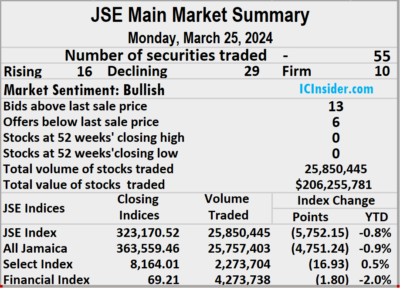

Stocks plunged on Jamaica Stock Exchange Main Market on Monday, sending the market indices sharply lower by the close after the volume of stocks traded rose 174 percent and the value surged 587 percent over Friday’s levels, with trading in 55 securities compared with 57 on Friday, ending with prices of 16 stocks rising, 29 declining and 10 ending unchanged.

The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday.

The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday.

Trading averaged 470,008 shares at $3,750,105 compared to 165,678 units at $527,048 on Friday and month to date, an average of 962,588 units at $2,406,562 compared with 991,657 units at $2,327,275 on the previous trading day and February that closed with an average of 385,143 units at $3,418,046.

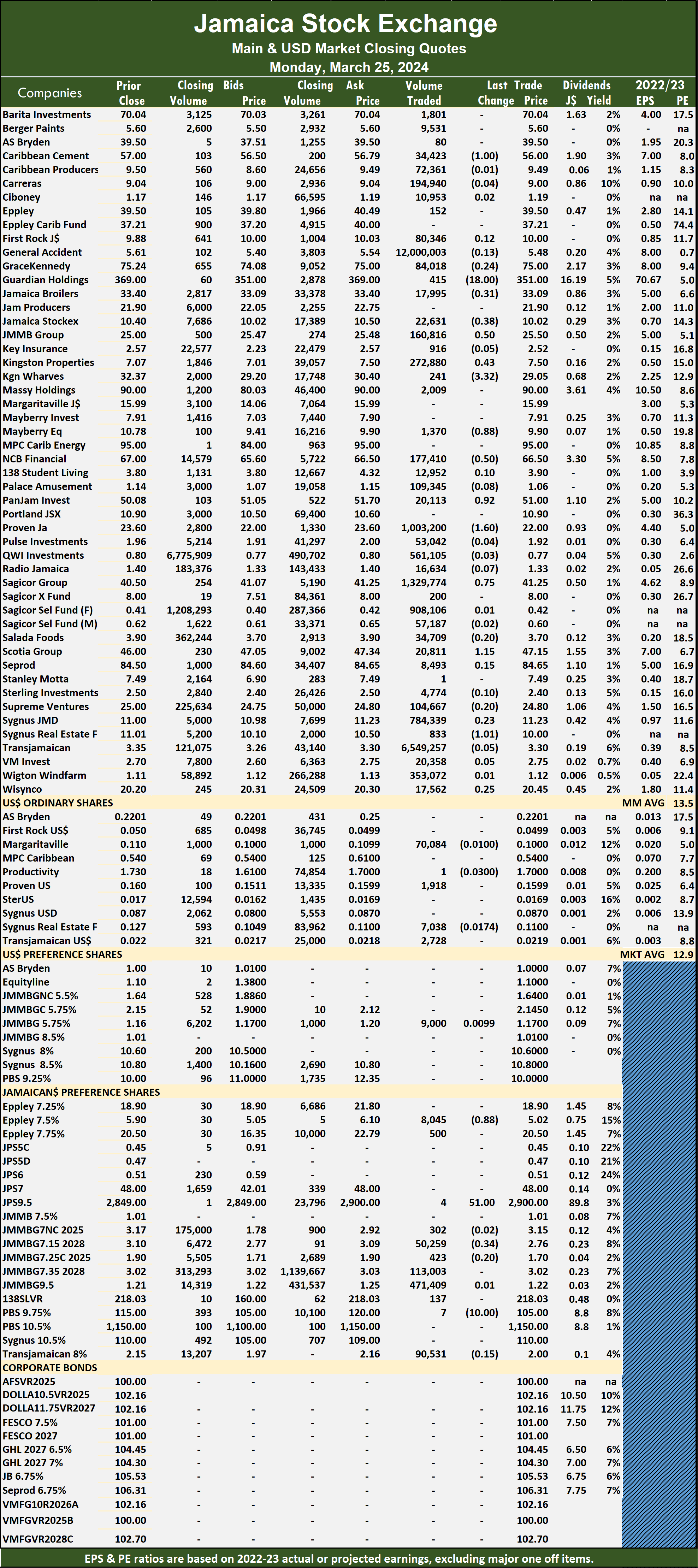

General Accident led trading with 12.0 million shares for 46.4 percent of total volume followed by Transjamaican Highway with 6.55 million units for 25.3 percent of the day’s trade, Sagicor Group chipped in with 1.33 million stocks for 5.1 percent of market share and Proven Investments with 1.0 million units for 3.9 percent of total volume.

The All Jamaican Composite Index dropped 4,751.24 points to 363,559.46, the JSE Main Index sank 5,752.15 points to end at 323,170.52 and the JSE Financial Index lost 1.80 points to 69.21.

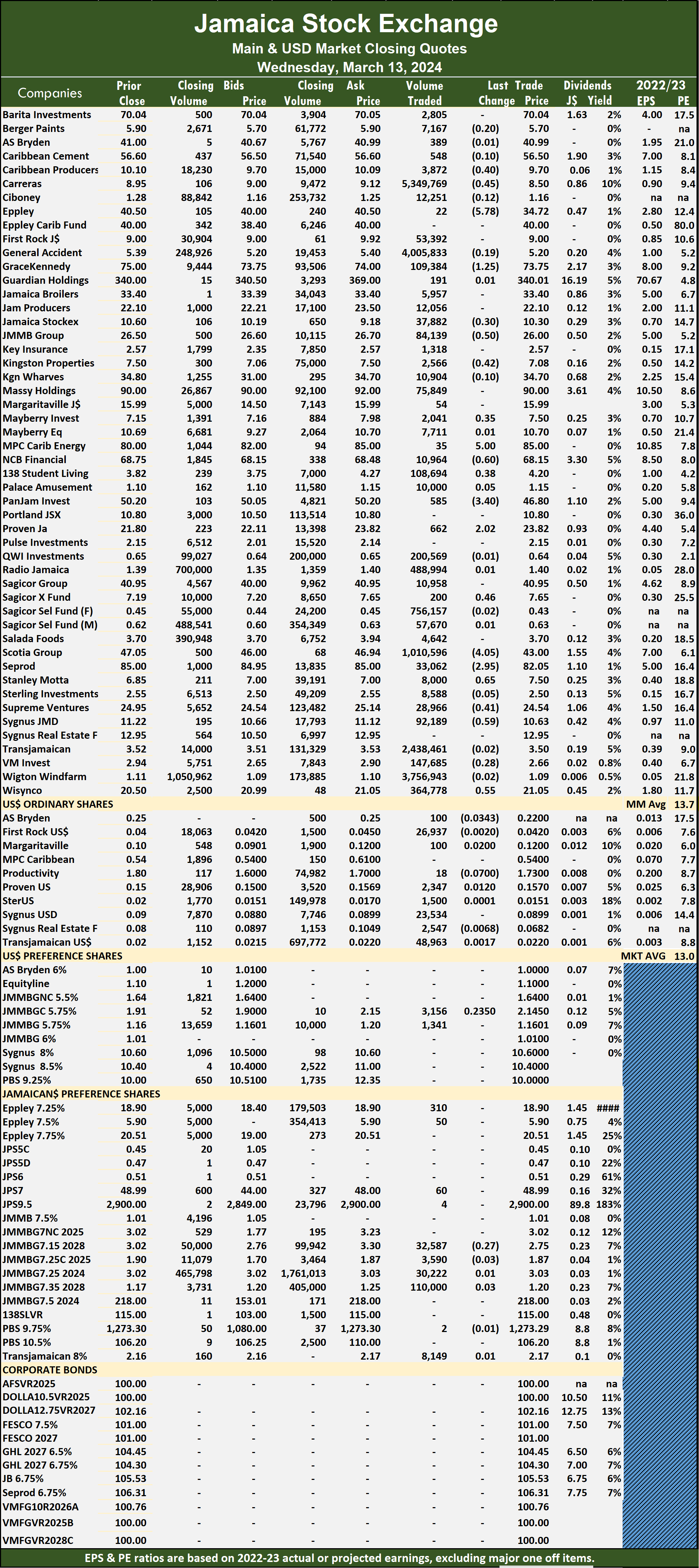

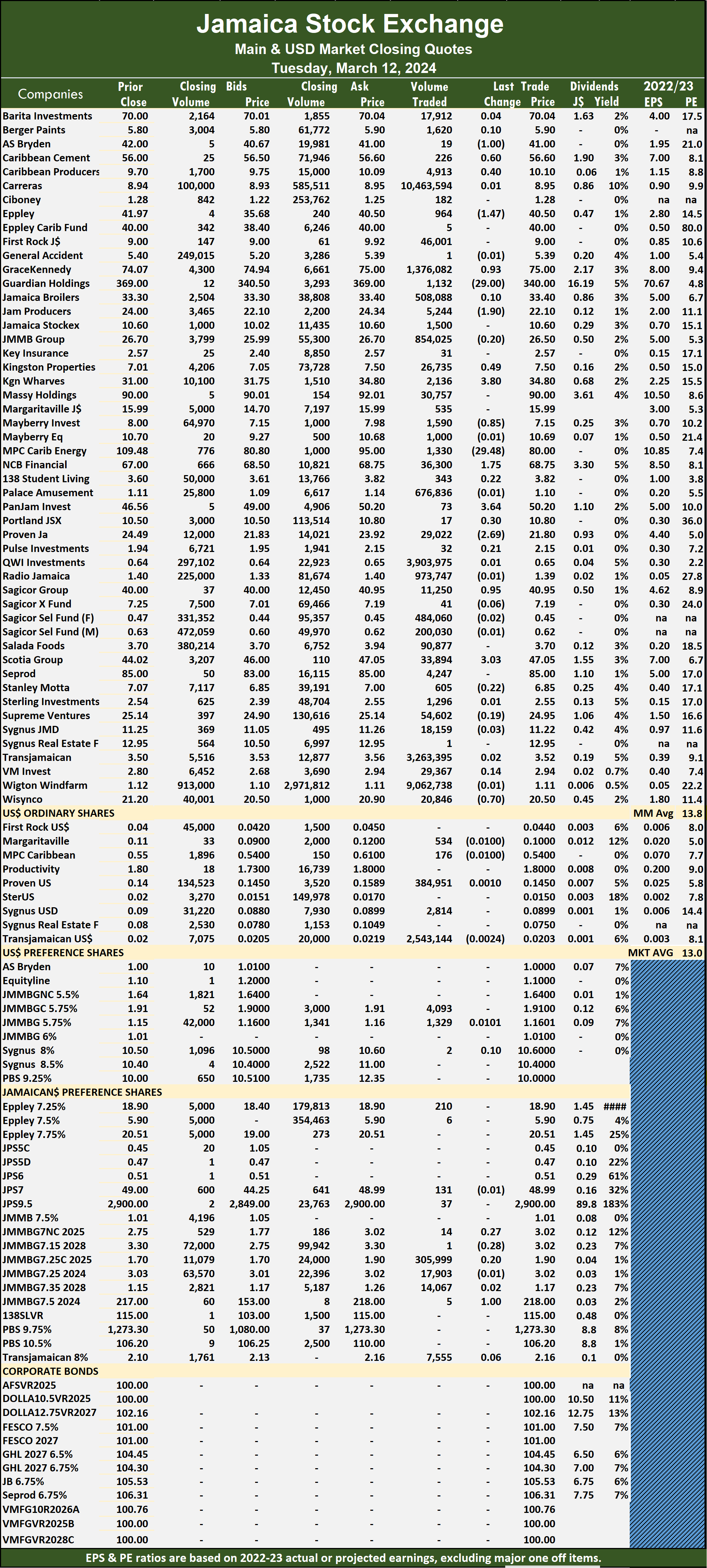

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

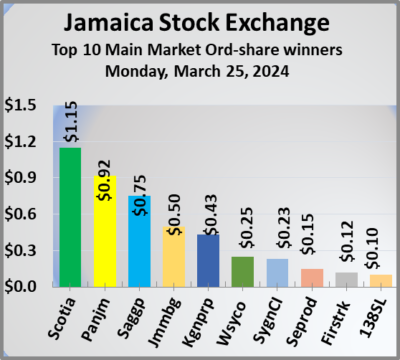

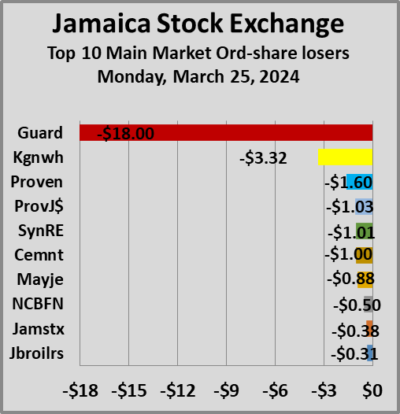

At the close, Caribbean Cement fell $1 to close at $56 after34,423 stocks passed through the market, Guardian Holdings skidded $18 to $351 with an exchange of 415 units, Jamaica Broilers lost 31 cents to end at $33.09, with 17,995 shares crossing the market. Jamaica Stock Exchange shed 38 cents in closing at $10.02 with traders dealing in 22,631 stock units, JMMB Group popped 50 cents and ended at $25.50 in switching ownership of 160,816 shares, Kingston Properties climbed 43 cents to $7.50, with 272,880 units crossing the exchange. Kingston Wharves dropped $3.32 and ended at $29.05 with investors swapping 241 stocks, Mayberry Jamaican Equities sank 88 cents in closing at $9.90, with 1,370 stock units crossing the market, NCB Financial declined 50 cents to close at $66.50 with trading of 177,410 shares.  Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units.

Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units.

In the preference segment, Eppley 7.50% preference share skidded 88 cents and ended at $5.02 while exchanging 8,045 stocks. Jamaica Public Service 9.5% increased $51 to $2,900 with investors transferring 4 stock units, JMMB Group 7.15% – 2028 sank 34 cents to close at $2.76 in an exchange of 50,259 shares and Productive Business Solutions 9.75% preference share dropped $10 in closing at $105 after 7 stocks changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market plunged

Trading dropped prices rise on JSE Main Market

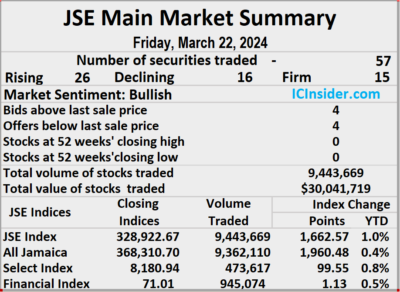

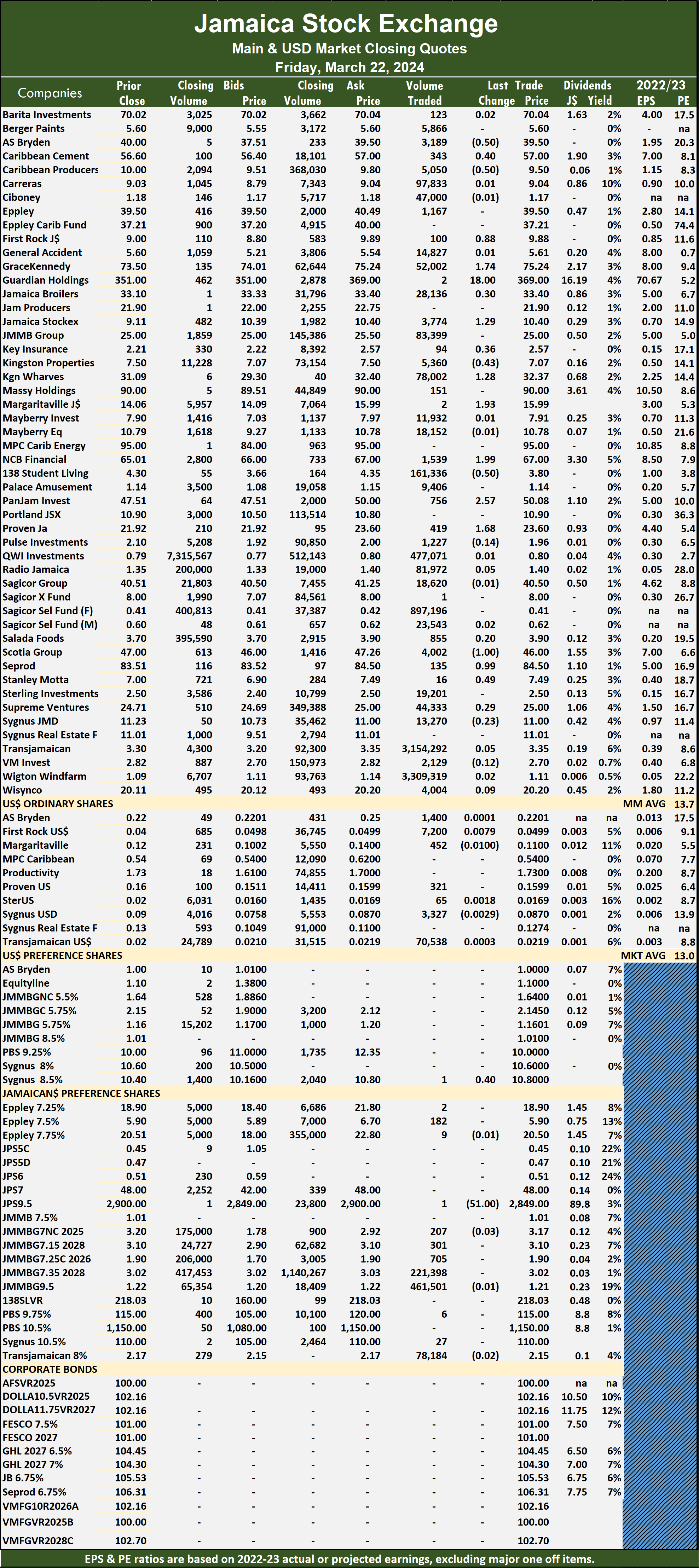

Trading dropped on the Jamaica Stock Exchange Main Market on Friday, with the volume of stocks traded plunging 63 percent and the value 61 percent lower, compared with market activity on Thursday, ending with trading in 57 securities as was the case on Thursday, with prices of 26 stocks rising, 16 declining and 15 ending unchanged.

The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday.

The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday.

Trading averaged 165,678 shares at $527,048 compared to 445,362 units at $1,335,486 on Thursday and month to date, an average of 991,657 stocks at $2,327,275 compared to 1,045,463 units at $2,444,547 on the previous day and February that closed with an average of 385,143 stock units at $3,418,046.

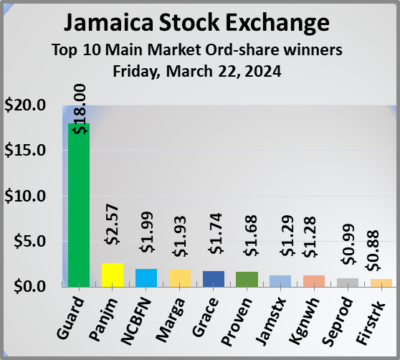

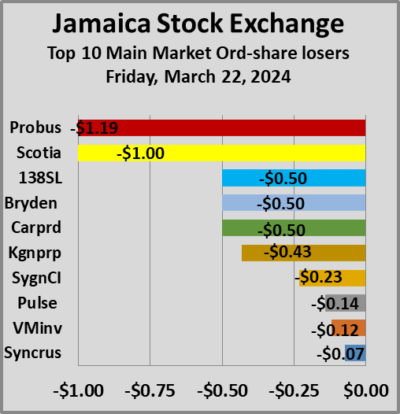

Wigton Windfarm led trading with 3.31 million shares for 35 percent of total volume followed by Transjamaican Highway with 3.15 million units for 33.4 percent of the day’s trade and Sagicor Select Financial Fund with 897,196 units for 9.5 percent market share.

The All Jamaican Composite Index increased 1,960.48 points to conclude trading at 368,310.70, the JSE  Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01.

Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, AS Bryden dropped 50 cents to $39.50 while exchanging 3,189 stock units, Caribbean Cement gained 40 cents to close at $57 in trading 343 shares, Caribbean Producers fell 50 cents in closing at $9.50 with 5,050 stocks clearing the market. First Rock Real Estate rose 88 cents and ended at $9.88 after exchanging 100 units, GraceKennedy advanced $1.74 to end at $75.24 with investors swapping 52,002 shares, Guardian Holdings popped $18 to $369 with an exchange of just two units. Jamaica Broilers increased 30 cents and ended at $33.40, with 28,136 stocks crossing the market,  Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units.

Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units.

In the preference segment, Jamaica Public Service 9.5% declined $51 in closing at $2849 with investors trading just one stock.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main market lost altitude

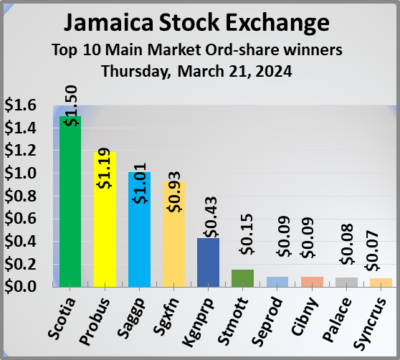

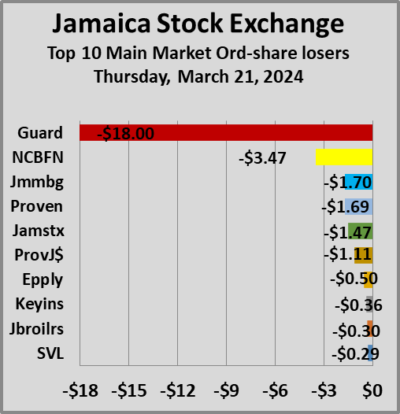

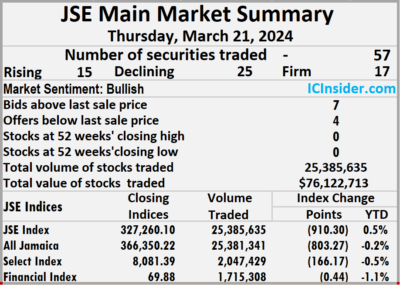

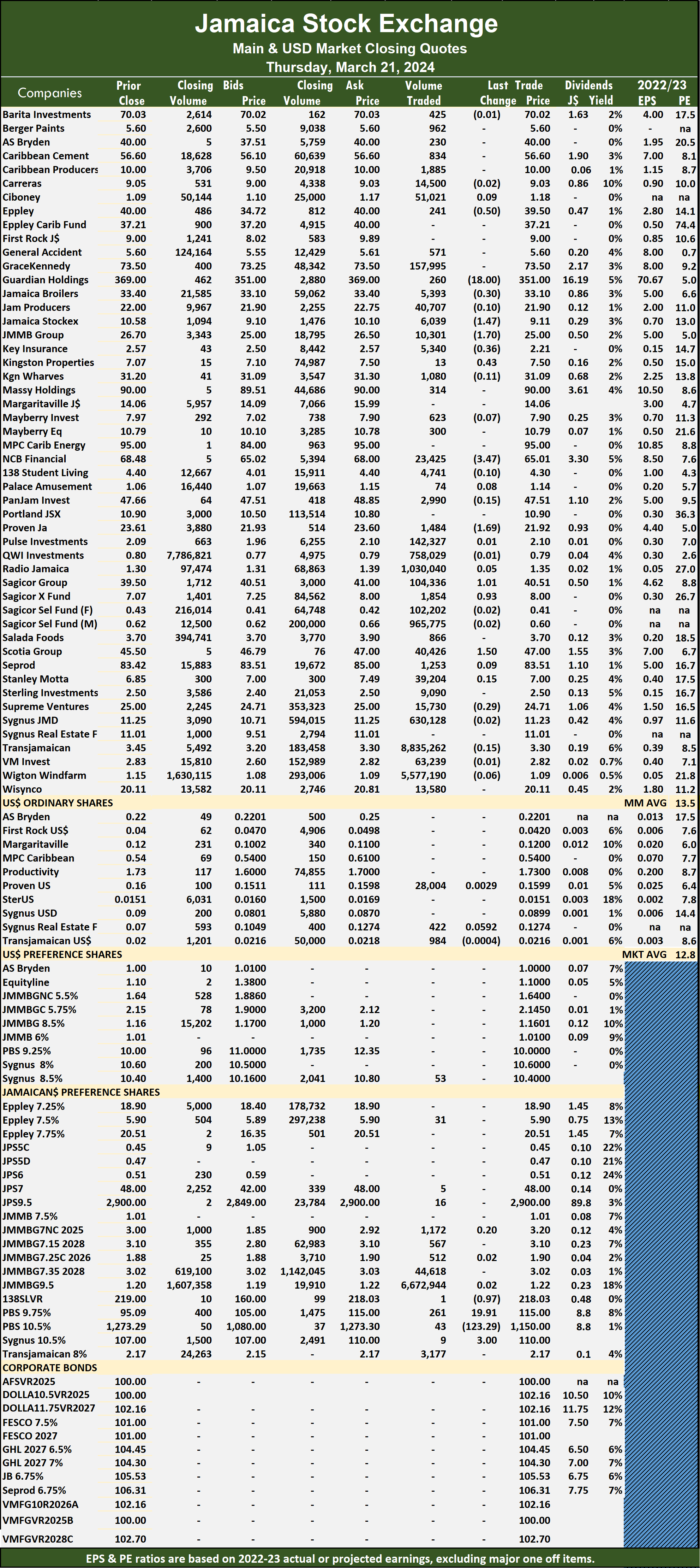

Trading on the Jamaica Stock Exchange Main Market ended on Thursday, with the volume of stocks traded rising 112 percent with a marginally greater value than on Wednesday, with trading in 57 securities compared with 58 on Wednesday, with prices of 15 stocks rising, 25 declining and 17 ending unchanged.

The market closed with 25,385,635 shares being traded for $76,122,713 compared with 11,956,313 units at $74,815,722 on Wednesday.

The market closed with 25,385,635 shares being traded for $76,122,713 compared with 11,956,313 units at $74,815,722 on Wednesday.

Trading averaged 445,362 shares at $1,335,486 compared with 206,143 units at $1,289,926 on Wednesday and for the month to date, an average of 1,045,463 units at $2,444,547 compared with 1,087,279 units at $2,521,829 on the previous day and February that closed with an average of 385,143 units at $3,418,046.

Transjamaican Highway led trading with 8.84 million shares for 34.8 percent of total volume followed by JMMB 9.5% preference share with 6.67 million units for 26.3 percent of the day’s trade, Wigton Windfarm chipped in with 5.58 million units for 22 percent market share and Radio Jamaica ended with 1.03 million units for 4.1 percent of total volume.

The All Jamaican Composite Index shed 803.27 points to end at 366,350.22, the JSE Main Index sank 910.30 points to end at 327,260.10 and the JSE Financial Index declined 0.44 points to close at 69.88.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Eppley declined 50 cents to end at $39.50 with 241 stocks clearing the market, Guardian Holdings fell $18 to $351 in an exchange of 260 units, Jamaica Broilers shed 30 cents and ended at $33.10 after 5,393 shares passed through the market. Jamaica Stock Exchange sank $1.47 to close at $9.11, with 6,039 stock units changing hands, JMMB Group skidded $1.70 in closing at $25 after an exchange of 10,301 shares, Key Insurance lost 36 cents to $2.21 with traders dealing in 5,340 units. Kingston Properties rose 43 cents to end at $7.50 with 13 stocks crossing the market, NCB Financial dipped $3.47 in closing at $65.01 after exchanging 23,425 stock units, Proven Investments dropped $1.69 and ended at $21.92 with a transfer of 1,484 shares.  Sagicor Group gained $1.01 to close at $40.51 as investors exchanged 104,336 stock units, Sagicor Real Estate Fund popped 93 cents to $8 after a transfer of 1,854 units and Scotia Group climbed $1.50 to end at $47 in trading 40,426 stocks.

Sagicor Group gained $1.01 to close at $40.51 as investors exchanged 104,336 stock units, Sagicor Real Estate Fund popped 93 cents to $8 after a transfer of 1,854 units and Scotia Group climbed $1.50 to end at $47 in trading 40,426 stocks.

In the preference segment, 138 Student Living preference share shed 97 cents in closing at $218.03 with just one share passing through the exchange, Productive Business Solutions 10.5 % preference share lost $123.29 to close at $1150 with investors trading 43 stock units, Productive Business Solutions 9.75% preference share increased $19.91 and ended at $115 in an exchange of 261 units and Sygnus Credit Investments C10.5% rallied $3 to $110, with a mere 9 stocks crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

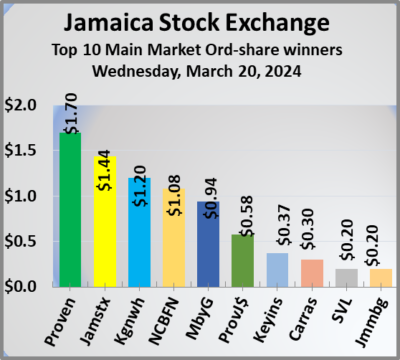

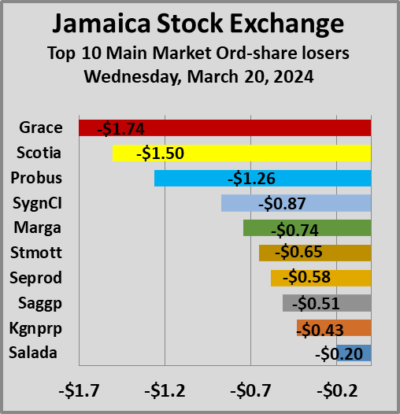

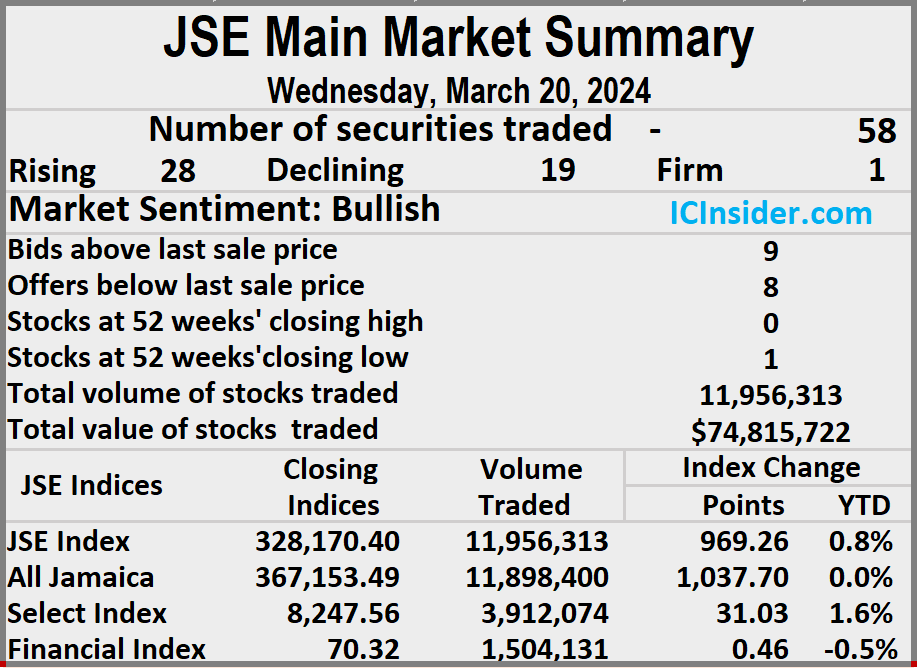

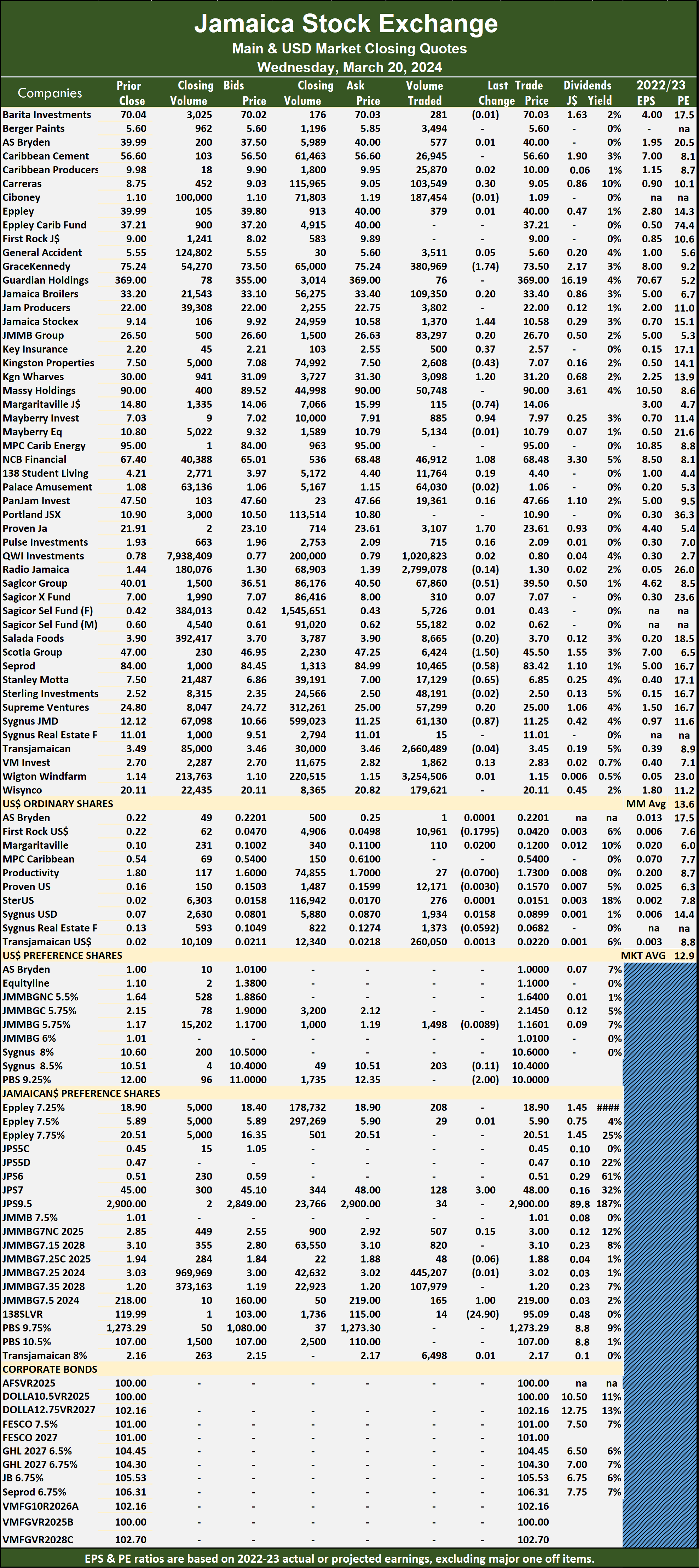

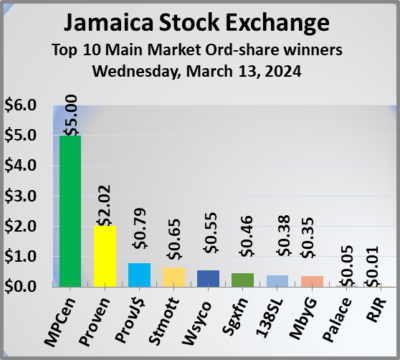

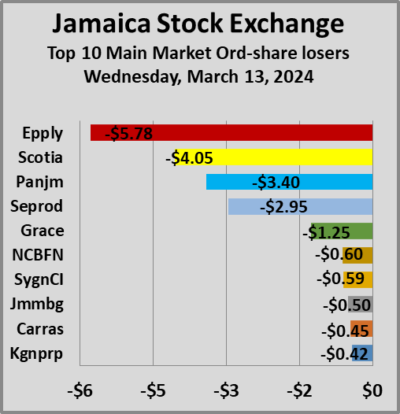

Gains for JSE Main Market

Trading on the Jamaica Stock Exchange Main Market ended on Wednesday, with a 48 percent decline in the volume of stocks and a 19 percent fall in the value compared with Tuesday, following trading in 58 securities compared with 59 on Tuesday, with prices of 28 rising, 19 declining and 11 ending unchanged resulting in the market indices rising to close out trading.

The market closed with 11,956,313 shares being traded for $74,815,722 down from 22,829,779 units at $92,714,302 on Tuesday.

The market closed with 11,956,313 shares being traded for $74,815,722 down from 22,829,779 units at $92,714,302 on Tuesday.

Trading averaged 206,143 shares at $1,289,926 compared to 386,945 units at $1,571,429 on Tuesday and month to date, an average of 1,087,279 units at $2,521,829, in comparison with 1,154,524 units at $2,615,843 on the previous day and February that closed with an average of 385,143 units at $3,418,046.

Wigton Windfarm led trading with 3.25 million shares for 27.2 percent of total volume followed by Radio Jamaica with 2.80 million units for 23.4 percent of the day’s trade, Transjamaican Highway chipped in with 2.66 million units for 22.3 percent market share and QWI Investments with 1.02 million units for 8.5 percent of total volume.

The All Jamaican Composite Index popped 1,037.70 points to close at 367,153.49, the JSE Main Index advanced 969.26 points to end at 328,170.40 and the JSE Financial Index rose 0.46 points to conclude trading at 70.32.

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and eight with lower offers.

At the close, Carreras rose 30 cents to $9.05 with 103,549 stocks clearing the market, GraceKennedy declined $1.74 in closing at $73.50 while exchanging 380,969 units, Jamaica Stock Exchange advanced $1.44 to end at $10.58, with 1,370 shares crossing the market. Key Insurance popped 37 cents and ended at $2.57 in trading 500 stock units, Kingston Properties shed 43 cents to close at $7.07, with 2,608 shares crossing the market, Kingston Wharves rallied $1.20 to $31.20 after exchanging 3,098 stock units. Margaritaville dropped 74 cents to end at $14.06 after 115 units passed through the market, Mayberry Group increased 94 cents in closing at $7.97 with an exchange of 885 stocks, NCB Financial climbed $1.08 to close at $68.48 after 46,912 shares changed hands.  Proven Investments gained $1.70 and ended at $23.61, with 3,107 stocks crossing the exchange, Sagicor Group fell 51 cents to a 52 weeks’ low of $39.50 with investors transferring 67,860 units, Scotia Group skidded $1.50 in closing at $45.50 after an exchange of 6,424 stock units. Seprod sank 58 cents to close at $83.42 with investors swapping 10,465 shares, Stanley Motta dipped 65 cents and ended at $6.85 after a transfer of 17,129 stock units and Sygnus Credit Investments lost 87 cents to end at $11.25 with investors dealing in 61,130 stocks.

Proven Investments gained $1.70 and ended at $23.61, with 3,107 stocks crossing the exchange, Sagicor Group fell 51 cents to a 52 weeks’ low of $39.50 with investors transferring 67,860 units, Scotia Group skidded $1.50 in closing at $45.50 after an exchange of 6,424 stock units. Seprod sank 58 cents to close at $83.42 with investors swapping 10,465 shares, Stanley Motta dipped 65 cents and ended at $6.85 after a transfer of 17,129 stock units and Sygnus Credit Investments lost 87 cents to end at $11.25 with investors dealing in 61,130 stocks.

In the preference segment, Jamaica Public Service 7% popped $3 in closing at $48, with 128 units changing hands, 138 Student Living preference share climbed $1 to $219 with investors trading 165 shares and Productive Business Solutions 9.75% preference share shed $24.90 to end at $95.09 in an exchange of 14 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Fall for JSE Main Market

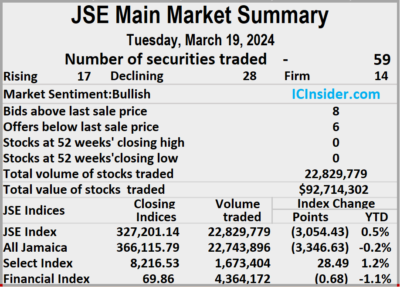

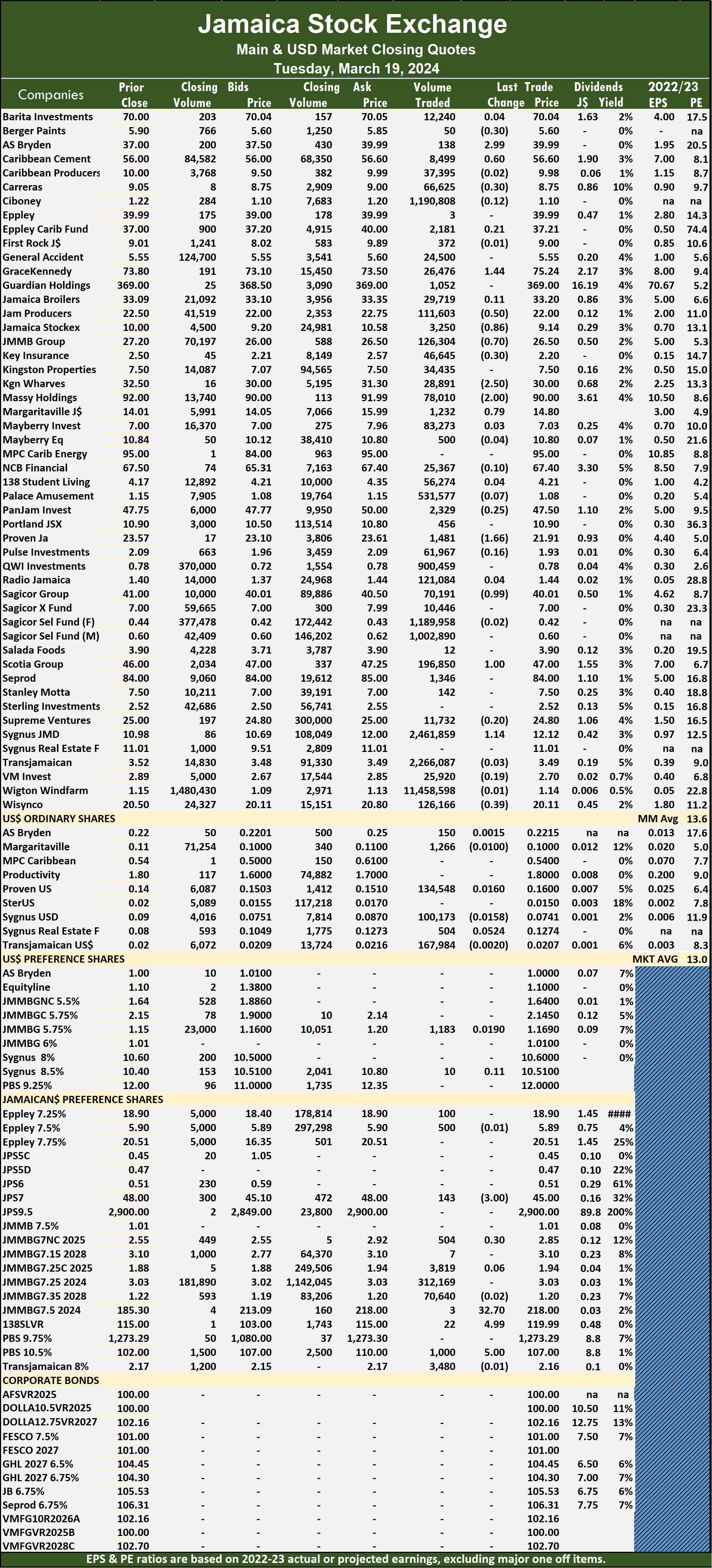

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded rising 11 percent and the value 113 percent more than on Monday, with trading in 59 securities the same as on Monday, with prices of 17 stocks rising, 28 declining and 14 ending unchanged and resulted in a decline in the market’s main indices.

The market closed with 22,829,779 shares being traded for $92,714,302 compared to 20,603,885 units at $43,453,436 on Monday.

The market closed with 22,829,779 shares being traded for $92,714,302 compared to 20,603,885 units at $43,453,436 on Monday.

Trading averaged 386,945 shares at $1,571,429 compared to 349,218 units at $736,499 on Monday and month to date, an average of 1,154,524 units at $2,615,843 compared with 1,219,128 units at $2,703,746 on the previous day and February with an average of 385,143 units at $3,418,046.

Wigton Windfarm led trading with 11.46 million shares for 50.2 percent of total volume followed by Sygnus Credit Investments with 2.46 million units for 10.8 percent of the day’s trade, Transjamaican Highway was next with 2.27 million units for 9.9 percent market share, Ciboney Group closed with 1.19 million units for 5.2 percent stock trading, while Sagicor Select Financial Fund ended with 1.19 million stocks for 5.2 percent market share and Sagicor Select Manufacturing & Distribution Fund 1.0 million units for 4.4 percent of total volume.

The All Jamaican Composite Index fell 3,346.63 points to settle at 366,115.79, the JSE Main Index fell 3,054.43 points to lock up trading at 327,201.14 and the JSE Financial Index dipped 0.68 points to end the day at 69.86.

The All Jamaican Composite Index fell 3,346.63 points to settle at 366,115.79, the JSE Main Index fell 3,054.43 points to lock up trading at 327,201.14 and the JSE Financial Index dipped 0.68 points to end the day at 69.86.

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and six with lower offers.

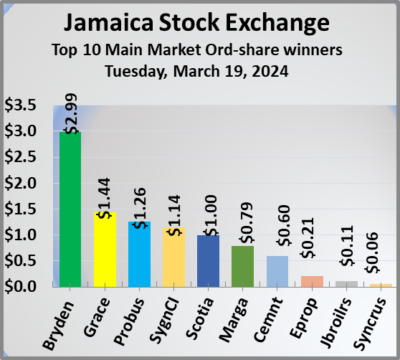

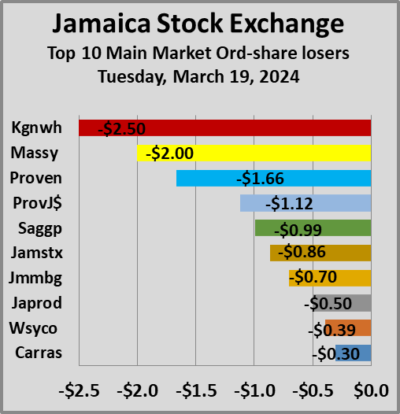

At the close, AS Bryden rose $2.99 to close at $39.99 after an exchange of 138 shares, Berger Paints lost 30 cents to close at $5.60 after trading 50 units, Caribbean Cement advanced 60 cents to end at $56.60 with 8,499 shares clearing the market. Carreras dipped 30 cents in closing at $8.75 with traders dealing in 66,625 stock units, GraceKennedy popped $1.44 and ended at $75.24 after closing with an exchange of 26,476 shares, Jamaica Producers sank 50 cents to $22 after exchanging 111,603 units.  Jamaica Stock Exchange dropped 86 cents to end at $9.14 in switching ownership of 3,250 stocks, JMMB Group shed 70 cents in closing at $26.50, with 126,304 stock units crossing the market, Key Insurance declined 30 cents to $2.20 in an exchange of 46,645 shares. Kingston Wharves fell $2.50 to close at $30 after 28,891 stock units passed through the market, Margaritaville increased 79 cents to $14.80 after a transfer of 1,232 stocks, Massy Holdings skidded $2 and ended at $90 with investors swapping 78,010 units. Proven Investments fell $1.66 to end at $21.91 with a transfer of 1,481 stocks, Sagicor Group dropped 99 cents in closing at $40.01, with 70,191 units passing the exchange, Scotia Group climbed $1 to close at $47 with investors transferring 196,850 shares. Sygnus Credit Investments gained $1.14 to end at $12.12, with 2,461,859 stock units crossing the market and Wisynco Group shed 39 cents to close at $20.11 as investors exchanged 126,166 shares.

Jamaica Stock Exchange dropped 86 cents to end at $9.14 in switching ownership of 3,250 stocks, JMMB Group shed 70 cents in closing at $26.50, with 126,304 stock units crossing the market, Key Insurance declined 30 cents to $2.20 in an exchange of 46,645 shares. Kingston Wharves fell $2.50 to close at $30 after 28,891 stock units passed through the market, Margaritaville increased 79 cents to $14.80 after a transfer of 1,232 stocks, Massy Holdings skidded $2 and ended at $90 with investors swapping 78,010 units. Proven Investments fell $1.66 to end at $21.91 with a transfer of 1,481 stocks, Sagicor Group dropped 99 cents in closing at $40.01, with 70,191 units passing the exchange, Scotia Group climbed $1 to close at $47 with investors transferring 196,850 shares. Sygnus Credit Investments gained $1.14 to end at $12.12, with 2,461,859 stock units crossing the market and Wisynco Group shed 39 cents to close at $20.11 as investors exchanged 126,166 shares.

In the preference segment, Jamaica Public Service 7% lost $3 and ended at $45 in trading 143 stock units. JMMB Group 7% preference share rallied 30 cents to end at $2.85, with 504 stocks changing hands, 138 Student Living preference share jumped $32.70 in closing at $218 in an exchange of 3 units, Productive Business Solutions 9.75% preference share climbed $4.99 to $119.99 with investors dealing in 22 stocks and Sygnus Credit Investments C10.5% popped $5 to end at $107 while exchanging 1,000 units.

In the preference segment, Jamaica Public Service 7% lost $3 and ended at $45 in trading 143 stock units. JMMB Group 7% preference share rallied 30 cents to end at $2.85, with 504 stocks changing hands, 138 Student Living preference share jumped $32.70 in closing at $218 in an exchange of 3 units, Productive Business Solutions 9.75% preference share climbed $4.99 to $119.99 with investors dealing in 22 stocks and Sygnus Credit Investments C10.5% popped $5 to end at $107 while exchanging 1,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

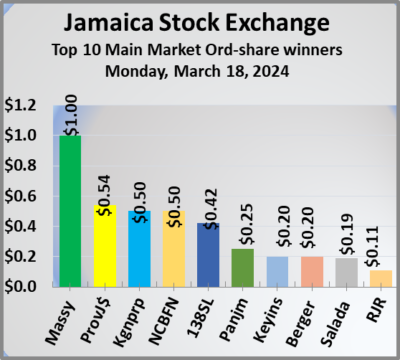

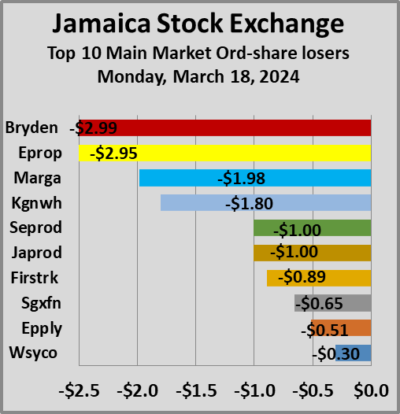

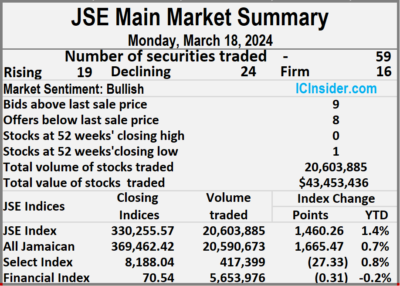

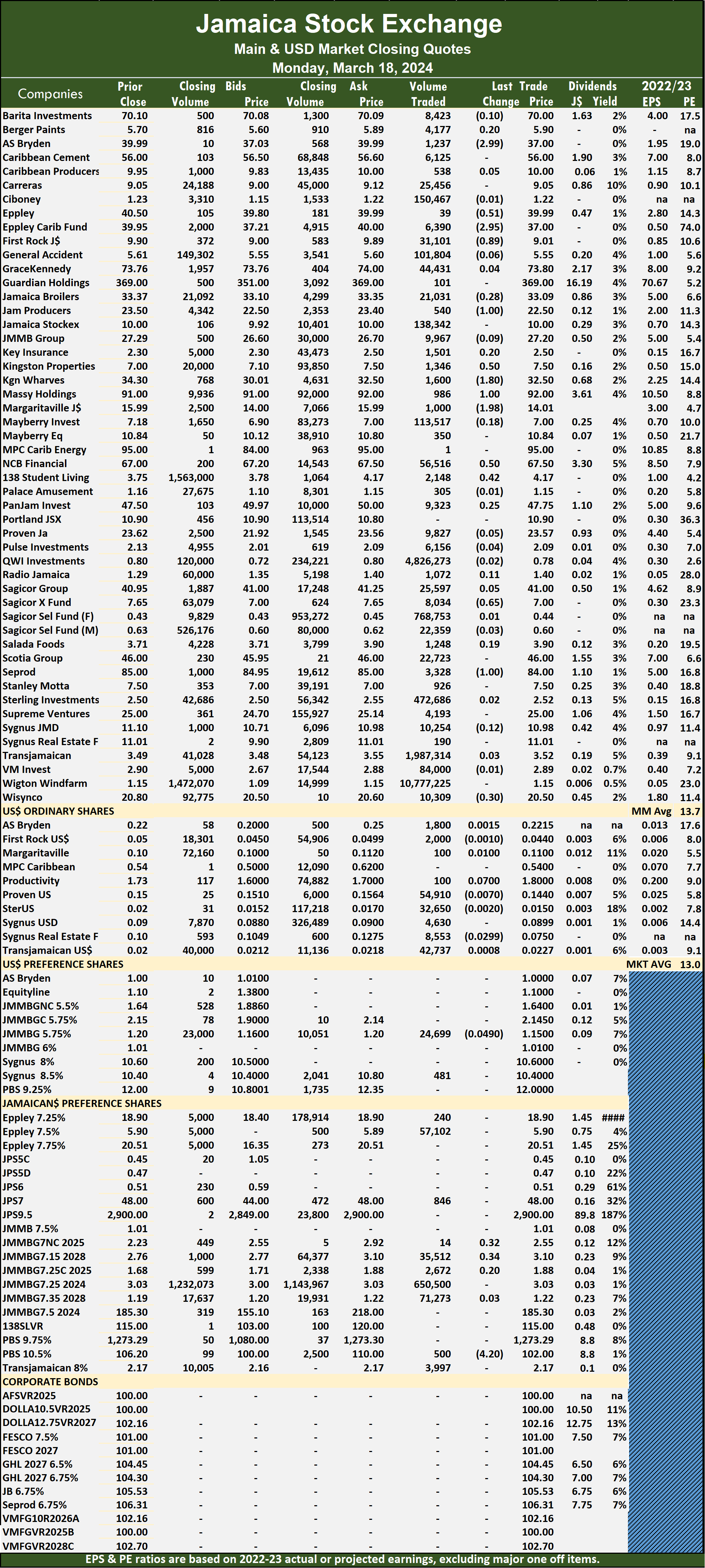

JSE Main Market rallies

The Jamaica Stock Exchange Main Market trading ended on Monday, with an exchange in the volume of stocks just inching higher and the value 39 percent lower than on Friday, following trading in 59 securities compared with 58 on Friday, with prices of 19 stocks rising, 24 declining and 16 ending unchanged.

The market closed with 20,603,885 shares being traded for $43,453,436 compared with 20,635,786 units at $71,375,395 on Friday.

The market closed with 20,603,885 shares being traded for $43,453,436 compared with 20,635,786 units at $71,375,395 on Friday.

Trading averaged 349,218 shares at $736,499 compared to 355,789 units at $1,230,610 on Friday and month to date, an average of 1,219,128 units at $2,703,746 compared with 1,299,073 units at $2,884,537 on the previous trading day and February that closed with an average of 385,143 units at $3,418,046.

Wigton Windfarm led trading with 10.78 million shares for 52.3 percent of total volume followed by QWI Investments with 4.83 million units for 23.4 percent of the day’s trade and Transjamaican Highway with 1.99 million units for 9.6 percent of the day’s trade.

The All Jamaican Composite Index climbed 1,665.47 points to 369,462.42, the JSE Main Index rallied 1,460.26 points to 330,255.57 and the JSE Financial Index dipped 0.31 points to 70.54.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and eight with lower offers.

At the close, AS Bryden dropped $2.99 to $37 in an exchange of 1,237 stock units, Eppley sank 51 cents to close at $39.99 after 39 shares passed through the market, Eppley Caribbean Property Fund dipped $2.95 in closing at $37 while exchanging 6,390 stocks. First Rock Real Estate fell 89 cents and ended at $9.01 with investors trading 31,101 units, Jamaica Producers shed $1 to end at $22.50 after exchanging 540 shares, Kingston Properties advanced 50 cents to $7.50 after closing with an exchange of 1,346 stock units. Kingston Wharves declined $1.80 and ended at $32.50 with investors transferring 1,600 units,  Margaritaville lost $1.98 to close at $14.01 after trading 1,000 stocks, Massy Holdings popped $1 in closing at $92 after investors exchanged 986 units. NCB Financial gained 50 cents to end at $67.50 with investors swapping 56,516 stocks, 138 Student Living rose 42 cents in closing at $4.17 in an exchange of 2,148 shares, Sagicor Real Estate Fund skidded 65 cents to close at a 52 weeks’ low of $7 with investors dealing in 8,034 stock units. Seprod sank $1 to $84 with 3,328 shares clearing the market and Wisynco Group dipped 30 cents to close at $20.50 in trading 10,309 stocks.

Margaritaville lost $1.98 to close at $14.01 after trading 1,000 stocks, Massy Holdings popped $1 in closing at $92 after investors exchanged 986 units. NCB Financial gained 50 cents to end at $67.50 with investors swapping 56,516 stocks, 138 Student Living rose 42 cents in closing at $4.17 in an exchange of 2,148 shares, Sagicor Real Estate Fund skidded 65 cents to close at a 52 weeks’ low of $7 with investors dealing in 8,034 stock units. Seprod sank $1 to $84 with 3,328 shares clearing the market and Wisynco Group dipped 30 cents to close at $20.50 in trading 10,309 stocks.

In the preference segment, JMMB Group 7% preference share rallied 32 cents to end at $2.55 with 14 units crossing the market, JMMB Group 7.15% – 2028 increased 34 cents to $3.10 in switching ownership of 35,512 stock units and Sygnus Credit Investments C10.5% lost $4.20 to end at $102. with 500 shares crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market bounce on Friday

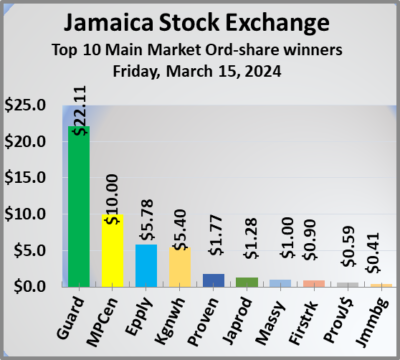

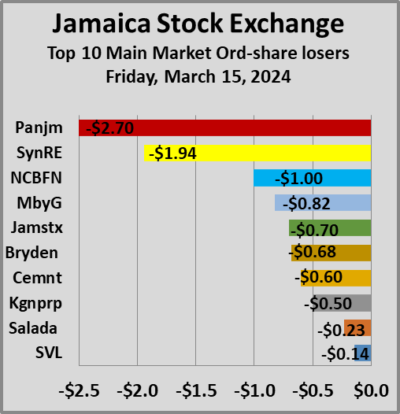

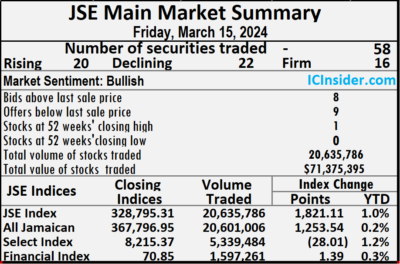

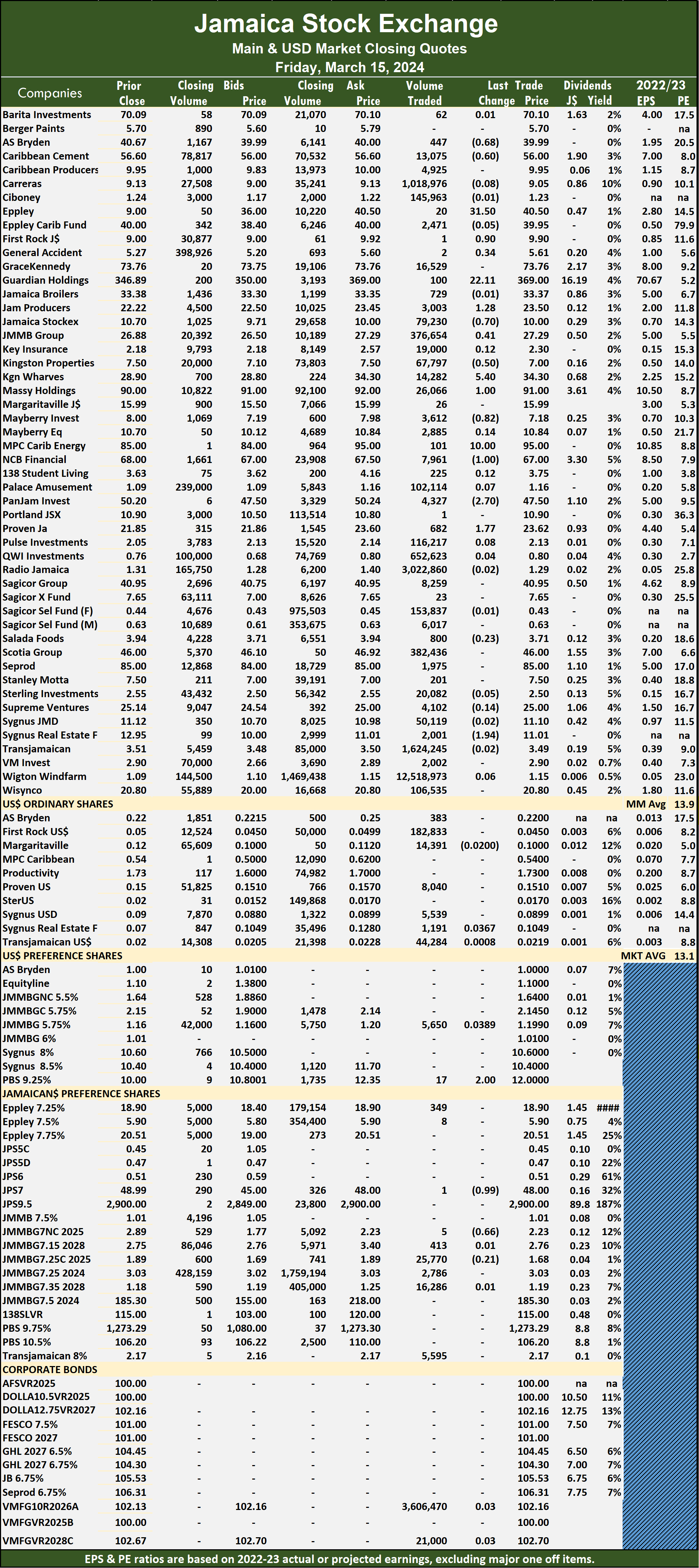

Trading activities fell on the Jamaica Stock Exchange Main Market ended on Friday, with a 13 percent dip in the volume of stocks that were exchanged, valued 50 percent lower than on Thursday, with trading in 58 securities compared with 55 on Thursday, with prices of 20 stocks rising, 22 declining and 16 ending unchanged after QWI Investments closed at 52 weeks’ high of 80 cents to be up 31 percent for the year to date.

The market closed with 20,635,786 shares trading for $71,375,395 down from 23,595,187 units at $144,177,624 on Thursday.

The market closed with 20,635,786 shares trading for $71,375,395 down from 23,595,187 units at $144,177,624 on Thursday.

Trading averaged 355,789 shares at $1,230,610 compared to 429,003 units at $2,621,411 on Thursday and month to date, an average of 1,299,073 units at $2,884,537 compared to 1,392,755 units at $3,048,797 on the previous day and February with an average of 385,143 units at $3,418,046.

Wigton Windfarm led trading with 12.52 million shares for 60.7 percent of the total traded volume followed by Radio Jamaica with 3.02 million units for 14.6 percent of the day’s trade, Transjamaican Highway ended with 1.62 million units for 7.9 percent market share and Carreras with 1.02 million units for 4.9 percent of total volume.

The All Jamaican Composite Index rallied 1,253.54 points to end at 367,796.95, the JSE Main Index gained 1,821.11 points to end at 328,795.31 and the JSE Financial Index climbed 1.39 points to end the day at 70.85.

The Main Market ended trading with an average PE Ratio of 13.9.The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.9.The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and nine with lower offers.

At the close, AS Bryden fell 68 cents and ended at $39.99 with investors trading 447 units, Caribbean Cement lost 60 cents to close at $56 with 13,075 stocks clearing the market, Eppley rallied $5.78 in closing at $40.50 after an exchange of 20 shares. First Rock Real Estate popped 90 cents to end at $9.90 after exchanging one stock unit, General Accident advanced 34 cents to close at $5.61, with just two shares crossing the market, Guardian Holdings rose $22.11 to $369 with traders dealing in 100 units. Jamaica Producers gained $1.28 and ended at $23.50 in an exchange of 3,003 stocks, Jamaica Stock Exchange sank 70 cents to end at $10 and closed after 79,230 stock units were traded, JMMB Group climbed 41 cents in closing at $27.29 in trading 376,654 shares.  Kingston Properties fell 50 cents to close at $7 as 67,797 units passed through the market, Kingston Wharves increased $5.40 to $34.30 with an exchange of 14,282 stocks, Massy Holdings popped $1 to $91, with 26,066 stock units changing hands. Mayberry Group skidded 82 cents to end at $7.18 with a transfer of 3,612 shares, MPC Caribbean Clean Energy gained $10 to close at $95, with 101 stocks crossing the exchange, NCB Financial dipped $1 and to $67 with investors dealing in 7,961 units. Pan Jamaica shed $2.70 to $47.50 while exchanging 4,327 stock units, Proven Investments rose $1.77 to end at $23.62 with investors transferring 682 shares and Sygnus Real Estate Finance dropped $1.94 in closing at $11.01 after an exchange of 2,001 stock units.

Kingston Properties fell 50 cents to close at $7 as 67,797 units passed through the market, Kingston Wharves increased $5.40 to $34.30 with an exchange of 14,282 stocks, Massy Holdings popped $1 to $91, with 26,066 stock units changing hands. Mayberry Group skidded 82 cents to end at $7.18 with a transfer of 3,612 shares, MPC Caribbean Clean Energy gained $10 to close at $95, with 101 stocks crossing the exchange, NCB Financial dipped $1 and to $67 with investors dealing in 7,961 units. Pan Jamaica shed $2.70 to $47.50 while exchanging 4,327 stock units, Proven Investments rose $1.77 to end at $23.62 with investors transferring 682 shares and Sygnus Real Estate Finance dropped $1.94 in closing at $11.01 after an exchange of 2,001 stock units.

In the preference segment, Jamaica Public Service 7% lost 99 cents and ended at $48 with investors swapping just one stock and JMMB Group 7% preference share declined 66 cents to close at $2.23 after 5 units crossed the market.

In the preference segment, Jamaica Public Service 7% lost 99 cents and ended at $48 with investors swapping just one stock and JMMB Group 7% preference share declined 66 cents to close at $2.23 after 5 units crossed the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE Main Market

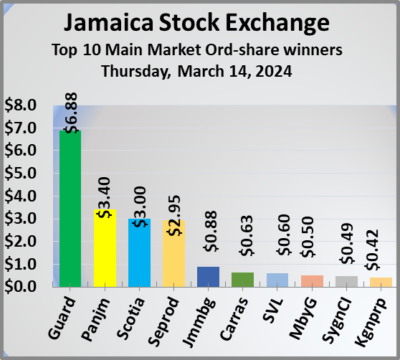

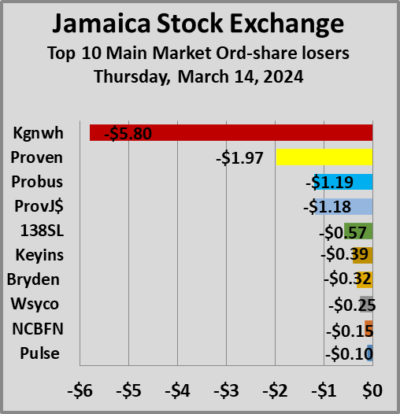

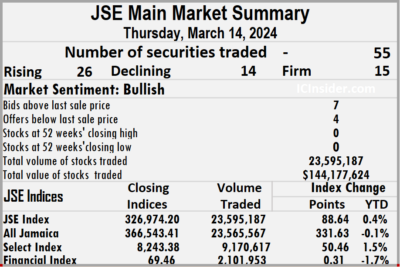

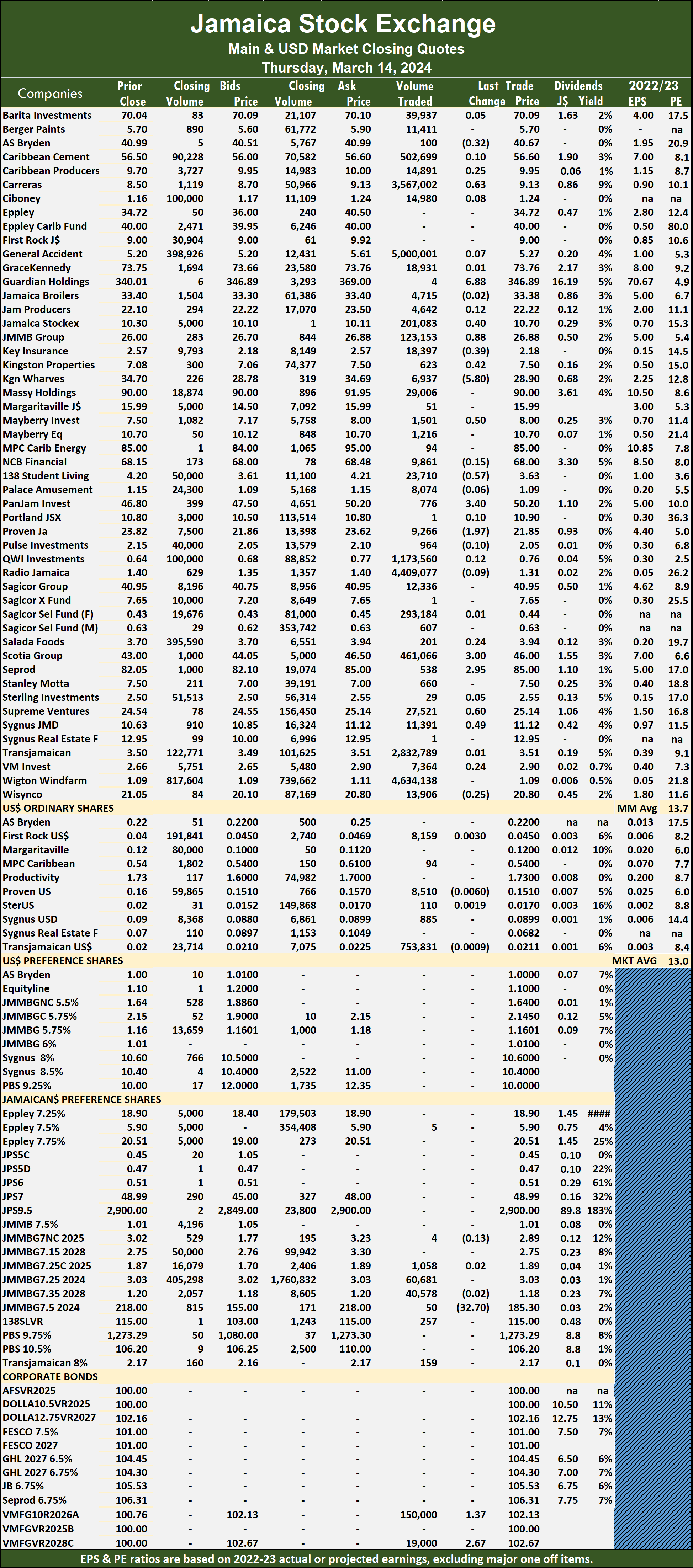

The Main Market of the Jamaica Stock Exchange ended on Thursday, with the volume of stocks traded rising 21 percent valued at 9 percent less than on Wednesday, with trading in 55 securities compared with 56 on Wednesday and resulted in prices of 26 stocks rising, 14 declining and 15 ending unchanged.

The market closed with 23,595,187 shares being traded for $144,177,624 compared with 19,510,472 units at $158,059,371 on Wednesday.

The market closed with 23,595,187 shares being traded for $144,177,624 compared with 19,510,472 units at $158,059,371 on Wednesday.

Trading averaged 429,003 shares at $2,621,411 compared to 348,401 units at $2,822,489 on Wednesday and for the month to date, an average of 1,392,755 stock units at $3,048,797, in comparison with 1,492,956 units at $3,093,232 on the previous day and February that closed with an average of 385,143 units at $3,418,046.

General Accident led trading with 5.0 million shares for 21.2 percent of total volume followed by Wigton Windfarm with 4.63 million units for 19.6 percent of the day’s trade, Radio Jamaica closed with 4.41 million units trading for 18.7 percent of the market trade, Carreras closed with 3.57 million units for 15.1 percent market share, Transjamaican Highway ended with 2.83 million units for 12 percent of trading and QWI Investments with 1.17 million units for 5 percent of total volume.

The All Jamaican Composite Index popped 331.63 points to finish at 366,543.41, the JSE Main Index rallied 88.64 points to end the day at 326,974.20 and the JSE Financial Index rose 0.31 points to end the day at 69.46.

The Main Market ended trading with an average PE Ratio of 13.7 The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.7 The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, AS Bryden fell 32 cents and ended at $40.67 as investors exchanged 100 stock units, Carreras climbed 63 cents to $9.13, with 3,567,002 shares changing hands, Guardian Holdings jumped $6.88 to close at $346.89 with investors dealing in 4 stocks. Jamaica Stock Exchange popped 40 cents to end at $10.70 while investors were exchanging 201,083 units, JMMB Group rallied 88 cents in closing at $26.88 with 123,153 stocks changing hands, Key Insurance dropped 39 cents to $2.18 in an exchange of 18,397 units. Kingston Properties rose 42 cents to close at $7.50, with 623 shares crossing the market, Kingston Wharves lost $5.80 and ended at $28.90 in trading 6,937 stock units, Mayberry Group gained 50 cents to end at $8 with 1,501 shares crossing the exchange.  138 Student Living sank 57 cents in closing at $3.63 in switching ownership of 23,710 stock units, Pan Jamaica advanced $3.40 to $50.20 after 776 units passed through the market, Proven Investments shed $1.97 and ended at $21.85 with investors trading 9,266 stocks. Scotia Group popped $3 to end at $46 after a transfer of 461,066 units, Seprod climbed $2.95 in closing at $85 with investors swapping 538 shares, Supreme Ventures increased by 60 cents to close at $25.14 in an exchange of 27,521 stock units and Sygnus Credit Investments rose 49 cents to $11.12 with investors transferring 11,391 stocks.

138 Student Living sank 57 cents in closing at $3.63 in switching ownership of 23,710 stock units, Pan Jamaica advanced $3.40 to $50.20 after 776 units passed through the market, Proven Investments shed $1.97 and ended at $21.85 with investors trading 9,266 stocks. Scotia Group popped $3 to end at $46 after a transfer of 461,066 units, Seprod climbed $2.95 in closing at $85 with investors swapping 538 shares, Supreme Ventures increased by 60 cents to close at $25.14 in an exchange of 27,521 stock units and Sygnus Credit Investments rose 49 cents to $11.12 with investors transferring 11,391 stocks.

In the preference segment, 138 Student Living preference share declined $32.70 to close at $185.30 after an exchange of 50 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big drop for JSE Main market

Stocks mostly fell at the close of trading on the Jamaica Stock Exchange Main Market on Wednesday, with the volume of stocks traded declining 40 percent and the value 42 percent lower than in trading on Tuesday, with activity in 56 securities compared with 61 on Tuesday, with prices of 15 stocks rising, 28 declining and 13 ending unchanged.

The market closed with an exchange of 19,510,472 shares at $158,059,371 compared with 32,587,303 units at $270,744,190 on Tuesday.

The market closed with an exchange of 19,510,472 shares at $158,059,371 compared with 32,587,303 units at $270,744,190 on Tuesday.

Trading averaged 348,401 shares at $2,822,489 compared to 534,218 units at $4,438,429 on Tuesday and month to date, an average of 1,492,956 units at $3,093,232, in comparison with 1,628,463 units at $3,125,286 on the previous day and February with an average of 385,143 units at $3,418,046.

Carreras led trading with 5.35 million shares for 27.4 percent of total volume followed by General Accident with 4.01 million units for 20.5 percent of the day’s trade, Wigton Windfarm ended with 3.76 million units for 19.3 percent market share, Transjamaican Highway chipped in with 2.44 million units for 12.5 percent of stocks traded and Scotia Group ended with 1.01 million units for 5.2 percent of total volume.

The All Jamaican Composite Index dipped 4,423.34 points to 366,211.78, the JSE Main Index declined 3,917.90 points to 326,885.56 and the JSE Financial Index lost 1.87 points to end at 69.15.

The All Jamaican Composite Index dipped 4,423.34 points to 366,211.78, the JSE Main Index declined 3,917.90 points to 326,885.56 and the JSE Financial Index lost 1.87 points to end at 69.15.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 15 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Caribbean Producers lost 40 cents in closing at $9.70 after trading 3,872 units, Carreras shed 45 cents to $8.50 in an exchange of 5,349,769 stocks, Eppley dropped $5.78 and ended at $34.72 with 22 shares clearing the market. GraceKennedy sank $1.25 to end at $73.75 after a transfer of 109,384 stock units, Jamaica Stock Exchange fell 30 cents to close at $10.30 with investors swapping 37,882 shares, JMMB Group declined 50 cents to $26, with 84,139 stocks crossing the market. Kingston Properties dipped 42 cents to close at $7.08 after exchanging 2,566 units, Mayberry Group popped 35 cents in closing at $7.50 with an exchange of 2,041 stock units, MPC Caribbean Clean Energy climbed $5 to $85 with an exchange of 35 shares. NCB Financial skidded 60 cents to $68.15 with investors dealing in 10,964 stocks, 138 Student Living rose 38 cents to $4.20 in an exchange of 108,694 units, Pan Jamaica lost $3.40 to close at $46.80, with 585 stock units changing hands. Proven Investments gained $2.02 to end at $23.82 with an exchange of 662 shares, Sagicor Real Estate Fund rallied 46 cents in closing at $7.65 after 200 stock units passed through the market, Scotia Group fell $4.05 and ended at $43 with investors trading 1,010,596 units. Seprod sank $2.95 to $82.05, with 33,062 stocks crossing the market, Stanley Motta increased 65 cents to end at $7.50 with traders dealing in 8,000 units, Supreme Ventures declined 41 cents in closing at $24.54 as investors exchanged 28,966 stocks. Sygnus Credit Investments shed 59 cents to close at $10.63 in trading 92,189 shares and Wisynco Group advanced 55 cents and ended at $21.05 after an exchange of 364,778 stock units.

MPC Caribbean Clean Energy climbed $5 to $85 with an exchange of 35 shares. NCB Financial skidded 60 cents to $68.15 with investors dealing in 10,964 stocks, 138 Student Living rose 38 cents to $4.20 in an exchange of 108,694 units, Pan Jamaica lost $3.40 to close at $46.80, with 585 stock units changing hands. Proven Investments gained $2.02 to end at $23.82 with an exchange of 662 shares, Sagicor Real Estate Fund rallied 46 cents in closing at $7.65 after 200 stock units passed through the market, Scotia Group fell $4.05 and ended at $43 with investors trading 1,010,596 units. Seprod sank $2.95 to $82.05, with 33,062 stocks crossing the market, Stanley Motta increased 65 cents to end at $7.50 with traders dealing in 8,000 units, Supreme Ventures declined 41 cents in closing at $24.54 as investors exchanged 28,966 stocks. Sygnus Credit Investments shed 59 cents to close at $10.63 in trading 92,189 shares and Wisynco Group advanced 55 cents and ended at $21.05 after an exchange of 364,778 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

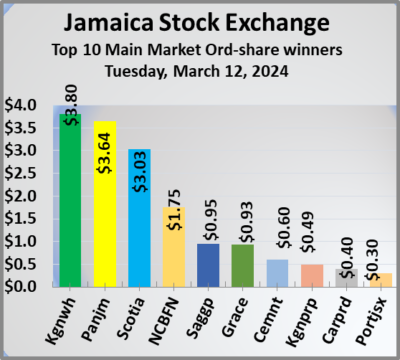

Gains for Main Market with trading jump

Trading picked up on the Jamaica Stock Exchange Main Market on Tuesday, with the volume of stocks traded rising and valued 37 percent more than on Monday, with trading in 61 securities compared with 60 on Monday, with prices of 25 stocks rising, 23 declining and 13 ending unchanged and resulted in the major market indices rising appreciably.

The market closed with trading of 32,587,303 shares for $270,744,190 compared with 30,745,022 units at $197,877,221 on Monday.

The market closed with trading of 32,587,303 shares for $270,744,190 compared with 30,745,022 units at $197,877,221 on Monday.

Trading averaged 534,218 shares at $4,438,429 compared to 512,417 units at $3,297,954 on Monday and month to date, an average of 1,628,463 units at $3,125,286, compared with 1,790,475 shares at $2,930,865 on the previous day and February with an average of 385,143 units at $3,418,046.

Carreras led trading with 10.46 million shares for 32.1 percent of total volume followed by Wigton Windfarm with 9.06 million units for 27.8 percent of the day’s trade, QWI Investments chipped in with 3.90 million stocks for 12 percent market share, Transjamaican Highway ended with 3.26 million units for 10 percent stocks traded and GraceKennedy closed trading with 1.38 million units for 4.2 percent of total volume.

The All Jamaican Composite Index increased 3,671.55 points to close at 370,635.12, the JSE Main Index rallied 2,050.06 points to 330,803.46 and the JSE Financial Index rallied 1.25 points to 71.02.

The Main Market ended trading with an average PE Ratio of 14.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 14.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and three with lower offers.

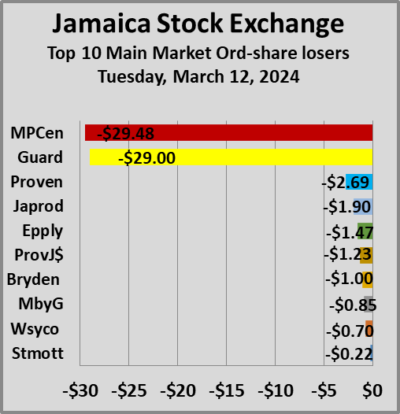

At the close, AS Bryden shed $1 to close at $41, with 19 stock units crossing the market, Caribbean Cement rallied 60 cents to $56.60 in trading 226 shares, Caribbean Producers increased 40 cents and ended at $10.10, with 4,913 units clearing the market. Eppley fell $1.47 to end at $40.50 in an exchange of 964 stocks, GraceKennedy climbed 93 cents in closing at $75 with investors transferring 1,376,082 shares, Guardian Holdings lost $29 to $340, with 1,132 stocks changing hands. Jamaica Producers dropped $1.90 to end at $22.10 after a transfer of 5,244 units, Kingston Properties rose 49 cents in closing at $7.50 with traders dealing in 26,735 stock units, Kingston Wharves advanced $3.80 to close at $34.80 while exchanging 2,136 shares. Mayberry Group sank 85 cents and ended at $7.15 with investors swapping 1,590 units,  MPC Caribbean Clean Energy skidded $29.48 to $80 with an exchange of 1,330 stocks, NCB Financial popped $1.75 to $68.75 with an exchange of 36,300 stock units. Pan Jamaica gained $3.64 and ended at $50.20 as investors exchanged 73 shares, Portland JSX popped 30 cents to $10.80 after investors traded 17 stocks, Proven Investments dropped $2.69 to $21.80, with an exchange of 29,022 units. Sagicor Group advanced 95 cents in closing at $40.95 with investors trading 11,250 stock units, Scotia Group rose $3.03 to $47.05 in switching ownership of 33,894 shares and Wisynco Group declined 70 cents to end at $20.50 with investors dealing in 20,846 stocks.

MPC Caribbean Clean Energy skidded $29.48 to $80 with an exchange of 1,330 stocks, NCB Financial popped $1.75 to $68.75 with an exchange of 36,300 stock units. Pan Jamaica gained $3.64 and ended at $50.20 as investors exchanged 73 shares, Portland JSX popped 30 cents to $10.80 after investors traded 17 stocks, Proven Investments dropped $2.69 to $21.80, with an exchange of 29,022 units. Sagicor Group advanced 95 cents in closing at $40.95 with investors trading 11,250 stock units, Scotia Group rose $3.03 to $47.05 in switching ownership of 33,894 shares and Wisynco Group declined 70 cents to end at $20.50 with investors dealing in 20,846 stocks.

In the preference segment, 138 Student Living preference share rallied $1 and ended at $218 with a transfer of 5 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 201

- Next Page »