The Jamaica Stock Exchange main market declined for a second consecutive day at the close on Tuesday with less than half the volume traded on Monday but with Barita Investments with a big 8 million units trade for $649 million following 6 million units valued $487 million on Monday.

The Jamaica Stock Exchange main market declined for a second consecutive day at the close on Tuesday with less than half the volume traded on Monday but with Barita Investments with a big 8 million units trade for $649 million following 6 million units valued $487 million on Monday.

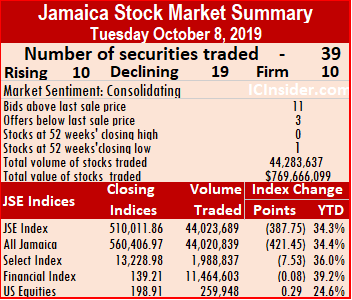

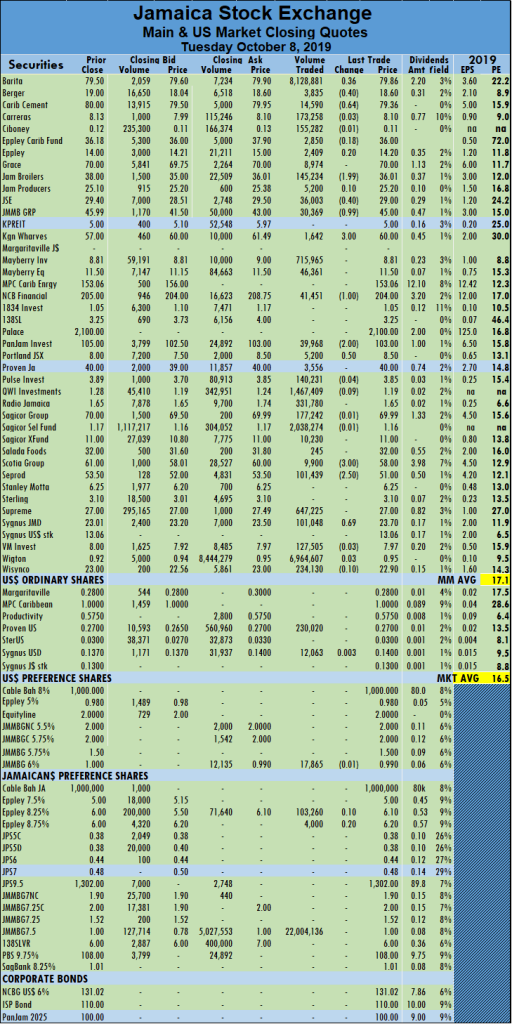

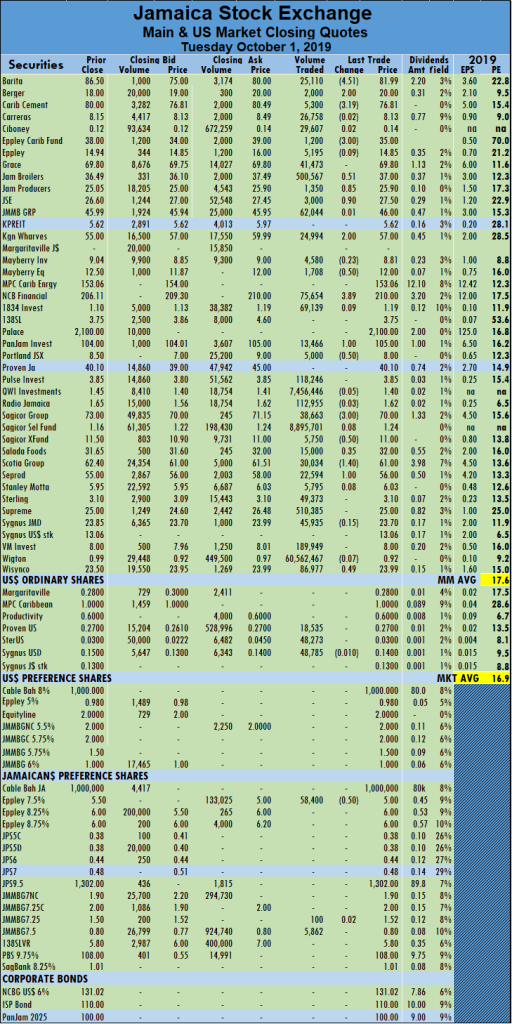

Trading ended with 39 securities changing hands in the main and US dollar markets with 10 advancing, 19 declining and 10 trading firm. The market closed with the JSE All Jamaican Composite Index dropped 421.45 points to close at 560,406.97. The JSE Index was down 387.75 points to 510,011.86 and the JSE Financial Index slipped 0.08 points to close at 139.21.

Main market activity ended with 36 securities trading resulting in 44,023,689 units valued at $758,570,804 in contrast to 98,349,184 units valued at $1,160,920,073 from 35 securities trading on Monday.

JMMB Group 7.5% preference share led trading with 22 million units for 50 percent of total volume, followed by Barita Investments with 8 million units accounting for 18 percent of the day’s trade and Wigton Windfarm with 7 million shares for 16 percent of the market’s trade. Also trading more than a million shares, were, Sagicor Select Funds with 2 million shares changing hands and QWI Investments with 1.5 million units and closing at an all-time low of $1.19.

The Market closed with an average of 1,222,880 units valued at an average of $21,071,411 for each security traded, in contrast to 2,809,977 units for an average of $33,169,145 on Monday. The average volume and value for the month to date amounts to 1,147,595 shares at $11,637,677 for each security traded and previously 1,360,410 units valued at $9,708,050 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 stocks ended with bids higher than their last selling prices and 3 with lower offers.

In main market activity, Barita Investments gained 36 cents to settle at $79.86 with an exchange of 8,128,881 shares, Berger Paints lost 40 cents to close at $18.60 with 3,835 units trading, Carib Cement closed 64 cents lower after 14,950 shares changed hands to end at $79.36. Jamaica Broilers ended with a loss of $1.99, closing at $36.01 as 145,234 shares traded, Jamaica Stock Exchange lost 40 cents, after exchanging 36,003 shares to settle at $29, JMMB Group closed 99 cents lower at $45, with 30,369 shares changing hands.  Kingston Wharves jumped $3 to settle at $60, after trading 1,642 shares, NCB Financial slid $1 to close at $204 while exchanging 41,451 units, PanJam Investment closed $2 lower in swapping 39,968 shares to end at $103. Portland JSX gained 50 cents in trading 5,200 shares to close at $8.50, Scotia Group dropped $3 to $58 with 9,900 shares changing hands, Seprod declined by $2.50 to end at $51 with an exchange of 101,439 shares and Sygnus Credit Investments gained 69 cents, after exchanging 101,048 shares.

Kingston Wharves jumped $3 to settle at $60, after trading 1,642 shares, NCB Financial slid $1 to close at $204 while exchanging 41,451 units, PanJam Investment closed $2 lower in swapping 39,968 shares to end at $103. Portland JSX gained 50 cents in trading 5,200 shares to close at $8.50, Scotia Group dropped $3 to $58 with 9,900 shares changing hands, Seprod declined by $2.50 to end at $51 with an exchange of 101,439 shares and Sygnus Credit Investments gained 69 cents, after exchanging 101,048 shares.

Trading in the US dollar market ended with 259,948 units valued US$81,583 with the market index rising 0.29 points to close at 198.91. Proven Investments exchanged 230.020 shares, to close at 27 US cents and JMMB Group 6% preference share traded 17,865 units, losing 1 US cent to end at 99 US cents.

More declines for JSE majors

Sharp fall for JSE main market

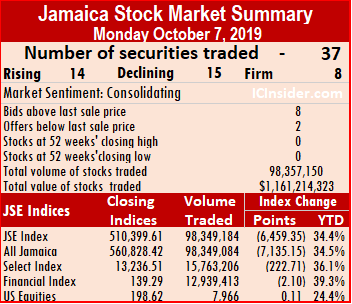

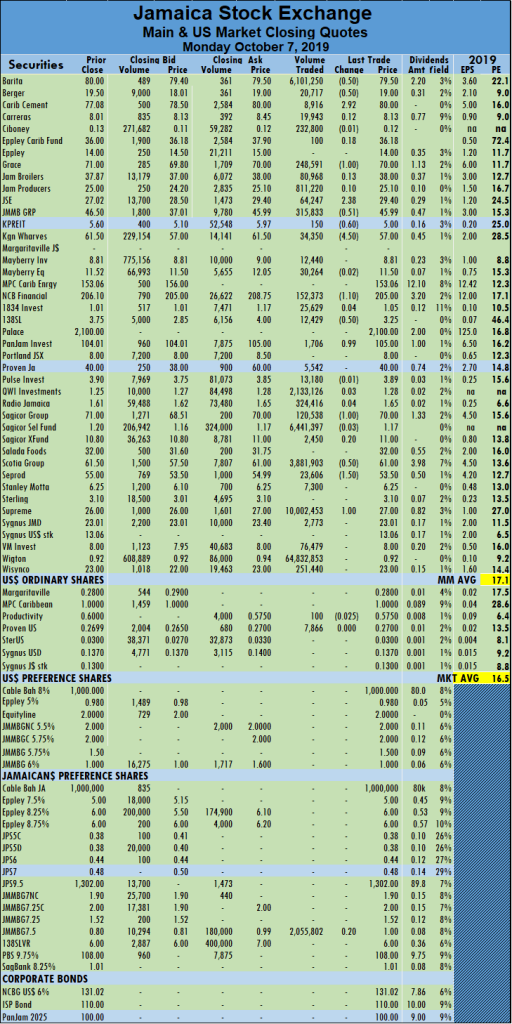

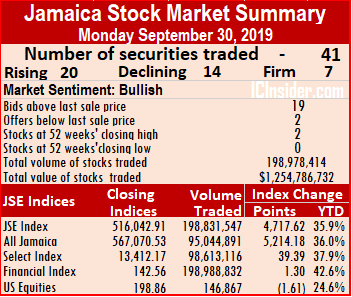

All major indices on the main market of the Jamaica Stock Exchange declined sharply at the close on Monday with a big rise in the volume and value of stocks traded.

All major indices on the main market of the Jamaica Stock Exchange declined sharply at the close on Monday with a big rise in the volume and value of stocks traded.

At the close, the JSE All Jamaican Composite Index plummeted 7,135.15 points to close at 560,828.42. The JSE Index fell 6,459.35 points to 510,399.61 and the JSE Financial Index lost 2.10 points to close at 139.29.

Trading ended with 37 securities changing hands in the main and US dollar markets with 14 advancing, 15 declining and 8 trading firm. Main market activity ended with 35 securities trading resulting in 98,349,184 units valued at $1,160,920,073 in contrast to 23,630,643 units valued at $239,877,355 on Friday.

Wigton Windfarm led trading with 64.8 million shares for 66 percent of total volume, followed by Supreme Ventures with 10 million units accounting for 10 percent of the day’s trade and Sagicor Select Funds with 6.4 million shares for 7 percent of the market’s trade. Also trading more than a million shares, are Barita Investments with 6,101,250 shares, Scotia Group with 3.88 million shares changing hands and QWI Investments with 2.1 million units and JMMB Group 7.5% preference share ended with 2 million units crossing the exchange.

The Market closed with an average of 2,809,977 units valued at an average of $33,169,145 for each security traded, in contrast to 675,161 units for an average of $6,853,639 on Friday. The average volume and value for the month to date amounts to 1,360,410 shares at $9,708,050 for each security traded and previously 1,000,589 units valued at $3,884,374 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ended with bids higher than their last selling prices and 2 with lower offers.

In main market activity, Barita Investments closed 50 cents lower to settle at $79.50 with an exchange 6,101,250 shares worth $487 million, Berger Paints lost 50 cents to close at $19 with 20,717 units traded, Carib Cement gained $2.92 after 8,916 shares changed hands to end at $80. Grace Kennedy ended with a loss of $1, in closing at $70 with 248,951 shares trading, Jamaica Stock Exchange advanced $2.38, after exchanging 64,247 shares to settle at $29.40, JMMB Group closed 51 cents lower at $45.09, after trading down to $35.01 with 315,833 shares changing hands.  Kingston Properties lost 60 cents to settle at $5 after trading a mere 150 units, Kingston Wharves dropped $4.50 to $57 with exchange of 34,350 shares, NCB Financial slid $1.10 to settle at $205 while exchanging of 152,373 units, 138 Student Living lost 50 cents to close at $3.25, after trading 12,429 shares. PanJam Investment gained 99 cents in swapping 1,706 shares in ending at $105, Sagicor Group dropped $1 to settle at $70 in trading 120,538 shares, Scotia Group closed 50 cents lower to $61 with 3,881,903 shares changing hands. Seprod declined by $1.50 to end at $53.50 with an exchange of 23,606 shares and Supreme Ventures ended at $27, after advancing $1 in trading 10,002,453 shares.

Kingston Properties lost 60 cents to settle at $5 after trading a mere 150 units, Kingston Wharves dropped $4.50 to $57 with exchange of 34,350 shares, NCB Financial slid $1.10 to settle at $205 while exchanging of 152,373 units, 138 Student Living lost 50 cents to close at $3.25, after trading 12,429 shares. PanJam Investment gained 99 cents in swapping 1,706 shares in ending at $105, Sagicor Group dropped $1 to settle at $70 in trading 120,538 shares, Scotia Group closed 50 cents lower to $61 with 3,881,903 shares changing hands. Seprod declined by $1.50 to end at $53.50 with an exchange of 23,606 shares and Supreme Ventures ended at $27, after advancing $1 in trading 10,002,453 shares.

Trading in the US dollar market ended with 7,966 units valued US$2,180 with the market index rising 0.11 points to close at 198.62. Proven Investments exchanged 7,866 shares, to close at 27 US cents after a marginal gain from 26.99 US cents and Productive Business Solutions traded 100 units after losing 2.5 US cents to end at 57.50 US cents.

JSE climbs on increased volume

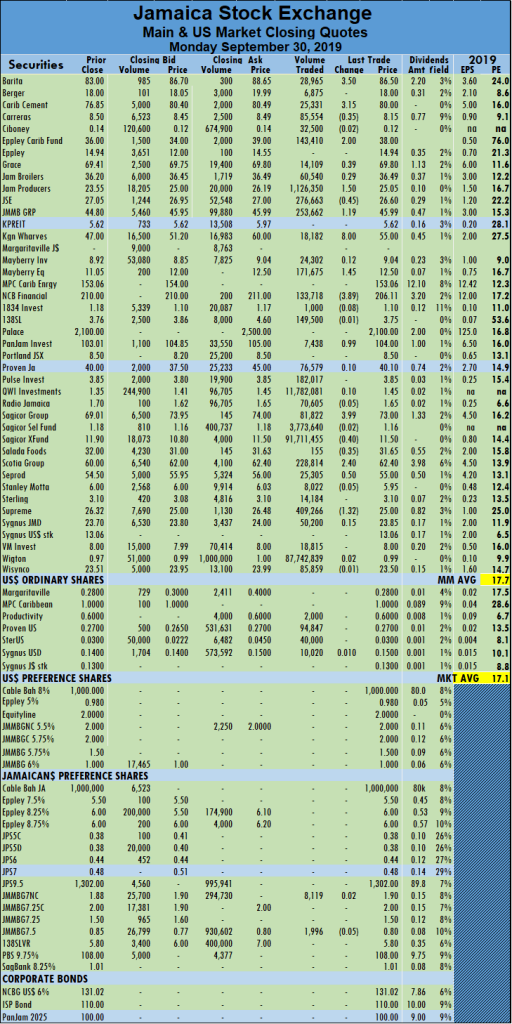

The main market of the Jamaica Stock Exchange on Friday saw all market indices advancing as rising stocks edged out decliners with a strong rise in the volume and value of stocks traded.

The main market of the Jamaica Stock Exchange on Friday saw all market indices advancing as rising stocks edged out decliners with a strong rise in the volume and value of stocks traded.

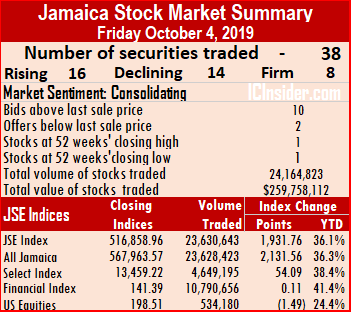

At the close, the JSE All Jamaican Composite Index advanced 2,131.56 points to close at 567,963.57. The JSE Index gained 1,913.76 points to 516,858.96 and the JSE Financial Index rose 0.11 points to close at 141.39.

Trading ended with 38 securities changing hands in the main and US dollar markets with 16 advancing, 14 declining and 8 trading firm. Main market activity ended with 35 securities trading resulting in 23,630,643 units valued at $239,877,355 in contrast to 17,528,310 units valued at $59,397,804 on Thursday.

QWI Investments led trading with 7.7 million shares for 33 percent of total volume after closing at an all-time low of $1,25, followed by Wigton Windfarm with 6.3 million units accounting for 27 percent of the day’s trade and Sagicor Select Funds with 2.6 million shares for 11 percent of the market’s trade.  Also trading more than a million shares, are Jamaica Stock Exchange and Kingston Wharves with just over 2 million units.

Also trading more than a million shares, are Jamaica Stock Exchange and Kingston Wharves with just over 2 million units.

The Market closed with an average of 675,161 units valued $6,853,639 for each security traded, in contrast to 547,760 units for an average of $1,856,181 on Thursday. The average volume and value for the month to date amounts to 1,000,589 shares at $3,884,374 for each security traded and previously 1,108,042 units valued at $2,903,957 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 stocks ended with bids higher than their last selling prices and 2 with lower offers.

In main market activity, Berger Paints lost 50 cents to close at $19.50 with 13,636 units traded, Grace Kennedy ended with gains of 80 cents, closing at $71 with 13,320 shares changing hands, Jamaica Producers climbed by $1.49, to settle at $25 with 29,791 shares crossing the exchange. Jamaica Stock Exchange lost 48 cents, after exchanging 2,009,880 shares to settle at $27.02, JMMB Group closed $1.10 higher at $46.50, with 103,069 shares changing hands, Kingston Wharves advanced $3.20 to $61.50 with 2,003,710 shares traded. Mayberry Jamaican Equities gained 32 cents to close at $11.52, after trading 5,558 shares,  NCB Financial dipped $3.90 to settle at $206.10 with an exchange of 20,585 units, Pan Jamaican Investment lost 99 cents in exchanging 6,095 shares, ending at $104.01, Sagicor Group added $1 to settle at $71 in trading 123,026 shares. Seprod gained $2 to end at $55 with 92,233 shares changing hands, Supreme Ventures ended at $26 and advancing $1.30 cents in trading 18,907 shares and Wisynco closed 99 cents lower at $23, with 142,804 shares trading.

NCB Financial dipped $3.90 to settle at $206.10 with an exchange of 20,585 units, Pan Jamaican Investment lost 99 cents in exchanging 6,095 shares, ending at $104.01, Sagicor Group added $1 to settle at $71 in trading 123,026 shares. Seprod gained $2 to end at $55 with 92,233 shares changing hands, Supreme Ventures ended at $26 and advancing $1.30 cents in trading 18,907 shares and Wisynco closed 99 cents lower at $23, with 142,804 shares trading.

Trading in the US dollar market ended with 534,180 units valued US$144,063 with the market index falling 1.49 points to close at 198.51. Proven Investments exchanged 531,430 shares, to close at 26.99 US cents, Sygnus Credit Investments traded 2,500 units and lost 1.3 cents to end at 13.7 US cents and JMMB Group 5.5% preference share traded 250 shares, to close at US$2.

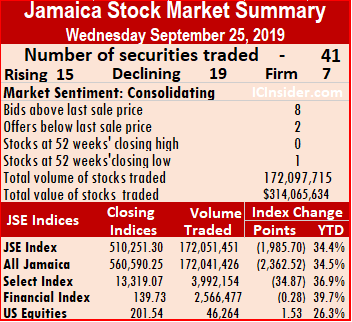

Trading drops sharply for JSE majors

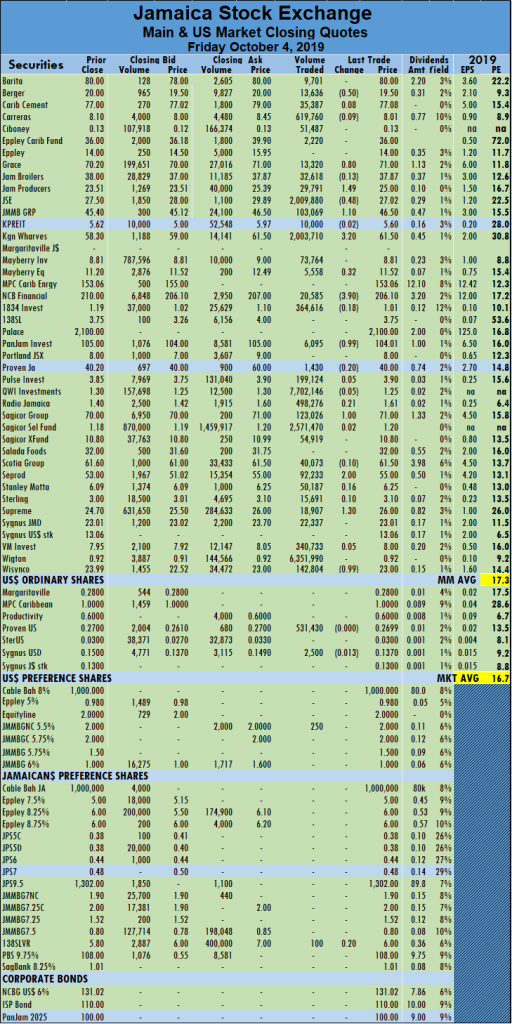

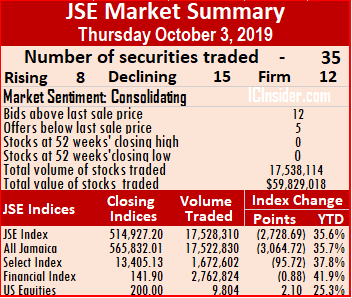

The main market of the Jamaica Stock exchange closed down for a second consecutive day with big declines in the market indices on Thursday as trading volume contracted sharply, to a third of the levels in August with the value falling to just 13 percent.

The main market of the Jamaica Stock exchange closed down for a second consecutive day with big declines in the market indices on Thursday as trading volume contracted sharply, to a third of the levels in August with the value falling to just 13 percent.

At the close, the JSE All Jamaican Composite Index dived 3,064.72 points to close at 565,832.01. The JSE Index dropped 2,728.69 points to 514,927.20 and the JSE Financial Index lost 62 points to close at 141.28.

Trading ended with 35 securities changing hands in the main and US dollar markets with 8 advancing, 15 declining and 12 trading firm. Main market activity ended with 31 securities trading resulting in 17,528,310 units valued at $59,397,804 in contrast to 20,815,331 units valued at $96,905,471 on Wednesday.

Wigton Windfarm led trading with 7.5 million shares for 43 percent of total volume, followed by Sagicor Select Funds with 4 million units accounting for 23 percent of the day’s trade and newly listed, QWI Investments with 3.8 million shares for 22 percent of the market’s trade.

The Market closed with an average of 547,760 units valued $1,856,181 for each security traded, in contrast to 578,204 units for an average of $2,691,819 on Wednesday.  The average volume and value for the month to date amounts to 1,108,042 shares at $2,903,957 for each security traded and previously 1,350,326 units valued at $3,357,049 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

The average volume and value for the month to date amounts to 1,108,042 shares at $2,903,957 for each security traded and previously 1,350,326 units valued at $3,357,049 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 12 stocks ended with bids higher than their last selling prices and 5 with lower offers.

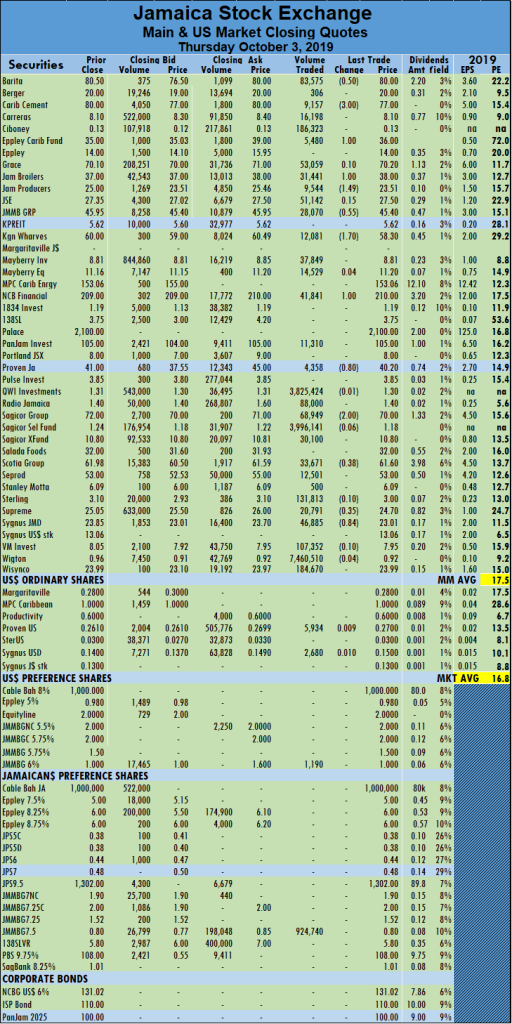

In main market activity, Barita lost 50 cents to close at $80 with 83,575 units traded, Carib Cement ended $3 lower at $77 with 9,157 shares changing hands, Eppley Caribbean Property gained $1 with an exchange of 5,480 shares to close at $36, Jamaica Broilers closed $1 higher in trading 31,441 shares and ending at $38. Jamaica Producers lost $1.49, to settle at $23.51 with an exchange of 9,544 shares, JMMB Group lost 55 cents to close at $45.40, after trading 28,070 shares, Kingston Wharves dropped $1.70 to $58.30 with 12,081 shares changing hands.  NCB Financial gained $1 to settle at $210 with 41,841 units trading, Proven Investments lost 80 cents, to close at $40.20 with 4,358 units changing hands, Sagicor Group closed $2 lower to settle at $70 in trading 68,949 shares. Scotia Group lost 38 cents to end at $61.60 with 33,671 shares changing hands, Supreme Ventures ended at $24.70, after losing 35 cents trading 20,791 shares and Sygnus Credit Investments closed 84 cents lower at $23.01, with 46,885 shares traded.

NCB Financial gained $1 to settle at $210 with 41,841 units trading, Proven Investments lost 80 cents, to close at $40.20 with 4,358 units changing hands, Sagicor Group closed $2 lower to settle at $70 in trading 68,949 shares. Scotia Group lost 38 cents to end at $61.60 with 33,671 shares changing hands, Supreme Ventures ended at $24.70, after losing 35 cents trading 20,791 shares and Sygnus Credit Investments closed 84 cents lower at $23.01, with 46,885 shares traded.

Trading in the US dollar market ended with 9,804 units valued US$3,194 with the market index advancing 2.10 points to close at 200. Proven Investments exchanged 5,934 shares, gaining 0.9 US cent to close at 27 US cents, Sygnus Credit Investments traded 2,680 units and gained 1 cent to end at 15 US cents and JMMB Group 6% preference share traded 1,190 shares, to close at US$1.

First drop for JSE main market in 4 days

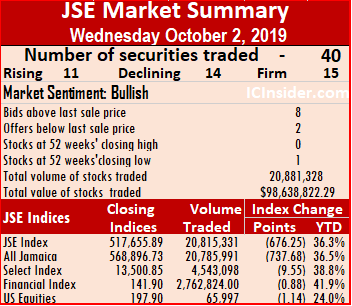

The main market of the Jamaica Stock exchange closed down for the first time in four trading sessions with modest declines in the market indices on Wednesday.

The main market of the Jamaica Stock exchange closed down for the first time in four trading sessions with modest declines in the market indices on Wednesday.

At the close, the JSE All Jamaican Composite Index declining 737.68 points to close at 568,896.73, down after 3 days of gains in the overall market.

At the close, the JSE Index dropped 676.25 points to 517,655.89 and the JSE Financial Index lost 88 points to close at 141.90.

At the close of trading, 40 securities changed hands in the main and US dollar markets with 11 advancing, 14 declining and 15 trading firm. Main market activity ended 36 securities trading resulting in 20,815,331 units valued at $96,905,471 in contrast to 79,108,777 units valued at $151,516,121 on Tuesday from 38 securities on Tuesday.

Wigton Windfarm dominated trading with 13.6 million shares for 66 percent of total volume, followed by Sagicor Select Funds with 3 million units accounting for 15 percent of the day’s trade and newly listed, QWI Investments with 1.3 million shares for 6 percent of the market’s trade as the stock closed at it lowest point since listing on Monday.

The Market closed with an average of 578,204 units valued $2,691,819 for each security traded, in contrast to 2,081,810 units for an average of $3,987,266 on Tuesday. The average volume and value for the month to date amounts to 1,350,326 units valued at $3,357,049 for each stock traded. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 stocks ended with bids higher than their last selling prices and 2 with lower offers.

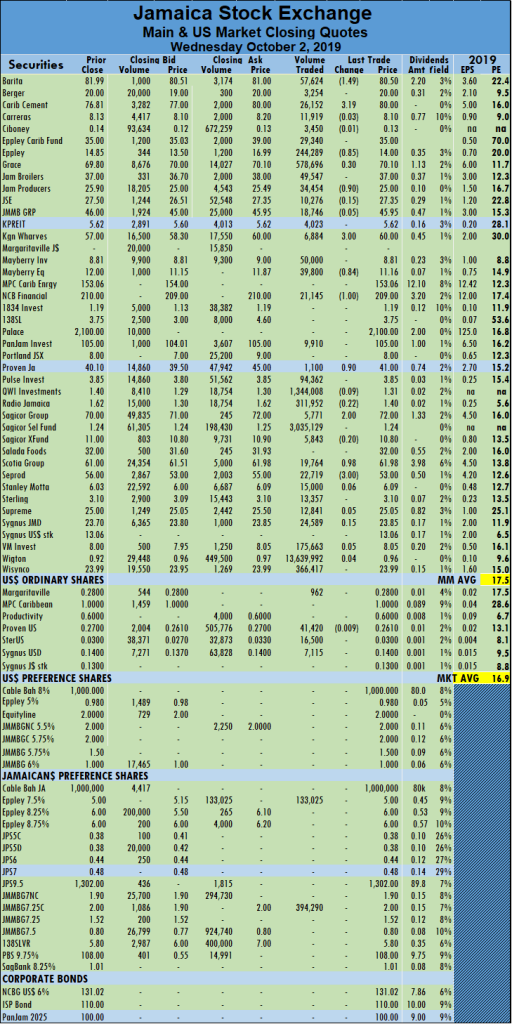

In main market activity, Barita lost $1.49 to settle at $80.50 with 57,624 units traded, Carib Cement regained $3.19 to close at $80 with 26,152 shares changing hands, Eppley gained 85 cents with an exchange of 244,289 shares to end at $14, Grace Kennedy closed 30 cents higher to settle at $70.10 trading 578,696 shares. Jamaica Producers lost 90 cents, to settle at $25 with 34,454 shares crossing the exchange, Kingston Wharves climbed $3 to $60 with 6,884 shares changing hands, Mayberry Jamaican Equities closed at $11.16, after losing 84 cents in trading 39,800 shares.  NCB Financial dropped $1 to settle at $209 with 21,145 units trading, Proven Investments gained 90 cents, in closing at $41 with 1,100 units changing hands, Sagicor Group closed $2 higher to settle at $72 in trading 5,771 shares. Scotia Group gained 98 cents to end at $61.98 with 19,764 shares changing hands and Seprod closed $3 lower at $53, after exchanging 22,719 shares.

NCB Financial dropped $1 to settle at $209 with 21,145 units trading, Proven Investments gained 90 cents, in closing at $41 with 1,100 units changing hands, Sagicor Group closed $2 higher to settle at $72 in trading 5,771 shares. Scotia Group gained 98 cents to end at $61.98 with 19,764 shares changing hands and Seprod closed $3 lower at $53, after exchanging 22,719 shares.

Trading in the US dollar market ended with 115,593 units valued US$13,607 with the market index losing 1.14 points to close at 197.90. Margaritaville traded 962 shares at 30 US cents, Proven Investments exchanged 41,420 shares and lost 0.9 of a cent to close at 26.10 US cents, Sterling Investments traded 16,500 units at 3 US cents and Sygnus Credit Investments traded 7,115 shares, to close at 14 US cents.

JSE main market starts October positively

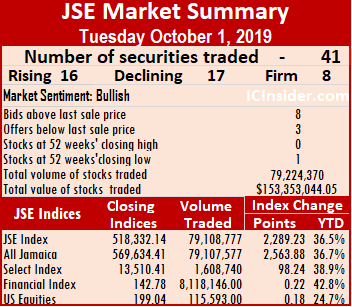

The main market of the Jamaica Stock Exchange closed higher on the first trading day of October following the big gains of more than 4,700 points on Monday to close out September.

The main market of the Jamaica Stock Exchange closed higher on the first trading day of October following the big gains of more than 4,700 points on Monday to close out September.

At the close on Tuesday, the JSE All Jamaican Composite Index advanced 2,563.88 points to close at 569,634.41; the JSE Index gained 2.289.23 points to 518,332.14 and the JSE Financial Index added 0.22 points to close at 142.78.

At the close of trading, 41 securities changed hands in the main and US dollar markets with 16 advancing, 17 declining and 8 traded firm. Main market activity ended with 79,108,777 units valued at $151,516,121 in contrast to 198,831,547 units valued at $1,248,840,350 on Monday

Wigton Windfarm dominated trading with 60.6 million shares for 77 percent of total volume, followed by Sagicor Select Funds with 8.9 million units accounting for 11 percent of the day’s trade and newly listed, QWI Investments with 7.5 million shares for 9 percent of the market’s trade.

The Market closed with an average of 2,081,810 units valued $3,987,266 for each security traded, in contrast to 5,373,826 units for an average of $33,752,442 on Monday. The market closed out September with an average of 1,585,081 units valued at $14,071,562 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8

stocks ended with bids higher than their last selling prices and 3 with lower offers.

In main market activity, Barita dived $4.51 to settle at $81.99 with 25,110 units traded, Berger gained $2, after exchanging just 2,000 shares to close at $20, Carib Cement lost $3.19 to end at $76.81 with 5,300 shares changing hands, Eppley Caribbean Property dropped $3 to end at $35 trading 1,200 shares. Jamaica Broilers closed 51 cents higher to settle at $37 after trading 500,567 shares, Jamaica Producers climbed by 85 cents, in settling at $25.90 with a mere 1,350 shares traded. Jamaica Stock Exchange gained 90 cents exchanging 3,000 units to end at $27.50, Kingston Wharves closed $2 higher to $57 with 24,994 shares changing hands. Mayberry Jamaican Equities closed at $12, after losing 50 cents trading 1,708 shares, NCB Financial climbed $3.89 to settle at $210 with 75,654 units traded, PanJam Investment rose $1 to end at $105 after exchanging 13,466 shares.  Portland JSX lost 50 cents, in closing at $8 with 5,000 units changing hands, Sagicor Group dropped $3 to settle at $70 in trading 38,663 shares, Sagicor Real Estate Fund lost 50 cents in trading 5,750 units at $11, Salada Foods closed 35 cents higher at $32, exchanging 15,000 shares. Scotia Group lost $1.40 to end at $61 with 30,034 shares changing hands, Seprod ended the day’s trade $1 higher to settle at $56 in trading 22,594 shares and Wisynco gained 49 cents to end at $23.99, after trading 86,977 shares. In the Preference segment, Eppley 7.5% lost 50 cents in trading 58,400 shares at a 52 weeks’ low of $5.

Portland JSX lost 50 cents, in closing at $8 with 5,000 units changing hands, Sagicor Group dropped $3 to settle at $70 in trading 38,663 shares, Sagicor Real Estate Fund lost 50 cents in trading 5,750 units at $11, Salada Foods closed 35 cents higher at $32, exchanging 15,000 shares. Scotia Group lost $1.40 to end at $61 with 30,034 shares changing hands, Seprod ended the day’s trade $1 higher to settle at $56 in trading 22,594 shares and Wisynco gained 49 cents to end at $23.99, after trading 86,977 shares. In the Preference segment, Eppley 7.5% lost 50 cents in trading 58,400 shares at a 52 weeks’ low of $5.

Trading in the US dollar market ended with 115,593 units valued at over US$13,607 with the market index gaining 0.18 points to close at 199.04. Proven Investments exchanged 18,535 shares at 27 US cents, Sterling Investments traded 48,723 units at 3 US cents and Sygnus Credit Investments traded 48,785 shares, falling by a cent to close at 14 US cents.

JSE stocks jump sharply on Monday

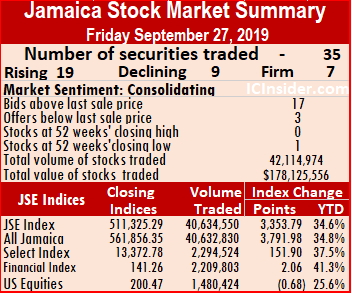

The Jamaica Stock Exchange raced sharply on Monday to close out October on a winning note with two main indices rising more than 4,700 points as rising stocks outnumbered declining ones by a wide margin.

The Jamaica Stock Exchange raced sharply on Monday to close out October on a winning note with two main indices rising more than 4,700 points as rising stocks outnumbered declining ones by a wide margin.

The market closed with a new listing QWI Investments, on the main market as the market capitalization exceeded 2 trillion dollars for the first time.

Trading ended with the JSE All Jamaican Composite Index soared 5,214.18 points to close at 567,070.53; the JSE Index advanced 4,717.62 points to 516,042.91 and the JSE Financial Index gained 1.30 points to close at 142.56.

At the close of trading, 41 securities changed hands in the main and US dollar markets with 20 advancing, 14 declining and 7 traded firm. Main market activity ended with 198,831,547 units valued at $1,248,840,350 in contrast to 40,634,550 units valued at $123,950,544 on Friday.

Sagicor Real Estate dominated trading with 91.7 million shares for 46 percent of total volume, followed by Wigton Windfarm with 87.7 million units accounting for 44 percent of the day’s trade, QWI Investments with 11.8 million shares for 6 percent of the market’s trade.

Sagicor Real Estate dominated trading with 91.7 million shares for 46 percent of total volume, followed by Wigton Windfarm with 87.7 million units accounting for 44 percent of the day’s trade, QWI Investments with 11.8 million shares for 6 percent of the market’s trade.

The Market closed with an average of 5,373,826 units valued at $33,752,442 for each security traded, in contrast to 1,269,830 units valued at an average of $3,873,455 on Friday. The average volume and value for the month to date amounts to 1,585,081 units valued at $14,071,562 and previously an average of 1,391,725 units at $12,363,616 for each security traded. The market closed out August with an average of 1,743,431 units valued at $9,907,963 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 19 stocks ended with bids higher than their last selling prices and 2 with lower offers.

In main market activity, Barita jumped $3.50 to close at $86.50 with 28,965 units traded, Carib Cement exchanged 25,331 units, after gaining $3.15 to settle at $80, Carreras lost 35 cents ending at $8.15 after trading 85,554 units, Eppley Caribbean Property climbed $2 in closing at $38, after exchanging 143,410 shares. GraceKennedy closed 39 cents higher to settle at $69.80 trading 14,109 shares, Jamaica Producers rose $1.50, in settling at $25.05 with 1,126,350 shares traded. Jamaica Stock Exchange lost 45 cents exchanging 276,663 units to end at $26.60, JMMB Group closed $1.19 higher at $45.99 with 253,662 shares changing hands, Kingston Wharves jumped $8 to $55 with 18,182 shares traded.  Mayberry Jamaican Equities closed at $12.50, after gaining $1.45 trading 171,675 shares, NCB Financial dropped by $3.89 to settle at $206.11 with 133,718 units traded, PanJam Investments rose by 99 cents and ending at $104 after exchanging 7,438 shares, Sagicor Group advanced $3.99 to settle at $73 while trading 81,822 shares. Sagicor Real Estate Fund lost 40 cents in trading 91,711,455 units at $11.50, Salada Foods closed 35 cents lower to $31.65, exchanging 155 shares, Scotia Group advanced $2.40 to end at a 52 weeks’ high of $62.40 with 228,814 shares changing hands, Seprod ended the day’s trade 50 cents higher to settle at $55 in trading 25,305 shares and Supreme Ventures dropped $1.32 to end at $25, after trading 409,266 shares.

Mayberry Jamaican Equities closed at $12.50, after gaining $1.45 trading 171,675 shares, NCB Financial dropped by $3.89 to settle at $206.11 with 133,718 units traded, PanJam Investments rose by 99 cents and ending at $104 after exchanging 7,438 shares, Sagicor Group advanced $3.99 to settle at $73 while trading 81,822 shares. Sagicor Real Estate Fund lost 40 cents in trading 91,711,455 units at $11.50, Salada Foods closed 35 cents lower to $31.65, exchanging 155 shares, Scotia Group advanced $2.40 to end at a 52 weeks’ high of $62.40 with 228,814 shares changing hands, Seprod ended the day’s trade 50 cents higher to settle at $55 in trading 25,305 shares and Supreme Ventures dropped $1.32 to end at $25, after trading 409,266 shares.

Trading in the US dollar market ended with 146,867 units valued at over US$29,408 with the market index declining 1.61 points to close at 198.86. Productivity Business Solutions traded 2,000 shares at 60 us cents, Proven Investments traded 94,847 shares, at 27 US cents, Sterling Investments traded 40,000 units at 3 US cents and Sygnus Credit gained 1 US cent exchanging 10,020 units to close at 15 US cents.

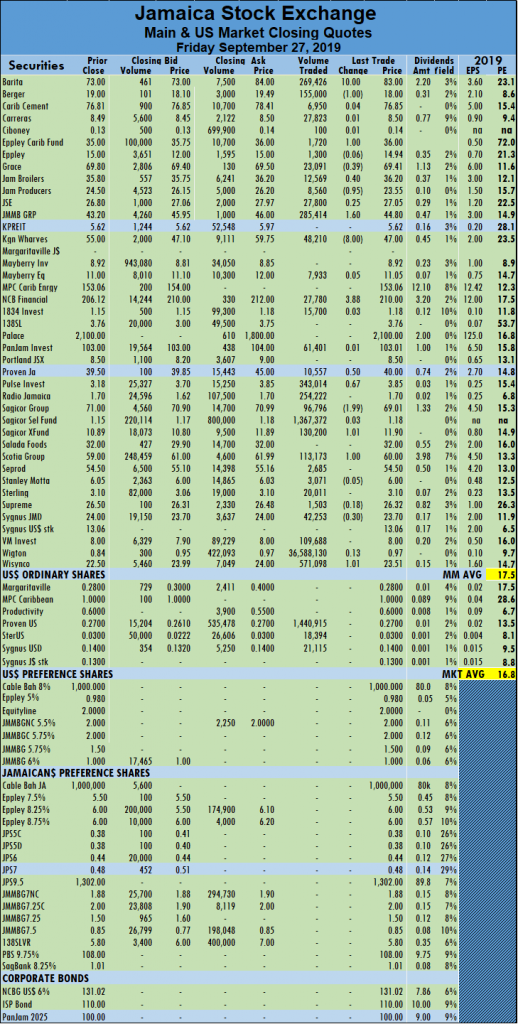

JSE main market climbs – Friday

Stock prices mostly rose in trading on the main market of the Jamaica Stock Exchange on Friday with the market indices rising after gainers beat losers 2 to 1.

Stock prices mostly rose in trading on the main market of the Jamaica Stock Exchange on Friday with the market indices rising after gainers beat losers 2 to 1.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading jumps to 17 stocks ending with bids higher than their last selling prices and 3 with lower offers, an indication that the market could move higher on Monday.

At the close of trading, 35 securities changed hands in the main and US dollar markets, from 39 on Thursday and ending with 19 advancing, 9 declining and 7 traded firm.

The JSE All Jamaican Composite Index jumped 3,791.98 points to close at 561,856.35, the JSE Index climbed 3,353.79 points to 511,325.29 and the JSE Financial Index advanced by 2.06 points to close at 141.26.

Main market activity, ended with 40,634,550 units valued at $123,950,544, in contrast to 146,463,942 units valued at $2,436,661,814 on Thursday.

Wigton Windfarm dominated trading with 36.6 million shares for 90 percent of total volume, followed by Sagicor Select Fund with 1.37 million units accounting for 3 percent of the day’s trade and Wisynco Group with 571,098 shares for under 1.4 percent of the market’s trade.

The Market closed with an average of 1,269,830 units valued at an average of $3,873,455 for each security traded, in contrast to 4,068,443 units for an average of $67,685,050 on Thursday.  The average volume and value for the month to date amounts to 1,391,725 units valued at $12,363,616 and previously an average of 1,397,353 units valued at $12,776,511 for each security traded. The market closed out August with an average of 1,743,431 units valued at $9,907,963 for each security traded.

The average volume and value for the month to date amounts to 1,391,725 units valued at $12,363,616 and previously an average of 1,397,353 units valued at $12,776,511 for each security traded. The market closed out August with an average of 1,743,431 units valued at $9,907,963 for each security traded.

In main market activity, Barita Investments leaped $10 to close at $83 with 269,426 units trading, Berger Paints traded 155,000 shares and lost $1 to close at $18, Eppley Caribbean Property rose 13 in closing at $36, after exchanging 1,720 shares. Grace Kennedy closed with a loss of 39 cents at $69.41 while trading 23,091 units, Jamaica Broilers ended at $36.20, after rising 40 cents with 12,569 shares changing hands. Jamaica Producers shed 95 cents, settling at $23.55 in trading 8,560 units, JMMB Group gained $1.60 to $44.80 after exchanging 285,414 shares, Kingston Wharves dropped $8 to $47 in trading 48,210 shares.  NCB Financial climbed $3.88 to settle at $210 while trading 27,780 units, Proven Investments added 50 cents to end at $40 with 10,557 stock units changing hands. Pulse Investments rose 67 cents in swapping 343,014 units at $3.85, Sagicor Group closed with a loss of $1.99 to settle at $69.01 with 96,796 shares crossing the exchange. Sagicor Real Estate Fund gained $1.01 to settle at $11.90 with an exchange of 113,173 shares, Scotia Group gained $1 to end at $60 while exchanging 113,173 shares and Wisynco Group traded 571,098 and rose $1.01 to end trading at $23.51.

NCB Financial climbed $3.88 to settle at $210 while trading 27,780 units, Proven Investments added 50 cents to end at $40 with 10,557 stock units changing hands. Pulse Investments rose 67 cents in swapping 343,014 units at $3.85, Sagicor Group closed with a loss of $1.99 to settle at $69.01 with 96,796 shares crossing the exchange. Sagicor Real Estate Fund gained $1.01 to settle at $11.90 with an exchange of 113,173 shares, Scotia Group gained $1 to end at $60 while exchanging 113,173 shares and Wisynco Group traded 571,098 and rose $1.01 to end trading at $23.51.

Trading in the US dollar market ended with 1,480,424 units valued at $392,573 with the market index lost 0.68 points to close at 200.47. Proven Investments traded 1,440,915 shares, to close at 27 US cents, Sygnus Credit Investments settled at 14 US cents trading 21,115 shares, Sterling Investments ended at 3 US cents in exchanging 18,394 shares.

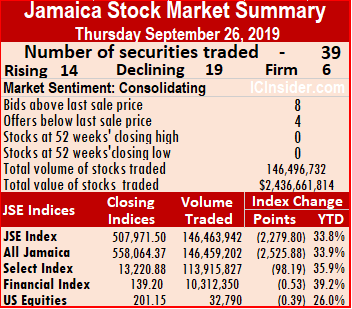

JSE main market down again – Thursday

Carreras accounted for 90% of the volume traded.

Most stock prices fell in trading on the main market of the Jamaica Stock Exchange on Thursday with the market indices falling for the second consecutive day.

At the close of trading, 39 securities changed hands in the main and US dollar markets, up from 41 on Wednesday and ending with 14 advancing, 19 declining and 6 traded firm.

The JSE All Jamaican Composite Index declining 2,525.88 points to close at 558,064.37, the JSE Index declined by 2,279.80 points to close at 507,971.50 and the JSE Financial Index lost 0.53 points to close at 139.20.

Main market activity, ended with 146,463,942 units valued at over $2,436,661,814, in contrast to 172,051,451 units valued at $307,622,863 on Wednesday.

Carreras dominated trading with 87 million shares for 59 percent of total volume, followed by Wigton Windfarm with 29.6 million units accounting for 20 percent of the day’s trade and Grace Kennedy with 14 million shares for under 9.6 percent of the market’s trade. Sagicor Group chip in trading 9.5 million shares and Sagicor Select Fund with 3.4 million shares.

The main market closed with an average of 4,068,443 units valued at an average of $67,685,050 for each security traded, in contrast to 4,650,039 units for an average of $8,314,131 on Wednesday.  The average volume and value for the month to date amounts to 1,397,353 units valued at $12,776,511 and previously an average of 1,250,992 units valued at $9,598,525 for each security traded. The market closed out August with an average of 1,743,431 units valued at $9,907,963 for each security traded.

The average volume and value for the month to date amounts to 1,397,353 units valued at $12,776,511 and previously an average of 1,250,992 units valued at $9,598,525 for each security traded. The market closed out August with an average of 1,743,431 units valued at $9,907,963 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ended with bids higher than their last selling prices and 4 with lower offers.

In main market activity, Barita Investments lost $1 to close at $73 with 4,839 units traded, Berger Paints traded 8,511 shares and lost 50 cents to close at $19, Caribbean Cement dropped $3.19 exchanging 9,135 stock units to end at 76.81, Eppley Caribbean Property recovered $3 in closing at $35, after exchanging 4,740 shares. Eppley closed $1 higher to settle at $15 while trading 4,200 units, Jamaica Broilers ended at $35.80, after losing 70 cents with 50,293 shares changing hands. Jamaica Producers shed $1.75, settling at $24.50 in trading 9,333 units, JMMB Group gained $2.20 to $43.20 after exchanging 114,781 shares, Kingston Wharves closed $2.50 higher to $55 in trading 22,568 shares.  Mayberry Jamaican Equities closed at $11, after falling $1 in trading 7,923 stock units, NCB Financial dropped $5.88 to settle at $206.12 while trading 195,000 units, PanJam Investment rose 45 cents and ended at $103 after exchanging 36,879 shares, Proven Investments fell 50 cents to end at $39.50 with 10,136 stock units changing hands. Pulse Investments lost 42 cents in swapping 42,851 units at $3.18, Sagicor Group closed $1 higher to settle at $71 with 9,485,998 shares crossing the exchange, Salada Foods rose $1 to settle at $32 trading 3,000 units. Scotia Group fell $2.15 to end at $59 while exchanging 93,970 shares, Seprod ended the day’s trade $1 down to settle at $54.50 with 20,129 units changing hands and Wisynco Group traded 1,246,570 to lose 50 cents and end trading at $22.50.

Mayberry Jamaican Equities closed at $11, after falling $1 in trading 7,923 stock units, NCB Financial dropped $5.88 to settle at $206.12 while trading 195,000 units, PanJam Investment rose 45 cents and ended at $103 after exchanging 36,879 shares, Proven Investments fell 50 cents to end at $39.50 with 10,136 stock units changing hands. Pulse Investments lost 42 cents in swapping 42,851 units at $3.18, Sagicor Group closed $1 higher to settle at $71 with 9,485,998 shares crossing the exchange, Salada Foods rose $1 to settle at $32 trading 3,000 units. Scotia Group fell $2.15 to end at $59 while exchanging 93,970 shares, Seprod ended the day’s trade $1 down to settle at $54.50 with 20,129 units changing hands and Wisynco Group traded 1,246,570 to lose 50 cents and end trading at $22.50.

Trading in the US dollar market ended with 32,790 units valued at $7,139 with the market index lost 0.39 points to close at 201.15. Proven Investments traded 19,690 shares, to close at 27 US cents, Sygnus Credit Investments lost 1 cent to settle at 14 US cents with trades of 13,000 shares and Sterling Investments lost 1.5 cents and ended at 3 US cents in exchanging 100 shares.

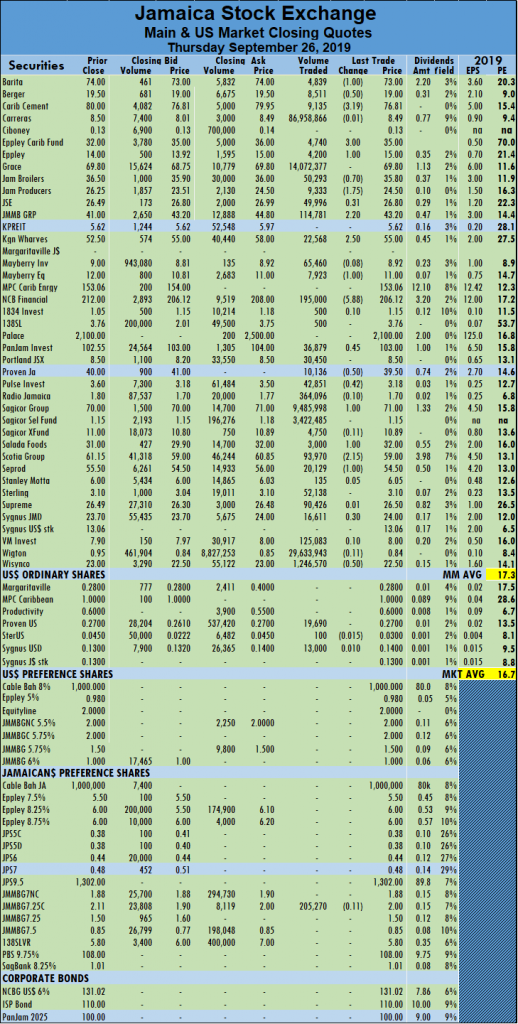

JSE main market drops back again

Stock prices continue to fluctuate in trading on the main market of the Jamaica Stock Exchange ended on Wednesday with the market indices falling following Tuesday’s gains.

Stock prices continue to fluctuate in trading on the main market of the Jamaica Stock Exchange ended on Wednesday with the market indices falling following Tuesday’s gains.

At the close of trading, 41 securities changed hands in the main and US dollar markets, up from 37 on Tuesday and ending with 15 advancing, 19 declining and 7 traded firm.

The JSE All Jamaican Composite Index declining 2,362.52 points to close at 560,590.25, the JSE Index dropped 1,985.70 points to 510,251.30 and the JSE Financial Index lost 0.28 points to close at 139.73.

Market activity ended with 172,051,451 units valued at $307,622,863 in contrast to 22,990,176 units valued at $375,090,753 on Tuesday.

Wigton Windfarm dominated trading with 165 million shares for 96 percent of total volume, followed by Sagicor Select Funds with 2.8 million units accounting for 1.6 percent of the day’s trade, Jamaica Broilers Group with 1 million shares for under 1 percent of the market’s trade.

The Market closed with an average of 4,650,039 units valued at an average of $8,314,131 for each security traded. In contrast to 696,672 units for an average of $11,366,386 on Tuesday.  The average volume and value for the month to date amounts to 1,250,992 units valued at $9,598,525and previously an average of 1,048,146 units valued at $9,679,760 for each security traded. The market closed out August with an average of 1,743,431 units valued at $9,907,963 for each security traded.

The average volume and value for the month to date amounts to 1,250,992 units valued at $9,598,525and previously an average of 1,048,146 units valued at $9,679,760 for each security traded. The market closed out August with an average of 1,743,431 units valued at $9,907,963 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ended with bids higher than their last selling prices and 2 with lower offers.

In main market activity, Barita Investments gained $2.50 to close at $74 with 25,594 units traded, Eppley Caribbean Property plummeted by $5 in closing at $32, after exchanging 10,025 shares, Grace Kennedy closed 80 cents higher to settle at $69.80 while trading 21,790 shares, Jamaica Broilers ended at $36.50, losing 49 cents with 1,031,417 shares changing hands. Jamaica Producers added $1.75, settling at $26.25 in trading 2,750 shares, JMMB Group dipped $1 to $41 after exchanging 312,567 shares, Kingston Wharves closed $2.70 lower to $52.50 in trading 37,453 shares. Mayberry Jamaican Equities closed at $12, after gaining 50 cents trading 12,700 shares, NCB Financial slipped by $2.90 to settle at $212 with trading with 14,492 units, 138 Student Living closed at $3.76 with gains of 36 cents in trading 1,000 shares.  PanJam Investments declined $1.45 while ending at $102.55 after exchanging 17,814 shares, Proven Investments added $2.20 to end the day’s trade at $40 with 6,300 shares changing hands. Sagicor Group closed $1 higher to settle at $70 in trading 54,449 shares, Scotia Group advanced $3.15 to end at $61.15 exchanging 780,883 shares and Seprod ended the day’s trade $2.50 higher to settle at $55.50 with 15,652 units changing hands.

PanJam Investments declined $1.45 while ending at $102.55 after exchanging 17,814 shares, Proven Investments added $2.20 to end the day’s trade at $40 with 6,300 shares changing hands. Sagicor Group closed $1 higher to settle at $70 in trading 54,449 shares, Scotia Group advanced $3.15 to end at $61.15 exchanging 780,883 shares and Seprod ended the day’s trade $2.50 higher to settle at $55.50 with 15,652 units changing hands.

Trading in the US dollar market ended with 46,264 units valued at over US$47,724 with the market index gaining 1.53 points to close at 201.54. Proven Investments traded 11,400 shares, gaining 1 US cent to close at 27 US cents, Sygnus Credit Investments lost 1 US cent to settle at 13 US cents with trades of 9,429 shares, JMMB Group 5.75% preference share ended at US$2 in exchanging 17,935 shares and JMMB Group 6% preference share ended the day’s activity at US$1.01.

- « Previous Page

- 1

- …

- 122

- 123

- 124

- 125

- 126

- …

- 257

- Next Page »