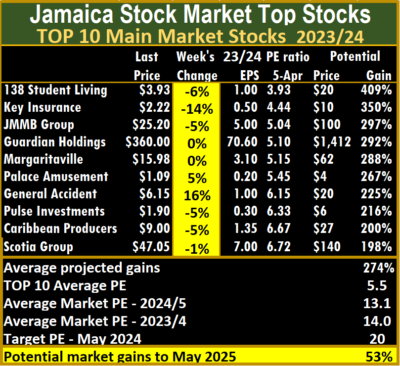

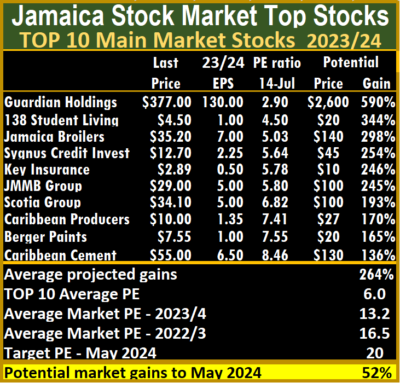

With what has become the norm, the markets pulled back to start April from the pump-up end of month prices in March, resulting in varied outcomes for the ICTOP10 and ending with Jamaica Broilers falling from the Main Market TOP10 and Caribbean Producers entering at the number 9 spot.

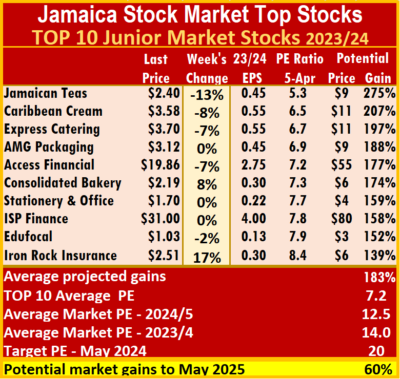

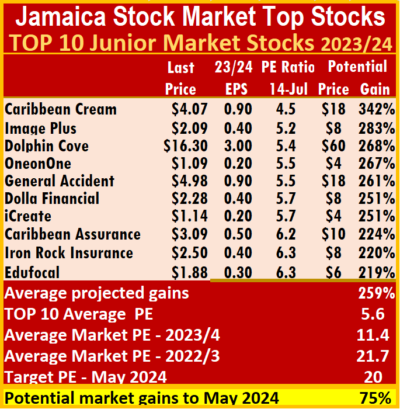

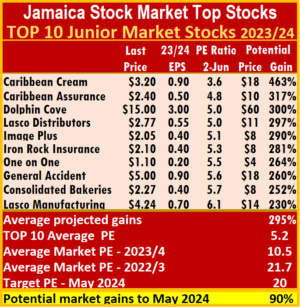

There were no changes to the list of companies in the Junior Market TOP10 this past week.

There were no changes to the list of companies in the Junior Market TOP10 this past week.

Caribbean Producers is the primary supplier of foods and beverages to the growing tourist industry on the north coast of Jamaica and St Lucia, the company is also expanding its meat processing arm as well as retail areas in both countries. ICInsider.com’s projected EPS is $1.35 for the fiscal year to June 2024. With plans for long term growth in the local tourism sector, the company has a B base for growth for many years to come.

Jamaica Broilers although out of the TOP10, is undervalued and possesses good long term growth prospects as they constantly spend resources to expand or modernise the operation.

In Main Market activity this past week, General Accident jumped 16 percent to $6.15, a 52 weeks’ high, with buying interest in recent weeks, being very high and active supply in the market low, a recipe for higher prices ahead and Key Insurance lost 14 percent to end at $2.22.

The Junior Market closed the week with a 17 percent jump for Iron Rock Insurance to $2.51 while Consolidated Bakeries gained 8 percent to $2.19 but Jamaican Teas dropped 13 percent to $2.40 and Caribbean Cream lost 8 percent to land at $3.58 while Express Catering and Access Financial fell by 7 percent to $3.70 and $19.86 respectively.

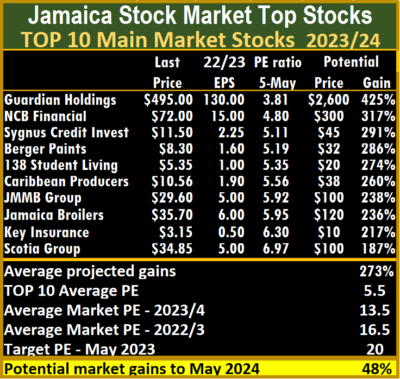

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5.

The Main Market ICTOP10 is projected to gain an average of 274 percent by May 2025, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 183 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 106, with an average of 30 and 27 excluding the highest PE ratios, and a PE of 24 for the top half and 21 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 9 stocks, or 20 percent of the market, with PEs ranging from 15 to 50, averaging 22, well above the market’s average. The top half of the market has an average PE of 17, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

With the 2024 financial year ending in March, the two companies will see a bump in earnings for 2025 and likely put them in the ICTOP10 again. Since the switch in listing, the number of stocks offered for sale has declined sharply and so have the bids to buy.

With the 2024 financial year ending in March, the two companies will see a bump in earnings for 2025 and likely put them in the ICTOP10 again. Since the switch in listing, the number of stocks offered for sale has declined sharply and so have the bids to buy.

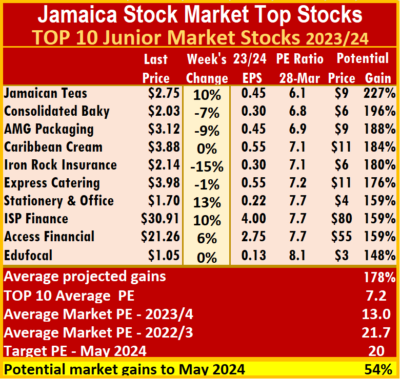

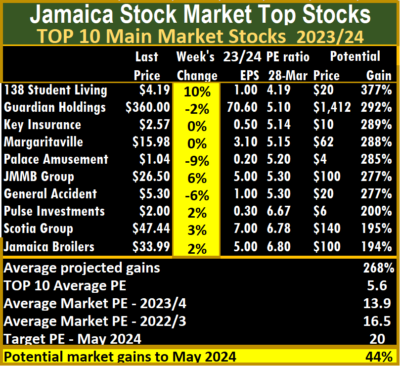

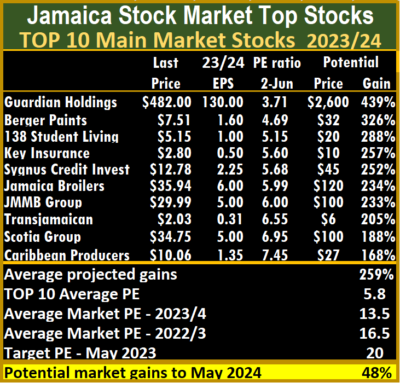

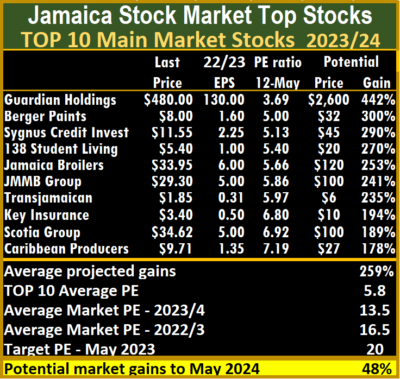

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

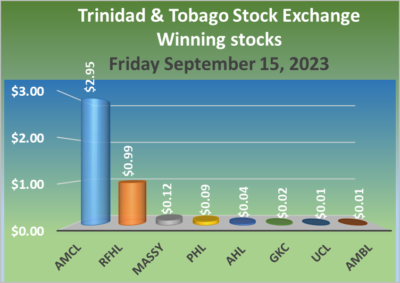

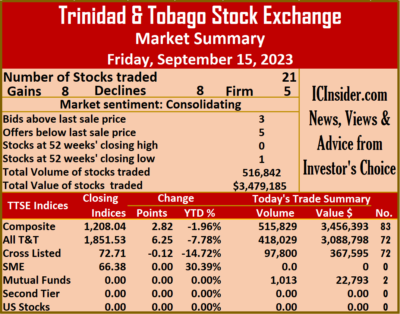

Investors exchanged 516,842 shares for $3,479,185 compared to 514,144 stocks at $10,312,415 on Thursday.

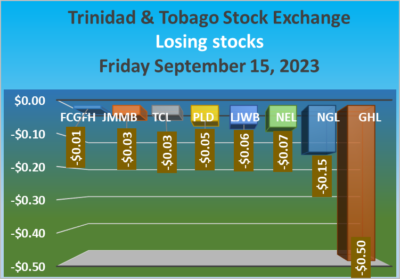

Investors exchanged 516,842 shares for $3,479,185 compared to 514,144 stocks at $10,312,415 on Thursday. In closing, Angostura Holdings rallied 4 cents to $22.99 with a transfer of 20 shares, Ansa McAl advanced $2.95 to $57 with shareholders swapping 529 stocks, Ansa Merchant Bank popped 1 cent to end at $42.21 with investors trading 100 stocks, Calypso Macro Investment Fund closed at $22.50 in trading 1,013 units. First Citizens shed 1 cent to close at $49, in trading 539 shares, FirstCaribbean International Bank ended at $7 with 15,800 stocks changing hands, GraceKennedy rose 2 cents to $3.17 with investors trading in 81,000 stock units, Guardian Holdings lost 50 cents to close at $19 after 1,582 shares were traded. JMMB Group skidded 3 cents to close at $1.32 with an exchange of 1,000 stocks, L.J. Williams B share fell 6 cents and ended at $2.49 after the swapping of 10 stock units, Massy Holdings climbed 12 cents and ended at $5 after 308,464 units passed through the market, National Enterprises declined 7 cents to close at $3.58 after 52,961 shares crossed the market.

In closing, Angostura Holdings rallied 4 cents to $22.99 with a transfer of 20 shares, Ansa McAl advanced $2.95 to $57 with shareholders swapping 529 stocks, Ansa Merchant Bank popped 1 cent to end at $42.21 with investors trading 100 stocks, Calypso Macro Investment Fund closed at $22.50 in trading 1,013 units. First Citizens shed 1 cent to close at $49, in trading 539 shares, FirstCaribbean International Bank ended at $7 with 15,800 stocks changing hands, GraceKennedy rose 2 cents to $3.17 with investors trading in 81,000 stock units, Guardian Holdings lost 50 cents to close at $19 after 1,582 shares were traded. JMMB Group skidded 3 cents to close at $1.32 with an exchange of 1,000 stocks, L.J. Williams B share fell 6 cents and ended at $2.49 after the swapping of 10 stock units, Massy Holdings climbed 12 cents and ended at $5 after 308,464 units passed through the market, National Enterprises declined 7 cents to close at $3.58 after 52,961 shares crossed the market.  National Flour Mills ended at $1.53 in switching ownership of 2,500 stock units, Point Lisas dipped 5 cents to $3.55 in an exchange of 193 shares, Prestige Holdings rallied 9 cents to end at $7.95 with traders dealing in 10,000 stocks, Republic Financial gained 99 cents in closing at $124.99, with 1,227 units clearing the market. Scotiabank ended at $72 in an exchange of 9,587 stocks, Trinidad & Tobago NGL dipped 15 cents to close at $12.85 after 3,990 units were traded, Trinidad Cement slipped 3 cents to $3.15 while exchanging 10 stock units, Unilever Caribbean rallied 1 cent to $12 as investors traded 10,574 shares and West Indian Tobacco remained at $10.31 in trading 15,743 stocks.

National Flour Mills ended at $1.53 in switching ownership of 2,500 stock units, Point Lisas dipped 5 cents to $3.55 in an exchange of 193 shares, Prestige Holdings rallied 9 cents to end at $7.95 with traders dealing in 10,000 stocks, Republic Financial gained 99 cents in closing at $124.99, with 1,227 units clearing the market. Scotiabank ended at $72 in an exchange of 9,587 stocks, Trinidad & Tobago NGL dipped 15 cents to close at $12.85 after 3,990 units were traded, Trinidad Cement slipped 3 cents to $3.15 while exchanging 10 stock units, Unilever Caribbean rallied 1 cent to $12 as investors traded 10,574 shares and West Indian Tobacco remained at $10.31 in trading 15,743 stocks.

In the Main Market,

In the Main Market,  The 14 most highly valued Main Market stocks representing 30 percent of the Main Market are priced at a PE of 15 to 95, with an average of 30 and 21 excluding the highest PE ratios, with a PE of 23 for the top half and 18 excluding the stocks with the highest PEs.

The 14 most highly valued Main Market stocks representing 30 percent of the Main Market are priced at a PE of 15 to 95, with an average of 30 and 21 excluding the highest PE ratios, with a PE of 23 for the top half and 18 excluding the stocks with the highest PEs. In the Junior Market, iCreate dropped 12 percent to $1.14, followed by a 10 percent decline in

In the Junior Market, iCreate dropped 12 percent to $1.14, followed by a 10 percent decline in  The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks. The

The The price of Main Market listed

The price of Main Market listed

Massey Holdings, Seprod,

Massey Holdings, Seprod,

The 15 highest valued Main Market stocks are priced at a PE of 15 to 110, with an average of 27 and 19 excluding the highest PE stocks and 19 for the top half excluding the stocks with the highest valuation.

The 15 highest valued Main Market stocks are priced at a PE of 15 to 110, with an average of 27 and 19 excluding the highest PE stocks and 19 for the top half excluding the stocks with the highest valuation.

At the previous week’s close, Image Plus released solid full year results showing profit after tax that jumped 125.6 percent to $213 million or 21 cents per share. Based on those numbers, ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously. On Monday, the company reported revised results, with the profit being even higher at $252 million, with a reduction in the amount previously booked as professional fees. Based on the revision, projected earnings were raised by the publication to 40 cents per share for the current fiscal year. The stock sits at the number three spot in the ICTOP10. The revision raises some serious questions about how such matters escaped the directors, auditors and the financial controller before the audited financial statements were released.

At the previous week’s close, Image Plus released solid full year results showing profit after tax that jumped 125.6 percent to $213 million or 21 cents per share. Based on those numbers, ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously. On Monday, the company reported revised results, with the profit being even higher at $252 million, with a reduction in the amount previously booked as professional fees. Based on the revision, projected earnings were raised by the publication to 40 cents per share for the current fiscal year. The stock sits at the number three spot in the ICTOP10. The revision raises some serious questions about how such matters escaped the directors, auditors and the financial controller before the audited financial statements were released. The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index in the previous week with more this past week, with the supply of some stocks continuing to fall sharply.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index in the previous week with more this past week, with the supply of some stocks continuing to fall sharply. The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.