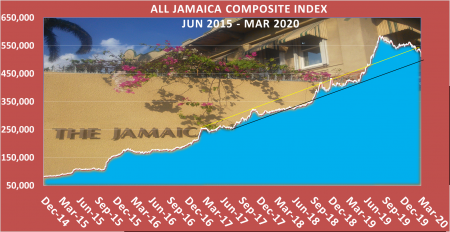

The Jamaica Stock Exchange Main Market on Tuesday suffered the biggest fall of the market index in the JSE 50 year history as nervous investors cut 8.7 percent of the value of stocks since the commencement of the year.

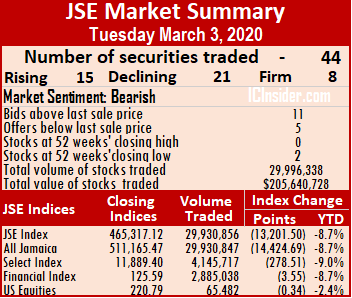

At the close, the JSE All Jamaican Composite Index plunged 14,424.69 points to close at 511,165.47. The previous biggest fall in the JSE Composite index was 12,616.74 points on October 18, 2018. The JSE Market Index nose-dived 13,201.50 points to 465,317.12 and the JSE Financial Index dropped 3.55 points to 125.59.

At the close, the JSE All Jamaican Composite Index plunged 14,424.69 points to close at 511,165.47. The previous biggest fall in the JSE Composite index was 12,616.74 points on October 18, 2018. The JSE Market Index nose-dived 13,201.50 points to 465,317.12 and the JSE Financial Index dropped 3.55 points to 125.59.

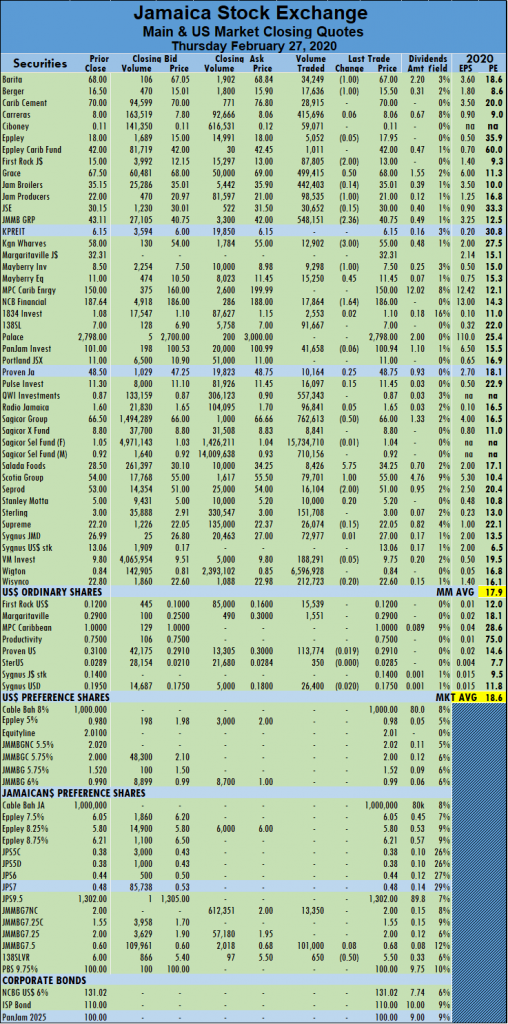

The market closed with 44 securities changing hands in the Main and US dollar markets with the prices of 15 advancing, 21 declining and 8 trading firm. The JSE Main Market activity ended with 41 securities accounting for 29,930,856 units valued at $203,577,617 in contrast to 32,117,425 units valued at $138,131,956 from 41 securities on Monday.

Sagicor Select Financial Fund dominated trading with 11.1 million shares for 37 percent of total volume, followed by Wigton Windfarm with 8.9 million units for 30 percent of the day’s trade and Sagicor Select Manufacturing and Distribution Fund with 3.6 million units for 12 percent of the market’s volume. The only other stock trading more than one million shares, was Wisynco Group, with 1.7 million units.

The Market closed with an average of 767,458 units valued at an average of $5,219,939 for each security traded, in contrast to 783,352 units valued at an average of $3,369,072 on Monday. The average volume and value for the month to date amount to 775,604 units valued at $4,271,370 for each security changing hands. Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eleven stocks ending with bids higher than their last selling prices and five closing with lower offers. The PE ratio of the market ended at 18.1, while the Main Market ended at 17.4 times the 2019 earnings.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eleven stocks ending with bids higher than their last selling prices and five closing with lower offers. The PE ratio of the market ended at 18.1, while the Main Market ended at 17.4 times the 2019 earnings.

In the Main Market, Barita Investments advanced $2 to $68, in trading 12,797 shares, Berger Paints closed $2.25 higher to $15, in transferring 700 units, Caribbean Cement dived $6.50 to end at $65, with an exchange of 213,258 shares, Eppley Caribbean Property Fund shed $4.49 to close at $37.51, in swapping a mere 9 units. First Rock Capital lost 65 cents and closed at its lowest level since listing in late February at $9.25, after it traded at a new low of $8.50, earlier in the day. The stock closed trading with 131,575 shares changing hands. Grace Kennedy gained $1.93 to finish at $67.92, after transferring 66,535 shares, Jamaica Broilers shed $1.50 to end at $34.50, with 399,300 shares changing hands. Jamaica Producers lost 86 cents trading 126,071 shares and closed at $21.14. Jamaica Stock Exchange settled at $26.51, with a loss of 99 cents with 716,481 stock units crossing the market, JMMB Group ended at $42.28, with gains of $1.53 after transferring 367,626 shares, Kingston Wharves closed $2 higher to $53, with 7,243 shares traded. Mayberry Investments lost 31 cents to end at $7.60, exchanging 21,212 units, PanJam Investment finished 99 cents lower trading 60,990 to close at $99, Proven Investments dropped $3.50 to settle at $44.50, in transferring 8,583 units, Pulse Investments lost 45 cents to close at $11, after swapping 85,736 shares. Sagicor Group shed $1.50 to end at $65, with an exchange of 167,791 shares. Sagicor Real Estate Fund closed at $9.85, with gains of 35 cents while trading 20,603 stock units,  Scotia Group ended at $54.01, after losing 49 cents and transferring 92,235 shares, Sterling Investments ended at $3, with a loss of 60 cents as 71,000 shares crossed the exchange. Supreme Ventures climbed $1.35 to settle at $22.35, in swapping 153,799 shares, Sygnus Credit Investments lost 50 cents to finish at $24.50, after trading 30,562 units and Victoria Mutual Investments gained 45 cents to end the day’s trade a $8.50, with 188,051 shares changing hands.

Scotia Group ended at $54.01, after losing 49 cents and transferring 92,235 shares, Sterling Investments ended at $3, with a loss of 60 cents as 71,000 shares crossed the exchange. Supreme Ventures climbed $1.35 to settle at $22.35, in swapping 153,799 shares, Sygnus Credit Investments lost 50 cents to finish at $24.50, after trading 30,562 units and Victoria Mutual Investments gained 45 cents to end the day’s trade a $8.50, with 188,051 shares changing hands.

Trading in the US dollar market ended with 65,482 units valued at over US$14,632. The market lost 0.34 points to close at 220.79. First Rock Capital lost 1.9 cents after trading 9,921 units at a new low of 8 US cents, JMMB Group 6% preference share exchanged 520 units at US$1, Proven Investments closed at 29 US cents, with 28,291 units changing hands. Sterling Investments swapped 790 units at 2.85 US cents and Sygnus Credit Investments closed at 18 US cents, with a loss of 1.5 cents after trading 25,960 shares.

Prices of securities trading for the day are those at which the last trade took place.

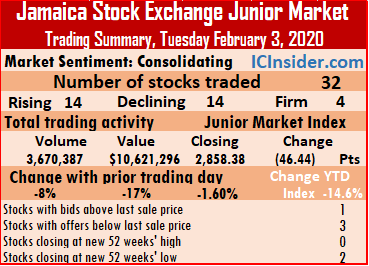

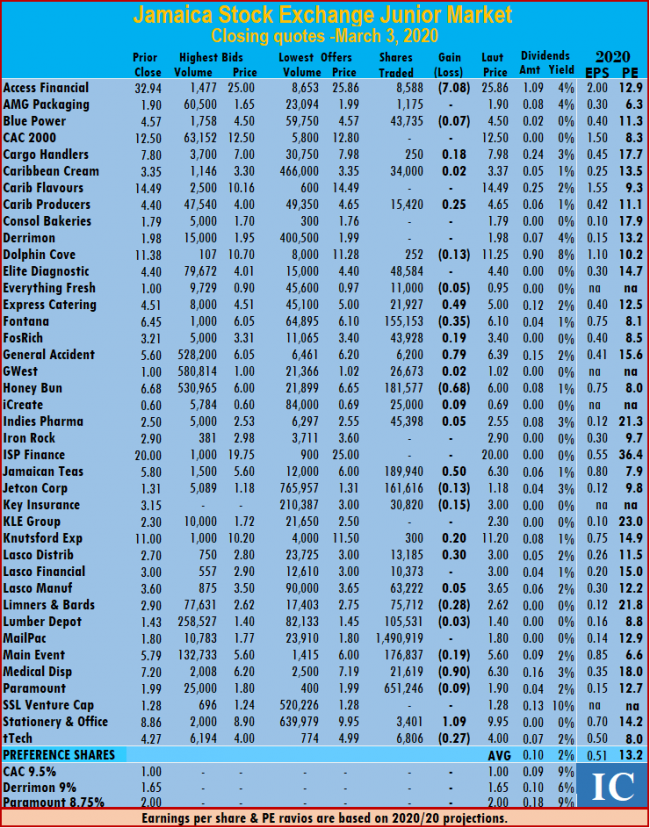

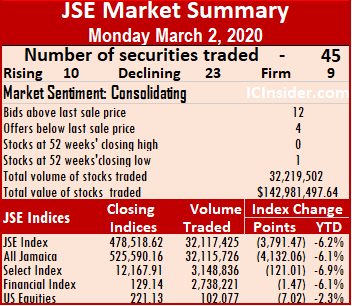

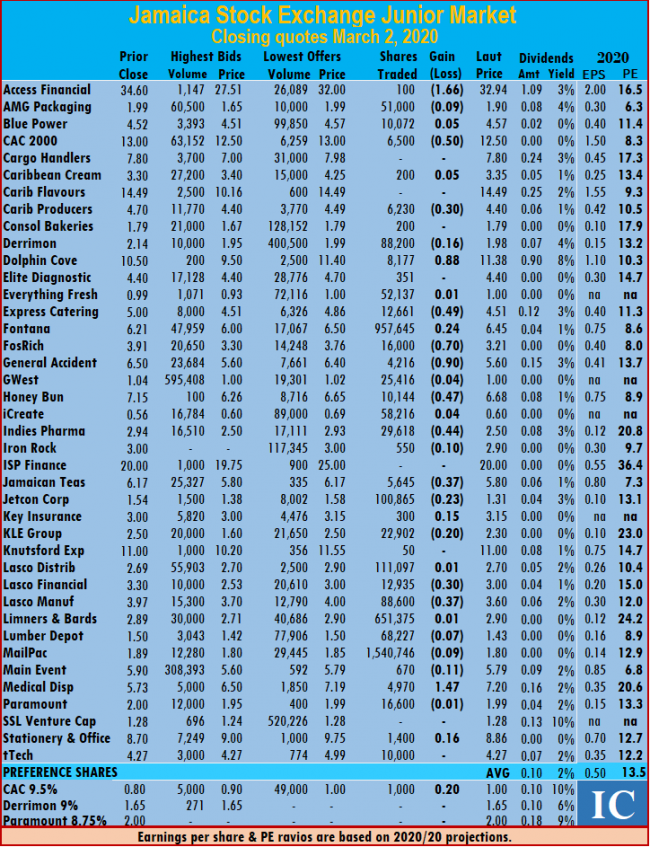

A significant drop of $7.08 in the price of Access Financial, 68 cents fall in Honey Bun and a 90 cents decline for Medical Disposables were stocks that had a major impact on the sharp decline of the market index on the second trading day in March.

A significant drop of $7.08 in the price of Access Financial, 68 cents fall in Honey Bun and a 90 cents decline for Medical Disposables were stocks that had a major impact on the sharp decline of the market index on the second trading day in March. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows one stock ended with the bid higher than the last selling price and five with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows one stock ended with the bid higher than the last selling price and five with lower offers. Jamaican Teas jumped 50 cents in trading 189,940 shares to settle at $6.30, Jetcon Corporation lost 13 cents in trading 161,616 shares to close at 52 weeks’ low of $1.18, Key Insurance lost 15 cents and ended market activity exchanging 30,820 shares to close at $3. Knutsford Express closed trading of 300 units and gained 20 cents to end at $11.20, Lasco Distributors swapped 13,185 shares, after rising 30 cents to end at $3, Lasco Manufacturing added 5 cents and exchanged 63,222 shares at $3.65. Limners and Bards ended market activity exchanging 75,712 shares to close at $2.62 after falling 28 cents, Lumber Depot lost 3 cents in trading 105,531 shares to close at $1.40, Main Event fell 19 cents to close at $5.60 with 176,837 shares traded. Medical Disposables declined 90 cents in swapping 21,619 units at $6.30, Paramount Trading dipped 9 cents in trading of 651,246 units at $1.90, Stationery and Office Supplies climbed to $9.95 after rising $1.09 with 3,401 shares changing hands and tTech declined by 27 cents to settle at a 52 weeks’ low of $4 with 6,806 units crossing the exchange.

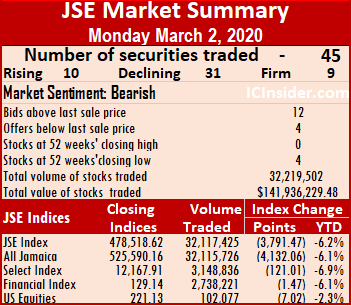

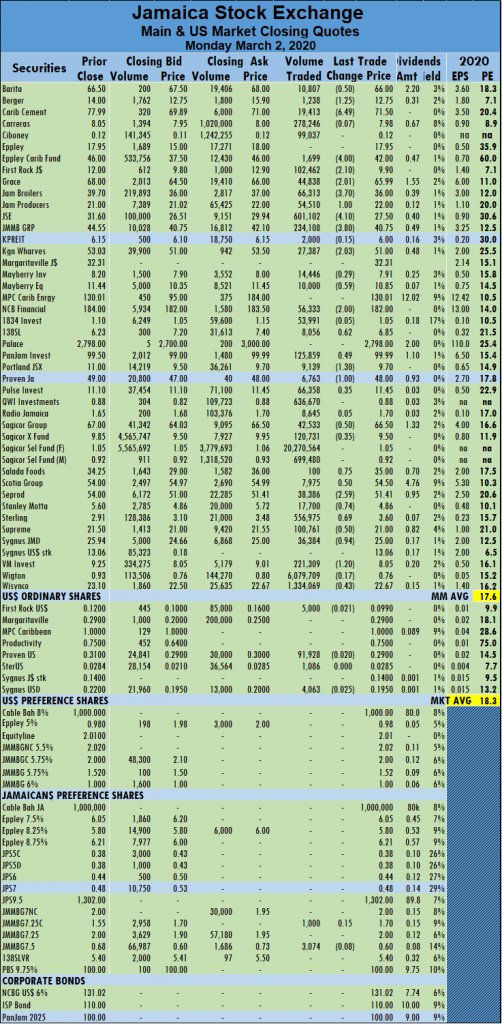

Jamaican Teas jumped 50 cents in trading 189,940 shares to settle at $6.30, Jetcon Corporation lost 13 cents in trading 161,616 shares to close at 52 weeks’ low of $1.18, Key Insurance lost 15 cents and ended market activity exchanging 30,820 shares to close at $3. Knutsford Express closed trading of 300 units and gained 20 cents to end at $11.20, Lasco Distributors swapped 13,185 shares, after rising 30 cents to end at $3, Lasco Manufacturing added 5 cents and exchanged 63,222 shares at $3.65. Limners and Bards ended market activity exchanging 75,712 shares to close at $2.62 after falling 28 cents, Lumber Depot lost 3 cents in trading 105,531 shares to close at $1.40, Main Event fell 19 cents to close at $5.60 with 176,837 shares traded. Medical Disposables declined 90 cents in swapping 21,619 units at $6.30, Paramount Trading dipped 9 cents in trading of 651,246 units at $1.90, Stationery and Office Supplies climbed to $9.95 after rising $1.09 with 3,401 shares changing hands and tTech declined by 27 cents to settle at a 52 weeks’ low of $4 with 6,806 units crossing the exchange. At the close, the JSE All Jamaican Composite Index plummeted 4,132.06 points to close at 525,590.16, the JSE Market Index tumbled 3,791.47 points to 478,518.62 and the JSE Financial Index lost 1.47 points to 129.14.

At the close, the JSE All Jamaican Composite Index plummeted 4,132.06 points to close at 525,590.16, the JSE Market Index tumbled 3,791.47 points to 478,518.62 and the JSE Financial Index lost 1.47 points to 129.14. In the prime market, Barita Investments lost 50 cents in closing at $66, with an exchange of 10,807 shares, Berger Paints ended at a 52 weeks’ low of $12.75, after losing $1.25 in transferring 1,238 stock units, Caribbean Cement dropped $6.49 to settle at $71.50, in swapping 19,413 units. Eppley Caribbean Property Fund slid $4 to $42 trading 1,699 shares, First Rock Capital fell $2.10 to a 52 weeks’ low of $9.90, with 102,462 stock units changing hands, Grace Kennedy slipped $2.01 to $65.99, exchanging 44,838 units. Jamaica Broilers shed $3.70 to end at $36 in transferring 66,313 stock units, Jamaica Producers gained $1 to close at $22 after trading 54,510 shares, Jamaica Stock Exchange dived $4.10 to $27.50, after swapping 601,102 stock units. JMMB Group ended at $40.75, with a loss of $3.80 in exchanging 234,108 shares, Kingston Wharves closed $2.03 lower to $51, in transferring 27,387 units. Mayberry Jamaican Equities lost 59 cents to end at $10.85, in swapping 10,000 stock units, NCB Financial shed $2 to end at $182 trading 56,333 units, 138 Student Living gained of 62 cents to $6.85, with and 8,056 stock units changing hands. PanJam Investment closed 49 cents higher to $99.99, with 125,859 shares traded, Portland JSX lost $1.30 to finish at $9.70, after exchanging 9,139 units, Proven Investments lost $1 to settle at $48, in trading 6,763 stock units. Pulse Investments gained 35 cents to close at $11.45, in swapping 66,358 shares, Sagicor Group lost 50 cents to end at $66.50, with an exchange of 42,533 shares, Sagicor Real Estate Fund closed at $9.50, with a loss of 35 cents after trading 120,731 shares. Salada Foods finished 75 cents higher after swapping 100 units and closed at $35.

In the prime market, Barita Investments lost 50 cents in closing at $66, with an exchange of 10,807 shares, Berger Paints ended at a 52 weeks’ low of $12.75, after losing $1.25 in transferring 1,238 stock units, Caribbean Cement dropped $6.49 to settle at $71.50, in swapping 19,413 units. Eppley Caribbean Property Fund slid $4 to $42 trading 1,699 shares, First Rock Capital fell $2.10 to a 52 weeks’ low of $9.90, with 102,462 stock units changing hands, Grace Kennedy slipped $2.01 to $65.99, exchanging 44,838 units. Jamaica Broilers shed $3.70 to end at $36 in transferring 66,313 stock units, Jamaica Producers gained $1 to close at $22 after trading 54,510 shares, Jamaica Stock Exchange dived $4.10 to $27.50, after swapping 601,102 stock units. JMMB Group ended at $40.75, with a loss of $3.80 in exchanging 234,108 shares, Kingston Wharves closed $2.03 lower to $51, in transferring 27,387 units. Mayberry Jamaican Equities lost 59 cents to end at $10.85, in swapping 10,000 stock units, NCB Financial shed $2 to end at $182 trading 56,333 units, 138 Student Living gained of 62 cents to $6.85, with and 8,056 stock units changing hands. PanJam Investment closed 49 cents higher to $99.99, with 125,859 shares traded, Portland JSX lost $1.30 to finish at $9.70, after exchanging 9,139 units, Proven Investments lost $1 to settle at $48, in trading 6,763 stock units. Pulse Investments gained 35 cents to close at $11.45, in swapping 66,358 shares, Sagicor Group lost 50 cents to end at $66.50, with an exchange of 42,533 shares, Sagicor Real Estate Fund closed at $9.50, with a loss of 35 cents after trading 120,731 shares. Salada Foods finished 75 cents higher after swapping 100 units and closed at $35.  Scotia Group ended at $54.50, with gains of 50 cents in transferring 7,975 shares, Seprod declined by $2.59 to $51.41, with 38,386 shares changing hands, Stanley Motta lost 74 cents to close at $4.86 in trading 17,700 shares, Sterling Investments jumped 69 cents and ended at $3.60, after exchanging 556,975 shares. Supreme Ventures lost 50 cents to settle at $21, in swapping 100,761 shares, Sygnus Credit Investments shed 94 cents to finish at $25, after transferring 36,384 shares, Victoria Mutual Investments dropped $1.20 to $8.05, trading 221,309 shares and Wisynco Group lost 43 cents to end the day’s trade of 1,334,069 shares at $22.67.

Scotia Group ended at $54.50, with gains of 50 cents in transferring 7,975 shares, Seprod declined by $2.59 to $51.41, with 38,386 shares changing hands, Stanley Motta lost 74 cents to close at $4.86 in trading 17,700 shares, Sterling Investments jumped 69 cents and ended at $3.60, after exchanging 556,975 shares. Supreme Ventures lost 50 cents to settle at $21, in swapping 100,761 shares, Sygnus Credit Investments shed 94 cents to finish at $25, after transferring 36,384 shares, Victoria Mutual Investments dropped $1.20 to $8.05, trading 221,309 shares and Wisynco Group lost 43 cents to end the day’s trade of 1,334,069 shares at $22.67. Derrimon Trading ended with a loss of 16 cents at $1.98, with 88,200 shares changing hands. Dolphin Cove finished at $11.38 with 8,177 shares traded after climbing 88 cents, Everything Fresh exchanged 52,137 shares at $1 after rising 1 cent, Express Catering lost 49 cents in trading 12,661 shares to close at $4.51. Fontana ended with 957,645 stock units changing hands after jumping 24 cents to end at $6.45, Fosrich swapped 16000 shares and declined 70 cents to settle at $3.21, General Accident lost 90 cents in trading of 4,216 units at $5.60. GWest Corporation dipped 4 cents to $1 with 25,416 units swapped, Honey Bun ended market activity, exchanging 10,144 shares to settle at $6.68 after falling by 47 cents, iCreate closed 4 cents higher at 60 cents, with 58,216 stock units trading. Indies Pharma finished with a loss of 44 cents at $2.50 with 29,618 shares changing hands, Iron Rock Insurance slipped 10 cents to $2.90 with an exchange of 550 units, Jamaican Teas shed 37 cents in trading of 5,645 stock units at $5.80. Jetcon Corporation fell 23 cents to $1.31 in the swapping of 100,865 shares, Key Insurance climbed 15 cents and exchanged 300 units at $3.15, KLE Group shed 20 cents in trading of 22,902 units at $2.30. Lasco Distributors closed 1 cent higher at $2.70, with 111,097 stock units trading, Lasco Financial lost 30 cents and exchanged 12,935 shares to close at $3, Lasco Manufacturing fell 37 cents trading of 88,600 units at $3.60.

Derrimon Trading ended with a loss of 16 cents at $1.98, with 88,200 shares changing hands. Dolphin Cove finished at $11.38 with 8,177 shares traded after climbing 88 cents, Everything Fresh exchanged 52,137 shares at $1 after rising 1 cent, Express Catering lost 49 cents in trading 12,661 shares to close at $4.51. Fontana ended with 957,645 stock units changing hands after jumping 24 cents to end at $6.45, Fosrich swapped 16000 shares and declined 70 cents to settle at $3.21, General Accident lost 90 cents in trading of 4,216 units at $5.60. GWest Corporation dipped 4 cents to $1 with 25,416 units swapped, Honey Bun ended market activity, exchanging 10,144 shares to settle at $6.68 after falling by 47 cents, iCreate closed 4 cents higher at 60 cents, with 58,216 stock units trading. Indies Pharma finished with a loss of 44 cents at $2.50 with 29,618 shares changing hands, Iron Rock Insurance slipped 10 cents to $2.90 with an exchange of 550 units, Jamaican Teas shed 37 cents in trading of 5,645 stock units at $5.80. Jetcon Corporation fell 23 cents to $1.31 in the swapping of 100,865 shares, Key Insurance climbed 15 cents and exchanged 300 units at $3.15, KLE Group shed 20 cents in trading of 22,902 units at $2.30. Lasco Distributors closed 1 cent higher at $2.70, with 111,097 stock units trading, Lasco Financial lost 30 cents and exchanged 12,935 shares to close at $3, Lasco Manufacturing fell 37 cents trading of 88,600 units at $3.60. Limners and Bards ended with 651,375 shares crossing the exchange after gaining 1 cent to end at $2.90, Lumber Depot lost 7 cents in trading of 68,227 units at $1.43, MailPac fell 9 cents in the exchange of 1,540,746 units at $1.80. Main Event dropped 11 cents to close at $5.79 with 670 units traded, Medical Disposables climbed $1.47 to settle at $7.20 with 4,970 shares changing hands, Paramount Trading ended at $1.99 with 16,600 stock units changing hands, after losing 1 cent. Stationery and Office Supplies closed 16 cents higher at $8.86, with 1,400 stock units crossing the exchange and CAC 2000 9.5% preference share closed trading of 1,000 units and gained 20 cents to end at $1.

Limners and Bards ended with 651,375 shares crossing the exchange after gaining 1 cent to end at $2.90, Lumber Depot lost 7 cents in trading of 68,227 units at $1.43, MailPac fell 9 cents in the exchange of 1,540,746 units at $1.80. Main Event dropped 11 cents to close at $5.79 with 670 units traded, Medical Disposables climbed $1.47 to settle at $7.20 with 4,970 shares changing hands, Paramount Trading ended at $1.99 with 16,600 stock units changing hands, after losing 1 cent. Stationery and Office Supplies closed 16 cents higher at $8.86, with 1,400 stock units crossing the exchange and CAC 2000 9.5% preference share closed trading of 1,000 units and gained 20 cents to end at $1.

JMMB Group shed 2 cents to end at $2.68, with investors trading 255,000 stock units. National Flour transferred 3,342 shares and fell 4 cents to end at $1.45, Trinidad & Tobago NGL transferred 2,303 shares and fell 25 cents to close at $20.50 and West Indian Tobacco lost 45 cents and closed at $39 while trading 99 stock units.

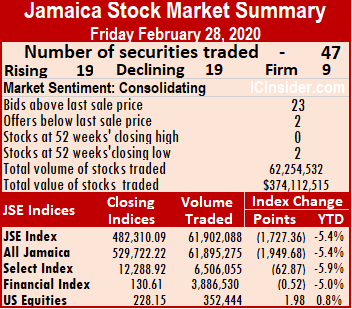

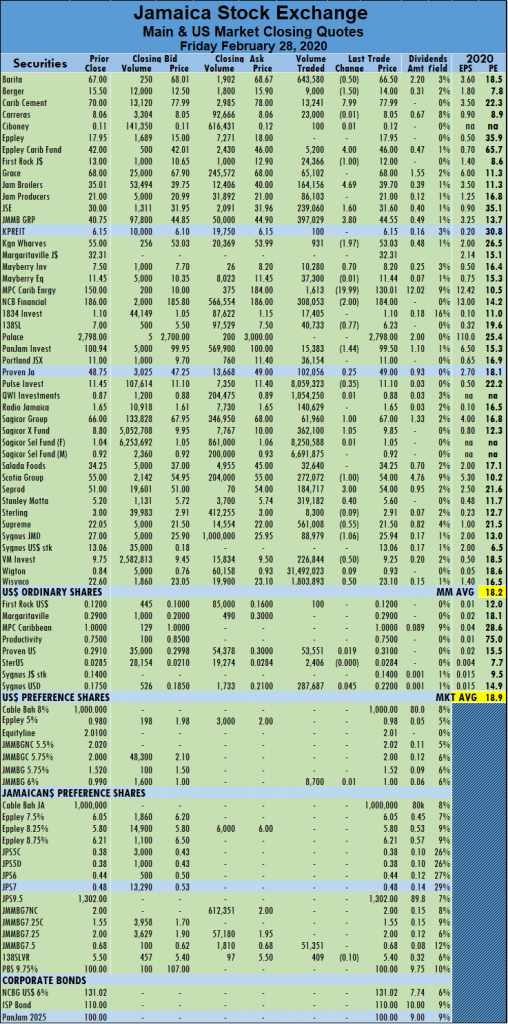

JMMB Group shed 2 cents to end at $2.68, with investors trading 255,000 stock units. National Flour transferred 3,342 shares and fell 4 cents to end at $1.45, Trinidad & Tobago NGL transferred 2,303 shares and fell 25 cents to close at $20.50 and West Indian Tobacco lost 45 cents and closed at $39 while trading 99 stock units. At the close of trading, the JSE All Jamaican Composite Index lost 1,949.68 points to close at 529,722.22, the JSE Market Index slipped 1,727.36 points to 482,310.09 and the JSE Financial Index lost 0.52 points to 130.61.

At the close of trading, the JSE All Jamaican Composite Index lost 1,949.68 points to close at 529,722.22, the JSE Market Index slipped 1,727.36 points to 482,310.09 and the JSE Financial Index lost 0.52 points to 130.61. The Market closed with an average of 1,473,859 units valued at an average of $8,907,441 for each security traded, in contrast to 678,890 units valued at an average of $4,524,631 on Thursday. The average volume and value for the month to date amount to 624,731 units valued at $3,239,665 for each security changing hands compared to 596,981 units valued at $2,909,960 for each security traded. Trading in January resulted in an average of 626,134 units valued at $3,511,981 for each security.

The Market closed with an average of 1,473,859 units valued at an average of $8,907,441 for each security traded, in contrast to 678,890 units valued at an average of $4,524,631 on Thursday. The average volume and value for the month to date amount to 624,731 units valued at $3,239,665 for each security changing hands compared to 596,981 units valued at $2,909,960 for each security traded. Trading in January resulted in an average of 626,134 units valued at $3,511,981 for each security. PanJam Investment dipped $1.44 to $99.50 with an exchange of 15,383 units, Pulse Investments lost 35 cents to close at $11.10, in swapping 8,059,323 shares, Sagicor Group gained $1 to settle at $67, in exchanging 61,960 shares, Sagicor Real Estate Fund closed at $9.85, with gains of $1.05 in trading 362,100 shares. Scotia Group ended at $54, with a loss of $1 in transferring 272,072 shares, Seprod climbed $3 to $54, with 184,717 shares changing hands, Stanley Motta rose 40 cents to $5.60, trading 319,182 shares. Supreme Ventures lost 55 cents to settle at $21.50, in swapping 561,008 shares, Sygnus Credit Investments shed $1.06 to finish at $25.94, after transferring 88,979 shares. Victoria Mutual Investments slipped 50 cents to $9.25, with the trading of 226,844 shares and Wisynco Group gained 50 cents to end the day’s trade at $23.10, with an exchange of 1,803,893 shares.

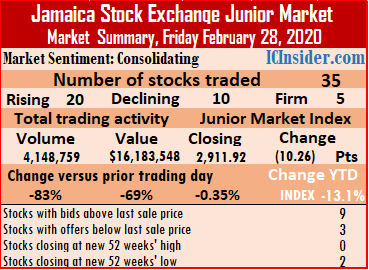

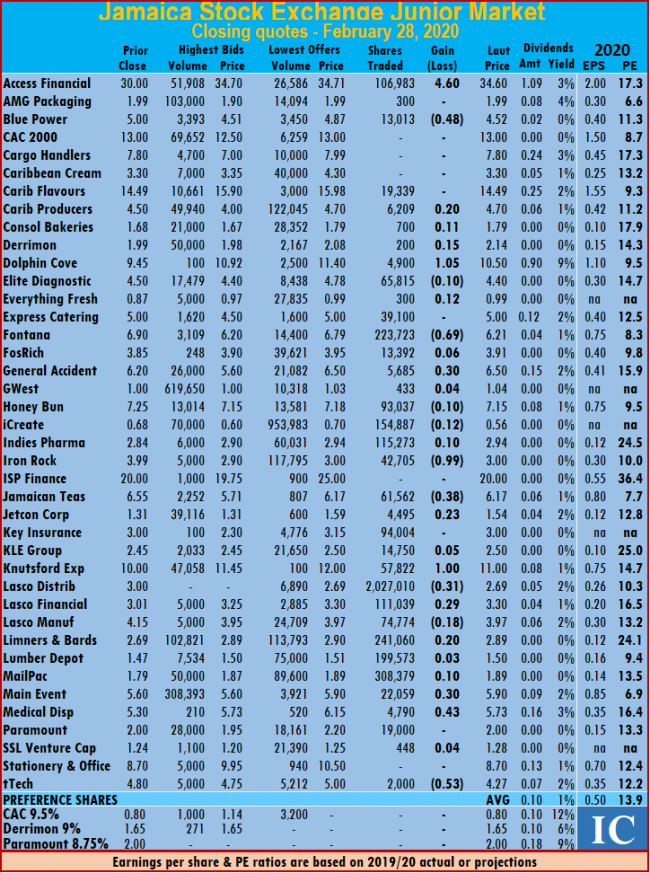

PanJam Investment dipped $1.44 to $99.50 with an exchange of 15,383 units, Pulse Investments lost 35 cents to close at $11.10, in swapping 8,059,323 shares, Sagicor Group gained $1 to settle at $67, in exchanging 61,960 shares, Sagicor Real Estate Fund closed at $9.85, with gains of $1.05 in trading 362,100 shares. Scotia Group ended at $54, with a loss of $1 in transferring 272,072 shares, Seprod climbed $3 to $54, with 184,717 shares changing hands, Stanley Motta rose 40 cents to $5.60, trading 319,182 shares. Supreme Ventures lost 55 cents to settle at $21.50, in swapping 561,008 shares, Sygnus Credit Investments shed $1.06 to finish at $25.94, after transferring 88,979 shares. Victoria Mutual Investments slipped 50 cents to $9.25, with the trading of 226,844 shares and Wisynco Group gained 50 cents to end the day’s trade at $23.10, with an exchange of 1,803,893 shares. At the close twenty stocks rose rising and ten declined with five remaining unchanged. Trading ended with an exchange of 35 securities resulting in just 4,148,759 units valued at $16,183,548 passing through the market, compared to 24,026,851 units valued at $52,414,301 from 36 securities on Thursday.

At the close twenty stocks rose rising and ten declined with five remaining unchanged. Trading ended with an exchange of 35 securities resulting in just 4,148,759 units valued at $16,183,548 passing through the market, compared to 24,026,851 units valued at $52,414,301 from 36 securities on Thursday. Consolidated Bakeries gained 11 cents, after exchanging 700 units and closed at $1.79. Derrimon Trading rose 15 cents to $2.14 after exchanging a mere 200 units, Dolphin Cove traded 4,900 stock units at $10.50, after gaining $1.05, Elite Diagnostic traded 65,815 shares and fell 10 cents to $4.40 at the close. Everything Fresh gained 12 cents to end at 99 cents, after swapping 300 units, Fontana dipped 69 cents and exchanged 223,723 shares at $6.21, Fosrich rose 6 cents to settle at $3.91, with an exchange of 13,392 stock units. General Accident added 30 cents transferring 5,685 units to close at $6.50, GWest Corporation gained 4 cents to close at $1.04 with an exchange of 433 shares, Honey Bun lost 10 cents with 93,037 shares at $7.15, iCreate declined by 12 cents to end at a 52 weeks’ low of 56 cents after trading 154,887 stock units. Indies Pharma climbed 10 cents after exchanging 115,273 shares at $2.94, Iron Rock Insurance dropped 99 cents to $3 with 42,705 shares changing hands, Jamaican Teas lost 38 cents to settle at $6.17 with 61,562 units crossing the market. Jetcon Corporation rose 23 cents and exchanged 4,495 shares in closing at $1.54. KLE Group climbed 5 cents, to close at $2.50 with the trading of 14,750 shares,

Consolidated Bakeries gained 11 cents, after exchanging 700 units and closed at $1.79. Derrimon Trading rose 15 cents to $2.14 after exchanging a mere 200 units, Dolphin Cove traded 4,900 stock units at $10.50, after gaining $1.05, Elite Diagnostic traded 65,815 shares and fell 10 cents to $4.40 at the close. Everything Fresh gained 12 cents to end at 99 cents, after swapping 300 units, Fontana dipped 69 cents and exchanged 223,723 shares at $6.21, Fosrich rose 6 cents to settle at $3.91, with an exchange of 13,392 stock units. General Accident added 30 cents transferring 5,685 units to close at $6.50, GWest Corporation gained 4 cents to close at $1.04 with an exchange of 433 shares, Honey Bun lost 10 cents with 93,037 shares at $7.15, iCreate declined by 12 cents to end at a 52 weeks’ low of 56 cents after trading 154,887 stock units. Indies Pharma climbed 10 cents after exchanging 115,273 shares at $2.94, Iron Rock Insurance dropped 99 cents to $3 with 42,705 shares changing hands, Jamaican Teas lost 38 cents to settle at $6.17 with 61,562 units crossing the market. Jetcon Corporation rose 23 cents and exchanged 4,495 shares in closing at $1.54. KLE Group climbed 5 cents, to close at $2.50 with the trading of 14,750 shares,  Knutsford Express climbed $1 higher to $11, with 57,822 units changing hands, Lasco Distributors lost 31 cents to end at 52 weeks’ low of $2.69, after transferring 2,027,010 units, Lasco Financial gained 29 cents in trading 111,039 units at $3.30. Lasco Manufacturing closed with 74,774 units changing hands, with a loss of 18 cents to finish at $3.97, Limners and Bards ended with an exchange of 241,060 shares to close at $2.89 after gaining 20 cents, Lumber Depot closed trading of 199,573 units and rising 3 cents to end at $1.50. MailPac added 10 cents to $1.89, after swapping 308,379 units, Main Event traded 22,059 units at $5.90, after rising 30 cents. Medical Disposables closed 43 cents higher at $5.73, after exchanging 4,790 units, SSL Venture Capital rose 4 cents to $1.28, with 448 shares crossing the exchange and tTech lost 53 cents in trading 2,000 units at a 52 weeks’ low at $4.27.

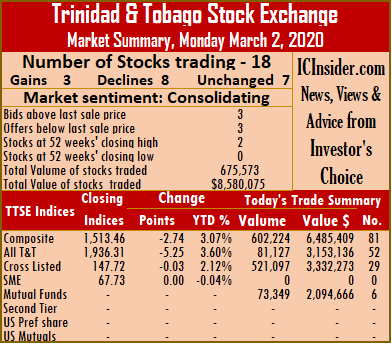

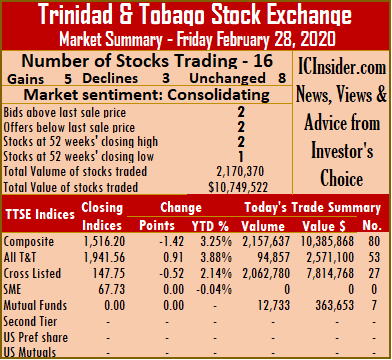

Knutsford Express climbed $1 higher to $11, with 57,822 units changing hands, Lasco Distributors lost 31 cents to end at 52 weeks’ low of $2.69, after transferring 2,027,010 units, Lasco Financial gained 29 cents in trading 111,039 units at $3.30. Lasco Manufacturing closed with 74,774 units changing hands, with a loss of 18 cents to finish at $3.97, Limners and Bards ended with an exchange of 241,060 shares to close at $2.89 after gaining 20 cents, Lumber Depot closed trading of 199,573 units and rising 3 cents to end at $1.50. MailPac added 10 cents to $1.89, after swapping 308,379 units, Main Event traded 22,059 units at $5.90, after rising 30 cents. Medical Disposables closed 43 cents higher at $5.73, after exchanging 4,790 units, SSL Venture Capital rose 4 cents to $1.28, with 448 shares crossing the exchange and tTech lost 53 cents in trading 2,000 units at a 52 weeks’ low at $4.27. The T&T Composite Index slipped 1.42 points to close at 1,516.20. The All T&T Index gained 0.91 points to end at 1,941.56, while the Cross Listed Index closed with a loss of 0.52 points to end at 147.75.

The T&T Composite Index slipped 1.42 points to close at 1,516.20. The All T&T Index gained 0.91 points to end at 1,941.56, while the Cross Listed Index closed with a loss of 0.52 points to end at 147.75. JMMB Group gained 1 cent to end at $2.70, with investors trading 1,756,480 stock units and Republic Financial Holdings traded 811 shares and gained 26 cents to close at a 52 weeks’ high of $145.01.

JMMB Group gained 1 cent to end at $2.70, with investors trading 1,756,480 stock units and Republic Financial Holdings traded 811 shares and gained 26 cents to close at a 52 weeks’ high of $145.01.

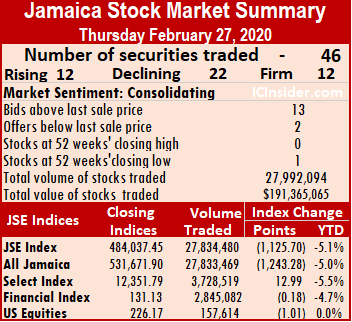

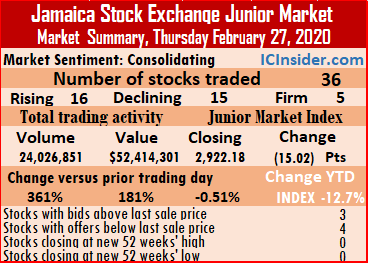

The Market closed with an average of 678,890 units valued at $4,524,631 for each security traded, in contrast to 565,203 units at an average of $3,795,319 on Tuesday. The average volume and value for the month to date amount to 596,981 units valued at $2,909,960 for each security changing hands compared to 592,330 units valued at $2,812,748 for each security traded. Trading in January resulted in an average of 626,134 units valued at $3,511,981 for each security.

The Market closed with an average of 678,890 units valued at $4,524,631 for each security traded, in contrast to 565,203 units at an average of $3,795,319 on Tuesday. The average volume and value for the month to date amount to 596,981 units valued at $2,909,960 for each security changing hands compared to 592,330 units valued at $2,812,748 for each security traded. Trading in January resulted in an average of 626,134 units valued at $3,511,981 for each security. NCB Financial closed $1.64 lower to $186 after trading 17,864 units, Sagicor Group dropped 50 cents to $66, in exchanging 762,613 shares, Salada Foods jumped $5.75 as 8,426 shares changed hands at $34.25. Scotia Group gained $1 and closed at $55, with 79,701 shares changing hands, Seprod lost $2 to close at $51 trading 16,104 shares, Sygnus Credit Investments closed at $26.99, after gaining 79 cents transferring 15,194 shares.

NCB Financial closed $1.64 lower to $186 after trading 17,864 units, Sagicor Group dropped 50 cents to $66, in exchanging 762,613 shares, Salada Foods jumped $5.75 as 8,426 shares changed hands at $34.25. Scotia Group gained $1 and closed at $55, with 79,701 shares changing hands, Seprod lost $2 to close at $51 trading 16,104 shares, Sygnus Credit Investments closed at $26.99, after gaining 79 cents transferring 15,194 shares. At the close of trading, the number of stocks rising and falling was almost equal, with 16 rising and 15 falling with five remaining unchanged as investors traded in more securities than on Tuesday. Express Catering and Fosrich traded at an intraday low of $4.89 and $3.20, respectively.

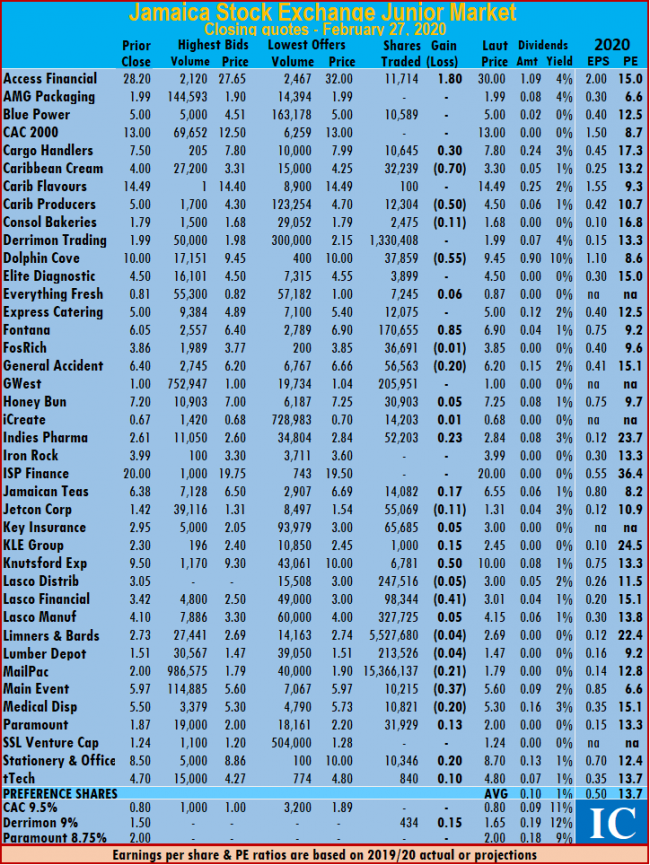

At the close of trading, the number of stocks rising and falling was almost equal, with 16 rising and 15 falling with five remaining unchanged as investors traded in more securities than on Tuesday. Express Catering and Fosrich traded at an intraday low of $4.89 and $3.20, respectively. At the close of the market, Access Financial gained $1.80 exchanging 11,714 shares at $30, Cargo Handlers rose 30 cents in trading 10,645 units at $7.80, Caribbean Cream lost 70 cents trading 32,239 stock units and closed at $3.30. Caribbean Producers shed 50 cents to end at $4.50 with 12,304 shares changing hands, Consolidated Bakeries lost 11 cents, after exchanging 2,475 units and closed at $1.68. Dolphin Cove traded 37,859 stock units at $9.45, after losing 55 cents, Everything Fresh gained 6 cents to end at 87 cents, after swapping 7,245 units, Fontana climbed 85 cents and exchanged 170,655 shares at $6.90, Fosrich lost 1 cent to settle at $3.85, with an exchange of 36,691 stock units. General Accident shed 20 cents transferring 56,563 units to close at $6.20, Honey Bun added 5 cents and exchanged 30,903 shares at $7.25, iCreate ended at 68 cents after gaining 1 cent trading 14,203 stock units. Indies Pharma climbed 23 cents after trading 52,203 shares at $2.84. Jamaican Teas gained 17 cents to settle at $6.55 with 14,082 units changing hands, Jetcon Corporation exchanged 55,069 shares in closing at $1.31, after losing 11 cents, Key Insurance ended trading with 65,685 stock units, after adding 5 cents to end at $3. KLE Group climbed 15 cents, to close at $2.45 with 1,000 shares crossing the market, Knutsford Express closed 50 cents higher to $10, with 6,781 units changing hands,

At the close of the market, Access Financial gained $1.80 exchanging 11,714 shares at $30, Cargo Handlers rose 30 cents in trading 10,645 units at $7.80, Caribbean Cream lost 70 cents trading 32,239 stock units and closed at $3.30. Caribbean Producers shed 50 cents to end at $4.50 with 12,304 shares changing hands, Consolidated Bakeries lost 11 cents, after exchanging 2,475 units and closed at $1.68. Dolphin Cove traded 37,859 stock units at $9.45, after losing 55 cents, Everything Fresh gained 6 cents to end at 87 cents, after swapping 7,245 units, Fontana climbed 85 cents and exchanged 170,655 shares at $6.90, Fosrich lost 1 cent to settle at $3.85, with an exchange of 36,691 stock units. General Accident shed 20 cents transferring 56,563 units to close at $6.20, Honey Bun added 5 cents and exchanged 30,903 shares at $7.25, iCreate ended at 68 cents after gaining 1 cent trading 14,203 stock units. Indies Pharma climbed 23 cents after trading 52,203 shares at $2.84. Jamaican Teas gained 17 cents to settle at $6.55 with 14,082 units changing hands, Jetcon Corporation exchanged 55,069 shares in closing at $1.31, after losing 11 cents, Key Insurance ended trading with 65,685 stock units, after adding 5 cents to end at $3. KLE Group climbed 15 cents, to close at $2.45 with 1,000 shares crossing the market, Knutsford Express closed 50 cents higher to $10, with 6,781 units changing hands,  Lasco Distributors lost 5 cents to end at $3.01, after transferring 247,516 units, Lasco Financial dipped 41 cents in trading 98,344 units at $3.01. Lasco Manufacturing closed with 327,725 units changing hands, with gains of 5 cents to finish at $4.15, Limners and Bards ended with an exchange of 5,527,680 shares to close at $2.69 after falling 4 cents, Lumber Depot closed trading of 213,526 units and lost 4 cents to end at $1.47, MailPac shed 21 cents to $1.79 with 15,366,137 units swapped. Main Event traded 10,215 units at $5.60, after losing 37 cents, Medical Disposables closed 20 cents lower at $5.30, after exchanging 10,821 units, Paramount Trading closed trading of 31,929 units and rose 13 cents to end at $2. Stationery and Office Supplies ended 20 cents higher to $8.70, with 10,346 shares crossing the exchange and tTech traded 840 units at $4.80, with gains of 10 cents. Derrimon Trading preference share climbed 15 cents in trading of 434 units at $1.65.

Lasco Distributors lost 5 cents to end at $3.01, after transferring 247,516 units, Lasco Financial dipped 41 cents in trading 98,344 units at $3.01. Lasco Manufacturing closed with 327,725 units changing hands, with gains of 5 cents to finish at $4.15, Limners and Bards ended with an exchange of 5,527,680 shares to close at $2.69 after falling 4 cents, Lumber Depot closed trading of 213,526 units and lost 4 cents to end at $1.47, MailPac shed 21 cents to $1.79 with 15,366,137 units swapped. Main Event traded 10,215 units at $5.60, after losing 37 cents, Medical Disposables closed 20 cents lower at $5.30, after exchanging 10,821 units, Paramount Trading closed trading of 31,929 units and rose 13 cents to end at $2. Stationery and Office Supplies ended 20 cents higher to $8.70, with 10,346 shares crossing the exchange and tTech traded 840 units at $4.80, with gains of 10 cents. Derrimon Trading preference share climbed 15 cents in trading of 434 units at $1.65.