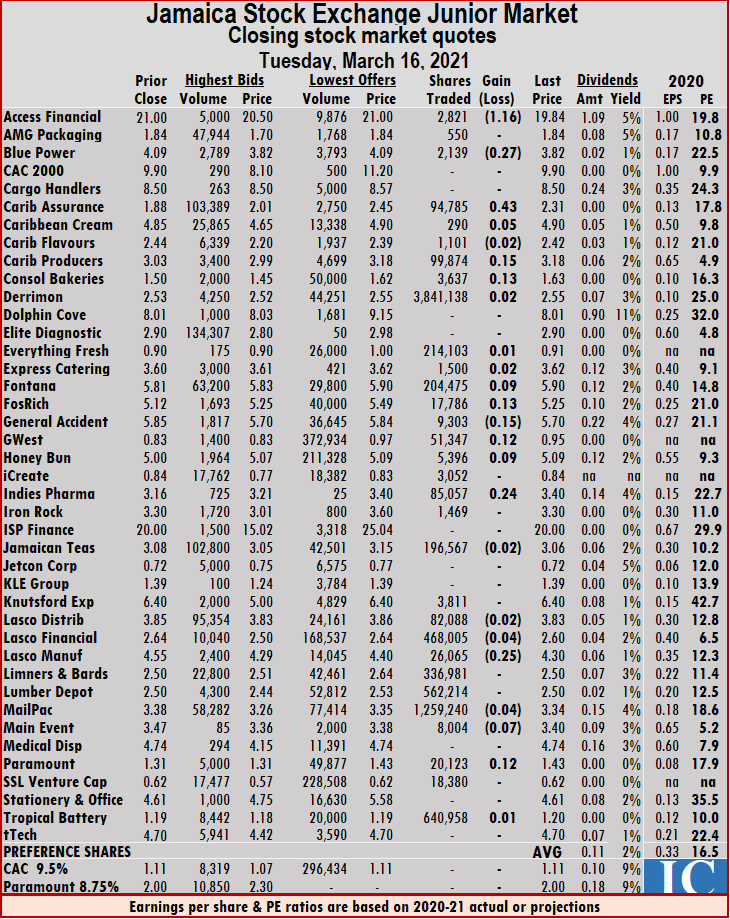

Trading ended with 31 securities changing hands, down from 37 on Monday and closed with 14 stocks rising, 10 declining and seven remaining unchanged. The average PE Ratio ended at 16.5 based on ICInsider.com’s forecast of 2020-21 earnings. At the close, Access Financial dropped $1.16 to $19.84, with the swapping of 2,821 shares, Blue Power lost 27 cents to close at $3.82, after exchanging 2,139 stocks, Caribbean Assurance Brokers rose 43 cents to $2.31 with 94,785 units crossing the market. Caribbean Cream picked up 5 cents to end at $4.90 trading 290 shares, Caribbean Producers gained 15 cents to finish at $3.18 in transferring 99,874 stock units. Consolidated Bakeries rose 13 cents to $1.63 with 3,637 units changing hands, Fontana ended 9 cents higher at $5.90 trading 204,475 stock units, Fosrich advanced 13 cents to $5.25 in an exchange of 17,786 shares. General Accident fell 15 cents to $5.70 in swapping 9,303 stock units, GWest Corporation gained 12 cents to 95 cents with a transfer of 51,347 shares, Honey Bun picked up 9 cents to close at $5.09 after exchanging 5,396 units. Indies Pharma rose 24 cents to $3.40 trading 85,057 stock units, Lasco Distributors fell 2 cents to $3.83 in exchanging 82,088 stocks, Lasco Manufacturing shed 25 cents to $4.30 after transferring 26,065 units.

At the close, Access Financial dropped $1.16 to $19.84, with the swapping of 2,821 shares, Blue Power lost 27 cents to close at $3.82, after exchanging 2,139 stocks, Caribbean Assurance Brokers rose 43 cents to $2.31 with 94,785 units crossing the market. Caribbean Cream picked up 5 cents to end at $4.90 trading 290 shares, Caribbean Producers gained 15 cents to finish at $3.18 in transferring 99,874 stock units. Consolidated Bakeries rose 13 cents to $1.63 with 3,637 units changing hands, Fontana ended 9 cents higher at $5.90 trading 204,475 stock units, Fosrich advanced 13 cents to $5.25 in an exchange of 17,786 shares. General Accident fell 15 cents to $5.70 in swapping 9,303 stock units, GWest Corporation gained 12 cents to 95 cents with a transfer of 51,347 shares, Honey Bun picked up 9 cents to close at $5.09 after exchanging 5,396 units. Indies Pharma rose 24 cents to $3.40 trading 85,057 stock units, Lasco Distributors fell 2 cents to $3.83 in exchanging 82,088 stocks, Lasco Manufacturing shed 25 cents to $4.30 after transferring 26,065 units.  Mailpac Group fell 4 cents to $3.34 in trading 1,259,240 shares, Main Event lost 7 cents ending at $3.40 with 8,004 shares crossing the market and Paramount Trading rose 12 cents to $1.43 with an exchange of 20,123 units.

Mailpac Group fell 4 cents to $3.34 in trading 1,259,240 shares, Main Event lost 7 cents ending at $3.40 with 8,004 shares crossing the market and Paramount Trading rose 12 cents to $1.43 with an exchange of 20,123 units. Trading ended with 12 stocks rising, 17 declining and eight remaining unchanged. The average PE Ratio ended at 16.3 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading ended with 12 stocks rising, 17 declining and eight remaining unchanged. The average PE Ratio ended at 16.3 based on ICInsider.com’s forecast of 2020-21 earnings. Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and three with lower offers.

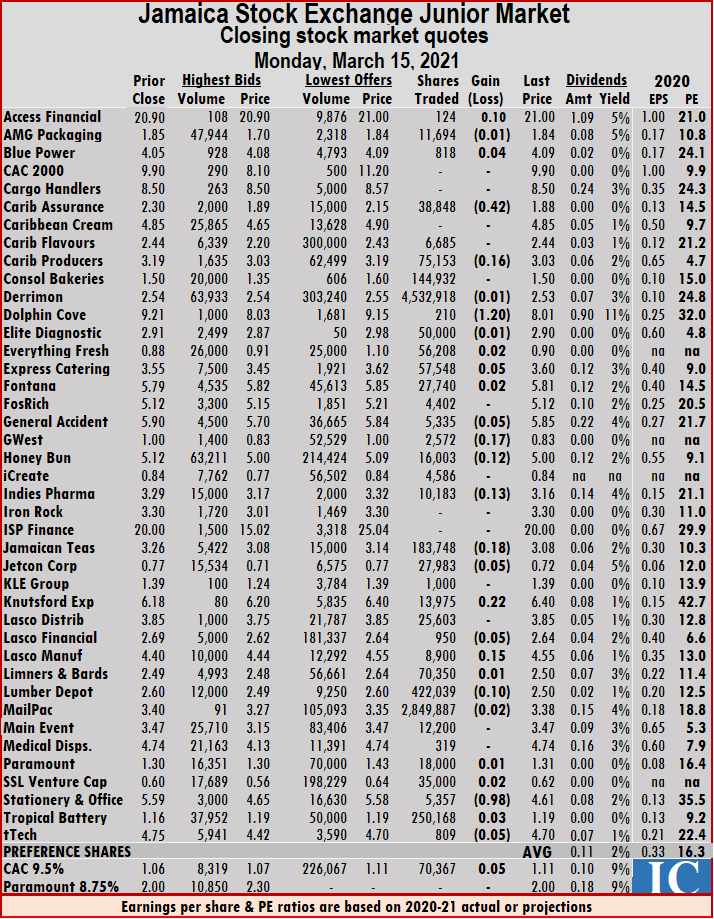

Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and three with lower offers. Lasco Financial slipped 5 cents to $2.64 after transferring 950 stock units, Lasco Manufacturing gained 15 cents to close at $4.55, with 8,900 units changing hands. Lumber Depot shed 10 cents to $2.50 with investors switching ownership of 422,039 shares, Stationery and Office Supplies dropped 98 cents to $4.61, trading 5,357 stock units and tTech lost 5 cents to end at $4.70 after exchanging 809 shares.

Lasco Financial slipped 5 cents to $2.64 after transferring 950 stock units, Lasco Manufacturing gained 15 cents to close at $4.55, with 8,900 units changing hands. Lumber Depot shed 10 cents to $2.50 with investors switching ownership of 422,039 shares, Stationery and Office Supplies dropped 98 cents to $4.61, trading 5,357 stock units and tTech lost 5 cents to end at $4.70 after exchanging 809 shares.

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside. The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.

The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment. The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE.

The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE. Trading ended with 31 active securities, down from 36 on Thursday and closed with eight rising prices, 13 declining and 10 remaining unchanged.

Trading ended with 31 active securities, down from 36 on Thursday and closed with eight rising prices, 13 declining and 10 remaining unchanged. Trading averaged 145,255 units at $366,311, from 153,162 at $547,055 on Thursday. The month to date averaged 227,879 units at $644,664, compared to 235,664 units at $670,892 on Thursday. February closed with an average of 365,365 units at $881,118.

Trading averaged 145,255 units at $366,311, from 153,162 at $547,055 on Thursday. The month to date averaged 227,879 units at $644,664, compared to 235,664 units at $670,892 on Thursday. February closed with an average of 365,365 units at $881,118. Honey Bun gained 6 cents to end at $5.12 in trading 27,055 stock units, Lasco Distributors gained 15 cents to close at $3.85 in an exchange of 110,217 units, Paramount Trading lost 15 cents in closing at $1.30 with 17,360 stock units clearing the market. SSL Venture lost 4 cents to close at 60 cents, with 54,312 stock units crossing the market and Stationery and Office Supplies advanced 99 cents to $5.59, trading 7,851 shares.

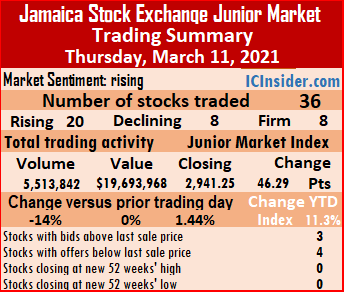

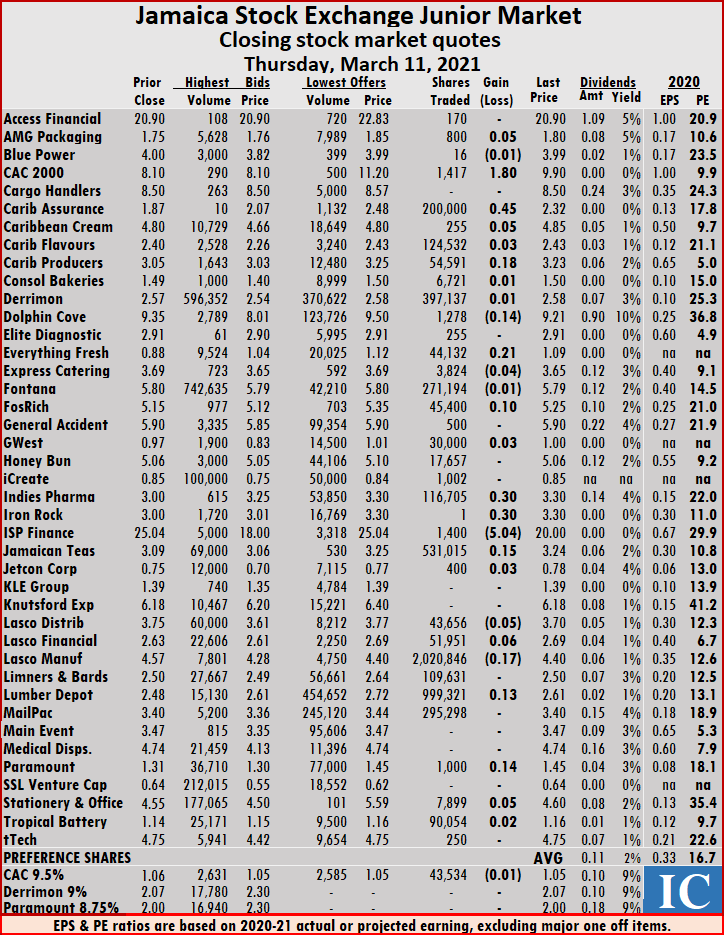

Honey Bun gained 6 cents to end at $5.12 in trading 27,055 stock units, Lasco Distributors gained 15 cents to close at $3.85 in an exchange of 110,217 units, Paramount Trading lost 15 cents in closing at $1.30 with 17,360 stock units clearing the market. SSL Venture lost 4 cents to close at 60 cents, with 54,312 stock units crossing the market and Stationery and Office Supplies advanced 99 cents to $5.59, trading 7,851 shares. A total of 36 securities traded against 35 on Wednesday and ended with 20 rising, eight declining and eight remaining unchanged. The average PE Ratio ended at 16.7 based on ICInsider.com’s forecast of 2020-21 earnings.

A total of 36 securities traded against 35 on Wednesday and ended with 20 rising, eight declining and eight remaining unchanged. The average PE Ratio ended at 16.7 based on ICInsider.com’s forecast of 2020-21 earnings. Investor’s Choice bid-offer indicator shows three stock ended with bids higher than their last selling price and four with lower offers.

Investor’s Choice bid-offer indicator shows three stock ended with bids higher than their last selling price and four with lower offers. Lasco Distributors slipped 5 cents to $3.70 with 43,656 units passing through the market, Lasco Financial rose 6 cents to $2.69 with 51,951 shares traded, Lasco Manufacturing climbed 17 cents to $4.40 with a transfer of 2,020,846 stock units. Lumber Depot advanced 13 cents to $2.61 with 999,321 units changing hands, Paramount Trading rose 14 cents to $1.45 with 1,000 stock units traded and Stationery and Office Supplies gained 5 cents to close at $4.60 with 7,899 shares crossing the exchange.

Lasco Distributors slipped 5 cents to $3.70 with 43,656 units passing through the market, Lasco Financial rose 6 cents to $2.69 with 51,951 shares traded, Lasco Manufacturing climbed 17 cents to $4.40 with a transfer of 2,020,846 stock units. Lumber Depot advanced 13 cents to $2.61 with 999,321 units changing hands, Paramount Trading rose 14 cents to $1.45 with 1,000 stock units traded and Stationery and Office Supplies gained 5 cents to close at $4.60 with 7,899 shares crossing the exchange.