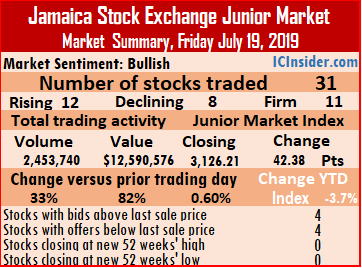

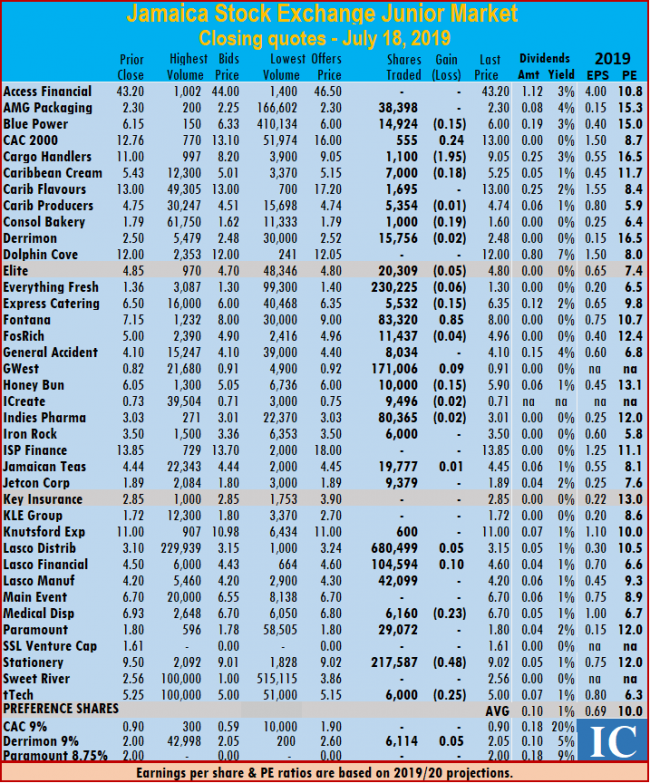

The Jamaica Stock Exchange Junior Market Index jumped 42.38 points to close at 3,126.21 on Friday as rising stocks beat declining ones 3 to 2.

The Jamaica Stock Exchange Junior Market Index jumped 42.38 points to close at 3,126.21 on Friday as rising stocks beat declining ones 3 to 2.

At the close of market activities, the prices of 12 securities advanced, 8 declined and 11 remained unchanged. Fontana jumped to a 52 weeks’ intraday high of $9 but pulled at the close to trade below Thursday’s last traded price.

The market close on Friday with 31 securities changing hands, similar to Thursday, resulting in an exchange of 2,453,740 units valued at $12,590,576 compared to 1,843,387 units for $6,929,942 on Thursday.

Trading ended with an average of 79,153 units at $406,148 for each security trading, in contrast to 59,464 units for an average of $223,547 on Thursday.  The average volume and value for the month to date amounts to 86,814 units with a value of $302,918 for each security traded, compared to 89,989 units with a value of $295,131 traded previously. June ended with an average of 166,169 units at $674,841 for each security traded.

The average volume and value for the month to date amounts to 86,814 units with a value of $302,918 for each security traded, compared to 89,989 units with a value of $295,131 traded previously. June ended with an average of 166,169 units at $674,841 for each security traded.

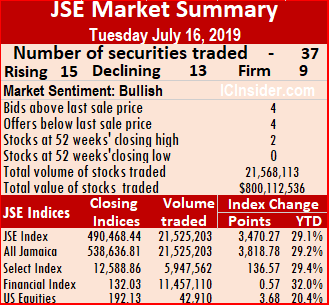

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 4 stocks closing with bids higher than their last selling prices and 4 closed with lower offers.

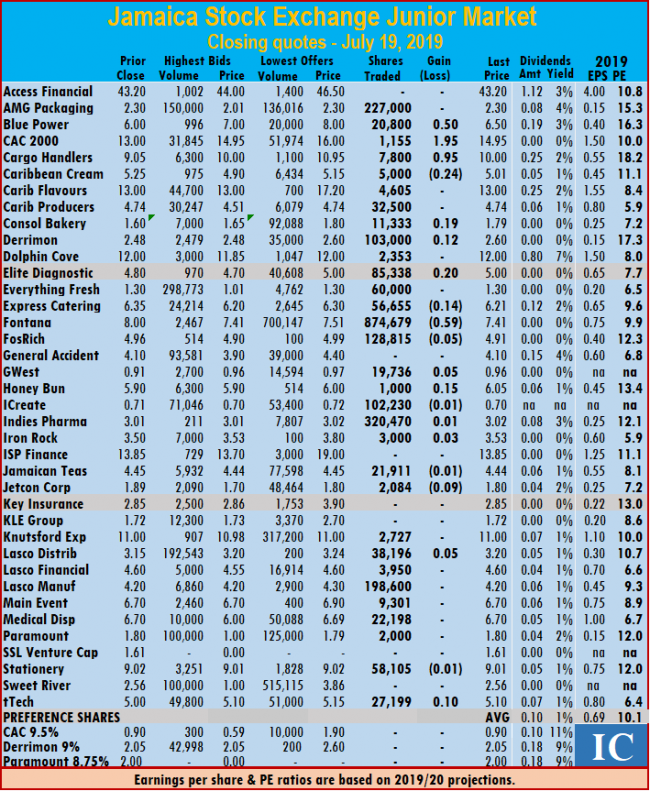

Stocks ending with price changes| Blue Power ended trading 20,800 shares, after rising 50 cents to end at $6.50, CAC 2000 gained $1.95 to end at $14.95 with 1,155 stock units changing hands, Cargo Handlers climbed 95 cents in exchanging 7,800 shares at $10, Caribbean Cream exchanged 5,000 shares to close at $5.01 after falling 24 cents. Consolidated Bakeries traded 11,333 units and gained 19 cents to end at $1.79, Derrimon Trading swapped 103,000 shares, after rising 12 cents to end at $2.60, Express Catering lost 14 cents in trading 56,655 units at $6.21, Elite Diagnostic closed trading with 85,338 shares, after rising 20 cents to end at $5. Fosrich Group dipped 5 cents trading 128,815 units at $4.91, Fontana declined 59 cents in trading of 874,679 units at $7.41 after hitting a new all-time high of $9 before selling came in and pushed the price down. Gwest Corporation climbed 5 cents and exchanged 19,736 shares at 96 cents,  Honey Bun climbed 15 cents and exchanged 1,000 shares at $6.05, iCreate ended with a loss of 1 cent at 70 cents with 102,230 stock units changing hands. Indies Pharma ended trading with 320,470 shares, after rising 1 cent to end at $3.02, Jamaican Teas ended with a loss of 1 cent at $4.44 with 21,911 stock units changing hands, Jetcon Corporation fell 9 cents in trading 2,084 units at $1.80. Lasco Distributors closed 5 cents higher at $3.20, with 38,196 stock units trading. Iron Rock Insurance closed trading of 3,000 units with a gain of 3 cents to end at $3.53, Stationery and Office Supplies declined 1 cent, to close at 9.01, with 58,105 stock units changing hands and tTech ended trading of 27,199 shares, after rising 10 cents to end at $5.10.

Honey Bun climbed 15 cents and exchanged 1,000 shares at $6.05, iCreate ended with a loss of 1 cent at 70 cents with 102,230 stock units changing hands. Indies Pharma ended trading with 320,470 shares, after rising 1 cent to end at $3.02, Jamaican Teas ended with a loss of 1 cent at $4.44 with 21,911 stock units changing hands, Jetcon Corporation fell 9 cents in trading 2,084 units at $1.80. Lasco Distributors closed 5 cents higher at $3.20, with 38,196 stock units trading. Iron Rock Insurance closed trading of 3,000 units with a gain of 3 cents to end at $3.53, Stationery and Office Supplies declined 1 cent, to close at 9.01, with 58,105 stock units changing hands and tTech ended trading of 27,199 shares, after rising 10 cents to end at $5.10.

Prices of securities trading for the day are those at which the last trade took place.

One Caribbean Media declined 5 cents and closed at $10.10, with an exchange of 31,833 units and Republic Financial ended trading of 4,572 units with a lost 49 cents to close at $121.01.

One Caribbean Media declined 5 cents and closed at $10.10, with an exchange of 31,833 units and Republic Financial ended trading of 4,572 units with a lost 49 cents to close at $121.01.

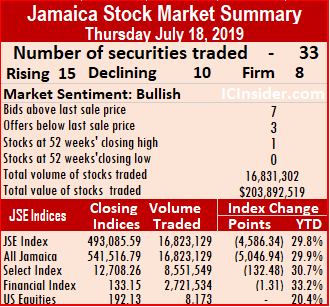

The average volume and value for the month to date is 1,201,668 shares amounting to $14,989,839 changing hands, compared to 1,247,788 shares valued at $15,618,666 for each security traded. June closed with an average of 1,608,485 units valued at $19,605,318 for each security traded.

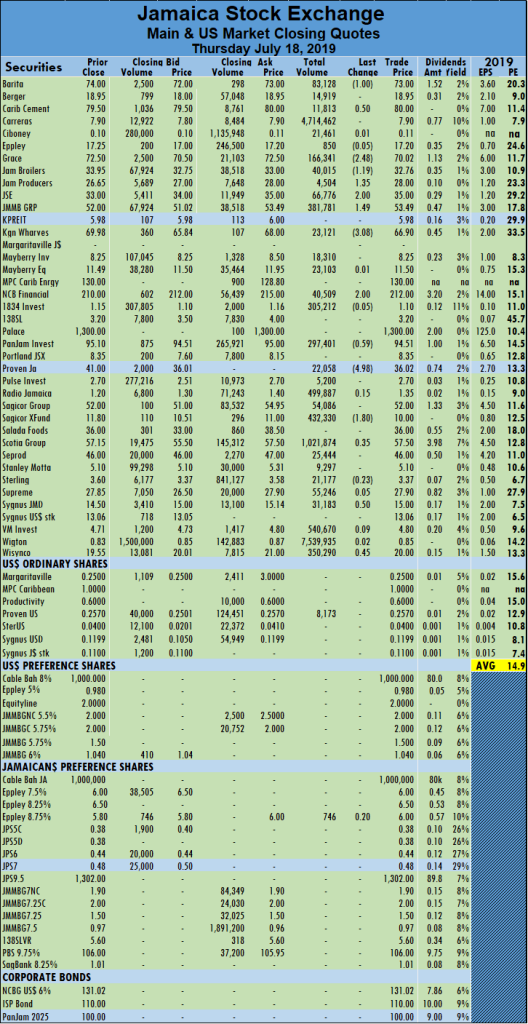

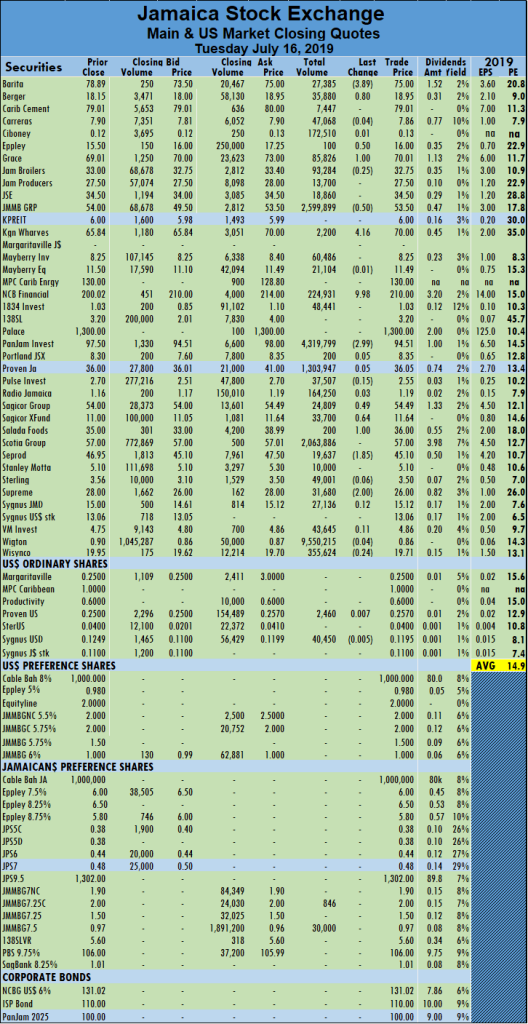

The average volume and value for the month to date is 1,201,668 shares amounting to $14,989,839 changing hands, compared to 1,247,788 shares valued at $15,618,666 for each security traded. June closed with an average of 1,608,485 units valued at $19,605,318 for each security traded. Kingston Wharves traded 23,121 shares but fell $3.08 to $66.90, NCB Financial rose with a gain of $2 in exchanging 40,509 shares and ended trading at a an all-time closing high of $212, PanJam Investment lost 59 cents in trading 297,401 stock units at $94.51, Proven Investments dropped $4.98, trading 22,508 shares to close at $36.02. Sagicor Real Estate Fund dropped $1.80 trading 432,330 stock units to end at $10, Scotia Group exchanged 1,021,874 shares to add 35 cents and ended at $57.50, Seprod rose 90 cents to close at $46 while trading 12,835 shares, Sygnus Credit Investments gained 50 cents to $15, in trading 31,183 units and Wisynco Group traded 350,290 shares to gain 45 cents and ended at $20.

Kingston Wharves traded 23,121 shares but fell $3.08 to $66.90, NCB Financial rose with a gain of $2 in exchanging 40,509 shares and ended trading at a an all-time closing high of $212, PanJam Investment lost 59 cents in trading 297,401 stock units at $94.51, Proven Investments dropped $4.98, trading 22,508 shares to close at $36.02. Sagicor Real Estate Fund dropped $1.80 trading 432,330 stock units to end at $10, Scotia Group exchanged 1,021,874 shares to add 35 cents and ended at $57.50, Seprod rose 90 cents to close at $46 while trading 12,835 shares, Sygnus Credit Investments gained 50 cents to $15, in trading 31,183 units and Wisynco Group traded 350,290 shares to gain 45 cents and ended at $20.

June ended with an average of 166,169 units at $674,841 for each security traded.

June ended with an average of 166,169 units at $674,841 for each security traded. GWest Corporation closed trading of 171,006 units with a gain of 9 cents to end at 91 cents, Honey Bun dipped 15 cents in trading of 10,000 units at $5.90. iCreate fell 2 cents in trading 9,496 units at 71 cents, Indies Pharma declined 2 cents in trading of 80,365 units to close at $3.01, Jamaican Teas climbed 1 cent in exchanging 19,777 shares at $4.45, Lasco Distributors closed 5 cents higher at $3.15, with 680,499 stock units trading. Lasco Financial ended trading with 104,594 shares, after rising 10 cents to close at $4.60, Medical Disposables declined 23 cents in trading 6,160 units at $6.70, Stationery and Office Supplies shed 48 cents in trading 217,587 units to close at $9.02, tTech shed 25 cents in trading of 6,000 units to end at $5. In the junior market preference segment, Derrimon Trading climbed 5 cents and exchanged 6,114 shares at $2.05.

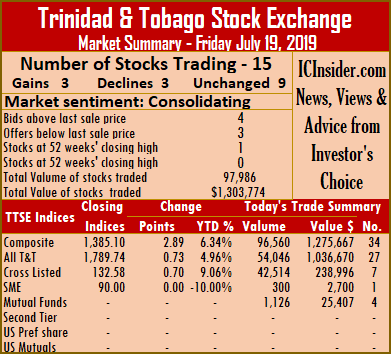

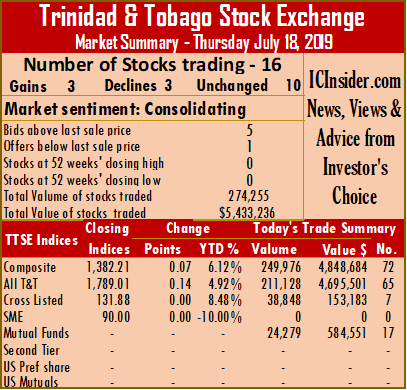

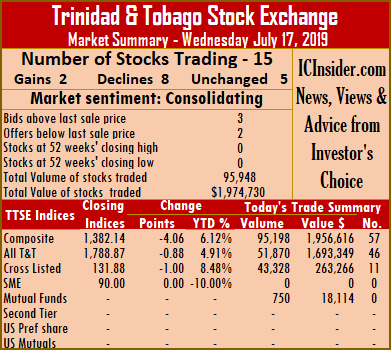

GWest Corporation closed trading of 171,006 units with a gain of 9 cents to end at 91 cents, Honey Bun dipped 15 cents in trading of 10,000 units at $5.90. iCreate fell 2 cents in trading 9,496 units at 71 cents, Indies Pharma declined 2 cents in trading of 80,365 units to close at $3.01, Jamaican Teas climbed 1 cent in exchanging 19,777 shares at $4.45, Lasco Distributors closed 5 cents higher at $3.15, with 680,499 stock units trading. Lasco Financial ended trading with 104,594 shares, after rising 10 cents to close at $4.60, Medical Disposables declined 23 cents in trading 6,160 units at $6.70, Stationery and Office Supplies shed 48 cents in trading 217,587 units to close at $9.02, tTech shed 25 cents in trading of 6,000 units to end at $5. In the junior market preference segment, Derrimon Trading climbed 5 cents and exchanged 6,114 shares at $2.05. Trading picked up on the Trinidad & Tobago Stock Exchange on Thursday, with 274,255 shares traded for $5,433,236, compared to 95,948 units with a value of $1,974,730, trading on Wednesday.

Trading picked up on the Trinidad & Tobago Stock Exchange on Thursday, with 274,255 shares traded for $5,433,236, compared to 95,948 units with a value of $1,974,730, trading on Wednesday.  Clico Investment Fund declined 15 cents after exchanging 24,204 shares to close at $24 and Trinidad & Tobago NGL lost $1.05 trading 42,223 units to close at $27.

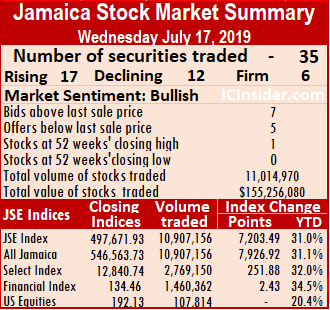

Clico Investment Fund declined 15 cents after exchanging 24,204 shares to close at $24 and Trinidad & Tobago NGL lost $1.05 trading 42,223 units to close at $27. Investors pushed the Jamaica Stock Exchange to a new record close on Wednesday, as NCB Financial traded as high as $219.99 and the All Jamaican Composite Index crossed the 550,000 mark during the day.

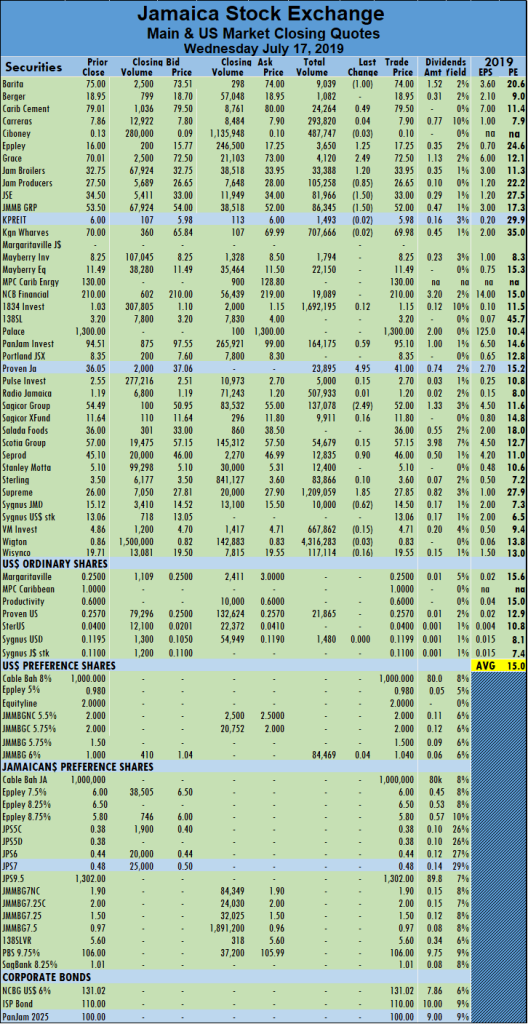

Investors pushed the Jamaica Stock Exchange to a new record close on Wednesday, as NCB Financial traded as high as $219.99 and the All Jamaican Composite Index crossed the 550,000 mark during the day.  Wigton Windfarm dominated trading with just 4.3 million shares for 40 percent of total main market volume, well down on the usually large volume, the stock traded at for most of the days since it listed in April. 1834 Investments followed with 1.7 million stock units for 16 percent of total volume and Supreme Ventures with 1.2 million shares for 11 percent of the day’s volume.

Wigton Windfarm dominated trading with just 4.3 million shares for 40 percent of total main market volume, well down on the usually large volume, the stock traded at for most of the days since it listed in April. 1834 Investments followed with 1.7 million stock units for 16 percent of total volume and Supreme Ventures with 1.2 million shares for 11 percent of the day’s volume. Jamaica Producers exchanged 105,258 stock units but lost 85 cents to close at $26.65, Jamaica Stock Exchange lost $1.50 in trading 81,966 units to end at $33, JMMB Group lost $1.50 to end at $52 with an exchange of 86,345 shares. PanJam Investment rose 59 cents in trading 164,175 stock units at $95.10, Proven Investments jumped $4.95, trading 23,895 shares to close at a record high of $41, Sagicor Group dropped $2.49 trading 137,078 stock units to end at $52. Seprod rose 90 cents to close at $46 while trading 12,835 shares and Supreme Ventures added $1.85 to close at $27.85 in trading with 1,209,059 shares and Sygnus Credit Investments lost 62 cents to $14.50, in trading 10,000 units.

Jamaica Producers exchanged 105,258 stock units but lost 85 cents to close at $26.65, Jamaica Stock Exchange lost $1.50 in trading 81,966 units to end at $33, JMMB Group lost $1.50 to end at $52 with an exchange of 86,345 shares. PanJam Investment rose 59 cents in trading 164,175 stock units at $95.10, Proven Investments jumped $4.95, trading 23,895 shares to close at a record high of $41, Sagicor Group dropped $2.49 trading 137,078 stock units to end at $52. Seprod rose 90 cents to close at $46 while trading 12,835 shares and Supreme Ventures added $1.85 to close at $27.85 in trading with 1,209,059 shares and Sygnus Credit Investments lost 62 cents to $14.50, in trading 10,000 units.

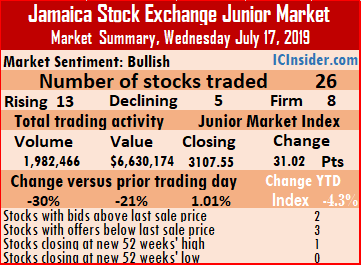

The average volume and value for the month to date amounts to 89,671 units with a value of $300,971 for each security traded, compared to 90,656 shares valued at $304,347 traded previously. June ended with an average of 166,169 units at $674,841 for each security traded.

The average volume and value for the month to date amounts to 89,671 units with a value of $300,971 for each security traded, compared to 90,656 shares valued at $304,347 traded previously. June ended with an average of 166,169 units at $674,841 for each security traded. Fontana gained $1.05 to end at a 52 weeks’ high of $7.15, trading 87,465 stock units, General Accident climbed 20 cents exchanging 6,688 shares to end at $4.10. Gwest Corporation gained 1 cent to end at 82 cents, in trading 284,451 shares, Honey Bun closed trading of 19,210 units and gained 5 cents to end at $6.05, iCreate ended trading with 127,464 shares, after rising 2 cents to end at 73 cents, Indies Pharma climbed 2 cents and exchanged 368,800 shares at $3.03. Jetcon Corporation traded 465 shares, after rising 19 cents to end at $1.89, KLE Group exchanged 20,000 shares, after rising 2 cents to end at $1.72, Lasco Financial lost 20 cents in trading 27,752 shares to close at $4.50. Main Event ended trading with 114,524 shares, after rising 30 cents to end at $6.70, Ironrock Insurance closed trading of 60,334 units with a gain of 15 cents to end at $3.50 and tTech declined 25 cents in trading of 1,811 units to close at $5.25.

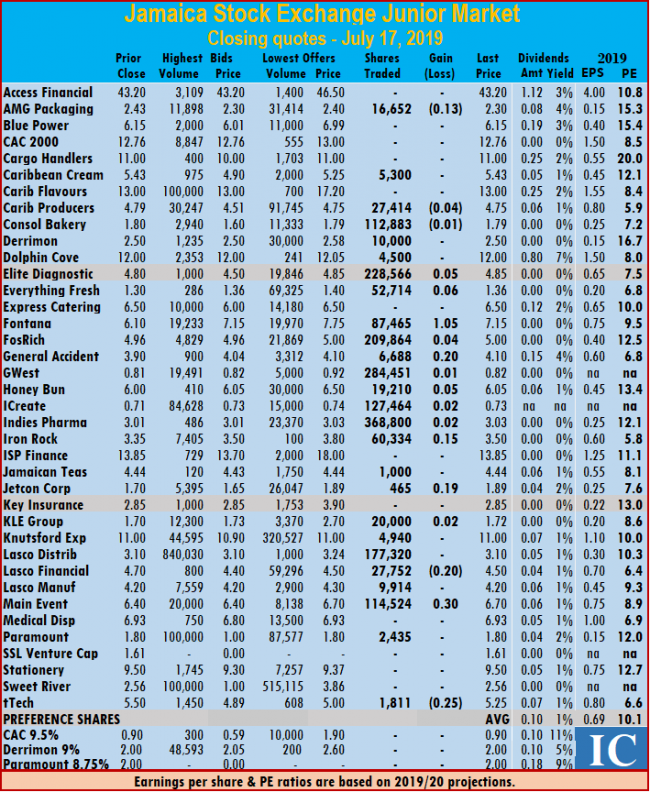

Fontana gained $1.05 to end at a 52 weeks’ high of $7.15, trading 87,465 stock units, General Accident climbed 20 cents exchanging 6,688 shares to end at $4.10. Gwest Corporation gained 1 cent to end at 82 cents, in trading 284,451 shares, Honey Bun closed trading of 19,210 units and gained 5 cents to end at $6.05, iCreate ended trading with 127,464 shares, after rising 2 cents to end at 73 cents, Indies Pharma climbed 2 cents and exchanged 368,800 shares at $3.03. Jetcon Corporation traded 465 shares, after rising 19 cents to end at $1.89, KLE Group exchanged 20,000 shares, after rising 2 cents to end at $1.72, Lasco Financial lost 20 cents in trading 27,752 shares to close at $4.50. Main Event ended trading with 114,524 shares, after rising 30 cents to end at $6.70, Ironrock Insurance closed trading of 60,334 units with a gain of 15 cents to end at $3.50 and tTech declined 25 cents in trading of 1,811 units to close at $5.25. Trading activity picked up on the Trinidad & Tobago Stock Exchange on Wednesday with 95,948 shares valued $1,974,730 trading, compared to 308,036 shares valued $6,367,532 on Tuesday.

Trading activity picked up on the Trinidad & Tobago Stock Exchange on Wednesday with 95,948 shares valued $1,974,730 trading, compared to 308,036 shares valued $6,367,532 on Tuesday.  Guardian Holdings lost 30 cents and settled at $18.10, trading 213 units, Massy Holdings lost 1 cent trading 1,050 stock units at $55.08, NCB Financial fell 15 cents and ended at $9.35, after exchanging 4,500 shares and West Indian Tobacco closed 2 cents down to settle at $110.25, with 75 units crossing the exchange.

Guardian Holdings lost 30 cents and settled at $18.10, trading 213 units, Massy Holdings lost 1 cent trading 1,050 stock units at $55.08, NCB Financial fell 15 cents and ended at $9.35, after exchanging 4,500 shares and West Indian Tobacco closed 2 cents down to settle at $110.25, with 75 units crossing the exchange.

Also trading good volumes were

Also trading good volumes were  Kingston Wharves recovered the $4.16 it lost on Monday, to end trading of 2,200 shares at $70.

Kingston Wharves recovered the $4.16 it lost on Monday, to end trading of 2,200 shares at $70.