Former Prime Minister Bruce Golding handing over the report of the finding and recommendations relating to Jamaica and its relationship with Caricom to current Prime Minister Andrew Holness at Jamaica House on Thursday.

The report was concluded after interviews with several former Prime Ministers and current ones from within the region, along with other interested persons from institutions such as Trade Unions and senior members of political parties and input from the general public were received over the internet.

Golding hands over Caricom report

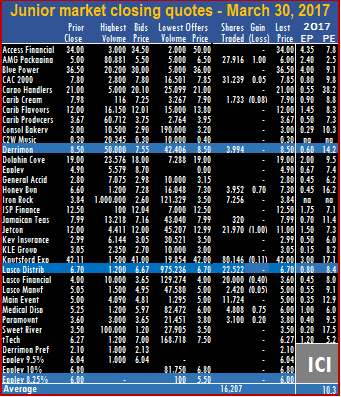

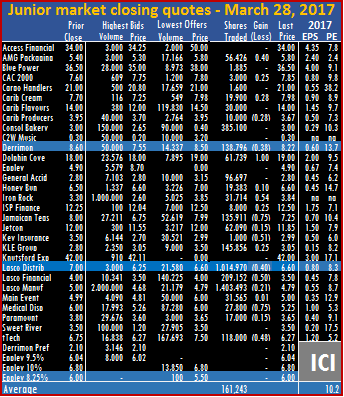

Modest rise in junior market

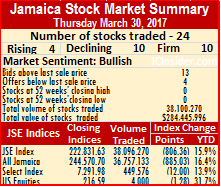

Trading on the junior market fell off sharply on Thursday from Wednesday’s levels, as demand declined below the previous day leaving the market index inching up by just 1.16 points to end at 2,991.64.

Trading on the junior market fell off sharply on Thursday from Wednesday’s levels, as demand declined below the previous day leaving the market index inching up by just 1.16 points to end at 2,991.64.

Market activity ended with only 15 securities trading, similar to the total on Wednesday with advancing and declining stocks ending at a 5 each. A total of 243,100 units valued at $4,441,436 passed through the market, compared to 699,545 units valued at $3,810,910 on Wednesday.

The junior market ended trading with an average of 16,207 units for an average value of $296,096 traded, compared to 46,636 units for an average value of $254,061 on the previous trading day. The average volume and value for the month to date ended at 138,835 units and $1,338,271. On the immediate preceding trading day, the average volume and value for the month to date, were 144,675 units and $1,385,643. The average volume and value for February, ended at 223,938 units and $1,379,459.

On the immediate preceding trading day, the average volume and value for the month to date, were 144,675 units and $1,385,643. The average volume and value for February, ended at 223,938 units and $1,379,459.

Trading ended with 10 stocks had bids higher than their last sale prices and 4 ended with lower offers, than the last sale.

At the close of the market on Thursday, AMG Packaging climbed $1 and closed at $6 with 27,916 units changing hands, CAC 2000 lost 5 cents and closed at $7.80 with 31,239 shares trading, Caribbean Cream dropped 8 cents in trading 1,733 units to end at $7.90, Derrimon Trading ended at $8.50 with 3,994 shares changing hands, Honey Bun had 3,952 shares changing hands, rose 70 cents and closed at $7.30. Iron Rock Insurance traded 7,256 shares to end at $3.84, Jamaican Teas traded just 320 shares to close at $7.99,  Jetcon Corporation dropped $1 and closed trading with 21,970 shares being exchanged, to end at $11, Knutsford Express lost 11 cents to end at $42 with 80,146 shares changing hands, Lasco Distributors ended with 22,522 units trading at $6.70, Lasco Financial fell 40 cents, with 20,000 shares changing hands, to end at $3.60, Lasco Manufacturing closed with 2,420 units changing hands at $5, after falling 5 cents, Main Event closed at $5 with 11,724 shares changing hands, Medical Disposables climbed 75 cents to $6 with 4,808 units trading and Paramount Trading had 3,100 shares changing hands, to close with a rise of 20 cents at $3.80.

Jetcon Corporation dropped $1 and closed trading with 21,970 shares being exchanged, to end at $11, Knutsford Express lost 11 cents to end at $42 with 80,146 shares changing hands, Lasco Distributors ended with 22,522 units trading at $6.70, Lasco Financial fell 40 cents, with 20,000 shares changing hands, to end at $3.60, Lasco Manufacturing closed with 2,420 units changing hands at $5, after falling 5 cents, Main Event closed at $5 with 11,724 shares changing hands, Medical Disposables climbed 75 cents to $6 with 4,808 units trading and Paramount Trading had 3,100 shares changing hands, to close with a rise of 20 cents at $3.80.

Sagicor caught in JSE ownership restriction

Sagicor Group JSE ownership exceeded 10% restriction..

The article sets a 10 percent limitation for ownership by any one shareholder. The restriction is meant to prevent anyone shareholder from dominating management of the company. The prospectus when the company sold ordinary shares to the public in June 2103 stated: Ordinary Shares – Special Provisions to Prevent Unacceptable Control Situations. Article 48 of the Articles of Incorporation of the Company contains provisions that are designed to prevent any Shareholder (including a Member Dealer) from holding Shares above the “Prescribed Percentage”, being over 10 percent of the issued share capital of the Company. If the voting power of any person (either alone or together with others) is more than the Prescribed Percentage, the Articles deem that an unacceptable control situation exists. In those circumstances, the same Article also deems that any Shares above the Prescribed Percentage are default shares that no longer carry rights to vote at general meetings of the Company. The Company has a power to give notice to the holder to dispose of any default shares, failing which the Company may dispose of them.

On March 3, a total of 35.3 million units of Jamaica Stock Exchange shares were trading through the market.

Iron Rock underperforms in year 1

Iron Rock came to the general insurance market just about when premium rates for catastrophe coverage is under pressure with consumers enjoying some of the lowest rates in years and with one element of good revenue losing it sting.

Iron Rock came to the general insurance market just about when premium rates for catastrophe coverage is under pressure with consumers enjoying some of the lowest rates in years and with one element of good revenue losing it sting.

Iron Rock ended 2016, their first full year of operations, with a loss of $50 million, before fair value gains on investments of $5.5 million, taking the net position to a loss of $45 million, up from the forecast in the prospectus of $30 million as the company underperformed on most fronts, compared to forecast. Gross premiums written projected at $170 million ended well down, with $127 million generated in the year. Profit before operating expenses came in at $9 million versus $20 million forecasted. Investment income ended at $17 million versus $39 million while foreign exchange gains ended at $15 million with forecast being $7 million. Operating expenses ended at $91 million, lower than the $96 million projected. Underwriting loss before other income ended at $82 million versus $76 million after a lower loss claim of $6 million than the $12 million projected.

William Mc Connel one of teh directors of Iron Rock

On the plus side, the big expansion on the way in the hotel and BPO sectors and other areas will provide an expanded market going forward and thus provide a base that they can expand their income from.

In spite of the loss, the company ended with a capital base of $560 million and holds investments of $366 million with $85 million in quoted equities. There is also an additional $70 million in short term investments. With growth in local equities the company should enjoy above average returns from this area that will boost the overall investment performance that could push them into an overall profit in 2017, but they are unlikely to see the same levels of foreign exchange gains enjoyed in 2016. Overall investment income realized or accrued could end up around $50 million in 2017 and would be well ahead of forecast.

Prices steady on TTSE

The last prices of stocks on the Trinidad & Tobago Stock Exchange ended on Wednesday without any change from the last traded price at the close on Tuesday. Based on the weighted average price movements, used in computing the market indices, the market recorded mostly falling values.

The last prices of stocks on the Trinidad & Tobago Stock Exchange ended on Wednesday without any change from the last traded price at the close on Tuesday. Based on the weighted average price movements, used in computing the market indices, the market recorded mostly falling values.

Trading levels fell to very low level with just 90,080 shares valued at $621,874 compared to Tuesday’s 178,508 units valued at $2,180,740 with 11 securities changing hands, the same as the day prior.

The Composite Index fell 5.36 points to 1,234.51, the All T&T Index declined by 11.56 points to 1,812.63 and the Cross Listed Index gained 0.13 points to 88.03.

IC bid-offer Indicator|The Investor’s Choice bid-offer ended with 10 stocks with bids higher than last selling prices and 12 with lower offers.

Firm Trades| Stocks changing hands on Wednesday with the last traded price unchanged are, Clico Investment closing at $22.50 with 4,158 units traded, JMMB Group at $1.22 with 43,325 units changing hands, National Enterprises closing at $10.88 with trades of 5,010 units.  Point Lisas traded 6,117 shares at $3.65, after trading earlier at $3.75, Prestige Holdings closed at $10.75 trading 100 units, Republic Financial Holdings exchanged 500 shares to end at $105.48 but traded as low as $102. Sagicor Financial held firm at $9.01 with an exchange of 18,217 units, Scotiabank closed at $59.01 with 1,169 shares changing hands, Scotia Investments traded 115 shares at $2.30, but traded as high as $2.50, Trinidad Cement closed at $4.17 trading 7,629 shares and Trinidad & Tobago NGL remained at $22.71 with 3,740 units traded, after being as high as low as $21.50.

Point Lisas traded 6,117 shares at $3.65, after trading earlier at $3.75, Prestige Holdings closed at $10.75 trading 100 units, Republic Financial Holdings exchanged 500 shares to end at $105.48 but traded as low as $102. Sagicor Financial held firm at $9.01 with an exchange of 18,217 units, Scotiabank closed at $59.01 with 1,169 shares changing hands, Scotia Investments traded 115 shares at $2.30, but traded as high as $2.50, Trinidad Cement closed at $4.17 trading 7,629 shares and Trinidad & Tobago NGL remained at $22.71 with 3,740 units traded, after being as high as low as $21.50.

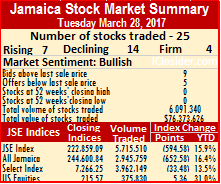

Sharp price moves push stocks down – Tuesday

Berger price closed with a loss of $1.95 on Tuesday.

Trading levels in main market ended at 5,715,510 units valued at $62,017,146 compared to 2,602,058 units valued at $19,772,383 at the close on Monday. Trading in the US dollar market accounted for 375,830 units valued at US$112,160.

The All Jamaica Composite Index declined 652.58 points to close at 244,600.84 the JSE Market Index fell 594.58 points to finish at 222,859.09 and the JSE US dollar market index gained 5.36 points to close at 215.57.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 9 stocks with bids higher than their last selling prices and 5 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 9 stocks with bids higher than their last selling prices and 5 with lower offers.The main market ended trading with an average of 122,740 units, compared to an average of 53,047 units on Monday. The average volume for the month to date ended at 136,817 units versus 150,894 units on the prior trading day. The average volume and value for February ended at 223,938 units and $1,379,459.

In market activity, Berger Paints slid $1.95 to $11.05, with 92,502 shares changing hands, Cable and Wireless lost 1 cent to close at $1.29 with trades of 255,042 shares, Caribbean Cement closed $1.20 lower to $31 with an exchange of 38,790 units. Carreras traded at $72, gaining $3 with 25,245 shares exchanged, Grace Kennedy advanced 90 cents to $43.90 with 170,701 units changing owners, Jamaica Broilers traded 124,547 shares at $15.99, for a loss of 1 cent, Jamaica Producers closed at $16 with 143,221 shares exchanged, Jamaica Stock Exchange closed 53 cents lower at $7, with trades of 861,904 units. JMMB Group closed at $16.81, losing 19 cents with 62,377 units traded, Kingston Properties closed at $16.35 trading 2,250 shares, Kingston Wharves lost 25 cents to close at $31.50, with 133,133 units changing hands, Mayberry Investments closed 10 cents lower at $4.60 with an exchange of 63,659 shares, NCB Financial Group gained 40 cents to close at $61.90, after exchanging 39,418 shares,

1834 Investments closed at $1.50, losing 10 cents trading 24,112 units, Palace traded 900 units at $200, Pan Jamaican closed at $35, with a loss of 1 cent trading 59,159 shares. Pulse Investments closed at $8.40, losing 5 cents with an exchange of 2,654 units, Radio Jamaica gained 30 cents to close at $1.90 exchanging 30,300 shares, Sagicor Group closed at $33.50 trading 151,851 shares, Sagicor Real Estate fund lost 6 cents to close at $10.50 with 184,285 shares traded, Scotia Group was down 99 cents, to close at $38.01, with 513,417 units exchanged, Scotia Investments traded $1.95 higher to $40 with a mere 1,000 units changing hands, Supreme Ventures advanced 35 cents to $6.35 trading 4,710 shares. Proven closed at 30 US cents, gaining 1 cent with an exchange of 375,830 ordinary shares and JMMB Group 7.5% preference share lost 1 cent to close at $1.08 with trades of 2,730,333 units.

1834 Investments closed at $1.50, losing 10 cents trading 24,112 units, Palace traded 900 units at $200, Pan Jamaican closed at $35, with a loss of 1 cent trading 59,159 shares. Pulse Investments closed at $8.40, losing 5 cents with an exchange of 2,654 units, Radio Jamaica gained 30 cents to close at $1.90 exchanging 30,300 shares, Sagicor Group closed at $33.50 trading 151,851 shares, Sagicor Real Estate fund lost 6 cents to close at $10.50 with 184,285 shares traded, Scotia Group was down 99 cents, to close at $38.01, with 513,417 units exchanged, Scotia Investments traded $1.95 higher to $40 with a mere 1,000 units changing hands, Supreme Ventures advanced 35 cents to $6.35 trading 4,710 shares. Proven closed at 30 US cents, gaining 1 cent with an exchange of 375,830 ordinary shares and JMMB Group 7.5% preference share lost 1 cent to close at $1.08 with trades of 2,730,333 units.

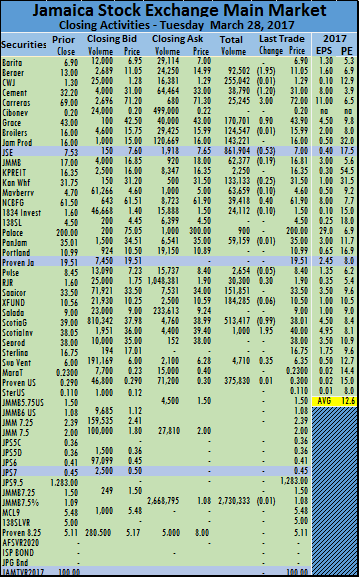

Junior market index jumps – Tuesday

I$P Finance hits a new high on Tuesday.

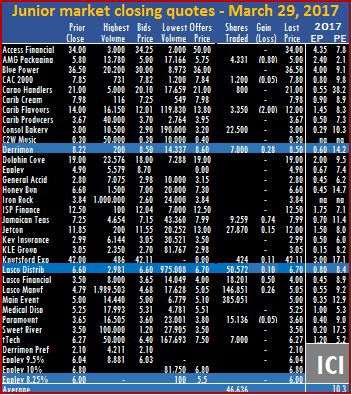

Market activity ended with 25 securities trading, up from 23 on Monday as 9 stocks rose and 11 declined. A total of 4,031,077 units valued at $23,768,156 passed through the market, compared to 1,062,024 units valued at $5,541,349 on Monday.

The junior market ended trading with an average of 161,243 units for an average value of $950,726 traded, compared to 46,175 units for an average value of $240,928 on the previous trading day. The average volume and value for the month to date, ended at 149,577 units and $1,439,528. On the immediate preceding trading day, the average volume and value for the month to date, were 148,963 units and $1,463,968. The average volume and value for February, ended at 223,938 units and $1,379,459.

Trading ended with 5 stocks had bids higher than their last sale prices and 2 ended with lower offers, than the last sale.

Trading ended with 5 stocks had bids higher than their last sale prices and 2 ended with lower offers, than the last sale.At the close of the market on Tuesday, AMG Packaging rose by 40 cents and closed at $5.80 with 56,426 units changing hands, Blue Power traded 1,885 units to close at $36.50, CAC 2000 rose 25 cents and closed at $7.85 with 3,000 shares trading, Cargo Handlers ended trading with 1,600 shares at $21, Caribbean Flavours traded 30,000 units to end at $14, Caribbean Producers lost 28 cents in trading 10,000 units at $3.67, Consolidated Bakeries ended with 385,100 shares changing hands, to close at $3. Derrimon Trading lost 38 cents and ended at $8.22 with 138,796 shares changing hands, Dolphin Cove gained $1 and closed trading with 61,739 shares, at $19, General Accident price closed trading with 96,697 shares at $2.80, Honey Bun gained closed with 19,383 shares changing hands at $6.60, after rising by 10 cents, Iron Rock had 31,714 units changing hands to close at $3.84 with a rise of 54 cents, ISP Finance traded 8,000 shares and rose 25 cents to a new high at $12.50, Jamaican Teas fell 75 cents in trading 135,911 shares to close at $7.25,

Jetcon Corporation lost 15 cents and closed trading with 62,090 shares being exchanged, to end at $11.85, Key Insurance lost 51 cents to end at $2.99 with 1,000 shares changing hands, KLE Group ended at $3.05 with 145,856 shares changing hands after rising by 25 cents, Lasco Distributors lost 40 cents and ended with 1,014,970 units trading at $6.60, Lasco Financial lost 50 cents with 209,152 shares changing hands, to end at $3.50, Lasco Manufacturing closed with 1,403,493 units changing hands at $4.79, after losing 21 cents, Main Event gained 1 cents and closed at $5 with 31,565 shares changing hands, Medical Disposables lost 75 cents in trading 27,800 shares to close at $5.25, Paramount Trading had 17,000 shares changing hands, to close with a loss of 15 cents at $3.65 and tTech fell 48 cents and ended with 118,000 units changing hands at $6.27.

Jetcon Corporation lost 15 cents and closed trading with 62,090 shares being exchanged, to end at $11.85, Key Insurance lost 51 cents to end at $2.99 with 1,000 shares changing hands, KLE Group ended at $3.05 with 145,856 shares changing hands after rising by 25 cents, Lasco Distributors lost 40 cents and ended with 1,014,970 units trading at $6.60, Lasco Financial lost 50 cents with 209,152 shares changing hands, to end at $3.50, Lasco Manufacturing closed with 1,403,493 units changing hands at $4.79, after losing 21 cents, Main Event gained 1 cents and closed at $5 with 31,565 shares changing hands, Medical Disposables lost 75 cents in trading 27,800 shares to close at $5.25, Paramount Trading had 17,000 shares changing hands, to close with a loss of 15 cents at $3.65 and tTech fell 48 cents and ended with 118,000 units changing hands at $6.27.

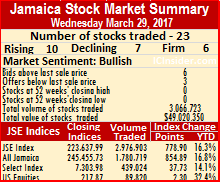

Jamaica Stock Exchange traded nearly 37 million shares one day after the Stock Exchange advised Sagicor Group that their holdings exceeded the limit of 10 percent stipulated in the company’s bye laws. The group bought nearly 36 million units in early March.

Jamaica Stock Exchange traded nearly 37 million shares one day after the Stock Exchange advised Sagicor Group that their holdings exceeded the limit of 10 percent stipulated in the company’s bye laws. The group bought nearly 36 million units in early March.  IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 13 stocks with bids higher than their last selling prices and 4 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 13 stocks with bids higher than their last selling prices and 4 with lower offers. NCB Financial Group slid 90 cents to close at $61, after exchanging 12,137 shares, 138 Student Living traded 60,146 shares at $4.50, Pan Jamaican gained 2 cents, closing at $34.52 while trading 5,240 shares. Pulse Investments traded 1,150 shares at $8.40, Sagicor Group closed at $34.01 with trades of 118,881 shares, Sagicor Real Estate Fund lost 5 cents, closing at $10.50 with 13,000 shares, Salada Foods closed at $9 trading 23,000 units, Scotia Group closed 77 cents lower to $37.98 with trades of 47,148 units, Scotia Investments traded at $39.50 with a mere 194 units changing hands, Seprod exchanged 7,245 shares at $38, Supreme Ventures lost 1 cent to close at $5.99 trading 27,155 shares. Proven fell 0.95 cent and closed at 30 US cents, with an exchange of 4,000 ordinary shares and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,327,000 units.

NCB Financial Group slid 90 cents to close at $61, after exchanging 12,137 shares, 138 Student Living traded 60,146 shares at $4.50, Pan Jamaican gained 2 cents, closing at $34.52 while trading 5,240 shares. Pulse Investments traded 1,150 shares at $8.40, Sagicor Group closed at $34.01 with trades of 118,881 shares, Sagicor Real Estate Fund lost 5 cents, closing at $10.50 with 13,000 shares, Salada Foods closed at $9 trading 23,000 units, Scotia Group closed 77 cents lower to $37.98 with trades of 47,148 units, Scotia Investments traded at $39.50 with a mere 194 units changing hands, Seprod exchanged 7,245 shares at $38, Supreme Ventures lost 1 cent to close at $5.99 trading 27,155 shares. Proven fell 0.95 cent and closed at 30 US cents, with an exchange of 4,000 ordinary shares and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,327,000 units.

The average volume and value for February, ended at 223,938 units and $1,379,459.

The average volume and value for February, ended at 223,938 units and $1,379,459. Jamaican Teas rose 74 cents in trading 9,259 shares to close at $7.99, Jetcon Corporation gained 15 cents and closed trading with 27,870 shares being exchanged, to end at $12, Knutsford Express rose 11 cents to end at $42.11 with 424 shares changing hands, Lasco Distributors added 10 cents and ended with 50,572 units trading at $6.70, Lasco Financial regained the 50 cents lost on Tuesday, with 18,201 shares changing hands, to end at $4, Lasco Manufacturing closed with 146,851 units changing hands at $5.05, after rising 26 cents, Main Event closed at $5 with 385,051 shares changing hands, Paramount Trading had 15,136 shares changing hands, to close with a loss of 5 cents at $3.60 and tTech ended with 7,000 units changing hands at $6.27.

Jamaican Teas rose 74 cents in trading 9,259 shares to close at $7.99, Jetcon Corporation gained 15 cents and closed trading with 27,870 shares being exchanged, to end at $12, Knutsford Express rose 11 cents to end at $42.11 with 424 shares changing hands, Lasco Distributors added 10 cents and ended with 50,572 units trading at $6.70, Lasco Financial regained the 50 cents lost on Tuesday, with 18,201 shares changing hands, to end at $4, Lasco Manufacturing closed with 146,851 units changing hands at $5.05, after rising 26 cents, Main Event closed at $5 with 385,051 shares changing hands, Paramount Trading had 15,136 shares changing hands, to close with a loss of 5 cents at $3.60 and tTech ended with 7,000 units changing hands at $6.27.

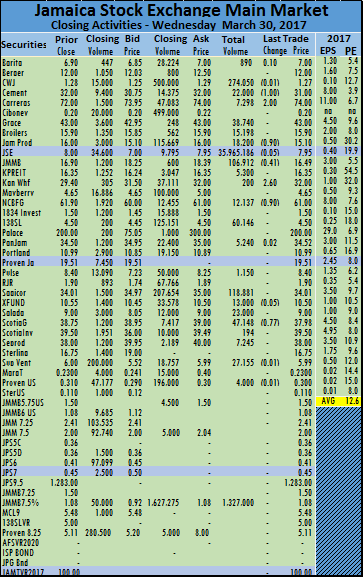

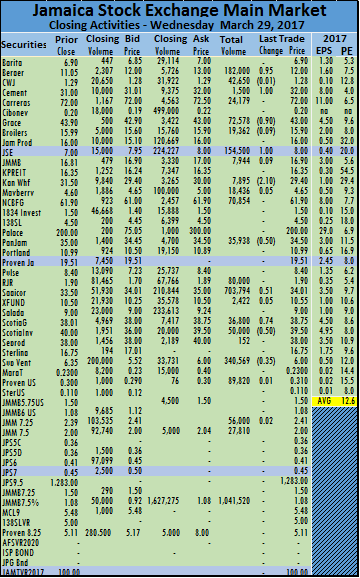

Trading in the main market of the Jamaica Stock Exchange ended with moderate gains in the indices at the close on Wednesday as 22 securities changed hands with 1 trading in the US dollar market. A total of 10 stocks advanced and 7 declined in the two markets.

Trading in the main market of the Jamaica Stock Exchange ended with moderate gains in the indices at the close on Wednesday as 22 securities changed hands with 1 trading in the US dollar market. A total of 10 stocks advanced and 7 declined in the two markets. The average volume for the month to date ended at 108,879 units versus 136,817 units on the prior trading day. The average volume and value for February ended at 223,938 units and $1,379,459.

The average volume for the month to date ended at 108,879 units versus 136,817 units on the prior trading day. The average volume and value for February ended at 223,938 units and $1,379,459. Mayberry Investments closed 5 cents higher to $4.65 with trades of 18,436 shares, NCB Financial Group closed at $61.90, after exchanging 70,854 shares, Pan Jamaican lost 50 cents, closing at $34.50 trading 35,938 shares. Radio Jamaica traded 80,000 shares at $1.90, Sagicor Group gained 51 cents to close at $34.01 with trades of 703,794 shares, Sagicor Real Estate fund closed at $10.55 with gains of 5 cents and 2,422 shares being exchanged, Scotia Group added 74 cents, closing at $38.75 trading 36,800 units, Scotia Investments traded 50 cents lower to $39.50 with 50,000 units changing hands, Seprod exchanged 152 shares at $38, Supreme Ventures lost 35 cents to close at $6 trading 340,569 shares. Proven closed at 30.95 US cents, gaining 0.95 cent with an exchange of 89,820 ordinary shares, JMMB 7.25% preference share rose 2 cents in trading 56,000 units at $2.41, JMMB 7.5% preference share exchanged 27,810 units at $2, and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,041,520 units.

Mayberry Investments closed 5 cents higher to $4.65 with trades of 18,436 shares, NCB Financial Group closed at $61.90, after exchanging 70,854 shares, Pan Jamaican lost 50 cents, closing at $34.50 trading 35,938 shares. Radio Jamaica traded 80,000 shares at $1.90, Sagicor Group gained 51 cents to close at $34.01 with trades of 703,794 shares, Sagicor Real Estate fund closed at $10.55 with gains of 5 cents and 2,422 shares being exchanged, Scotia Group added 74 cents, closing at $38.75 trading 36,800 units, Scotia Investments traded 50 cents lower to $39.50 with 50,000 units changing hands, Seprod exchanged 152 shares at $38, Supreme Ventures lost 35 cents to close at $6 trading 340,569 shares. Proven closed at 30.95 US cents, gaining 0.95 cent with an exchange of 89,820 ordinary shares, JMMB 7.25% preference share rose 2 cents in trading 56,000 units at $2.41, JMMB 7.5% preference share exchanged 27,810 units at $2, and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,041,520 units.