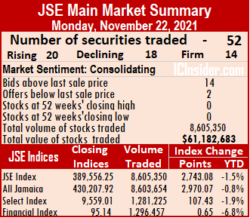

Market activity ended on Monday with the volume of shares trading declining modestly as the value plunged 69 percent below Friday trades at the close of the Jamaica Stock Exchange Main Market as rising stocks exceeded those falling, sending the market indices higher in the process.

The All Jamaican Composite Index surged 2,970.07 points to 430,207.92, the JSE Main Index climbed 2,743.08 points to 389,556.25 and the JSE Financial Index rose 0.65 points to end at 95.14.

The All Jamaican Composite Index surged 2,970.07 points to 430,207.92, the JSE Main Index climbed 2,743.08 points to 389,556.25 and the JSE Financial Index rose 0.65 points to end at 95.14.

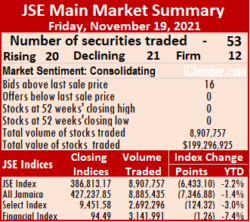

Overall, 52 securities traded compared to 53 on Friday, with 20 rising, 18 declining and 14 ending unchanged.

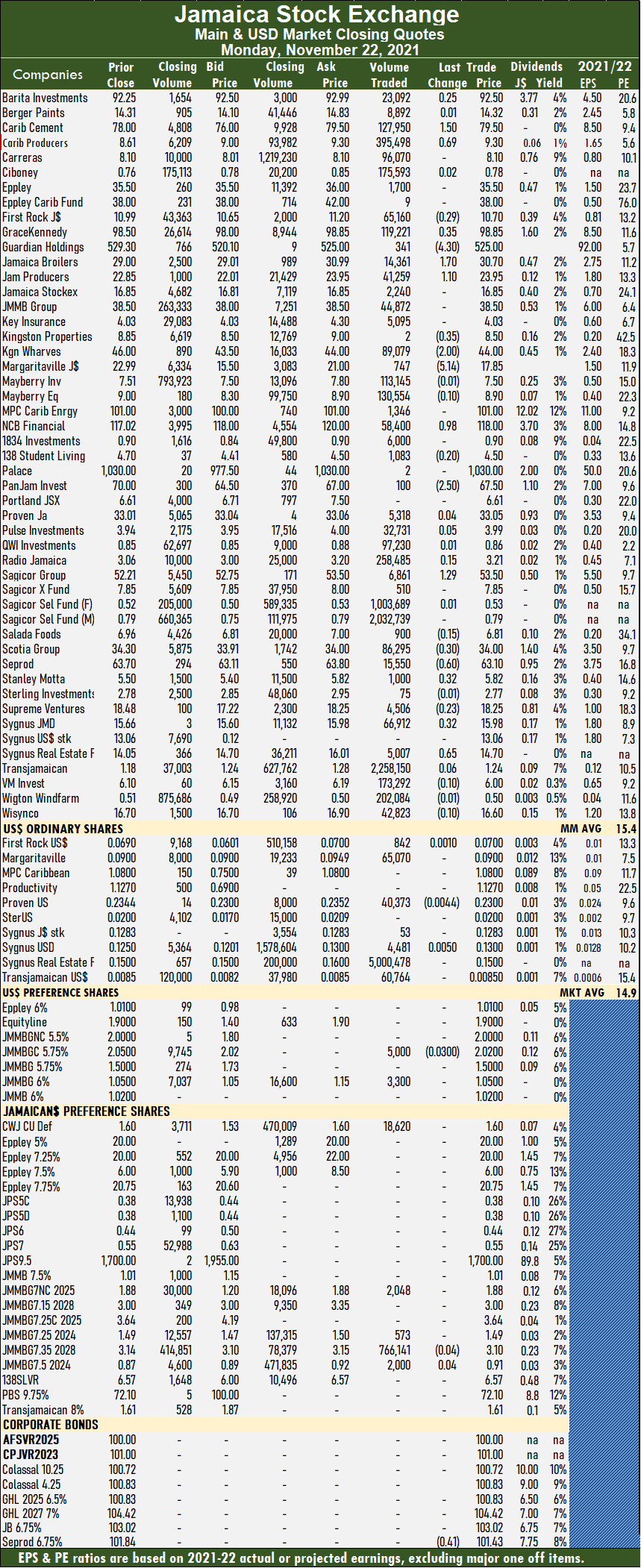

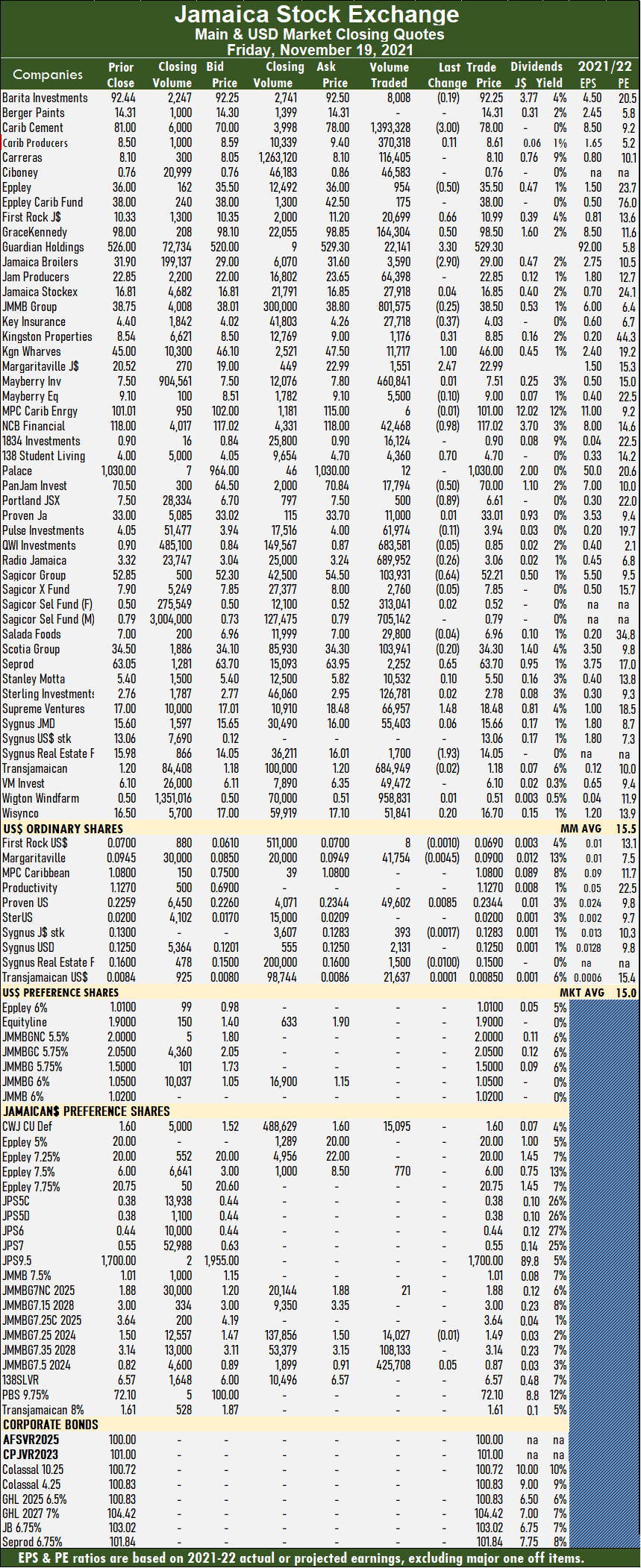

The PE Ratio, a formula for computing appropriate stock values, averages 15.4. The PE ratio for the JSE Main and USD Market closing quotes are based on earnings forecasted by ICInsider.com for companies with financial years ending between the current year and August 2022.

Trading ended with 8,605,350 shares changing hands for $61,182,683 versus 8,907,757 units at $199,296,925 on Friday. Transjamaican Highway led trading with 26.2 percent of total volume after a transfer of 2.26 million shares followed by Sagicor Select Manufacturing & Distribution Fund 23.6 percent, with 2.03 million units for 23.6 percent of the day’s trade and Sagicor Select Financial Fund with 11.7 percent after trading 1 million shares.

Trading averaged 165,488 units at $1,176,590, down from 168,071 shares at $3,760,319 on Friday and month to date, an average of 253,830 units at $3,057,633, versus 259,804 units at $3,184,829 on Friday. October averaged 251,350 units at $2,773,208.

Trading averaged 165,488 units at $1,176,590, down from 168,071 shares at $3,760,319 on Friday and month to date, an average of 253,830 units at $3,057,633, versus 259,804 units at $3,184,829 on Friday. October averaged 251,350 units at $2,773,208.

Investor’s Choice bid-offer indicator shows 14 stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments rallied 25 cents to $92.50 in exchanging 23,092 shares, Caribbean Cement advanced $1.50 to $79.50 after 127,950 stock units cleared the market, Caribbean Producers rose 69 cents to $9.30 in trading 395,498 units. First Rock Capital lost 29 cents to end at $10.70 with 65,160 stocks changing hands, GraceKennedy gained 35 cents in closing at $98.85 with the swapping of 119,221 shares, Guardian Holdings declined $4.30 to finish at $525 with 341 units crossing the exchange. Jamaica Broilers rallied $1.70 to end at $30.70 in switching ownership of 14,361 shares, Jamaica Producers popped $1.10 to $23.95 after exchanging 41,259 stock units, Kingston Properties fell 35 cents to $8.50 after a transfer of 2 stock units. Kingston Wharves fell $2 to $44 with an exchange of 89,079 stocks, Margaritaville declined $5.14 to $17.85, with 747 shares changing hands, NCB Financial popped 98 cents to $118 with a transfer of 58,400 units.  PanJam Investment fell $2.50 to $67.50 in exchanging 100 stocks, Sagicor Group advanced $1.29 to $53.50 after trading 6,861 stock units, Scotia Group lost 30 cents in closing at $34 with the swapping of 86,295 units. Seprod shed 60 cents to close at $63.10 in switching ownership of 15,550 shares, Stanley Motta gained 32 cents to end at $5.82 in trading 1,000 stock units, Sygnus Credit Investments popped 32 cents to $15.98 after an exchange of 66,912 shares and Sygnus Real Estate Finance climbed 65 cents to $14.70 with 5,007 stocks changing hands.

PanJam Investment fell $2.50 to $67.50 in exchanging 100 stocks, Sagicor Group advanced $1.29 to $53.50 after trading 6,861 stock units, Scotia Group lost 30 cents in closing at $34 with the swapping of 86,295 units. Seprod shed 60 cents to close at $63.10 in switching ownership of 15,550 shares, Stanley Motta gained 32 cents to end at $5.82 in trading 1,000 stock units, Sygnus Credit Investments popped 32 cents to $15.98 after an exchange of 66,912 shares and Sygnus Real Estate Finance climbed 65 cents to $14.70 with 5,007 stocks changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

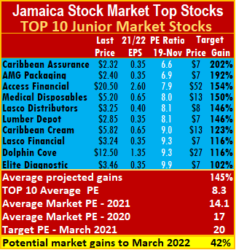

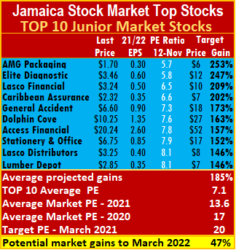

General Accident inched from $6.60 last week to $6.70 this week, but earnings were revised downwards to 65 cents for the year, helping it exit the TOP10. New to this week’s ICTOP10 are the Junior Market’s Medical Disposables, with the price falling 23 percent to $5.20 from $6.78 last week and Caribbean Cream. Sygnus Credit Investments dropped out of the TOP10 the previous week and returns with the price dropping 17 percent from $18.90 down to $15.66 this past week, while Proven Investments also returns.

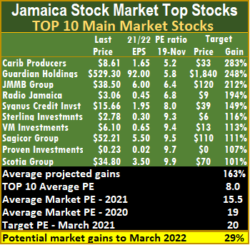

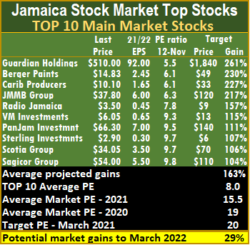

General Accident inched from $6.60 last week to $6.70 this week, but earnings were revised downwards to 65 cents for the year, helping it exit the TOP10. New to this week’s ICTOP10 are the Junior Market’s Medical Disposables, with the price falling 23 percent to $5.20 from $6.78 last week and Caribbean Cream. Sygnus Credit Investments dropped out of the TOP10 the previous week and returns with the price dropping 17 percent from $18.90 down to $15.66 this past week, while Proven Investments also returns. The top three Main Market stocks are Caribbean Producers, Guardian Holdings and JMMB Group, which are projected to gain between 212 to 283 percent expected versus last weeks’ 227 to 261 percent.

The top three Main Market stocks are Caribbean Producers, Guardian Holdings and JMMB Group, which are projected to gain between 212 to 283 percent expected versus last weeks’ 227 to 261 percent. The average gains projected for the TOP 10 Junior Market stocks moved from 185 percent last week to 145 percent and Main Market stocks remains unchanged at 163 percent.

The average gains projected for the TOP 10 Junior Market stocks moved from 185 percent last week to 145 percent and Main Market stocks remains unchanged at 163 percent. The average PE for the JSE Main Market is 15.5, which is 23 percent less than the PE of 19 at the end of March and 29 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 52 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average PE of 25.5, suggesting that the accepted multiple maybe around 25 times the current year’s earnings.

The average PE for the JSE Main Market is 15.5, which is 23 percent less than the PE of 19 at the end of March and 29 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 52 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average PE of 25.5, suggesting that the accepted multiple maybe around 25 times the current year’s earnings. ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes. The All Jamaican Composite Index plunged 7,346.88 points, following Thursday nearly 5,000 points drop, to close the week at 427,237.85, and the lowest point since late-December last year. The JSE Main Index dived 6,433.10 points to 386,813.17 and the JSE Financial Index declined 1.26 points to end at 94.49.

The All Jamaican Composite Index plunged 7,346.88 points, following Thursday nearly 5,000 points drop, to close the week at 427,237.85, and the lowest point since late-December last year. The JSE Main Index dived 6,433.10 points to 386,813.17 and the JSE Financial Index declined 1.26 points to end at 94.49. Investor’s Choice bid-offer indicator shows 16 stocks ended with bids higher than their last selling prices and none with a lower offer.

Investor’s Choice bid-offer indicator shows 16 stocks ended with bids higher than their last selling prices and none with a lower offer. NCB Financial shed 98 cents to end at $117.02 with an exchange of 42,468 stocks, 138 Student Living rose 70 cents to $4.70 in transferring 4,360 shares, PanJam Investment lost 50 cents to close at $70 after exchanging 17,794 units, Portland JSX fell 89 cents to $6.61 with 500 shares clearing the market. Radio Jamaica lost 26 cents to close at $3.06 in switching ownership of 689,952 stock units, Sagicor Group shed 64 cents in ending at $52.21 while trading 103,931 shares, Seprod popped 65 cents to finish at $63.70 after exchanging 2,252 stocks. Supreme Ventures rose $1.48 to $18.48 with 66,957 units changing hands and Sygnus Real Estate Finance declined $1.93 to $14.05 after 1,700 stock units crossed the market.

NCB Financial shed 98 cents to end at $117.02 with an exchange of 42,468 stocks, 138 Student Living rose 70 cents to $4.70 in transferring 4,360 shares, PanJam Investment lost 50 cents to close at $70 after exchanging 17,794 units, Portland JSX fell 89 cents to $6.61 with 500 shares clearing the market. Radio Jamaica lost 26 cents to close at $3.06 in switching ownership of 689,952 stock units, Sagicor Group shed 64 cents in ending at $52.21 while trading 103,931 shares, Seprod popped 65 cents to finish at $63.70 after exchanging 2,252 stocks. Supreme Ventures rose $1.48 to $18.48 with 66,957 units changing hands and Sygnus Real Estate Finance declined $1.93 to $14.05 after 1,700 stock units crossed the market.

The average trade for the day was 70,196 units at $5,401,049 versus 440,284 shares at $9,078,293 on Wednesday and month to date, an average of 266,594 units at $3,142,230, compared to 273,987 units at $2,968,998 on Wednesday. October closed with an average of 251,350 units at $2,773,208.

The average trade for the day was 70,196 units at $5,401,049 versus 440,284 shares at $9,078,293 on Wednesday and month to date, an average of 266,594 units at $3,142,230, compared to 273,987 units at $2,968,998 on Wednesday. October closed with an average of 251,350 units at $2,773,208. Margaritaville popped $2.68 ending at $20.52 in switching ownership of 510 stock units, 138 Student Living lost 45 cents to end at $4 in exchanging 8,290 shares, Palace Amusement rallied $30 to $1,030 with 27 units clearing the market, PanJam Investment gained 50 cents in closing at $70.50 with an exchange of 18,453 shares. Proven Investments lost 49 cents to settle $33 with the swapping of 2,500 stock units, Sagicor Group declined $1.91 to end at $52.85 after 70,956 stocks crossed the market, Scotia Group fell $2 in closing at $34.50 with the swapping of 157,337 units. Seprod shed 70 cents to close at $63.05 in trading 12,286 shares, Stanley Motta lost 26 cents in ending at $5.40 with 1,000 stock units changing hands, Sygnus Credit Investments lost 41 cents to finish at $15.60 in trading 66,085 shares and Wisynco Group shed 45 cents to close at $16.50 in switching ownership of 114,643 stocks.

Margaritaville popped $2.68 ending at $20.52 in switching ownership of 510 stock units, 138 Student Living lost 45 cents to end at $4 in exchanging 8,290 shares, Palace Amusement rallied $30 to $1,030 with 27 units clearing the market, PanJam Investment gained 50 cents in closing at $70.50 with an exchange of 18,453 shares. Proven Investments lost 49 cents to settle $33 with the swapping of 2,500 stock units, Sagicor Group declined $1.91 to end at $52.85 after 70,956 stocks crossed the market, Scotia Group fell $2 in closing at $34.50 with the swapping of 157,337 units. Seprod shed 70 cents to close at $63.05 in trading 12,286 shares, Stanley Motta lost 26 cents in ending at $5.40 with 1,000 stock units changing hands, Sygnus Credit Investments lost 41 cents to finish at $15.60 in trading 66,085 shares and Wisynco Group shed 45 cents to close at $16.50 in switching ownership of 114,643 stocks. Trading ended with 21,573,918 shares changing hands for $444,836,346 versus 10,040,879 units at $123,722,251 on Tuesday. Carreras led trading with 39.9 percent of total volume after exchanging 8.60 million shares followed by JMMB Group with 13.4 percent for 2.89 million units, PanJam Investment held 9.3 percent with 2.02 million units, Sagicor Select Financial Fund accounted for 7.8 percent, with 1.68 million units and Wisynco Group with 5 percent with a transfer of 1.09 million units.

Trading ended with 21,573,918 shares changing hands for $444,836,346 versus 10,040,879 units at $123,722,251 on Tuesday. Carreras led trading with 39.9 percent of total volume after exchanging 8.60 million shares followed by JMMB Group with 13.4 percent for 2.89 million units, PanJam Investment held 9.3 percent with 2.02 million units, Sagicor Select Financial Fund accounted for 7.8 percent, with 1.68 million units and Wisynco Group with 5 percent with a transfer of 1.09 million units. JMMB Group fell $1.65 in closing at $38.80 with 2,893,439 shares crossing the exchange, Kingston Wharves rallied 50 cents to $47 in trading 2,100 stocks, Margaritaville advanced $1.41 to $17.84 in an exchange of 11,007 stock units. NCB Financial popped $2 to close at $118 in transferring 60,945 units, Palace Amusement dropped $24 to close at $1,000 after an exchange of 63 stocks, PanJam Investment gained 50 cents in closing at $70 after trading 2,015,921 shares. Proven Investments climbed 49 cents to $33.49 with 9,015 units changing hands, Sagicor Group popped $1.76 to end at $54.76 after 802,872 stock units crossed the market and Sygnus Credit Investments dipped 29 cents to $16.01 with a transfer of 144,549 shares.

JMMB Group fell $1.65 in closing at $38.80 with 2,893,439 shares crossing the exchange, Kingston Wharves rallied 50 cents to $47 in trading 2,100 stocks, Margaritaville advanced $1.41 to $17.84 in an exchange of 11,007 stock units. NCB Financial popped $2 to close at $118 in transferring 60,945 units, Palace Amusement dropped $24 to close at $1,000 after an exchange of 63 stocks, PanJam Investment gained 50 cents in closing at $70 after trading 2,015,921 shares. Proven Investments climbed 49 cents to $33.49 with 9,015 units changing hands, Sagicor Group popped $1.76 to end at $54.76 after 802,872 stock units crossed the market and Sygnus Credit Investments dipped 29 cents to $16.01 with a transfer of 144,549 shares. The All Jamaican Composite Index jumped 1,731.22 points to 439,283.18, the JSE Main Index climbed 2,587.35 points to 397,380.02 and the JSE Financial Index gained 0.70 points to end at 96.12.

The All Jamaican Composite Index jumped 1,731.22 points to 439,283.18, the JSE Main Index climbed 2,587.35 points to 397,380.02 and the JSE Financial Index gained 0.70 points to end at 96.12. Trading averaged 189,451 units at $2,334,382, compared to 311,171 shares at $2,962,626 on Monday and month to date, an average of 260,759 units at $2,483,031, compared to 267,472 units at $2,497,025 on Monday. October closed with an average of 251,350 units at $2,773,208.

Trading averaged 189,451 units at $2,334,382, compared to 311,171 shares at $2,962,626 on Monday and month to date, an average of 260,759 units at $2,483,031, compared to 267,472 units at $2,497,025 on Monday. October closed with an average of 251,350 units at $2,773,208. PanJam Investment spiked $1.50 to close at $69.50 with the swapping of 7,698 shares, Proven Investments gained 49 cents to end at $33 with an exchange of 6,359 units. Sagicor Group declined $1.50 to $53 after 668,437 stocks cleared the market, Salada Foods lost 46 cents in ending at $7 in trading 815 units, Scotia Group popped $2 to $36.50 in transferring 33,791 shares. Seprod gained 45 cents in closing at $63.95 after exchanging 8,641 stock units, Supreme Ventures shed 46 cents to end at $17 in switching ownership of 161,242 units and Sygnus Credit Investments fell $1 to $16.30 with 183,314 stock units changing hands.

PanJam Investment spiked $1.50 to close at $69.50 with the swapping of 7,698 shares, Proven Investments gained 49 cents to end at $33 with an exchange of 6,359 units. Sagicor Group declined $1.50 to $53 after 668,437 stocks cleared the market, Salada Foods lost 46 cents in ending at $7 in trading 815 units, Scotia Group popped $2 to $36.50 in transferring 33,791 shares. Seprod gained 45 cents in closing at $63.95 after exchanging 8,641 stock units, Supreme Ventures shed 46 cents to end at $17 in switching ownership of 161,242 units and Sygnus Credit Investments fell $1 to $16.30 with 183,314 stock units changing hands. The All Jamaican Composite Index dipped 92.62 points to 437,551.96, the JSE Main Index fell 378.65 points to 394,792.67 and the JSE Financial Index slipped 0.10 points to end at 95.42.

The All Jamaican Composite Index dipped 92.62 points to 437,551.96, the JSE Main Index fell 378.65 points to 394,792.67 and the JSE Financial Index slipped 0.10 points to end at 95.42. Trading averaged 311,171 units at $2,962,626, compared to 219,447 shares at $3,368,215 on Friday and month to date, an average of 267,472 units at $2,497,025, compared to 262,931 units at $2,448,639 on Friday. October closed with an average of 251,350 units at $2,773,208.

Trading averaged 311,171 units at $2,962,626, compared to 219,447 shares at $3,368,215 on Friday and month to date, an average of 267,472 units at $2,497,025, compared to 262,931 units at $2,448,639 on Friday. October closed with an average of 251,350 units at $2,773,208. NCB Financial rose $1.98 to $117 while exchanging 31,547 stock units, Palace Amusement rallied $40 to $1000, trading 157 units, PanJam Investment popped $1.70 to $68 with 24,886 shares changing hands. Proven Investments declined 99 cents to $32.51, with 8,710 stock units clearing the market, Sagicor Group climbed 50 cents in closing at $54.50 in exchanging 218,439 shares, Salada Foods popped 46 cents to $7.46 after 22,641 stocks crossed the exchange. Scotia Group rose 45 cents to $34.50 after trades of 138,131 units and Sygnus Credit Investments lost $1.60 to $17.30, with 335,969 shares changing hands.

NCB Financial rose $1.98 to $117 while exchanging 31,547 stock units, Palace Amusement rallied $40 to $1000, trading 157 units, PanJam Investment popped $1.70 to $68 with 24,886 shares changing hands. Proven Investments declined 99 cents to $32.51, with 8,710 stock units clearing the market, Sagicor Group climbed 50 cents in closing at $54.50 in exchanging 218,439 shares, Salada Foods popped 46 cents to $7.46 after 22,641 stocks crossed the exchange. Scotia Group rose 45 cents to $34.50 after trades of 138,131 units and Sygnus Credit Investments lost $1.60 to $17.30, with 335,969 shares changing hands.

During the past week, Caribbean Brokers jumped 30 percent to close at $2.32 after hitting $2.96 on Thursday, following the company’s surprise to the market with outstanding results for the nine months to September. Elite Diagnostic rose 15 percent ahead of the release of the first quarter results that show increased sales over the June quarter and ended with a loss of $500,000 in the quarter versus a $10million loss in 2020, but the company generated cash inflows of $27 million for the quarter, slightly more than the dividend they recently paid. General Accident rose 8 percent ahead of quarterly results, Stationery & Office Supplies gained 7 percent, following improved nine months results. In the Main Market, Caribbean Producers jumped 24 percent following a big spike in September quarterly profit, but the stock has much more to do with earnings upgraded to J$1.65 per share for the year. Proven rose 6 percent, the rest were mostly downhill with a 10 percent fall for Guardian Holdings, VM Investments fell 7 percent and Radio Jamaica slipped 8 percent as investors reacted hurriedly to half year results that show the company is on track to reach ICInsider.com forecast of 45 cents per share.

During the past week, Caribbean Brokers jumped 30 percent to close at $2.32 after hitting $2.96 on Thursday, following the company’s surprise to the market with outstanding results for the nine months to September. Elite Diagnostic rose 15 percent ahead of the release of the first quarter results that show increased sales over the June quarter and ended with a loss of $500,000 in the quarter versus a $10million loss in 2020, but the company generated cash inflows of $27 million for the quarter, slightly more than the dividend they recently paid. General Accident rose 8 percent ahead of quarterly results, Stationery & Office Supplies gained 7 percent, following improved nine months results. In the Main Market, Caribbean Producers jumped 24 percent following a big spike in September quarterly profit, but the stock has much more to do with earnings upgraded to J$1.65 per share for the year. Proven rose 6 percent, the rest were mostly downhill with a 10 percent fall for Guardian Holdings, VM Investments fell 7 percent and Radio Jamaica slipped 8 percent as investors reacted hurriedly to half year results that show the company is on track to reach ICInsider.com forecast of 45 cents per share. The top three Main Market stocks are Guardian Holdings, Berger Paints and Caribbean Producers. These stocks are projected to gain between 227 to 261 percent expected versus last weeks’ 220 to 230 percent.

The top three Main Market stocks are Guardian Holdings, Berger Paints and Caribbean Producers. These stocks are projected to gain between 227 to 261 percent expected versus last weeks’ 220 to 230 percent. The latest results show that there are many undervalued stocks, but investors should focus on these stocks that could deliver good earnings growth in 2022.

The latest results show that there are many undervalued stocks, but investors should focus on these stocks that could deliver good earnings growth in 2022. The average PE for the JSE Main Market is 15.5, which is 23 percent less than the PE of 19 at the end of March and 29 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 51 percent discount to the market and well below the potential of 20. A total of 12 stocks or 25 percent of the market trade at or above a PE of 19, with most over 20, for an average PE of 25.5, suggesting that the accepted multiple maybe around 25 times the current year’s earnings.

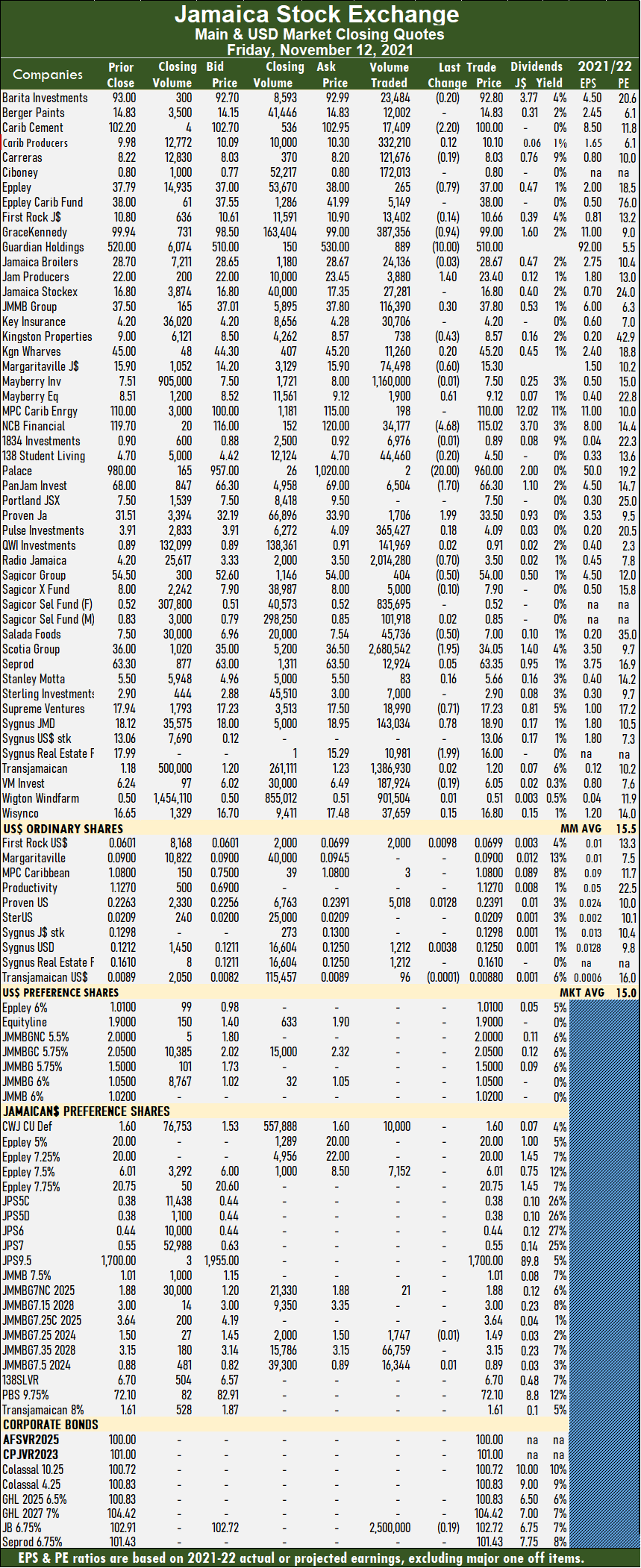

The average PE for the JSE Main Market is 15.5, which is 23 percent less than the PE of 19 at the end of March and 29 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 51 percent discount to the market and well below the potential of 20. A total of 12 stocks or 25 percent of the market trade at or above a PE of 19, with most over 20, for an average PE of 25.5, suggesting that the accepted multiple maybe around 25 times the current year’s earnings. At the close, Caribbean Cement fell $2.20 to $100 trading 17,409 shares, Eppley fell 79 cents to $37 with 265 units crossing the market, GraceKennedy slipped 94 cents to $99 after exchanging 387,356 stock units. Guardian Holdings declined $10 to $510, with 889 stocks crossing the exchange, Jamaica Producers advanced $1.40 to $23.40, after 3,880 units cleared the market, JMMB Group gained 30 cents after ending at $37.80 after an exchange of 116,390 shares. Kingston Properties lost 43 cents to close at $8.57 in trading 738 stock units, Margaritaville dipped 60 cents to $15.30 with a transfer of 74,498 shares, Mayberry Jamaican Equities rose 61 cents to $9.12, in swapping of 1,900 units. NCB Financial declined $4.68 to a 52 weeks’ closing low of $115.02 in transferring 34,177 shares, Palace Amusement dropped $20 to $960 after trading two stocks, PanJam Investment fell $1.70 to $66.30 with the swapping of 6,504 stock units.

At the close, Caribbean Cement fell $2.20 to $100 trading 17,409 shares, Eppley fell 79 cents to $37 with 265 units crossing the market, GraceKennedy slipped 94 cents to $99 after exchanging 387,356 stock units. Guardian Holdings declined $10 to $510, with 889 stocks crossing the exchange, Jamaica Producers advanced $1.40 to $23.40, after 3,880 units cleared the market, JMMB Group gained 30 cents after ending at $37.80 after an exchange of 116,390 shares. Kingston Properties lost 43 cents to close at $8.57 in trading 738 stock units, Margaritaville dipped 60 cents to $15.30 with a transfer of 74,498 shares, Mayberry Jamaican Equities rose 61 cents to $9.12, in swapping of 1,900 units. NCB Financial declined $4.68 to a 52 weeks’ closing low of $115.02 in transferring 34,177 shares, Palace Amusement dropped $20 to $960 after trading two stocks, PanJam Investment fell $1.70 to $66.30 with the swapping of 6,504 stock units. Proven Investments advanced $1.99 to $33.50 with 1,706 units changing hands, Radio Jamaica shed 70 cents in closing at $3.50 with the swapping of 2,014,280 stocks, following the release of record six months results, Sagicor Group lost 50 cents to finish at $54 in trading 404 stock units. Salada Foods slipped 50 cents to $7 with an exchange of 45,736 shares, Scotia Group fell $1.95 to end at $34.05 after trading 2,680,542 stock units, Supreme Ventures shed 71 cents to close at $17.23 in switching ownership of 18,990 stocks. Sygnus Credit Investments rallied 78 cents to $18.90 in an exchange of 143,034 units and Sygnus Real Estate Finance declined $1.99 in closing at a 52 weeks’ low of $16 with 10,981 shares clearing the market.

Proven Investments advanced $1.99 to $33.50 with 1,706 units changing hands, Radio Jamaica shed 70 cents in closing at $3.50 with the swapping of 2,014,280 stocks, following the release of record six months results, Sagicor Group lost 50 cents to finish at $54 in trading 404 stock units. Salada Foods slipped 50 cents to $7 with an exchange of 45,736 shares, Scotia Group fell $1.95 to end at $34.05 after trading 2,680,542 stock units, Supreme Ventures shed 71 cents to close at $17.23 in switching ownership of 18,990 stocks. Sygnus Credit Investments rallied 78 cents to $18.90 in an exchange of 143,034 units and Sygnus Real Estate Finance declined $1.99 in closing at a 52 weeks’ low of $16 with 10,981 shares clearing the market. The All Jamaican Composite Index popped 1,608.31 points to 440,499.56, the JSE Main Index rose 1,916.17 points to 397,981.66 and the Financial Index popped 0.93 points to end at 96.40.

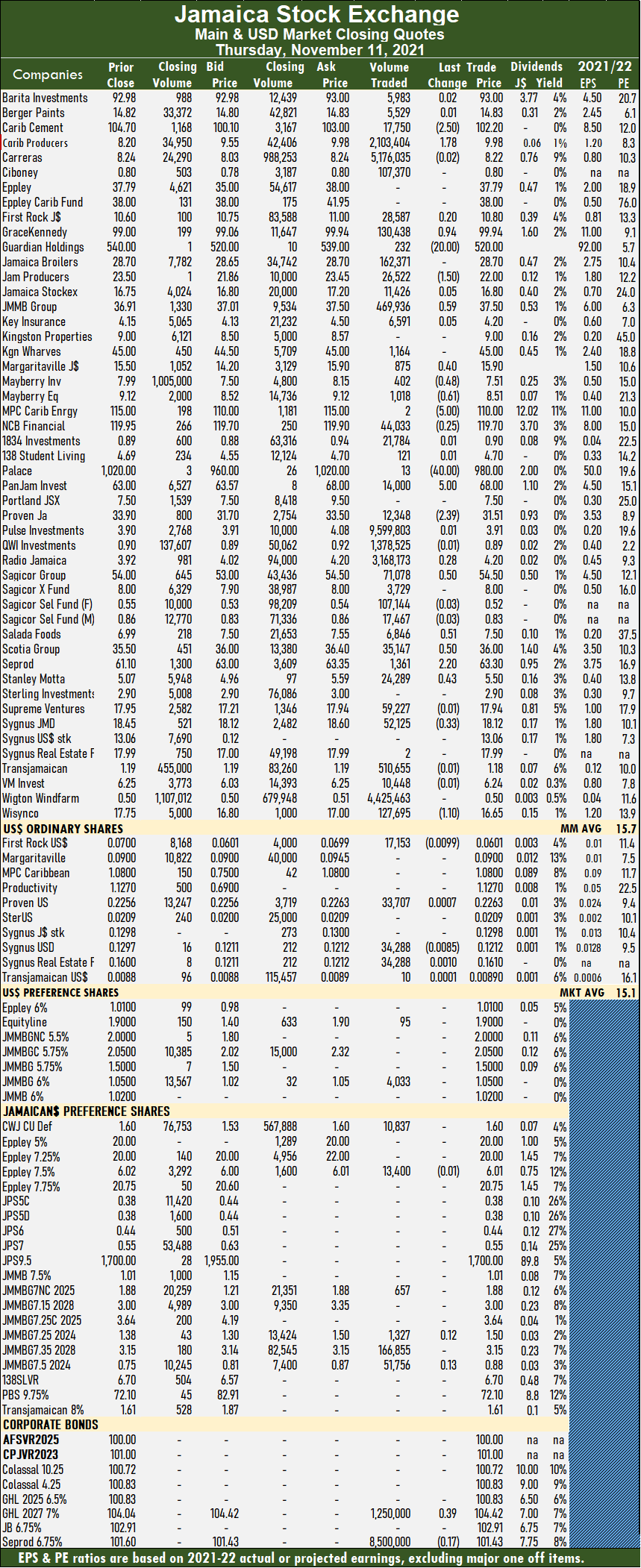

The All Jamaican Composite Index popped 1,608.31 points to 440,499.56, the JSE Main Index rose 1,916.17 points to 397,981.66 and the Financial Index popped 0.93 points to end at 96.40. Trading averages 575,346 units at $3,582,646, compared to 175,120 shares at $1,797,342 on Wednesday and month to date, an average of 267,974 units at $2,341,992, versus 231,059 units at $2,192,992 on Wednesday. October closed with an average of 251,350 units at $2,773,208.

Trading averages 575,346 units at $3,582,646, compared to 175,120 shares at $1,797,342 on Wednesday and month to date, an average of 267,974 units at $2,341,992, versus 231,059 units at $2,192,992 on Wednesday. October closed with an average of 251,350 units at $2,773,208. Sagicor Group rose 50 cents to $54.50 in switching ownership of 71,078 stocks, Salada Foods rallied 51 cents to $7.50 with 6,846 stock units crossing the market, Scotia Group gained 50 cents in ending at $36 with the swapping of 35,147 shares. Seprod spiked $2.20 in closing at $63.30 in exchanging 1,361 units, Stanley Motta rose 43 cents to end at $5.50 after 24,289 stock units changed hands, Sygnus Credit Investments shed 33 cents to close at $18.12 trading 52,125 units and Wisynco Group declined $1.10 to $16.65 in an exchange of 127,695 stock units.

Sagicor Group rose 50 cents to $54.50 in switching ownership of 71,078 stocks, Salada Foods rallied 51 cents to $7.50 with 6,846 stock units crossing the market, Scotia Group gained 50 cents in ending at $36 with the swapping of 35,147 shares. Seprod spiked $2.20 in closing at $63.30 in exchanging 1,361 units, Stanley Motta rose 43 cents to end at $5.50 after 24,289 stock units changed hands, Sygnus Credit Investments shed 33 cents to close at $18.12 trading 52,125 units and Wisynco Group declined $1.10 to $16.65 in an exchange of 127,695 stock units.