Massive speculation in the US dollar in Jamaica since March this year, maybe ending with the latest move by Bank of Jamaica exposing the extent of the market’s acceptance of rates above J$150 to one US dollar, currently and effecting some revaluation of the local dollar.

Bank of Jamaica placed on sale through their B-FXITT Flash sale mechanism, US$20 million on Tuesday, with the results suggesting exhaustion of the speculative bubble. The sale was the first on record when the demand was less than the amount offered by the central bank since they started this method of intervention three years ago.

Bank of Jamaica placed on sale through their B-FXITT Flash sale mechanism, US$20 million on Tuesday, with the results suggesting exhaustion of the speculative bubble. The sale was the first on record when the demand was less than the amount offered by the central bank since they started this method of intervention three years ago.

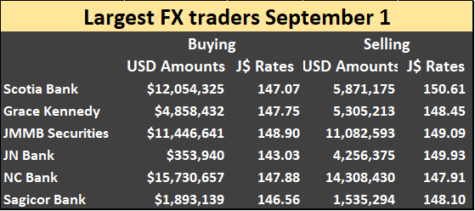

At the latest auction, only ten eligible bids amounting to a mere $7.8 million went after the amount offered. The Central bank accepted only five Bids for $6 million at $146.81 to the US dollar. The highest accepted bid was for US$2 million at a rate of US$148.30 to one US dollar. The move spilled over into the daily exchange market, with the average rate declining. Dealers bought US$55 million at an average rate of $147.545 to one US dollar and sold $53.85 million at J$148.6516 to the US. On Monday. Dealers bought US$42.68 million at an average of J$147.3109 and sold US$57.28 million at J$149.2881 each.

Jamaica’s Central Bank sold only US$6M in its FX flash auction on Tuesday.

Trading on Friday last saw buying by dealers of US$40.5 million at $148.3155 and selling of US$28.9 million at J$149.5907 each.

In August, Bank of Jamaica sold US$30 million to Authorized Dealers and select Cambios on Tuesday 18, through a B-FXITT Flash Auction that saw US$36.4 million demanded. Bank of Nova Scotia, First Caribbean International Bank, bought US$6 million, each and JMMB Securities with US$4.45 million, were the largest takers, buying between them. NCB Group was notably absent from the buyers in the August sale when the average rate was J$150.64 to the US.

The Jamaican dollar traded at an average of $136.94 to the US dollar on Tuesday. Dealers sold US$52.7 million and bought $49.4 million at an average of $135.81.

The Jamaican dollar traded at an average of $136.94 to the US dollar on Tuesday. Dealers sold US$52.7 million and bought $49.4 million at an average of $135.81.  On Thursday dealers bought only US$29.78 million, but sold US$51.4 million, with the rate clearing at an average of $137.55. In all, dealers sold the equivalent of US$53 million in all currencies.

On Thursday dealers bought only US$29.78 million, but sold US$51.4 million, with the rate clearing at an average of $137.55. In all, dealers sold the equivalent of US$53 million in all currencies. In October, Bank of Jamaica stated that the present arrangement requiring foreign exchange dealers to surrender around 25 percent to 30 percent of their daily intake is to be phased out. The central bank now considered that the market is deep and liquid enough for government entities to go directly into the market for their needs. After that announcement the central bank followed up with a 5 percentage points cut in the amount to be surrendered in October.

In October, Bank of Jamaica stated that the present arrangement requiring foreign exchange dealers to surrender around 25 percent to 30 percent of their daily intake is to be phased out. The central bank now considered that the market is deep and liquid enough for government entities to go directly into the market for their needs. After that announcement the central bank followed up with a 5 percentage points cut in the amount to be surrendered in October.